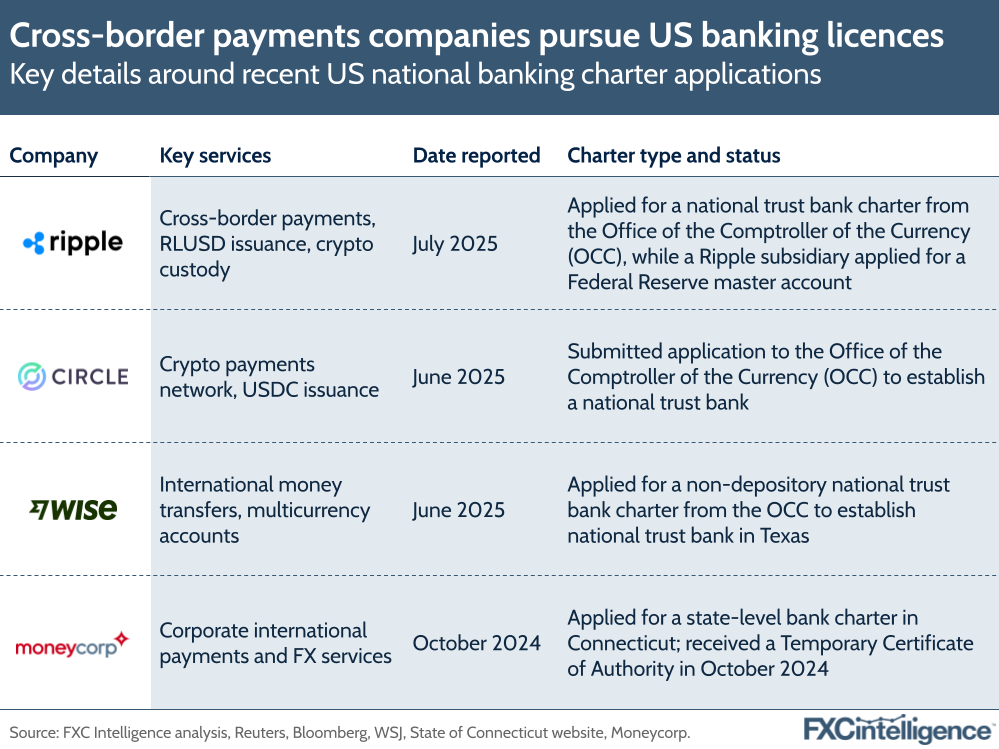

Recently a flurry of fintechs – several of them in the cross-border payments space – have applied for licences (or charters) that would allow them to operate as a bank in the US. But what does this unlock for cross-border payments, and why now?

Under the US’s complex banking system, there are a variety of licence types. Circle, Wise and Ripple, for example, have recently applied for national trust bank charters, with the ‘national’ part of the licence meaning they are federally regulated to cover all 50 states, and ‘trust’ meaning they are not able to take deposits or make loans without further approval.

Moneycorp, meanwhile, has been approved for a state-level Innovation Bank Charter from the Connecticut Department of Banking, meaning it also cannot accept deposits but is regulated specifically by the State of Connecticut to operate in that state (read more on Moneycorp’s strategy in my conversation with CEO Velizar Tarashev last week).

National bank charters are more difficult than other licence types to acquire and tend to come with higher costs, but enable companies to scale up more quickly and mean they don’t have to comply with a patchwork of laws across different states. Importantly, the charters mentioned give these cross-border players access to crucial money movement systems in the US – particularly Fedwire, ACH and RTP – and enable them to settle transactions in USD, the world’s global reserve currency.

Previously, a company like Wise would have to work with an intermediary US bank to do this, and so having its own branch will help it provide faster, more cost-effective payments to and from the US. Some companies are already seeing the benefits of such a move, with B2B payments player Banking Circle opening a new US headquarters in March 2024, having received a charter from the Connecticut Department of Banking in July 2023.

A significant number of companies in the crypto space have applied for US banking charters recently. Circle is looking to build a national trust bank to hold and manage the reserve assets behind its own stablecoins, while Ripple is currently seeking access to the Federal Reserve’s payments infrastructure through one of its subsidiaries.

As the regulatory landscape evolves and demand for seamless payments grows, bank charters could enable faster cross-border payments to the world’s primary payments market. Don’t be surprised if more companies follow suit this year.