Financial services platform Marex has acquired FX provider Hamilton Court Group in one of several M&A deals looking to capitalise on the growing potential of the B2B cross-border payments space. We spoke to Marex Chief Strategist and CEO of Capital Markets Paolo Tonucci and Hamilton Court Group CEO Tony Keterman to find out more.

The B2B cross-border landscape continues to see both banks and non-bank financial services providers looking to evolve their cross-border services to meet a massive, growing opportunity.

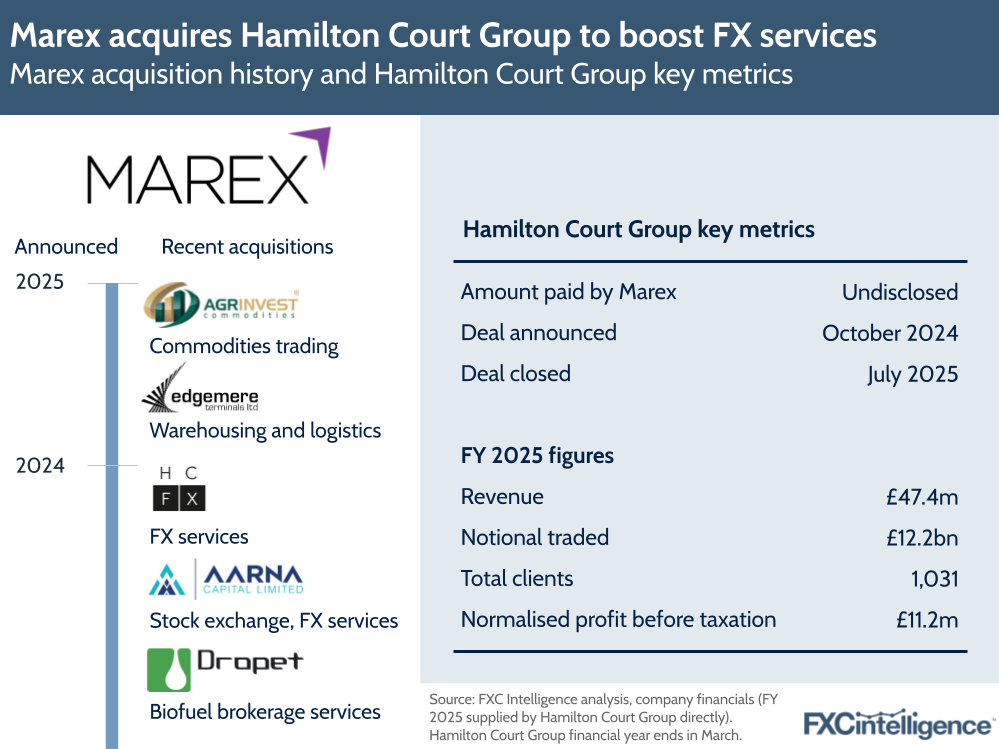

Financial services platform Marex’s recent acquisition of FX provider Hamilton Court Group is an example of this. Announced in October 2024 and closed this week, Marex’s takeover is a means of expanding the foreign exchange services it offers to existing clients while also bringing new clients onto the platform.

Founded in 2005, Marex has made its name providing liquidity, market access and infrastructure services to a range of blue-chip clients, including corporates, banks and trading houses across the energy, commodities and financial markets. Hamilton Court Group, meanwhile, has focused on providing FX services to mid-sized UK and Europe-based corporates since 2011.

We caught up with Marex Chief Strategist and CEO of Capital Markets Paolo Tonucci and Hamilton Court Group CEO Tony Keterman to find out more about the deal, where both companies see the value in each other and find more about how the acquisition fits into a shifting picture of B2B services in 2025.

Marex and Hamilton Court: Key benefits from the deal

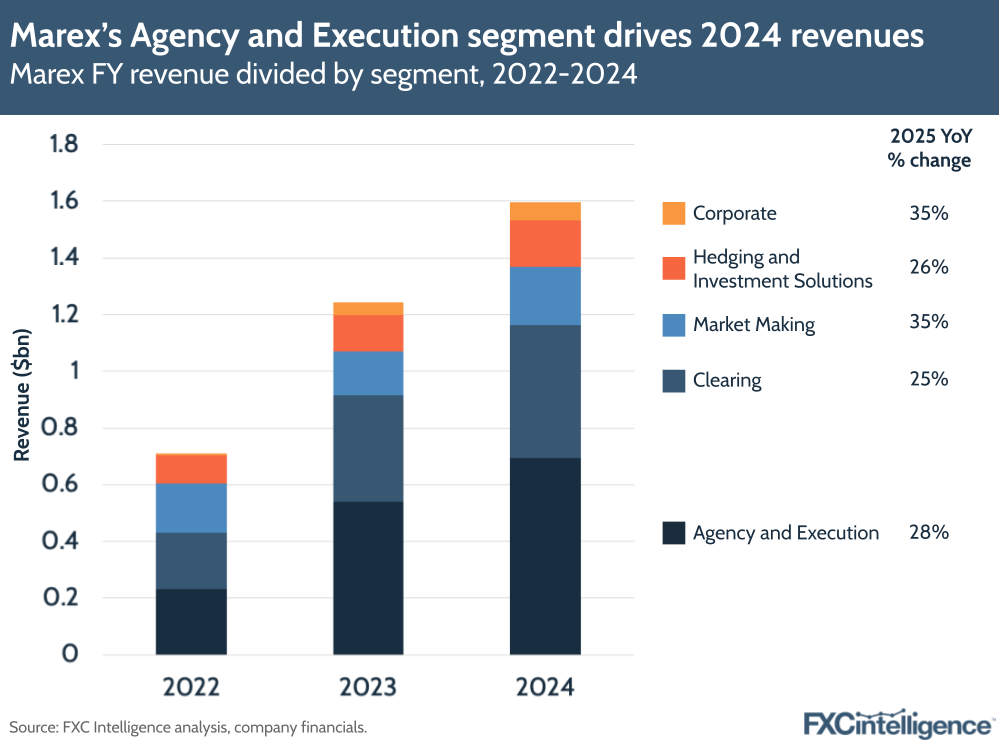

Marex currently spreads itself across multiple segments, spanning clearing, agency and execution, market making and hedging and investment solutions.

Tonucci says that the company has been built to offer infrastructure and access to liquidity for corporate clients, investors, asset managers and hedge funds. However, the company didn’t have a fully comprehensive FX offering, and the opportunity to provide something similar to its current products but as a more specialised non-bank was “compelling”.

“We pride ourselves on the fact that we will, in most cases, act as an agent and so provide the best market price,” Tonucci explains. “We thought that this approach would extend very well into the FX space. But rather than build the business ourselves, we wanted to use the expertise that you would acquire from an existing player.”

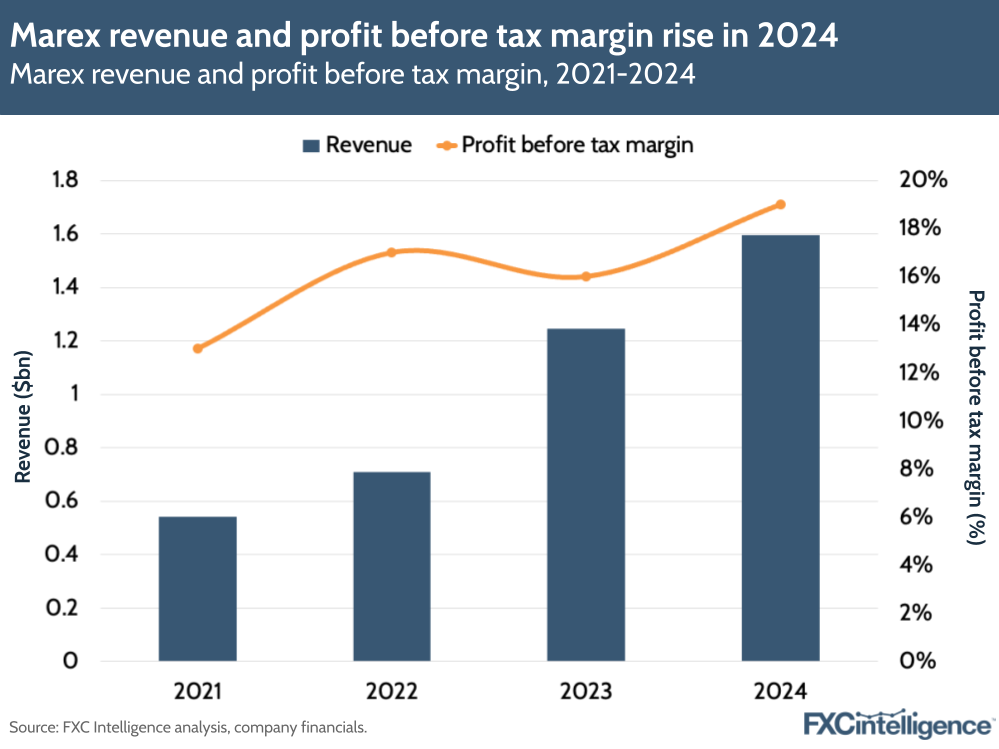

Per the company’s Q1 2025 results released in May 2025, Marex saw revenue rise 28% YoY to $467m, driven primarily by 42% growth in its Agency and Execution segment, through which it brokers deals between buyers and sellers in energy and financial markets.

Before this, in its annual results for 2024, the company had seen 28% revenue growth to $1.6bn, with profit before tax rising 51% to $296m, giving a profit before tax margin of 19%.

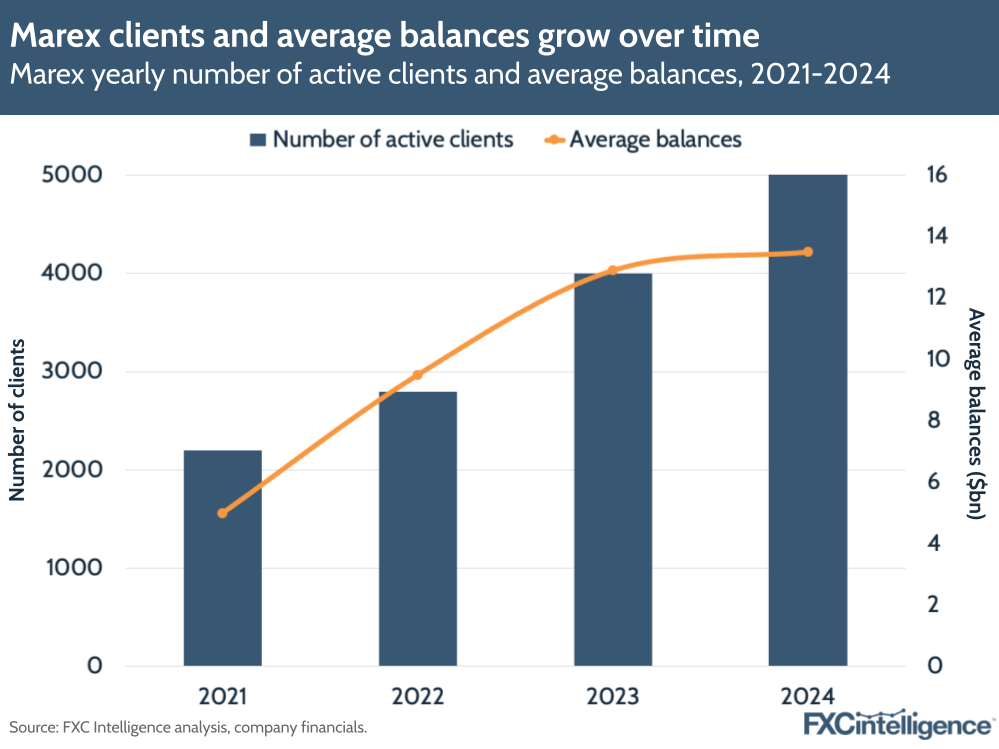

While Marex will obtain the benefit of a built-out FX offering aligned with its goals, for Hamilton Court Group the move is all about expanding its services to Marex’s customer base of 5,000 clients, who may be trading in different commodities but also have need of FX services. It will also look to expand its presence in Europe beyond the UK.

“It’s about how we look at cross-selling our services into their clients and their clients into our services,” says Keterman. “That’s probably one of the biggest attractions.”

In FY 2025 (ending in March 2025), Hamilton Court Group saw revenue rise 20% to £47.4m – equating to around $60m, based on historical exchange rates over its FY period, which is a fraction of the size of Marex’s revenue based on the latter’s FY 2024 figure.

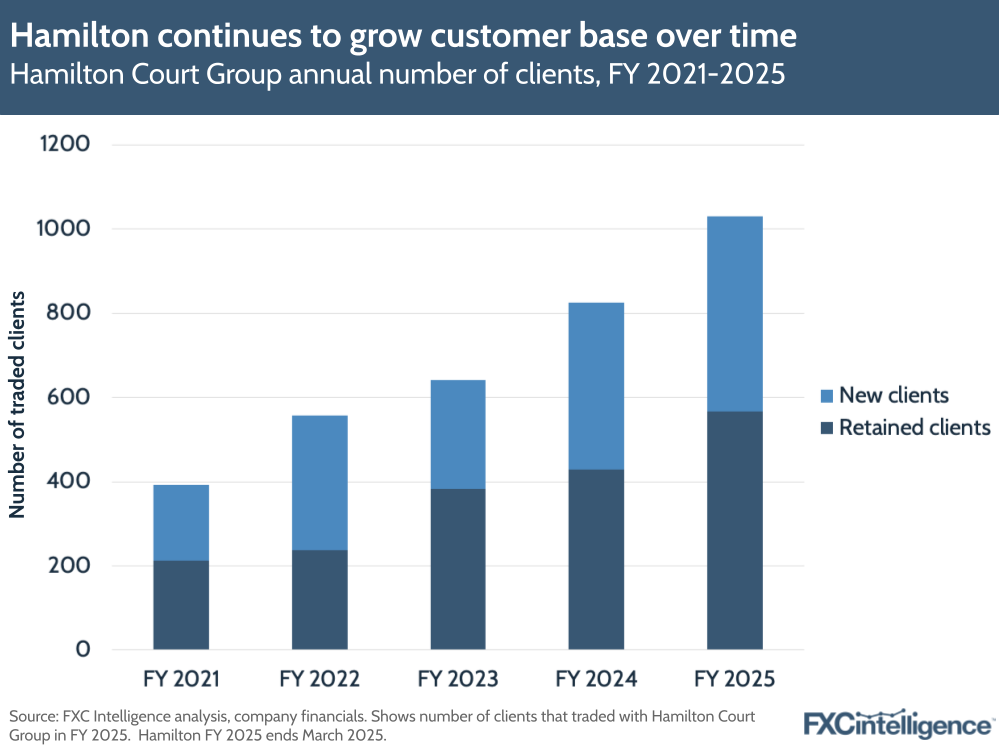

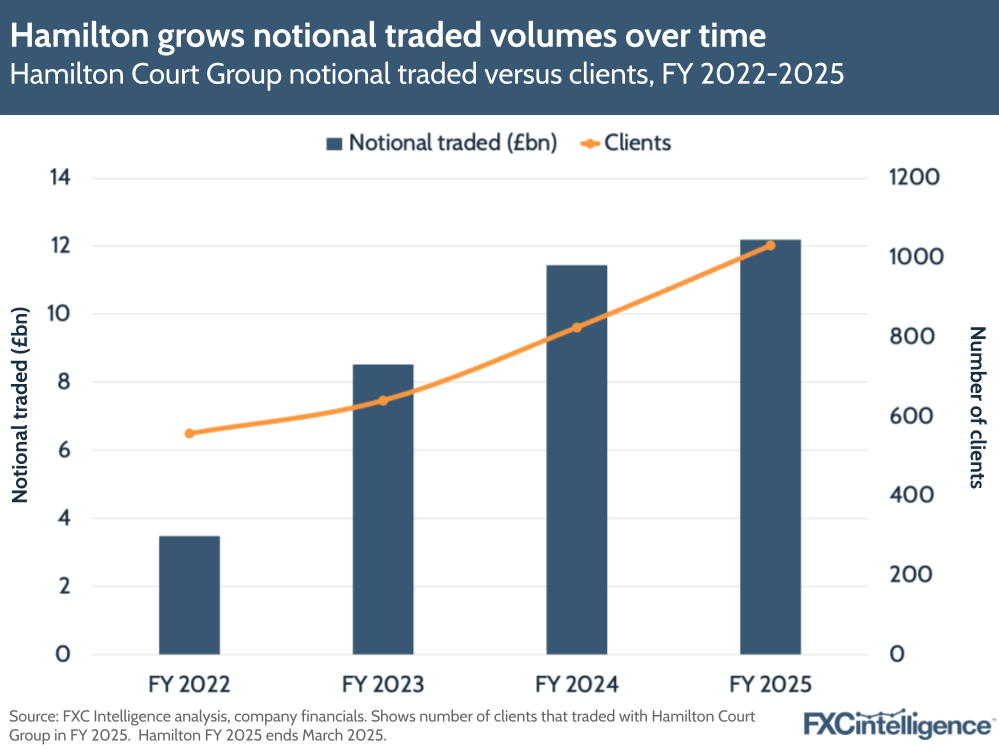

The company noted a profit before tax of £5.3m in FY 2025, giving a profit before tax margin of 11% (though on a normalised basis excluding exceptional costs, profit before tax was £11.2m). Traded clients grew 25%, driving a 7% growth in notional traded volumes to £12.2bn.

Previously, Hamilton had noted a significant jump in revenue and profit in its FY 2023 earnings, when it noted a significant rise in ‘high-notional’ trades (trades with notional over £5m) compared to the previous year.

Hamilton Court Group will benefit from Marex’s corporate sponsorship and the fact that it carries an investment-grade credit rating, which will differentiate it from other FX players and give prospects and clients more confidence in the company’s ability to sustain in challenging markets. Keterman gives the example of Argentex, which was recently acquired by IFX Payments after being exposed to the significant devaluation of the US dollar.

“For us, it’s about being part of a much larger ecosystem where an independent business is no longer running credit risk and managing credit and the finances,” he adds.

Tonucci says that Marex will continue to focus on typical corporate UK customers through to large international groups. However, he adds that providing FX services to the latter group – which Marex already serves in other areas – is challenging for smaller independent businesses.

“Tony’s team have the expertise to service a wider community of clients, but they’re constrained by the fact that you need balance sheets, liquidity, capital and risk management capabilities, which we hope we will be able to supplement,” he explains.

Competing as a non-bank in FX services

One area where Marex and Hamilton Court Group align is in competing with banks to offer services to corporates. In FXC Intelligence’s own analysis, banks are still serving a significant portion of B2B cross-border payments flows. So how can non-banks continue to perform and take share from traditional banks?

For Tonucci, Marex’s differentiator is in offering more specialised services than typical banks. “Without denigrating any of the banks, I think they have a very generalist service and it can be quite difficult for them to make decisions around each component, because getting through a credit process with a bank can be challenging,” he says. “We can do that. And we supplement that with better technology and more modern systems that allow much more flexible deployment.”

Tonucci adds that the company’s low staff turnover helps it stay ready for clients. “We keep the relationships, we keep the operational expertise,” he says. A key driver is that Marex is “less complacent” than a typical bank, and, as Tonucci says, must “fight for every transaction”.

“We know we have to compete, and we know that for clients in most cases it’s about having a much better client experience, whether that’s onboarding or the expertise in the products that you are selling,” he explains.

For Keterman, Marex’s ability to act quickly and not be as cumbersome as a bank, yet offer similar infrastructure, was part of the appeal. Though he sees payments as a highly competitive market with many technologically advanced players, he says Hamilton Court Group could potentially hold space in it. The company is currently looking at whether it could build into treasury management, and if it could add payments as part of that strategy with its existing clients.

Hamilton has continued to build its client base over time. In FY 2025, the group grew its overall number of clients by 25% YoY to 1,031, with 45% of these being new clients and 55% retained. The addition of Marex could allow it to expand to new customers while it continues to pursue new features to keep clients onboard.

How macro factors could affect the FX and cross-border payments market

Serving clients with secure, specialised cross-border services is growing increasingly important as the world faces growing volatility. Regarding how the FX and cross-border space could change in the next few years, Keterman believes there could be significant changes in the companies serving them.

In particular, banks could seek to retreat from segments that are higher risk, while clients could move to larger, well-capitalised providers such as Corpay and Convera, which in turn could push out smaller providers. More than anything, trust and certainty matter in volatile markets now more than ever, which is a big part of why the deal matters to Hamilton Court Group.

“It’s about confidence,” says Keterman. “I think it’s about how much certainty you can provide that you are going to be here tomorrow, and it’s about building that trusted relationship over a period of time that can withstand challenging times where the market is volatile.”

On Marex’s side, Tonucci says that the future challenges are likely to be dominated by US politics and the geopolitical interactions between the US and the other large economies. However, he noted that high levels of volatility are pushing businesses towards seeking hedging solutions, with Marex seeing increasing business as a result.

“If there’s one thing that I think I feel confident will remain, it’s a slightly elevated level of volatility,” explains Tonucci. “I think there’ll be a lot of client opportunity. Typically, we find that you get these periods where it’s very intense and then it slows a little from the peaks, but I think the average over this cycle will be a pretty high level of activity.”

M&A strategies in cross-border payments

Marex’s acquisition is one of several major deals made in the cross-border payments space recently. Corpay recently announced it was buying a 33% share in AvidXchange, while Mastercard is also set to take a 3% stake in Corpay’s cross-border payments business. Elsewhere, Global Payments is set to acquire Worldpay in a $24.25bn dollar deal.

Businesses within the space are combining for a multitude of reasons, whether that is entering new markets, adding new products, building out their client base or expanding services for existing clients.

Marex recently completed its acquisition of Abu Dhabi-based clearing firm Aarna Capital to help the company further expand its services in the Middle East. The company’s CEO Ian Lowitt said during the Q1 2025 earnings call the company would be “very active looking at potential acquisitions in the future”, though any further takeovers need to be aligned with the company’s return on equity targets.

Regarding the Hamilton Court Group acquisition, Tonucci says that in the time the two companies have been talking with each other, the combination of technology to unlock new opportunities has been an exciting prospect.

“There are areas where we will invest and that will include in payments infrastructure and within the technology that Tony’s team has built, we’re going to try and combine that with some of the technology that Marex can offer,” he says.

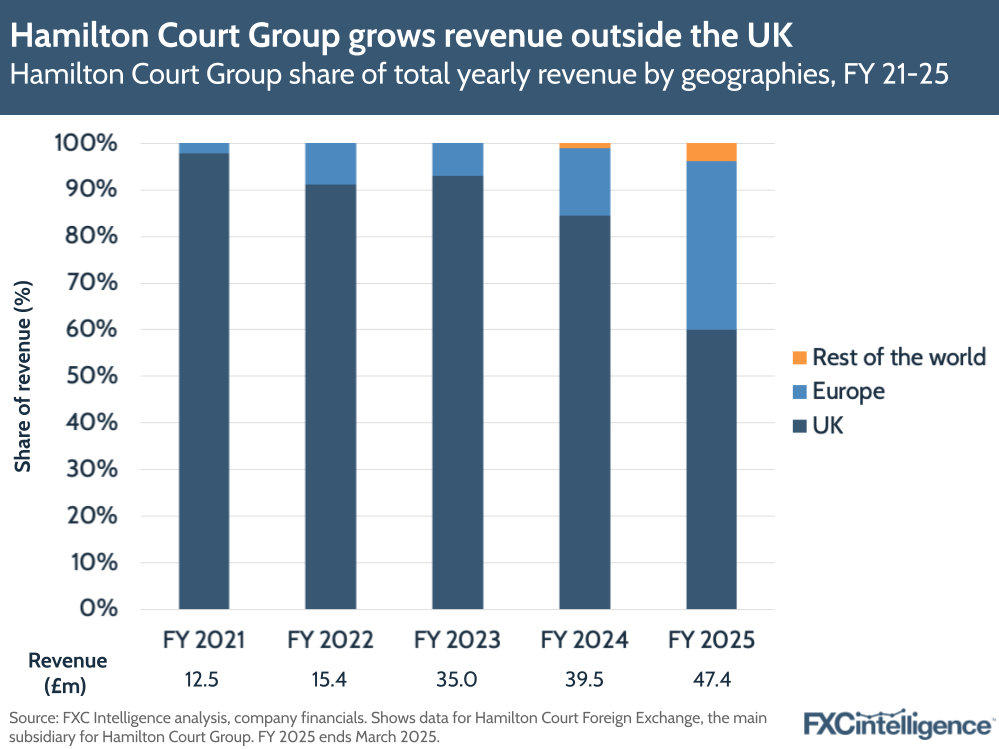

From Hamilton Court Group’s side meanwhile, geographical expansion will be a big part of its role in integration with Marex as it looks to move its services across Europe. The group has already seen its mix change over the last two years, with its UK revenue declining by -15% YoY in FY 2025 to account for 60% of its total revenue, down from 85%. Meanwhile, Europe revenues grew by 203% and now account for over a third of its overall total.

“Marex has obviously got a global footprint, so I think we will look to use that global footprint as a base from which we can attack new geographies,” explains Keterman.

In an ever-shifting space, we could expect to see more deals in a similar vein to Marex and Hamilton Court Group as companies seek to expand their footprint while hedging against volatility. Marex is the bigger company in this transaction, but it is still fighting to compete with banks to capture a broad share of corporate customers.

As non-bank FX providers continue to compete to attract corporate business away from banks, it’s not just size that matters – it’s trust and customer relationships.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.