The Q2 2023 earnings season has generally been positive for the C2C money transfers and remittances industry, but there are signs of changing strategies. We explore some of the money transfers trends that unfolded in remittances this quarter.

Among publicly traded companies, the Q2 2023 earnings season was fairly positive for remittances, with all major money transfer companies reporting growth in their C2C revenue lines. However, beyond the top line numbers were a number of ongoing trends that reflect a remittances industry in flux.

In the first in a new report series, we look across the latest and past quarterly earnings to determine how the industry is faring, which metrics companies are pulling ahead on and how key trends are emerging in the remittances and money transfers space.

We cover the main money transfer players who are publicly traded: Western Union, Intermex and Remitly, as well as Euronet’s money transfer division – which covers Ria and Xe – and the personal side of Wise’s business. In this report, we bring together all available comparable data for each metric to provide side-by-side comparisons over multiple quarters, as well as including keyword analysis from earnings calls to get a sense of the differences in priorities between major companies.

Revenue growth in Q2 2023 remittances

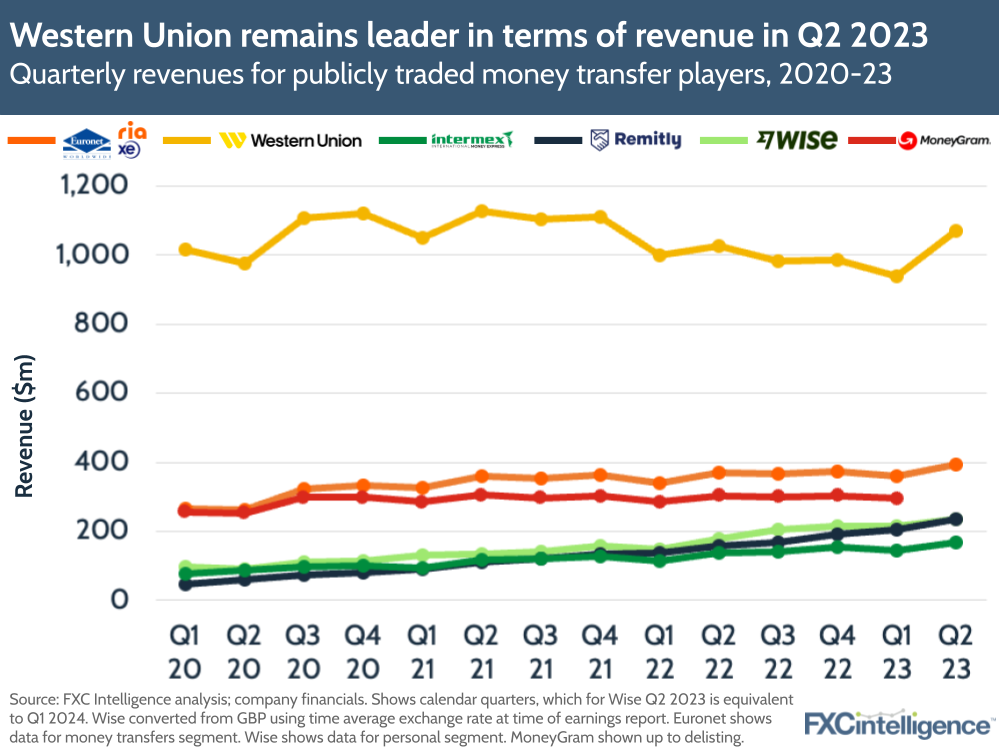

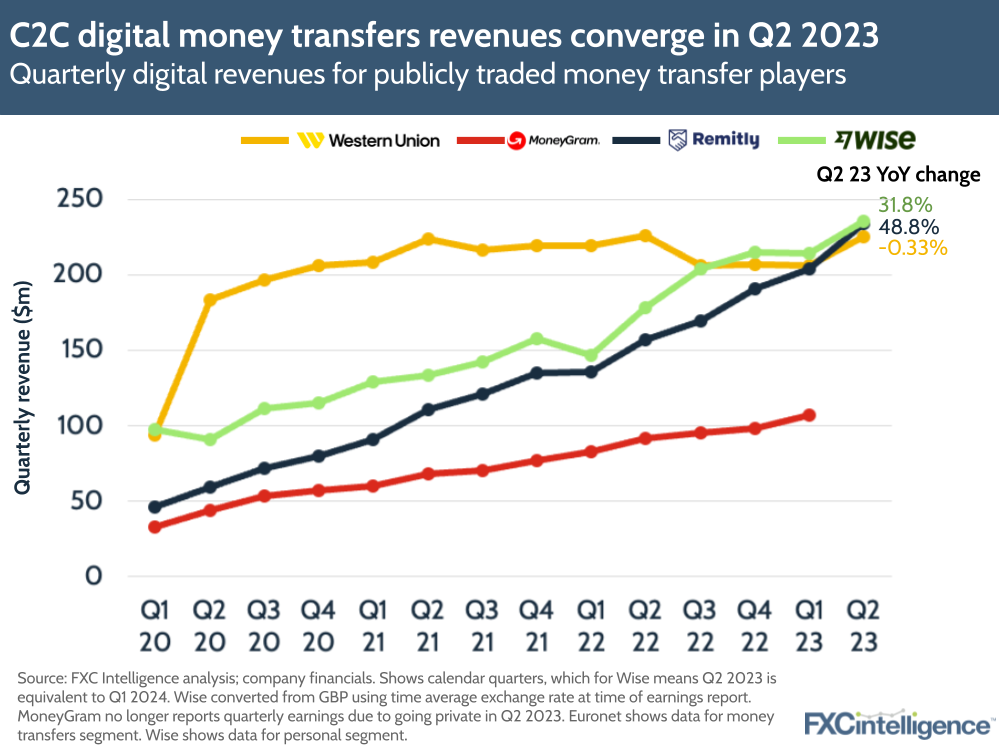

When reviewing the revenue of Western Union, Intermex and Remitly alongside Wise’s C2C revenue and Euronet’s money transfers revenue, it’s clear that Western Union remains the leader among the publicly traded remittance companies. However, the gap has been consistently narrowing over the past few years, with Ria and Xe in second place.

Wise, Remitly and Intermex all have very similar revenue and growth trajectories, although Remitly has moved above Intermex since the start of 2021.

Notably, MoneyGram, which went private as of last quarter, is likely to have seen revenue of around $300m in Q2 2023, putting it in third place in terms of revenue for remittance companies.

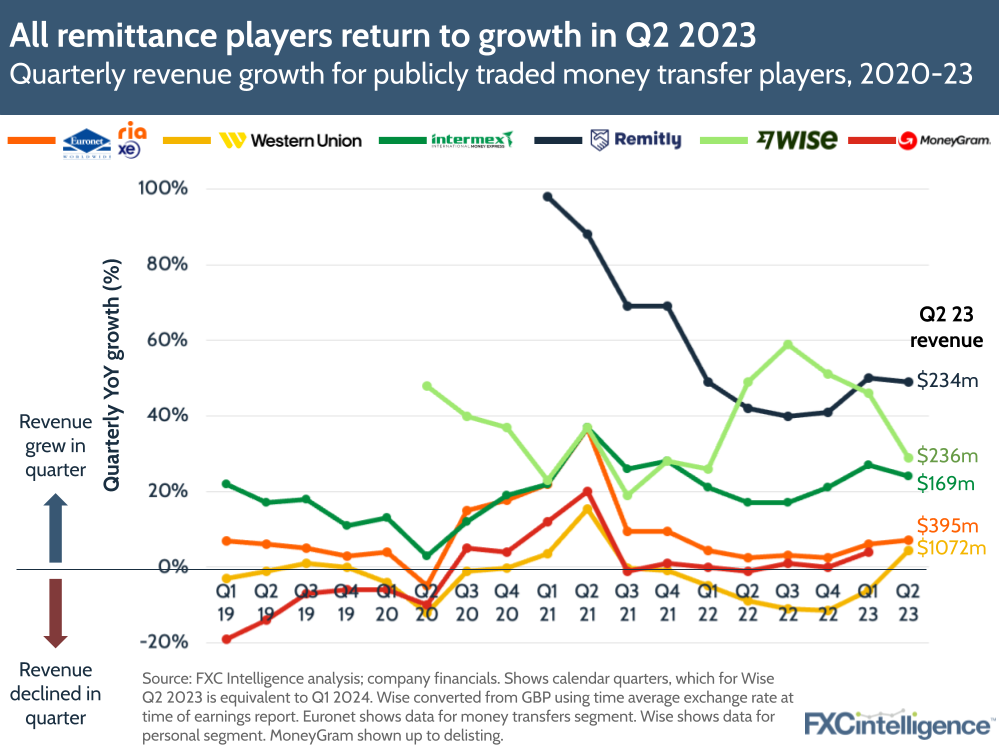

Looking to remittance revenue growth rates, this has been a generally positive quarter. Western Union returned to growth for the first time since Q2 2021, seeing a year-on-year increase of 4.4% to $1,072bn.

Meanwhile, Euronet saw its strongest rate of growth since Q4 2021, rising 7.1% to $395m for its money transfers segment. Intermex, by contrast, continues strong rates of growth, rising 24% to $169m.

Remitly and Wise, which are both newer companies still on a higher growth trajectory, saw increases of 49% and 29% respectively.

The reasons for these revenue increases varied considerably across the respective companies. For Intermex, this growth was primarily due to the integration of the recently acquired La Nacional, while the company saw a slowdown of growth in its core LatAm and Caribbean remittance markets that prompted a drop in share price on the Q2 2023 earnings announcement.

Western Union’s growth also failed to impress shareholders, potentially due to the fact that while increased operational efficiencies helped the gains, much of its growth was due to short-term benefits from Argentinian inflation and changing Iraqi central bank policy.

Euronet, meanwhile, saw its share price drop largely due to other parts of its overall business, with its money transfer segment being one of its better performing divisions. The company’s modest growth was offset by a 17% decline in its US domestic business, while US-outbound and international-originated money transfers increased 11% and 13% respectively.

By contrast, Wise saw its share price increase on its latest results, which were buoyed by higher income from both interest and a 33% increase in active customers. Remitly, meanwhile, saw its performance aided not only by a 47% growth in active customers and a 38% increase in send volume, but also by its adjusted EBITDA margin reaching its highest ever level.

How do different money transfers players approach their pricing strategies?

ARPU in money transfers for Q2 2023

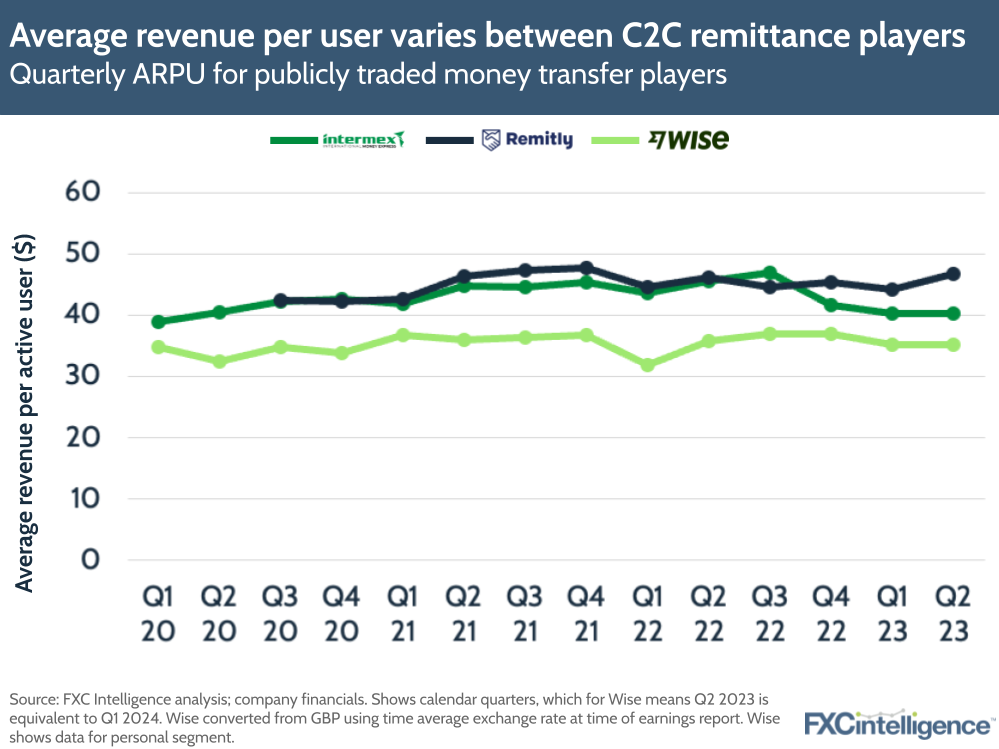

When it comes to average revenue per user (ARPU), not every company in the space puts out sufficient data to accurately calculate this. However, Intermex, Remitly and Wise all release active customer numbers, enabling comparable ARPU numbers to be calculated.

Notably here, Wise has the lowest ARPU of the three, and has done consistently for over three years. By contrast, Remitly’s has remained roughly the same as Intermex over time, but has pulled ahead in the last few quarters.

This difference is likely to be attributed to the very different customer types Remitly and Intermex serve compared to Wise. While Remitly and Intermex both provide traditional remittance-type services – albeit on a purely digital send basis for Remitly compared to an omnichannel basis for Intermex – Wise caters to the international money transfers market.

This sees the former two companies largely cater to migrant customers looking to send money home to friends and family, while Wise’s customer base includes migrants transferring money to themselves across borders to make large international purchases.

This difference is also shown in the variation in volume per customer, a metric that is only available for Wise and Remily. Here, while Remitly reported an average volume per customer of $1,920 in Q2 2023, Wise reported $4,082 send volume per customer in its personal division.

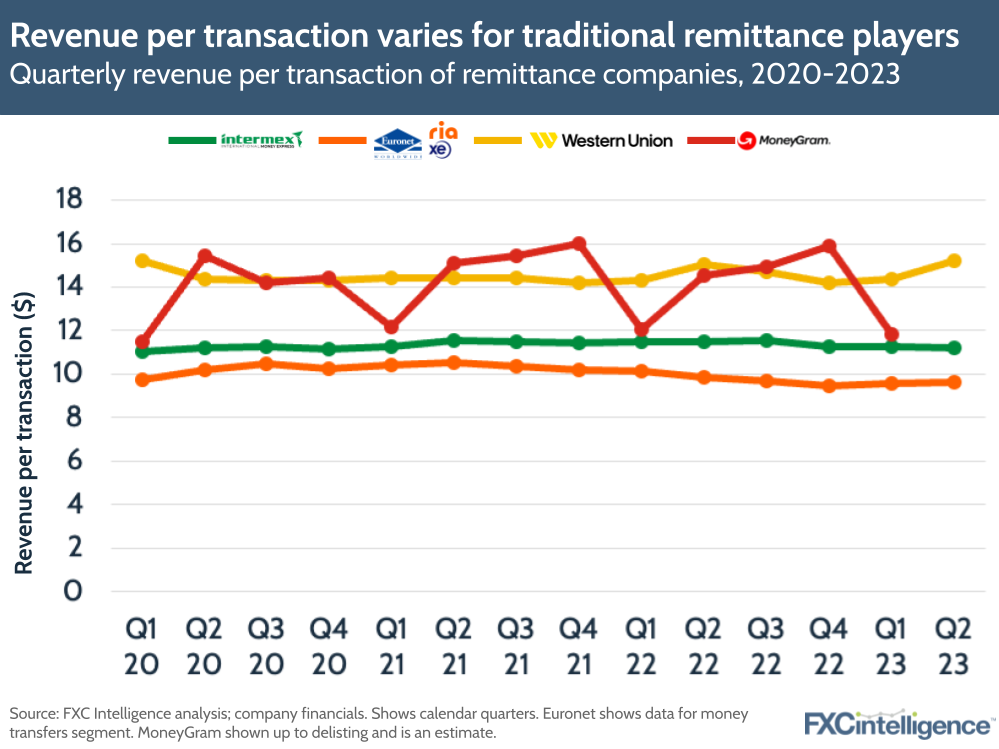

Transaction rates in remittances

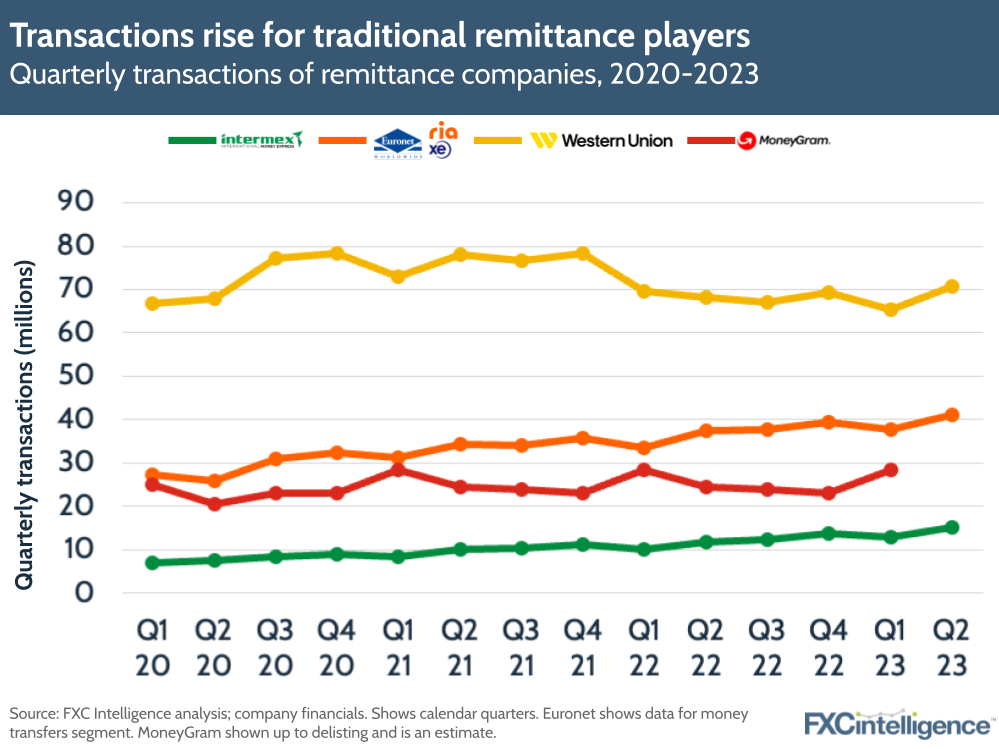

Looking at the number of transactions that customers made in Q2 2023 – a metric only reported by the traditionally retail-led remittance players Western Union, Euronet and Intermex – we see a similar division to revenue.

Again, Western Union leads as the largest company of the three in terms of remittances, while Ria and Xe are in second and Intermex is in third. However, while the latter two have consistently grown each quarter, Western Union has faltered far more, and its transaction rates remain below their 2021 peaks.

Looking at revenue per transaction, however, while Western Union remains the leader, and has been notably more consistent than its transactions alone might suggest, Intermex sits above Euronet in terms of the amount of revenue it takes from each individual transaction. This reflects Intermex’s approach of higher prices but increased customer support.

The fact that Western Union has seen a rise in revenue per transaction this quarter but Intermex and Euronet has not is interesting. Western Union has been undergoing a multi-year strategic transformation programme since its new CEO Devin McGranahan took over in 2022. However, it is not yet clear whether the improvements it has seen in Q2 2023 are indications of true improvement trends or just a short-term blip.

What remittance corridors present the biggest opportunities in terms of market size?

The rise of digital remittances versus the retail environment

Digital remittances have been a strong macro trend in the money transfers space for some time, as the industry responds to a growing move away from cash in much of the world. While cash remains critical to some economies, it has seen a sharp drop in use in others, a trend that is expected to continue for the foreseeable future.

For the remittances industry, therefore, digital is expected to be the biggest source of future growth, particularly on the send side. This expectation has drawn investor interest in digital-only players Remitly and Wise, as well as Euronet’s Xe brand, and has also seen traditionally retail-led players – including Western Union, Intermex and Ria, as well as the recently privatised MoneyGram – refocus their efforts to grow their digital businesses, with varying levels of success.

For Western Union, this has been a particularly telling quarter. The company has been enacting digital plans for some time, but these seem to have faltered in the last few quarters, with the company reporting YoY declines in its branded digital revenue every quarter since Q1 2022 on a GAAP basis.

Continued declines this quarter have resulted in the first time where both Wise’s personal business and Remitly’s business have higher revenues than Wise’s digital business.

MoneyGram, meanwhile, is likely to still be below its counterparts in terms of revenue, however it is making digital one of a number of priority trends as a private company, so it is likely that the company will gain on the others at a faster rate from now on, particularly as it reached 50% of transactions being digital in Q1 2023.

While neither Euronet’s money transfer business nor Intermex report sufficient digital revenue data to be included on the chart above, they have put out some information on their digital progress.

Euronet reported that it saw a 28% YoY increase in direct-to-consumer digital transactions in its money transfers segment in Q2 2023 and also confirmed that digital payouts had passed 35% of all transactions for the first time. Intermex, meanwhile, reported that transactions that were digital on either the send or receive side reached 31% in Q2 2023, up from 26% a year ago.

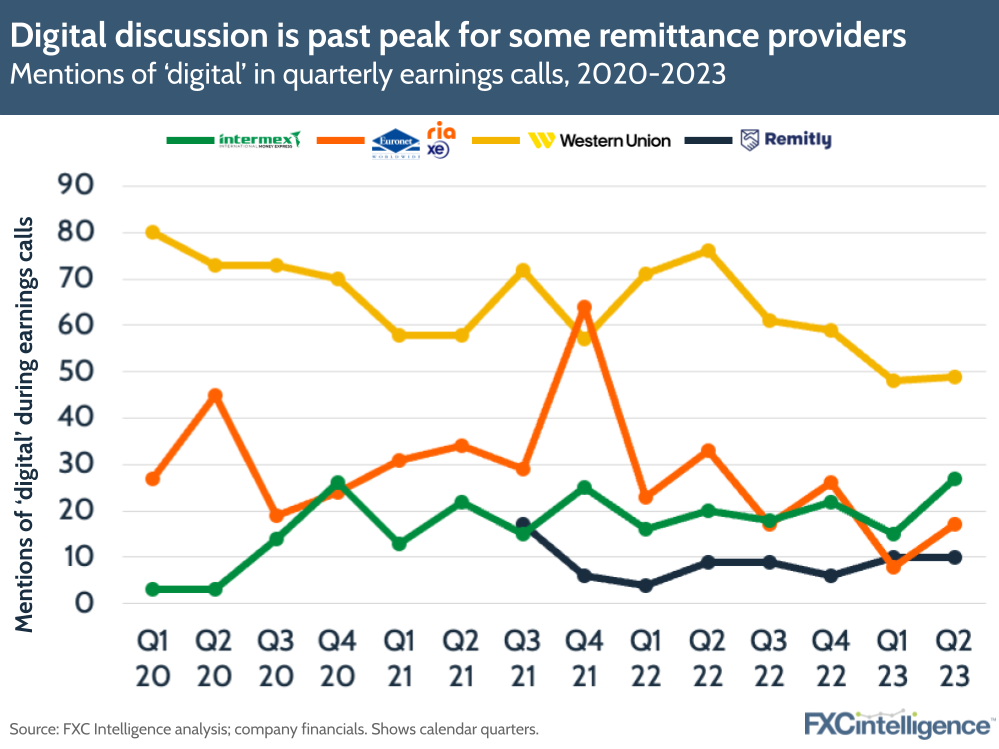

The importance of digital transactions was also reflected in discussion in the respective companies’ earnings calls, where we analysed how often specific keywords appeared in each quarter’s transcripts.

Mentions of digital have consistently been highest in Western Union earnings transcripts, but have been steadily declining in their frequency over the past three years. Aside from a brief jump in Q4 2021, which is likely to be reflective of a specific project or question, Euronet has also seen a slow drop.

By contrast, Intermex, which began with the lowest rate of mentions of ‘digital’ has risen to have the second highest mentions in the group. Digital-only Remitly is likely to have remained low, as there has never been a need for it to differentiate digital from any other parts of the business.

These trends suggest that Western Union and Euronet may not be placing as much focus on digital as they were in the past, while Intermex is increasingly looking at digital.

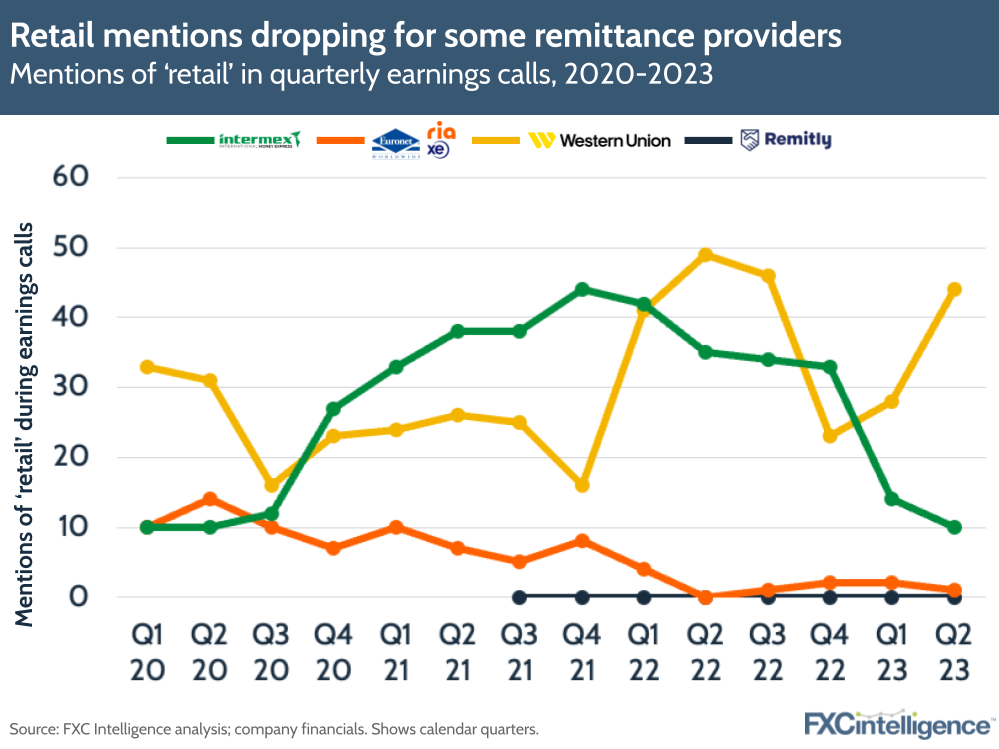

By contrast, mentions of ‘retail’ are comparatively lower across all businesses, although while Western Union has seen an upward trend of mentions of the word, Euronet has seen a firm downward trend, with Intermex also seeing a drop-off since the start of 2022.

Finally, omnichannel, a word that largely came to prominence in the post-pandemic period to indicate a combination of digital and retail, remains the lowest used of the three words, despite a brief peak in 2021. For Intermex, which adopted the word later and more consistently, also did not use it at all in its Q2 2023 earnings call.

Sentiment trends in remittances: Growth and beyond

Analysis of keyword use in earnings calls also provides a sense of other trends within the space, including an overall measure of sentiment within the industry.

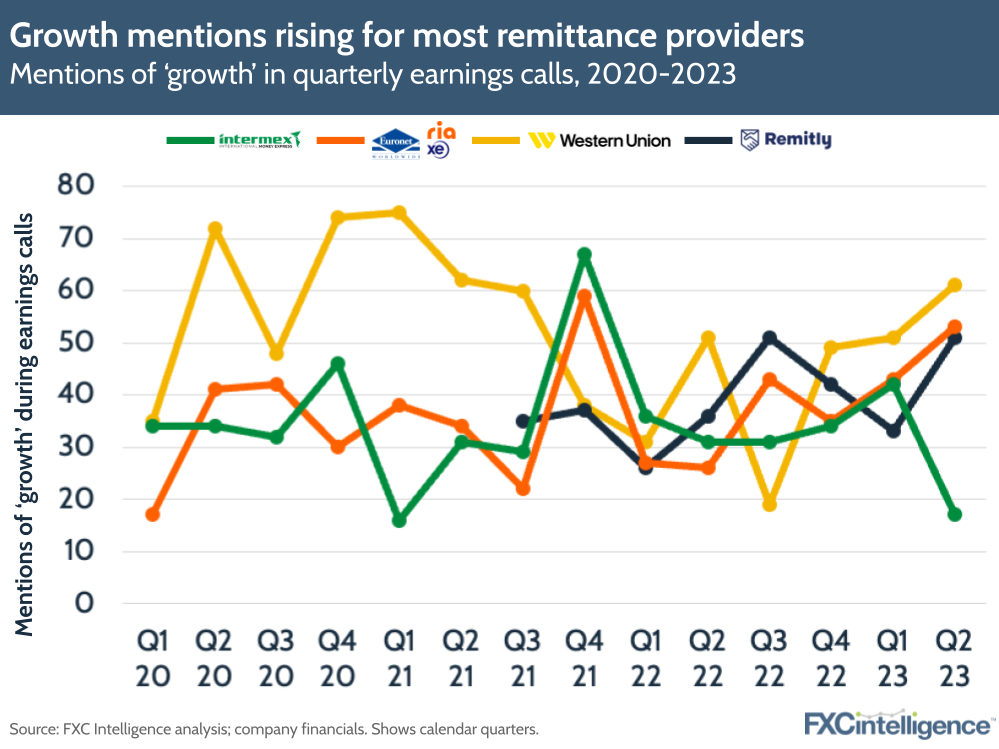

Growth, a popular term across the earnings calls of all industries, has remained consistently high in use across the last three years, although Western Union has seen a downward trend in recent quarters, Euronet has seen an upward trend, as has Intermex, with the exception of the most recent quarter.

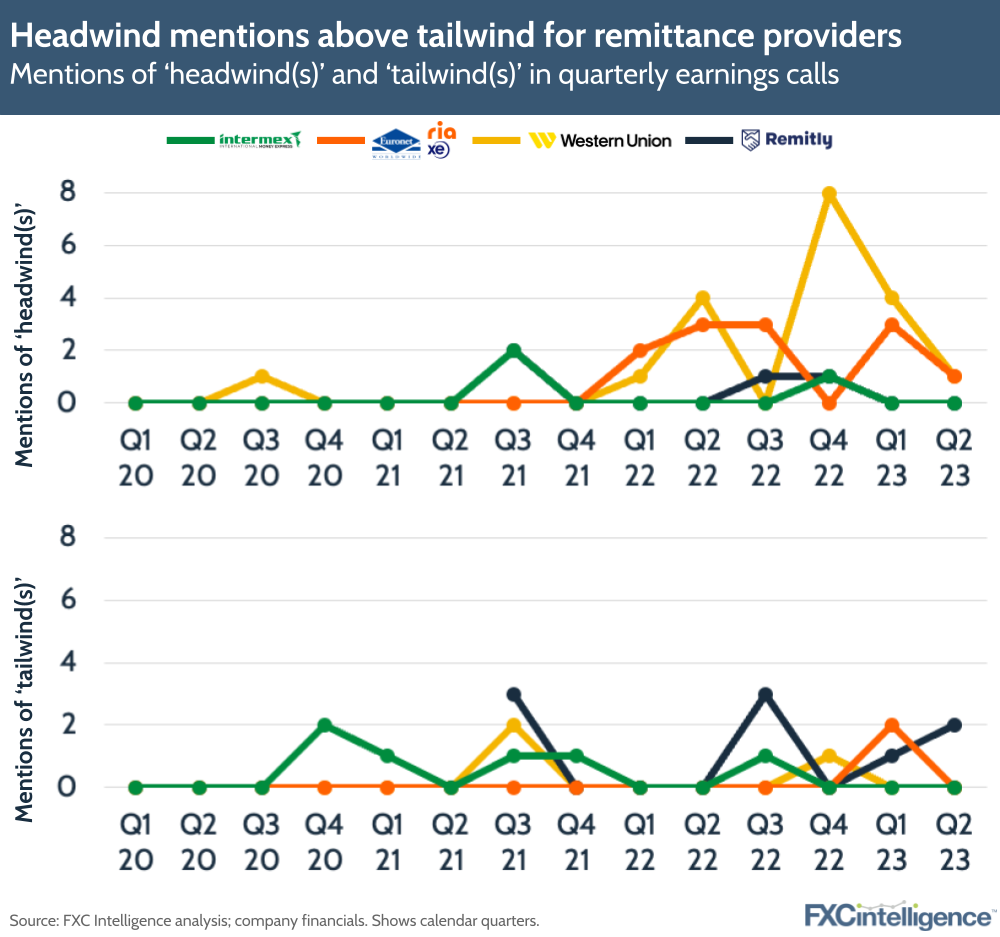

However, comparison of paired positive and negative words provides deeper insights. Looking at the use of ‘headwind’ versus ‘tailwind’ shows that while the former was used slightly more, the difference between the two is relatively mild. Western Union spoke of headwinds considerably more than it mentioned tailwinds, while for Remitly it was the reverse – a reflection of their differences in revenue growth over the period.

Intermex has seen mentions of tailwind slightly outmatch those of headwind, while for Euronet headwinds have been mentioned more, particularly since the start of 2022.

Use of the words ‘positive’ and ‘negative’ are also relatively close in number, with the former slightly ahead. Interestingly, Western Union has used both more than other companies in recent quarters, while Remitly used ‘negative’ far more across 2022, but has not used the word at all this year.

Strategic thinking and partnership-led approaches

Analysis of the frequency of mentions also provides some insights into the broader trends in remittances and how they are playing out among individual companies up to Q2 2023.

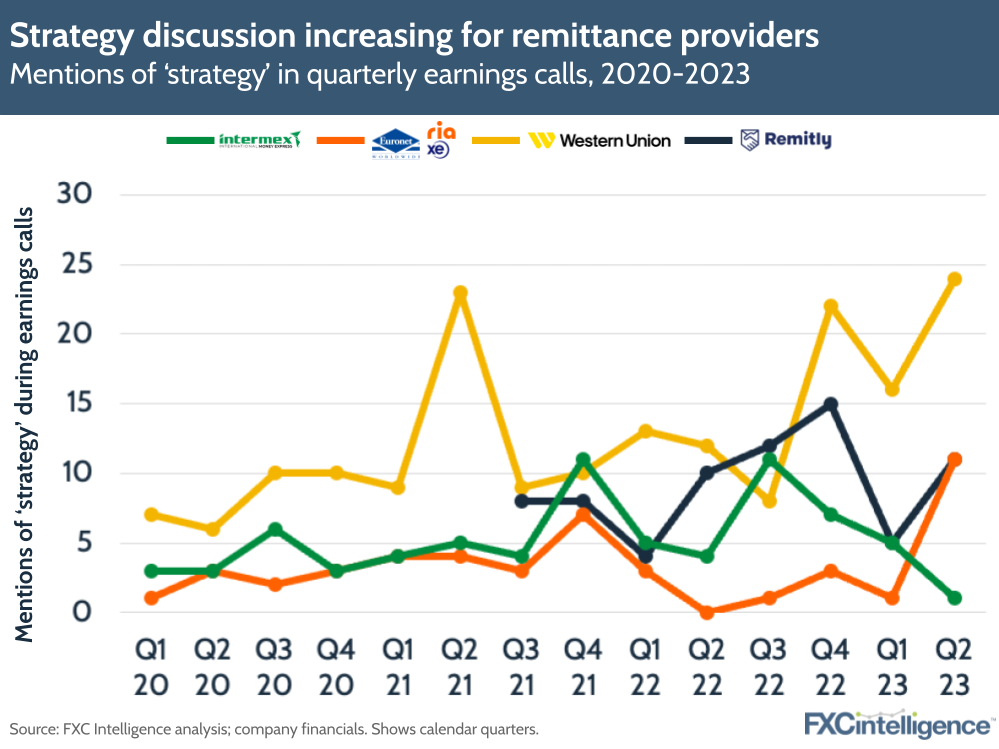

Use of ‘strategy’ and related words has generally increased since 2020, indicating a greater need to discuss strategy as the market has become more challenging. Again, Western Union leads on this, although Remitly also mentions strategy frequently.

Euronet, meanwhile, has largely used the word less frequently until the most recent quarter, while Intermex’s use of it has declined since Q3 2022.

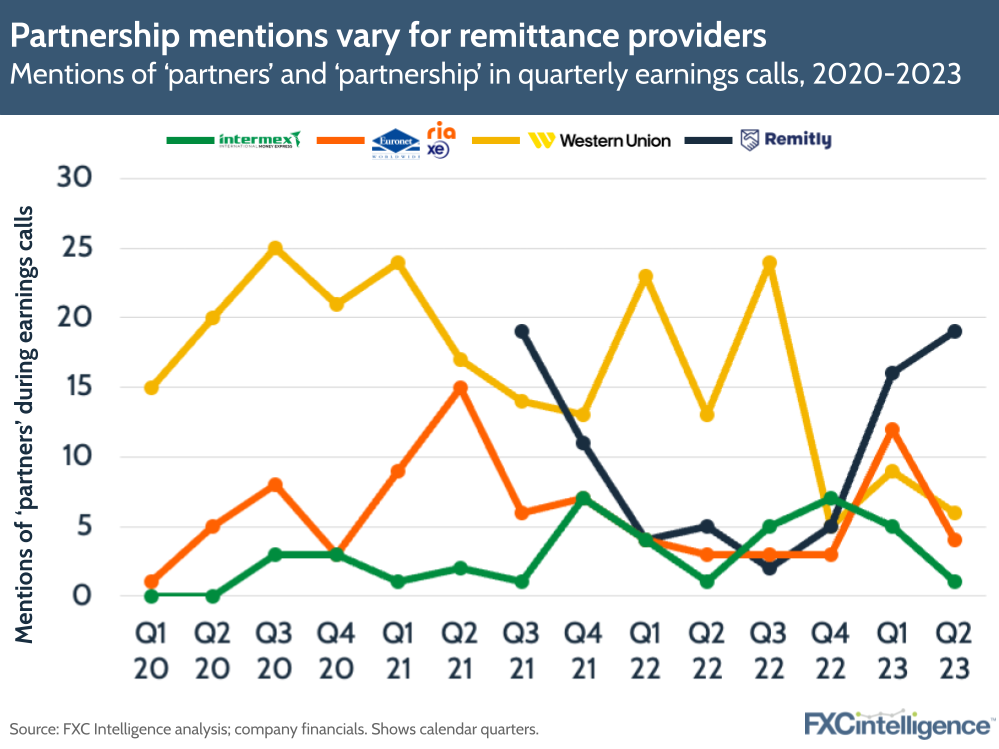

Meanwhile, partnerships have been a growing trend in the industry as a whole, however use of the word in earnings calls has remained pronounced but relatively flat – likely a reflection of the use of the platform to announce new partnerships or highlight them as examples of business wins.

However, the fact that Remitly is the only company to increase its use of the word in Q2 2023 is interesting, particularly as its use declined among the other three. It will be illuminating to see if this trend continues throughout the rest of the year.

Beyond this, the absence of another keyword was telling for the industry. The use of the words ‘artificial intelligence’ and ‘AI’ were extremely sparse throughout the period covered, with no mentions at all by Euronet or Intermex and only brief mentions in 2021 by Western Union.

Remitly, meanwhile, mentioned the technology twice in the most recent call, but has not mentioned it previously, suggesting that the wider industry enthusiasm for generative AI and similar has not meaningfully reached the remittances space.