As finance increasingly digitalises, banks are exploring the prospect of central bank digital currencies (CBDCs) and what they could mean for payments.

Governments around the world are now part of the latest disruptive force in finance: the digitisation of currencies. The declining use of cash and the threat posed by private digital currencies, through emerging technologies from the private sector, has spurred several central banks to explore the opportunities for central bank digital currencies (CBDCs), particularly in the payments space.

A CBDC is a digital currency backed and issued by a central bank. Operating as a third form of central bank money, alongside cash and bank reserves, CBDCs are much like cash in function, but solely stored and accessed digitally.

Central bank money, broadly, refers to the the cash that it brings into circulation and the deposits the central bank holds. Both these instruments are in some way tied to commercial banks, as cash becomes the liability of a commercial bank once it has been digitally issued (though remains the liability of the central bank if withdrawn physically) and deposits may be held either as part of loans to commercial banks or as reserves that those banks are required to maintain with the central bank.

The matter of liability is where CBDCs truly differentiate themselves from existing digital money. The present financial system is predicated in no small part on the presence of stores of physical cash and the theoretical ability to convert digital currency back into physical cash should it be desired. Whereas in that system, the liability of your money changes based on its form, the creation of a CBDC would create a digital cash that is fully the responsibility of the central bank, and each unit of which would have a unique, immutable digital identity.

Although in some part inspired by the proliferation of cryptocurrencies, the issuance by a state and the fact that they will not necessarily be reliant on a distributed ledger technology (DLT) such as blockchain, places them in a very different category.

Over the years, money has evolved through a variety of forms, from the physicality of leather, coins, paper and cards to the new frontier of digital currencies. This latest revolution has seen the birth of high-level digital payment systems that offer financial inclusion and accessibility; cheaper and more secure transactions; and innovative financial collaboration.

Riding on the back of the Covid-19 pandemic, which increased the necessity for effective and convenient digital payment services, financial transformation is now increasingly turning to both cryptocurrency and CBDCs – a reflection of the desire for convenience and the digitalisation of payment services.

What is the difference between CBDC and cryptocurrency?

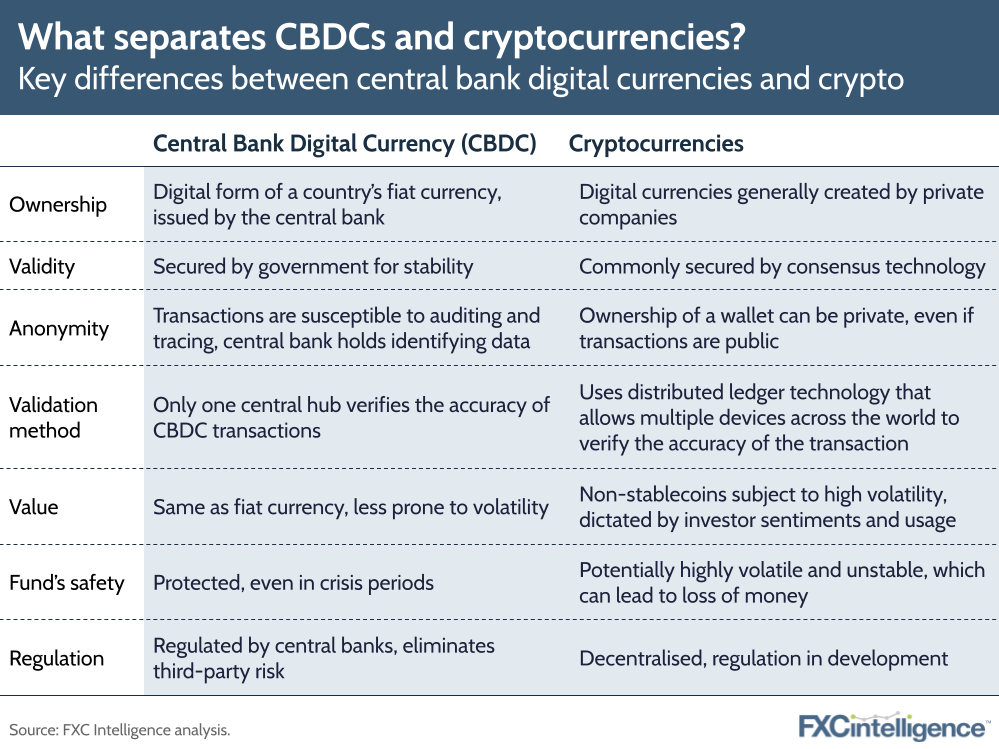

Perhaps the central divide between cryptocurrency and CBDCs is a matter of control: CBDCs are state-backed and run by a nation’s central bank, perhaps in partnership with commercial partners depending on the CBDCs architecture. Cryptocurrencies, on the other hand, are private operations, almost uniformly without any form of centralised oversight.

This provides certain differences in security that will likely have a significant impact on sentiment around each. For example, using a CBDC means placing faith in how your government may handle your data and knowledge of your financials; a cryptocurrency, on the other hand, offers more potential for anonymity in that while the usage of a wallet can be traced, the user’s identity does not have to be tied to that wallet. The counterpoint to both sides of the equation is that although you may be offering up more data to a CBDC, your money is far more protected and far less subject to volatility as it has the same functionality as physical fiat currency.

There are exceptions to this rule: stablecoins, assuming they do not lose their peg, are tethered to the value of fiat currency. The stablecoin USDC, for example, is backed 1:1 by reserves of cash and US Treasuries.

A final note is on the state of regulation. A CBDC would be regulated by the central bank as with existing fiat currency, though would likely require the development of new regulation depending on its design, while cryptocurrency is largely decentralised and regulation is still developing. Notably, several such pieces of regulation are examining cryptocurrency as an asset, not a currency.

Why countries are exploring CBDCs

Countries around the world are jumping on the CBDC wagon in different ways; some are simply at the research stage, while others have begun pilot programmes or have already rolled out their CBDCs.

Some of the key reasons that CBDCs are being considered include bringing unbanked and underbanked citizens online, creating alternative payment instruments and lowering the costs of international settlements.

Unbanked and underbanked citizens are served on two fronts. The first is that some people may simply fall into these categories due to physical geography; perhaps they do not live near a bank or one may be hard to access for them. Secondly, the fact that the currency is provided by the state provides a strong instrument for inclusion as it makes it possible for any legal resident or citizen to be provided with a basic bank account.

Theoretically, these issues could be solved through existing digital systems but would require working with private partners and may not have the same trust as a state-backed initiative.

A CBDC can further assist users through the creation of an alternative payment instrument, preventing concentration in private networks of banks and fintechs by providing, or even demanding, interoperability between such networks. While these private operators may serve as intermediaries, depending on the CBDC architecture, CBDCs can help to prevent monopolies and ultimately create choice for users and potential efficiency in the system by diversifying financial intermediaries.

In regards to international settlements, CBDCs can benefit from a clean start versus the frictions endured by current cross-border operations. Additionally, with the UN’s Sustainable Development Goals including the improvement of remittances and the G20 having a roadmap to enhance cross-border payments, a CBDC may have the advantage of significant international drive behind its success. And while there are still a variety of challenges posed by international interoperability, the general stability of a central bank gives CBDCs a far greater finality to any settlement.

CBDCs may also be able to offer monetary sovereignty to countries reliant on foreign currency for transactions. For example, under the Protocol on Economic Relations, a deal signed by Israel and the Palestine Liberation Organisation in 1994, Palestine is compelled to use the New Israeli Shekel as its currency and may not produce a separate currency. A CBDC may allow the country to circumvent this prohibition.

Additionally, CBDCs may assist in eliminating financial crime, serve as a substitute for privately-controlled and often volatile cryptocurrency and contribute to the creation of efficient payment structures.

Designing a CBDC

According to the Bank for International Settlements (BIS), CBDCs are contingent on consumer use cases, public policy objectives and technology. In the words of the BIS: “A CBDC would need to be adopted and used if it is to fulfil public policy goals that motivate its issuance. Integral to achieving adoption and use of a general purpose CBDC in a jurisdiction would be understanding and serving current and future user needs in a fast-changing payments landscape.”

The first two elements are connected in an almost reciprocal manner; a government issues a CBDC in order to meet certain policy objectives, but it is necessary for consumer demand to exist in order to justify that issuance and maintain the CBDCs use over time.

Both sides of this equation are underpinned by the third design pillar: technology. The underlying technology of the CBDC must not only meet all the existing demands of a payment instrument, particularly one guaranteed by the state, but must account for what is likely to be a rapidly changing digital finance landscape. As the BIS suggests: “As payments become increasingly integrated into digital living, a CBDC could combine innovative features into a single product in a new and unique way.”

The technology underpinning CBDCs

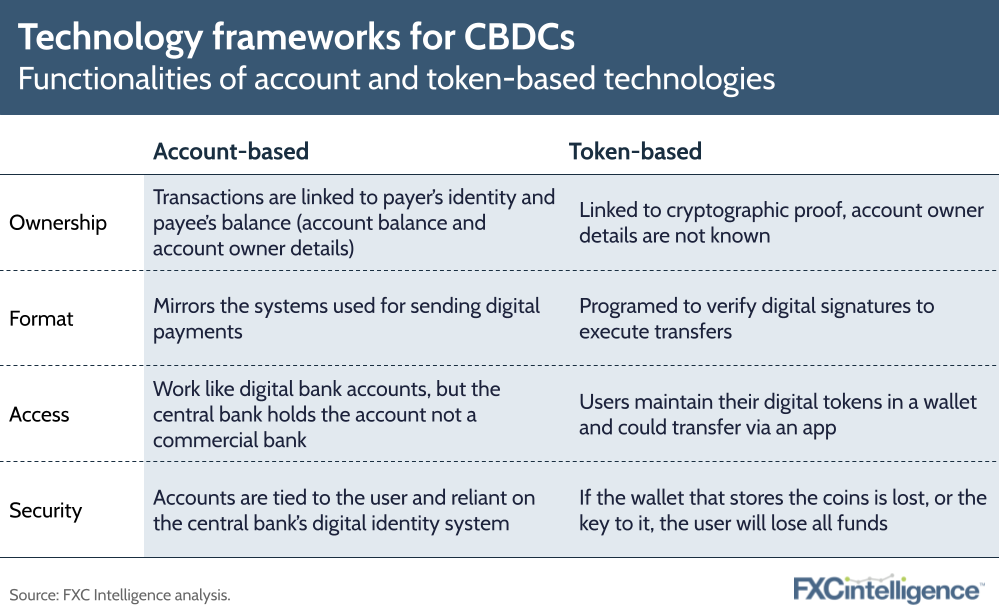

CBDCs need technology for their functionality. The choice of that technology will define features such as ease of use, transfer speed, availability, privacy, security, identity, validity and safety. CBDC technology can be based on a conventional, centralised database or distributed ledger technology (DLT), and function using an account-based framework, a token-based framework or a combination of the two.

The major difference between token-based and account-based frameworks is that while an account-based CBDC verifies the identity of the payer, a token-based CBDC verifies the validity of the token used for a given transaction.

The value of a token is the balance of the account, a figure that is validated by checking the history of the token. An account-based CBDC requires all users to identify themselves to access it, while a token-based CBDC can be accessed anonymously via digital signatures. This particular facet would make a token-based CBDC of particular benefit to users that are unbanked or rely on cash, but may pose challenges for KYC and subsequent security difficulties.

Benefits of a CBDC

Research from several governments has already explored how CBDCs can benefit their national economies. The principal beneficiaries are central banks themselves, with private banks benefiting in architectures in which they serve as intermediaries (fulfilling a similar function to their current role with currency issuance). Consumers may see some knock-on advantages but the potential transition to CBDCs largely serves to answer several challenges that central banks are facing.

Perhaps most prominently, the clean slate digitalisation of the payment system offers the chance for a huge transformation for central banks. The transition away from cash to a digital currency would give central banks colossal amounts of insight into the flow of money nationwide, a transparency that would, if nothing else, significantly increase each bank’s ability to combat money laundering.

In addition, one of the ways in which a CBDC could strengthen payments and serve both the central bank and the consumer is by opening up the market to greater competition and innovation. The European Central Bank (ECB) has warned that “just a few global players have come to dominate certain segments of the payments market”. To continue with the ECB as an example, it intends to design its CBDC in such a way that developers can build features on top of the basic system.

This is of course not without its own risks, and would require a certain level of trust in those developers but trust is also one of the core factors that CBDCs are thought to improve on. Aside from the concerns around monopolies in payments, recent years have seen an increasing distrust in big tech. Given the particularly volatile state of current digital currencies in the form of crypto, which is unlikely to give consumers a reason to trust a currency offering from the tech sector, CBDCs offer governments a chance to offer consumers a stable alternative.

A move away from cash is already noticeable in several countries and presents one of the major reasons that CBDCs are being explored. By creating a digital alternative with all the financial backing and security of a fiat currency, central banks can not only assist consumers with the move to digital payments but build trust in their financial institutions at the same time.

CBDCs are also equipped to promote real-time domestic and international settlement for several reasons. As already discussed, there is a certain weight behind CBDCs and international settlement purely by benefit of organisations such as the G20’s interest in improving cross-border payments.

Beyond this, central banks already operate real-time gross settlement systems that execute wholesale transactions. Because CBDCs are state-run, they would be able to benefit from these mechanisms, such as Eurosystem’s TARGET 2. Under that system, one bank issues instructions to pay a beneficiary bank, at which point the system reconciles, confirms and completes the transaction by transferring funds between the two banks’ accounts at the European Central Bank, all in real-time.

While real-time payments are gathering steam at the retail level, many accounts and banks simply don’t yet have the infrastructure set up to enable real-time transactions. There is also the additional wrinkle of risk: real-time means the transaction is irrevocable, something that is far easier to countenance when backed by the strength and structure of a central bank.

Risks of a CBDC

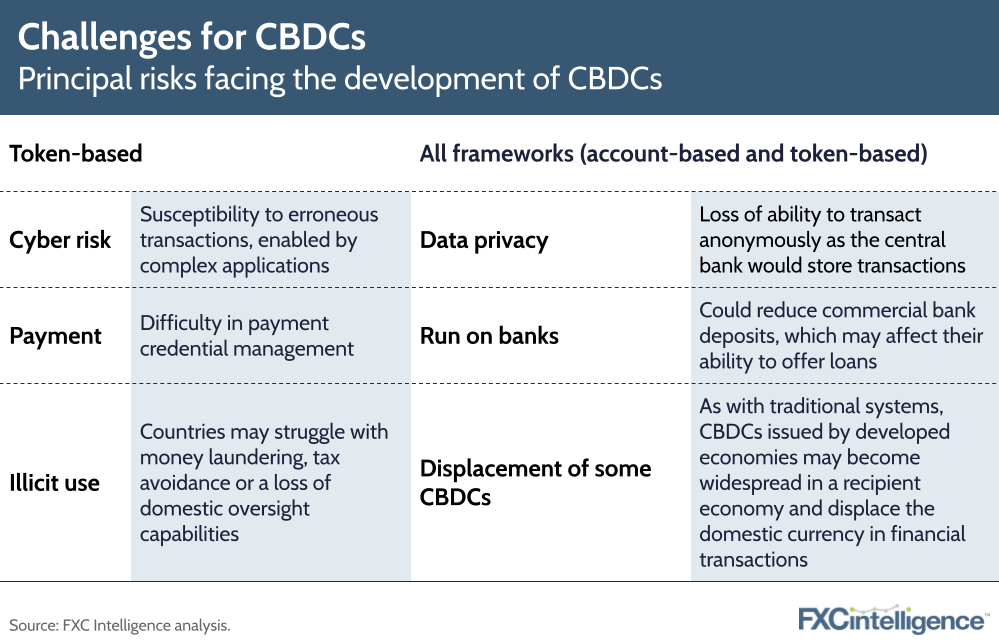

A major concern with digital currency is its safety and stability. Before something like a CBDC can be adopted, it is necessary to create a regulatory framework that accounts for the design, technology and use case. In addition to this, CBDC issuance will be determined by the differing mandates of central banks, meaning that monetary policies need to ensure openness, financial stability and access, as well as interoperability.

According to the World Bank: “The introduction of CBDC could disrupt the existing financial-intermediation structure. In addition, depending on design and country context, CBDC could pose risks to financial stability, financial integrity, data protection and privacy, and cyber resilience.”

There is also a fear of the complications that CBDCs could create. For example, CBDCs are even more at risk from cyberattacks than standard financial organisations, given that even a short outage could disrupt an entire nation’s transactions. This of course assumes a certain level of adoption, but the security risk may pose a worry to users that is not present in the more diversified private banking sector.

User trust is also at risk from the loss of privacy posed by CBDCs. While it would be inaccurate to say that consumer trust in existing, private financial institutions is absolute, CBDCs pose a unique risk in the ownership of financial data by a government. If designed with ill intention, a CBDC could easily become a surveillance tool, or even one of coercion, a fact likely to provide particular friction in nations that already have low trust in government.

One concern that is dependent on the chosen architecture of a CBDC is that its creation could lead to an increased reliance on the private sector. Indirect or hybrid architectures, whereby private partners are acting as intermediaries, could allow for the disruption of private monopolies if intermediaries are properly diversified, as previously mentioned, but would also have them assume a perhaps overly vital role in a national currency.

Perhaps the greatest threat, however, is the possibility of a run on banks. Because the CBDC provides an account at the central bank, it may be considered as more secure, and even risk-free, than an account with a commercial bank. Its issuance could therefore lead to a mass exodus of accounts over to the central bank, reducing commercial bank deposits and affecting their ability to offer loans.

The development of retail and wholesale CBDCs

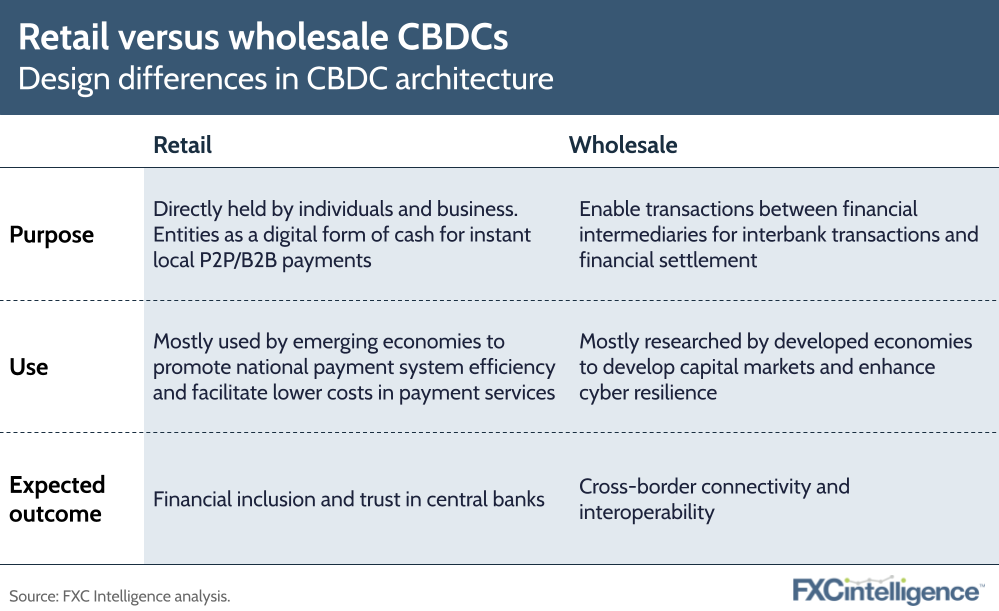

There are two ways in which CBDCs could be developed: country-specific (retail CBDCs) or for interbank/cross-border purposes (wholesale CBDCs).

Wholesale CBDCs are largely being explored to improve interbank operations, making cross-border payments faster, cheaper and more transparent. On the other hand, retail CBDCs are being adopted, often by emerging economies, to solve a challenge that has become steadily more apparent: maintaining an open and public means of payment that could replace decentralised digital currencies and protect against the potential loss of monetary control.

Retail CBDC architectures

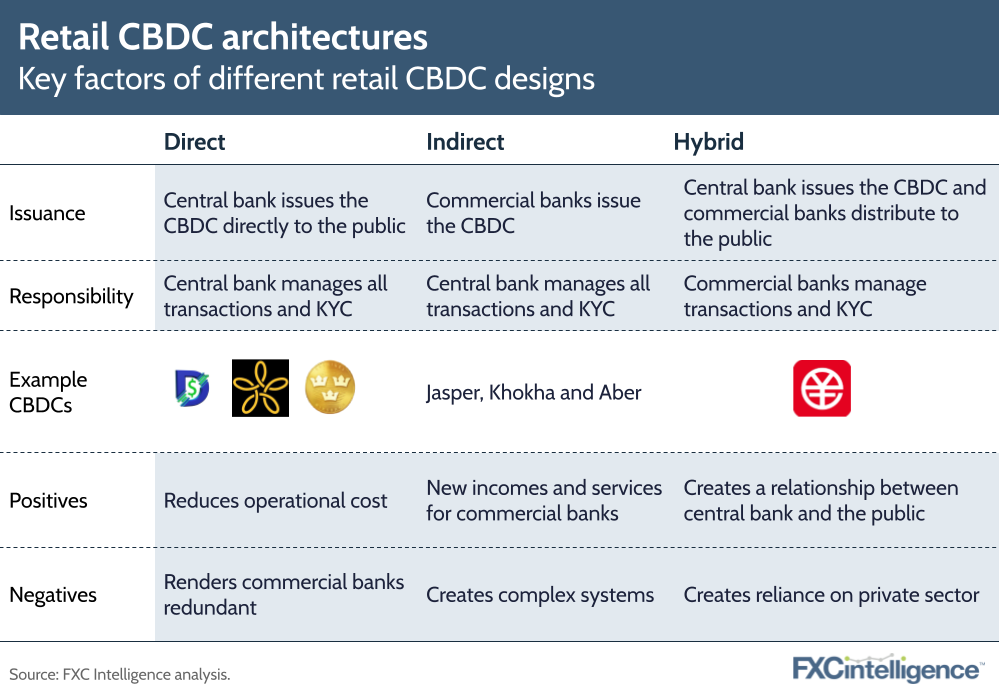

There are three architectures for retail CBDCs: direct, indirect and hybrid.

Under a direct retail CBDC architecture, the central bank issues the currency directly to the public and manages all transactions, as well as KYC. Under this model, the CBDC serves as a direct claim on the central bank, which then keeps a record of all balances that is updated with each transaction.

In the Bank of International Settlements’ view, “The direct CBDC is attractive for its simplicity, as it eliminates dependence on intermediaries by doing away with them.” There have been some arguments however, that the private sector is better placed to build and operate technical capacity of the necessary scale.

Indirect retail, on the other hand, has commercial banks operating as intermediaries to issue the CBDC and handling retail payments, while the central bank retains control of the wholesale payments. An indirect architecture’s appeal is that it retains the established capacity and appeal of existing payments systems that consumers may be used to. Concerns about a central bank’s ability to expand operations to match KYC and customer due diligence could be answered by this model.

Hybrid is a combination of both of the above, whereby the CBDC acts as a claim on the central bank but the commercial banks serve as intermediaries to take care of KYC and retail payments. This combination of direct claim on the central bank, which would also periodically record retail balances, with a private sector messaging layer, may offer improved resilience over an indirect retail architecture but also requires a more complex infrastructure from the central bank.

Wholesale CBDC projects

Due to the propagation of different CBDC models, it is necessary to examine the interoperability of these various CBDCs, specifically for DLT-based cross-border payments. Interoperability is currently a significant challenge for conventional payment systems, and CBDCs have been touted as a potential solution. However, this requires them to have agreed standards and interoperation from the outset as a universal CBDC is generally considered unworkable due to issues around economic stability and currency sovereignty.

Fortunately, there has already been collaboration between multiple countries to explore this topic through initiatives such as Project mBridge – a collaboration between the BIS Innovation Hub Hong Kong Centre, the Hong Kong Monetary Authority, the Bank of Thailand, the Digital Currency Institute of the People’s Bank of China and the Central Bank of the United Arab Emirates – to create a prototype platform joining up multiple CBDCs.

Other such initiatives include Project Dunbar, which saw the Reserve Bank of Australia, Bank Negara Malaysia, the Monetary Authority of Singapore and the South African Reserve Bank work together to test the use of CBDCs for international settlements, and Project Jasper-Ubin, which combines the Bank of Canada’s Project Jasper and the Monetary Authority of Singapore’s Project Ubin to use DLT to make cross-border payments faster and less expensive.

The various projects have one conclusion in common: cross-border payment using the DLT platform is feasible. Some projects have gone further, establishing that CBDC cross-border payment innovations can be integrated into existing banking systems and processes. Not only that but CBDCs could offer better transparency, helping countries to monitor currency flows even outside of their jurisdiction.

However, there is the need for a generally agreed framework, including the compatibility, integration and interconnection of the CBDC models. This will define the guidelines and responsibility of all parties; without it we may see CBDCs simply becoming another fragmented set of payment systems with the same interoperability challenges.

The status of CBDCs around the world

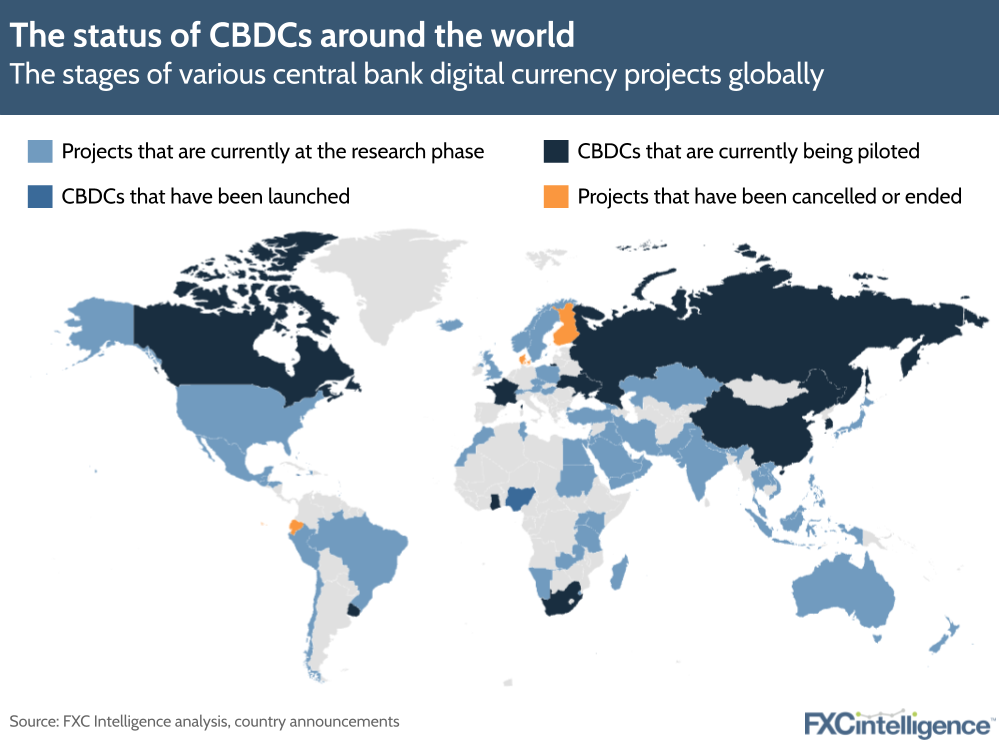

Despite these challenges, countries representing more than 95% of global GDP continue to research, test and pilot CBDCs, according to the Atlantic Council’s CBDC tracker. More than 60% of these countries are in the research and development stage, meaning they are exploring use cases, impact and feasibility or have initiated a technical build and early testing in a controlled environment.

Roughly 15% are then in the pilot stage, having begun small-scale testing in real-world conditions. These pilots have limited users and typically run over set timescales, rolling out over a series of stages that aim to establish the CBDCs functionality when in the hands of actual users.

10 countries have officially launched a CBDC. This means that the currency is available for widespread wholesale or retail use, and in most cases a primary goal of the rollout has been improving financial inclusion. These systems run alongside existing currency and have seen variable success.

Countries that have launched a CBDC

Countries that have officially launched their CBDC include the Bahamas, Nigeria, Jamaica and the Eastern Caribbean Currency Union (an organisation composed of Anguilla, Antigua and Barbuda, Saint Kitts and Nevis, Montserrat, Dominica, Saint Lucia, Saint Vincent and the Grenadines, Grenada).

Bahamas

In October 2020, the digital version of the Bahamian dollar – the Sand Dollar – was officially launched. It is accessible through a physical payment card and a digital wallet that allows consumers access even without an internet connection.

The main intention behind the Sand Dollar is to boost financial inclusion and financial access, and shorten the settlement time on transactions. The Sand Dollar’s three-tier system also increases controls around illegal activities associated with cash usage.

In part, the Sand Dollar’s strength comes from providing digital infrastructure to a region that, as a series of islands, can struggle with physical infrastructure (following Hurricane Dorian for example, it took more than a year for banks to restore branch facilities). According to a 2021 Bloomberg interview with John Rolle, the country’s central bank governor, the challenges faced by the currency include a greater demand for the CBDC than current access can accommodate and a need to better educate potential users as to the security of the currency.

Speaking further, Rolle said that there were more than 200,000 Sand Dollars in circulation at the time, but he expected that to grow rapidly. According to a PwC report, the Bahamas is currently the most mature retail CBDC project worldwide, ahead of countries like Cambodia and China.

Eastern Caribbean Currency Union

The Eastern Caribbean Central Bank’s (ECCB) Dcash was first piloted in 2019 on a private-permissioned blockchain network as part of a partnership with fintech company Bitt. In 2021, Dcash became legal tender that can be used with or without a bank account.

Dcash was launched to drive financial inclusion, reduce transaction costs and banking services fees, as well as create a more efficient form of payment than cheques and build resilience into the Eastern Caribbean Currency Union’s financial system.

In early 2022, Dcash became emblematic of the challenges faced by digital currency adoption as it went offline for more than a month. Supposedly caused by an expired certificate on the blockchain framework hosting Dcash’s ledger, while the outage didn’t compromise any data, it halted all transactions. Fortunately, Dcash seems to still represent a relatively small percentage of transactions in the Union and the interruption was thus not too severe, but it raises hard questions about the risks of going all-in on a CBDC.

Nigeria

Nigeria is the first country in Africa to launch a CBDC, called eNaira. The currency, launched in October 2021, is meant to improve the cash-based economy, boost financial inclusion and access, remove transaction fees and create a secure and low cost remittance inflow to the country.

eNaira can be set up using a consumer’s national identification number, after which it is stored in a digital wallet for contactless in-store payments and money transfer. Uptake of eNaira among Nigerians is low; as of May 2022, 756,000 app downloads had been recorded, in contrast to the 260 million users China’s CBDC saw in its pilot stage.

There has been some suggestion from the Central Bank of Nigeria (CBN) that adoption has been hindered by a sense of apathy from the commercial banks, potentially related to a desire to maintain customer’s accounts in their systems rather than see them transfer to eNaira. The CBN has admitted however that there is also still plenty of work to be done around user education and engagement from its end.

Jamaica

On 14 June 2022, the Bank of Jamaica launched JAM-DEX. JAM-DEX is intended to boost financial inclusion and access, reduce the costs of handling and securing cash for merchants and banks, as well as providing a safe and convenient way to pay for goods and services.

The Jamaican CBDC can be acquired by contacting a wallet provider (commercial bank, building society, merchant bank or authorised payment service provider). Currently, National Commercial Bank offers JAM-DEX through its digital wallet: Lynk. Users can convert the CBDC to cash using a smart ATM or at any wallet provider.

Following amendments to the Bank of Jamaica Act being passed into law in June 2022, JAM-DEX is now proceeding with a phased rollout. According to the Jamaica Observer, more than 120,000 users have signed up to the Lynk platform so far and are able to use the CBDC for transactions with more than 2,000 merchants. Lynk is now involved in an education programme designed to inform users about how JAM-DEX is increasing the accessibility of digital payments for Jamaicans.

The country’s prime minister, Andrew Holness, has stated that he expects 70% of the population to be using the CBDC by 2027. Although he acknowledged challenges to providing digital access to the population, there is also a confidence in the CBDCs ability to bring Jamaicans into the formal financial system.

JAM-DEX has, however, been highlighted by the Atlantic Council as an example of the potential privacy risks posed by CBDCs. The currency’s architecture means that users’ transactions are all visible to the Bank of Jamaica in plaintext. Although the bank itself may be trustworthy, such a cache presents a valuable target for hackers.

Example countries in the CBDC pilot stage

CBDCs are complicated mechanisms, with a variety of possible designs and policy intentions. Countries that have begun to pilot digital currency, having established some level of design via research & development, are looking to see how the intentions and mechanics of the CBDC hold up under real-world conditions. While limited in scope, these pilots can often show critical flaws or benefits in the system.

Cambodia

In 2019, the National Bank of Cambodia launched a pilot CBDC with Malaysian universal bank Maybank. This is designed to enable Cambodian citizens working in Malaysia to transfer funds to Cambodia with much lower costs than the traditional payment system.

The CBDC pilot leveraged mobile phone utilisation to boost financial inclusion, promote real-time electronic transactions in Cambodian riels and to offer access to credit for SMEs.

Uruguay

Uruguay launched a CBDC pilot called E-Peso in November 2017, with a limited level of issuance. The six-month pilot was mainly used for payment in registered stores and businesses, and peer-to-peer transfers without an internet connection. $20m was issued for 10,000 mobile users, with a limit of $30,000 per wallet for individuals and $200,000 for registered businesses.

Banco Central del Uruguay has explored the possibility of outsourcing CBDC development but is currently still considering full-scale public E-peso issuance.

China

China piloted its CBDC (known as e-CNY or the digital yuan) in four major cities in 2020. The People’s Bank of China issues e-CNY to commercial banks, which then distribute it to the public. Only a registered phone number is needed for a balance limit of 10,000 e-CNY. For a higher balance, ID and banking information is needed.

Users can download the e-CNY wallet application or manage their e-CNY transactions using the AliPay and TenPay apps – the two mobile payment giants in China, with more than 900 million monthly active users each.

The e-CNY pilot will explore the use of blockchain technology by using a centralised ledger to record retail transactions. It will test the scalability of e-CNY transactions, offer greater visibility on the flow of payment transactions and improve the efficiency of the retail payment system both online and offline. China’s e-CNY will most likely affect the economic developments of several countries in Southeast Asia.

In 2022, the e-CNY was also used at the Beijing Winter Olympics. Foreign visitors were able to download an app, get a physical card that stores e-CNY or convert bank notes into e-CNY via self-service machines. The CBDC was a supported currency, alongside Visa cards and CNY cash, in the Olympic Village.

Korea

The Bank of Korea and GroundX, the blockchain unit of Korean communications giant Kakao, launched a two-stage CBDC pilot in August 2021.The pilot was designed to identify the best design and technology for the CBDC, as well as explore partnerships with the private sector and test the functionality and security of a blockchain platform.

Sweden

Sweden’s Sveriges Riksbank launched a pilot for a retail token-based CBDC called e-Krona in 2020. The currency used a plaintext payment token scheme and the pilot found that not only was the CBDC easy to scale, but it made payment verification faster than the traditional payment system. However, privacy protection for users was not guaranteed as both the amount being transferred and the identities of both payer and recipient were visible.

Ukraine

The pilot for the Ukrainian CBDC – E-hryvnia – was launched in 2018 to test distributed ledgers, as well as study the impact such a currency would have on macroeconomic stability and explore the legal position of CBDC circulation. The pilot suggested that E-hryvnia would not disrupt financial stability but further testing is in the works.

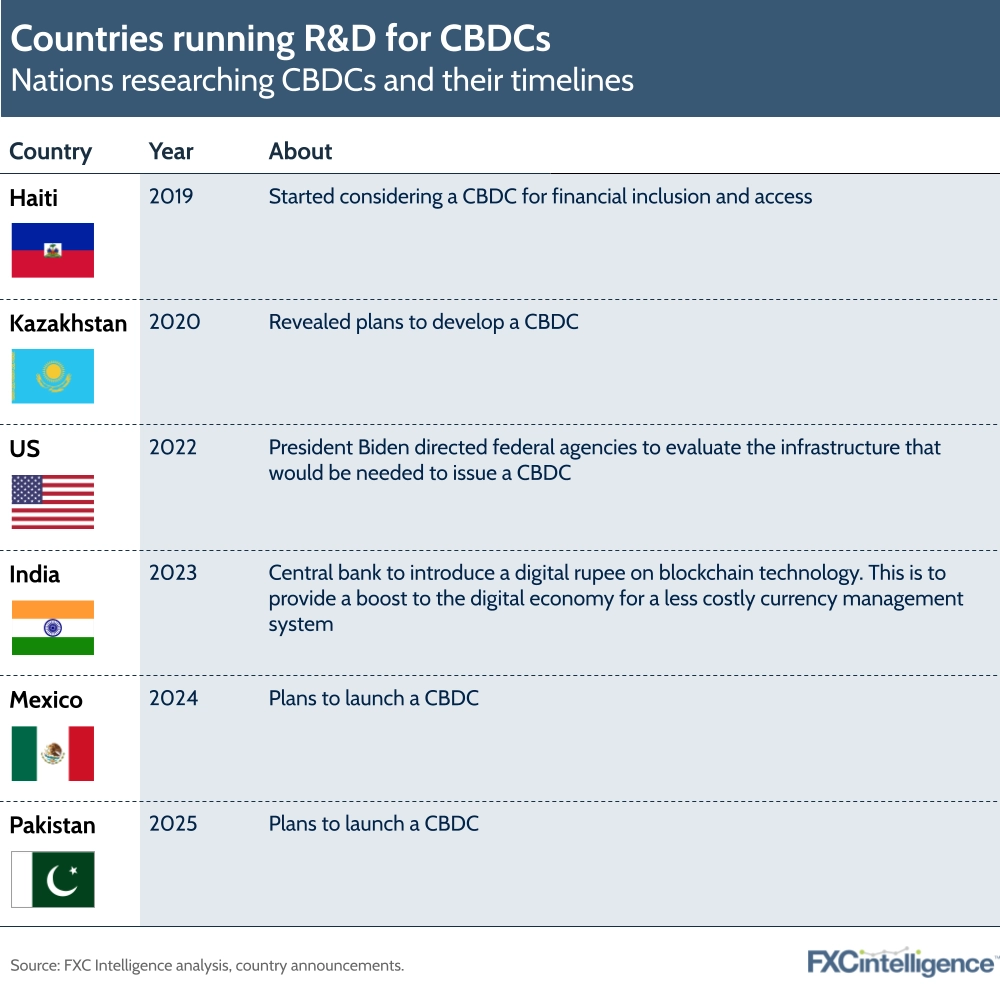

Example countries undergoing R&D for a CBDC

Other countries are still in the research and development stage. Some have established specific timelines in which they plan to launch a CBDC, yet several remain in more nebulous phases of exploration.

Those with more specific timelines are largely involved in research on the type of CBDC they will be deploying, as well as the technologies and structures that will be required for implementation, and include nations such as India, which is set to launch its digital rupee by the end of March 2023.

Other countries, including the UK, Turkey, the Philippines, Spain, Morocco and Malta have announced various research projects but are yet to set concrete timelines for adoption.

European Union

The European Union is said to be planning to launch a digital euro in the near future, though no specific date has been announced as yet. Germany and France have been the major proponents of the EU launching a CBDC.

The main source of funding for EU banks is deposit, meaning that a digital currency could pose a threat to the commercial banks. To protect against this financial risk, the Union would set an overall cap on digital euro holdings at 1 to 1.5 trillion.

The US

On 9 March 2022, President Biden signed an executive order to define the US Government’s strategy around digital assets. Part of this strategy is the preparation of reports on the possibility of creating a digital dollar and ensuring the nation has the digital assets necessary for a world banking power. A central goal for this reporting is assessing the technological infrastructure needed for a CBDC.

It should be noted that, as in other countries, industry trade groups are of the opinion that a CBDC could cause a bank run and limit banks’ ability to offer credit.

Palestine

Palestine is piloting a CBDC in the hope of developing a sovereign currency. Currently, the country primarily relies on the Israeli shekel for payment transactions, while the Jordanian dinar and US dollar act as stores of value.

Palestine faces several challenges however. Not only is it not serviced by any payment companies, such as PayPal, but Israeli anti-money laundering laws prohibit large cash transactions and limit how much Palestinian banks can transfer monthly. These factors will prove a serious hindrance to any attempt to issue a digital currency.

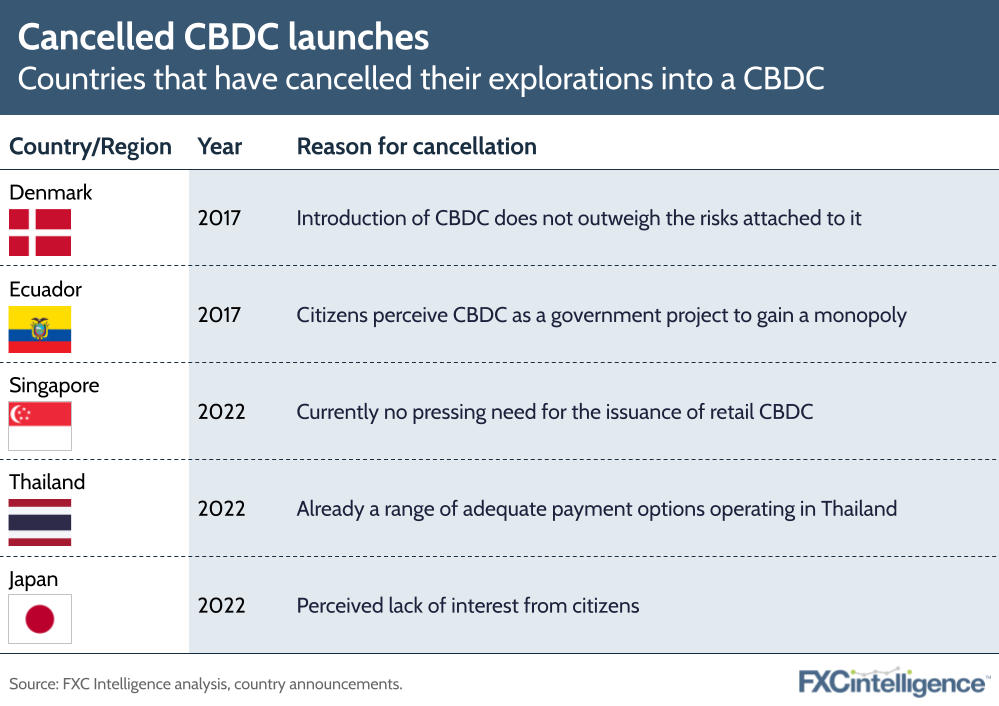

Cancelled CBDC launches

While CBDCs are now attracting increasing interest from a variety of nations, several projects have also fallen by the wayside over the years. As with successful and developing CBDCs, they have taken a range of forms and purposes, but have often served as warning of the complications that can come with such a radical transformation of a country’s financial system.

Finland

Arguably the first CBDC, the Avant smart card system was created in the 1990s with the expectation that it would replace coins for small purchases. Based on technology similar to that used in credit and debit cards, the system was eventually sold off to commercial banks. As debit cards became cheaper and were upgraded with smart card technology, the Avant system was steadily made obsolete.

Denmark

In 2016, Denmark explored the viability of a digital currency called the e-Kroner. Plans were shelved in 2017, however. It was stated that the considerable challenges of CBDC introduction, including potential financial instability, would not be worth it.

In part, the country’s reluctance seems to stem from the fact that while the majority of physical transactions in Denmark are currently cashless, the system has not struggled without a CBDC. Since the e-Kroner’s shelving, the country has continued to explore the technologies underlying CBDCs, but remains uncommitted to a launch.

Ecuador

Ecuador was the first country to start a CBDC pilot, with the issuance of dinero electrónico (DE) in 2014. The pilot made it possible for users to own a CBDC account through a mobile application managed by state-owned enterprise mobile telco operator CNT.

DE was piloted to reduce government expenditure on exchanging old notes for new dollars, which is about $3m annually. It was also intended to serve as a claim against the government’s US dollar reserves (Ecuador dollarised its monetary system in 2000).

However, citizens proved sceptical due to the provision of mobile payments systems being solely controlled by the state. Several additional criticisms arose, including the public refusing to recognise the DE as being as safe as deposits held in commercial banks.

Thailand

Thailand’s efforts around a CBDC are currently somewhat confused. The Bank of Thailand (BOT) has said that it doesn’t have plans to issue a retail CBDC, explaining in a statement that “the issuance requires thorough consideration of benefits and associated risks for the financial system”. It is possible that the lack of momentum is due to existing payment options in Thailand proving adequate for consumer needs.

However, it was also reported by Bloomberg in August 2022 that the BOT is planning to advance development of a retail CBDC to a pilot phase by the end of the year. This pilot will see the currency conduct cash-like activities within limited areas and among roughly 10,000 retail users selected by the BOT, along with the Bank of Ayudhya, Siam Commercial Bank and payments platform provider 2C2P (Thailand).

The future of CBDCs in flux

In conclusion, launching a CBDC comes with a lot of responsibilities, particularly when it comes to ensuring that it does not lead to financial instability. For some nations, it may be that instilling better management of existing monetary regulation may prove more successful.

The chief difficulty here may be matching the levels of privacy offered by digital currency. However, other concerns – such as security and and tackling the complexity of a new financial system – will prove no less challenging.

No matter what architecture a central bank decides to use, a CBDC will have significant cybersecurity challenges to overcome and a lot of work will need to be done to reassure users of the trustworthiness of the system. Even among CBDCs that have already been launched, there have already been examples of the dangers posed by the transition to a digital currency, as in the case of Dcash.

Such challenges emphasise that while it is vitally important to test all aspects of a CBDC before launching – including security, design and technology – there will always be unforeseeable factors placing the system at risk. While such testing ensures that the CBDC can be launched with as few challenges as possible, and that it has been designed as harmoniously with a nation’s economy as can be expected, it is worth bearing in mind that these are still new technologies that still have much development to come.

Fundamentally, it is perhaps best to think of the space around CBDCs as being in flux. As digital currencies of all stripes continue to gain attention and popularity, and societies become increasingly cashless, CBDCs are only likely to see further exploration. The exploration so far has seen a wide range of success, and some countries’ cancellation or slowdown of CBDC projects emphasises the complexity of any such adoption, but there are pinpoints of hope.

Although some launches have been slow, others, even in the pilot stage, have seen rapid adoption. China’s e-CNY has seen notably uptake and with plans to expand the system in 2023 or 2024, it could serve as the foremost example of a successful CBDC and perhaps lay the path for further digital currencies to follow. No doubt many will adopt their own approach, and we will see a spectrum of underlying designs, but with proper testing, and thorough integration, the next few years may well see an undeniable acceleration of CBDCs into the public sphere.