The economic downturn of the past year has had a significant impact on the investment landscape as a whole, but how has investment activity in payments fared? We review the most prolific investors in payments, where the key regional focuses for investment are and what stages investment is being focused on.

The world of startup investment has changed considerably over the past few years, as shifting economic conditions have prompted an adjustment in expectations and values. Gone is the growth-at-all-cost mentality, with venture capital investors (VCs) increasingly expecting startups to demonstrate a far more robust path to profitability in order to attract support.

Meanwhile, the global economic downturn has caused considerable belt-tightening among investors. According to Crunchbase, global venture funding dropped 35% in 2022 – down to $445bn from 2021’s $681bn – with the drop particularly sharp in H2. While this was an increase on 2020, it does speak to an environment where capital is tougher to attract and where startups need to make a stronger case for VC interest.

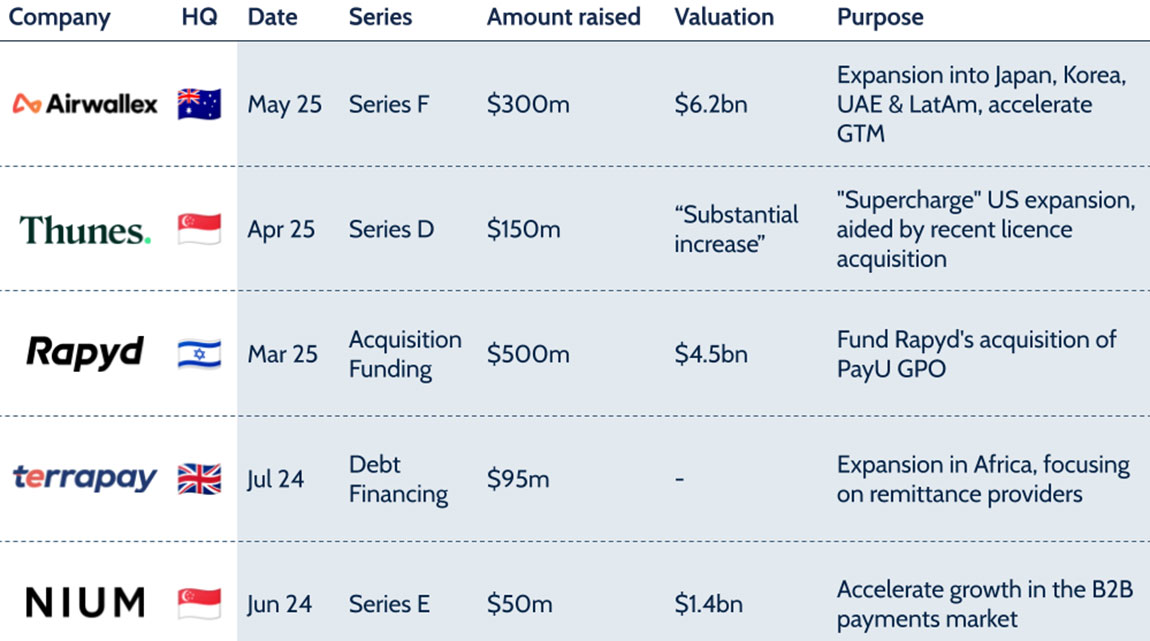

Amid this, however, the world of payments is seeing many companies continue to attract support from VCs, providing strong indications for the future development of the industry. The combined total of latest funding from companies in Crunchbase’s payments and mobile payments categories who raised money in 2022 is $24.4bn, compared to $23.1bn for those who raised money in 2021.

But who is being attracted to invest in payments, and where and when are they putting their money? This report looks at payments’ 2022 investors to determine how the industry is faring and where future growth is likely to be focused.

Investment in the payments industry: An overview

For this report, we looked at all companies listed under payments or mobile payments in Crunchbase’s investment database for the past year, excluding any without a significant payments focus. This produced a final count of 547 payments companies who had some form of funding round in the past year.

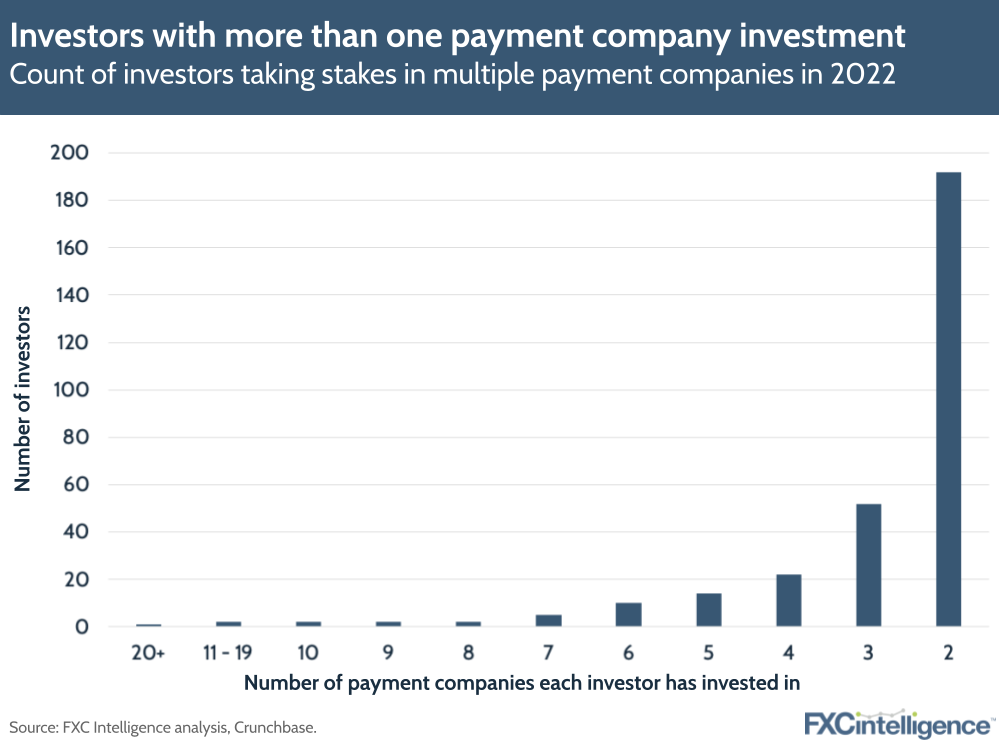

By analysing which companies invested in which rounds, we were able to get a count of the number of VCs that invested in multiple companies in the payment space in 2022. While a total of 1,753 investors participated in at least one round held by a payments company, 304, or 17%, invested in two or more payments companies in 2022, while 112, or 6%, invested in three or more. However, some made much larger numbers of investments in the payments space.

The payments industry’s most prolific investors

While many companies invested in more than one payments company in 2022, a small number (24) made investments in at least six companies in the payments space, making them significant contributors to the future of the industry.

Out of these, many are prolific general investors that are making multiple investments into payments alongside other key industries. This speaks to the perceived growth potential of payments compared to other industries, particularly in light of the current economic climate.

However, there are also some specialists on the list who more commonly focus on areas such as finance, fintech and technology, such as Endeavour and J.P. Morgan.

Meanwhile, it is notable that Alameda Research, the VC arm of disgraced crypto trading platform FTX, was the 15th most prolific investor in payments companies in 2022. With court cases against the founders ongoing, it is not yet clear what will happen to these investments, however it is likely that they will be sold on as part of the company’s bankruptcy proceedings.

Profiling the top investors in payments for 2022

The most prolific investors in payments in 2022 are largely global investment powerhouses, whose levels of investment in the space is reflective of investor interest in the industry as a whole. Perhaps significantly, these investors are often interested in the same companies, with names such as Flash, Qonto and Zippi appearing in the investments of multiple of the top five.

1. Tiger Global Management

As prolific hedge fund with global reach, it is no surprise that Tiger Global Management tops payments activity for 2022, as reflected by our previous coverage of the company.

However, given how many investments the company makes, the fact that 1 in 13 are in payments companies is notable, as is the focus on India and Brazil in addition to the more traditional fintech startup hubs of the US and Western Europe. It should be noted that Tiger, which invests in both public and private companies, had a very disappointing 2022, although its investments here are not the cause – most will not yield returns for several years.

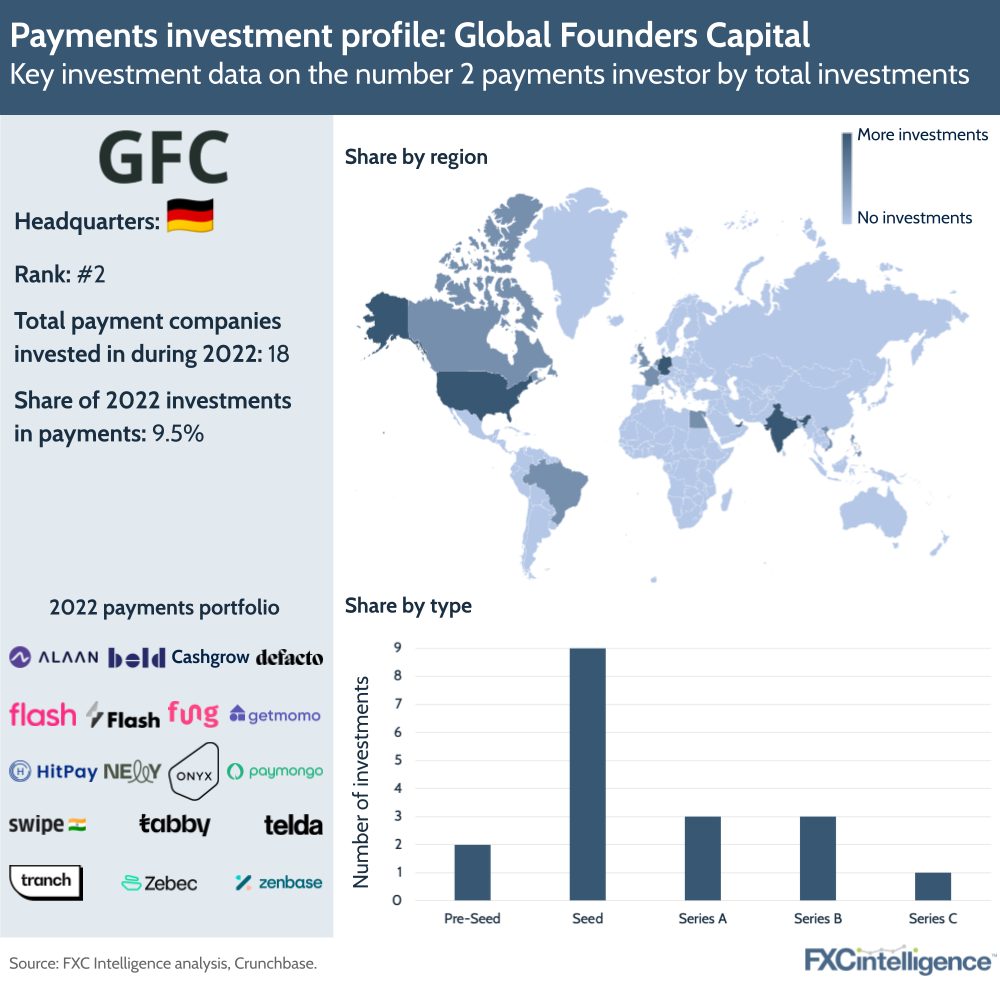

2. Global Founders Capital

With almost 10% of its 2022 investments in payments, Global Founders Capital is another investment giant vouching for the space, albeit one hailing from Europe rather than the US. GFC’s investment focus also reflects a growing interest in India and Brazil’s payments landscape.

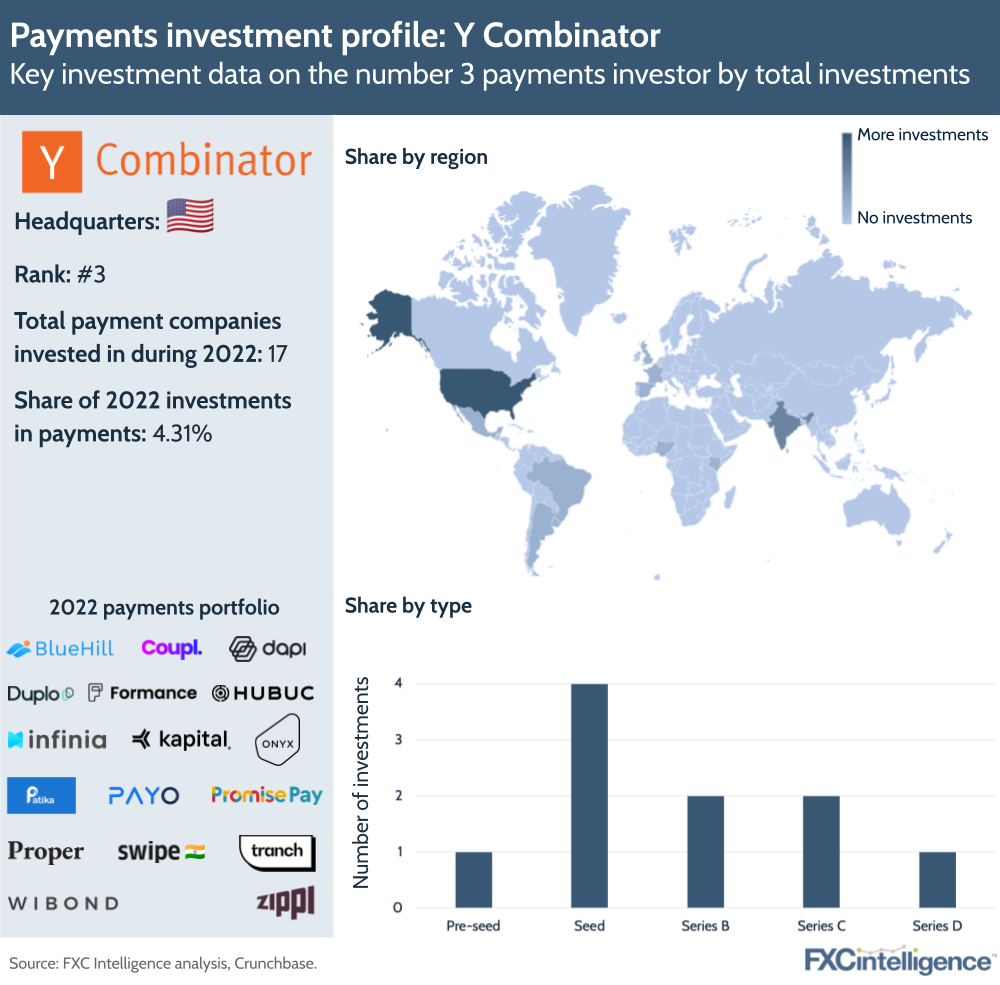

3. Y Combinator

A truly prolific funder of startups, Y Combinator inevitably has a smaller share of investments that are payments-related. However, 1 in 23 still represents outsized importance for the space, and the company’s investments in LatAm and Africa reflect key growth areas for the region.

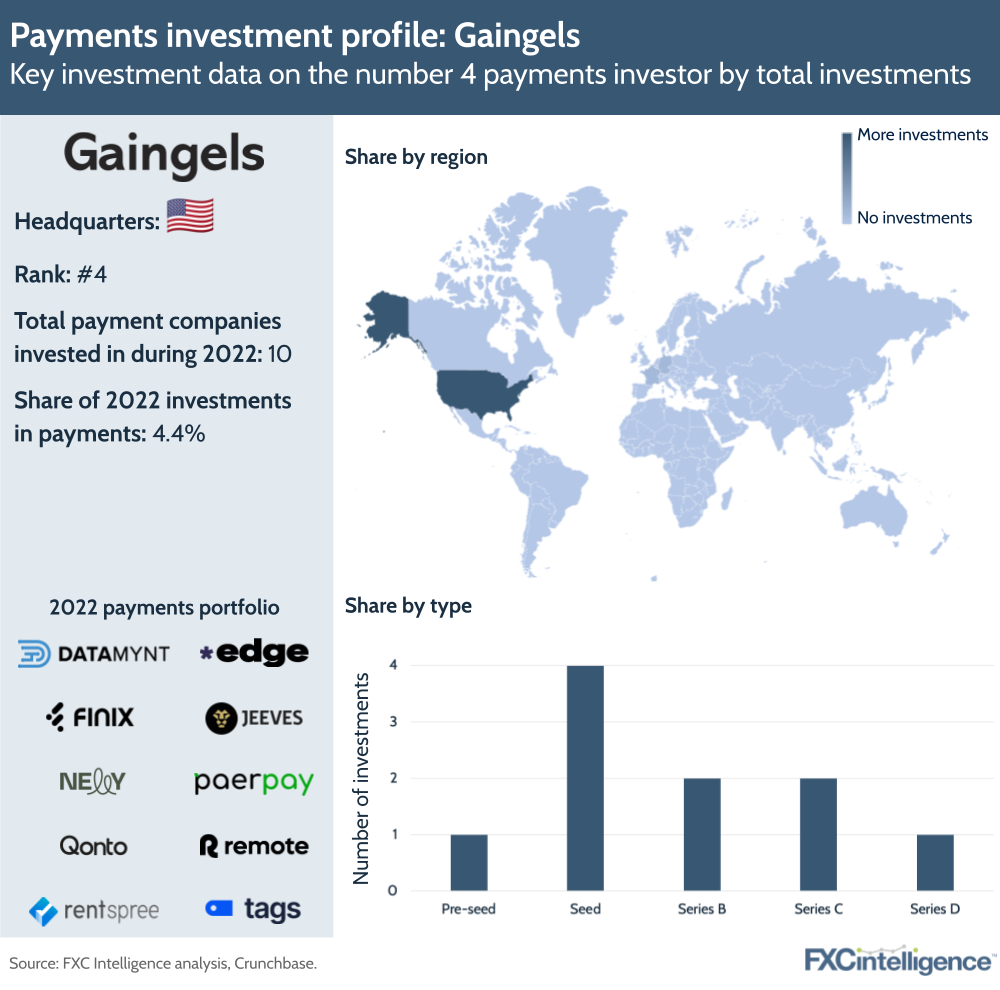

4. Gaingels

Gaingels is similarly prolific as an investor, with around 1 in 23 of its investments also in payments, although here its regional focus is more notable. While many others have spread their investments fairly broadly internationally, Gaingels has largely focused on the US, with its other investments in Western Europe.

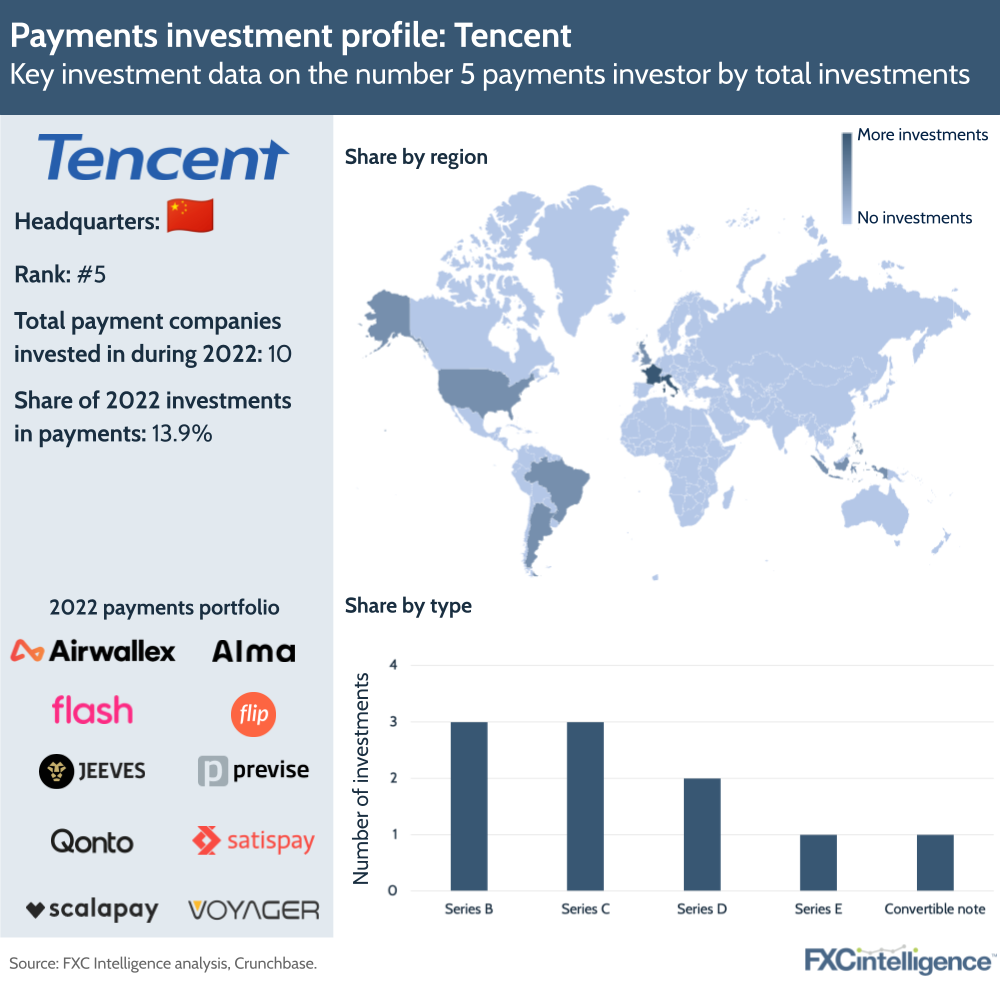

5. Tencent

Chinese technology giant Tencent makes an interesting final addition to the top five, with the company spreading its investments fairly broadly across Europe, the US, LatAm and APAC. Tencent’s payments investments are perhaps most notable for occurring in more mid-stage series than other investors in the top five, and including major names such as Airwallex.

At what stage are startups attracting the most investment?

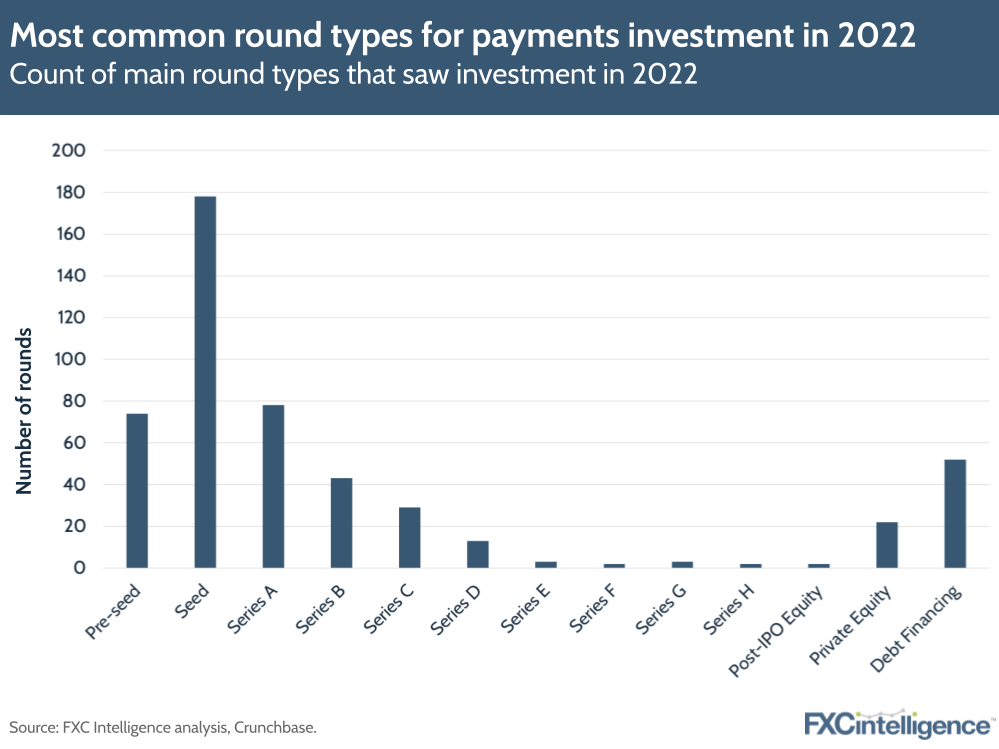

While there has been a perception that VCs are in general focusing their efforts on later stage companies where the chances of a return are greater, in payments investment in 2022 has heavily skewed towards early-stage companies.

Seed, Series A and pre-Seed investments dominated, although debt financing is also relatively popular, reflecting an increasing investment trend as startups look to find fresh ways to raise capital amid a more challenging climate.

This is a good indicator for the future of the industry as it speaks not only to the levels of support for still-developing companies in the space, but also to the breadth of companies who are building in payments.

Geographical focus: Where in the world are payments investors putting their money?

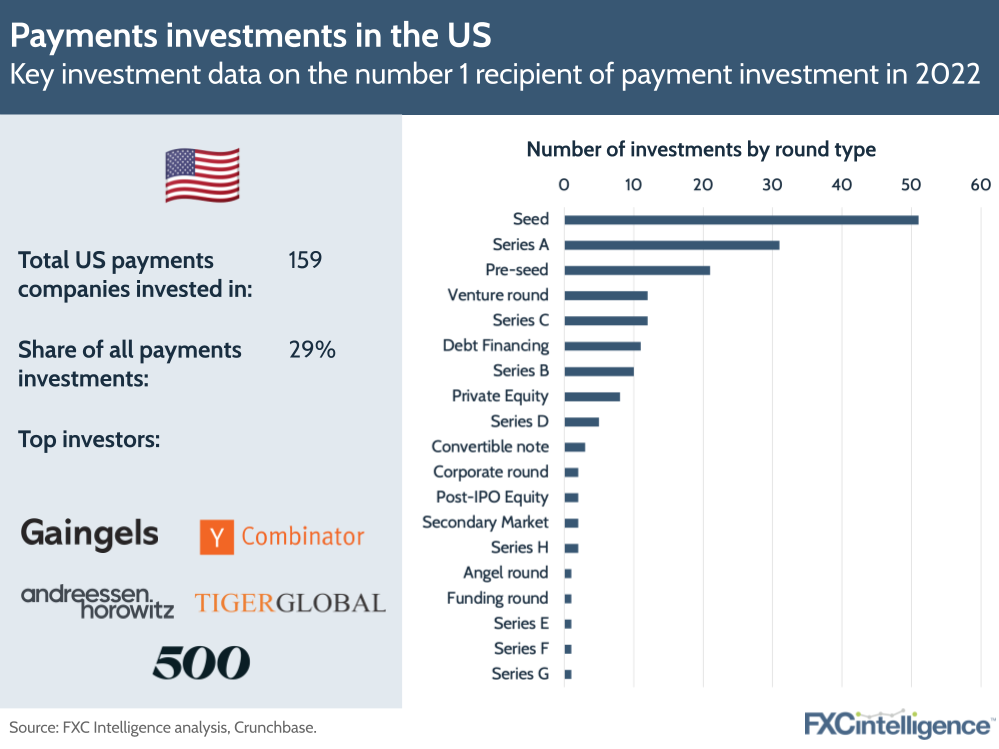

Looking globally, while 69 countries were headquarters to payments companies that received investment in 2022, the US remains largely dominant. This can be explained by the country’s strong tech scene and long-standing startup ecosystem, as well as the fact that some companies opt to headquarter there despite having been originally founded elsewhere.

In payments, a notable example of this is Flutterwave, a Nigerian-founded company that is now headquartered in the US despite largely catering to an African customer base.

The top 10 markets for payments investments

While the US leads, there are a number of key markets for payments investment, which represent both the traditional focuses for the industry as well as a number of rapidly growing regional hubs.

1. US

As the traditional focus for startup investment, it is perhaps not surprising that the US represents almost a third of payments company investment in 2022. While early-stage investments dominate here, we also see a wide range of investment types utilised in the country.

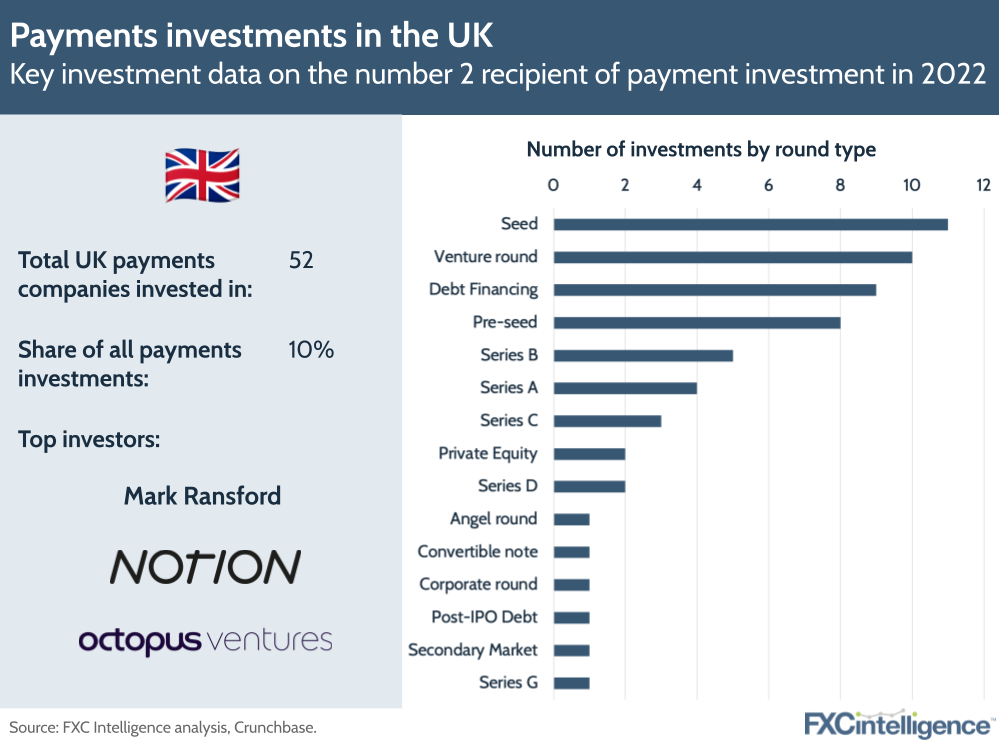

2. UK

The UK is the second strongest market for payments investment, with one in 10 such investments made in companies headquartered there. Notably, while Seed rounds are again the most common type, debt financing is in third place and later-stage investments are more common than the global average. The UK is one of two countries where an individual investor is one of the most prolific.

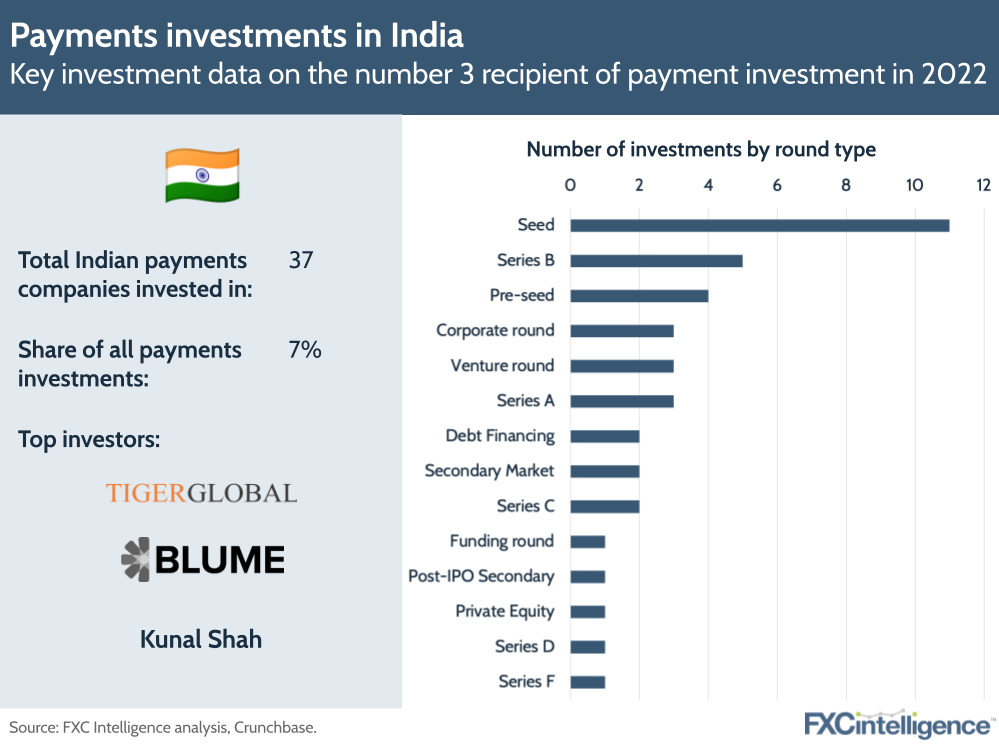

3. India

India, which is the other market with an individual investor among the most prolific in payments, is seeing significant investment that appears to reflect the continuing development of the country. India has a broad and rapidly evolving payments ecosystem, with technologies such as e-wallets seeing significant adoption, which appears to be lending itself to a strong startup environment.

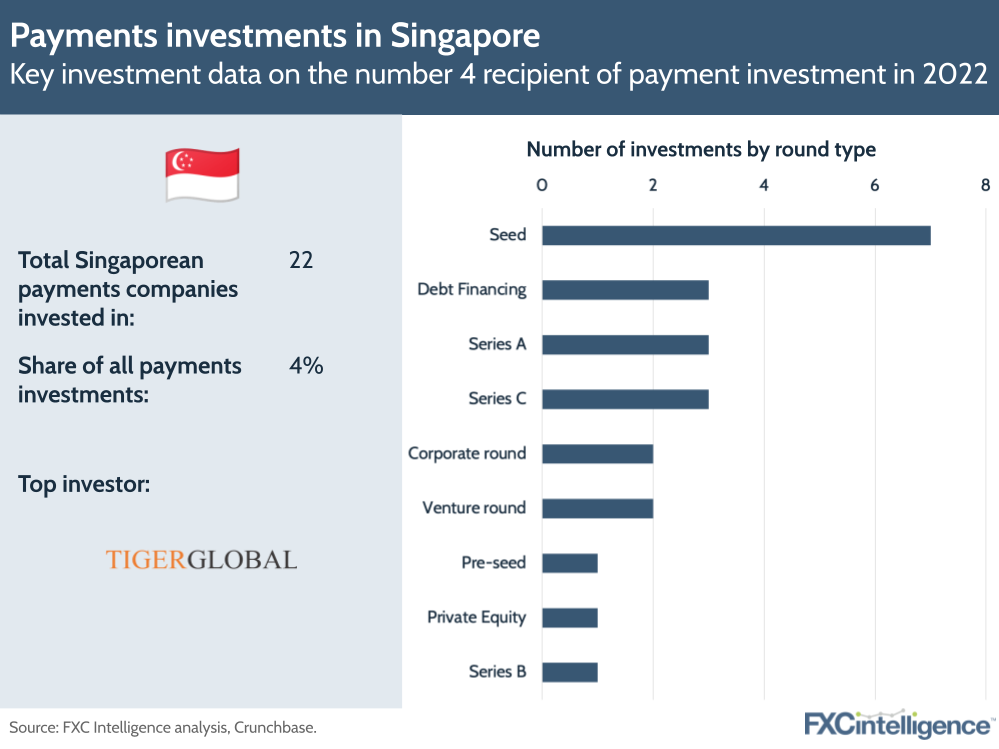

4. Singapore

As a strong hub for innovation in Asia that is notable for its startup-friendly fintech legislation, Singapore is seeing interest at multiple levels, with a lean towards early-stage companies. While Tiger Global was far from the only investor financing payments companies in the region in 2022, it was the only one to make more than two investments in Singapore.

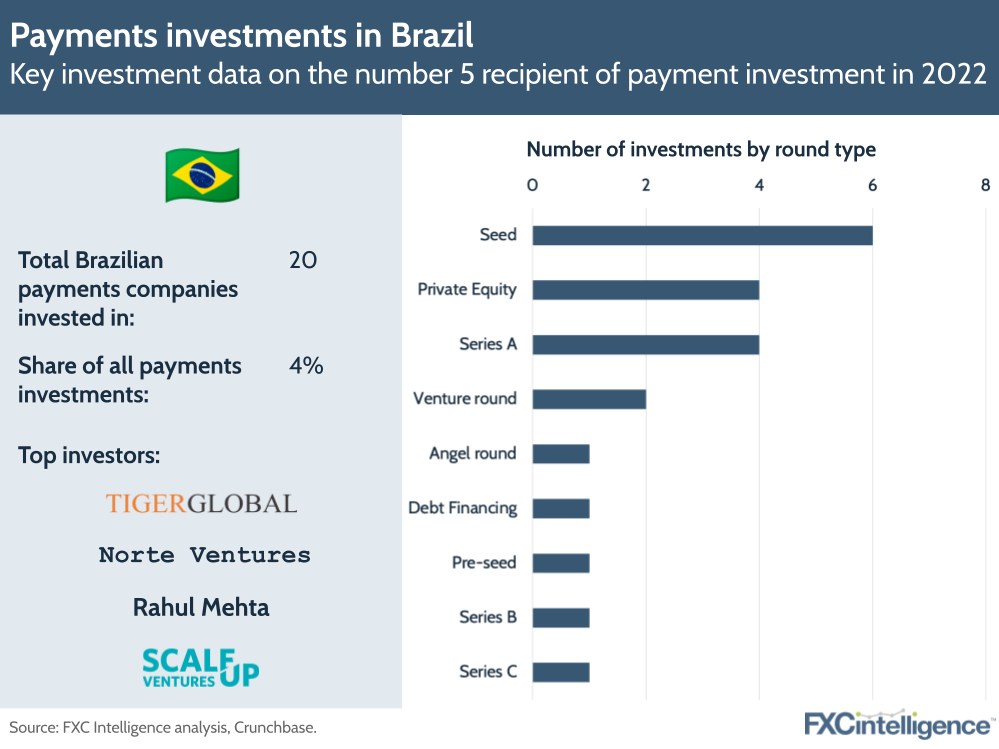

5. Brazil

As the leading country for fintech in LatAm, Brazil is rapidly becoming a major player in payments globally, and its position on this list reflects that. The dominance of early-stage investments speaks to future strength within the region’s payments landscape, particularly when paired with the rapid development currently underway in the region.

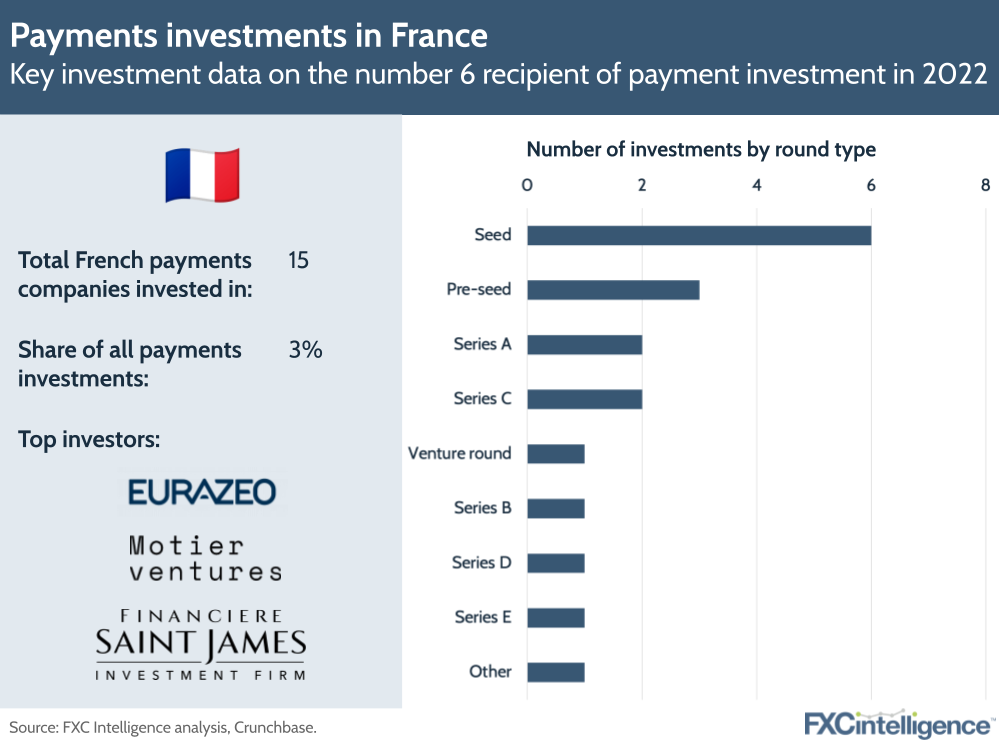

6. France

France is a more traditional hub for fintech, making this a relatively expected entrant on the list. However, the fact that the spread of investments largely reflects global trends is interesting, as is the fact that the most prolific investors here are largely home-grown.

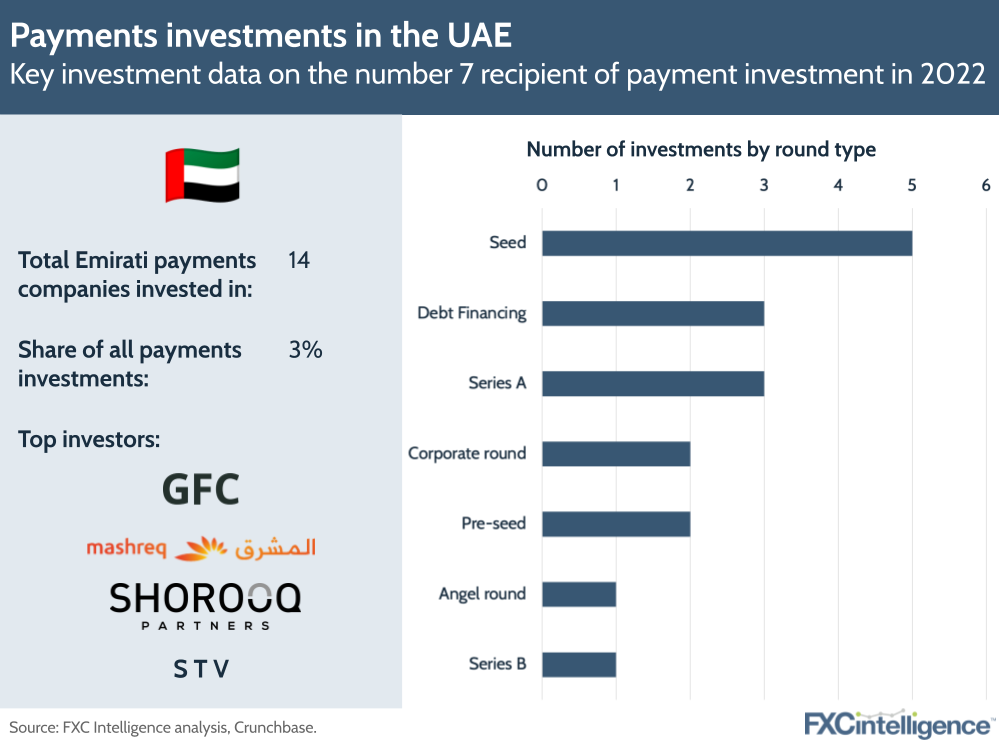

7. UAE

Largely dominated by startups from Dubai, the UAE is seeing a mixture of home-grown and international investors take an interest in its payment companies. Its presence on the list speaks to the increased development of fintech and particularly payments in the UAE.

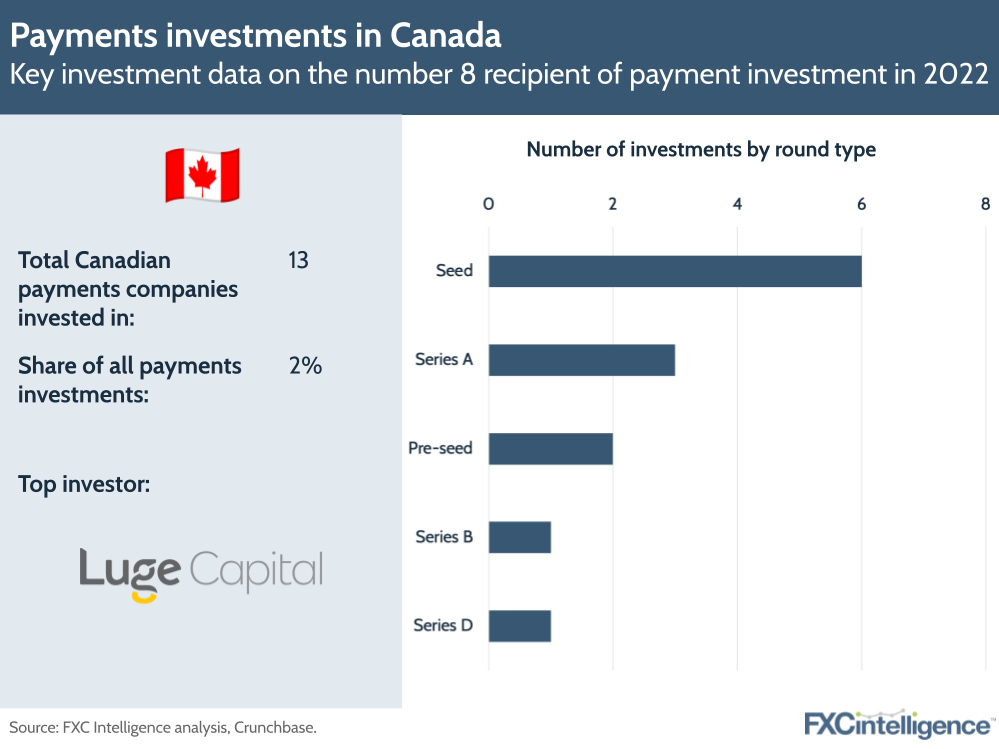

8. Canada

Canada has long had a relatively strong presence in payments, in part aided by its proximity to the US as well as its strong financial infrastructure. The dominance of early-stage companies suggests that future development will continue this trend.

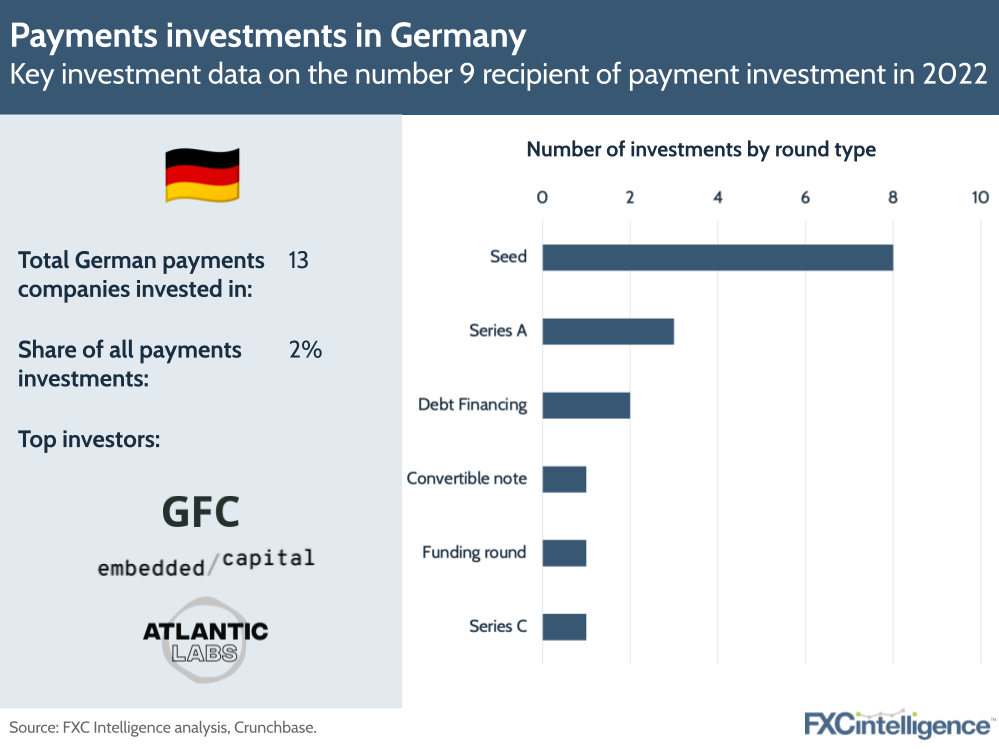

9. Germany

Germany has a strong startup ecosystem and the dominance of Seed and Series A startups speaks to payments companies being supported by its continuing pipeline. It is notable that, as with France, investment is dominated by local firms.

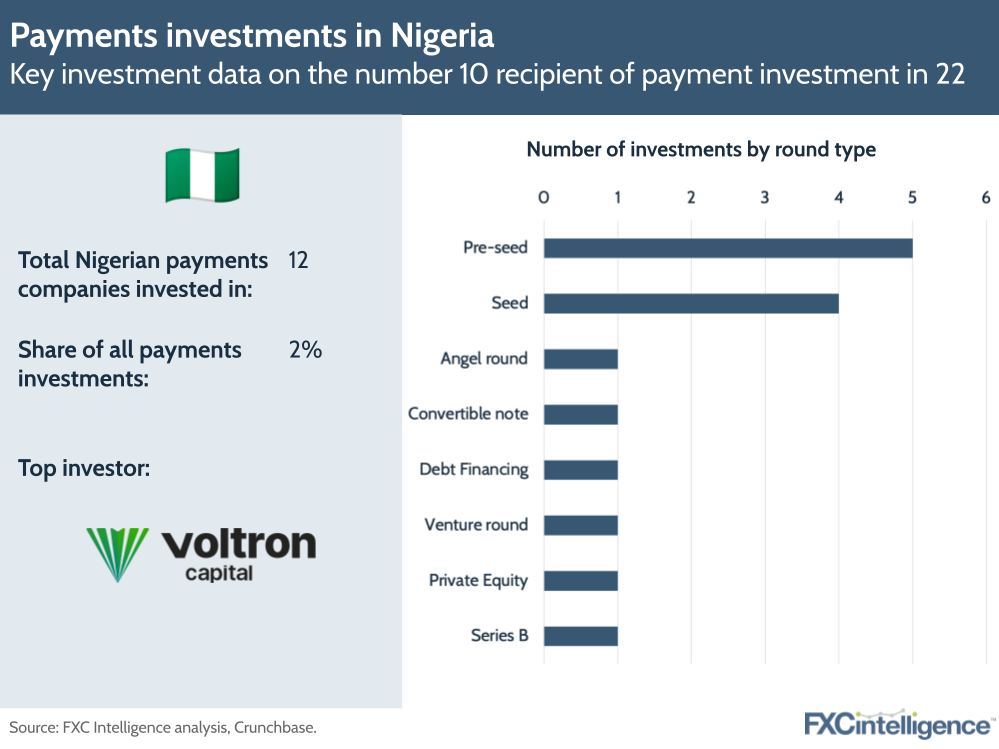

10. Nigeria

As the emerging hub for African payments, Nigeria is growing to become a powerful presence in the payments landscape, with a number of high-profile companies already from the region. The fact that most investments are Seed or pre-Seed suggests that Nigeria’s development as a payments player is just beginning, and we expect the country to see greater investment over the next few years.

Conclusion

Despite an increasingly tough global economic climate, 2022’s investment trends in payments speak to a strong market in terms of funding levels, where there is broad investment across multiple countries and at multiple stages of startup maturity.

Investment activity from some of the world’s biggest VC firms demonstrates payments’ image as an industry with considerable growth potential in the future – which is also reflected in the rebound that many cross-border payments stocks have already begun to see.

The large amounts of investment in early-stage companies shows also how much innovation is happening in the payments space, and suggests that we may see some upheaval in the next few years as such companies grow in size and reach.

The diversity of investment locations also reflects how increasingly global and nuanced payments is becoming. While Western hotspots remain dominant, we are seeing strong emerging hubs around the world – in particular Brazil, India and Nigeria – where we can expect to see outsized growth over the next few years.

As we move into 2023, the first payments investments have already begun to be announced, and we can expect far more as the year progresses. While the investment landscape may no longer be in the heady period of a few years ago, payments remains a strong option for VCs in search of growth.