Western Union has announced that it will be acquiring Intermex, a key cash-led player in the North American consumer money transfers space. We explore the conditions that led to the sale, and how it is set to benefit WU.

On 10 August 2025, Western Union announced that it would be acquiring consumer money transfers player Intermex in a deal that values the company at around $500m.

The deal, which is designed to boost Western Union’s North American retail operations, is expected to close in mid 2026.

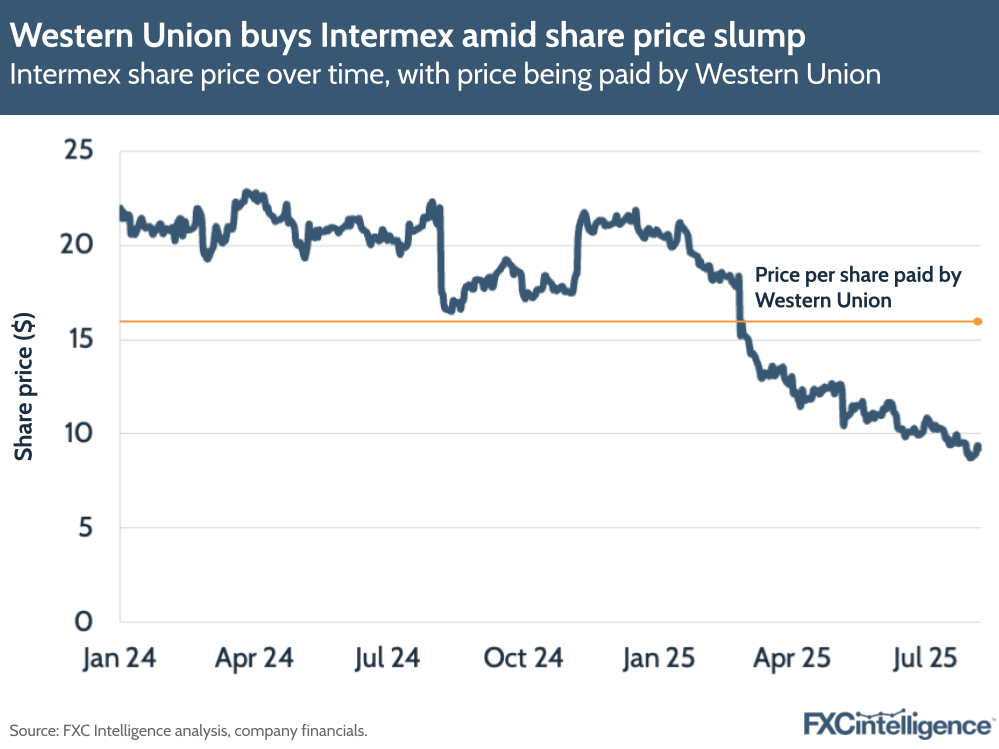

It follows a November 2024 announcement by Intermex that it was putting itself up for sale, although in its Q4 2025 earnings call in March it said that it had received no suitable offers and was suspending the plan. However, Intermex’s share price dropped following the call, largely due to a reported slowdown in the Latin American remittances market, and it has not seen a meaningful recovery since.

In an investor call announcing the acquisition, Western Union CEO Devin McGranahan said that in undertaking diligence, “it became obvious that combining these two great companies made strong strategic sense”.

“With this acquisition, we expect to accelerate the transformation of our North American retail operations,” he added.

“Intermex’s go-to-market strategy is very similar to our approach in Europe and in some instances is better tailored to the complexities of the US market.”

In this report we dig into the numbers to explore why Intermex is an attractive business for Western Union, its place in the market and how it is expected to add value for the remittances giant. Topics covered:

Drivers of Intermex’s $16 purchase price

Under the agreement, Western Union is buying Intermex at $16 per share, which is around a 50% increase on the average weighted share price the company has seen for the last three months. However, it remains below the price Intermex was trading at before its FY 2024 earnings announcement, and is below the lowest price its shares reached across 2024.

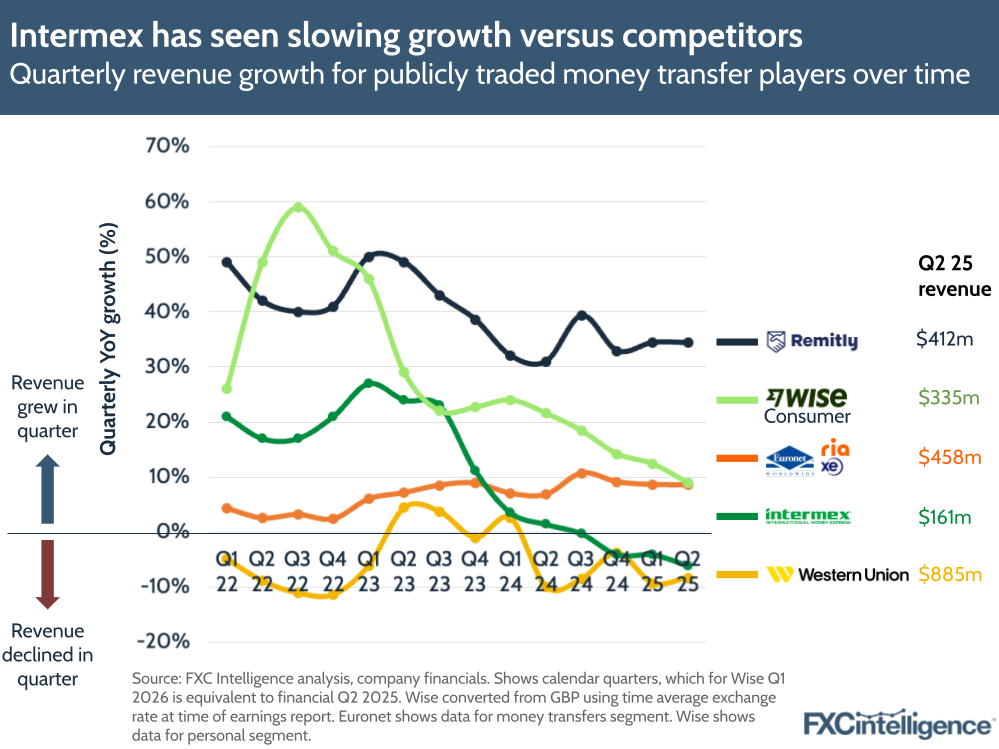

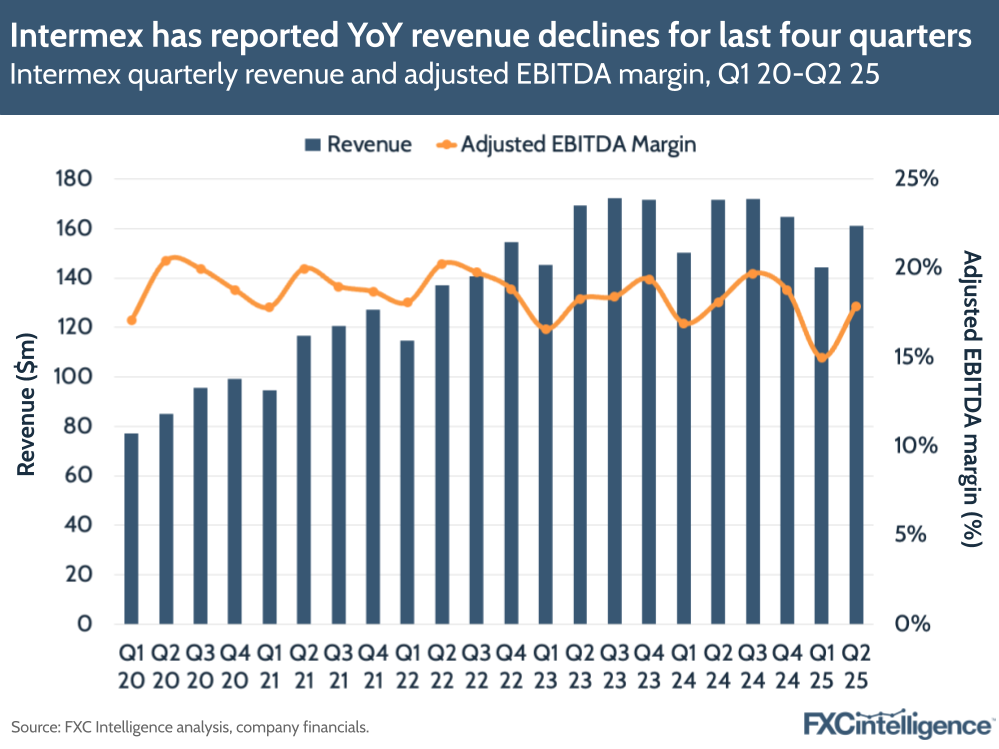

This reflects the fact that after seeing slowing revenue growth from H2 2023, Intermex slipped into a run of YoY revenue declines in H2 2024. While FY 2024 saw flat YoY revenues, as of Q2 2025, the company has now seen YoY revenue declines for the last four quarters. In its latest earnings, which were announced shortly after the acquisition announcement, the company reported a YoY revenue decline of 6% for Q2 25, while H1 2025 saw revenue drop by 5%.

Latin American and cash-led headwinds

This contraction in revenue is due to the fact that Intermex is currently facing critical headwinds to its core business, which is cash-based remittances from the US to Latin America. At present, less than 3% of Intermex’s transactions are sent outside of corridors in Latin America and the Caribbean, however volume of such transactions has been down in the market as a whole, as a result of US policy and wider geopolitical challenges.

“The economic, political and immigration backdrop presented many challenges to our business model and to the US to Latin America corridor in general,” explained Intermex CEO Bob Lisy in the company’s Q1 2025 earnings call in May.

This saw Intermex report a 9% contraction in its revenue from money transfer fees in Q2 and a 5% drop in Q1, although in the latest quarter the company did see increased foreign exchange gain that offset some of its overall declines in revenue. The passing of the US remittance tax as part of the One Big Beautiful Bill Act in July is set to create further headwinds, as it applies a 1% tax to remittances from the US sent in cash, but not those using digital methods. While it is too soon to see the impact of this in earnings, it is likely to disproportionately impact Intermex due to the cash-led nature of its business, which may have contributed to the sustained slump in its share price.

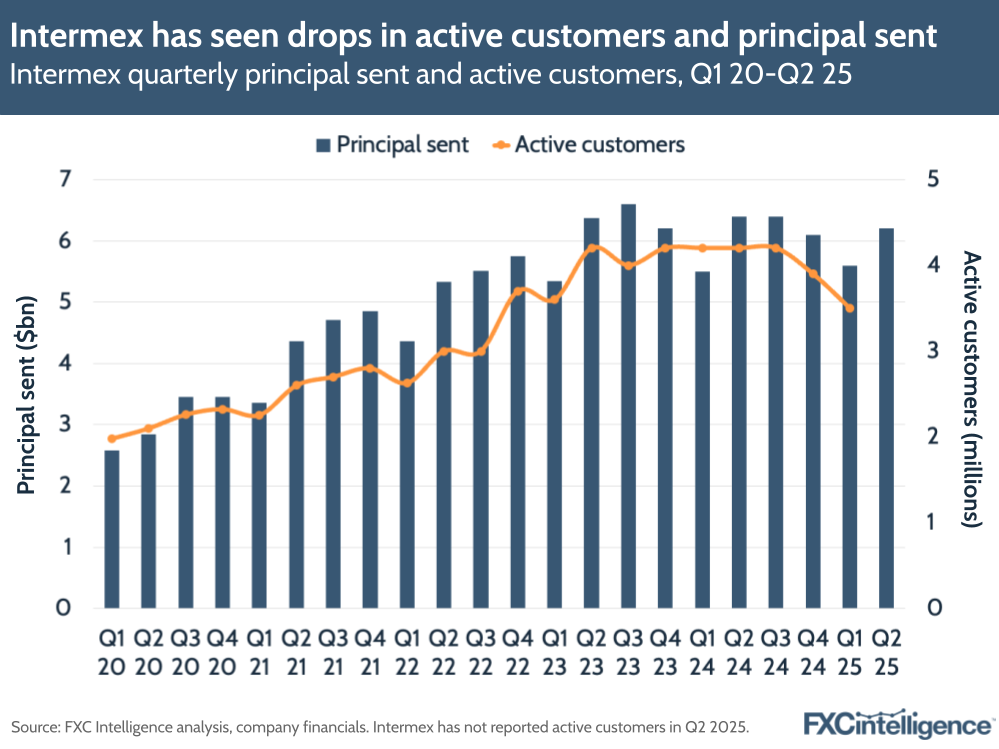

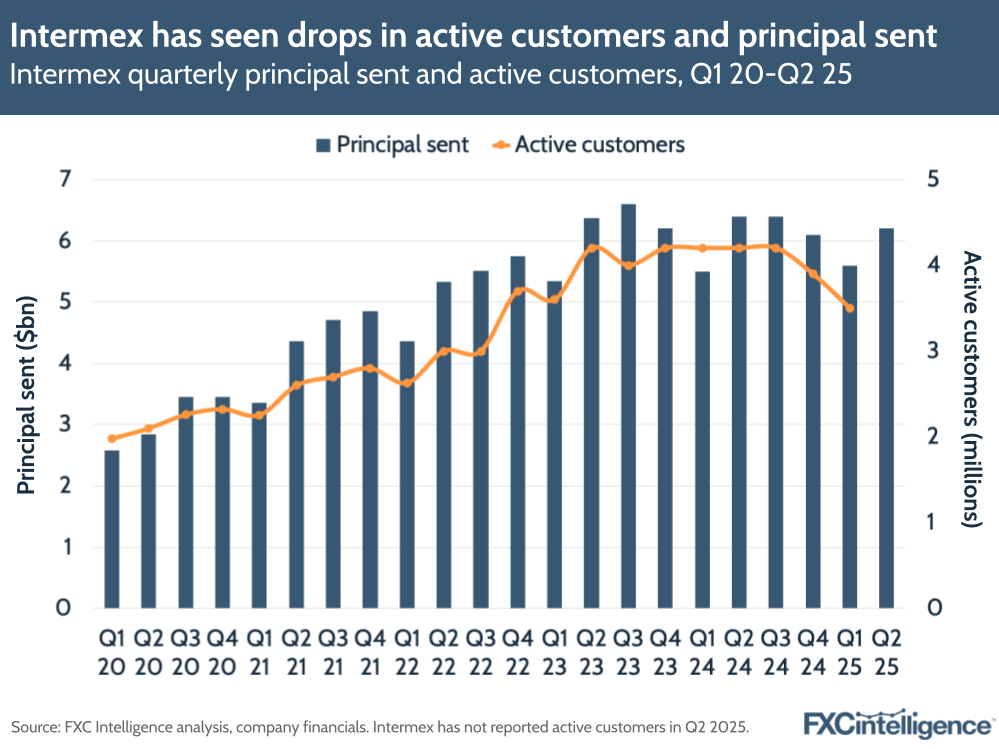

As part of this, the company has seen its number of active customers decrease in recent quarters. While it did not report this figure in its Q2 results, which did not include an earnings call or the associated presentation due to the acquisition announcement, it saw active customers drop by 17% in Q1 2025.

The company did report a decline in transactions in Q2 2025, which dropped 8% YoY to around 14 million, following a 5% decline the previous quarter. Intermex has now seen transaction numbers reduce for four quarters in a row.

Meanwhile, principal – the total money sent in transactions – also saw a 3% decline to $6.2bn in Q2 2025, although this metric has generally seen smaller declines than transaction or customer numbers, and in Q1 2025 saw a 2% YoY increase.

This difference is due to the fact that Intermex’s active customers have been steadily increasing the amounts they are sending in each transaction over the past few quarters. Intermex has reported YoY increases in the average principal sent per transaction for the last three quarters, with Q1 2025 seeing 9% growth and Q2 seeing 5%.

Meanwhile, the average total principal sent by each customer over the quarter has also been growing, with Q1 25 seeing a 7% YoY increase.

In the last few quarters Intermex has underscored that its customers are sending larger amounts in smaller numbers of transactions, which is in particular driving increased revenue from foreign exchange gain.

Moves to digitise Intermex

With a customer base dominated by blue-collar workers who are often paid in cash, Intermex has been slower to make moves into digital money transfers, although in the last few years has begun to make moves in this area, including via the launch of a new app and a refined omnichannel strategy.

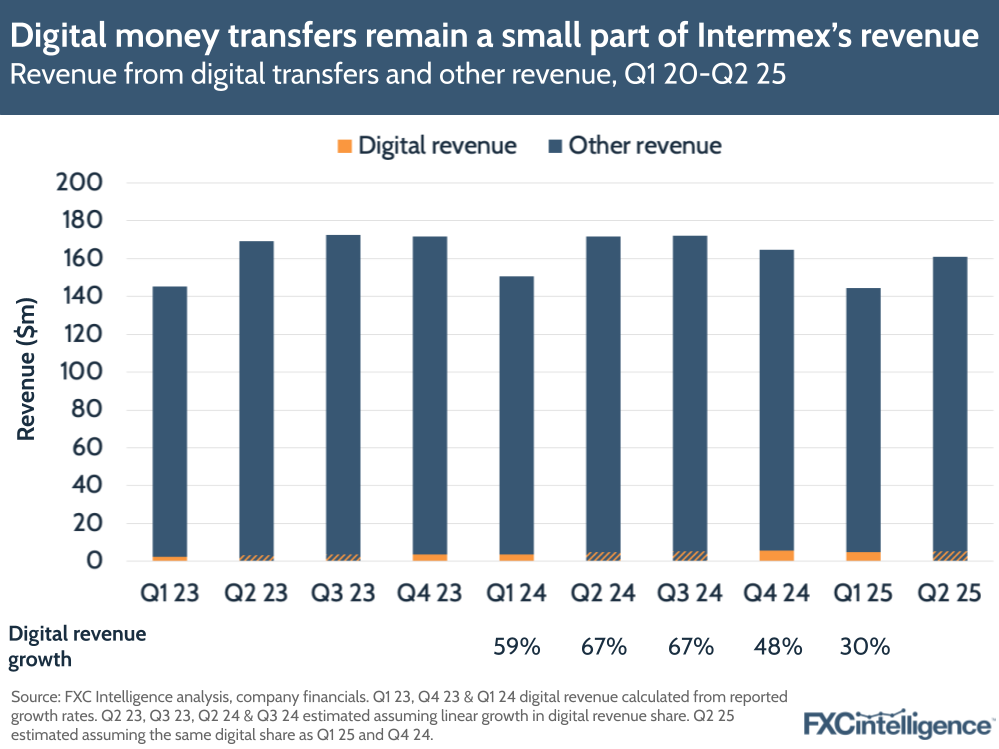

This has seen it report significant climbs in digital transactions and, more recently, digital revenue, with the latter averaging 60% growth across FY 2024. However, digital revenue still remains comparatively small compared to revenue generated from cash-based money transfers.

In Q1 2025 Intermex reported $4.9m in digital revenue, which represented just 4% of its revenue from wire transfers and money order fees, and 3% of its revenue overall. This is also the biggest share of Intermex’s revenue that digital has accounted for to-date, up from a 2% share in Q1 2023.

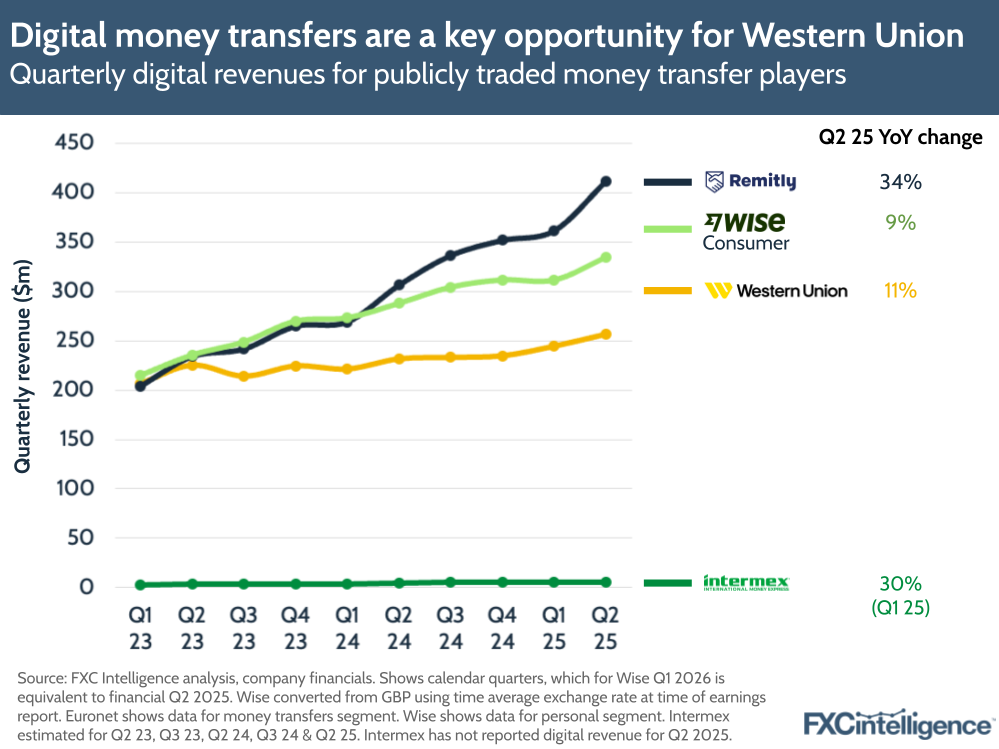

This places Intermex’s digital revenue far below that of other competitors, with Western Union reporting digital revenue of around $257m in Q2 2025. However, the remittance giant did highlight digital as a key growth opportunity for Intermex in its investor call on the acquisition, particularly given the anticipated increase in digital in response to the remittance tax.

“With the recent changes in the US market, such as the remittance tax and ongoing immigration pressures, we expect to see continued acceleration of migration from retail to digital,” said McGranahan.

“This customer base has the potential to provide us with a cost-effective digital customer acquisition channel for years to come, lowering our digital customer acquisition costs and improving the returns on our marketing budget.”

Projected benefits for Western Union

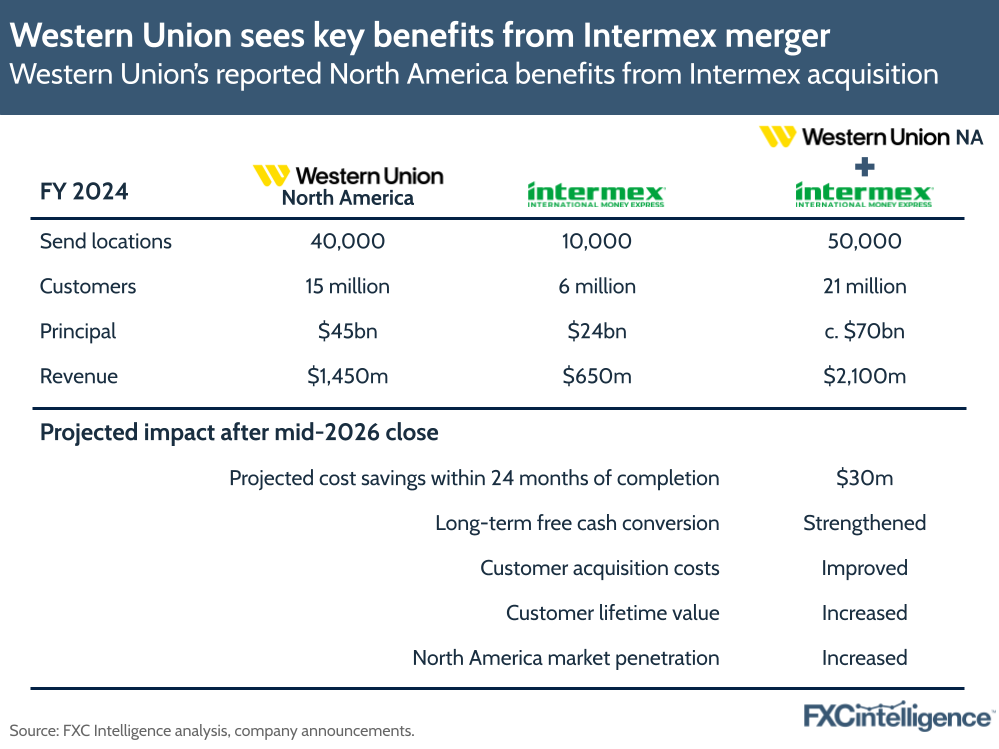

Beyond having strong long-term potential as a digital acquisition channel, Western Union has also highlighted a number of other key benefits from bringing Intermex onboard.

Intermex has a very strong agent network in the US, which is highly localised to its target market, bringing combined send locations to 50,000 across North America. However, Intermex also offers a number of products and services that Western Union does not currently have, including cheque acceptance and payroll cards, as well as digital agent onboarding. Western Union plans to incorporate these across its own agents to expand its product set in the region, and in doing so drive incremental revenue.

Meanwhile, WU also plans to bring its broader payout network to Intermex agents, and also sees the acquisition serving its wider goal of driving a controlled expansion of company-owned stores in the US. This is something that it has achieved successfully in Europe, and sees the level of control inherent in the Intermex store network being very favourable to this strategy, particularly high-volume locations.

McGranahan also cited Intermex’s strong brand value as central to the acquisition, describing the company as “a highly recognised brand” in the sector that “has strong customer awareness and loyalty”.

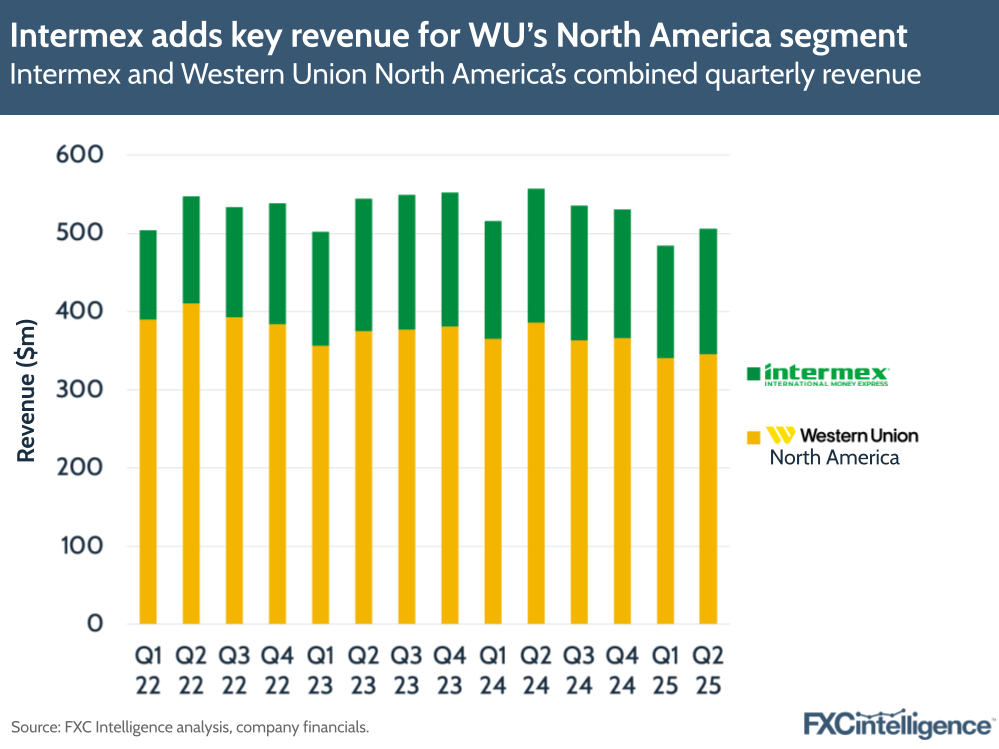

The combining of the two brands already represents a significant uplift for WU’s revenue in the region. For FY 2024, the company reported that its North America business plus Intermex saw revenue of $2.1bn, while the combined Q2 2025 revenue is around $500m.

The additional synergies from the acquisition are expected to provide further revenue growth for Western Union in North America, which is key as this region has been one of the company’s weaker performing regions in recent quarters. Western Union has seen North American C2C revenue contract for the past four quarters, with Q2 seeing an 11% YoY decline.

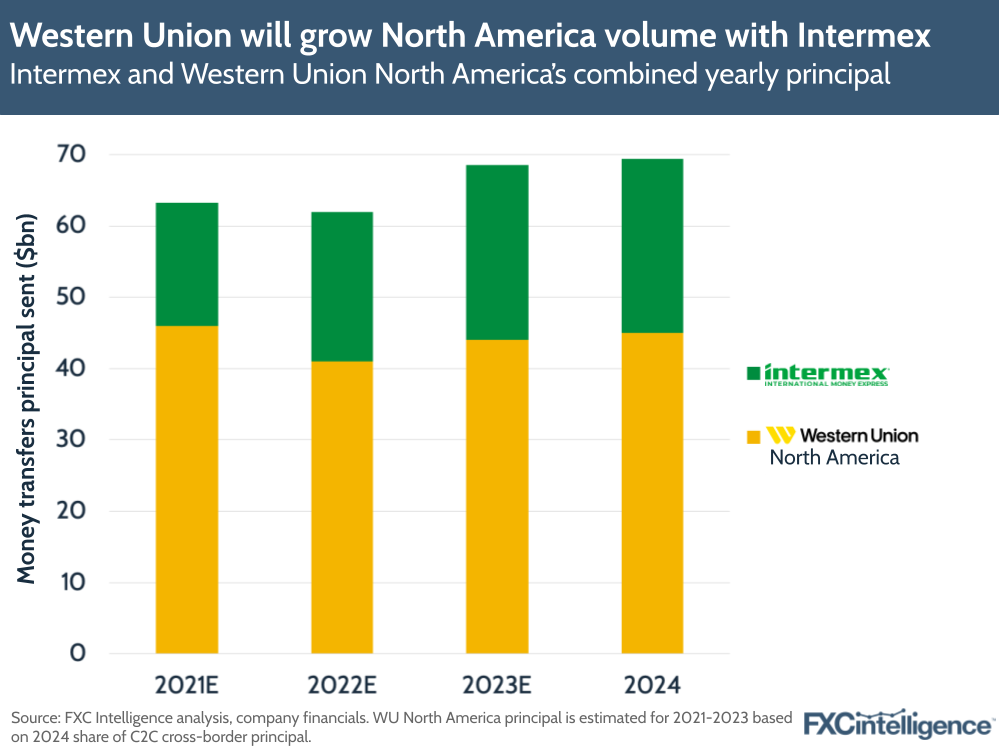

There are also expected to be similar potential gains for send volume, with WU reporting that together Intermex and Western Union North America saw around $70bn principal in FY 2024. This represents a 56% increase on Western Union alone, and indicates a strong potential base from which to build on.

Longer term outlook

Western Union anticipates achieving annual run-rate cost synergies of around $30m within two years of the deal closing, which is currently set for mid 2026.

However, the company is framing this as a long-term strategy designed to position it for strength over years rather than quarters. As part of this, the company highlighted that it expected migration to continue to be vital to economic growth in North America and beyond, while it is projecting the remittance tax to only be a short-term impediment.

“We do not believe that the law we are seeing today will persist even over the intermediate term, which is what has allowed us to acquire a very good business at an attractive entry point while still paying Intermex’s shareholders a substantial premium to the public market value for the company,” said McGranahan.

“We believe this time horizon arbitrage has created a unique opportunity for us and we are excited to welcome the entire Intermex team to the Western Union family.”