2023 has presented headwinds for some companies, but B2B cross-border payments has for the most part seen a strong year as it continues to mature and develop. We look at some of the key trends for the segment this year.

2023 sees continued B2B payments consolidation

2023 has not been a strong year for IPOs in any industry, and cross-border payments has been no different. B2B payments has seen the IPO of one company: emerging markets-focused CAB Payments, but for the most part this has been a quiet year.

Arguably more significant for the space in 2023, however, is the industry’s use of acquisitions to continue what is likely to be a multi-year journey of consolidation. With the industry remaining highly fragmented, there are many acquisition opportunities for companies with the available credit, and those that are purchasing other players are doing so to augment their own organic growth strategies.

While 2022 saw slightly more high-profile B2B payments acquisitions, this year still saw a number of major deals in the space. For many, these acquisitions provide additional geographical capabilities, such as Nexi’s acquisition of Spanish player Paycomet and Equals’ acquisition of Belgium-based Oonex.

For others, acquisitions are a means to strengthen specific business capabilities. This is reflected in American Express’s acquisition of Nipendo, to help build out its end-to-end B2B payments platform, as well as Paynetics’s acquisition of Phyre, to bolster its embedded finance proposition. We also saw this approach echoed by OFX, with its acquisition of Paytron following the 2022-announced Firma acquisition.

Meanwhile, for some, acquisitions are simply a means to add strength to a company’s technology stack. Improvements in the job market for recruiters has lessened last year’s trend of buying companies for their tech team, but there are still those purchasing companies for their infrastructure, as evidenced by Nuvei’s recent reported acquisition of Till Payments.

Looking forward, we expect to see acquisitions continue to be a regular theme in B2B payments, and may even see them form an alternative to other means of company restructuring. For example, Corpay, the B2B payments arm of public company Fleetcor, is considering acquiring a company to merge with the brand as part of a move to make it a standalone organisation.

B2B growth rates outpace other areas of cross-border payments

Acquisitions are driving growth in the space, but so too is the general development of the non-bank B2B cross-border payments industry. Companies are becoming more sophisticated in terms of their expectations of cross-border payments – even at the SME scale – and changes in global trade are evolving the corridors with significant payment flows.

This is being aided by the fact that decision makers within companies are increasingly guided by their expectations on the consumer side, which have become far more complex, and so are looking for similar experiences from their business products.

As a result, most non-bank players in this space are getting their new customers not from each other but from the banking sector, and are growing rapidly, in part as a result of this.

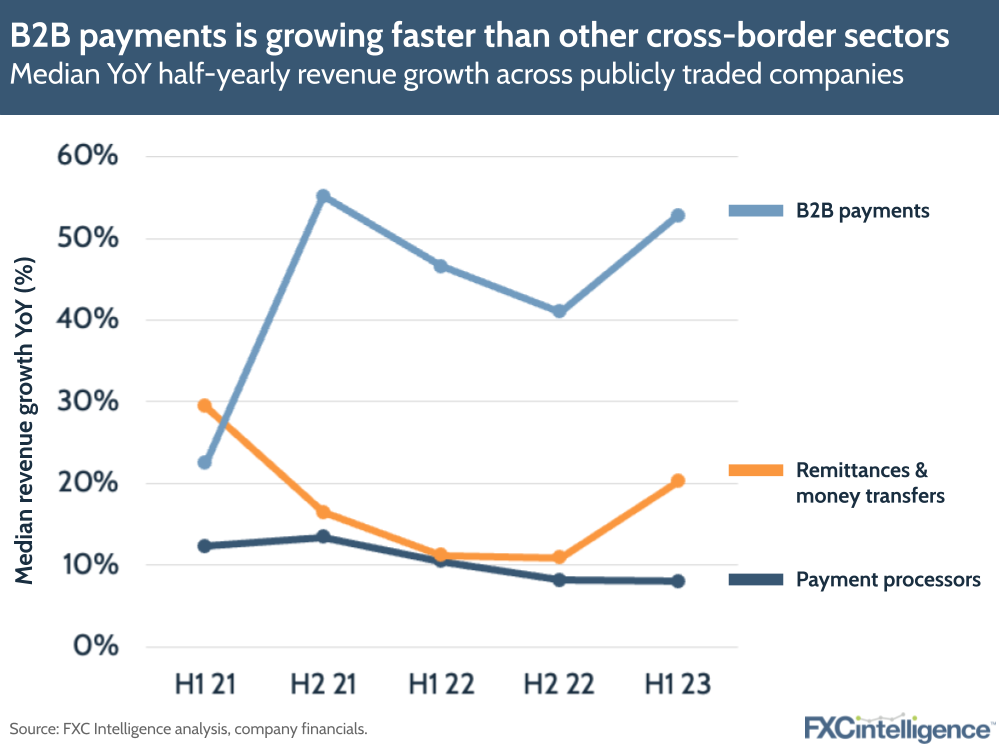

Looking at the performance of publicly traded B2B payments players – many of whom report on a half-yearly basis – shows a mean revenue growth rate that has remained significantly above that of consumer money transfers players and payment processors since H2 2021. While currently above 50% YoY, the mean revenue growth rate for B2B has consistently been above 40% over the last four halves, Meanwhile, remittances is at around 20% for H1 2023, but has generally had a mean growth rate in the low to mid teens, while payment processors has generally remained around or below 10%.

This reflects the relative lack of maturity in B2B payments compared to consumer money transfers or payment processors, and suggests an industry with significant near-term growth still ahead.

Startups focus on B2B payments

The growth potential of B2B payments is also evidenced by newer companies in the space, as we found in several reports this year.

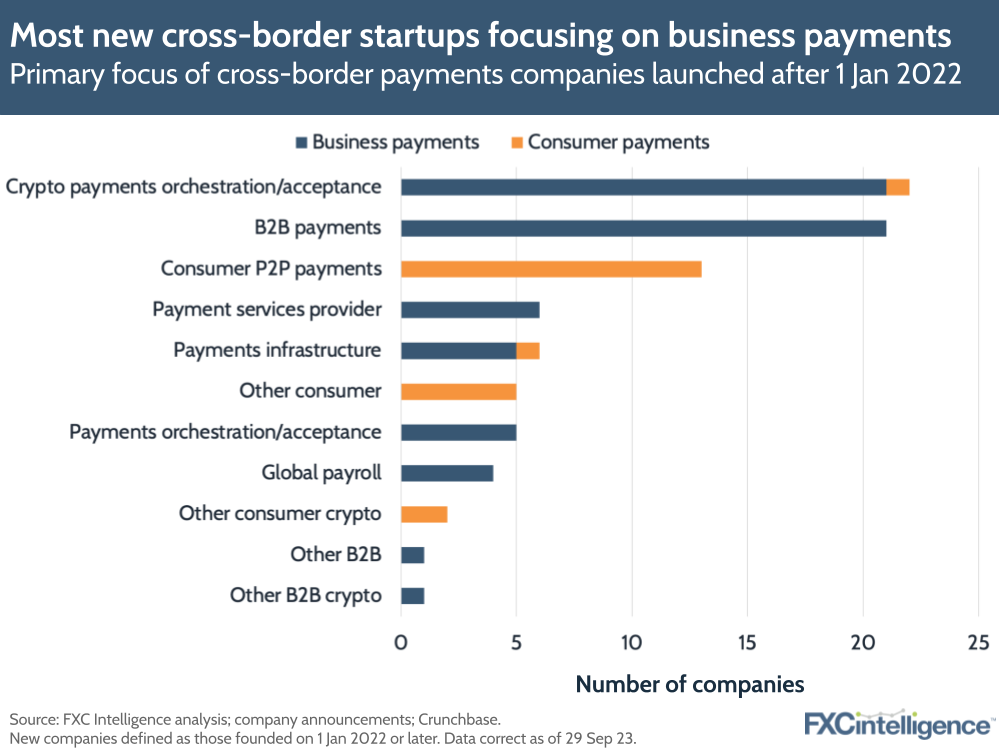

Among cross-border payments companies founded since the start of 2022, B2B payments was the second most popular business category after companies that provided cryptocurrency payments acceptance services. In the same report, we also found that companies catering to businesses were more likely to have received startup funding (53%), than those catering to consumers (27%).

In a separate report analysing companies that had received startup funding in 2023, we also found that B2B payments was the biggest source of investment this year, with 32% of cross-border payments companies raising money in at least one round this year primarily catering to the sector.

The dominance of B2B payments among startups this year suggests that the sector is presenting greater potential for disruption than in other areas such as money transfers, where much of the transformation of the space by digital players has been well underway for several years.

B2B key for established cross-border payments players

Crucially, among players that cater to multiple sectors, B2B has also proved to be a key earner in 2023. Payments services provider Payoneer, for example, has been focusing its attention on growing its customer base internationally, focusing on APAC, SAMEA and LatAm. Here, it has grown customers by 12% in Q3 2023, however it grew its B2B business volume in these areas by 23% YoY over the same period.

OFX, meanwhile, has significant Corporate and High-Value Consumer segments, which together account for 84% of the company’s revenues. However, in H1 2024, equivalent to calendar Q2 and Q3 2023, the company saw Corporate account for 60% of revenue, up from 57% in the same period the previous year and 42% in the year before that.

There has also been growth among players that are not yet public. For example, Convera, formerly Western Union Business Solutions, told us in September that the company has grown by around 50% since its sale was first announced in 2021.

2024 is set to pose fresh challenges to the B2B payments space, however the prospects for the industry remain strong and growing.