Intermex has become the latest remittance provider to report record results in Q2 2021, with year-on-year revenue climbing 37% to $117m. This has been fuelled by a 53% increase in volumes to $4.4bn, with remittance transactions reaching 10m for the first time. I spoke to CEO Bob Lisy to learn what the company plans next.

Intermex has become the latest remittance provider to report record results in Q2 2021, with year-on-year revenue climbing 37% to $117m. This has been fuelled by a 53% increase in volumes to $4.4bn, with remittance transactions reaching 10 million for the first time.

Key to this has been an omnichannel strategy that reflects the cash needs of the company’s blue collar customers, as well as growth in both core and emerging markets.

Given the company’s sustained growth, how does Intermex plan to continue its success, and what role will both retail and digital play?

Daniel Webber spoke to CEO Bob Lisy to build on the company’s earnings call and discuss Intermex’s plans for the future.

Topics covered:

- Key drivers of Intermex’s growth

- Definition and drivers of digital

- Challenging customer lifetime value claims

- Intermex’s omnichannel strategy

- Growing the retail business

- Intermex’s acquisition plans

Drivers of Intermex’s Growth

Daniel Webber: First of all, well done, that’s a good quarter. Let’s start with your growth – you’ve seen strong principal and growth in both your core and emerging markets, which importantly is sustaining over multiple quarters. What’s driving that?

Robert Lisy:

I’ll talk about the overall drivers of the market first. The economy’s been really strong in the US and there’s been a lot of money put out on the street; people have more money in their pocket. Our consumers have either been benefiting directly in some cases, in getting government subsidies or government incentives, or they’re benefiting second-stage from that.

Someone says, “We just got this $2,500 from the government or this $10,000 or whatever it is. We’re not going to take a vacation this year because of Covid. Why don’t we finally put that deck on the back of the house? Why don’t we re-landscape the yard,” or whatever, and the people doing that work are our customers. So, anecdotally, that’s a big piece of it.

Along with that, there’s a bigger need because the recovery and Covid relative’s seriousness and the damage to the economy in some of our receiving countries is much bigger and stronger than even anywhere in the US.

So there’s a need south of the border, more money north of the border. It’s going to flow south of the border. That’s resulted in higher principal amounts and more money going and traveling to Latin America – Mexico, obviously, most importantly – than it otherwise would and the growth there.

The other part of our growth and the driver behind it is that, unlike our much more nervous public company competitors, when Covid came around we really didn’t lose our cool.

We stayed the course. We kept everyone employed. We kept our full sales team employed. They began laying off people almost immediately. They cut commissions, they cut salaries.

We picked up people from some competitors, and we went to our salespeople and said, “Not only are we going to keep you fully employed, but we’re going to guarantee your commissions here for April, May and June, and after June, we’ll kind of take a look at things and tell you whether we can continue to guarantee them or where we are.”

But by July, our business was coming back, and having kept our people employed, we were able to exploit the weaknesses of our competitors who had deserted retail, both our public company competitors and our private company competitors. That just built a snowball. You saw a tremendous growth in the second half of 2020 relative to the marketplace. We really came back fully, had a little downturn in second, but we grew year over year 20 versus 19, even in second. And that rolled into the momentum of 2021.

That combined with the fact that the market’s been strong. I’ve seen a really strong market, but then have seen us perform sometimes as much as 50% better than the market in terms of our growth to Mexico and Guatemala and performing well better than the market.

Those have been the top-line drivers. Agent performance continues to be really good with same store, and our average agent today still averages well over 400 transactions per month even though we’ve added agents. So we continue to have that count of agents up.

Mexico’s been tremendous growth and Guatemala’s held up really well. We’ve had the other two core countries, Honduras and El Salvador grow really well, but also countries like Ecuador, Dominican Republic, Colombia, Nicaragua and others.

We continue to send wires from Canada. It’s still a fledgling early stage business for us, and it’s not because we don’t think there’s a big opportunity. Our biggest problem is we have too many opportunities to invest in all at the same time and still maintain that growth that the market would like to see from us.

It’s the same thing with Africa. So our growth opportunity has been so great with Latin America, and we’ve been exceeding what anyone thought we could produce. Given our market shares and where it was prior to this, we’ve been able to continue to invest more in that.

In Mexico, Guatemala, El Salvador, Honduras, the four countries that represent 75% of all the money from the US to Latin America, we’ve now obtained a 21% market share. And I believe by far the number one brand in the world to those four countries.

Western Union does more business to those four countries in total, but not with Western Union, not with Vigo, not with Orlandi, with the three together. So they’d be the bigger company, we’d be the largest brand, and we think those prospects continue.

We believe that, as you see from our guidance – other than the fact that we’re lapping target numbers in the second half because we rebounded so quickly, and the fact from the bottom line perspective, we’re going to invest in more salespeople, more people selling our commercial product our card product, more focus on our online, our digital online business – we expect those results to continue through the second half of the year.

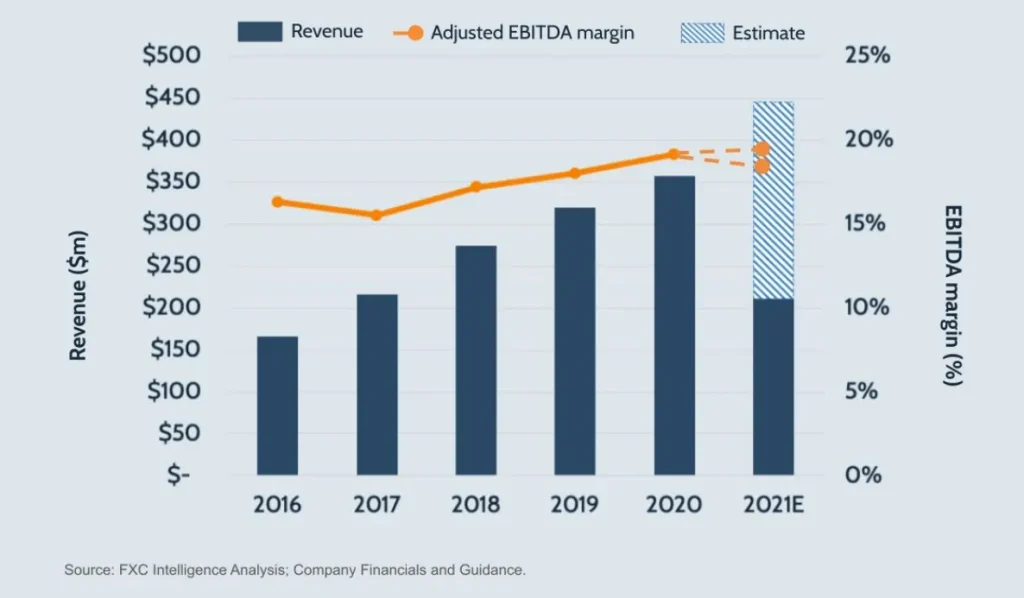

Figure 1

Intermex revenue and EBITDA margin, 2016 – 2021

The Digital Mix in Intermex’s Business

Daniel Webber: Let’s talk about the digital piece. A lot of your growth has come on the digital receive side, while the send side is much more commonly cash, which is reflective of your core customer base. That’s a contrast to other players who generally have more digital initiated and cash received. Is that impacting how you define digital?

Robert Lisy:

It’s not really our definition. It’s really when you take a look at the market, because Remitly, TransferWise, Xoom, let’s say 100% of their businesses is digital, but they’re not 100% digital from cradle-to-grave on that wire. They pay some of those wires out over the counter in cash. They use the same payers we do, and those payer wires get paid in cash.

If the definition is for it to be 100% digital, they have to be cashless, both sides, and nobody’s 100% digital. MoneyGram has been calling those wires paid to bank accounts digital for a long time, Western Union is in some cases. We’re not trying to create a new definition, we’re just saying that there’s varying shades of gray.

Digital on the receive side is faster because it’s easier for people to get bank accounts in Guatemala or Mexico than it is in the US. In many cases in the US they’re undocumented. Banco Rural wants Guatemalan depositors; Bank of America probably doesn’t, they want American depositors. So at the end of the day, it’s a lot easier and a lot more efficient to bank people south of the border. There’s more of our receivers who have bank accounts than there are of our senders who have bank accounts. It’s still a small minority, but it’s a bigger share.

Keep in mind that we not only pay to bank accounts south of the border, but we also pay to mobile wallets. We also pay out through ATMs that don’t require an over-the-counter where someone goes with the pin number and gets the money out.

Also on this side of the border, when it’s not digital online, when we send a transaction that’s cashless, that would be considered digital, [such as] when we do our debit cards in retail, which we have a percentage of our business that’s doing.

So for us, it’s varying shades of gray, whether it’s cashless digital on which side; whether it’s online; whether it’s in retail. The world thinks that everything’s digital and it’s not. The world thinks digital is going to be the most profitable, which it hasn’t proven to be. Look at Wise, they do the same revenue as us and they’re half as profitable with a market cap of 20 times as big.

But you look at that and you see that the world has overestimated digital. We’re not trying to underestimate digital, we’re trying to right size it and say, we think digital could be 30, 40% of our business down the road. Maybe a little more than that.

Is it going to be 100%? No, not digital in the sense of digital online from someone’s handheld device. Parts of it will be digital. It might be a debit card in retail. It might be getting paid to a mobile wallet on the other side. It might be paid to a bank account on the other side. But varying shades of gray.

What we’re trying to do is not force people to do things. When you force consumers to do things that are not natural, it costs a lot of money to do it. I always use the example – and it sounds kind of corny – but if I’m walking around a festival in Miami, Florida in the middle of August on a hard blacktop, it’s not going to be really hard to sell me bottles of cold water. But at the same time, if I’m walking around in a hard blacktop in Miami, in middle of August, you probably can’t sell me a hot chocolate. The might’s going to take a little bit more.

For these acquisition fees to be so high for digital business and the inability to really show a large profitability because of the customer lifecycle or lifetime value of the customer and everything else combined, it seems to me that there’s a little bit too much of an overplay going on there.

Customer Lifetime Value

Daniel Webber: I’ve been speaking to your other peers over the last month or so, and there’s been a lot about the different customer lifetime values. They talk a lot about the much stronger customer lifetime value of a digitally initiated customer. How do you guys think about the customer lifetime?

Robert Lisy:

It’s just a lie. They don’t know enough yet. How can they talk about lifetime value? How long have they been in the digital business? How long are they saying the lifetime of the customer is?

Daniel Webber: Well, they’re saying the value of an app customer is three times greater than the value of a pure retail customer.

Robert Lisy:

Based on what? They’ve been in the retail business for decades, and they’ve been in the digital business for maybe five or six years. How are they doing that comparison? I think you need to ask them those questions.

It just doesn’t work that way. They don’t know the lifetime is three times the value. Based on what? Because they send three times as often? Because they stay with them three times as long?

I can’t buy into what I believe is most likely an erroneous if not exaggerated claim without first saying based on what because I don’t believe that number. I don’t believe that lifetime value. Nobody knows that. It’s absurd to say that.

They are saying that because if you look at where their revenue was three years ago in first quarter, in 2018 when we were going public and in first quarter and in second quarter, do you realize their company is smaller in revenue and EBITDA than they were three years ago?

If that lifetime value is so great and they’re moving towards digital, why are they shrinking?

Daniel Webber: How do you think about comparing the economics between your pure retail customers and your non-retail customers if you don’t use customer lifetime values?

Robert Lisy:

I think it’s incredibly more profitable to be in retail today, not even close. I can put up a retailer who I invest $2,500 and within four to five months, he’s brought me enough wires for on the gross margin, not on the total revenue, on the gross margin, I could pay back everything including the cost of equipment, which is CapEx. That’s an incredible payback.

They don’t have anything like that when they go after a customer on digital, I’ll guarantee you. There’s certainly not a preponderance of customers on digital that are paying back in four to five months. Our investment isn’t in the consumer, we don’t invest anymore after putting up the retail. We do almost a negligible amount of advertising; we’re spending about three cents a wire annualized for our advertising.

So there’s just no investment in driving wires at a new retail. The investment is the front end, which costs us about $2,400 and in 125 wires, we recoup that in four to five months. About half of that is CapEx, which is really going to be amortized over five years. So, if you amortize that CapEx you’d really be talking about a payback in probably about three months.

My contention would be that they forgot how to do retail, and they’re going to try to make it sound like it’s really ineffective when I could demonstrate to you with our performance, why it is so, so effective. They forgot how to do it. I think it’s no question they have, and MoneyGram as well. So they have to spin the digital because they see the market values there.

We’ll see over time. I think the digital is a strong component in the business. I think Wise and others are going to be greatly overvalued and their market caps are going to come back to reality. And I think Western Union and MoneyGram are willing to play the game and get on the coattails of these digital guys even though they know that it’s not the reality and sort of fool themselves.

When I say it’s not the reality, I don’t mean that digital is not going to be digital online is not going to be an important component. But to say that the customer has three times the value. It’s just craziness when they don’t even have a comparison for that.

Intermex’s Omnichannel Strategy

Daniel Webber: Your omnichannel strategy is focused around choice for the customer to make sure you do retain the customer within your ecosystem. But you’d be perfectly happy if they were all retail customers. So you have to offer them the options and they pick the option that they most want to stay within your ecosystem. Do you see them moving back and forth between being a retail or being a digital?

Robert Lisy:

Yeah, we’ve actually seen more people that have done both settle back into retail than to settle into online. That’s just our customers. Again, it’s only tens of thousands that we’ve studied, not millions. So we qualify our contentions on like Western Union, but it is a pretty large sample size.

We’re seeing more of them come back to retail-only than go to digital-only, but many of them do both. So we want to give the customers the options and let them pick.

Daniel Webber: From the customer’s side, what’s driving that? Is there a convenience point that they may be out and about so they want to go to retail or they may not be out and about so they’ll sit and use their mobile device?

Robert Lisy:

Typically our customers are out and about because unlike most of us, they don’t have the option to work from home. They’re not on Zoom calls all day.

Now I think that some of the people will get paid some of their money to a bank card, to a payroll card. That payroll card comes with a bank account attached and they’ll send money, but they also do side work and get paid in cash. When they get paid in cash, it’s convenient for them to send it retail or they have cash out and they pay it retail. So I think that the retailer is a tried and true and very tested and trusted component in this for the sender. They trust them more than the bank. They trust them more than their government because it’s a friendly guy in the neighborhood, that they not only send money with but do all kinds of other business with.

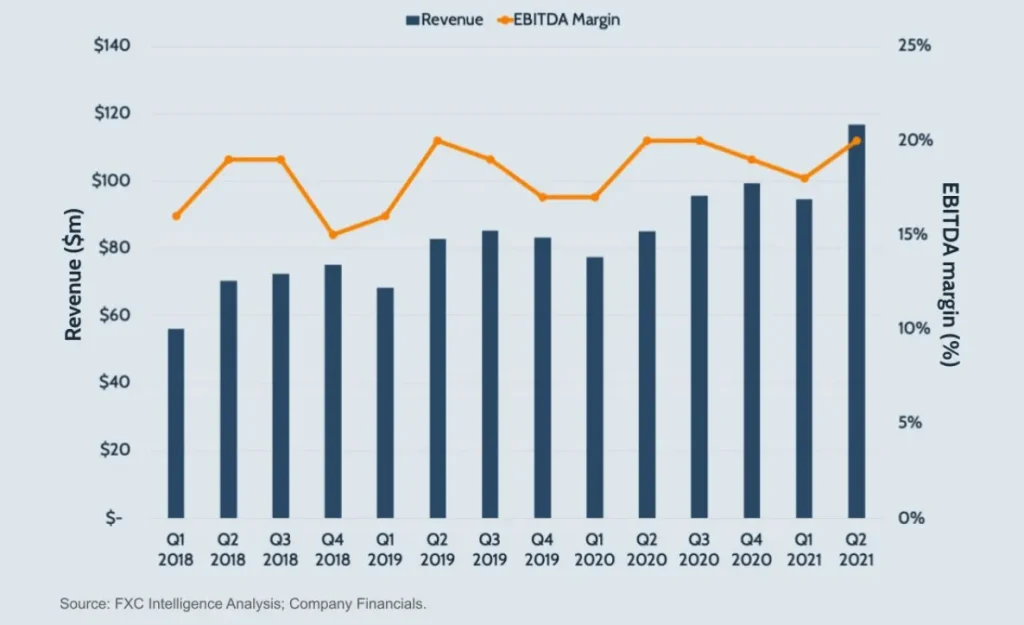

Figure 2

Intermex weathers the pandemic

Growing the Retail Business

Daniel Webber: You talked a lot about growing retail across other geographic areas of the US, particularly in the east, where there’s a lot of opportunity. Are you at a point where you’re now going after areas and share that were traditionally dominated by the incumbents? Where do you find really good retail growth for your business?

Robert Lisy:

We don’t really take business from MoneyGram or Western Union or anyone you would call an incumbent based on that our offering is better.

We’re typically, for the consumer, more expensive than MoneyGram and many times more expensive than Western Union. We take our business not by being a discounter, but by being a value added provider.

Western Union’s unit that competes with us most in retail, Vigo, is a deep discounter. They offer agents higher commissions and they offer consumers a higher FX. Today it would be argued that we would be the incumbent almost everywhere, maybe in the West less of an incumbent, of course, where it really wouldn’t be Western Union or MoneyGram, Ria would be strong, but it would be companies like Sigue and Maxitransfer and Barri and a bunch of regional guys or guys that are just more heavily loaded up in the West.

Western Union, for instance, if you look at their market and when we sold them Vigo, they were 39 share to Mexico. Today we think they’re probably, as a company, 22, maybe 23, share total. But not one of their brands is anywhere near the size of us. So Western Union might be an eight or nine share, and Vigo might be a 10 share, and Orlandi might be a two or three share, and that’s how they get to 23. So not one of their brands would be seen as an incumbent by the consumer.

Western Union is a well-known brand, but people are not using it, and Vigo is a relatively well-known brand, but people aren’t using it as much as us. So they’re not really the incumbent, if you will.

We’re not really taking them out by being a more favorable economics. Ours is not about that. Ours is about better quality service, faster and better technology, better banking relationships, our check direct product, better picking up our agents, to understanding where the business is, vetting those agents and putting up only those retailers who could do wires. That’s why we do four times as many wires as Western Union does at the average retailer, even though they have many more countries. So those are really the competitive advantages, not necessarily anything economically.

Daniel Webber: So does the growth come from winning share against those other players that you mentioned?

Robert Lisy:

It’s on all those things I talked about because the other guys are the discounters. So if you talk about stealing share from anyone else out there, we’re at the high end of the price to the consumer and the low end of the commission to the agent.

Our margins are better than Ria’s by far. Ria’s a division of Euronet; they grow about half the speed we do. Take away Covid for a minute, our two year growth is over 40%. Their two year is 20%.

They’re a discounter, which is nothing wrong with that. Somebody has got to give it away, and we’re actually a value added provider. Where we make more money per transaction.

So different models, but they probably attain share over time. We’ve gained a lot of share over time and there’s some small guys that have gained shares, small guys that lost shares, but ours is all of that on the value proposition and having an affordable price at a value proposition.

Acquisition Plans

Daniel Webber: Is there anything else you want to cover or anything coming up?

Robert Lisy:

I think you should keep in mind that we have $100m of cash on our balance sheet that’s ready and waiting for the right acquisitions. And we add to that every month by three or four million dollars. So not only are we at high growth, but we’re high productivity relative to bottom line cash, and we expect to continue to do that.

Daniel Webber: What are you looking for in potential acquisition? What’s the scope of that?

Robert Lisy:

It could be a remittance company that today is going to a particular country that we’re not one of the leaders in. Dominican Republic, Columbia. It could be a remittance company that’s strong in a particular geography that we’re not yet fully penetrated and they would speed us up and make it faster, say in the west, or particularly in somewhere like Texas.

It could be someone offshore. Someone, say, that’s operating in Europe and has a big business or even a business or foothold in Europe outbound, so that we could not only start to do business in Europe, as we do in the US, but open up more corridors where money’s going in through Europe and also to Africa and Asia.

Then it could be businesses that would either help us with our current verticals that are early stage, like our card business, or present a new vertical that would be in financial services. We wouldn’t restrict ourselves to remittances. It would have to make sense for their business, but we feel like we’ve got great technology. We’ve got great banking relationships and licenses that could help us land a lot of quality to someone out there that’s in early stage, that’s in a financial services business.

Daniel Webber: Bob, thank you for your time.

Robert Lisy:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.