The 2023 Remittances Africa Conference took place last week, on 18-19 May, with diaspora professionals, key industry players, thought leaders, regulatory bodies and government officials in attendance to discuss the African diaspora and remittances. The conference tackled topics including blockchain in the remittance industry; the disruptive potential of fintechs to reduce the cost of remittances; creating an enabling environment for mobile money remittances to thrive in Africa; the rise of central bank digital currencies (CBDCs); and the money transfer industry in Africa.

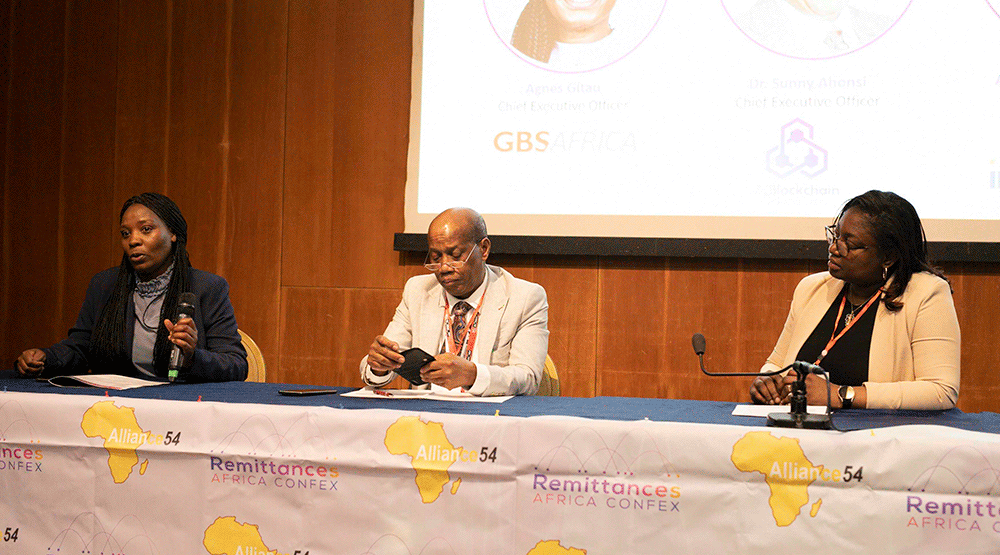

Adeyanju Pinheiro-Aina represented FXC Intelligence at the conference, discussing developments post-pandemic, migration and African diaspora perspectives on remittances. Below are some of the key topics covered during the conference and some of our major takeaways.

The African diaspora and remittance

As international borders reopen post-Covid, a huge influx of migrant workers and refugees continues to be seen across Europe and North America. According to the African Development Bank, about 20 million Africans have migrated outside the continent over the past 20 years. More than half of them live in Europe, about a quarter in Asia and about three million in North America. Many of these people migrated in the last two years as a result of the severe impacts of the pandemic on emerging economies. For instance, more than 29 million jobs were lost in Africa during the pandemic, driving more people further into poverty.

Remittances have been providing a significant contribution towards sustaining migrants’ family members and related economies, especially in Africa. In the words of African Development Bank President Dr. Akinwumi Adesina: “The African diaspora has become the largest financier of Africa in the form of gifts or grants.”

The potential of remittances for investment in Africa

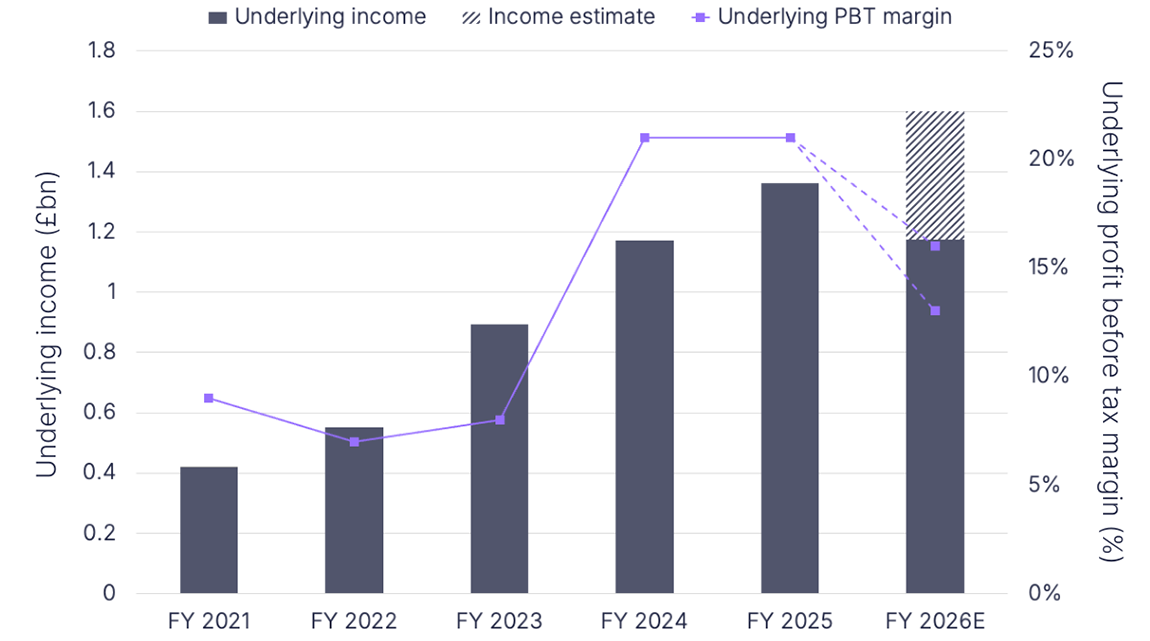

According to FXC Intelligence’s market sizing data, the value of remittances to Africa increased from $31Bn in 2010 to $43.8Bn by 2022. Nigeria is among the top 10 remittance recipients globally, with $19.3Bn in 2022. The UN 2030 Agenda for Sustainable Development emphasises the need to reduce remittance costs, as well as mobilise diaspora savings and investments.

Engaging the diaspora to improve development financing remains the crux of policy debates in Africa, especially harnessing and investing remittances more cost-effectively through novel financial mechanisms. With the African Development Bank expecting the continent’s internet economy to reach $180bn by 2025, and African fintech revenues projected to reach more than $30bn by 2025, there are massive opportunities to foster a digital economy that will transform the payments systems.

In an attempt to transform digital payments on the continent, the African Development Bank and partners launched the Africa Digital Financial Inclusion Facility to help manage investments that support innovative financial solutions, including the $525,000 Africa Fintech Hub Project signed on 4 April 2023. The Fintech Hub Project is a digital platform that will enable fintech associations across Africa to pool resources and knowledge aimed at increasing access to and usage of digital financial solutions by all Africans. This is expected to contribute to the strengthening of the fintech ecosystem and boost competitiveness in the digital world in Africa by leveraging partnerships.

While remittances have helped to sustain families by boosting local economic activities and the incomes of other households in the community, it can still be better tapped into for Africa’s development by eliminating the “Africa-premium” charged on remittances.

Diaspora investments – how money transfer companies can play

There are several challenges causing the cost of sending remittances to remain high, in particular the dependence of some remittance corridors on cash and the complex, fragmented African remittance market.

There has been a steady growth in the adoption of mobile money across different regions, especially in eastern and southern Africa, because it offers cheaper cross-border payments; this growth is expected to continue in the coming years.

Though mobile remittance is reducing the cost of certain remittance corridors, there is the need for money transfer operators (MTOs) to adopt other new and cheaper transfer methods such as CBDCs or leverage the Pan-African Payment and Settlement System in order to encourage the use of remittances for long-term investment.

Creating crowdfunding platforms for securitised remittances by MTOs, in partnership with the government of African countries, is another way the African diaspora can be encouraged to invest in Africa. For instance, over $31bn – from more than 1,800 participants – was mobilised within 72 hours at the recent African Investment Forum. MTOs, in partnership with the governments of African countries, can get tax rebates or exemptions for diaspora remittances from the host countries where African diasporas are resident.

Increasing financial services for the African diaspora, refugees and SMEs

While it is true that the African diaspora needs digital financial solutions that can be used for direct investment, there also needs to be an enabling environment in place as well as greater financial awareness to make economic growth more inclusive and to accelerate economic resilience in Africa. This will strengthen financial stability and promote trade integration within the continent.

Having an enabling environment means giving financial policy priority to African diasporas through relaxed foreign exchange restrictions, designing and implementing special economic incentives, de-risking investments and improving transparency and accountability.

However, it is imperative to have an interoperable digital information database of the African diaspora to stimulate ideation, promote information exchange, drive Africa-led fintech solutions and support innovation within the financial service sector across Africa. This will also create a platform for investors and project sponsors to profile their investment interests and projects.