For B2B payments players, the H1 2023 earnings season has been broadly positive. We consider how the latest results and earnings calls are highlighting trends in the B2B payments industry.

Companies catering to the B2B payments space are currently operating in a fast-growing and evolving market, and for publicly traded businesses this is translating into generally strong results, particularly in H1 2023.

In the first in a new report series, we explore the top-line and more detailed earnings numbers from key publicly traded B2B payments companies, as well as analysing their earnings calls, to determine how the industry as a whole is developing now and in the future.

B2B payments remains a highly fragmented market, with no non-bank player currently having a share of more than 1% and most new customers being lured over from banks. Within the industry, there is also significant variation in the customer types that companies serve – from SMBs to large corporates – and a range of different verticals.

The industry is also made up of a wide range of company backgrounds, with long-established, solely B2B players sitting alongside newer organisations and those that have diversified from being primarily consumer-focused companies.

With this in mind, this report is designed to take the pulse of the industry as a whole through the results of major publicly traded companies across B2B payments. This covers solely B2B-focused players Alpha, Argentex, CAB Payments and Equals; Fleetcor-owned corporate payments specialist Corpay; multi-vertical specialist Flywire and the business arms of OFX and Wise, both of which also have significant consumer offerings.

Here we compare available data for all of the above players, alongside keyword analysis of available earnings calls over the past few years, to determine how different players and parts of the market are performing against the whole.

Growth in B2B payments revenue for H1 2023

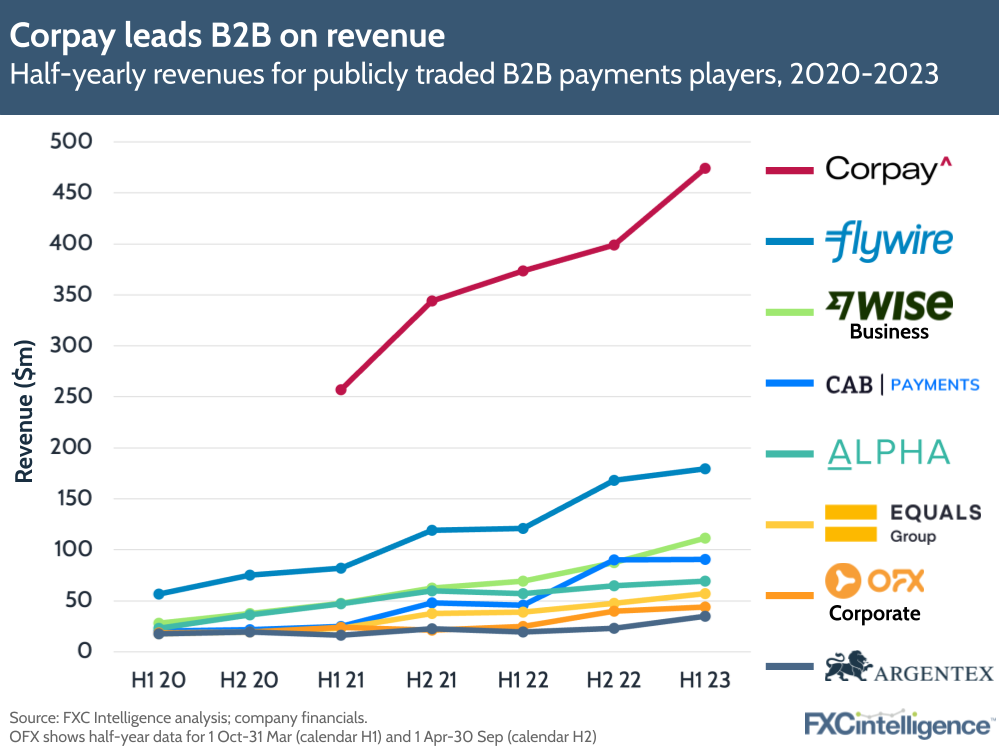

Looking at the revenue performance of the major players this quarter and historically, the majority of players report within a relatively small spectrum. They have also generally remained relative to one another, with a few notable exceptions.

Corpay is by far the largest of the companies looked at for this report in terms of revenue, with H1 revenues that were larger than Alpha, Argentex, CAB Payments, Equals, OFX Corporate and Wise Business combined. However, it has also widened this gap over the past few years. This is likely in part due to the number of acquisitions that parent company Fleetcor has made to bolster the division, although recent strong growth in accounts-payable and cross-border offerings may have also been key.

Flywire, meanwhile, caters to a number of specific verticals, including healthcare, education and travel, that set it apart from other players in this report, and a recent WeChat partnership helped raise its FY 2023 guidance in H1 2023.

Among the smaller businesses, Wise is starting to break ahead of other players as it continues to push its business division to take an ever-greater share of its top-line revenue, which now sits at around 22% – up from around 17% in 2020. Meanwhile, CAB Payments, which had its IPO in July, is more seasonal due to its focus on emerging markets-related payments but has similarly begun to break ahead of other players.

Equals, Alpha and Argentex – all UK-based players focusing on classic business payment offerings – have fairly similar revenue profiles, although while Argentex saw a drop in its recent European performance, Equals is expanding its offering there.

Meanwhile, OFX, which switched from being a largely consumer-focused player amid the pandemic, has steadily seen its corporate revenue share grow from slightly under 40% in 2020 to over 60% in its most recent half-yearly results, which cover calendar Q4 2022 and Q1 2023.

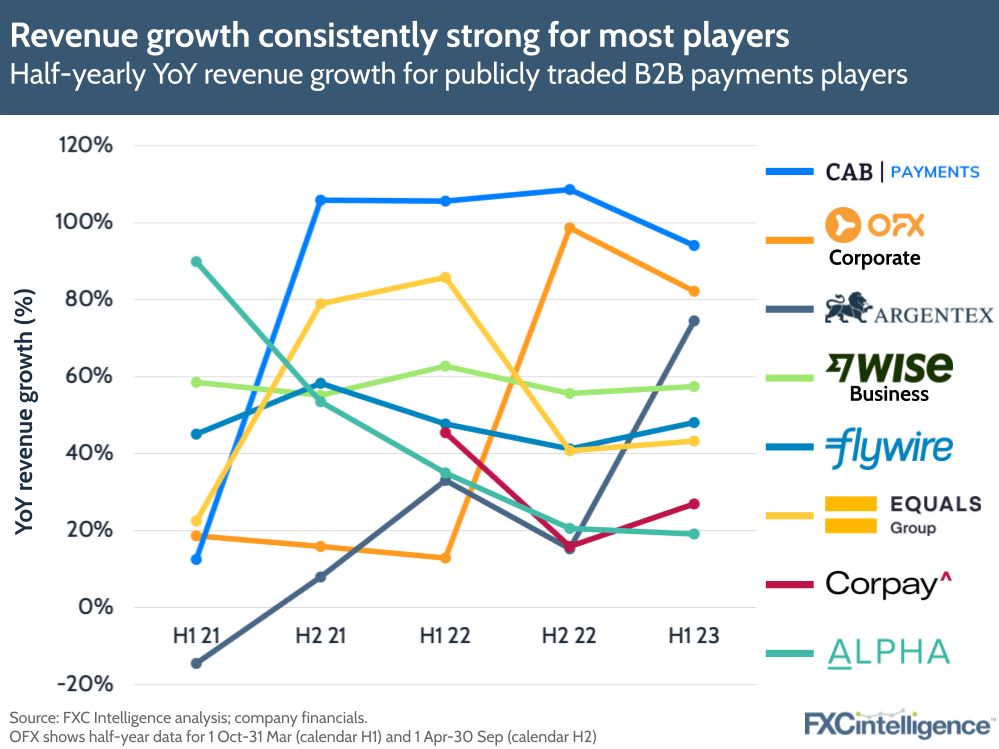

Revenue growth, meanwhile, is a more complex story, but in general shows the strength and pace of development in the industry, with most players consistently reporting half-yearly year-on-year growth over 40%.

Players who are either newer or have more recently developed B2B offerings are seeing the highest consistent growth, with CAB Payments still reporting near-100% YoY growth as it begins to negotiate life as a public company, while OFX Corporate has seen similarly strong growth as it shifts its focus to the division.

Corpay and Alpha, as more established players, have seen lower growth rates, but at around 20% these remain strong and are far higher than companies in other parts of the cross-border payments industry. Interestingly, Argentex – the only company to see a period of negative revenue growth during the three years – has since seen an impressive jump and is now growing at one of the strongest paces in the space.

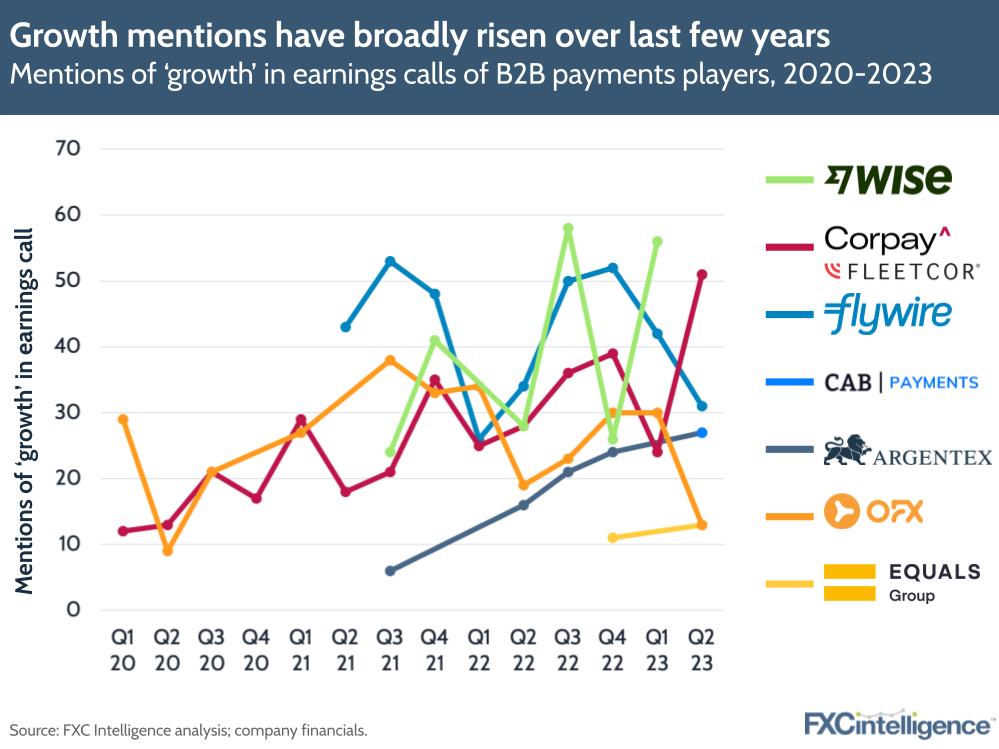

This rate of growth, which is far above that of other areas of the industry such as consumer payments, is interestingly reflected in mentions of the term ‘growth’ during companies’ earnings calls.

Not every company in this space has earnings calls every quarter or even every half, but an analysis of the available calls does indicate that discussions of growth have broadly been on the rise over the past few years for most players.

How are B2B payment players approaching pricing?

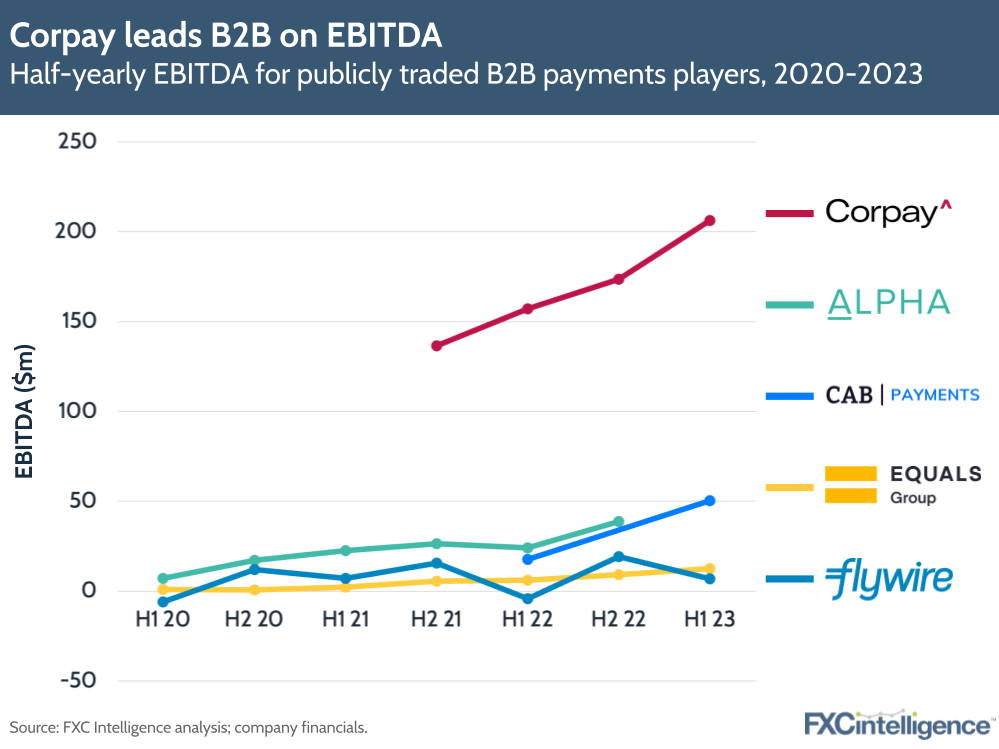

EBITDA shows more nuanced picture

Among players who publish EBITDA numbers, this provides vital additional context into the relative performance of different players. While revenue-leader Corpay again leads on EBITDA, CAB Payments and Alpha sit higher than some other players.

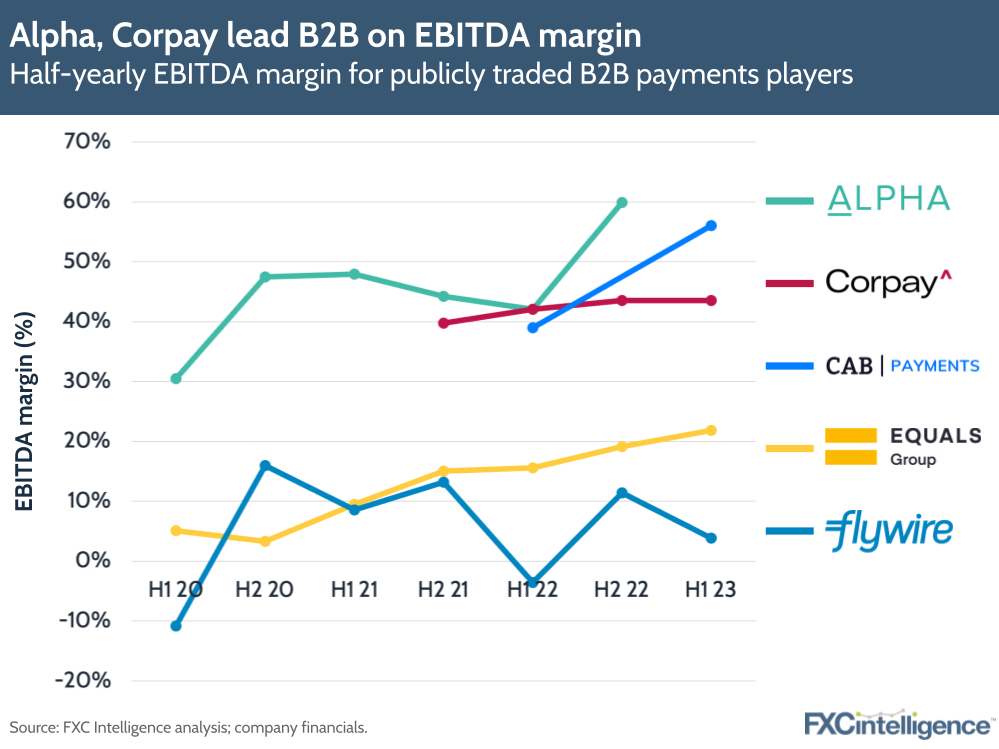

On EBITDA margin, however, this provides a stronger sense of how much companies are making from their revenue relative to each other. Here, Alpha and CAB Payments actually have higher EBITDA margins than Corpay, although it remains strong, with all three seeing margins consistently north of 40%.

Meanwhile Flywire’s focus on growth rather than immediate profitability is reflected in its lower EBITDA margin, although its move into positive shows the company is maturing in this area. By contrast, Equals has been consistently growing its own EBITDA margin, which passed 20% for the first time this half.

Customer variation highlights different market focuses

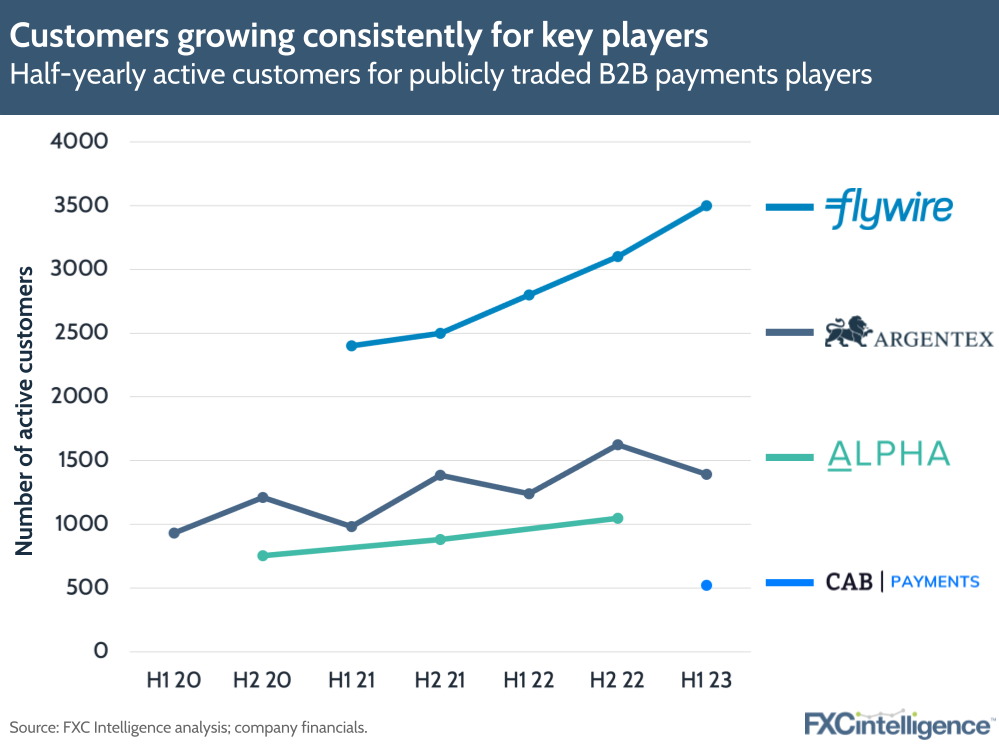

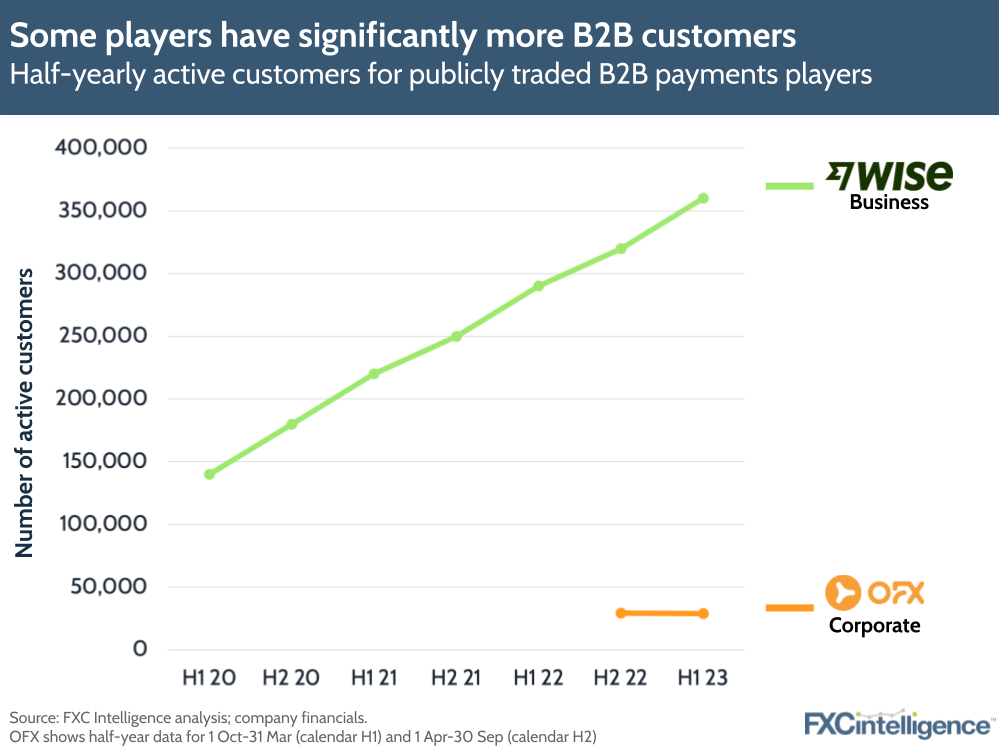

The variations in customer types and profiles are key to some of the differences in financial performance between different B2B payments players, and number of active customers is one of the strongest indicators of the differences among the players in this report, with around 360,000 customers between the biggest and smallest in the group.

This variation generally indicates quite different customer profiles, with larger customer numbers typically being the result of catering to smaller companies with lower send amounts and less direct interaction with the B2B payments company. Meanwhile, smaller numbers of customers typically have higher send amounts and receive a far greater level of personal support.

Among those at the smaller end of the spectrum, Flywire is the largest, with customers that include higher education institutions and healthcare providers. Argentex and Alpha, meanwhile, generally cater to corporates and financial institutions looking for high-value cross-border transactions, with services such as FX risk management included.

CAB Payments, the smallest in terms of customers, is a smaller business but also caters to organisations that need to send large amounts to or from emerging markets, with international development organisations and emerging market financial institutions each accounting for around a third of the company’s revenue.

At the higher end of the spectrum, Wise Business is a small business-focused player, providing a service similar to its consumer offering to organisations looking to make cross-border payments. Lower profit margins from each customer therefore necessitate a much larger number of customers for the business to be viable.

OFX, meanwhile, is similarly catering to smaller businesses than some of the traditionally B2B-focused players.

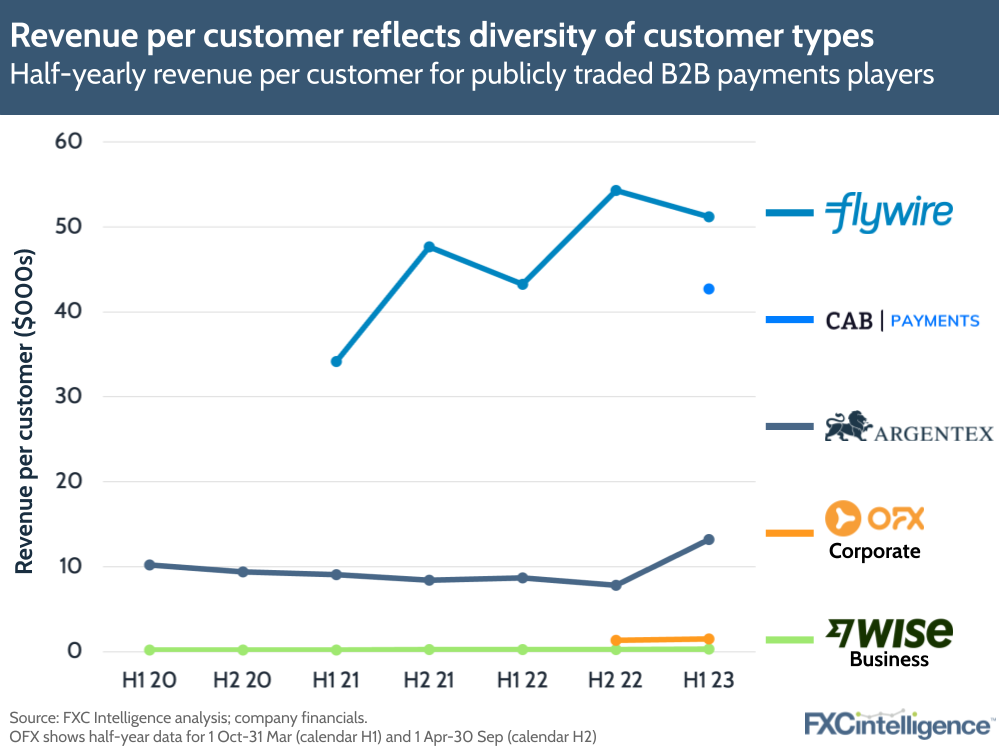

This difference in customer types is strongly reflected in the difference in revenue per customer, with both Flywire and CAB Payments’ institutional focuses being reflected in much larger revenue per customer than other players.

Argentex sits between this group and the small business-focused players, with a recent uptick reflecting its growth trajectory, while Wise Business and OFX, as expected, make comparatively small amounts of revenue per customer.

How is the B2B payments market set to grow over the next few years?

Partnerships remain strong as macroeconomic focus wanes

Looking to trends in the sector, analysis of the various companies’ earnings calls provides some insights into the changing priorities of different players and the market as a whole.

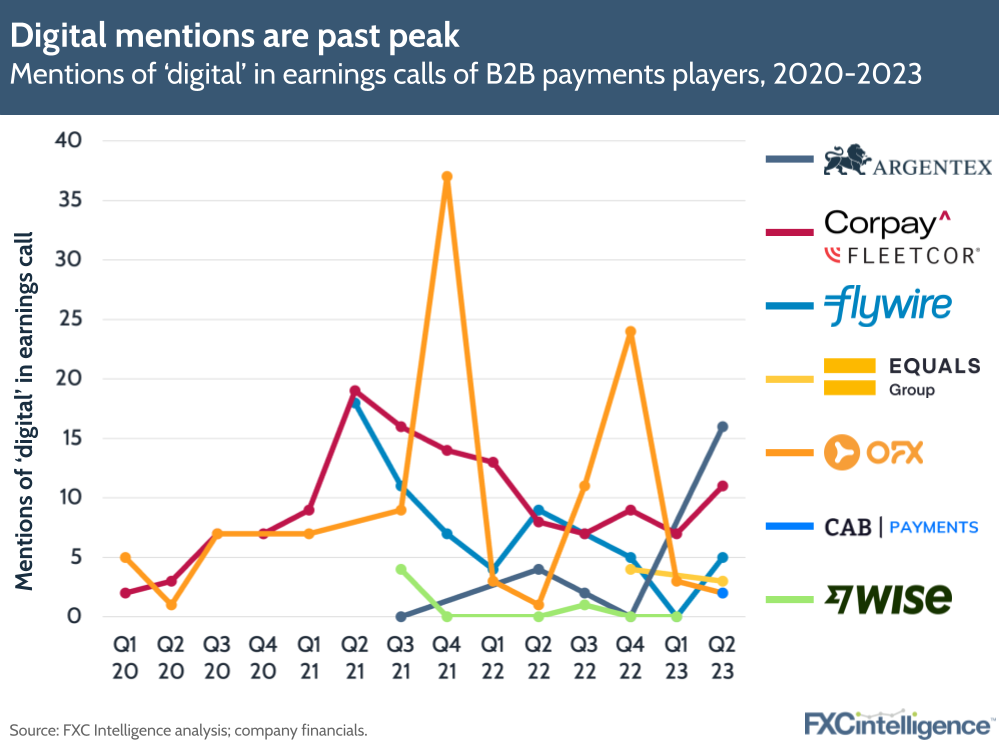

Interestingly, mentions of artificial intelligence have remained very low, despite seeing an increase among some other areas of cross-border payments, primarily payment processors. However discussions of ‘digital’ are elevated, although lower than they have been for most players. This is likely a reflection of digitisation efforts, which have been commonplace across B2B payments but which, for most players, have now been largely enacted.

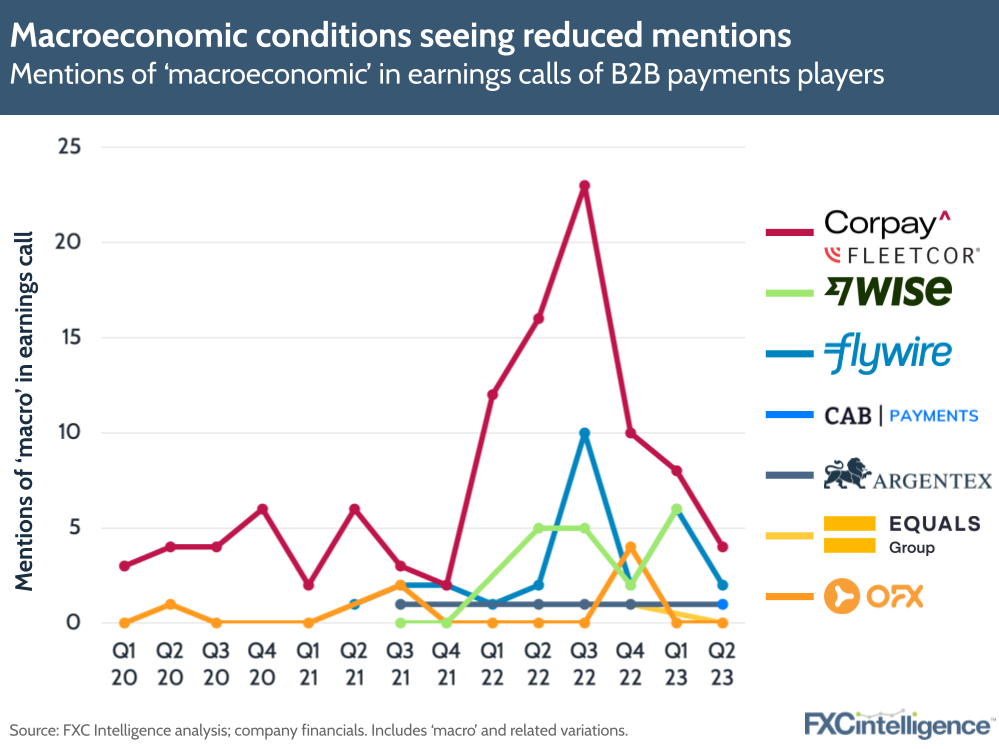

Meanwhile, though the impact of macroeconomic conditions such as the global economic downturn, inflation and Russia-Ukraine war have clearly been a topic of concern for players in this space, peaking in 2022, there has been a sharp drop-off in mentions in the most recent calls that is more pronounced than we have seen in other parts of the industry.

This suggests that B2B payments may be feeling past the worst of the impacts in this area, although we will need to monitor future calls to see if this sentiment prevails.

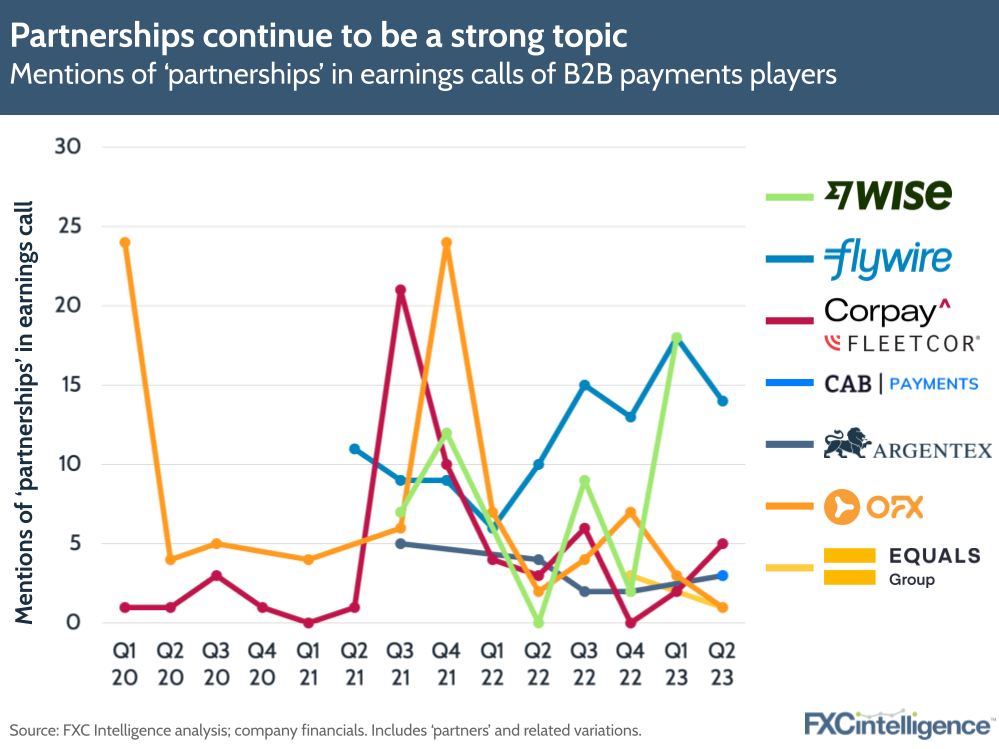

Meanwhile, the multi-year trend of partnering to achieve broader goals, access greater markets and augment product offerings appears to be continuing to prevail for many. While we are past a late 2021 peak in discussion around partners and partnerships, mentions of this topic remain strong across several players.

As an industry, mentions of ‘positive’ remain notably higher than ‘negative’, while mentions of ‘tailwinds’ have been around the same level as ‘headwinds’, which is not the case with consumer payments where headwinds have generally been a greater focus of discussion. Given the continued growth and evolution of the space, this reflects an industry that is broadly optimistic about its future potential, and with our own data projecting the B2B payments market to climb by a CAGR of 5.9% between 2024 and 2032, there is considerable opportunity ahead.