As part of its Q3 2024 results, Latin America remittances major Intermex has announced it has put itself up for sale. But why has it made the move and what opportunities does the company present to a potential buyer, particularly compared to its competitors?

Six years after it made its public market debut via a merger with a special purpose acquisition company (SPAC), remittances player Intermex has announced that it is exploring a potential sale during its Q3 2024 earnings.

“We are initiating a process to assess strategic initiatives, which could include, among others, a potential sale in a private transaction,” said Chairman and CEO Bob Lisy during the company’s earnings call, adding that the company had retained FTP Securities (investment bank FT Partners) as a financial advisor to support the process.

“We believe this move will create flexibility to optimise our growth and better fulfil our potential as an industry-leading fintech.”

While the sale is not guaranteed, it may prove to be a key move for Intermex. Though it retains a powerful market share in a number of key US to Latin America corridors, the company’s presence beyond these markets is minimal, and requires considerable investment to grow. Intermex was also slower than some of its competitors to commit to a shift to digital, and while it is seeing strong growth and profitable margins here, it also requires further investment to maximise this.

As a result, a move to becoming a privately held company – in a manner similar to MoneyGram’s 2022 acquisition by private equity firm Madison Dearborn Partners – may allow Intermex to break out from its cycles of sluggish growth and commit serious investment to stepping up the company’s presence and reach.

But where is its main potential, and where do challenges lie for any would-be buyer of the remittances player? In this report we explore Intermex’s strategy, financials and proposition versus the market with a view to a potential sale.

Intermex’s background and history as a public company

Founded in 1994 as Intermex Wire Transfer, the company initially operated only in a small number of US states sending to key Latin American markets, focusing initial expansion on areas with large Hispanic populations. Over the next two decades, it built out its send capabilities across the US, while also increasing its receive capabilities across Mexico, Central and South America. Establishing a strong cash-focused agent network alongside a smaller online offering, it saw remittance transactions grow by 71% between 2015 and 2017.

After being acquired by a private equity firm in 2017, Intermex made its public market entry on the Nasdaq via a merger with the SPAC Fintech Acquisition Corp II in 2018. At the time, Lisy highlighted opportunities to continue growing both its core business, as well as making acquisitions, pointing to its US agent network as its primary growth driver, aided by development of its “online services, loyalty cards and scalable proprietary processing capacity”.

As a public company, Intermex has made some key acquisitions, including the acquisition of La Nacional and I-Transfer, both of which were announced in 2022, but which fully closed in 2023. The former, the bigger of the two acquisitions, saw the company further bolster its presence in Latin America, making Intermex the market leader in the region’s five biggest markets, which together account for more than 80% of remittances sent from the US to the LatAm region. It also saw Intermex’s send capabilities expand from 28 markets to over 70, adding countries across Asia, Europe and Africa.

While smaller, the acquisition of Spain-based I-Transfer also broadened Intermex’s send capabilities beyond the US for the first time, adding send capabilities from Canada, Italy, Spain and Germany. Meanwhile, the 2024 acquisition of a small unnamed remittances player saw the company add the UK as a send market.

Intermex has also made moves into the digital space in this time, launching an improved app that supports sending from the US in 2022.

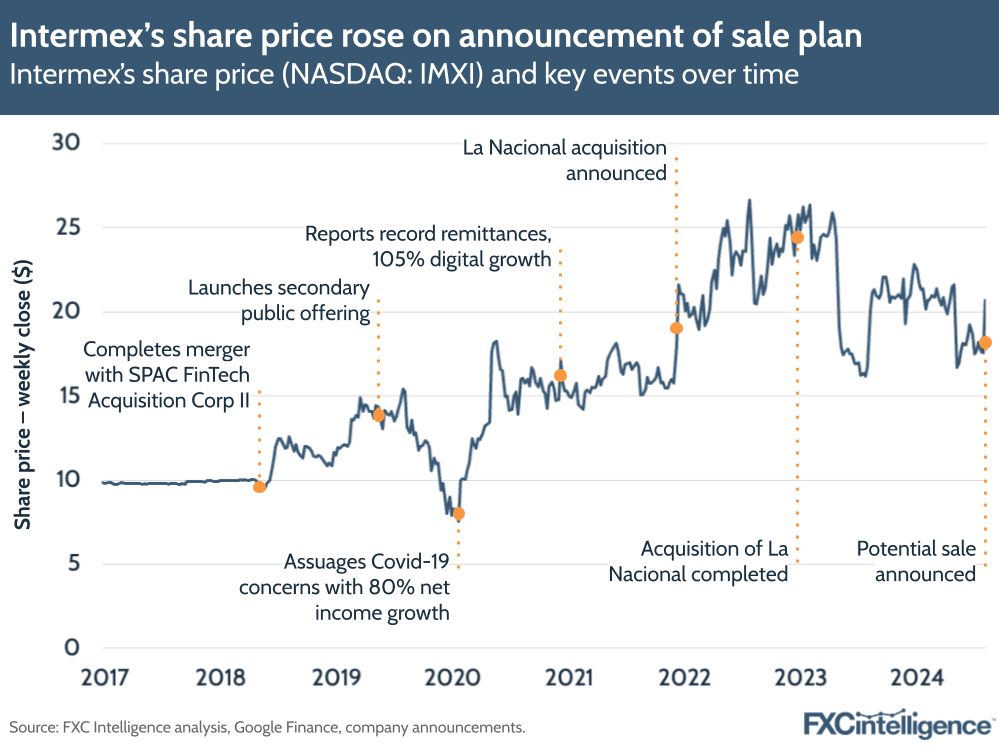

Since its initial market listing, Intermex’s share price has seen numerous peaks and troughs, but it has generally moved above its initial price, only dropping below this point at the outset of the Covid-19 pandemic when there were fears that the impact on remittances would be considerably more severe than was ultimately the case.

However, there have been a number of sharp declines following earnings that did not live up to investor expectations, particularly in the last year. Today, the company’s share price is around twice its initial listing price, although it has risen sharply since the company announced its plans for a potential sale.

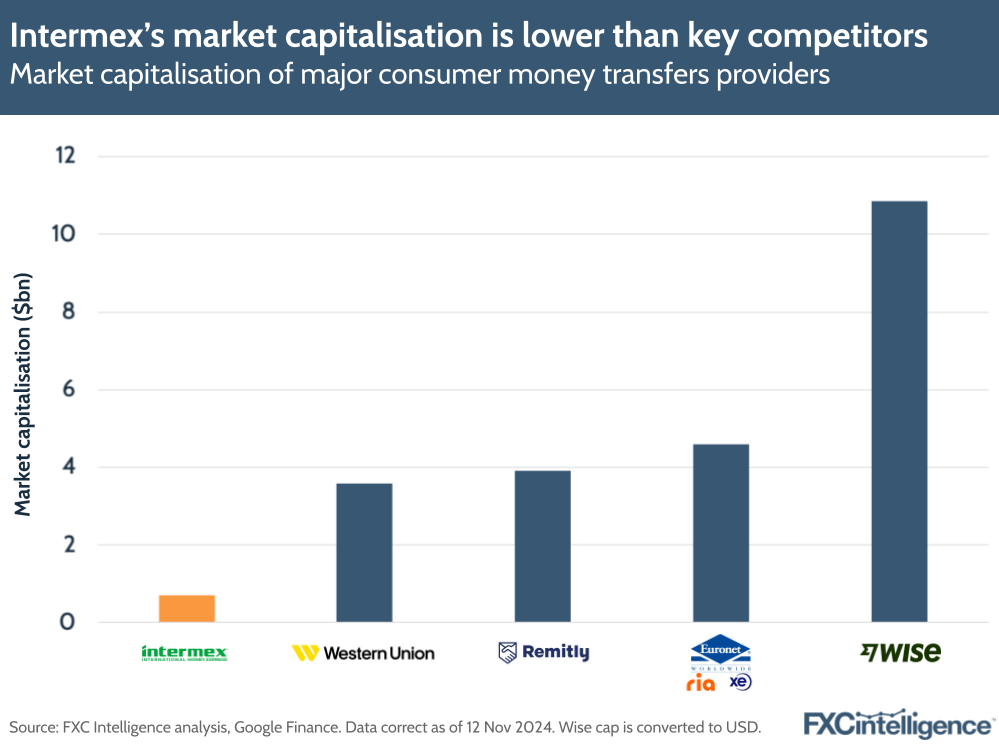

Despite the uplift from the announcement, Intermex’s market capitalisation remains significantly below many of its competitors, at around $0.7bn. By contrast, traditional remittance major Western Union has a market capitalisation of $3.6bn, while digital-first challenger Remitly’s sits at $3.9bn. Intermex is also below MoneyGram’s market capitalisation when it was a publicly traded company, which stood at $1.1bn prior to its delisting.

Latin American market presence

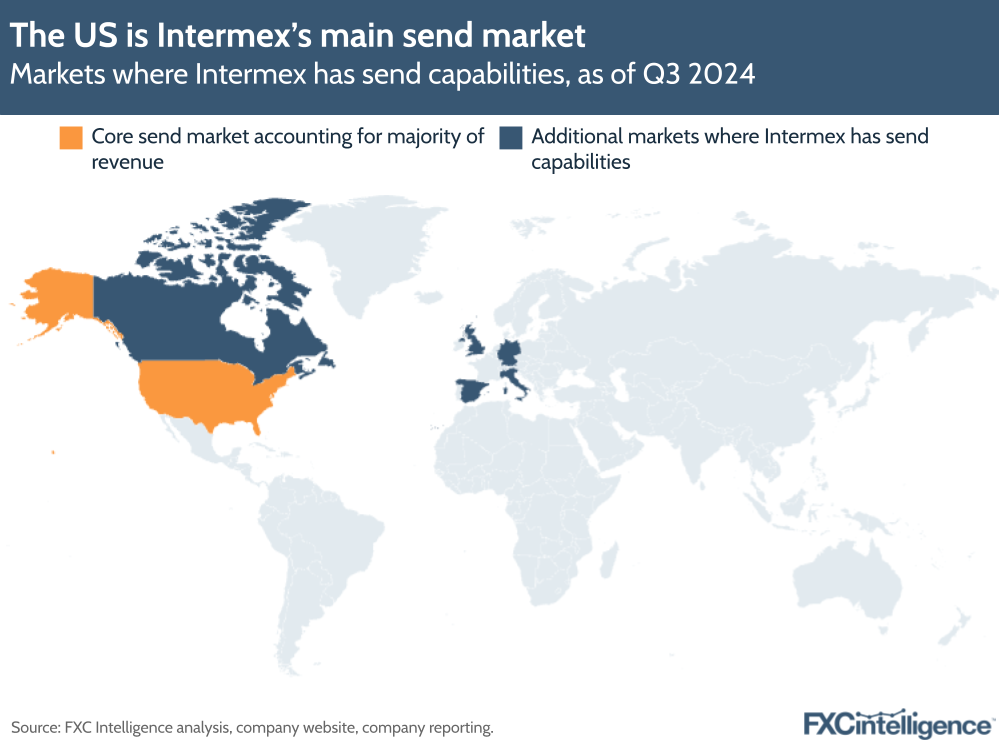

While most major money transfers players have a significant global presence, Intermex ultimately remains a regional player, albeit in a very important market for remittances.

On the send side, its primary market – and from a brand perspective, its sole market – is the US. While it lists send capabilities in the UK, Canada, Spain, Germany and Italy in its earnings reports, these are at present not accessible via Intermex’s website or app, and instead are accessed via the websites and outlets of the companies it has acquired.

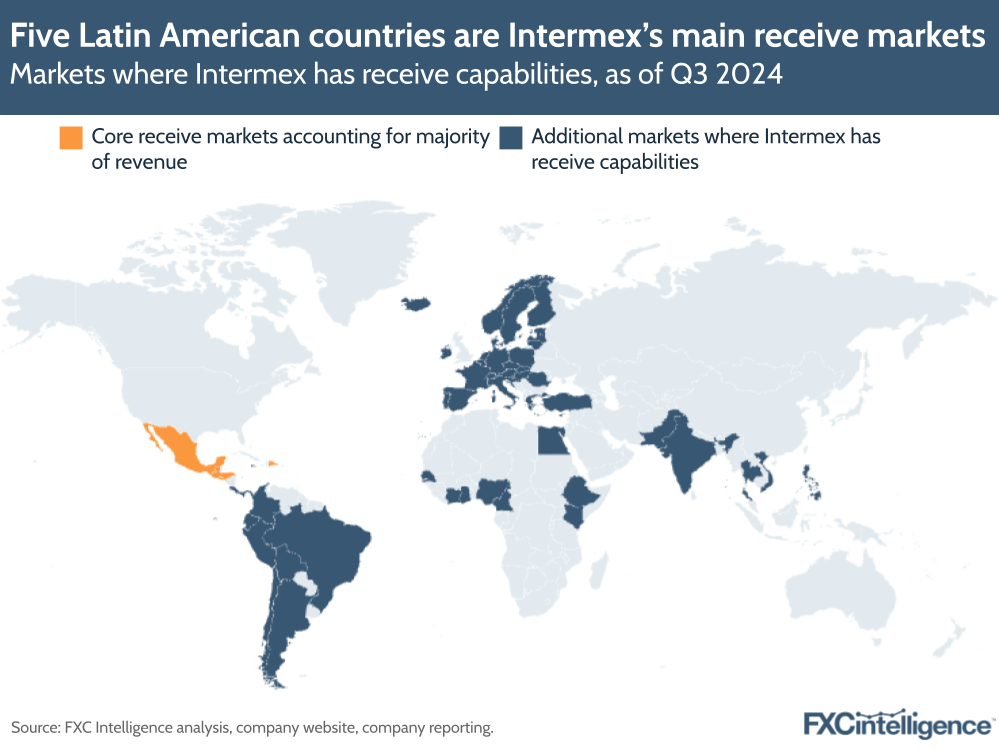

On the receive side, Intermex reports that the majority of its revenue comes from Mexico, Guatemala, El Salvador, Honduras and the Dominican Republic, although it does also offer payout services to numerous markets across South America, Africa, Asia and Europe.

While across Latin America it has a significant retail presence, for many of the markets beyond this region, the company only lists payouts through select digital payment methods. In many European markets, for example, payouts are via Visa, while in parts of Africa they are offered via digital wallets.

While its offering beyond the US to Latin America corridors remains limited, Intermex’s presence in Latin America is significant. In 2023, the company reported that its market share of consumer remittance volumes across Mexico, Guatemala, Dominican Republic, Honduras and El Salvador was 21.4%. This group of five countries are estimated to account for 82% of flows from the US to Latin America, making Intermex a very significant player in the market.

In Guatemala, Intermex’s share totaled 29.7% of remittance volumes in 2023, while for the US to Mexico corridor – the largest corridor in terms of remittance flows globally – the share was 20.8%.

Intermex largely caters to blue collar workers, many of whom have traditionally favoured retail over digital due to a mixture of trust and being paid in cash for work.

“When they get paid in cash, it’s convenient for them to send it retail or they have cash out and they pay it retail,” explained Lisy in a conversation following the company’s Q2 2021 earnings.

“The retailer is a tried and true and very tested and trusted component in this for the sender.”

Revenue performance and market comparison

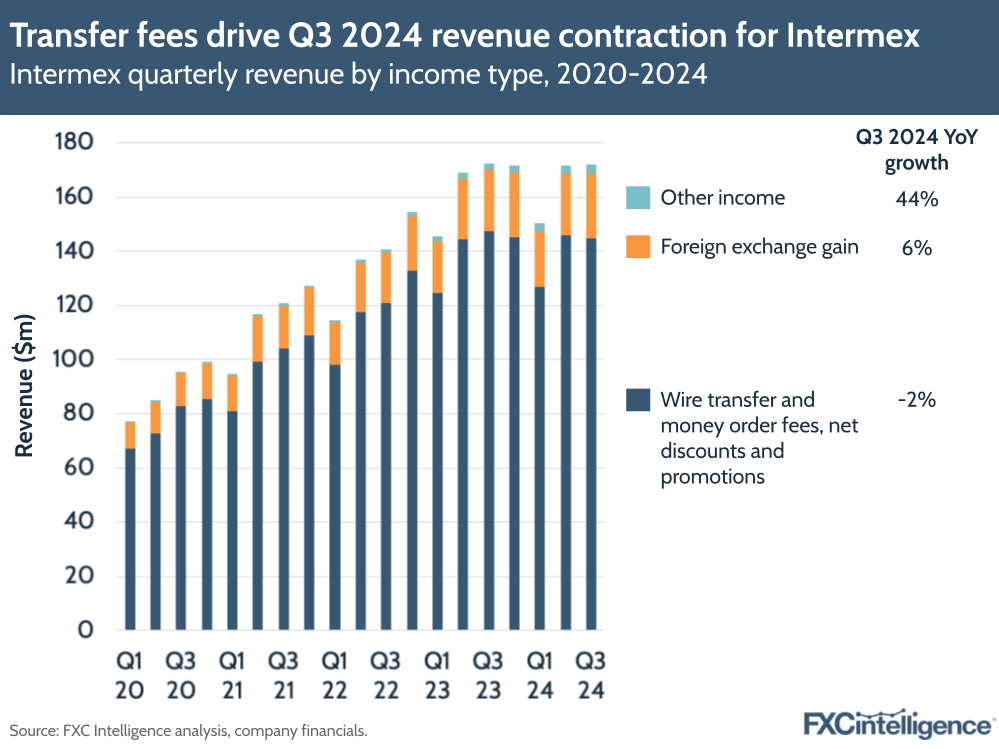

In the company’s latest Q3 2024 results, Intermex reported a slight reduction in top-line revenues, which contracted by -0.3% to $171.9m. The company attributed this to a general slowing of growth in the Latin American remittances market, particularly on the retail side, but also said that the digital side of its business had provided some uplift.

However, it did see a 6.9% gain in adjusted EBITDA to reach $33.9m, for an adjusted EBITDA margin of 19.7% – its strongest margin in two years.

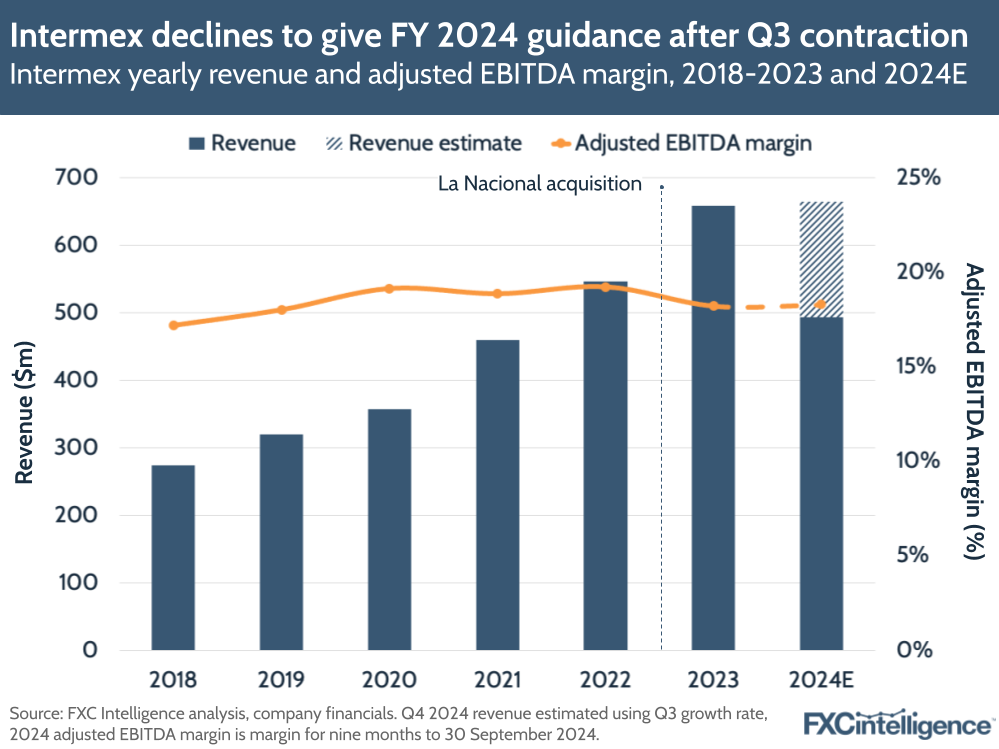

Intermex also opted not to provide FY 2024 revenue guidance, having previously revised this down to projected revenue growth of 0-3% in Q2 2024. However, if the company sees the same -0.3% YoY reduction in Q4 as Q3, its full-year revenue will be 1% above that of 2023.

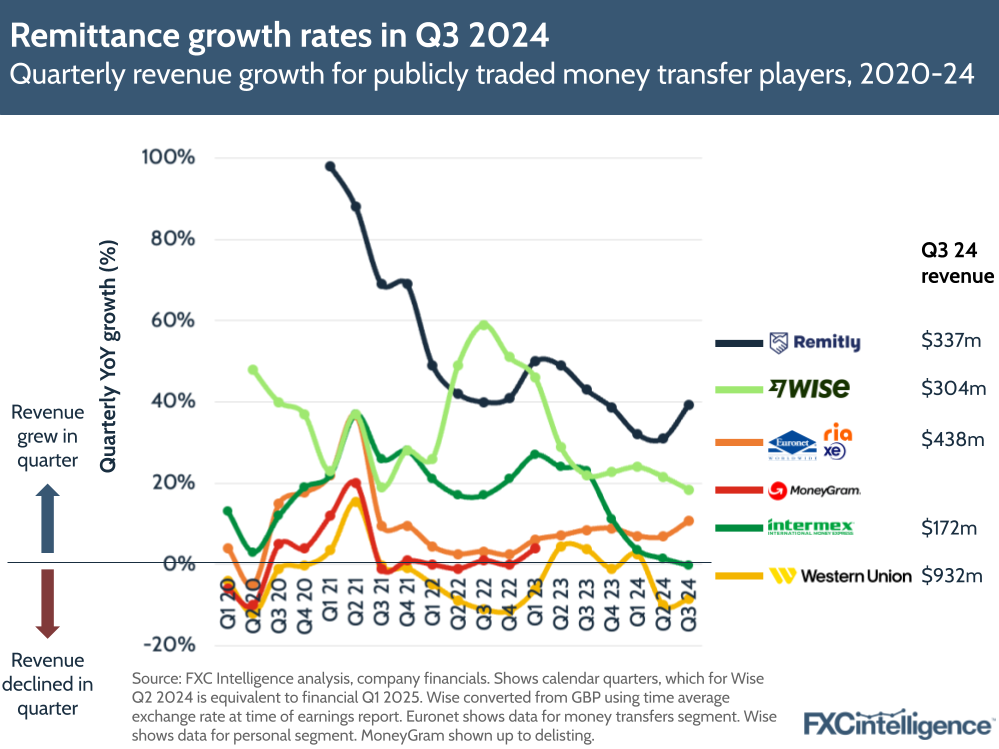

This is the first quarter of negative revenue growth that the company has reported, however it does follow successive quarters of slowing growth. Having reported growth of 20%+ in almost every quarter from Q1 2021 onwards, in Q4 2023 the company saw this drop to 11%, and in Q1 2024 it fell to a then record-low for Intermex of 3%, followed by 1% in Q2.

This decline in growth has been driven by the company’s wire transfer and money order fees, which saw a -2% decline in the latest quarter. Making up the majority of the company’s revenue, this represents the fees the company makes from money transfers and money orders, with the majority derived from money transfers initiated at retail outlets in the US to one of its five core markets in Latin America.

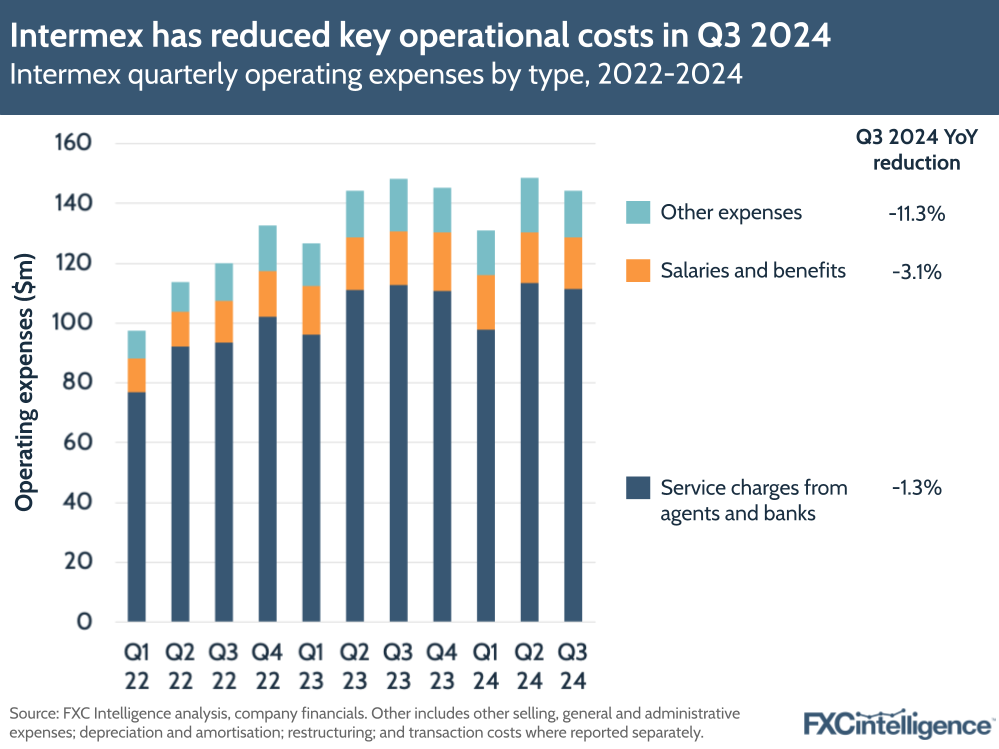

While its core revenue source has contracted, Intermex has improved its adjusted EBITDA margin through improved operational efficiencies, having achieved reductions to all forms of operating expenses, particularly salaries and benefits, which saw a 3.1% reduction.

On the most recent call, Lisy also highlighted that the company’s retail sales and marketing costs are “well below 10% of gross margin, making this business highly profitable”.

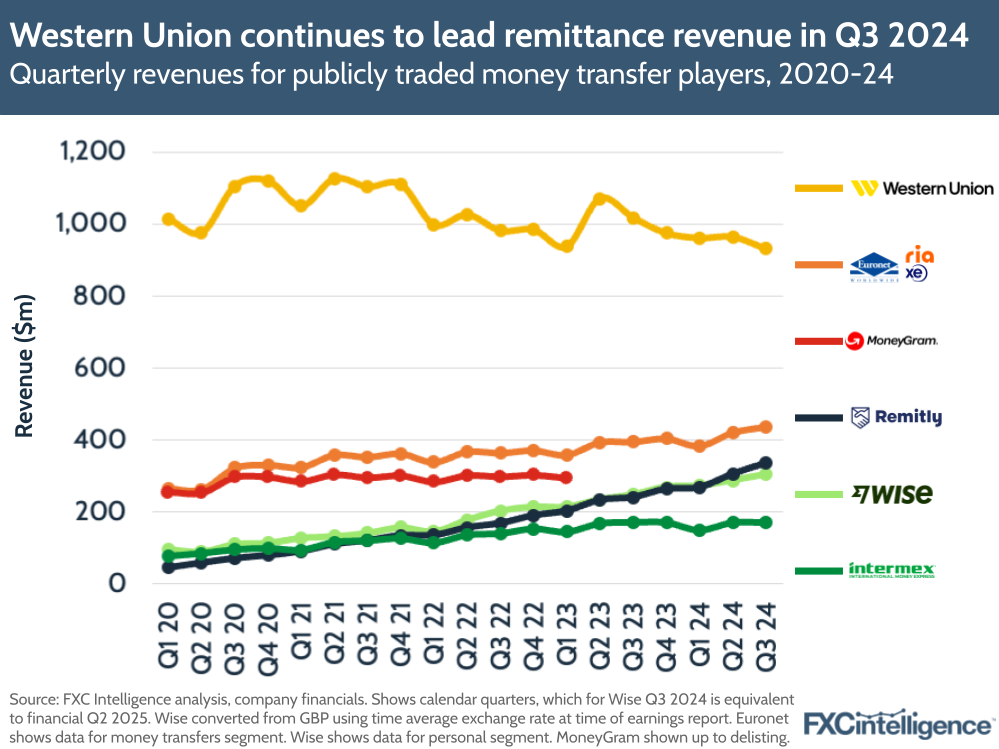

Compared to other publicly traded money transfers players, Intermex’s revenue is relatively small. For the latest quarter, Western Union remains the leader in terms of revenue, at $932m – 5.4 times Intermex’s $172m – while Euronet’s money transfer segment, which includes Ria and Xe, totalled 2.5 times Intermex at $438m.

Despite having reported very similar revenue to Intermex across 2021, Remitly is now twice Intermex’s revenue, while Wise is at around 1.8 times the revenue.

As with previous quarters, the revenue growth of money players is largely split along digital lines, with digital-first Remitly and Wise continuing to see strong double-digit growth, while Euronet, buoyed by digital-first Xe, saw 11% growth. However, the traditionally retail-led Western Union saw the poorest growth, with a -8.5% decline.

Intermex’s market position: Volume and transactions

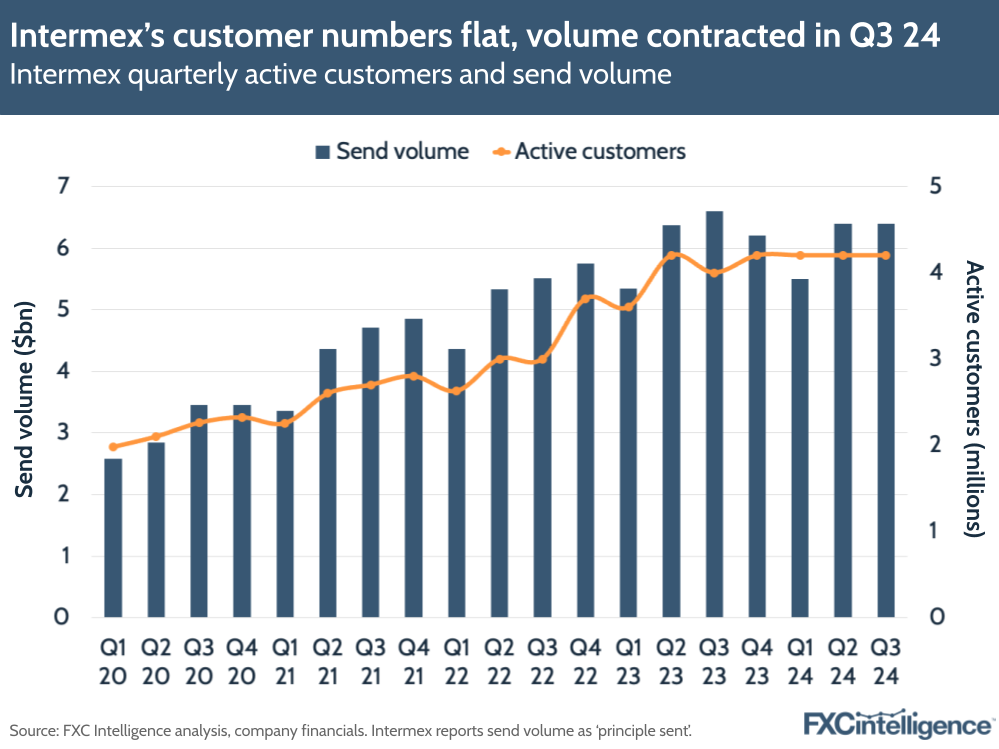

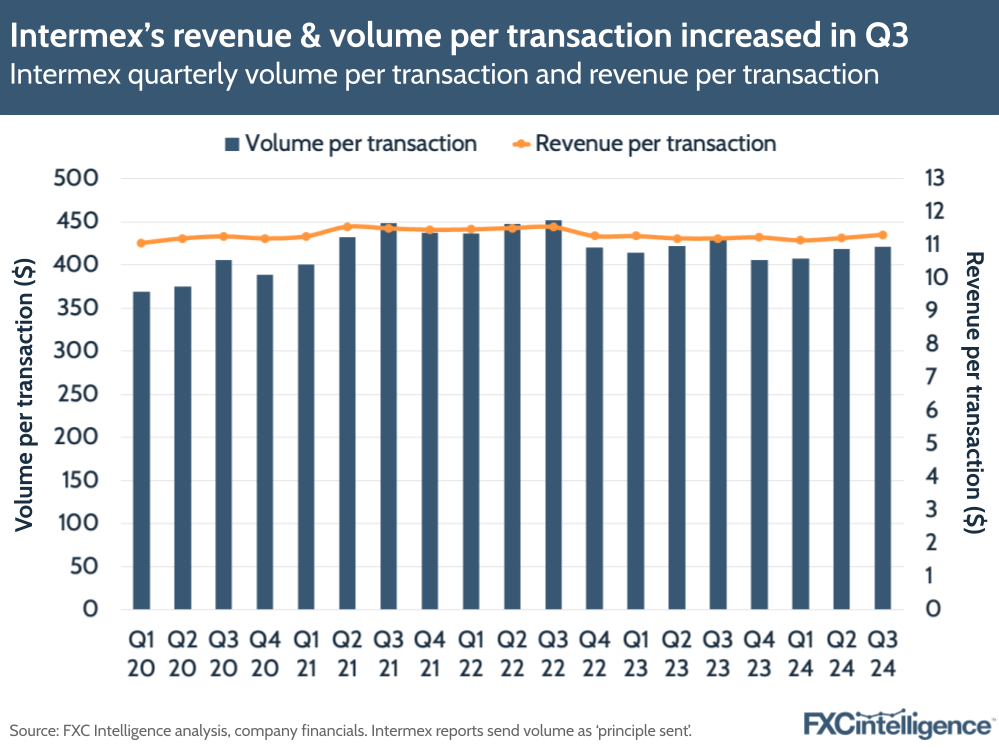

Looking to volume, there is a relatively similar story to revenue at the top level for Intermex. In Q3 2024, the company reported $6.4bn principal sent, representing a -3.02% decline on the previous year. It also saw a drop in the average principal sent in an individual transaction, which dropped -2.3% to $419.

However, while there was no notable growth in active customers compared to the previous quarter, with the total having remained flat at 4.2 million for the past four quarters, this does represent a 5% improvement on Q3 2023.

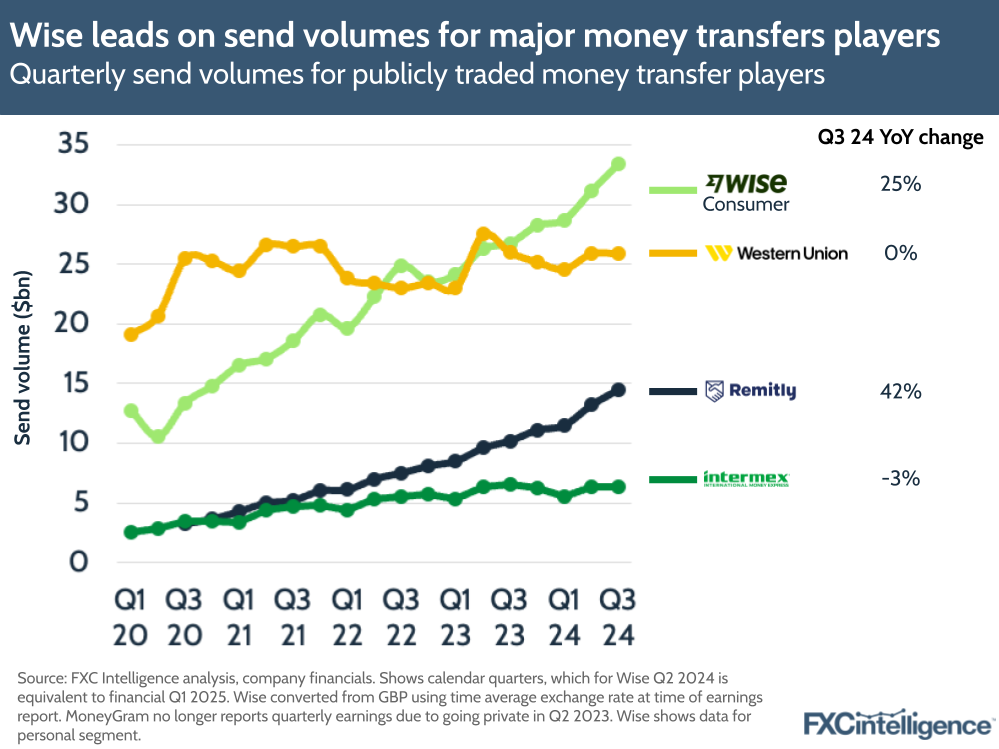

Intermex’s volumes are, as with its revenue, below those of other publicly traded money transfers companies. On this metric, Wise has now outstripped traditional market leader Western Union and is 5.2 times Intermex at around $33bn. Remitly, meanwhile, is 2.3 times Intemex’s volume at $14.5bn.

However, it is worth noting that all of these companies operate in considerably more corridors than Intermex. Remitly, for example, serves more than ten times as many corridors than Intermex at present, with around five times the send markets and 2.1 times the receive markets.

Although Intermex’s volume has declined, its per-transaction metrics show a slightly different story. While its volume per transaction remains -1.7% below Q3 2024, it is the highest it has been in four quarters. Meanwhile, its revenue per transaction is 1% above the previous year and 10 cents above Q2 2024, at $11.31.

This is likely to have been aided by changes to its loyalty programme, which saw the company reduce the expiration period for points earned on transactions from 180 days to 90 days.

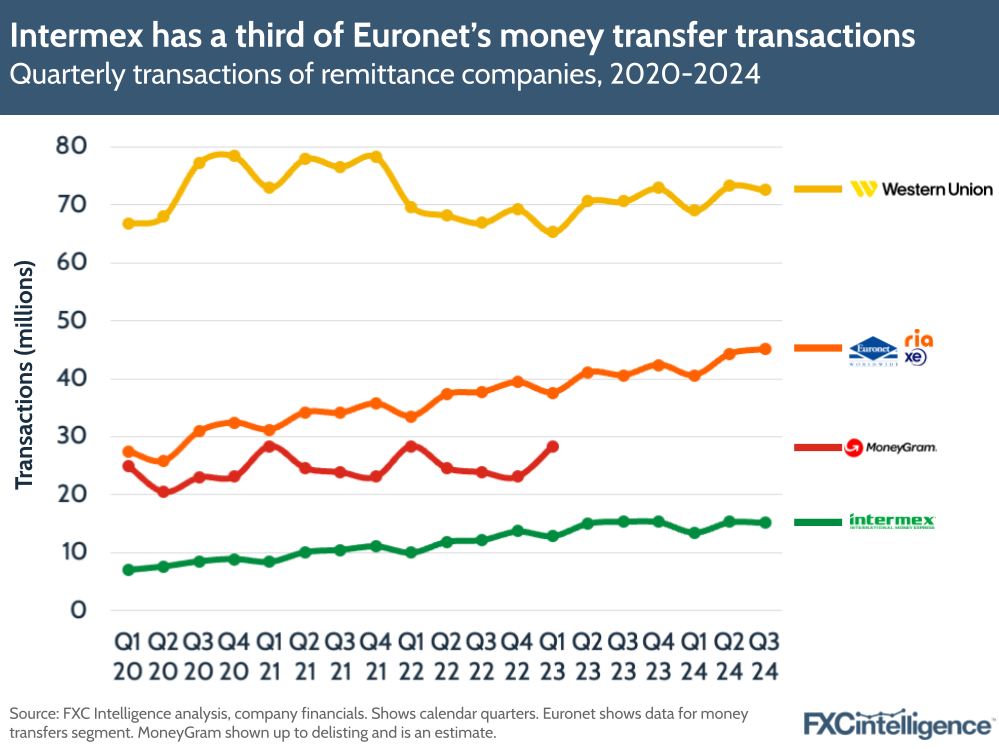

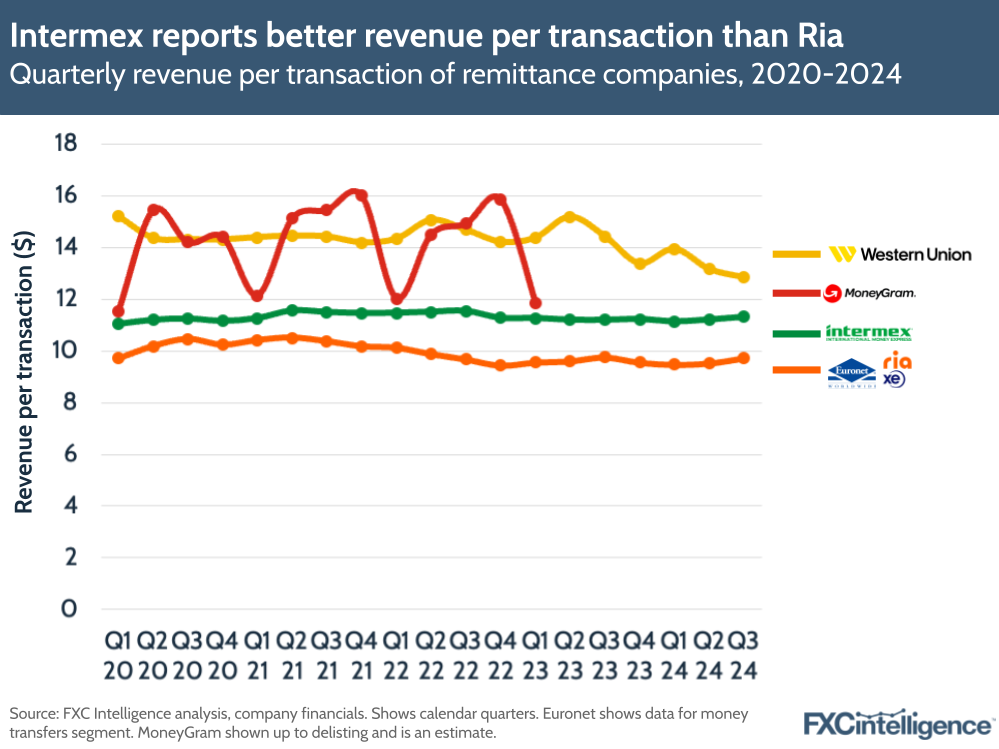

When compared to other money transfers companies who report this metric, Intermex’s transaction numbers are lower, but not as sharply as on some other measures. Euronet’s money transfer division saw 3 times the number of transactions, while Western Union saw 4.8 times.

Crucially, Intermex performed better than Euronet on revenue per transaction, with the latter reporting $9.72 in Q3 2024. Western Union was slightly above Intermex’s $11.31, however, at $12.84.

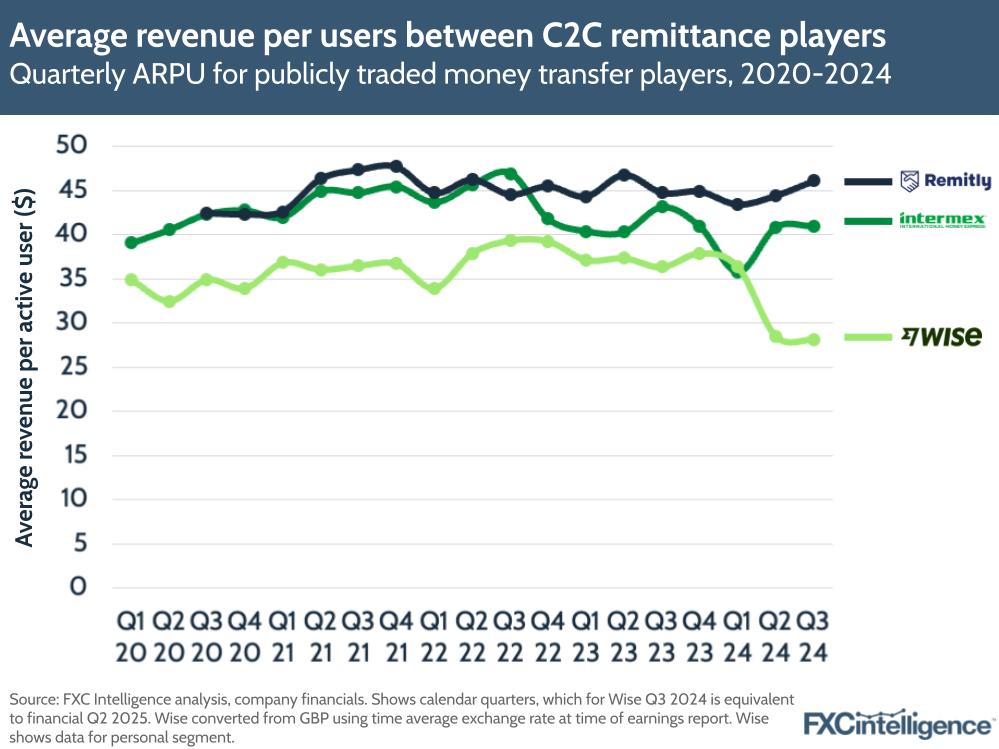

While Euronet and Western Union do not consistently report active customer numbers, it is possible to compare Intermex’s average revenue per user (ARPU) to those of Remitly and Wise.

Here, Intermex is above Wise with a Q3 2024 ARPU of $40.94, compared to Wise’s $28.07. Remitly, however, is slightly ahead, at $46.09.

Digital money transfers: Intermex’s growth and potential

While Intermex has traditionally been a retail remittances player, and has in the past insisted that retail remains the primary focus for its customer base, particularly on the send side, in the last few years it has begun to wake up to the opportunities in digital money transfers, and the need for it to more effectively pivot in this direction.

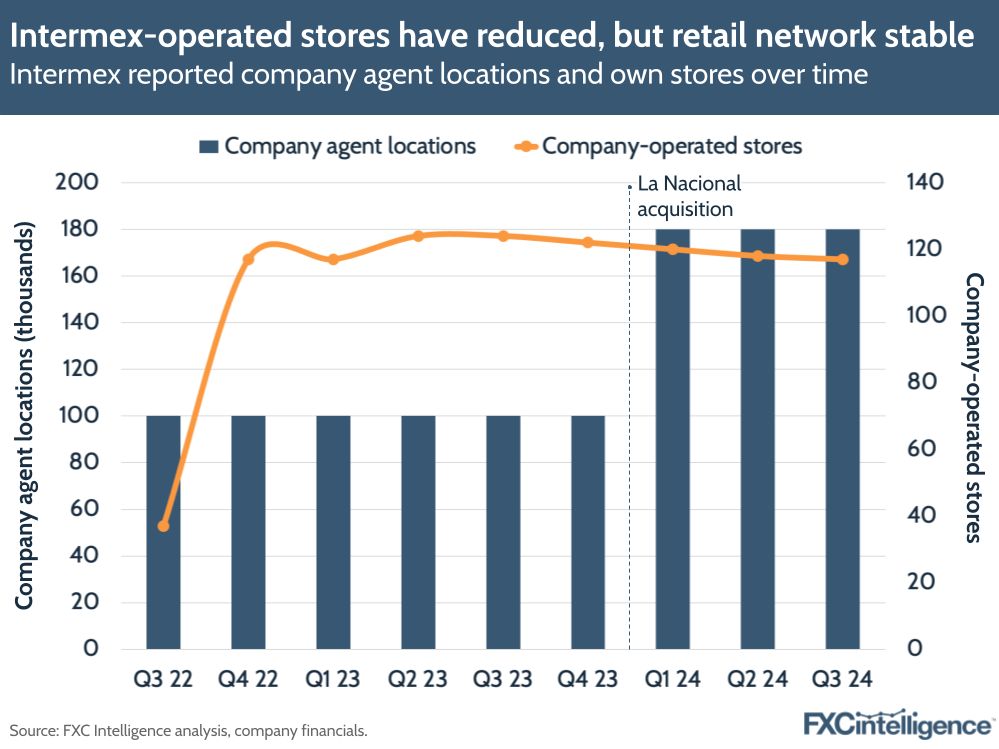

This is reflected by its reports of a contracting retail market in the US-LatAm corridors, and also in its retail metrics. The company has also reported flat metrics in terms of its retail agent locations since a jump caused by its acquisition of La Nacional, while its company-operated stores have consistently declined in number since Q2 2023.

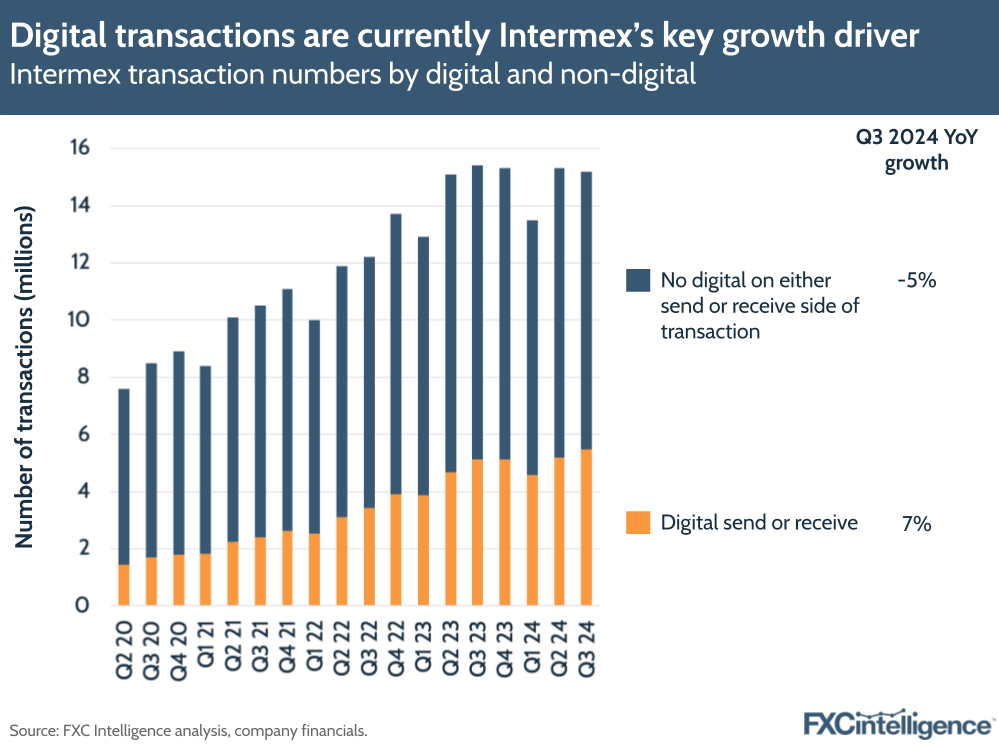

While Intermex does not yet break out many key metrics related to its digital business, it has seen transactions that are either digital on the send or receive side grow consistently, reaching 36% for the first time this quarter.

This represents around 5.5 million transactions, up 7% from the previous year, while the number of transactions with no digital on either the send or receive side has dropped by -5% over the same period.

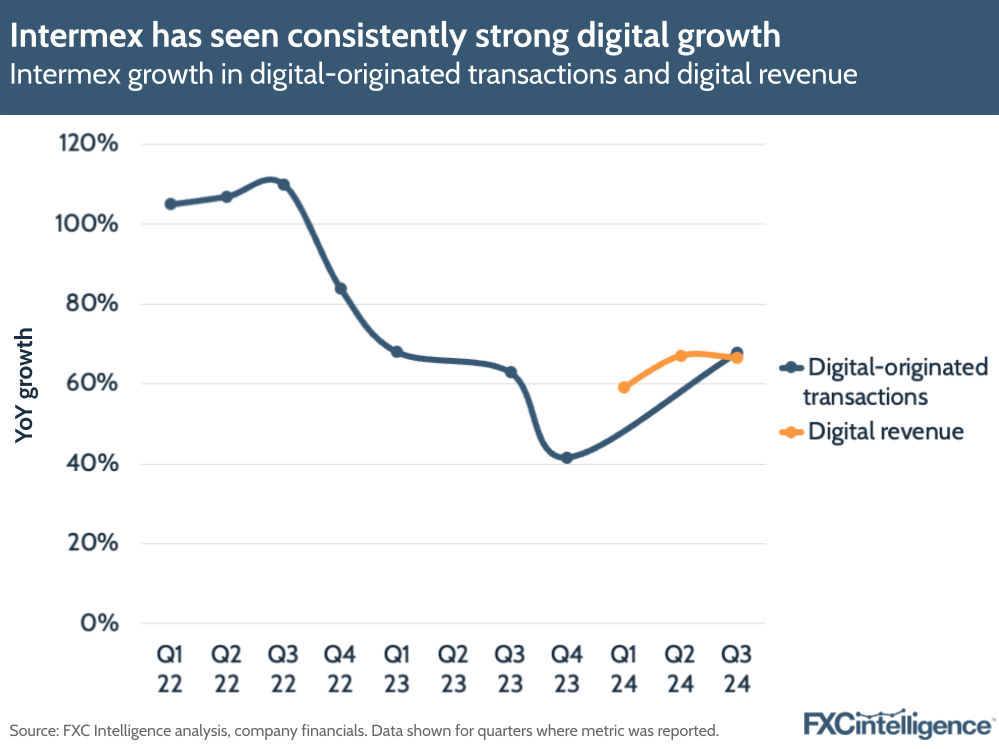

Transactions that are digital on the send side represent a smaller share of the overall number, with the company reporting this at “a little less than 10%” but are growing far more quickly, having consistently seen double-digit growth over the past few years and in Q3 2024 gaining 67.8%.

There has been a similar picture for digital revenue growth, a metric that Intermex has only begun to break out in the last three quarters but which saw a 66.5% increase in the latest quarter.

The company also highlighted digital’s improved unit economics during the latest earnings call, including that gross profit per transaction was now higher for digital than retail. Marcelo Theodoro, Intermex’s Chief Product, Digital & Marketing Officer, also confirmed that much of this improvement was the fact that the company does not need to pay agent fees on digital, although there is a card processing cost not typically associated with a cash-based transaction.

For Intermex, the digital shift represents a move with its customers, driven by increasing digitisation across Latin America. However, the company also stresses that retail is by no means vanishing, and at present still represents around 70% of the US to LatAm market.

“We’re not looking at a retail market that we think goes away in five years,” said Lisy.

“Our projections [suggest] the retail market might still be bigger than the digital market in five years, but there will be faster growth in digital than there is in retail.”

While there is potential, there is some way to go versus the market.

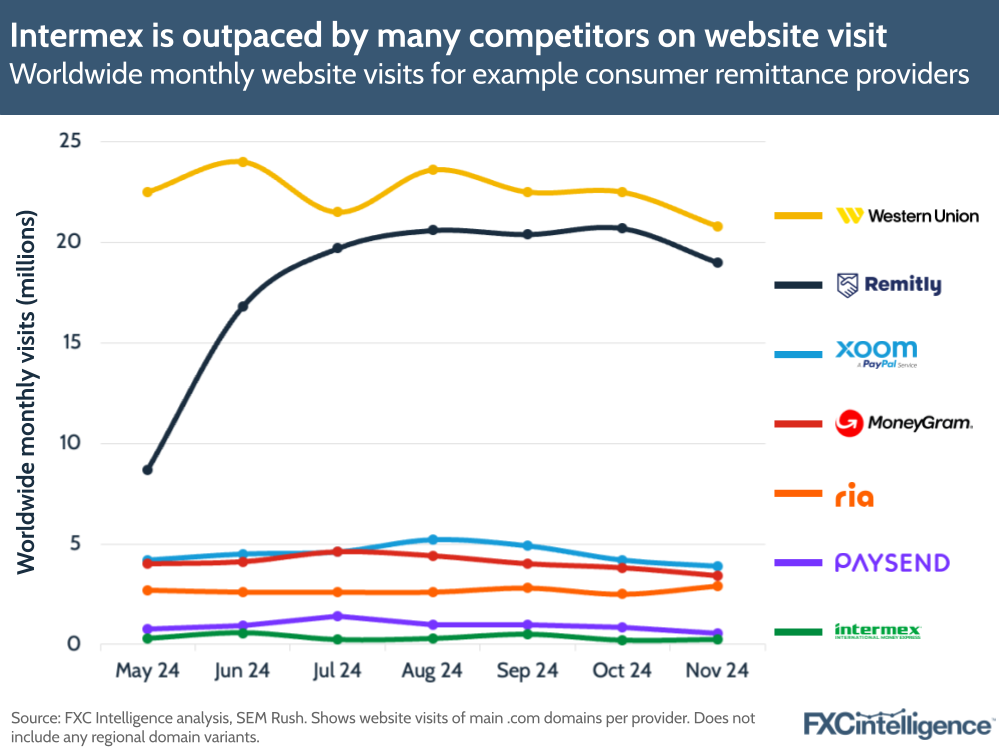

Intermex’s digital presence remains smaller than many of its competitors, as reflected by its website traffic compared to many other key companies. While it is below Paysend, a UK-headquartered player whose key markets include LatAm, it is relatively close, but sits far below the traffic of larger players such as Remitly and Western Union.

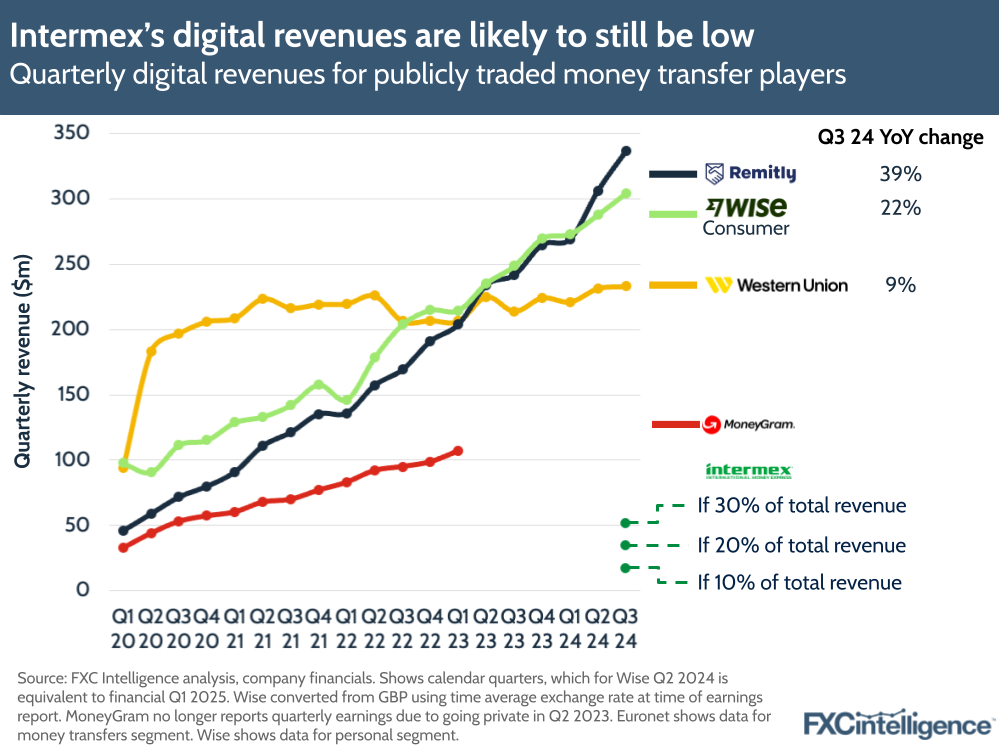

Although Intermex does not report direct revenue metrics from its digitally initiated transactions, they are unlikely to be much over 10-20% of its overall revenue. And even at a highly optimistic 30% share of total revenue, Intermex would still be far below many of its competitors on the metric.

While both Remitly and Wise now far outstrip Western Union on digital revenue, the latter still has digital revenues that are likely to be at least five times those of Intermex. However, while smaller, the LatAm-focused player is seeing far stronger digital revenue growth rates than Western Union, at 66.5% versus WU’s 9%.

Growth opportunities and potential buyer profile

For Intermex, a sale is ultimately an attempt to better reach the market potential of the business. While announcing that Intermex was putting itself up for sale, Lisy highlighted that its management and board “firmly believe that [Intermex’s] current market valuation does not fully capture the company’s performance, superior positive cash, intrinsic value or growth potential”.

This is highly reminiscent of other recent moves, including MoneyGram’s sale, as well as Nuvei’s move private through a deal with private equity firm Advent International and Worldpay’s sale to GTCR. In all these cases, the sale was ultimately to a private equity player, and it is likely that if Intermex does sell, it will do so to a similar organisation, who will look to realise rapid growth and transformation via significant short-term investment.

While the actual results in Intermex’s latest earnings were highly muted, much of the narrative of its release, and in particular the call itself, was framed around positioning the company as an appealing prospect for a potential buyer. And central to that positioning was the company’s digital growth in Latin America.

“We feel the optimal time is now to unlock the company’s opportunity with regard to its digital channels offering,” said Lisy, adding that the company’s app was “as good as any in the industry”.

“Combined with the highest standard of superior customer care and our strong reputation in the Latin American corridor, Intermex is in an ideal position to compete and to win.”

For any buyer, the focus is therefore likely to be on investment to maximise the company’s shift to digital in a region that includes the world’s largest remittance corridor. However, there was a curious lack of discussion about Intermex’s other receive markets.

While Lisy did highlight the potential to grow in Europe on the send side, pointing to the company’s licences in the UK and Europe, there was no mention of Asia or Africa despite the company only adding these send markets in the last few years.

These broader market capabilities do present some long-term opportunities for Intermex, however it’s clear that its presence in such markets remains highly nascent relative to Latin America, and therefore the investment required to realise growth in these areas would likely need to be considerably higher.

For any company reviewing Intermex as a potential acquisition, this is therefore a Latin America-focused company with strong digital potential first, and an international remittances company with international potential in distant second.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.