FXC Intelligence’s Daniel Webber spoke to OFX CEO Skander Malcolm about the company’s FY 2021 earnings results and transition to B2B and enterprise.

OFX has released its FY 2021 results, and despite these running across the course of the pandemic, the numbers have been broadly positive.

The company has provided more detailed breakouts in its corporate and online seller segments, providing a greater sense of how OFX is developing into a B2B and enterprise focused company. For the first time in the company’s 20+ year history, B2B made up a majority of revenues.

With this in mind, how has the company fared amid the pandemic, and how is it responding to a market that is fundamentally changed compared to a year ago?

FXC Intelligence CEO Daniel Webber has a detailed discussion with OFX CEO Skander Malcolm on the FY2021 results and the broader company strategy.

Topics covered:

- Pandemic impact on business segments

- Changing market dynamics in the consumer space

- How Amazon and China are driving the online sellers segment

- OFX’s investment in its platform and operating leverage

- Factors driving its corporate and online sellers growth

Pandemic Impact on Business Segments

Daniel Webber: Let’s start with your business segments, as this is the first time you’ve broken out numbers for all of them individually. What are the stories for each?

Skander Malcolm:

Let’s start macro and then we’ll get into specifics. I’d say the two big macro points are, one, such a strong second half – and that gives us tremendous encouragement.

Revenue up 17% versus the first half and within that, corporate up nearly 24%, North America up nearly 20%. We saw EBITDA up 82% in the second half versus the first half. Bad and doubtful debts are down 40% – we recovered a lot of what has been going on industry, so we are incredibly happy with that number. And turnover up 23% in the second half versus the first half.

Our fiscal year is 1 April to 31 March, so as my chairman describes, it is the perfect Covid case study. Everything is mixing up, but that is a strong second half.

The second thing on that macro-level is, we have got a lot of the things that we’ve been working on for several years operating well now. We believe we’ve got a much more valuable company than we did three or four years ago when we started.

On the segments, corporate and online sellers are now a little bit north of 50% of our revenues. Both have very good tailwinds, they both play into difficult segments where we have advantage. The enterprise winds are very encouraging and we are starting to get traction on and activate the deals we have, but also the pipeline has probably never been healthier. To a point where we have done more to break out what that pipeline looks like, we can go into that.

The North American investment continues to be hugely strategic, but also encouraging, and that is just going from strength to strength. There’s more coming on that.

We are not one of those companies where when turnover goes up, costs go up. In fact, if you actually look at our risk costs, as an example, or our bad and doubtful debts, they are going down while turnover goes up. And that is a very healthy operating leverage point for us, which we think is really critical if you want to scale the company globally.

Risk is right at the heart of any money transfer business. It is largely digital, so if it doesn’t work and if you start writing off large amounts of money, the whole house of cards can collapse. Because your bankers lose faith, your regulators lose faith, your clients lose faith. That is the great acuity for these businesses.

To see those bad debts come back under control, but also investments in things like the transaction monitoring system that really cater for incoming payments and outgoing payments, is a big strategic positive as we push into the online sellers segment. Because clearly our bankers want us to understand what is coming in, as well as what is going out. We know definitively: we are seeing some folks in that space giving feedback.

Having that rigor is really, really valuable. The executive team is the best we have had, employee engagement is up 11 points, so the team feels like they’re part of something. So we feel like a strong rebound, but also a lot of the medium stuff we have been investing in is starting to bear fruit and give us a good feeling about the value of the company going forward.

Those are the macro points. In terms of the different segments, obviously with consumer, and particularly the consumers that we work with or the use cases that we are typically exposed to and try to win, it is not necessarily the case that you lose clients, but you can lose use cases.

The analysis we did showed that certain use cases obviously were down too, in travel, but also expats, immigration, emigration, they were down. On the flip side there were some that were very positive. Wealth transfers have been a real feature of the last 12 months, particularly the second half. There’s a lot of folks who have sold a property or are buying or selling equities, and moving the money, one way or the other, back home.

We did a full piece of research into the clients that had been active in fiscal year 20, that weren’t active in fiscal year 21, and we were very encouraged by that, because actually as the CEO my great fear is that I’ve lost them to a company.

First off, the response rate was very strong. Second of all, of those who did respond, three quarters actually indicated that in this year they are intending to transfer. That is good. You can’t always tell – you can have an intention which just doesn’t materialize, we are all like that, but at least there is a gift on the table.

On top of that, of those, 97% said, “We withheld our debts. We are not going with someone else. It is just that the reason we stopped was mostly Covid-related.” I think the consumer business over the cycle will be a very healthy business that we grow consistently and sustainably.

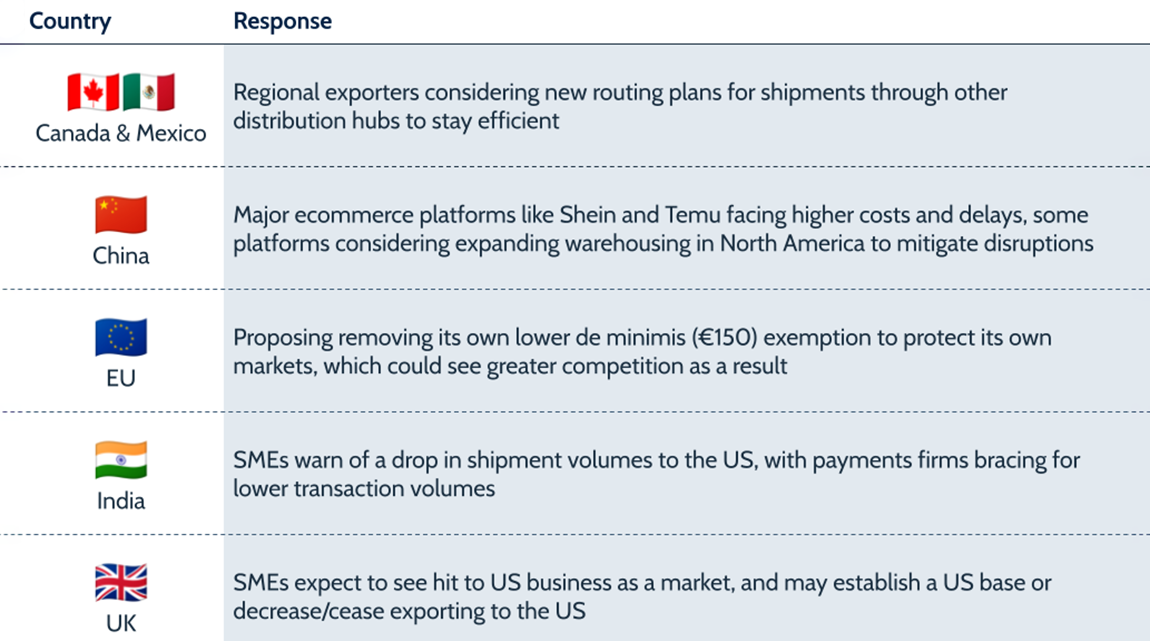

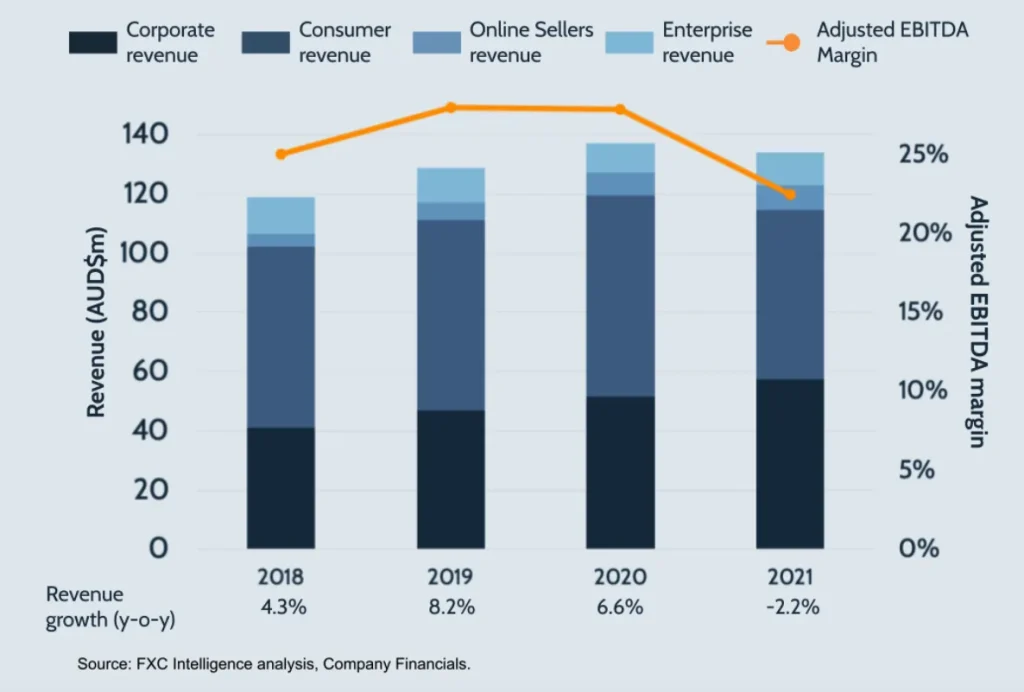

Figure 1

OFX revenue and EBITDA margin by segment, 2018 – 2021

Changing Market Dynamics

Daniel Webber: The market dynamics have changed during the pandemic. Companies are leaving the market, leaving not very many, and Wise and Revolut are not that close yet to fully serving the high-touch overseas property buyer or expat. It is just a different use case; it requires humans. What are your thoughts on this? Because it feels quite positive, but it’s also not a segment that has very fast underlying growth.

Skander Malcolm:

I agree with everything you just said. The consumers that we target to some extent are driven by macro, so factors beyond our control – either volatility or tax or events beyond our control. But it isn’t really going to be a very strong, explosive growth segment.

I think the way to minimize risk to consumer, if you are a medium-growth player like us, where it is meaningful for our investors, is through enterprise. Where you can win 10,000 to 20,000 high-value consumers in one go, that is incredible.

Daniel Webber: For sure, because it changes the acquisition economics overnight and the stickiness. Then you will have a warm referral in as well, as opposed to [paid] Google, which is not warm.

Skander Malcolm:

That’s exactly right, but there is another factor, which is that type of consumer, by their very makeup, is more conservative. They are not terribly well informed; they are not terribly bold. They are not typically out on Google looking for the greatest and latest deal. That is the nature of that consumer segment. So, if you can pick up 10,000-20,000 in one go through a unified-style bill, they are very, very sticky.

I looked at the OFX clients in the research and it is very similar to what we found back in 2018 as well. They love you, they are just not that active as a segment.

So, the way to acquire those today, is ultimately more likely to be through enterprise over time. It does not mean we will not do various marketing until we find what it is. But for a public company that has ambition to grow faster, that is going to be the best way to grow faster, both economically and realistically, with that type of consumer.

OFX’s Platform

Daniel Webber: There is more of a platform in what you’ve built than people realise, and obviously enterprise deals are one way to help explain it, but can you talk through the pillars of that platform?

Skander Malcolm:

A platform in a sense comprises pillars. One is obviously technology, so you have got to have a platform that is digital, that consumers or corporate or online sellers can use, can self-serve. In our case 90% of those come back and more than 90% are actually self-served. So, in a sense a platform that allows your client to do what they want to do, when they want to do it, that is your starting point.

Second of all, it has to be scalable. It has to be something where you don’t constantly add cost as you add clients or transactions. We are investing in things like straight through payment processing, risk management tools, so that as you add clients, as you add transactions, you don’t just add a fee every time to pay a bank to do something that you can do yourself.

The third thing is risk. A platform has to offer a way that regulators, banks, clients can see contemporary risk management. It really is one of those things that I talk a lot about as changing it from a shield to a sword.

You’ve seen the way regulators and banks are working harder and harder in this sector. Anything like a Wirecard, a Westpac, anything like that only increases their view that there’s a lot of actors here that don’t have a very mature view of risk. If you are considered to be mature, contemporary, light risk ultra, then your platform is considered to be a platform that both clients, regulators, banks support, and that is really, really critical.

The fourth is, this is such a global business by its very definition. You can win corridors and you feel good about that, you’re still a player, especially if you want to go into corporate and online sales, you have got to be global. You can’t just say, “Well I’m going to play in Asia, I’m going to play in US, I’m going to play in Europe.” You need to play in all of those places to be a corporate and online sales space. By definition they are quite global. They’ve all got supply chains of clients, or they are receiving funds from marketplaces in multiple different currencies. That piece is all about licensing and running what we call a world operating role. Having teams that are sitting in these locations that are matured, that can manage clients, that can see risk, that can make decisions.

That is a global problem and that is hard. You’ve heard me talk about that in the past in my career. I saw the best and the worst of that. There’s no way to deploy one key guy, put a team in place somewhere in the US and then don’t worry about it. All sorts of problems can go wrong there. For me, that team and having the right executives, middle management and tools that allow us to do all this, that is the other part of the platform. Now, what myself and the board are very focused on, we have invested forward in that. If you look at the size of our company relative to the executives and all that tech, I would say we are ready for a much bigger company.

Daniel Webber: I would agree with that. You can see the direction you are going, which essentially takes it to an enterprise player that will still play in consumer through enterprise in the end, plus corporate and online sellers. That is where the high value businesses in payments are at the moment.

Skander Malcolm:

That’s right. In the case of enterprise, it’s EBITDA-equated for the group because it allows you to onboard clients, scale, make payments at scale, and put industrial-strength solutions around those. Whereas when you are onboarding one consumer at a time, everyday I work on us being better in that respect, but it is not half as easy as when you onboard 50,000 in one go or you take 50,000 payments and you do it once, rather than 50,000 different ways. So, that is why that segment is very attractive to us.

Figure 2

OFX revenue and EBITDA margin by region

Factors Driving Corporate Growth

Daniel Webber: Let’s talk about corporate, which has a good North American skew to it too, which is an interesting one because there’s not many players. It is a competitive space, but you are having decent growth in it. What is driving that?

Skander Malcolm:

In corporate a couple of things have contributed. Some companies have taken huge losses, which basically just wipe out any contribution over multiple years. So our mantra has always been, don’t get out over your speed on a particular segment of corporate, or a product feature that could wipe out all your progress.

But overall, I would say the things that have changed in the last 12 months with corporate, one is it has taken us a couple of years to get the right marketing programs. You will see anywhere in the world now, we are aligning data and issuing corporate around this whole expert idea. That is very much targeted towards corporates.

Historically you would have found our advertising to be more targeted towards consumer, now it is more corporate. It is a very clever proposition, because our consumer value is viewed like that too. But at the end of the day, that is a big change.

The second thing is it has taken us years to get our commercial excellence programs where we want. Implementing Salesforce; adding specific definitions of where things are at in the sales pump; improving your conversion rate between moments in the sales hub; pricing; straight through processings multi-user access; fraud tools. All of that stuff, we’ve been working on for years, but in the last 12 months I think we started to see that all come together.

I would say the biggest single difference in the last 12 months has been the marketing programs have had a much, much more positive effect on our ability both to find new clients and support existing clients.

We’ve probably got the strongest corporate business now. UK, Europe had a pretty tough year in that space. Not only Covid, but Brexit, everything else. But they are coming back nicely this year, but that business feels like it is in the best shape it has ever been for us. And we expect that to grow well.

Online sellers, that was put together with elastic and twine four or five years ago, taking the same principles of what we do for corporate, with the one huge extra dimension of you have got to connect with the marketplace.

Obviously the big daddy is Amazon, they are honestly a huge partner for us. Amazon announced their Approved Sellers program: there’s only 11 approvals, and only one of those is not Chinese.

Daniel Webber: Two: Payoneer.

Skander Malcolm:

Well, Payoneer, let’s see how non-Chinese they are. The reason they’re one is because they are bringing a lot of Chinese sellers through Amazon. And I wouldn’t be at all surprised if on their investment register over time there’s a bit of Chinese influence.

What you will see over time is that Amazon are dealing with this conundrum: if you’re that big, you want to grow, you have to grow, you are priced for growth, you have to work with the Chinese. It’s the only way you can grow a business of that size.

On the flip side from that space, there’s all sorts of things going on. Amazon have just literally switched off more than 10 sellers whose GMV is over a billion. There’s a ton of non-compliance in that space. Amazon are having to thread the needle between growth and the brand integrity of their marketplace. Because if they get the latter wrong, the whole thing blows.

What you see from Amazon, which has really been a couple of years in the making, and obviously juiced up by Covid, is who is going to be on the marketplace? China has got to be on the marketplace, has got to be quality China. Early in the ecosystem, whether they are PSDs or anyone else, and supporters into and out of China, but also who is going to satisfy our brand and safety?

We think it is incredibly valuable for us to be that robust, that compliant, that clear on what needs to happen with Amazon. Obviously it creates a bit of value for our sellers. It creates the opportunity for us to win more.

You can see because we broke it ou for the first time, the non-Asian growth. We are definitely seeing stuff, being in the industry for a while, which really concerned us about sellers and the payment companies that were supporting sellers. We have been very public about it, but also with that I said, “Look, it is a nice thing if you’re British. I can do that business. We were doing some of the business. But it is not worth betting the company on.”

We found much better sellers in that part of the world, but also the rest of the world, that we can grow our online sellers with the rest of it. So, we will just tread carefully up there and make sure that Amazon love us, other marketplaces love us, and that we grow whatever for our target online seller at a healthy rate.

We’re very well positioned, particularly with things like the risk management investment, the transaction monitoring that allows you to look at incoming payments as well as outgoing. That is a big differentiator with our banks. Virtual account issuance is getting harder and harder. I can tell you several of the Australian major banks have declared it no more. I’m sure you have seen the media down here are upset with our competitors.

I would say no smoke without fire there. The banks themselves are under tremendous pressure in this space to only work with players that they know very well, who still satisfy the regulators. That’s the other thing, they are saying to the banks, “Well, how do you satisfy yourself while these transactions are coming in? Show me your transaction monitoring tools.” It is no longer just to beneficiaries.

It’s huge win in terms of the relationship we have with Quantexa that that tool allows you to do both. We have obviously been working very hard with them to make sure it is ready. To be blunt, we didn’t put our foot down in online sellers until that was ready. And I was very, very clear about that with our risk committee.

That said, I feel like it is in good shape. There is more I want to do in the space. You are going to see things over the next year or so that I think will play well in that space.

Then there is enterprise. The types of prospects we are targeting are large, typically, although some of them are smaller. I think we have surprised a few people because the enterprise client can have end-clients that are consumer, like Link. They could have any clients that are corporate, like WiseTech. Or they could have end-clients that are online sellers.

In any of those three cases, what you are doing is building a platform that works for your client so that they can support their clients much more efficiently, with a much better experience, better price, and that is the key to enterprise.

Daniel Webber: Great. Skander, thank you, as ever.

Skander Malcolm:

Thanks, mate.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.