Investment may be down, but cross-border payments is still seeing new startups emerge regularly. We look at trends in recently established companies to get a sense of where the industry is going.

While VC investment may be down across fintech and beyond, including in cross-border payments, there are still new companies emerging regularly, catering to specific niches and markets across the full spectrum of the industry.

Developing solutions to perceived gaps in the payments space, some of these startups are likely to go on to become major players, while others may struggle to build momentum or be acquired at an early stage. Regardless of their ultimate destination, such companies, and trends across them, provide a sense of where new development is being focused and so give an indication of where the industry may be in the future.

In this report, we look at trends among cross-border payment startups by analysing companies founded in the space since the start of 2022. To do this, we focused on companies within the ‘payments’ or ‘mobile payments’ section of Crunchbase that were listed as active. From there, we refined the list to only include those operating primarily in or with a significant focus on cross-border payments, as well as discounting those without a functioning website. This resulted in a list of 86 cross-border payments startups founded since the beginning of 2022, which we analysed to identify key trends and focuses.

What business areas are cross-border payments startups focusing on?

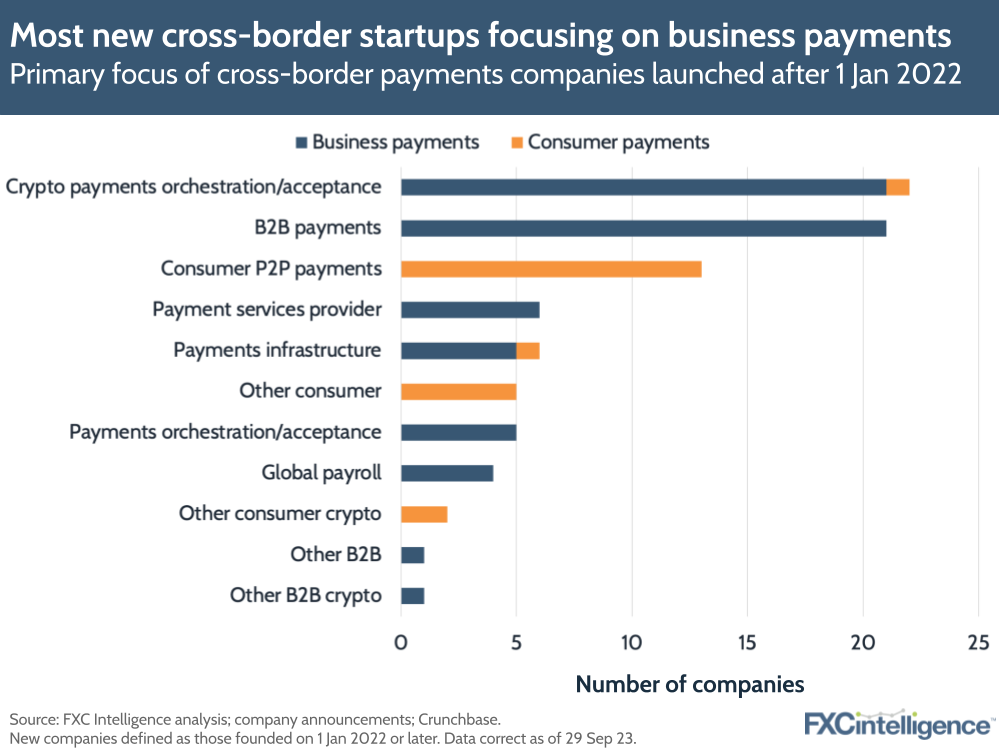

While in the past there has been considerable focus on the consumer side of cross-border payments, it is notable that startups catering to business customers have been founded at a much greater rate than those serving consumer customers since the start of 2022. 74% of the companies analysed catered primarily to businesses, while just 26% primarily focused on consumers.

However, while B2B payments was the second most common area of business, and led when combined with other business-focused categories (global payroll and other B2B), this was not the most popular business category. Instead, companies that provide payments orchestration and acceptance for cryptocurrencies, either stablecoins or non-asset backed tokens, were in the lead. This is significant given the current and ongoing crypto winter, and suggests that there are green shoots for the industry.

Notably, the vast majority of these were focused on businesses, with most providing services to enable businesses to interoperate between fiat and cryptocurrencies either to accept payments from customers or to interact with crypto-facing businesses and operations.

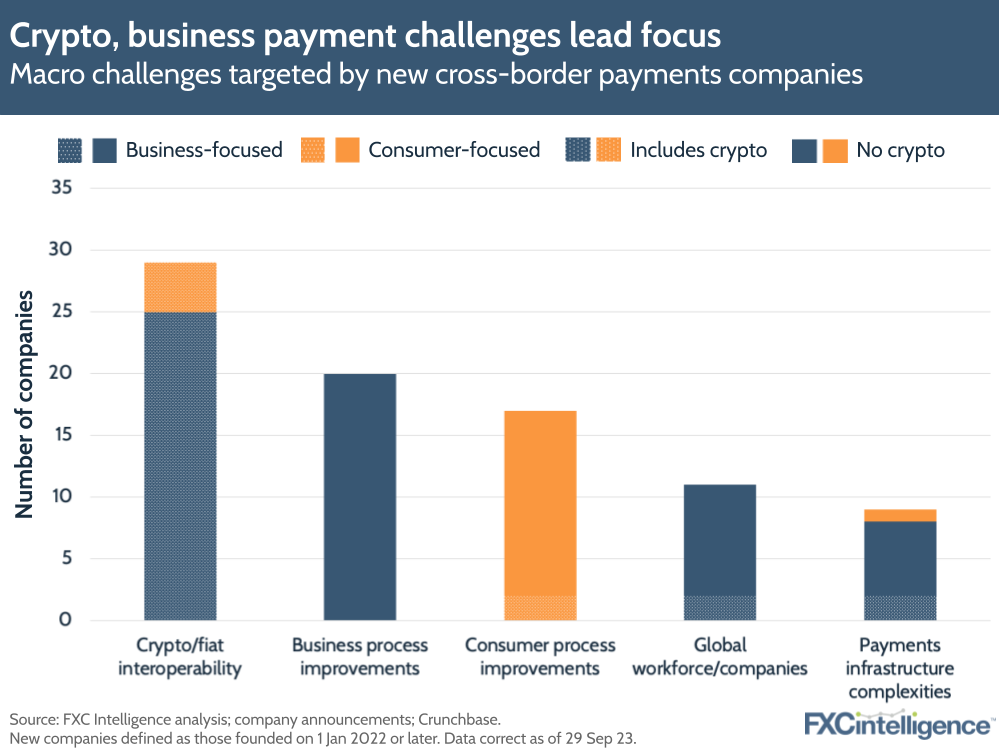

We also grouped the businesses by the primary macro challenge that they were looking to solve in order to determine the most common areas that businesses perceived gaps in the market. Here, solving issues related to crypto-fiat interoperability was the most common focus of payment startups’ offerings, although again this was largely focused on the business sector, rather than catering to consumers where the market is already more mature.

The next two most common focuses were around improving processes for either business customers or consumer customers, with many companies focusing on specific niches. This includes emerging markets support and ease of doing business on particular corridors on the business side, while on the consumer side this includes tackling financial inclusion and reducing friction to send payments.

This focus is similar to many previously founded businesses in the space, and reflects the breadth of process improvement opportunities within the cross-border payments industry globally. Many of the companies focusing on this area are located in areas of the world that have traditionally been seen as a lower priority or too challenging due to market size, local infrastructure or market maturity.

The final two areas also reflect ongoing trends within payments and beyond. The first, global workforce, reflects the growing interest in hiring international employees following the rise of remote working during the pandemic. Companies in this section fall largely into one of two types: those that provide global payroll and related services, and those that enable freelancers, contractors and similar to get paid internationally.

The second are companies that provide infrastructure solutions, and reflect the fact that while multiple high-profile cross-border payments companies have their own networks and infrastructure solutions, this space remains very fragmented and is yet to undergo extensive consolidation.

Fundraising status of cross-border payments startups

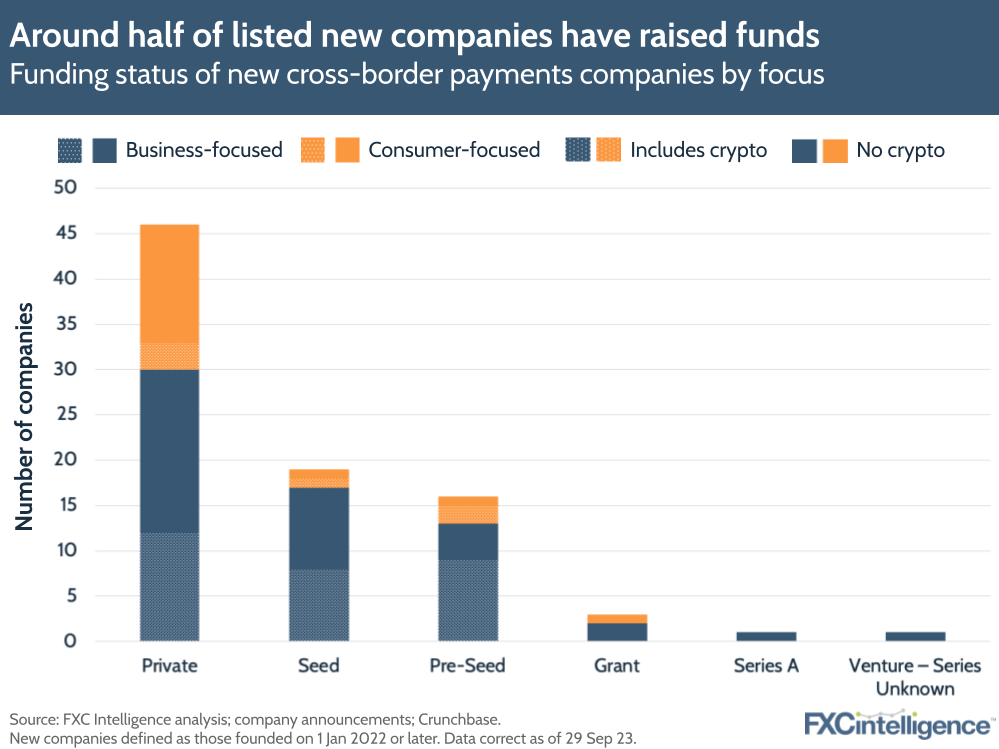

Among the companies analysed, just over half (53%) were private and had not received any form of publicly stated funding. Seed round funding was the most popular category among those who had funding, with 22% of all analysed companies, or 48% of those with some form of funding, having raised money in a Seed round. Pre-Seed was the second most popular, accounting for 19% of all startups, or 40% of those with funding.

As this list draws from Crunchbase, it will not include companies that have opted to remain in stealth mode, so the true percentage of non-funded payments startups is likely to be higher. However, there were some trends by company focus in terms of those with funding.

Companies that had some form of crypto as part of their offering were the most likely to have received funding, with 57% having funding, compared to just 39% of those who did not have a product involving crypto. Business-focused companies were also more likely to have funding, with 53% of such companies having raised money compared to just 27% of consumer-focused companies.

Business-focused companies with a crypto product were the most likely group to have funding, at 59%, while consumer-focused companies with no crypto product were the least likely, at 19%.

Geographical spread of new companies

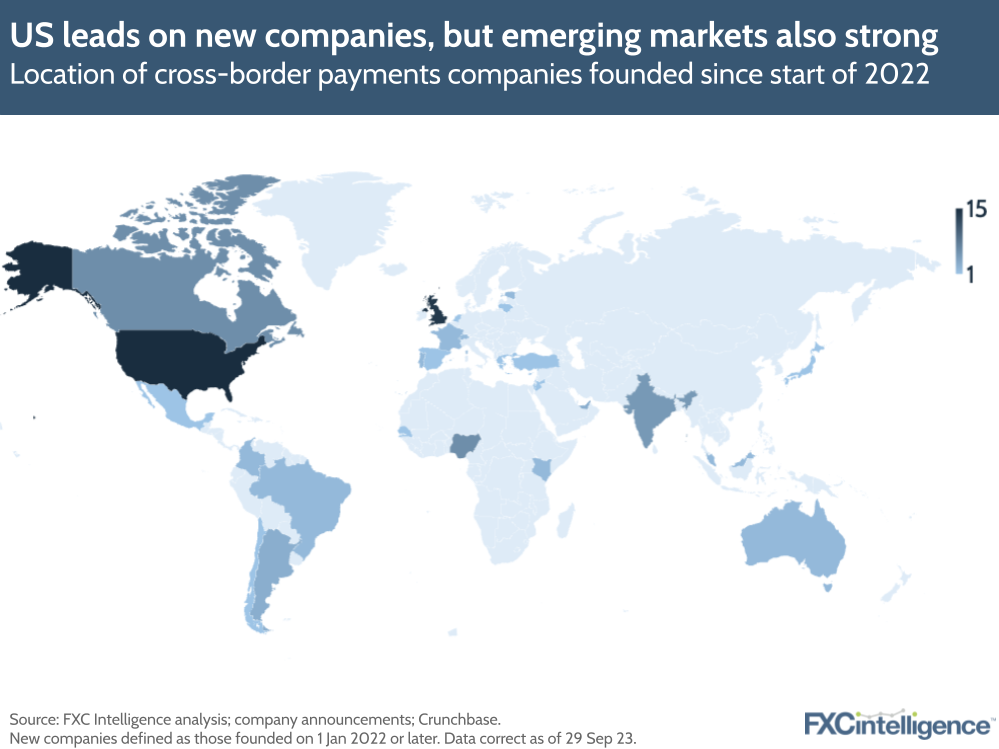

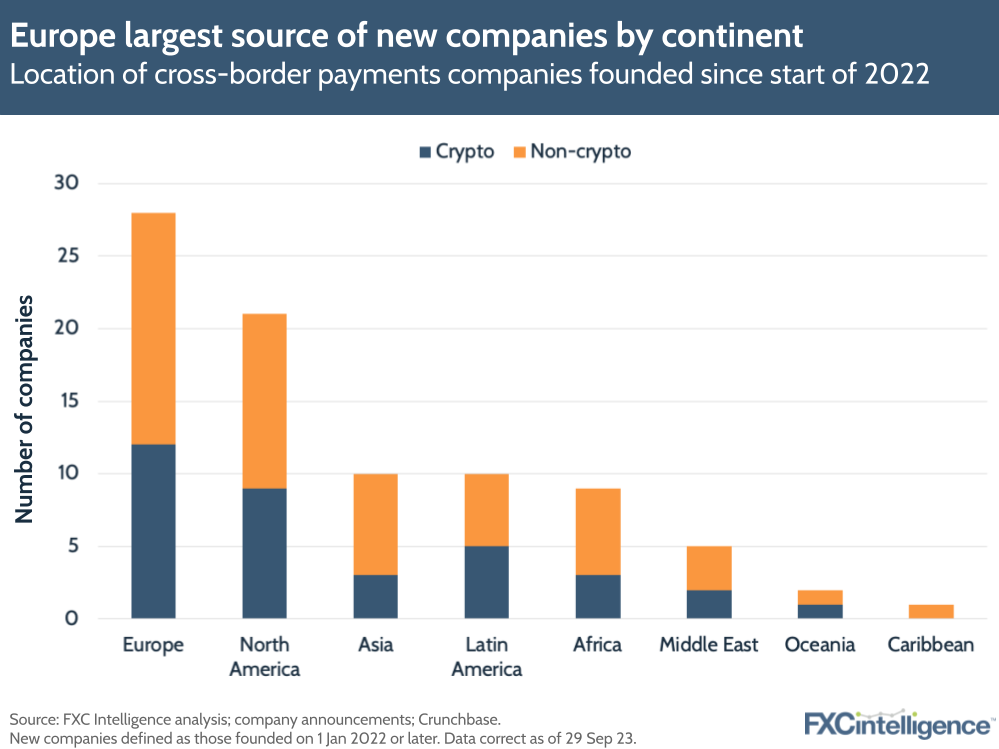

Looking geographically, while the dominance of traditionally strong companies in payments – namely the US and Western Europe – remained, there was a stronger presence of emerging markets than among lists of larger, more established cross-border payments companies, such as our own Top 100.

This was particularly notable in Africa, where the majority of new companies were located in West Africa, as opposed to South Africa, where more established players are based. Similarly, there was a much stronger presence of countries in Latin America than in the Top 100, which accounted for 12% of cross-border payments startups.

There was some variation when it came to companies using crypto, however. A greater percentage of non-crypto companies were located in Europe and North America, where 33% of non-crypto startups are based, compared to crypto companies, where 24% of companies are based in the two regions. Crypto use also varied by continent. In Latin America, crypto and non-crypto companies both accounted for 6% of the total respectively, while in Asia the crypto share was 4% and the non-crypto share was 8%.

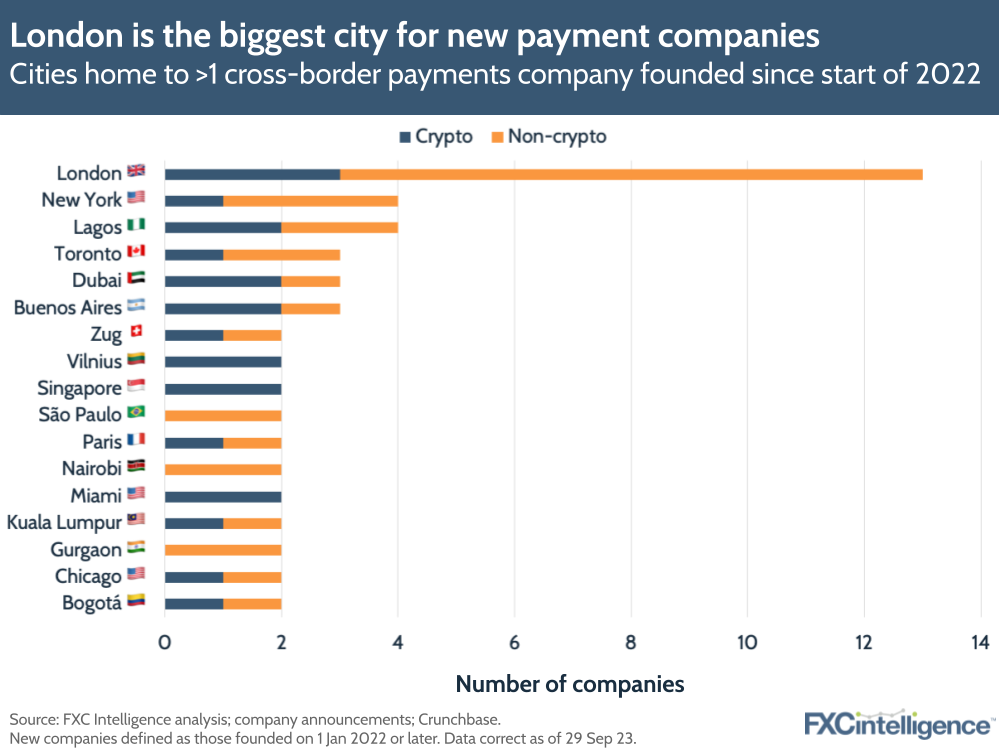

However, when it comes to cities that hosted a greater share of payments startups, there was one clear leader. London, UK, is home to 15% of the cross-border payments startups founded since the start of 2022, with New York, US, and Lagos, Nigeria coming in joint second at 7% respectively.

This is in some ways unsurprising, as London already has a strong established presence in the payments space, although it does suggest that Brexit is not diminishing its position here, which some had feared.

Similarly, New York’s position reflects both the US’s role in payments, as well as the greater focus on the East Coast for this industry – 50% of the US-based cross-border payment startups are located in this region. By contrast, there were notably few Silicon Valley-adjacent startups in the group, with only one based in San Francisco and the other two in California located in the region near Los Angeles instead.

However, the high placement of Lagos reflects Nigeria’s growing importance in both Africa and globally, and this, along with the presence of several cities across Africa, Latin America and Southeast Asia, reflects an ongoing emergence of these regions into the ranks of key players in the cross-border payments space.

Female representation among startup CEOs

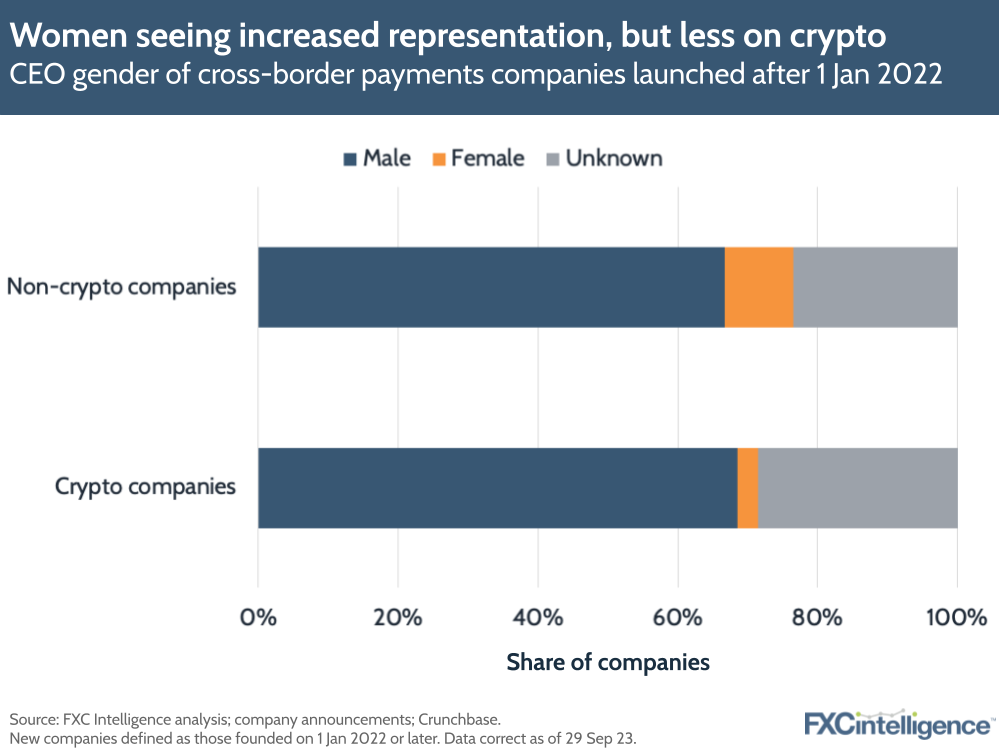

Alongside a greater presence of emerging market players compared to incumbent companies, this group also reflected greater diversity in terms of the genders of their CEOs compared to more established companies.

While a significant minority of companies (26%) have not yet named their CEO publicly in a way that was possible to determine, among those that have, 91% had male CEOs, while 9% had female CEOs. While this may seem low, this is a marked improvement on the 5% of CEOs for our Top 100.

Interestingly, there was a notable difference between companies that have a crypto product and those that don’t. Of the companies where the CEO’s gender could be determined, 13% of non-crypto companies had a female CEO, while among crypto companies, just 4% – a single company – had a female CEO. This indicates that while parts of the payment space are making positive moves on this issue, the crypto space has more work to do.

A picture of the future of payments?

This list is by no means a guarantee of the future of payments, but it does portray the makeup of the current pipeline of startups that will help the cross-border space grow. When combined with other trends and developments, it also provides a sense of how the industry is developing.

There are promising indications for the space, particularly with the growth of companies in emerging markets, as well as in inclusion. There are also indications that much of the growth is set to be on the business side of payments – something that is reflected in the strong growth rates of more established players in this industry. Notably, it also indicates that crypto has a strong presence in the future of cross-border payments, although whether this bears fruit remains to be seen.

Whether this cohort of companies develops consistently, or the market provides greater growth to some areas than others is also to be determined. What is clear is that cross-border payments continues to be a space where startups are finding their footing.