Dutch payments processor Adyen has announced its H2 2023 results, delivering a period of growth that includes strong gains in revenue and processed volume despite elevated investment during the period.

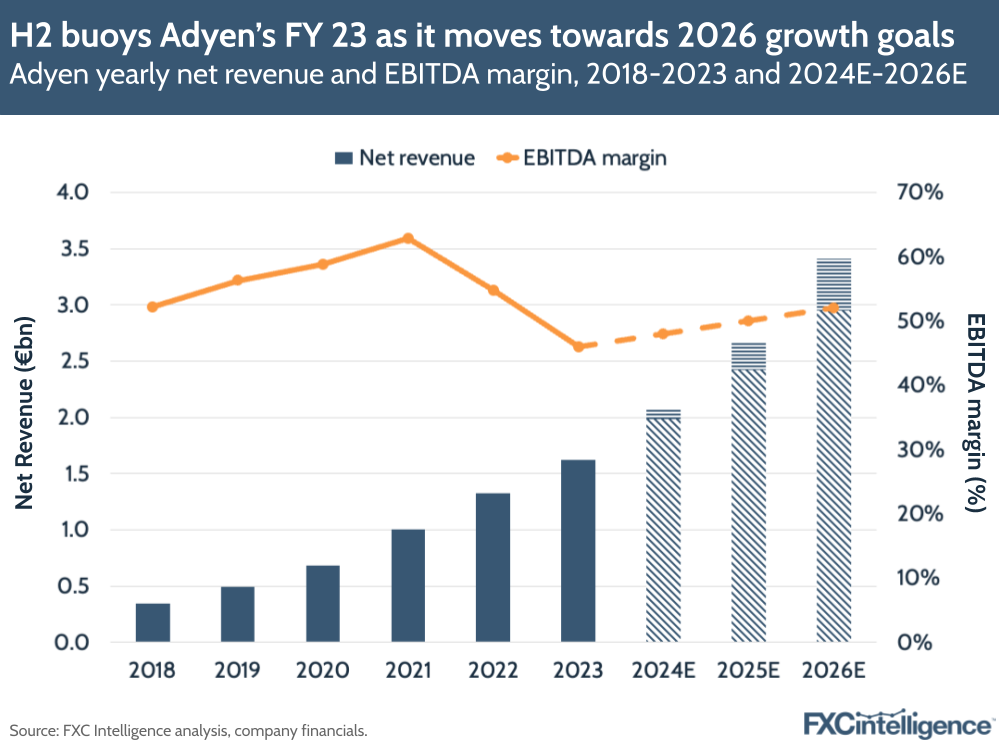

The company reported a 23% YoY rise in net revenue for H2 23 to €887m, with FY 23 seeing a 22% increase to €1.6bn. Meanwhile, processed volume increased 29% YoY for H2 to €544bn and 26% YoY for FY to €970bn.

Having dropped in the first half of the year due to hiring, EBITDA also saw a return to growth in H2 23, with a 14% YoY increase to €423m in the half producing an EBITDA margin of 48%. This also saw FY 23 EBITDA grow 2% overall, to reach €743m.

This represented a welcome return for investors, with Adyen’s stock rising over 25% in the days following the publication of the results. Previously, investors had reacted negatively to the company’s H1 earnings call over news of its focus on hiring at a time when many other companies were enacting layoffs. In the interim, Adyen held an investor day to better communicate its strategy and outline financial objectives through to 2026, which was positively received.

Today’s market reaction suggests investors feel Adyen is on track to reach its multi-year goals, which remain unchanged at yearly net revenue growth in the low-to-high twenties each year and to reach EBITDA margin levels of above 50% by 2026.

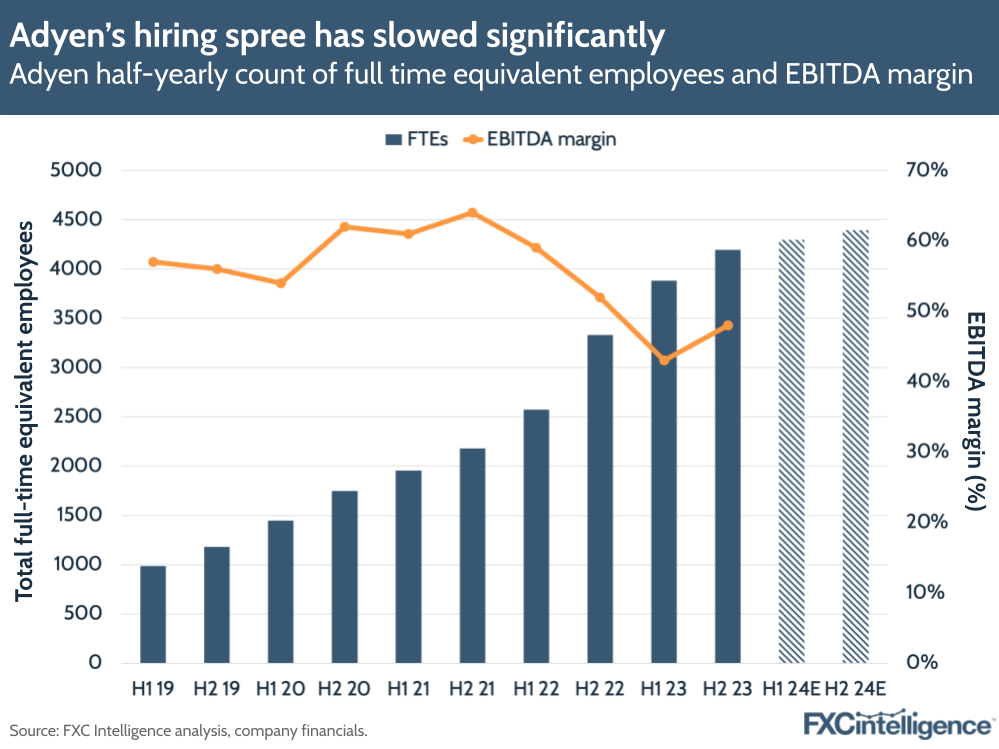

Hiring slowdown drives rise in EBITDA

A significant driver of investor enthusiasm following the results is likely the fact that Adyen has reported that it is now at the end of a two-year focus on investment. This saw it hire over 300 full-time-equivalent employees (FTEs) in 2023, largely in engineering roles beyond its Amsterdam HQ. This followed the onboarding of more than 1,700 people in the previous year.

However, this prompted an EBITDA margin drop, which is now beginning to reverse as hiring slows. This is expected to continue to improve in 2024 as the company plans to hire more slowly, with around 200 FTEs set to be added.

Adyen’s growth drivers

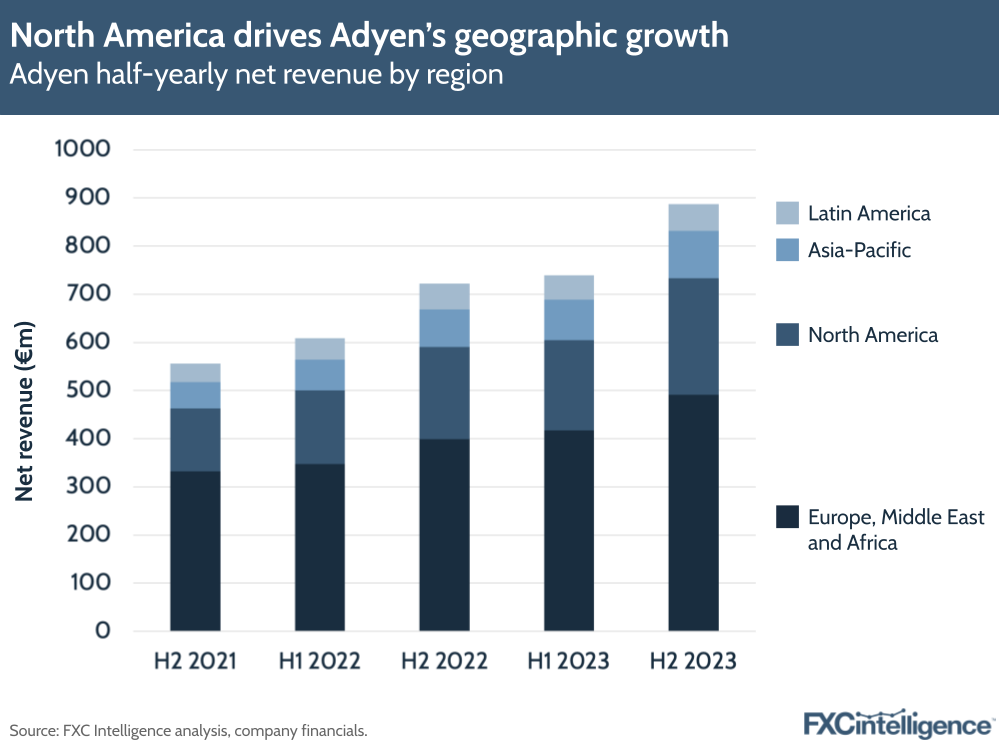

The company says that the global nature of this hiring is positioning it to better serve its increasingly geographically diverse customer base, with Adyen seeing H2 revenue growth above 20% in regions except Latin America. North America led the way, with 27% growth YoY in H2 23, followed by Asia-Pacific (25%) and Europe, Middle East and Africa (23%).

Core to this was a focus on the company’s land-and-expand approach, where it seeks to grow revenue within its existing customer base. This resulted in the company seeing more than 80% of its growth from existing customers, as well as volume churn of less than 1%.

This was reflected particularly in the company’s Digital segment, which saw an increase in volumes in H2 due to significant additional business from a single customer. This resulted in Digital processed volume growing 28% YoY for FY 23 to €606bn.

Meanwhile, the company also saw double-digit volume growth from all its other business segments, which it refers to as pillars. Unified Commerce saw the strongest growth, increasing 29% YoY to €253bn, with record volumes processed during the holiday season.

The company’s Platforms segment also grew 11% YoY to €111bn, although not including eBay volumes this segment climbed far more significantly, up 99% YoY for FY 23.

Adyen grows network connections

Adyen also made improvements to its network in H2, in part aided by it obtaining a UK banking licence. This enabled the company to obtain direct access to the Bank of England’s centralised clearing and real-time payment rail Faster Payments Services.

This is enabling Adyen to add instant payouts in the UK and follows its connection to the US Federal Reserve’s instant payment infrastructure in H1 2023.

The company is also working to support the EU’s upcoming PSD3 directive, through collaboration with card schemes and regulators.