Last week, we launched what is now one of our most widely shared and referenced market maps ever – The Challengers vs The Incumbents in the Cross-Border sector. If you missed it, get it here.

We continue that theme and start this week with a look at the some of the top-performing UK based private companies who are in or serve the sector. We preview their 2018 results as few have officially reported these numbers. We also cover some of the current issues with obtaining payment and banking licenses.

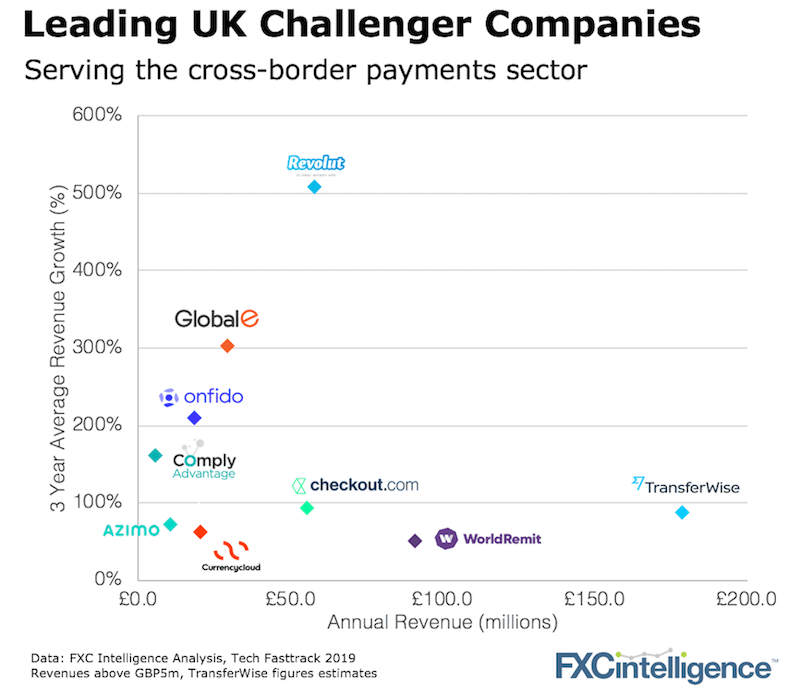

To some high-performing UK challengers:

The above analysis looks at privately-held UK companies that are in cross-border payments and regtech companies serving the cross-border space. Revenues are all above £5m.

Some takeaways:

- The biggest jump by far has come from Revolut. In the year to December 2017, their revenue was £12.8m. In the year to December 2018, it has jumped to £58.3m. This shows real traction.

- Regtech is hot. Players such as Onfido and ComplyAdvantage that support many of the players in the space are selling their wares fast.

- Cross-border ecommerce and facilitating cross-border online payments is a great segment to be in (see checkout.com – biggest ever European Series A raise)

This is just one snippet of some of the global trends. Although the companies above are headquartered in the UK they operate in many countries across the globe. It used to be 20% year or year growth was impressive. No more.

The trials and tribulations of licenses

Obtaining a banking license is not easy.

Just ask Revolut, which this week canned their Luxembourg banking efforts to focus on Ireland.

The Singapore Monetary Authority recently announced their digital full bank license requirements. Paid up capital required once stabilised is S$1.5bn (c.US$1.1bn) – that’s billions not millions. The Singapore entry ticket is S$15m (US$11m). Will Singapore still be as popular a destination with this requirement when Europe’s requirement is typically EUR 5m?

Credit to Moneycorp, which this week secured a Brazilian banking license for their local subsidiary. They will be one of five licensed FX banks in the country.

And even if you’re Facebook, it’s hard to get away with no license. Yesterday, Facebook accepted it has to apply to Switzerland’s Financial Market Supervisory Authority to be regulated as a payment systems operator for its Libra project.

[fxci_space class=”tailor-INF”][/fxci_space]