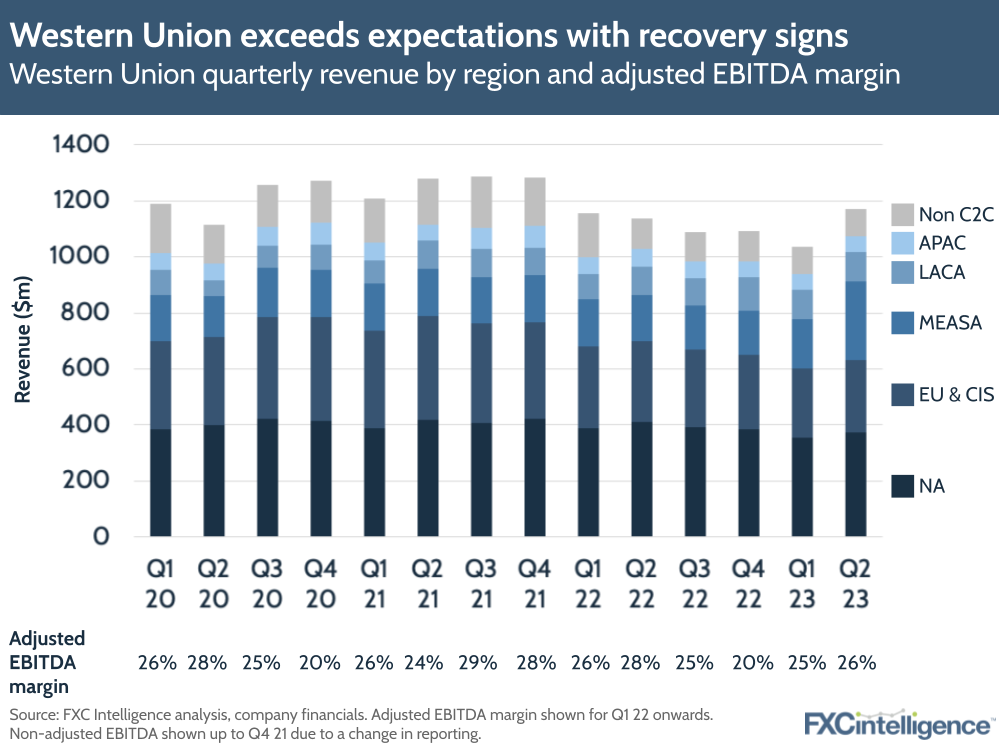

Western Union has reported its Q2 2023 results with better-than-expected numbers, providing an improved outlook after a tough few quarters.

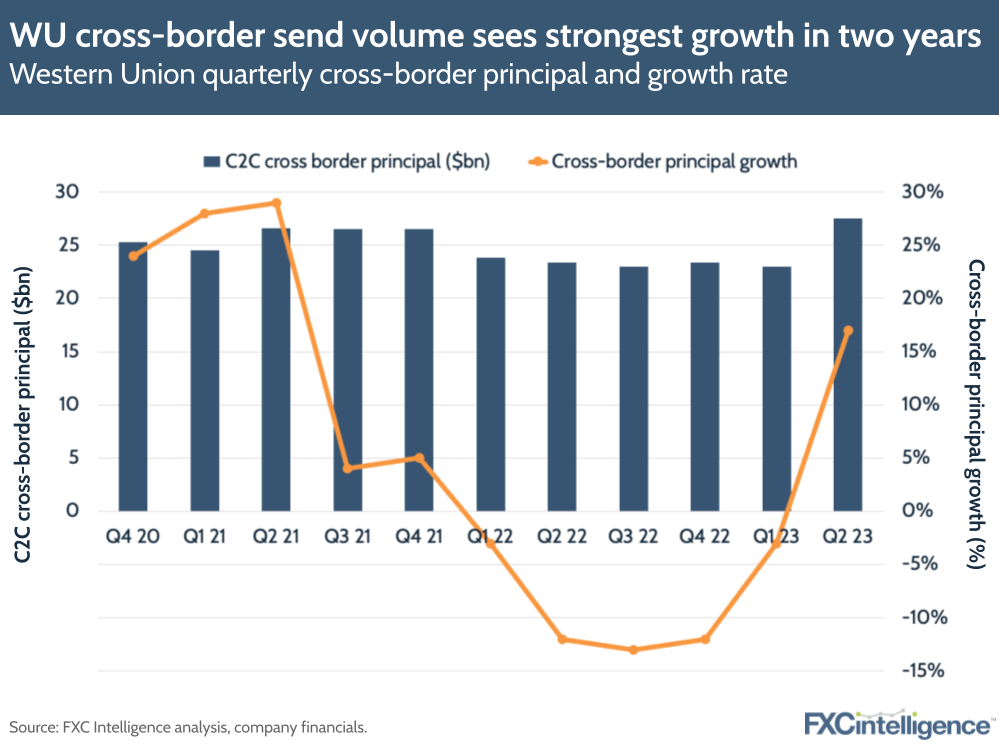

Revenue for the quarter increased 3% YoY (9% on a constant currency basis) to $1.17bn, excluding contributions from the Business Solutions division, which saw the completion of its third and final sale closing on 1 July 2023. The company also saw transaction numbers and cross-border principal increase for the first time since 2021, with overall increases of 4% and 17% respectively.

These improvements were partially attributed to increased operational efficiencies, as well as Argentinian inflation, although much was the result of previously unanticipated gains in Iraq as a result of changing central bank policy, which is not expected to continue into H2.

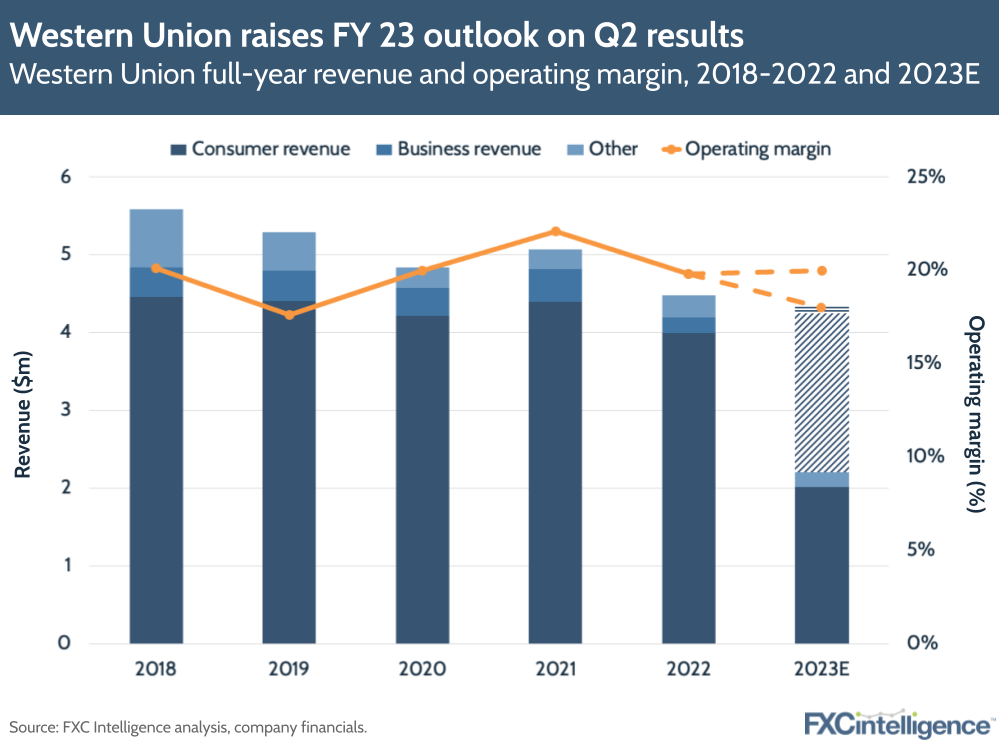

While WU has raised its FY expectations on the results, investors have not responded positively, with shares down following the company’s earnings call.

Iraq revenues shape Western Union Q2 2023 results

The unexpected revenue increase from Iraq is the result of a monetary policy change in the country that Western Union first reported an impact from in Q1 2023. Then it contributed a 2% benefit to adjusted revenue, however in Q2 2023 this rose to a 10% benefit.

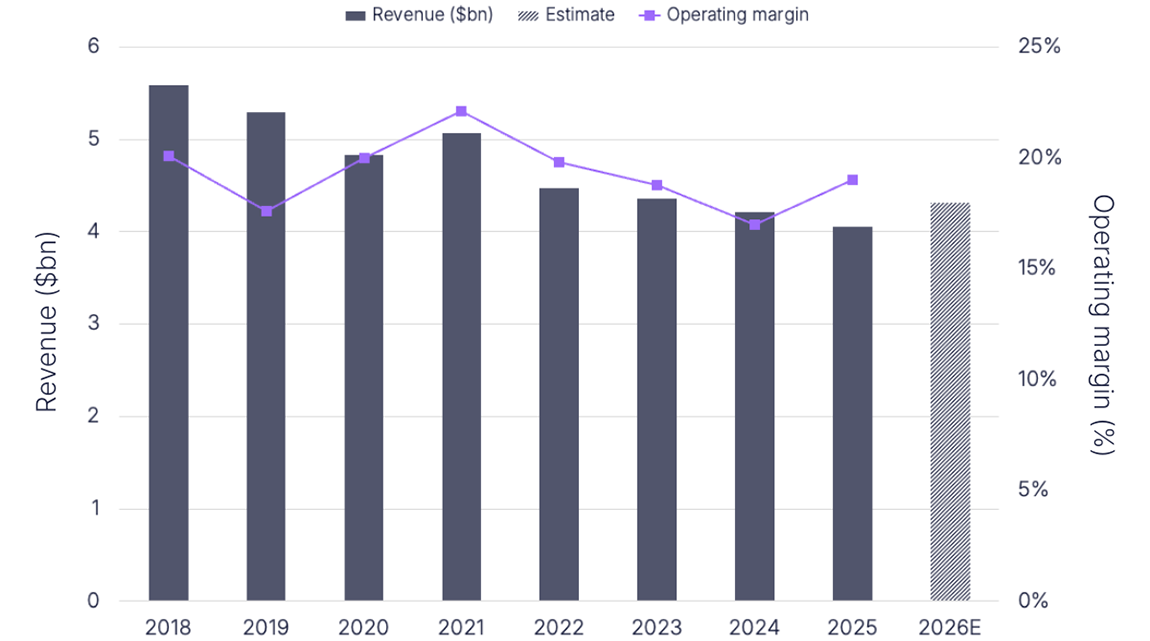

WU does not expect this to continue meaningfully into Q3 and beyond due to recent actions by the US government, and so has excluded it from projections for the rest of the year, however it has helped drive an improved projection for the company’s FY 2023 results. Western Union has increased its revenue projections for the year from between -9% and -7% to between -5% and -3% on a GAAP basis, while its operating margin remains at 18-20%.

Looking at the broader regional changes, while transactions increased in all regions except for Latin America and the Caribbean (LACA) revenue remained lower in several regions. While Iraq gains drove 66% YoY revenue growth for the Middle East, Africa and South Asia, and Argentinian inflation saw LACA revenue increase by 6%, all others saw revenue reduce. This was most pronounced in EU & CIS, where it dropped by 12% YoY, followed by North America (NA) (-8%) and APAC (-7%).

Despite this, Western Union expects to see positive global revenue growth from Q4 2023, aided in particular by green shoots from its digital business.

Digital remittances business sees gains

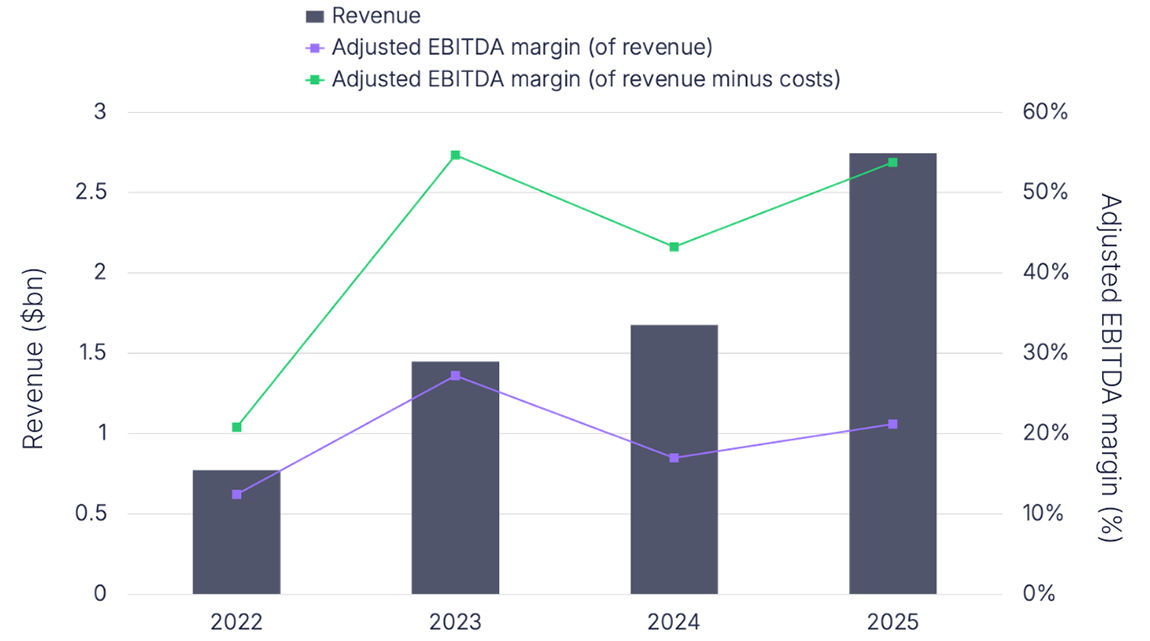

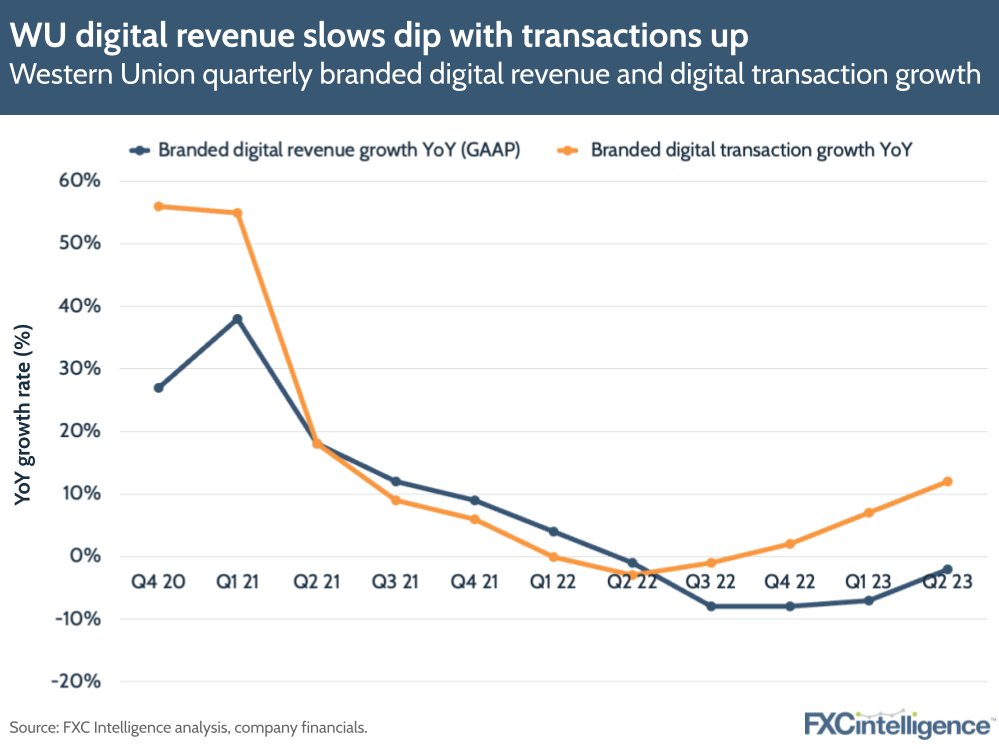

Western Union’s digital business is a critical component of its Evolve 2025 strategy to return to growth, and here Q2 2023 saw positive signs of progress. While branded digital revenues were slightly down on a year ago, at -2% YoY on a constant currency basis, and remained at 21% of overall C2C revenue compared to 22% in Q2 2022, digital transactions were up 12% YoY globally.

This compares favourably to the growth rates in Q2 2022, where digital revenue was up 1% but transactions were at -2% YoY. WU also reports that global new customer acquisition is up 20% and says it is slightly ahead of the digital trajectory it set out at its 2022 investor day.

There are also some markets where the digital business is now larger than the retail business on a transaction basis, including Brazil.

As part of its bid to improve its digital offering, WU has also been making improvements to its digital sales funnel in order to improve how many prospects it converts to digital customers. In Q2, it refined its registration process by limiting the number of fields required and connecting the details of previously retail-only customers, as well as improving its decisioning models.

This has driven an improvement in web conversion rates of nearly 500 basis points in WU’s US outbound business versus Q1 2023, and has also improved first transaction approval rates by around 600 basis points YoY for US outbound customers.

Digital wallet set for US trial, Brazil launch

The company also provided an update on its digital wallet project, which is currently fully live in four markets. In Brazil, where the product is currently in friends and family testing, the full product is set to go live in Q3 2023, and the company has also made improvements to the onboarding and customer migration processes in its European markets.

It also plans to launch a trial for friends and family in the US by the end of 2023, and is also relaunching a prepaid debit card product in the country, with a trial having begun in July 2023.

Critically, the company has seen that digital wallet customers who are either current or lapsed retail or digital customers are ultimately more valuable digital wallet customers. This is both in terms of the number of transactions per month, which CEO Devin McGranahan said is “up significantly”, as well as the revenue generated per customer.

WU shifts retail strategy in stabilisation bid

Finally, the other key component of WU’s Evolve 2025 strategy to begin showing results this quarter is its retail business. Here the company is looking to stabilise the business, which is set to be a slower process than its digital efforts due to the size of the 400,000-strong agent network.

However, there have already been some promising signs, including in Africa, which saw a 6% YoY revenue growth in the company’s retail business as a result of locally focused performance optimisation.

Meanwhile, in Europe, the sending landscape has been tough due to macroeconomic conditions including the Russia-Ukraine war and wider inflation. However, WU has enacted a controlled distribution strategy that focuses on omnichannel, multi-product offerings, which has seen the launch of 70 concept stores in the region.

There has also been a focus on delivering improved customer service, which is reflected by the launch of a Quick Resend feature to significantly reduce the time to send repeat transactions. This has seen a 10x increase in use in the US since March and in one brand’s locations now accounts for 30% of transactions.

Meanwhile, the company has also improved call centre efficiency, primarily through the launch of a One Step Refund tool, which has driven a 20% reduction in refund support calls.

How does Western Union’s pricing strategy compare to other players?