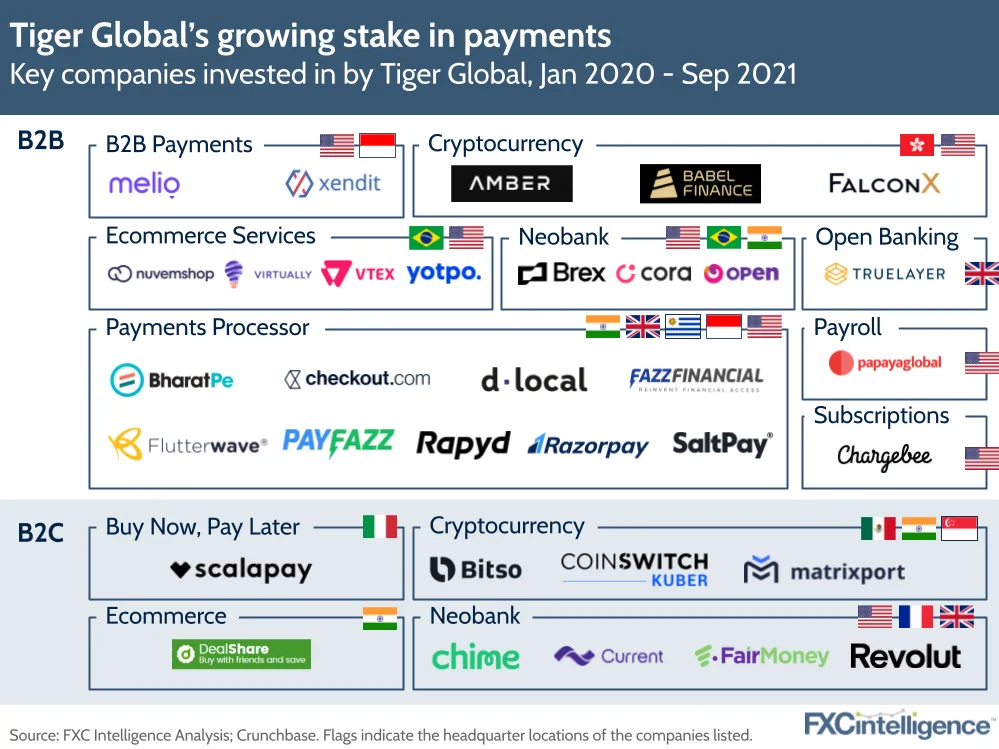

TrueLayer recently received funding from Tiger Global Management, but it isn’t the only organisation operating in cross-border payments to see investment from the company. The investment firm has increasingly focused on the fintech space, becoming one of the industry’s hottest, biggest and quickest funders.

Tiger Global Management started life as Tiger Technology back in 2001, when its focus was on fast-growing public company investments in the rapidly changing tech space. However, it has increasingly moved into venture capital investments over the last decade. While in 2011 it was investing in the private markets with its sixth fund, worth $1.3bn, its latest, the January 2021-announced number 14, is worth $6.7bn. Much of that money is already invested, and the company is expected to begin accepting capital for its next fund, worth $10bn, from October.

Since January 2020, Tiger Global has made a total of 311 investments, around 13% of which are in companies operating at least partially in cross-border payments. Together, this saw the company participate in funding rounds which saw companies in the industry raise a combined $9bn.

This makes Tiger Global a significant player in the space, particularly given the broad range of geographies it is investing across, as well as the range of sectors within cross-border payments. The investment company has shown a preference for investing in B2B companies, although this may at least in part be a reflection of the greater opportunities currently present in B2B compared to B2C. In addition, while it occasionally participates in Seed rounds, the company generally favours later stage investments where it can deploy more capital, with 77% of those above being Series C rounds or higher.

TrueLayer’s investment is unlikely to be the last Tiger Global makes in cross-border payments. It has significantly increased its rate of investments in 2021, with Q2 2021 currently holding the record for number of investments and Q3 close behind. Expect to see far more funding round announcements with Tiger Global attached in the future.