Whilst both companies are fintech unicorns and big fish in the space, TransferWise and Payoneer are eyeing the public markets, where they will be up against the whales.

On TransferWise:

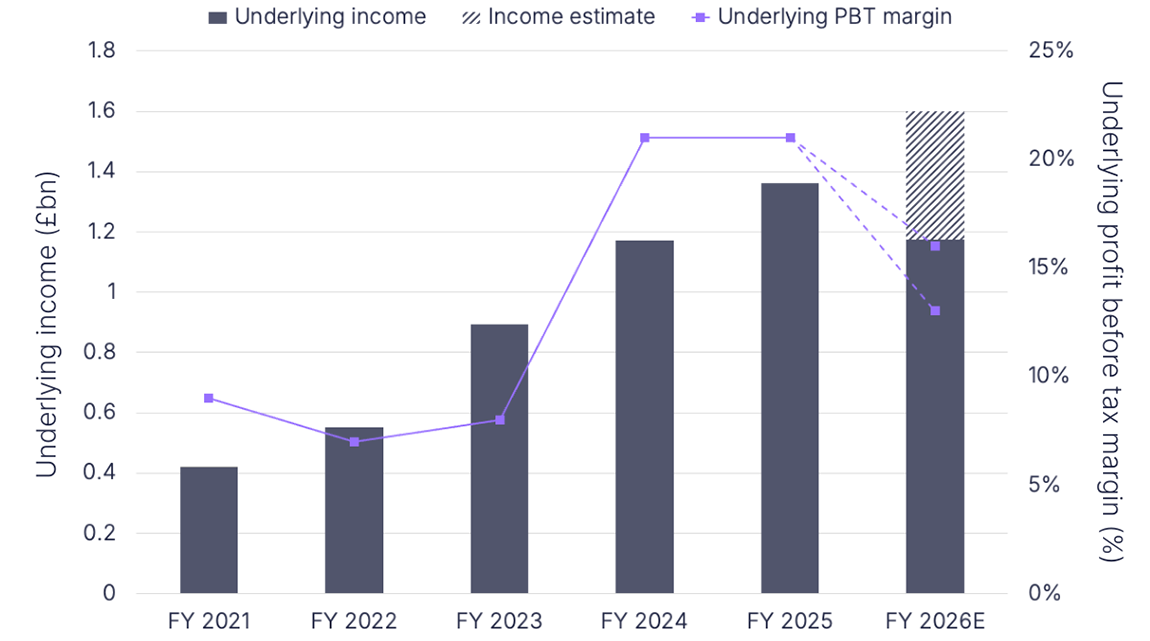

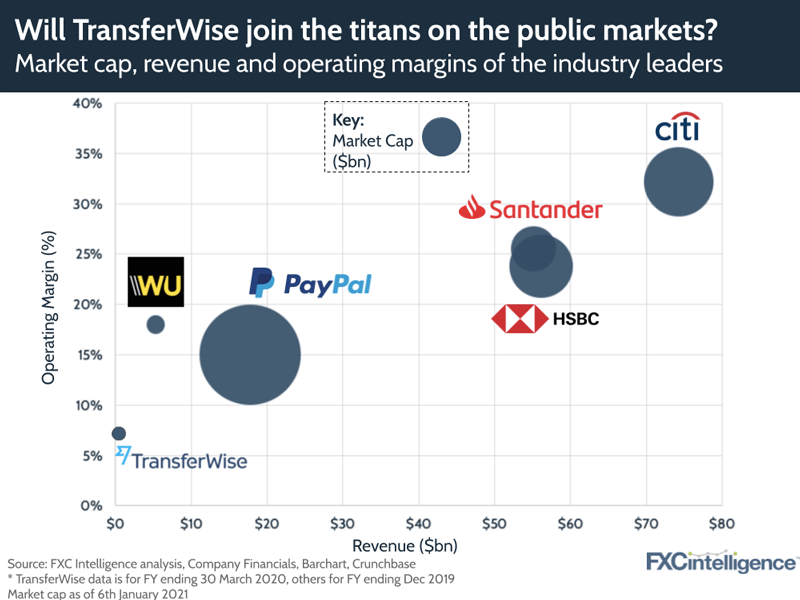

TransferWise has always stated that an IPO is its end goal as it wants the trust and transparency of a public company. In addition to competing with Western Union and PayPal, TransferWise will increasingly be on the radar of HSBC and Citi (the two biggest expat focused banks, albeit not their only focus) and Santander (the biggest SME focused bank and owner of PagoFX, a self-styled TransferWise competitor).

Up against the major players, it is clear that TransferWise has plenty of room to grow revenue but will also have to do substantial work to improve its operating margins. With pricing (and margins) leaning towards zero, will scale do this alone? Initiatives such as TransferWise for Banks, which enlarge the basic payments offering, would significantly benefit from the backing of a public company. However, will TransferWise’s bank-bashing marketing techniques pass compliance as a public company? We’d expect much less so.

It’s too early to start discussing potential IPO valuations, but expect much from us as this journey progresses.

On Payoneer:

After Paysafe announced it was going public through a SPAC last December, we predicted more companies would follow. Less than a month later, Payoneer has been reported to be in advanced talks to enter the US stock market via the same route (although rumors of Payoneer going public circulate periodically). Payoneer continues to benefit from the growth of global e-commerce and digital services and has itself started rolling out more products around lending and white labels. Both of these business lines would certainly benefit from the trust of a public company.

Unlike TransferWise, Payoneer has always kept its numbers close to its chest, so it will have to get used to the public scrutiny that comes with a public listing.

2021 might be an interesting year for cross-border payments if both listings go through. How they will impact the competitive landscape, though, remains to be seen.