Remitly has seen another strong quarter, with revenue and active customers up and net loss down. In the latest instalment in our Post-Earnings Call series, Remitly CEO Matt Oppenheimer talks about the drivers behind profitability and how the company is differentiating its remittance product.

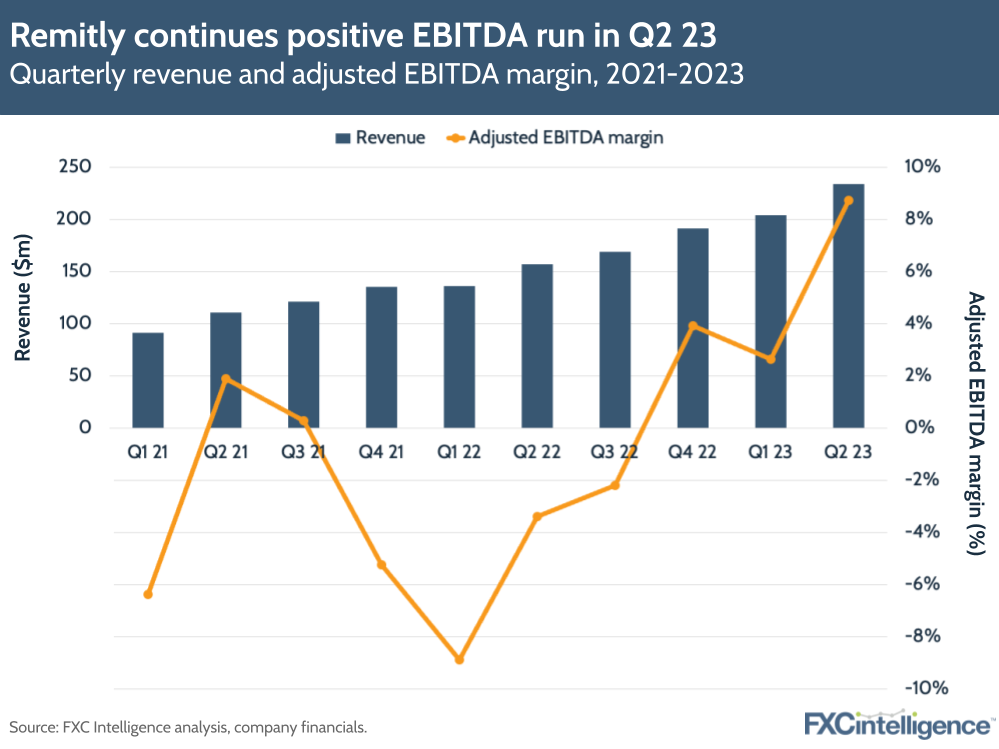

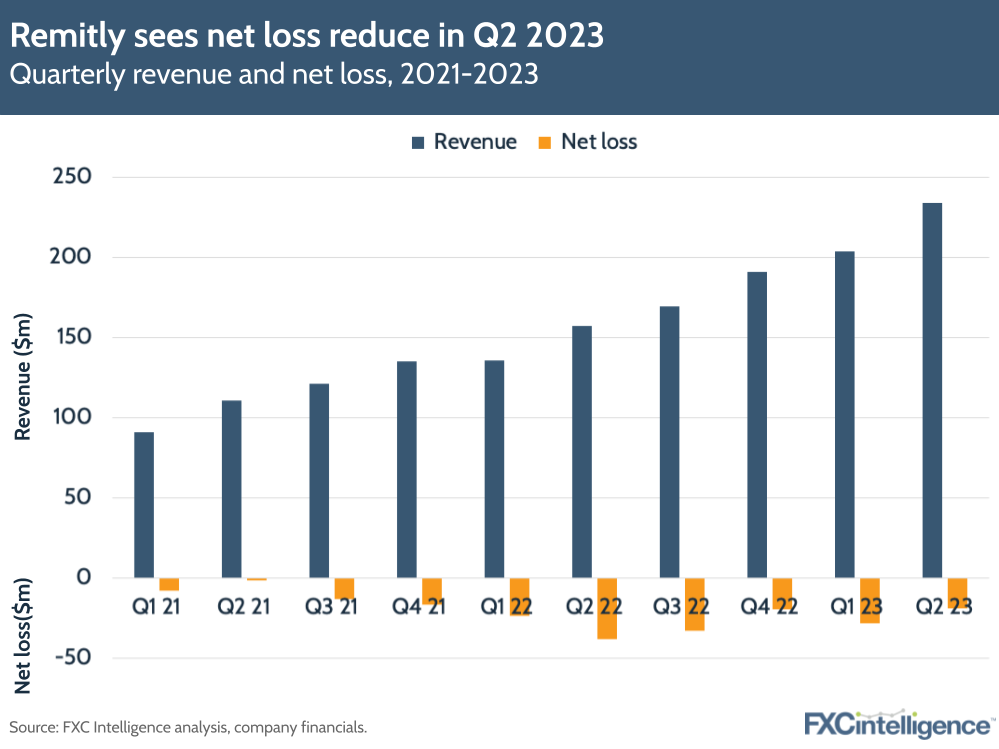

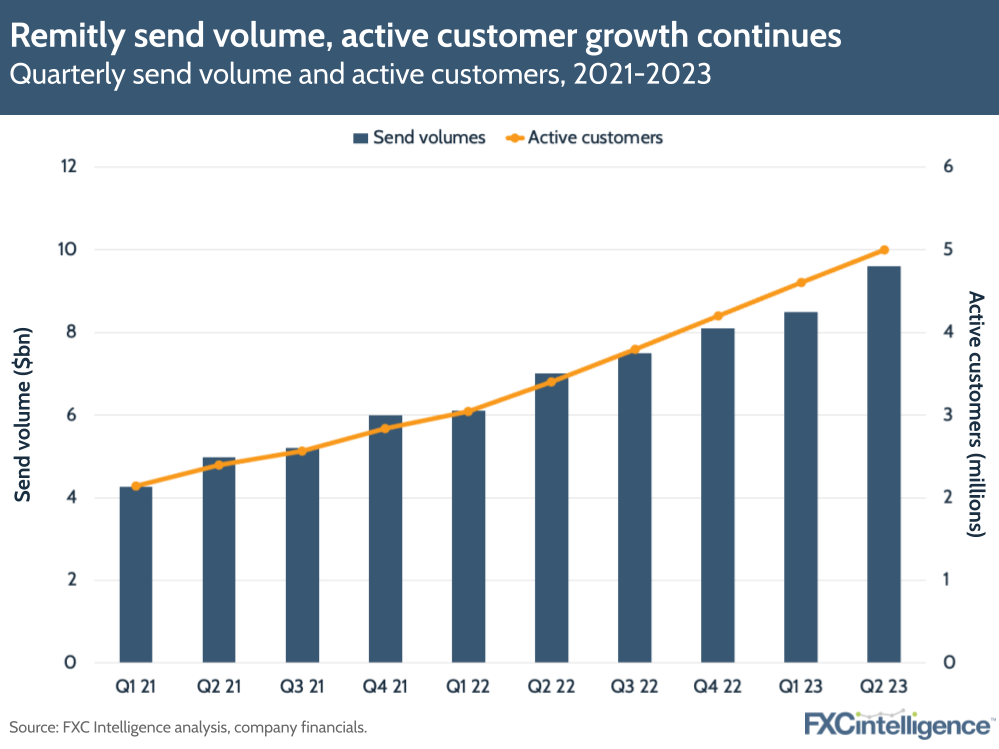

Remitly’s revenue increased 49% to $234m in Q2 2023, with similar gains in active customers – up 47% to five million. Send volume also increased, up 38% to $9.6bn, and adjusted EBITDA was firmly in the positive: $20.4m versus -$5.3m in Q2 22. The company’s adjusted EBITDA margin was 8.72% – the first time it has been above 4%.

On geography, Remitly is now serving 170 countries and territories across 4,800 corridors and plans to expand further in the Middle East, Europe, Latin America and Africa. The company is still seeing healthy growth and further opportunity to grow customers in the US and Canada, but business outside North America growing faster and represents the biggest opportunity. In Q2 23, business outside North America was over 20% of total business and grew 120% YoY.

Remitly CEO Matt Oppenheimer attributed this success to the company’s investments in its strategic priorities – new customer acquisition; geographic expansion; remittance product enhancements and complementary new products – which he expects to continue to pay off “for many years to come”. In particular, he highlighted the company’s ability to deploy capital to fund additional investments.

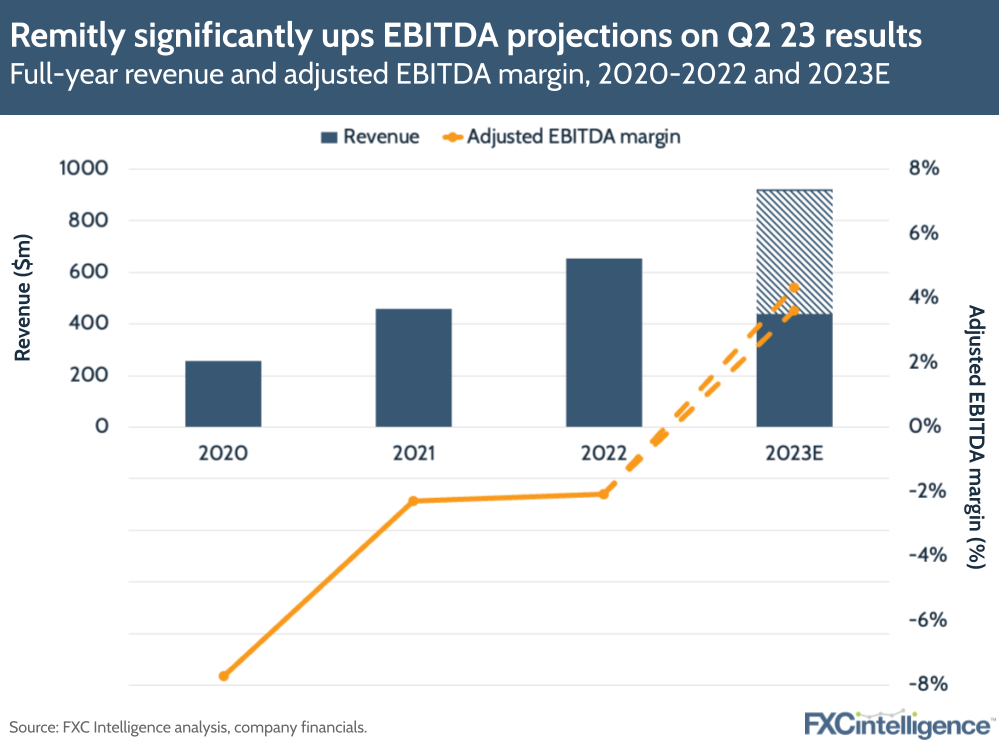

Remitly has revised its FY 23 numbers upwards significantly on the results, for the second time in a row, and is now projecting FY revenue of $915m-925m – a 40-42% YoY improvement on the previous projecting of $875m-895m. The company is also now projecting adjusted EBITDA of $33m-40m, up from $5m-15m – the first FY positive EBITDA Remitly has seen. We spoke to CEO Matt Oppenheimer to find out what’s behind Remitly’s continued success in 2023.

Remitly’s growth and profitability drivers in Q2 2023

Daniel Webber:

I always like to take it from the top: why don’t you take us through what’s been driving another great quarter of results?

Matt Oppenheimer:

If you first just take remittances and then we’ll talk about our performance, remittances are resilient regardless of economic cycles. They’re non-discretionary, they’re used for really important things like basic living expenses, emergency medical expenses, college tuition, and our customers have just such grit, tenacity and resilience to be able to have that commitment and fulfil that commitment to their families and loved ones back home. So that is foundational, in terms of why the business is performing well.

I think that we are really pleased with our results both on the top and bottom line, and that’s because of the fact that our product continues to get more and more differentiated, if you look at the ease, the speed, the transparent and affordable cost to get money back home. I think our product resonates. So we have really strong repeat usage and then on top of that, we’re continuing to add customers in a very methodological way.

And you see that in our unit economics, which we shared is above the six times LTV [lifetime value] to CAC [customer acquisition cost] ratio that we shared at the IPO. And I think that’s partially driven by the fact that our product is great. So that drives word of mouth and we now have five million quarterly active users and those users are telling a lot of their friends and families and loved ones about their great experience with Remitly.

But I think it’s partially due to this proprietary marketing platform that we’ve built out. And it’s partially due to just continued really strong overall execution of our team. So it’s that combination of new customers coming in at really healthy rates and good unit economics with continued, strong repeat usage given the differentiation of our product and the resilience of remittances.

Daniel Webber:

What’s helping to drive profitability through now?

Matt Oppenheimer:

I think that what’s helping drive the profitability is that, at a principle level, we have been and continue to be prudent stewards of capital in terms of how we invest to deliver the 49% year-on-year growth in Q2 and 58% compound annual growth rate over the last two years. And so we’ve had to make investments to do that, but I think we have done it and continue to do it in a disciplined way. And so in terms of what drove profitability, you see the transaction expense improving as a percentage of revenue by 440 basis points. You see marketing expense as a percentage of revenue improving by 520 basis points. You see G&A improving, again as a percentage of revenue, by 190 basis points.

I’m especially excited about customer support, how that improved 150 basis points, because it shows that our product is getting better and driving less contact. Tech and dev increased by 100 basis points, so marginal increase because of the long-term investments we’re making. And we have guided to continued profitability of $33m-40m in adjusted EBITDA for the year, while also giving us the opportunity to make the investments that we need to make to continue to drive the kind of growth that we’ve seen in the past.

Differentiating Remitly’s remittance product

Daniel Webber:

Let’s talk about the product for a bit; walk us through what the differentiated remittance product means.

Matt Oppenheimer:

Absolutely. I think that remittances are much more complex than meets the eye, which causes a lot of delays in transactions, particularly when combined with trust being paramount for our customers. We’re asking them for a lot of their personal information and we’re asking them to give us money, to trust us to deliver it back home. And for a lot of either legacy players or subscale money transmitters, it’s really hard to do that reliably.

I think that the peace of mind that we bring customers, meaning how well we collect payments across processors and banks across 30 origination countries; how well we disburse funds across, call it 150, 170 countries total; and how well we disburse funds to four billion bank accounts, 460,000 cash pickup locations and over a billion mobile wallets is vital. That was really hard to do well when we were subscale.

And then you look at all the risk components, the fraud systems. One of the reasons our transaction expense improved is because our fraud modelling – our machine learning models and the data that we feed into them – are getting better, our compliance modelling, all of that, goes back to the fact that customers can get their funds instantly. 92% of our transactions are delivered within one hour; that was up quarter-on-quarter. And that just gets better every time. And what that does is it creates a flywheel effect that makes it so more customers hear about Remitly, about having a great experience. It builds a trusted brand, it brings down our customer acquisition cost.

And then on the LTV side there’s continued word of mouth and stickiness for our product because customers say, “You know what? It’s a fair price and I just have the peace of mind that my money’s going to get there, it’s going to get there fast and I don’t need to worry”. And that ultimately is very hard to do, but is paramount when it comes to delivering a differentiated remittance experience.

Balancing transaction speed with reliability

Daniel Webber:

I think feedback from some people has been that contact is often driven by the fundamental question of ‘where is my money?’. If you’re delivering it instantly or very fast, that’s a key driver to help drive down contact, which drives down customer cost and drives happiness. Do you see that as one of the key things that helps to drive customer habits?

Matt Oppenheimer:

I think yes. Customers will always prefer a faster transaction when it has comparable costs and other factors. That being said, what customers really care about is knowing when the funds are going to get there, and that’s where we offer what we call a perfect delivery promise. The day and time that funds will be available. And sometimes payment speeds like ACH in the US are slower but it’s less expensive, so we can charge our customers less.

But we say exactly when the funds will be there and there is a segment of customers that says, “Okay, I’m willing to wait as long as you tell me when the funds are going to be there and as long as you deliver on that promise”. And I kind of draw the analogy to delivering a package. It was really hard when Amazon was subscale to do that reliably. As they’ve gotten to more scale, they’ve gotten better and better at just that reliability. And if you buy something off Amazon, you do have options on speed. You might pay an extra $2.99 to get the same day.

Some customers are willing to do that and others say, “I’m willing to wait”. So it’s about that optionality. Having the option of speed is critical, to your point. It’s critical. But if there’s an additional cost, some customers are willing to pay and some customers just really want to know when funds are going to be available and have that peace of mind.

Daniel Webber:

How are you thinking about the platform piece to Remitly for developers?

Matt Oppenheimer:

Yeah. We continue to believe that the platform that we’ve built out has extensibility to businesses. And so I think that you’ll see more from us in that space in the future, but we’re still excited about that area.

Remittance customers’ unmet needs and macro factors

Daniel Webber:

There’s another comment which you made, which was just worth having a quick discussion: your belief that remittance customers still have various unmet needs. What does that mean to you?

Matt Oppenheimer:

I can’t obviously go into details until we’ve launched and announced some things publicly, but it’s probably a lot of the financial services pain points that you can imagine that somebody moving to a new country has. Remittances are at the centre of that, but if you think about your financial wellbeing and you think about the range of financial services that you have, a lot of immigrants don’t have access to some of those things.

And so we think that we can add value to them, to their families back home over time. And we’re excited about being able to talk more about that once we’ve launched and ramped some of those products to where they reach enough scale that it makes sense for us to talk about.

Daniel Webber:

Any other comments on some of the different macro factors or anything else that you’re seeing from an external perspective that’s impacting the business either positively or negatively?

Matt Oppenheimer:

Two things come to mind. One is the resilience of our customers we’ve already talked about, but that is foundational. The second is I really like that we’re in 170 countries now because there’s a diversification that comes with being in multiple currencies around the globe. Most of our customers are sending part of their paycheck and sending money very regularly. So FX movements don’t have much of an impact in terms of the strengthening of the USD or euro or pound – demand might pull forward or back slightly but it’s going to be less for most of our customers given the behaviour and sending patterns.

But there are some segments of our customers that are more affluent where that can impact a little bit of short-term volume, pulling it forward or back. And what I like about our business now compared to five years ago is we’re in 170 countries, so as currencies fluctuate, there’s a portfolio approach now that creates more kind of predictability and diversification in our business that I’m really pleased with as I think about just the overall health of the business.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.