In January, the African Export-Import Bank (Afreximbank) launched the Pan-African Payment and Settlement System (PAPSS) with 12 African central banks, increasing the cross-border payments and trade capabilities within the continent.

In Africa, SMEs account for 80% of businesses. With over 40 currencies, payment delays and disparate regional payment systems, cross-border payment transactions have been challenging.

Many African cross-border payment transactions originating from African banks have had to be routed offshore for clearing and settlement using international banks. However, this is set to change with the launch of PAPSS.

About the Pan-African Payment and Settlement System

PAPSS was developed by Afreximbank in July 2019 as a key instrument for the execution of the African Continental Free Trade Agreement (AfCFTA) in order to ease trade challenges and boost cross-border transactions across the continent.

It is the first African consolidated payments and settlement system that connects commercial banks, payment service providers, fintechs and other intermediaries in Africa as ‘participants’ for cross-border trade across the continent.

PAPSS provides real-time processing of cross-border direct debit payment services, invoicing, and billing; request to pay, escrow services, intra-African remittance and sanctions screening. Participants have to pre-fund their accounts to ensure liquidity.

In September 2021, the payment and settlement system was piloted in West African Monetary Zone (WAMZ) countries – Nigeria, Ghana, Liberia, Sierra Leone, The Gambia and Guinea – with live transactions completed instantly.

PAPSS went live in January 2022 with 12 African Central Banks using the exchange rate for the importers’ and exporters’ FX window (I&E) for cross-border payments.

Afreximbank acts as the main settlement agent for PAPSS, in partnership with African Central Banks connected to the PAPSS system. The central banks oversee, supervise and enforce compliance of banks, fintechs, and financial institutions in their jurisdiction.

Find out more about our data tracking money transfers in Africa

The history of PAPSS

Afreximbank is a supranational financial institution based in Cairo with operations in Abuja, Abidjan, Harare and Kampala. It was established in 1993 to offer financial solutions as well as advisory services to promote the development of African trade. It paved the way for AfCFTA.

AfCFTA was launched in March 2018 as part of Agenda 2063: ‘The Africa We Want’, and commenced trade in January 2021. It was set up to improve intra-African trade and economic development by having a single market for goods and services that is free of tariffs.

PAPSS was developed to aid AfCFTA, and was piloted in WAMZ countries in September 2021. It received $500m from Afreximbank for its implementation and another $3bn to support its continent-wide implementation when it went live fully in January 2022.

How will PAPSS change African trade and cross-border payments?

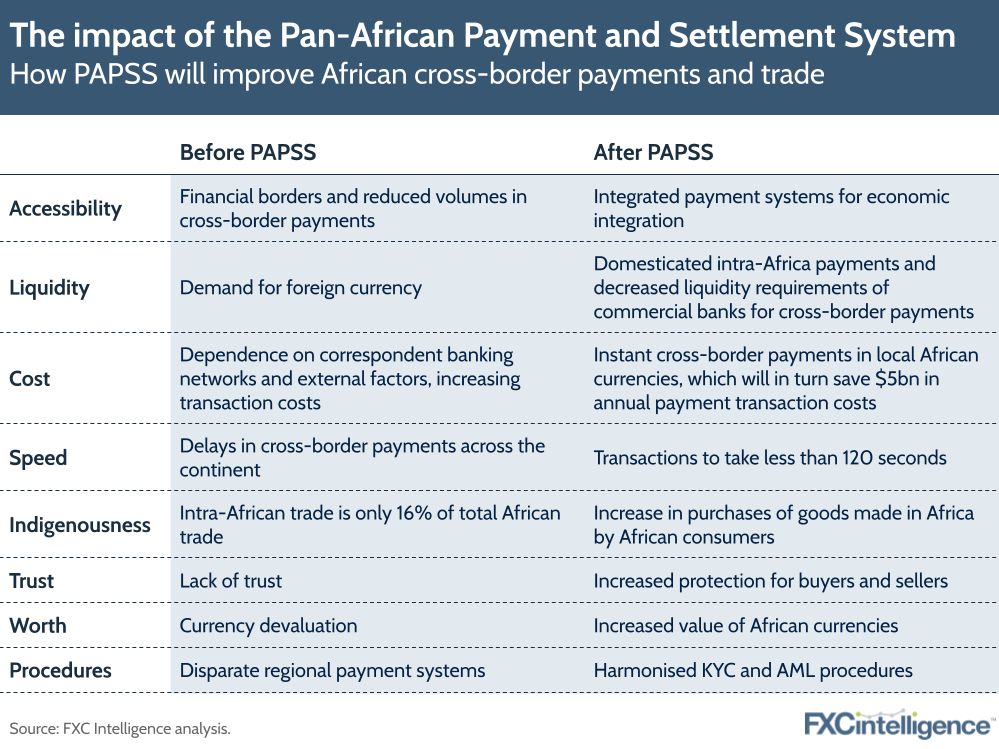

PAPSS will support economic integration across Africa, reducing the heavy dependence on correspondent banking networks and foriegn currencies. Cross-border transactions will be completed almost instantly at reduced cost.

The settlement system is expected to prompt an increase in Intra-African trade, which in turn would boost the purchase of African goods as well as African currencies.

The payment system is also designed to harmonize KYC and anti-money laundering across the continent in order to promote trust and interoperability.

Find out more about our data tracking cards in Africa

PAPSS’s transfer route

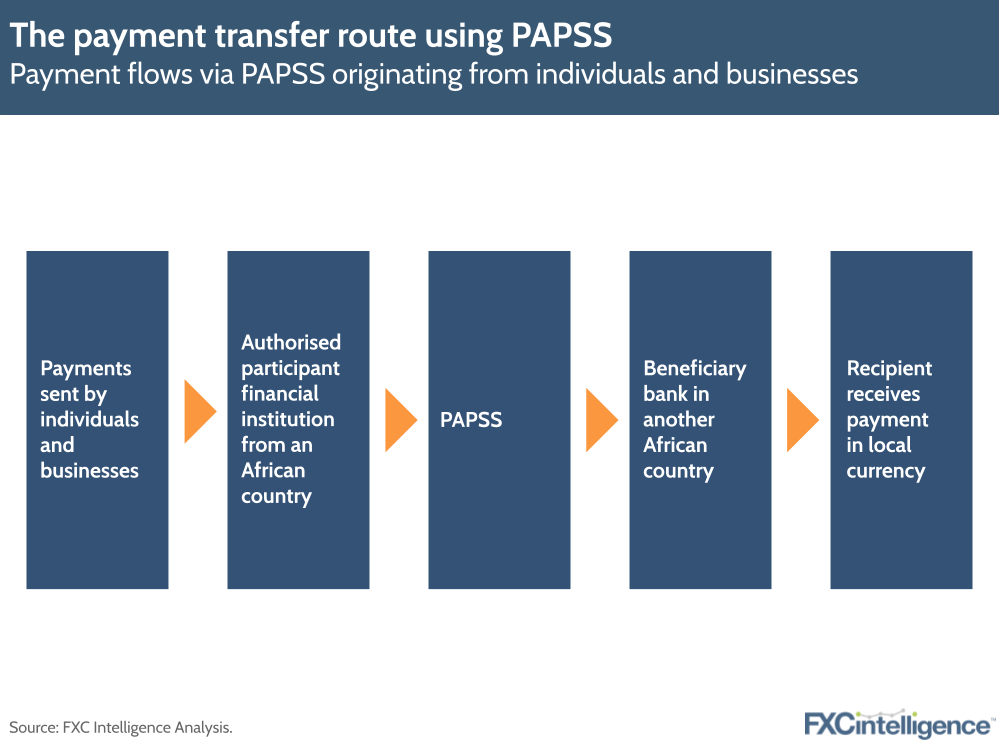

In order to send money via PAPSS, individuals and businesses can initiate a cross-border payment through an authorized PAPSS participant – a commercial bank from an African country. The participant then sends the payment to PAPSS, which validates the payment instructions that have been sent.

Next the beneficiary bank receives validated payment instructions from PAPSS and pays the recipient, located in another African country, in their local currency.

Direct participants of PAPSS must fulfill some conditions, including being a financial institution with a full banking license. They must also comply with all financial and regulatory requirements set out by their applicable Central Bank as well as have a settlement account with the domestic central bank that is a settlement member in the country where the PAPSS service will be used.

Challenges of PAPSS

While PAPSS presents significant benefits, there are also potential challenges, most notably around information and access.

Lack of access to trade and market information about the payment system, especially on how African businesses can begin to take advantage of the platform, is one of the major challenges PAPSS faces. Private sector groupings and business membership organizations across Africa who are supposed to benefit from the system are also yet to be on-boarded.

Nevertheless, PAPSS presents a promising development for African cross-border payments and trade, and may prove to have profound benefits for the continent.