After being sold to private equity groups Goldfinch Partners and The Baupost Group for $910m, Western Union Business Solutions (WUBS) is being renamed Convera. But initial leadership appointments suggest that it’s not just the company’s name that will be changing when it begins life as a standalone entity once the complex deal closes.

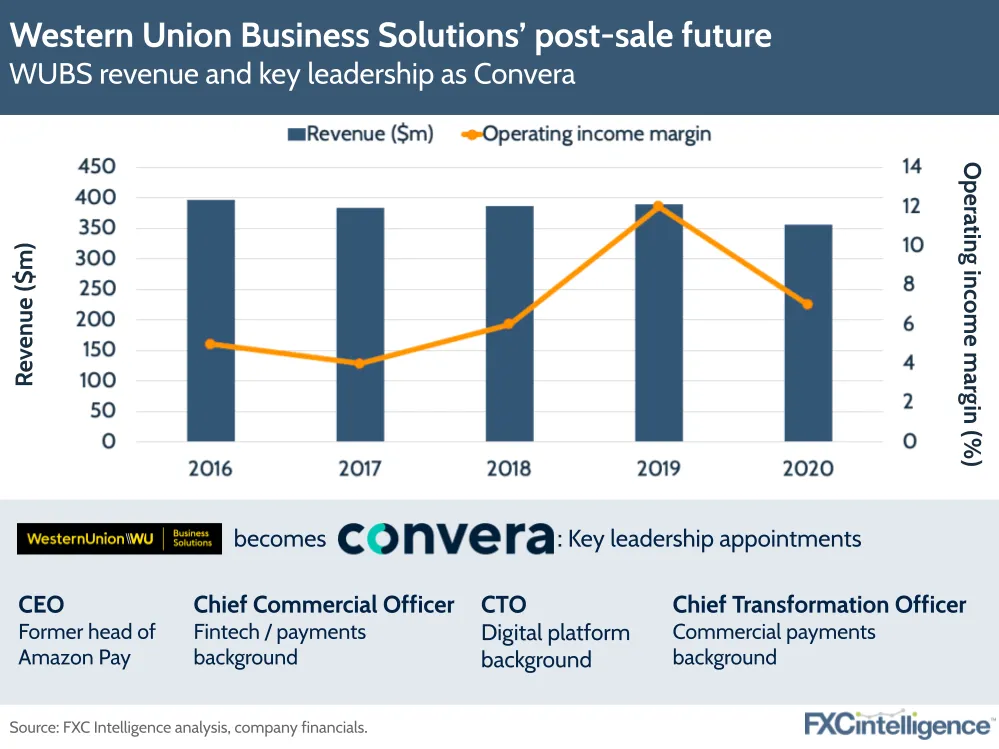

WUBS has c.1,800 employees in over 30 countries worldwide. Convera, the new entity, has so far announced four leadership positions: Chief Executive Officer, Chief Commercial Officer, Chief Technology Officer and Chief Transformation Officer. And these together indicate strong plans for change as the company strikes out on its own.

While WUBS has traditionally had two key business lines, FX risk management and payments, these appointments indicate that Convera will be pushing far more into the latter.

The appointment of a Chief Transformation Officer speak volumes. The role will be held by Jody Visser, who previously advised global payments clients as Managing Director at The Boston Consulting Group. Top of the transformation agenda will likely be a transition to payments, plotting a path to growth and changing the culture to suit these new goals as a standalone entity.

The appointment of Patrick Gauthier, former head of Amazon Pay, as CEO also speaks to a payments focus, particularly given his experience both at payments and ecommerce startups and at PayPal and Visa. Meanwhile, Drew Weinstein, with a fintech and payments-focused background at both startups and established companies, has been appointed as chief commercial officer. And Dharmesh Syal, whose leadership experience includes building platform-based businesses, completes the four as Chief Technology Officer.

In its initial marketing materials, Convera is describing itself as a fintech company, and states that it “will build on its customer-driven culture and accelerate its investments in technology, product innovation and people to drive growth”. Exactly what that will look like remains to be seen, but with B2B cross-border payments seeing so much attention at present in the wider industry, Convera looks to be focusing on the segment for its future growth.