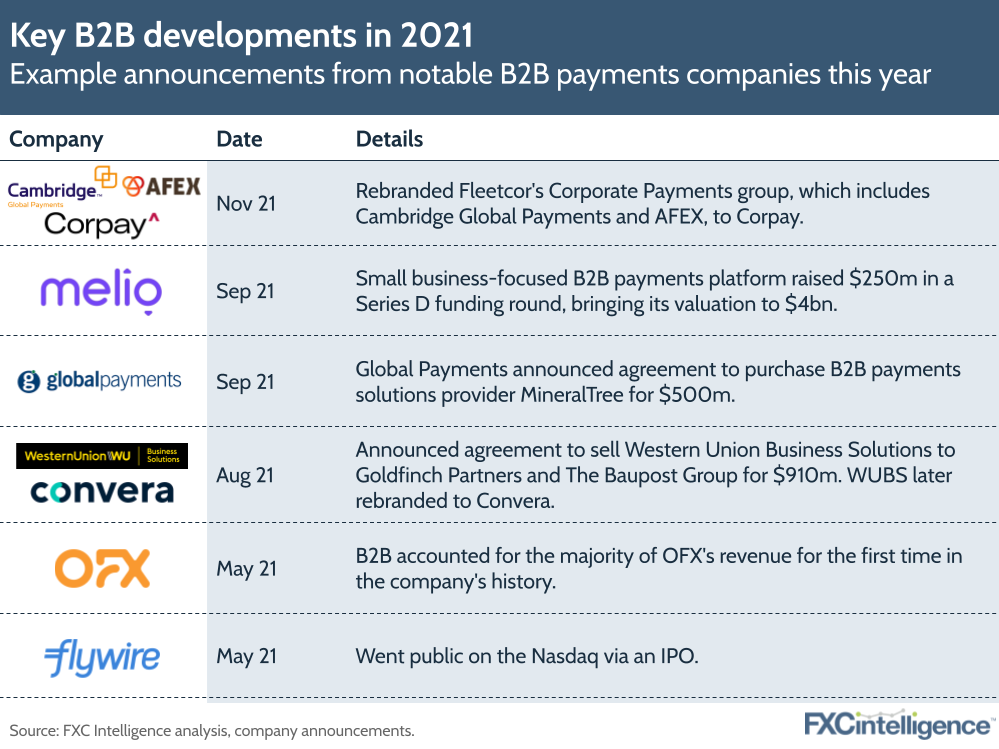

Over the year, we have seen money transfer companies make significant developments in the B2B space, and some traditionally consumer-focused players have also shifted their focus.

Here’s a brief recap of some of the news:

- OFX saw B2B revenues as its largest segment for the first time in the company’s 20+ year history. In May, CEO Skander Malcolm told us that consumer businesses had been affected by Covid, with a particular impact on travel and immigration. Asked about the business segments, the CEO explained that “if you are a medium-growth player like us, where it is meaningful for our investors, is through enterprise. Where you can win 10,000 to 20,000 high-value consumers in one go, that is incredible.”

- Equals Group’s H1 2021 results showed that the B2B segment increased 26% year-on-year compared to 15% in B2C. This follows recent developments such as the launch of larger corporate multi-currency collection account Equals Solutions as well as own-name IBAN capabilities. The company is similarly positioning itself away from the travel and retail sectors and towards SMEs.

- Western Union Business Solutions (WUBS) sold for $910m to private equity groups Goldfinch Partners and The Baupost Group in August of this year, and is in the process of re-branding as Convera. The recent C-suite hires, including CEO Patrick Gauthier and Chief Transformation Officer Jody Visser, hint at the company prioritising its payments business over the FX risk management.

Covid has had winners but also losers, which has led many companies to reduce their focus on the travel industry as well as the consumer segment which relies heavily on expats and migrant workers. This resulted in the more agile players shifting towards a more stable and profitable B2B business model.