Cross-border payment network major Thunes has had a strong year, and continues to build out its reach both geographically and in terms of network capabilities. We speak to President and COO Chloé Mayenobe to find out more.

B2B2X player Thunes has been growing its reach for some time, and in 2025 has bolstered both its geographical reach and technical capabilities. In the last few months alone, the company has announced a real-time expansion into Saudi Arabia, its market launch in Morocco and its securing of all 50 licences to operate in the US.

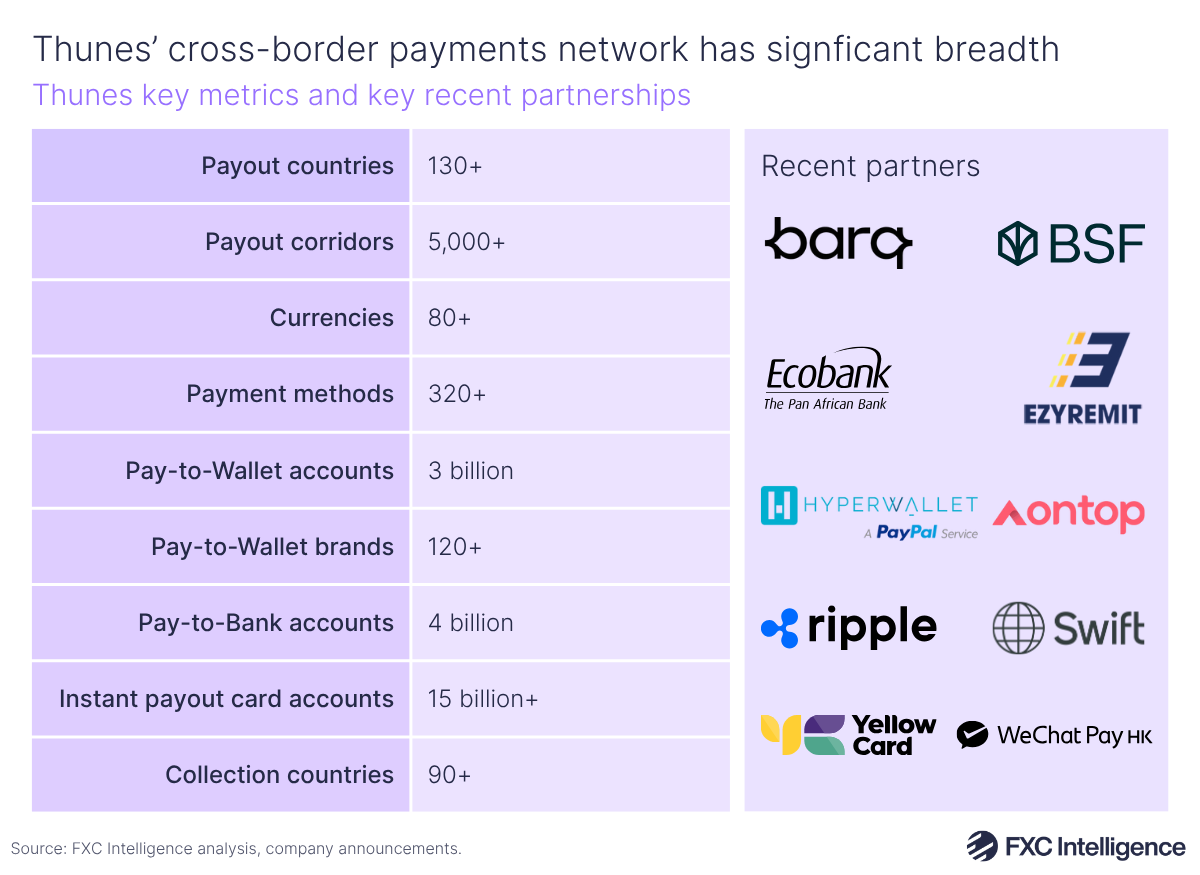

Alongside this, the company has also built out its existing stablecoin capabilities with the launch of its Pay-to-Stablecoin-Wallets solution and has bolstered its presence globally through partnerships with organisations including Ecobank, Yellow Card and Swift.

At the recent Money20/20 USA event, Thunes’ presence was particularly strong, as the company looks to capitalise on its US licences with an increased presence in the country. Daniel Webber, CEO of FXC Intelligence, caught up with Chloé Mayenobe, President and Chief Operating Officer of Thunes, to discuss how the company is thinking about its offering and where its growth priorities lie.

Inside Thunes’ core business offering

Daniel Webber:

Let’s start with Thunes’ core business. Talk us through how you are framing that.

Chloé Mayenobe:

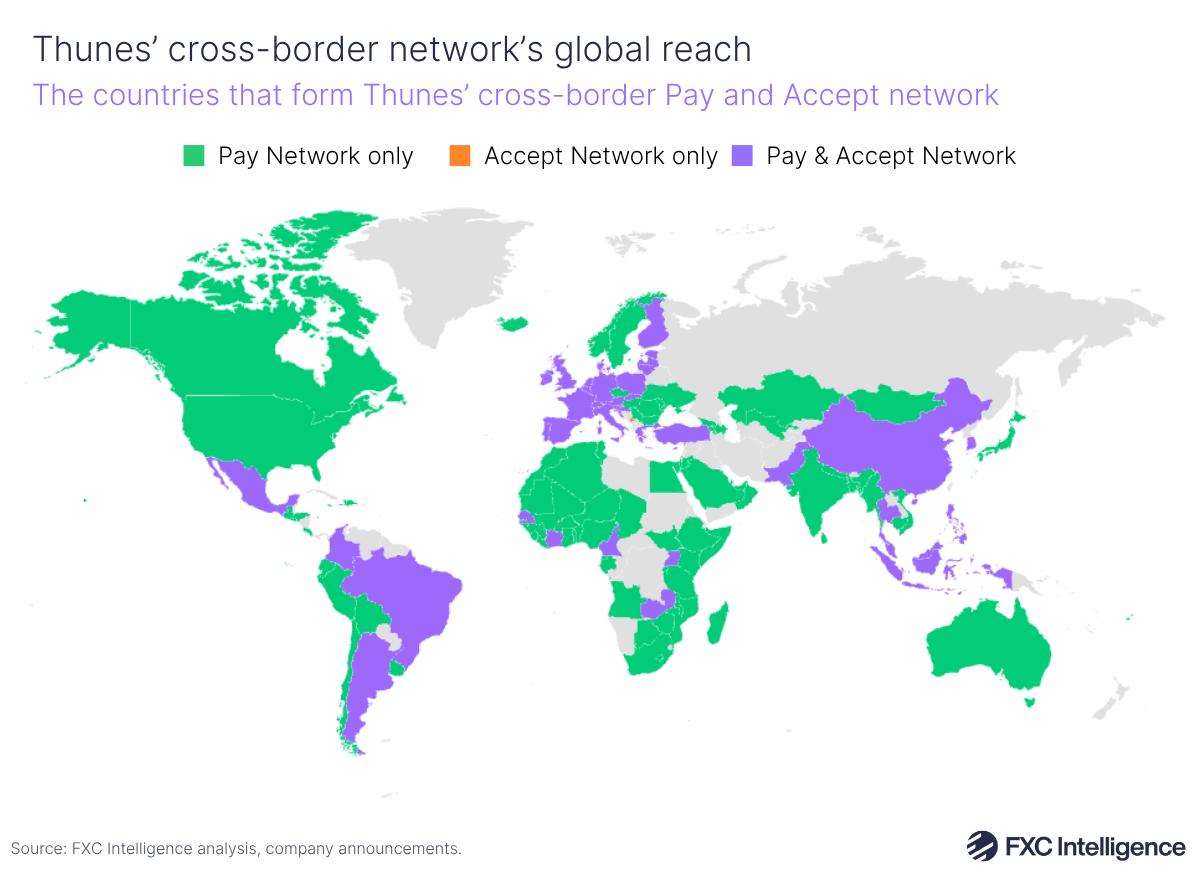

At Thunes we describe ourselves as the smart superhighway for moving money around the world. We make cross-border payments simple and instant, connecting our members to 130 countries and 80 different currencies. Through our network, we can reach seven billion mobile wallets and bank accounts, plus over 15 billion cards.

Part of the power of our network is down to how easy it is to access new corridors and localise last mile payouts or acceptance: our members can tap into more than 320 payment methods through a single API.

Targeting key verticals

Daniel Webber:

Which of the verticals do you have the most traction in, and what do you have that is really resonating?

Chloé Mayenobe:

We work with businesses that are B2B, B2B2C or B2B2B. We started out in the money transfer operator (MTO) space and from there we’ve expanded to serve other verticals like banks, fintechs and super apps, PSPs, the gig economy, payroll providers and the insurance sector, among others.

Every vertical we operate in has a common thread: instant cross-border money movement is essential and truly transformational. Take the insurance sector: international insurers often need to pay multiple parties in remote countries of the world. This can be where organisations struggle: how can they move funds quickly when every hour counts? In many cases it’s a matter of urgency, so we enable them to send money instantly, wherever it’s needed.

The gig economy is another great use case. Content creators can work for platforms based anywhere, in the US, Asia or beyond, yet they themselves may be located in Africa or somewhere else. Making sure they’re paid seamlessly and instantly, no matter where they are, is exactly what we make a reality.

For the financial services sector, over the past year we’ve launched a new solution with Swift, one of our strategic partners. Any bank connected to Swift can now leverage our rails to make payments directly to wallets or bank accounts.

Financial institutions can connect to Thunes via their existing Swift connection without any additional integration or setup. With that single connection, they can access our network to send real-time payments, whether to wallets or to bank accounts, seamlessly and efficiently. This is a game-changer for cross-border money movement in the financial services sector.

Building out Thunes’ stablecoin capabilities

Daniel Webber:

Stablecoins are the big topic of the moment. How do you see the stablecoin space and Thunes’ role in it?

Chloé Mayenobe:

Stablecoins are transforming the financial landscape, and we see them as a real bridge between traditional finance and the new digital economy. The space is moving fast, with lots of potential to make money movement quicker, cheaper and more accessible. But it also brings new challenges, especially when it comes to interoperability, reconciliation and the practical side of last-mile delivery.

At Thunes, we see our role as making stablecoins useful and scalable in the real world through interoperability. We are focused on connecting banks, digital wallets and now stablecoins through our network. The different financial systems leave us with a fragmented market that changes from region to region and by payment flow, whether C2C, B2C or beyond, and that is exactly what we are working to solve.

Stablecoins bring both complexity and opportunity. They help with liquidity and enable 24/7 payments, but they also create new reconciliation needs between fiat and digital assets. That is where Thunes steps in, to make those transitions smooth and simple. This is the type of complexity that we thrive on.

We started by enabling pre-funding in stablecoins, and since then we’ve expanded to what we call the ‘stablecoin sandwich’: on-ramp, off-ramp and last-mile payouts. At Money20/20 USA this year, we announced our new capability to reach stablecoin wallets with instant payouts in more than 130 countries.

As adoption grows, our focus is on real-world use cases, where stablecoins can really make a difference in speed, cost and inclusion for cross-border payments. I truly believe stablecoins only have real value when they are tied to meaningful, practical applications. That is what we are building at Thunes: global connectivity that helps us deliver on our mission, which is to enable the next billion end users to take part in the global economy.

Responding to stablecoin use cases

Daniel Webber:

Talk us through the main use cases that you are solving for at the moment.

Chloé Mayenobe:

One great example, which we’ve just shared at Money20/20, is for our new Pay-to-Stablecoin-Wallets solution. Imagine a woman in Argentina, a market where local currency volatility is high. She works in the gig economy, providing services to multiple clients around the world, and she needs to be paid. More importantly, she wants the freedom to choose how she receives those payments. While she could be paid in Argentine pesos, she prefers stablecoins to protect her earnings from currency fluctuations.

That’s exactly the type of problem we are able to solve. We enable our members, the companies she works for, to offer that choice, allowing her to receive payments in the form and currency that best suit her needs.

Daniel Webber:

Who are the core customers you are offering that use case to?

Chloé Mayenobe:

We operate in a B2B2X model, which means we serve businesses that serve other businesses or consumers. Our members include fintechs, banks and payroll providers, but the best use case for the Argentine example is probably gig economy platforms. We also work with NGOs, which are a particularly strong use case for stablecoins, enabling them to send funds instantly and securely to hard-to-reach countries where traditional payment channels may not be available.

Continuing geographic expansion

Daniel Webber:

Away from stablecoins, you’ve also been expanding geographically, with launches in a number of key markets over the past few months. Talk us through some of the interesting opportunities that you see around the world.

Chloé Mayenobe:

Being close to our customers and understanding their needs is an essential part of how we’re planning to grow. Whenever we expand into a new market, we start by identifying what kind of money movement that country or our customers in that region need most.

The UAE, Saudi Arabia and the wider Middle East are key focus areas for us right now, and we see tremendous potential there. We’ve recently enabled real-time payments across the region, into Saudi Arabia, and we’ve also expanded our network to include direct real-time payments to Morocco.

Today, with coverage in 130 countries and a network of 550 members, we enable over 5,000 payment corridors worldwide. Each new connection strengthens our ability to move money seamlessly, instantly, and where it’s needed most.

Making the US a key priority

Daniel Webber:

What are the big priorities you’re focusing on for 2026?

Chloé Mayenobe:

In 2026, our main priorities will be expanding in the Middle East and deepening our presence in the United States. 2025 marked a major milestone for us: we secured licences in all 50 US states, which I think is a remarkable achievement for a company of our size and international footprint.

The US is the world’s largest sending market, and while we’ve been active there for quite some time, this new licensing footprint allows us to operate at an entirely different scale. Our focus now is to serve the same key verticals, such as financial services, gig economy, enterprise and fintechs, but to do so from within the US, while continuing to strengthen cross-border capabilities.

We see the US as one of our biggest growth drivers now, and that’s where a significant part of our investment will go in the coming year. From a product perspective, we’ll also be launching some new innovations particularly around stablecoins and other next-gen payment technologies.

B2B’s role in the future of cross-border payments

Daniel Webber:

How do you think the cross-border market is going to change over the next two years?

Chloé Mayenobe:

The cross-border payments space has evolved hugely in recent years, and we’re now seeing banks and fintechs working together more closely than ever before. Traditional players are recognising the value that fintechs bring in enhancing speed, reach and customer experience and are more open to innovation. That growing collaboration is helping to drive real progress across the industry.

We both know well that cross-border payments continue to grow rapidly, with annual growth rates of around six to seven percent. There’s room for everyone, but also a pressing need to meet this rising demand efficiently and inclusively.

One area that’s still really underdeveloped but absolutely full of potential is B2B cross-border payments. While fintech innovation has largely focused on C2C use cases, the B2B segment is now gaining momentum and we see major opportunities there.

We’re also seeing strong growth in mobile wallets, which are becoming a key channel for receiving and sending cross-border payments, especially in emerging markets.

And then there’s stablecoins. Not just a buzzword, I am sure we’re going to see huge growth here, although they’re not replacing existing rails but complementing them. We believe stablecoins will continue to grow as part of a broader, interoperable ecosystem where multiple payment methods coexist. Together, these innovations are going to make cross-border money movement faster, more flexible, and more accessible than ever. The only constant is going to be change!

Daniel Webber:

Absolutely, and B2B is at least 20 times larger. Chloé, thank you.

Chloé Mayenobe:

Thank you.