After our first analysis piece on our 2023 Cross-Border Payments Top 100 last week, this piece looks back over the versions of our map for the last five years to see how the payments industry has shifted.

Just as the payments landscape has changed since 2019, so too has the Cross-Border Payments 100 Map. Having already looked at key trends from our 2023 list in situ, this piece looks back at previous versions of our map to find out how the makeup of companies has changed in terms of where they are founded, who’s leading them and who’s backing them.

For the uninitiated, every year FXC Intelligence analyses more than 15,000 companies to create the Cross-Border Payments 100: a definitive list of the 100 most important companies operating in the space today. Companies span the full width of payment services, including money transfers, B2B payments, ecommerce, payment processors, crypto payments and more.

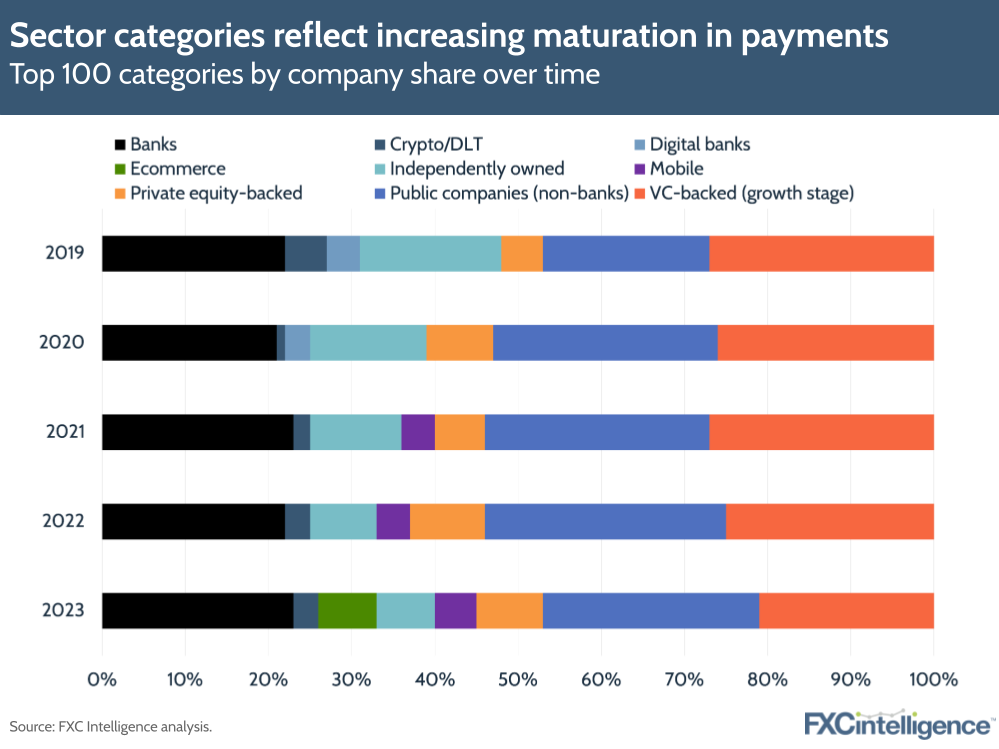

Below is the Cross-Border Payments Top 100 for 2023, which is split into eight categories, including venture capital-backed, private equity-backed, ecommerce, mobile, banks, public (non-bank) companies, independently owned and crypto providers.

Note that in the five years the map has been going, it has seen several category changes. For example, the digital banks section was retired from the map in 2021 in favour of a new category focusing on mobile payments, while this year a new ecommerce section was added. These changes have resulted in some companies moving into different areas.

Some players, including many incumbent banks and public companies, have been on our map every year, some have only been included in some years and others have ceased trading or been acquired. It’s important to bear this in mind when considering the figures we’ve included below.

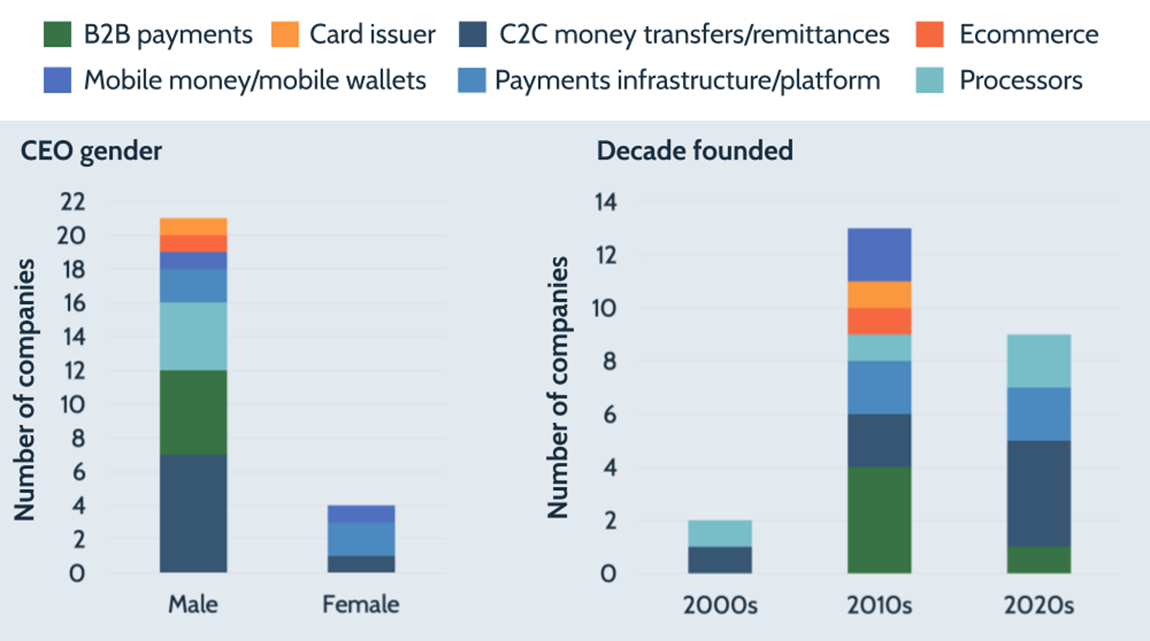

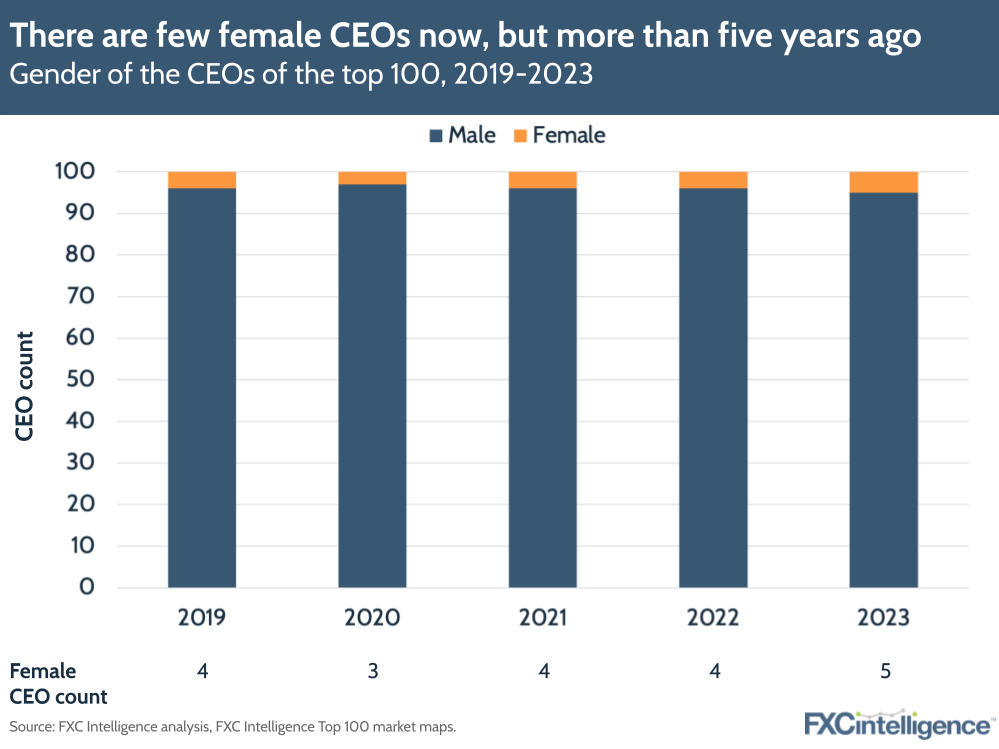

There are very few female CEOs in cross-border payments

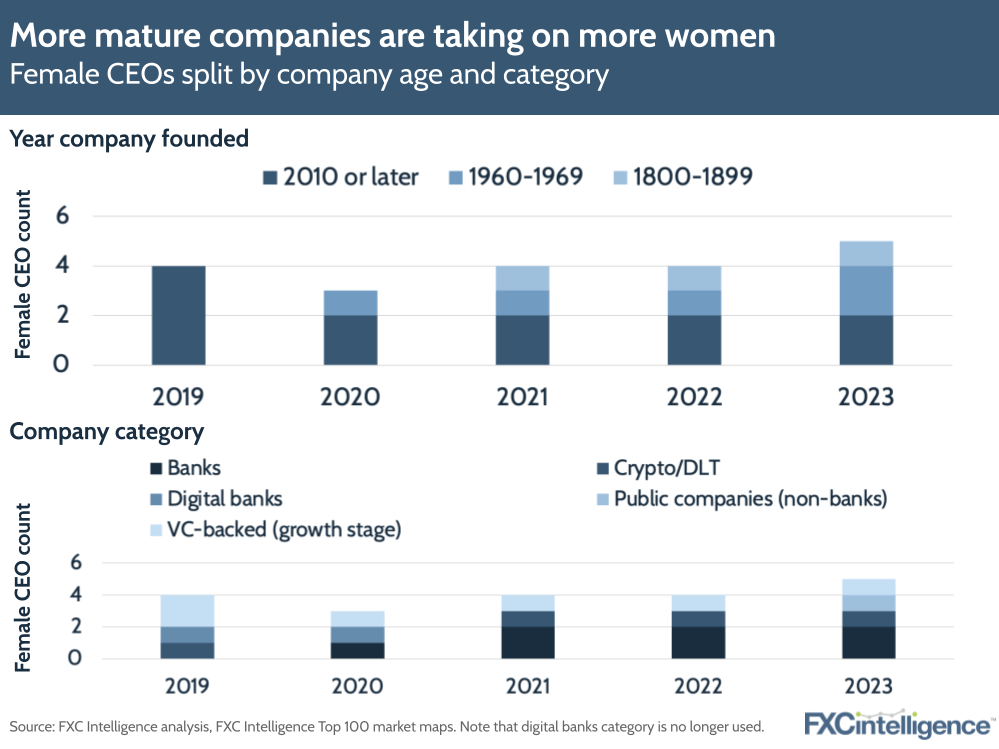

As we noted in the previous top 100 analysis piece, out of the 100 companies on our list, only five have a female CEO (one in 20 across the sample). This is still very low and, while the number has slightly increased from 2019, it’s clear that the sector is still lagging behind when it comes to bringing women into leadership positions.

One of the biggest obstacles to improving the male/female split is that new opportunities for payments CEOs do not come up often. In the companies covered in the top 100, many male CEOs have been in the role for more than a decade and many have been there since the company’s founding. People are also often promoted internally, limiting opportunities to diversify.

When breaking down CEO gender by year founded, we can see that companies that have recruited female CEOs in recent years have generally been more established, incumbent players, such as Natwest and FIS. The top 100 remains a small sample size, making it harder to draw concrete conclusions about the wider industry, but it is clear that more needs to be done to support female-led startups.

Challenger numbers fall due to industry consolidation

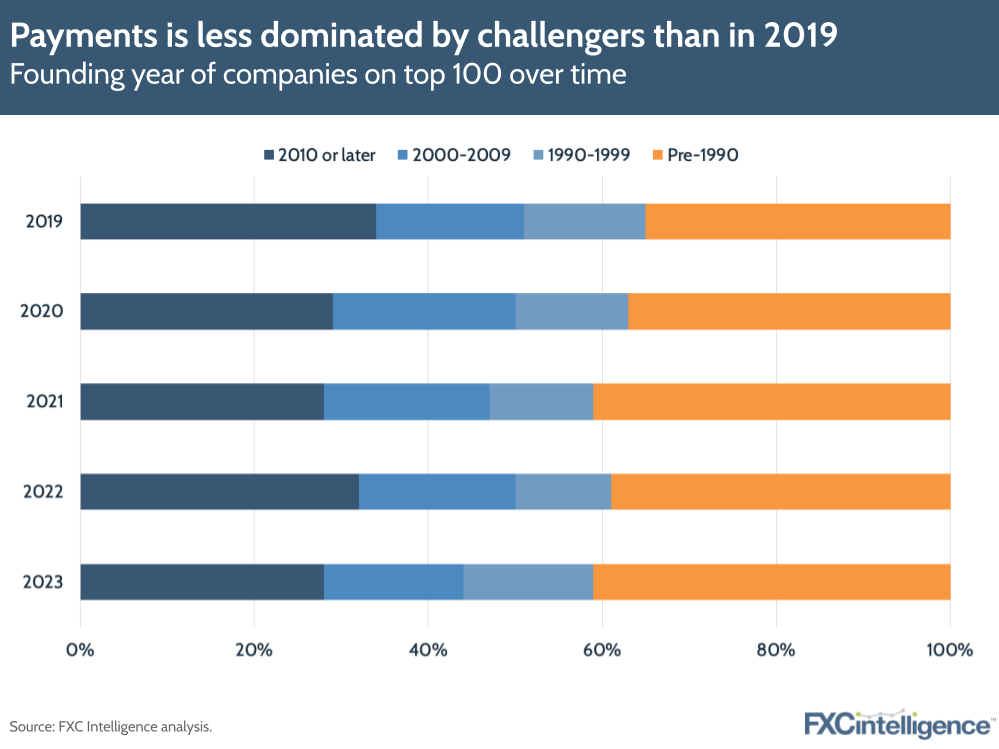

Turning now to when companies are founded, this graphic shows that there are fewer younger challengers (founded in 2010 or later) on our map in 2023 compared to 2019.

This was largely due to the industry seeing growing consolidation – smaller companies being acquired by bigger players – which was the number one reason for companies being taken off the list between years. Some of the notable acquisitions we’ve covered in the last year include Global Payments targeting B2B payments by acquiring its rival Evo; Ant Group growing its cross-border payments network beyond Asia; and Papaya Global buying remittance provider Azimo.

Reflecting the diminishing number of smaller companies, the amount of venture capital-backed companies was down from 27 in 2019 to 21 this year, with a few of these being the result of acquisitions. With regards to the general venture capital space, 2022 saw investors pull back somewhat and this continued in Q1 2023 despite a couple of major funding rounds, including a $6.5bn round for Stripe.

There were also three crypto players in 2023 compared to five in 2019; a small difference, but feeding into the picture of crypto still being in recovery mode after last year’s downturn.

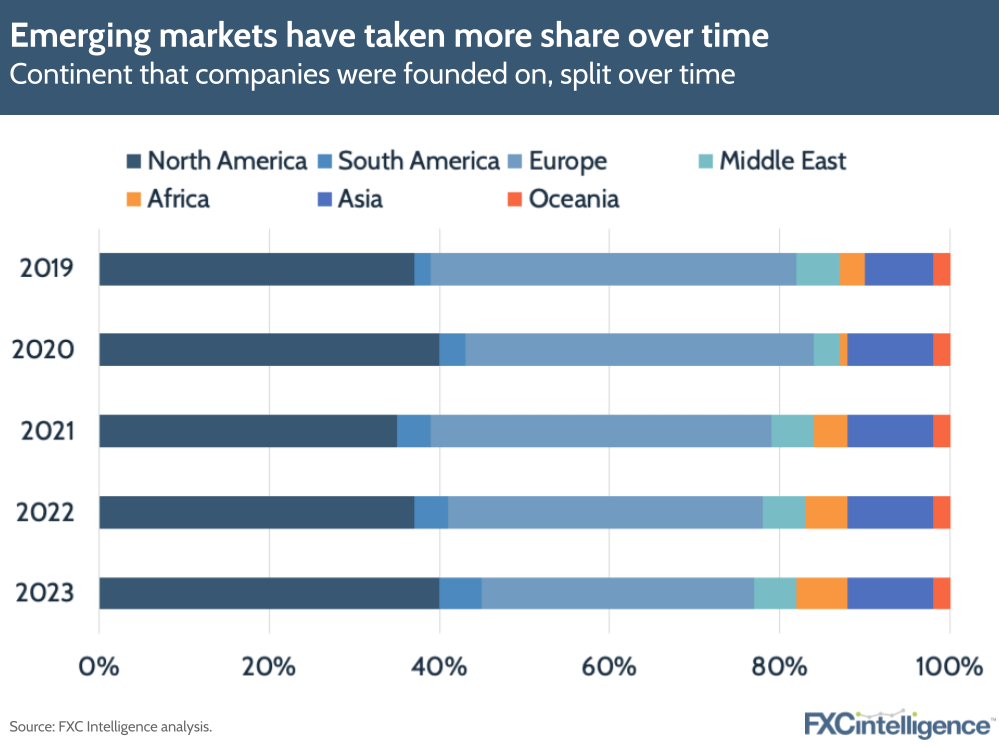

Emerging markets are taking a higher share of the industry

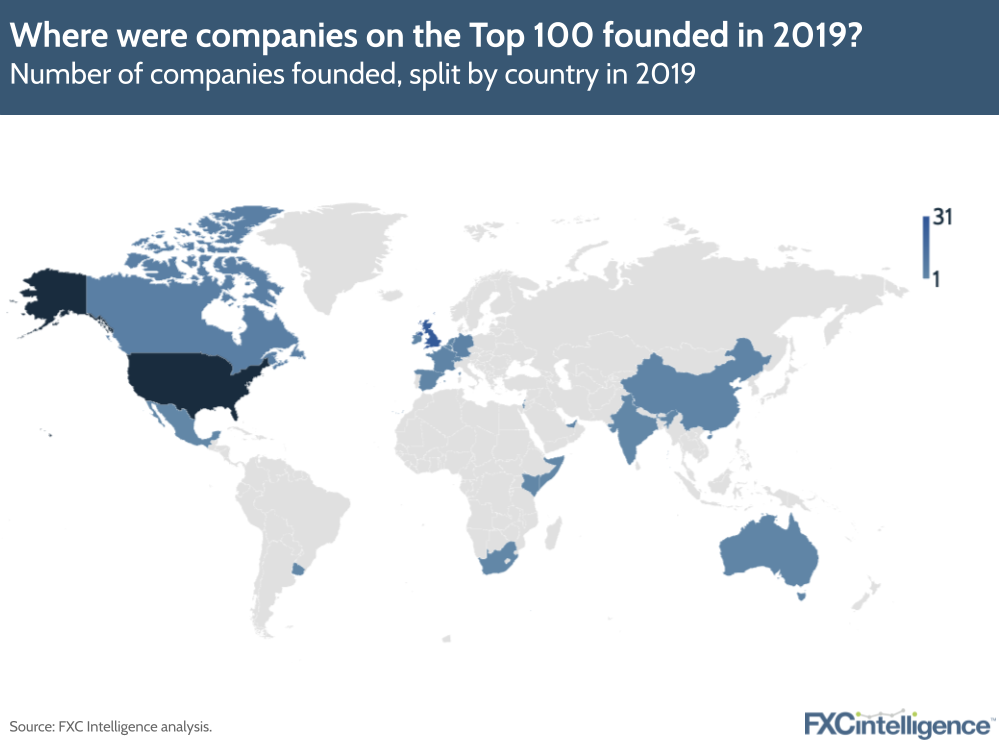

Here’s where companies on our top 100 were founded in 2019:

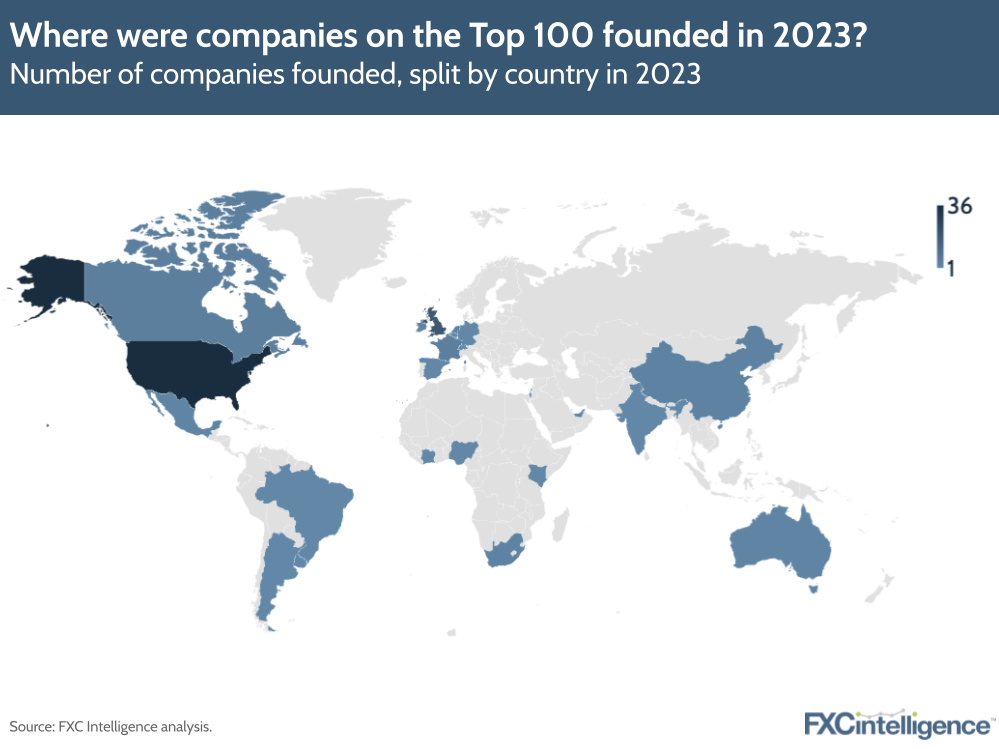

And now, here’s the map for 2023:

Looking at both maps, it’s clear that North America has remained the core region, with 40 companies founded on the continent and 43 with headquarters there (both increasing compared to 2019). The US was the most prominent country, growing from 31 companies founded there on our 2019 map to 36 US-founded companies in 2023.

However, emerging markets in South America and Africa are playing much more of a role on this map than previous years. The number of companies in South America rose to five in 2023, up from two in 2019, and included Mercado Pago, Ebanx, dLocal, Monex and Banorte (which owns remittances company UniTeller). The number of companies founded in Africa has doubled since 2019 from three to six, including Orange Money, MPesa, Flutterwave, MFS Africa, Mukuru and brand new addition MTN Mobile.

APAC-founded companies rose from 10 in our 2019 map to 12 in 2020, and have remained steady ever since. By contrast, the number of companies founded in Europe fell from 43 in 2019 to 32 in 2023, though 36 (more than a third) still have a headquarters there.

Africa, Asia and South America have been areas of growing interest for payments companies as remittances and ewallet providers seek to provide easier and less costly ways to store, manage and send money overseas. For more on this, see our reports on Africa, Asia and LatAm specifically, as well as our wider report on strengthening remittances in emerging markets.

Conclusion

Our map may only cover a sample of cross-border payments companies, but they are the most important businesses in the sector, meaning there are findings over the last five years that speak to the wider industry. Namely, that the payments industry is lagging behind others when it comes to gender diversity across the most senior leadership positions; that consolidation in the industry has grown over the years; and that emerging markets are becoming a more and more important part of the overall picture.

FXC will continue to track companies in the payments space and discuss how these trends develop in 2023. For more of a deep dive on each of the individual companies on our Cross-Border Payments 100 map, read the full report here.