Money transfer remittances player Intermex saw an expected slowdown in growth in Q2 2024, with revenue rising 1.4% YoY to $171.5m. The company is continuing to see external market conditions affecting transfers but is seeing strong digital growth, which it hopes to bolster through a UK licence it has acquired from a new acquisition in July.

Highlights from Intermex’s Q2 2024 results are as follows:

- Principal sent saw nominal growth YoY to $6.4bn, while customer numbers grew 3.9% to 4.2 million. Overall, money transfer transactions grew 1.3% to 15.3 million.

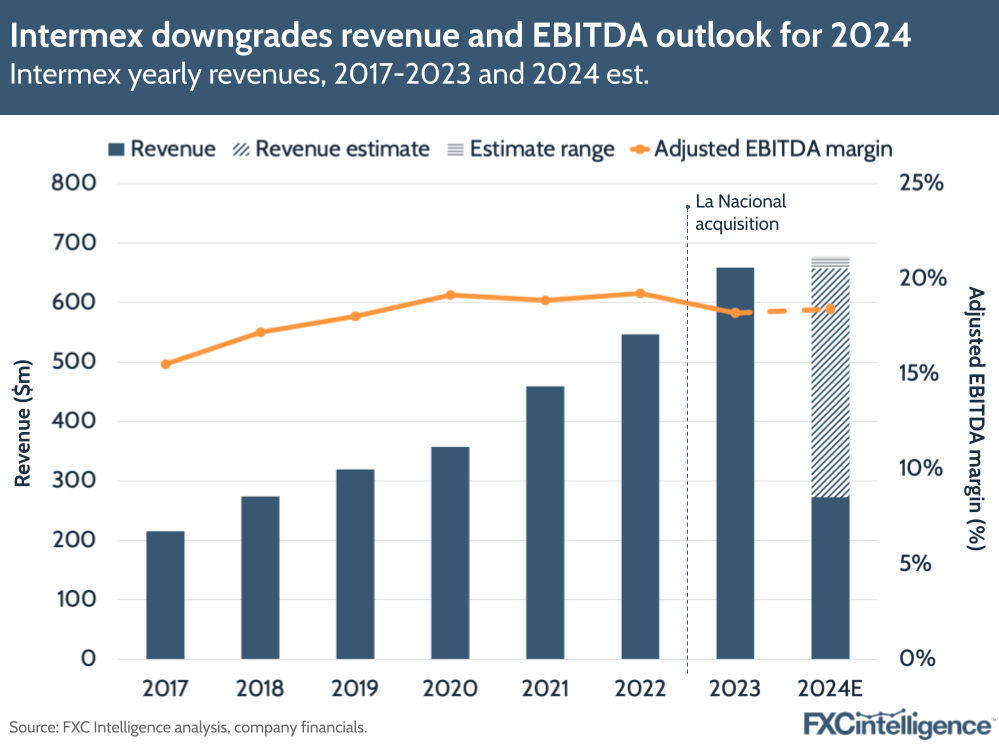

- Intermex downgraded its revenue guidance, which it now expects to be $657.6m-677.6m (down from $681m-701.8m), while it anticipates EBITDA to be between $121.1m and $124.7m, giving a margin of around 18.4%.

- Adjusted EBITDA for Q2 2024 came in just below expectation at $31.1m, a 0.6% growth, giving a slightly lower margin than last year at 18.1%, while net income was $14m, down by 9.1%. However, the company did note that La Nacional – a rival remittances player Intermex acquired last year – saw a threefold increase in EBITDA.

- Amid a slowdown in growth, Intermex grew digital revenues by 67%, while the share of transactions sent or received digitally was 34%, up by 11% YoY compared to the previous share figure. During the earnings call, CEO Bob Lisy said that the gross margin for the company today was actually better for digital than retail, but the company needs to rebuild its strength as a retail business to invest more in digital.

- Lisy said that its European business is still relatively small and currently driven by Spain and Italy, but the company is targeting expansion in big remittances markets such as Germany, France and the UK. This in turn will aid digital expansion, as he says the market is “more ready” for digital than the US.

- On competitors, Lisy said that some of these have suffered from being too diluted, while Intermex was built specifically to focus on markets such as Mexico and Guatemala, where the metrics show these to be major remittances markets.

How can I find the biggest markets for remittances globally?