Innovative fintech ecosystems; digital inclusion; domestic payment cards; real-time payments; private sector investment; and an enabling environment are building India’s digital economy, though there are more opportunity gaps to plug.

In recent years, technology has increasingly offered organisations the ability to transform their operations and commercial transactions. Many countries are taking advantage of these transformations, and the networks of economic activity they create, to build a digital economy.

One such example is India. With high penetration of mobile internet devices, new financial technologies and a budding ecommerce sector, the Indian economy is witnessing a growing shift from cash payments to digital payments. This digital transformation has created opportunities across the finance value chain for the government, fintechs, investors and private organisations to work together to pave the way for a greater digital economy in the country.

According to the International Data Corporation, global investment in digital transformation will reach $2.8tn in 2025, which is more than half of all the spending on information and communication technology.

Just like in other emerging markets, shifts in consumer behaviour as a result of the Covid-19 pandemic have made ecommerce a rapidly growing sector in India. With a population of about 1.4 billion and more than 560 million internet users, India is the second largest digital consumer market in the world.

In the past, there has been a digital divide in India as a result of digital illiteracy, poor infrastructure and low internet speed, all of which can be attributed to the fact that the country remains more rural than urban, a fact that has also created economic disparities across both consumers and businesses.

To bridge this divide, the Indian government is aiming to achieve a low-cost digital economy that is home-grown and inclusive. An initiative called ‘Digital India’ was launched by the Indian government in July 2015. The goal is to become a $5tn economy within a decade by establishing a secure and stable digital infrastructure, delivering digital services and ensuring that every citizen has access to the internet.

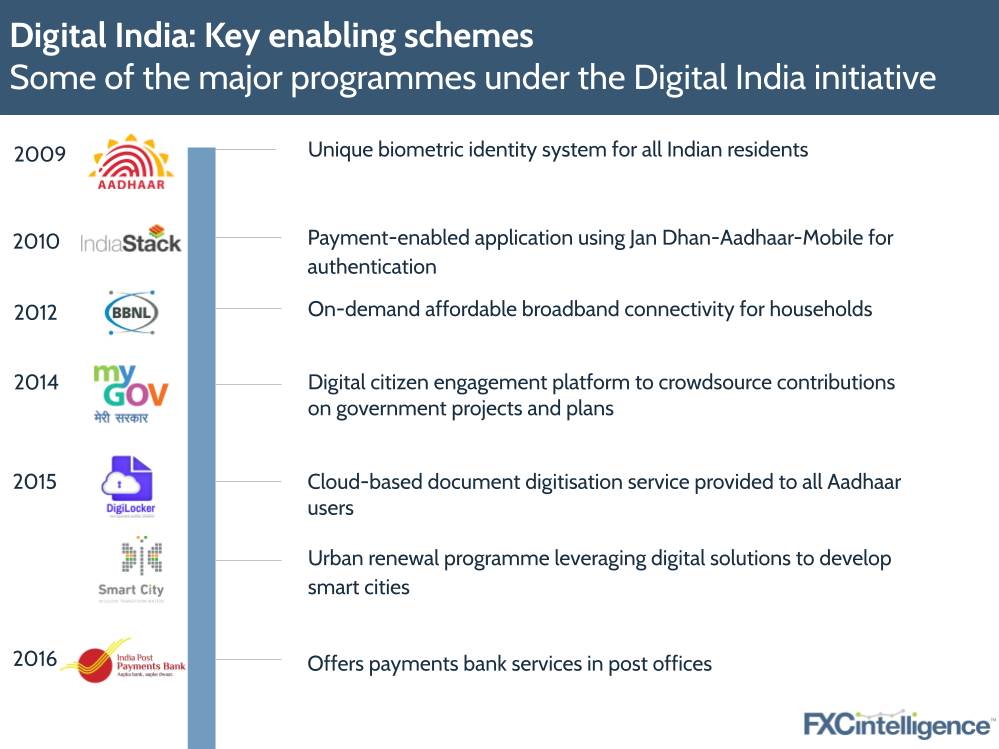

Digital India: Key enabling schemes

There had been some schemes that promoted digital transformation before the advent of Digital India, some of which Digital India has built on. Some of these schemes include Aadhaar – the world’s largest biometric ID system, providing every Indian resident with a unique identity number; India Stack – a set of APIs intended to create a unified digital infrastructure; and BharatNet – the world’s largest rural broadband connectivity program, providing on-demand, affordable broadband connectivity of 2Mbps to 20Mbps for all households.

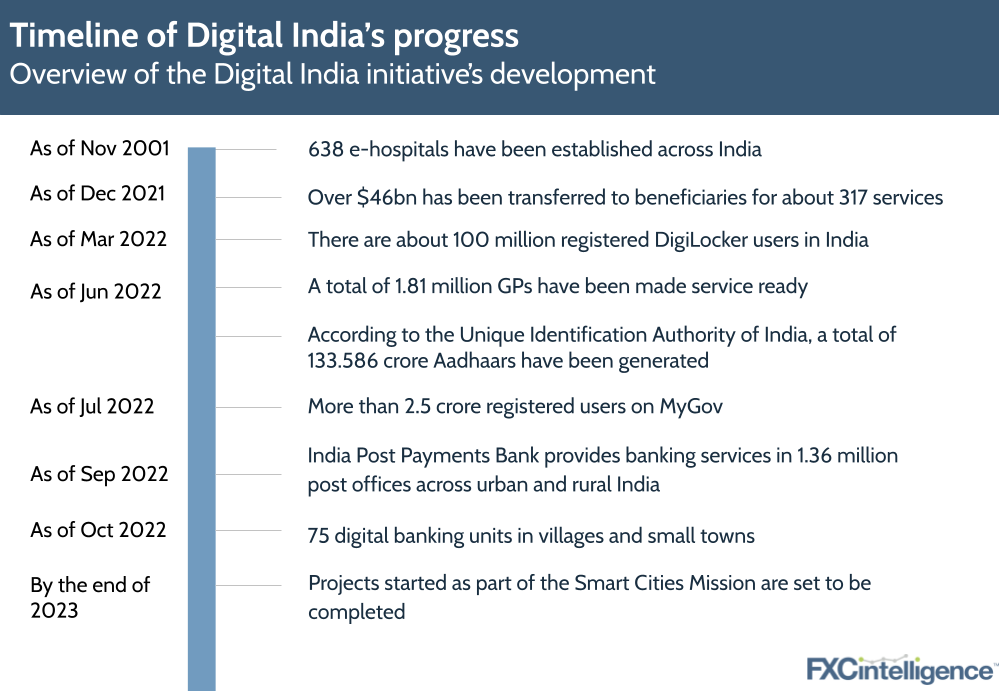

Seven years after the launch of Digital India, there has been a transformation in technology infrastructure, especially with the linking of remote areas to high-speed internet networks through BharatNet and public Wi-Fi hotspots. This is vital for a country with a majority rural population (according to the World Bank, India’s population was 65% rural as of 2021).

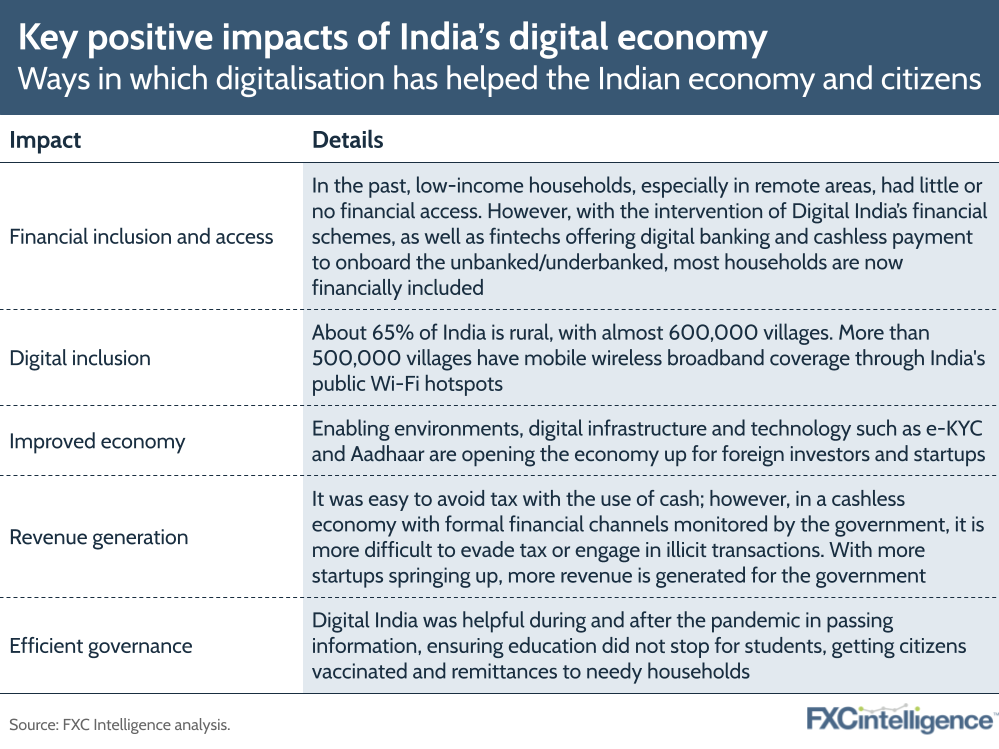

The proliferation of the internet has boosted financial inclusion (56.4% in March 2022 from 46.4% in 2017 according to RBI) and accessibility for the unbanked, promoting the growth of digital banking and online transactions where they were almost non-existent before.

The initiative has been supporting equality through digital literacy; promoting awareness about online payments and encouraging its use, transforming the country into a digitally empowered economy and making it easier to do business online in India.

In order to get banking services to remote areas and financially excluded citizens, post offices in India were digitised through the Digital Advancement of Rural Post Office for A New India project. Handheld devices with a mobile app were given to postal workers to enable last-mile banking services for remote areas through the Post Office Savings Bank Scheme. With this, they have been able to provide doorstep financial services such as savings, bill payments, insurance, pensions and other digital transactions, promoting financial inclusion and accessibility that was previously lacking.

Digital India has also created a platform for partnership between government and citizens where all government activities could become accessible online. This is in addition to the National Smart Cities Mission, an initiative designed to develop smart cities that leverage technology for improved quality of life and sustainability. According to a 2019 Ministry of Electronics and Information Technology (MeitY) report, the Digital India initiative is expected to boost the country’s digital economy from $200bn in 2018 to $1tn by 2025.

Digital India’s current status and progress

Under the Digital India initiative, low rates for mobile data are providing more of the Indian population with access to the internet and contributing to the growth of the country’s GDP.

According to the I-Cube 2021 study prepared by the Internet and Mobile Association of India and market research company Kantar, there are 692 million active internet users in India (351 million of them rural, 341 million of them urban) with around 346 million Indians engaged in ecommerce and digital payments.

This means that almost half of the Indian population is internet users, more than 20% growth from the 27% penetration rate in 2015. This can be attributed to more areas being connected to the internet, as well as the reduced cost of an internet subscription for wireless data. In 2015, it cost about INR 226 to buy a gigabyte of data but in 2022, it cost just INR 13.5.

As part of the Digital India scheme, the government also set out its National Smart Cities Mission in 2015, aimed at driving economic growth and improving the quality of life of people in cities in India. According to Prime Minister Narendra Modi: “The Smart City Mission will help prepare our cities to take up the challenges of New India; and prepare world class, intelligent urban centres in India for the 21st century”.

The initiative leverages digitalisation to create efficient, sustainable and inclusive digital services for cities, which in turn supports the growth of a digital economy. Spain, the US, Germany, Japan, France, Singapore and Sweden have all shown interest in India’s Smart Cities Mission.

For the initiative, 100 cities were identified and 7,902 projects were commissioned, 4,436 of which have been completed as of the end of September 2022. Some of the projects include redevelopment of public land, as well as building incubation and skill development centres. All of these are intended to foster local development, using technology to promote citizens’ well-being and boost the economy.

The merits of Digital India

According to Prime Minister Modi, “The Digital India movement can bring about revolutionary changes in India and the lives of the common man”. Indeed, revolutionary change has been the case in India.

For decades, India remained a cash-based economy, with its retail sector dominated by several micro, small and medium enterprises. However, digitalisation has not only transformed how citizens and communities connect with each other but has succeeded in transitioning the country into a far less cash-reliant economy through new digital payment methods’ disruption of the conventional system.

Prior to the Digital India initiative, cash was the dominant payment method, followed by bank transfers and debit/credit cards. Cash on delivery took over when ecommerce started growing, until 2020 when the pandemic made the country gravitate towards digital payments. Cashless payment methods such as mobile wallets, POS terminals and QR code payments have made it easy and quick to conduct transactions seamlessly.

With so many merchants, diverse business models and payment options to choose from, some of the methods for cashless transactions come with value added benefits as incentives for adoption and usage. For instance, payments company Paytm offers discounts on mobile recharges above INR 99, the fintech PhonePe gives coupons to all users and Google Pay and AmazonPay offer cashback schemes. Incentive/cashback schemes were also launched by the Ministry of Electronics & IT to promote faster adoption of digital payments by customers and merchants in India.

Digital India has also promoted better communication and governance, especially during and after the pandemic when information was easily passed to citizens, even in remote areas, and it could be ensured that remittances got to needy households through the adoption of mobile phones for Aadhaar-linked payments, digital wallets and other mobile app remittances.

The Indian fintech ecosystem

A report by ETBFSI identifies India as the third largest fintech ecosystem in the world and one of the few emerging markets competing at a global level. Thanks to its large digital consumer market, with cheap internet access and high penetration of mobile phones, India has become a fertile ground for fintech disruption. Several local companies have sprang up to cater to the country’s financial demands with readily available digital products and services, including digital lending, digital banking and BNPL. Over the years, there has been an increased number of venture capitalists and angel investors providing funding to the sector, especially for digital payments and lending tech.

According to Som Prakash, the Minister of State for Commerce and Industry, there has been a huge rise in startups – from 471 in 2016 to over 77,000 startups recognised by the Department for Promotion of Industry and Internal Trade as of 29 August 2022. With about 107 unicorns (21 of them achieving unicorn valuation in 2022), worth a total of $340.79bn as of 7 September 2022, Indian Minister of Finance Nirmala Sitharaman has attributed the growth of fintech in India to the easy availability of funding. More than 26 states have policies that give support to startups, creating a fertile ground for large corporations to invest or partner with them.

Almost half of these recognised startups are clustered in metropolitan cities; according to research company Trackxn, the five cities with the most unicorns as of March 2022 were Bangalore (39), Mumbai (16), Gurgaon (15), Delhi (10) and Noida (7).

These Indian cities offer infrastructure for digital payments to support startup activity. For instance, Bangalore is home to the Reserve Bank Innovation Hub, a subsidiary of the country’s central bank set up to develop external partnerships that promote innovation in the financial sector. These cities are important to startups because they can offer innovator meetups and other business events for networking, as well as a low cost of living that allows startups to launch at a more affordable cost.

The private sector’s contributions to India’s digital economy

The private sector has been contributing to the advancement of the digital economy in India by addressing some of the challenges of digitalisation in the country and offering access to economic development. Most of the private sector’s contributions have been geared towards moving traditional financial systems and businesses to digital by offering consumers multiple online payment options.

Among the key private sector contributors are Google, Amazon and Meta. The ‘Google for India Digitisation Fund’ is promoting the development of more affordable smartphones for consumers; Amazon is helping 10 million small and medium enterprises transition to online platforms and Meta is helping consumers get groceries from neighbourhood stores through WhatsApp. In addition, Microsoft has a partnership with broadband provider AirJaldi, called the Airband Initiative, that is helping to bring fast and reliable internet connections to rural and semi-urban areas across India with no access to power or mobile connectivity.

Fintech solutions are also providing small businesses and other merchants with support to access multiple payment options (such as QR code payment, payment link and others), as well as inventory management, bookkeeping and sales forecasts. For instance, DuNOW is an online application helping businesses generate digital bills and manage customer communication.

India’s Unified Payments Interface

Most small stores and street vendors were prompted by the pandemic to switch to digital payment for ease of operation and wider coverage. This evolution has fostered the growth of India’s digital payments and transformed the retail sector. According to the IMF, India’s digital payment volume is one of the world’s fastest growing spaces in the fintech industry. This growth has been made easy through innovative platforms such as the Unified Payments Interface (UPI) and Aadhaar-Enabled Payment Systems.

In India, the use of credit or debit cards for transactions is quite limited, with UPI being the more commonly used payment system. UPI is India’s real-time, mobile-enabled system that allows users to connect their bank accounts using a telephone number and a user’s preferred virtual payment address or a QR code.

UPI was developed by the National Payments Corporation of India (NPCI) in 2016, just before the announcement of the demonetisation initiative that supported high-denomination banknotes being withdrawn from circulation, and is regulated by the Reserve Bank of India, India’s central bank. It is used to make instant transfers across bank accounts and online payments with no merchant fees. It was initially available only to smartphone users but in March 2022 it became available to users of feature phones (a type of phone with limited functionality compared to a smartphone), which made UPI services more accessible in remote areas.

UPI and cross-border payment

According to FXC’s market sizing data, inward remittance flow to India was $89bn and outflow remittance was $16bn in 2021. Most of the inward remittance flow comes from the Middle East and US, while most outward remittances go to Bangladesh, Pakistan, Nepal, Sri Lanka and China. Over the years, increases in international travel and migrant workers have made cross-border payments the next evolution for UPI after its success in domestic payments.

There have been several UPI partnerships in different countries, including the adoption of UPI in Nepal and BHIM UPI in Bhutan (Bharat Interface for Money (BHIM) is a payment app that allows easy and quick transactions using UPI by scanning their QR with the BHIM app). UPI partnerships have soared because the system only requires a phone number to send or request money and does not require a bank for implementation.

The earliest UPI partnership was with the Royal Monetary Authority of Bhutan in July 2021. The partnership saw Bhutan adopting UPI standards for its QR code application, as well as issuing and accepting RuPay cards (a NPCI domestic electronic payment card).

In Nepal, the first country outside India to adopt UPI as a full payment platform, Gateway Payment Service and Manam Infotech are using the service to drive the digitalisation of cash transactions and pave the way for real-time cross-border P2P remittances.

There have been other strategic UPI partnerships, one of which is with the UAE. UPI went live on NEOPAY POS terminals in April 2022; previously, in August 2021, Lulu Financial Holdings signed an agreement with NPCI International Payments Limited to offer real-time remittances to India from the UAE. The UAE is a leisure and business destination for millions of Indians and the India-UAE corridor is one of the world’s largest remittance corridors.

Lower transaction time is one of the major advantages of the UPI payment platform. The use of proxy identifiers, in this case a mobile phone number, also makes it more attractive to partners as it is less time consuming and easier to use for cross-border payments than alternatives. Currently, most cross-border payments are bound by banking time but UPI offers real-time capability across multiple digital channels that are not limited to banking days and hours.

Conclusion

The digital economy in India has blossomed since 2015 as a result of deliberate advancement through investments and policy interventions in digitalisation. Notable developments include enrolling more than a billion citizens into the country’s biometric digital identity program, which has empowered the Aadhaar Enabled Payment System to provide public services and financial assistance.

There has been notable evolution and growth in the payment space, especially with UPI creating a neutral platform that is accessible at low cost for simple, easy and quick payments both locally and cross border. UPI has been an outstanding success in enabling seamless merchant transactions, round-the-clock availability for customers and solving common cross-border challenges. With the number of current international UPI partnerships, there will likely be more adoption of UPI for cross-border payments in the near future, which will also boost India’s GDP.

However, despite the growth of internet connectivity in the last five years, there are still some communities with no access to the internet. Achieving an increase in penetration will require continuous effort but, if successful, it will increase financial activities and drive economic development, especially in rural communities.

Public-private partnerships (PPP) are likely to continue to play a major role going forward, as observed in the 2022 budget where the Finance Minister emphasised PPP projects for infrastructure development and asset monetisation. Initiatives such as the Viability Gap Funding incentive, which will allow up to 40% of project cost to be accessed in the form of capital grants, will incentivise these collaborations.

Lastly, there is a need to put strong data privacy and protection laws in place as the digital economy continues to expand in order to counter potential threats, such as the recent Aadhar card scams. Improper data management and insecurity issues related to fake identities on Aadhaar may cause people to avoid or limit the use of digital services, which will be detrimental to economic development and inclusion. Data protection is compulsory in most countries and with India currently lacking a common privacy law, leaving data regulation open to a wide variety of sectoral regulations, it might be a hindrance to a certain level of cross-border partnerships.

India’s digital economy has come a long way to bridge the gap between the digital haves and have-nots, moving from a cash-based economy to a real-time digital payment system and creating opportunities for the government, investors and private organisations to work together to pave the way for the country’s digital future.