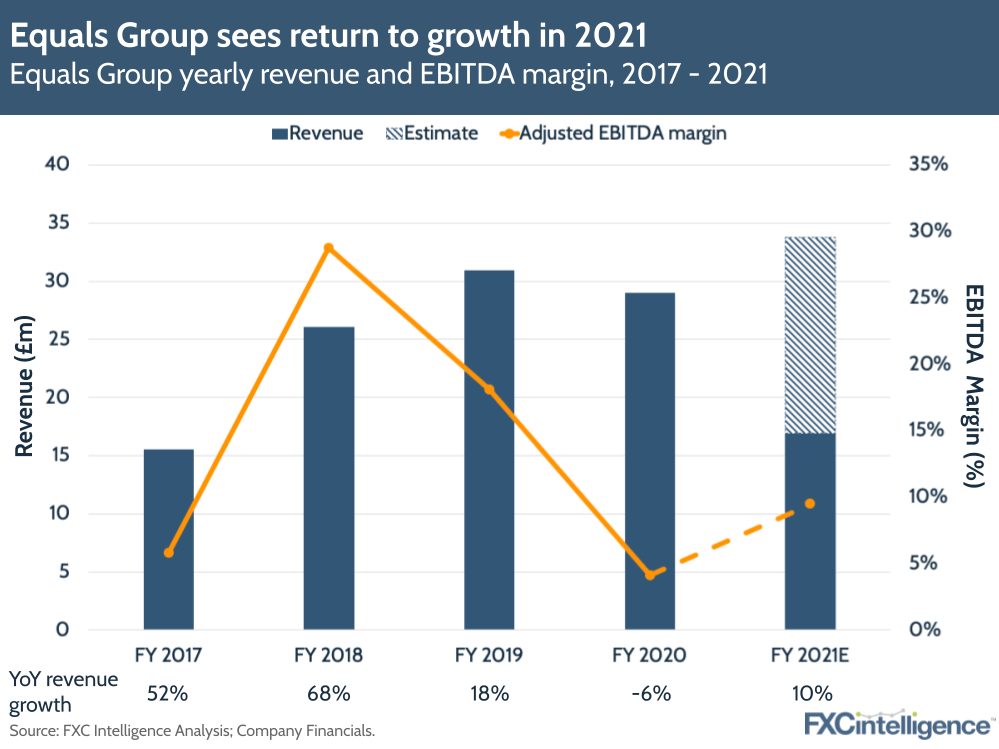

After a tough 2020, international payments player Equals Group’s H1 2021 results indicate the company is set for a bounceback year. Its investors agree, with its share price around three times up from a year ago.

Equals has seen a 23% year-on-year revenue increase in the half, up to £16.9m, with adjusted EBITDA climbing by 138% over the same period.

Much of this has been driven by an ongoing shift to B2B for Equals Money, as the group continues to move away from travel and retail and towards SMEs. The group’s B2B segment increased 26% year-on-year compared to 15% in B2C. The launch of larger corporate-focused multicurrency collection account Equals Solutions has also contributed, with the segment accounting for 13% of revenue in Q3 21 to date.

However, B2C has shown recovery compared to 2020, with B2B now for 69% of revenue compared to 72% in H2 2020.

Equals expects future growth to continue to be driven by B2B, helped by the addition of own-name IBAN capabilities, which it sees as key to growth in both Equals Money and Equals Solutions. The company is already seeing B2B-led performance accelerate in Q3 2021, with revenue per day increasing to a projected £180k in the quarter, compared to £145k in Q2 2021 and £128k in Q1.

Equals plans to invest in more product and marketing to continue its growth with more products to launch over the latter half of the year.