Last week, Klarna outlined significant financial gains from its recent AI adoption, including a sharp cut in headcount that the company plans to continue. But should others in payments be looking to follow suit?

At the end of August, Swedish buy now, pay later (BNPL) major Klarna released H1 2024 results that showed the company seeing significant operational and financial gains from its recent use of AI.

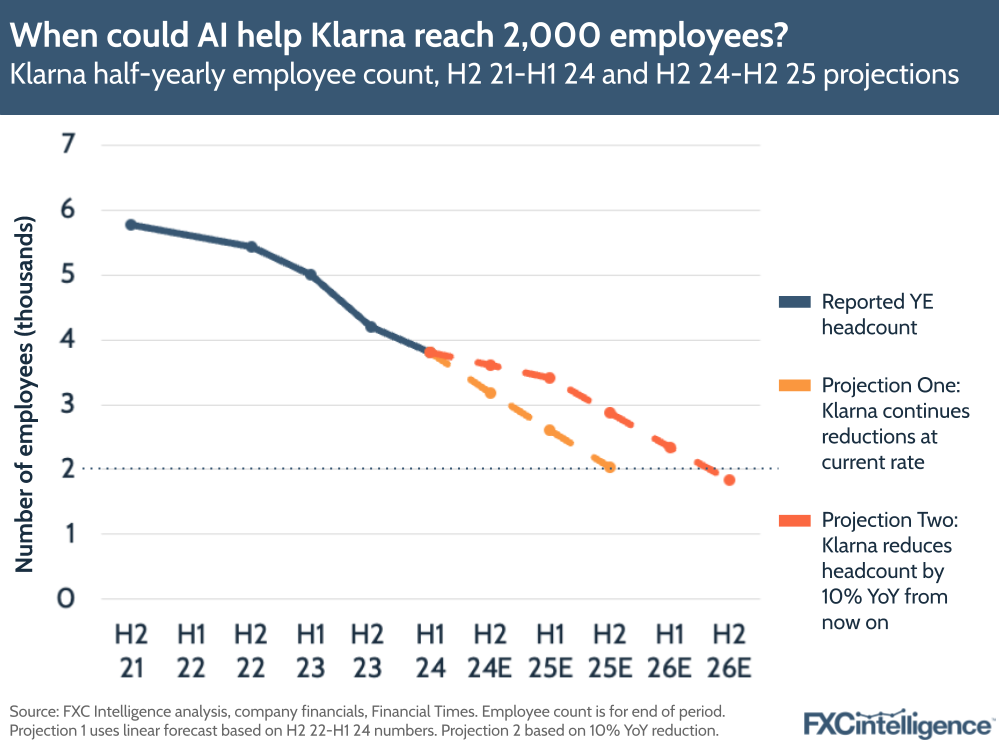

Through a variety of company-wide initiatives enabled by its partnership with ChatGPT maker OpenAI, the company has seen its number of full-time-equivalent employees drop by 24% within a year, from 5,000 to 3,800. It now plans to go further, with a target of 2,000 – although it has not specified a timeline for this goal.

These cuts have enabled it to return to breakeven after several years of climbing losses, having previously been a profit-making company. Such a focus on returning to profitability is largely driven by a long-anticipated IPO, which may come as soon as next year. As a result, Klarna is embracing AI arguably more intensely than any other payments industry player as it makes rapid preparations for its public market debut.

But how has it harnessed AI to reach these gains, have there been any drawbacks and what can others in the payments industry learn from the company? In this report, we break down the details of Klarna’s AI-led return to profitability and unpack the key lessons from its AI initiatives.

Profitability and a potential IPO: Why Klarna needed to lean into AI

While over the past few years it has reported the typical losses of a rapidly scaling company of its age, Klarna has in the past – unusually for a fintech – been a profitable company. It reported profitable yearly results between 2007 and 2018, with its earnings before tax peaking at SEK 523m ($61m) in 2017.

However, the company has recently seen its spending climb as it has sought to significantly broaden its market reach, share and depth. This has seen the company invest heavily in its operational capabilities, as well as launching the Visa-issued Klarna card across key markets from 2019 onwards. It has also made several acquisitions to enhance its capabilities, including most recently the now-defunct New Zealand arm of BNPL player Laybuy in August.

Such investments have shown returns. Between 2019 and 2022, the company saw market penetration in its established, primarily Western European, markets grow from 36% to 52%. Meanwhile in the US, a country Klarna only entered in 2015, the company saw market penetration grow from 1% to 9% over the same period. The number of purchases Klarna’s customers have made has also grown every year, with average revenue per user increasing as a result.

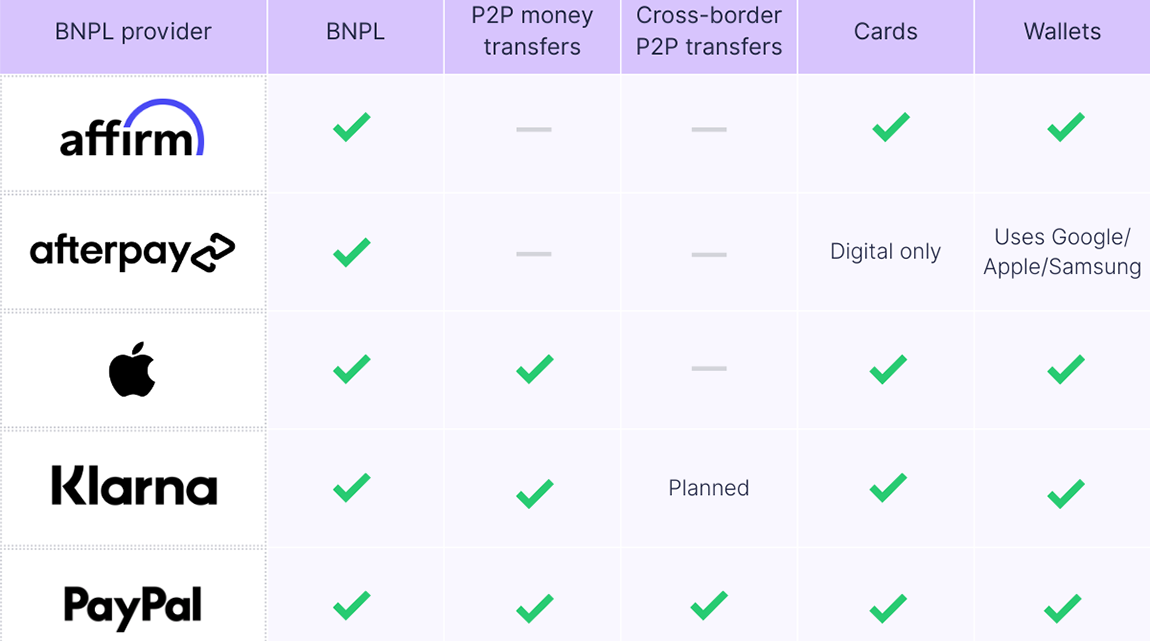

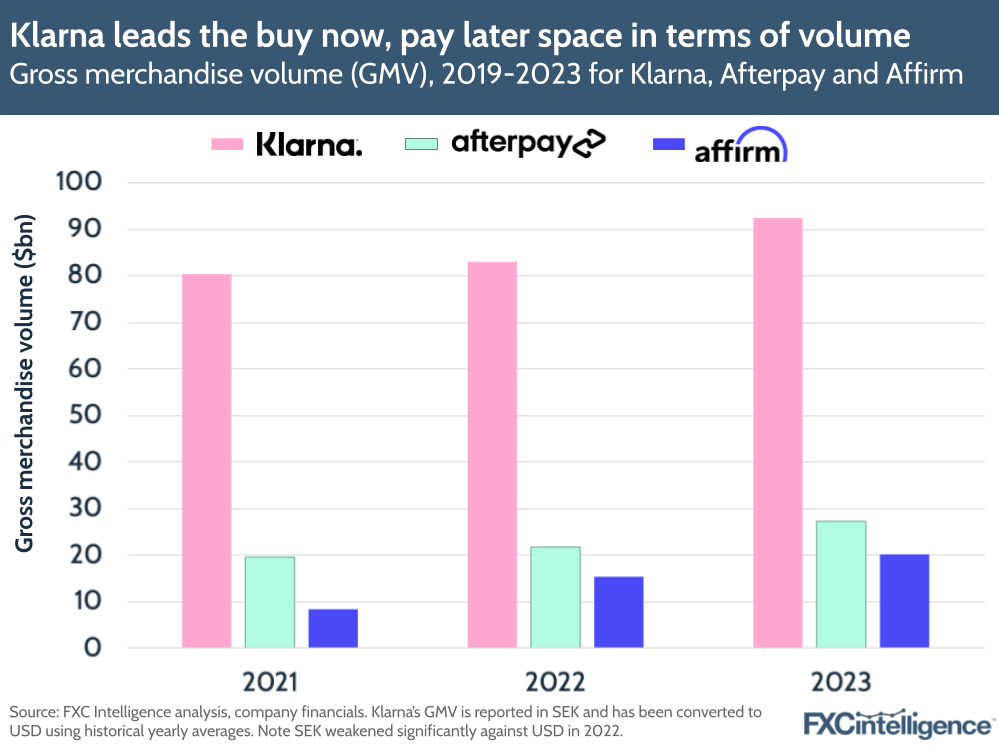

As it stands, Klarna is the leading BNPL player globally, reporting gross merchandise volume (GMV) of considerably more than twice that of Affirm and Afterpay, the two next biggest players, combined in 2023. It also has a relatively strong cross-border payments offering for a lending-based player, supporting cross-border BNPL purchases in at least 10 of its biggest markets.

However, such growth has been fuelled by significant venture capital investment, with Klarna netting $4.5bn in funding since its launch, more than two-thirds of which has been raised in the last five years.

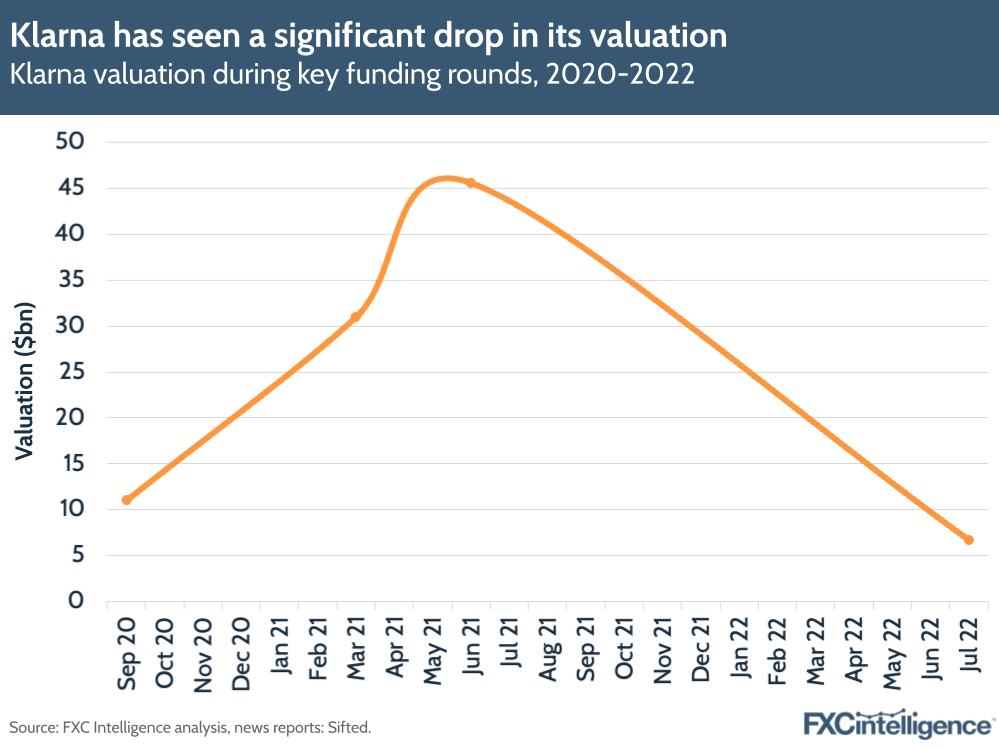

During this time the company’s valuation soared to a high of $45.6bn in 2021, making it the second most valuable fintech after Stripe at the time, having already achieved the crown of Europe’s most valuable startup from its previous fundraise. However, conditions changed in 2022 as the wider technology landscape began to sour and post-pandemic interest rises prompted a drop in consumer spending.

In May 2022, the company announced that it was laying off 10% of its staff – reportedly around 650 people – and in June 2022 news broke that Klarna was looking to raise at a $15bn valuation. When the company announced its latest round, however, the news was worse: Klarna had raised $800m at a valuation of $6.7bn – an 85% reduction from the previous year.

Now its investors, which include Sequoia Capital, Silver Lake and SoftBank Vision Fund, will be expecting a return on their investment, and Klarna is set to deliver this in the form of an IPO in the US. Although not yet formally announced, there are signs this is imminent; the company reportedly began lining up financial advisors earlier in the summer and there have been suggestions that a Klarna IPO could happen as early as H1 2025.

However, given the significant markdowns many of its investors have endured, the company will be looking to net as strong a valuation as possible, and profitability, or at least the strong potential of it, will be key.

All signs suggest that Klarna has been taking rapid steps to deliver this as quickly as possible, mindful of the fact that how soon this is achieved, and to what extent, could have a very real impact on what it can earn in its public debut. Reports here have been varied, with Reuters suggesting a potential $14bn valuation in November 2023, while Bloomberg reported a potential $20bn valuation in February 2024.

AI appears to be key to this in two ways. On the one hand, the company has driven strong productivity gains through its adoption of AI and so closed in on profit, reporting a positive adjusted operating income in both H1 24 and H2 23 after successive periods of losses.

On the other, the company has been highly vocal about its use of AI, particularly in the last few weeks where it has specifically focused on its AI initiatives in discussions with the media. This is likely not only to showcase its successes so far, but also to intended to signal the long-term prospects of the company for potential investors.

Klarna’s AI-led job cuts and hiring freeze

The most head-line grabbing part of Klarna’s AI efforts has been the reduction in headcount that the company has achieved through it, with the company’s full-time employee (FTEs) headcount now at 3,800 – only slightly above 2020 levels and around 40% below reported mid-2022 highs of 6,500.

Crucially, while back in 2022 the company achieved job cuts through active redundancies, over the past year it has shed around 1,200 members of its workforce through natural attrition. Klarna says it has had a hiring freeze in place for all roles except those in engineering, with the company expecting AI to help take over the work of those leaving the company from other departments.

An analysis of recent Glassdoor interview reviews for Klarna suggests that the company is making an exception for a small number of roles, but that the vast majority of positions that were interviewed for over the past year were engineering-related.

This does not appear to have harmed the company’s diversity, with the company reporting that 52% of its average FTEs were women in 2023, compared to 35% in 2022.

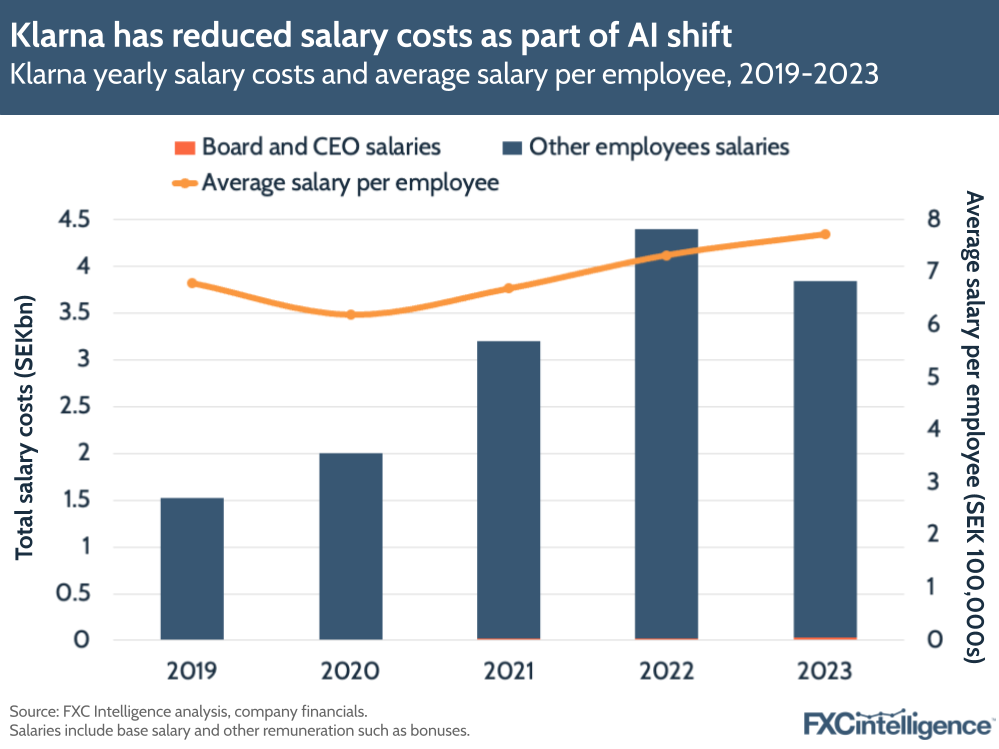

While Klarna does not report salary data in its interim reports, data from its full-year 2023 report suggests that this was already having a net benefit for the company’s salary costs. While salaries and other remuneration increased by 33.3% for Klarna’s CEO and Board, total salary costs for other employees reduced by -13.1%, with salary costs overall dropping by -12.8%.

Average salary per employee also only saw a slight increase, rising from around SEK 732,600 to SEK 772,300 ($72,600 to $72,800) between 2022 and 2023.

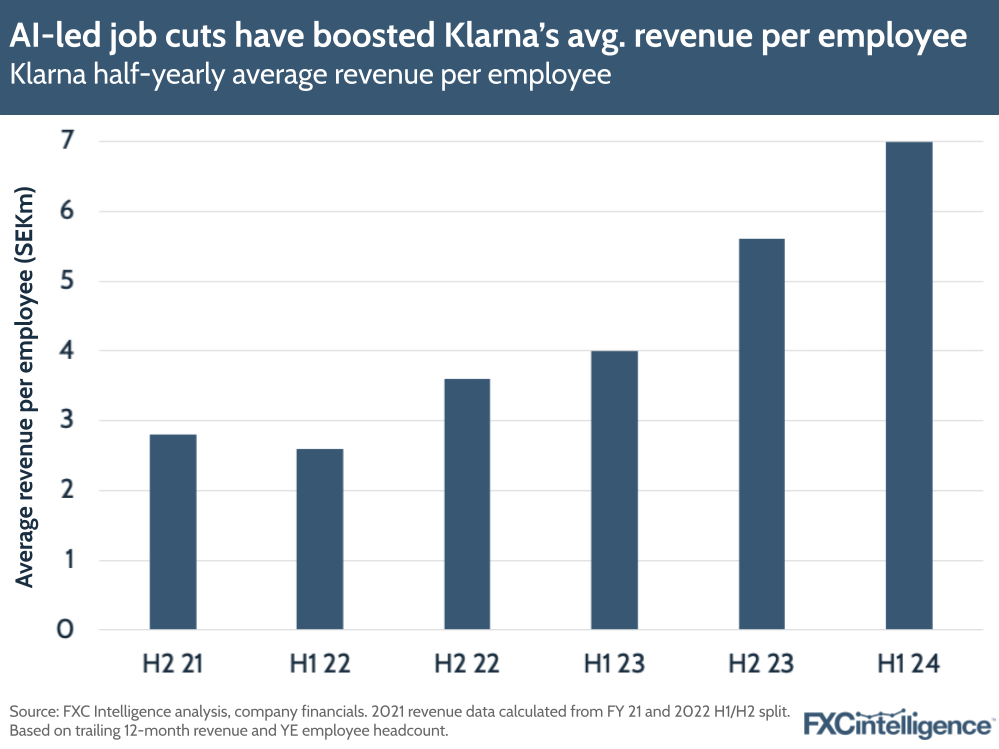

At the same time, Klarna has continued to see revenue gains, reporting a 27% rise in revenue in H1 24 and a 21% increase in FY 2023.

This has helped drive revenue per employee up significantly. In H1 2024, the company reported SEK 7m ($820,000) revenue per employee, a 75% increase on H1 23, when the company reported SEK 4m ($377,000).

Speaking to the Financial Times shortly after the release of its H1 24 results, Klarna CEO Sebastian Siemiatkowski said that the company planned to continue to cut jobs over the next few years.

“Not only can we do more with less, but we can do much more with less. Internally, we speak directionally about 2,000 [employees],” he said, adding that the company didn’t want to “put a specific deadline on that”.

However, such a target may be achieved relatively quickly. If Klarna continues to cut roles at the rate it has done so over the past two years, it would achieve a headcount of just above 2,000 at the end of 2025. If it takes a more conservative approach, cutting at 10% year-on-year from now on, it would see its 2,000 headcount target reached by mid-2026.

How AI has impacted Klarna’s financial performance

In its H1 2024 earnings report, Klarna reported significant improvements across multiple metrics, while seeing its overheads drop significantly. Alongside its 27% revenue increase, with the company also highlighting that this metric had climbed 46% versus H1 22, it also saw a 16% rise in GMV (up 32% on H1 22) and a 22% increase in gross profit (up 91% on H1 22).

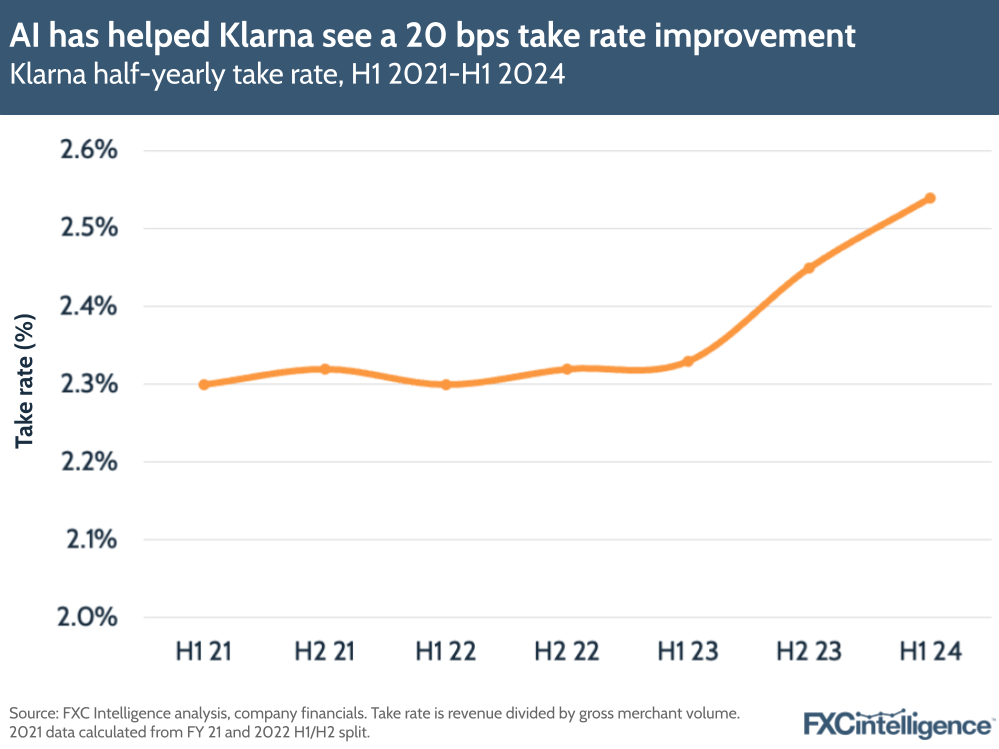

This also helped the company see a significant take rate improvement, which, having sat at around 2.3% since before 2021, began to meaningfully climb in H2 23 and in H1 24 achieved a 21 bps improvement on the previous year at 2.54%.

This is key because this number aligns closely with when Klarna began its AI initiatives, and suggest that its use of the technology is not only contributing to cost reductions but also to its end results.

On cost reductions though, the impact has been meaningful. Klarna reported adjusted operating income of SEK 673m ($79m) in H1 24, a 250% YoY increase, following its first positive half of adjusted operating income in H2 2023 when it reported SEK 78m ($7m).

Its non-adjusted operating income did not quite reach positive, at SEK 285m (-$33m), but represented an 88% improvement on the previous year. It also reported that it had achieved break-even on net income in Q2 2024.

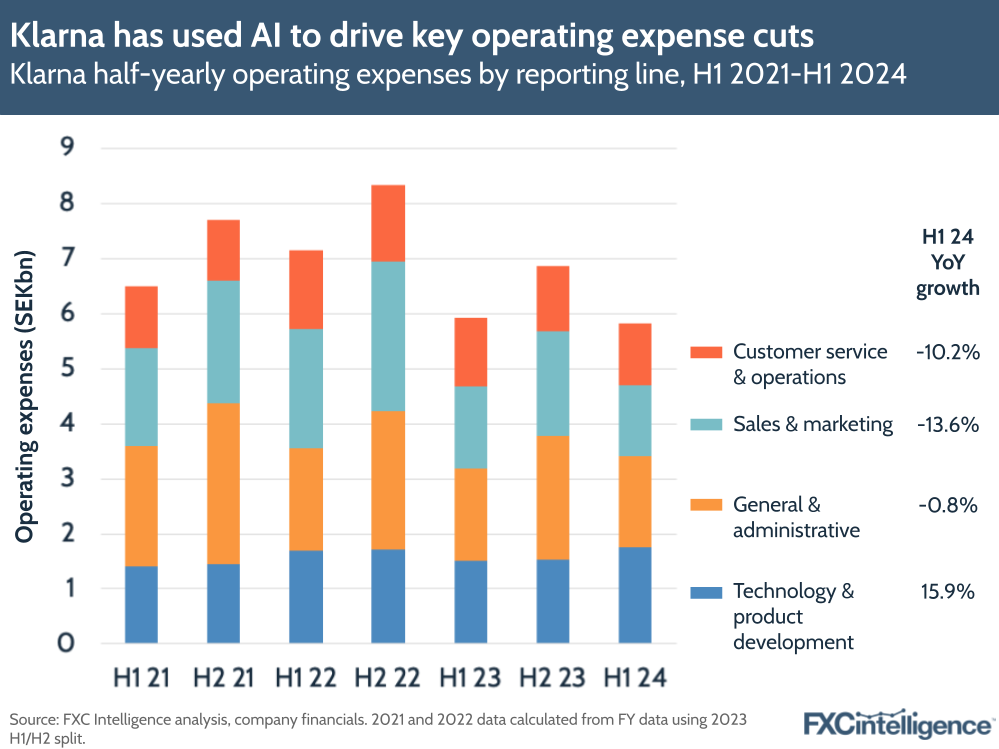

The company’s significant reductions in salary have been key to this, but Klarna has also reported gains from the reduction or cancellation of contracts with more than 2,500 suppliers as the company uses a variety of OpenAI-powered tools to drive efficiency. As a result, the company reported operating income reductions in three of its four departments in H1 2024, with only technology and product development seeing increases overall.

This means that while adjusted operating expenses have overall seen a very slight increase of 0.3% – effectively flat – non-adjusted operating expenses have reduced by -6.5% to SEK 6.6bn ($774m).

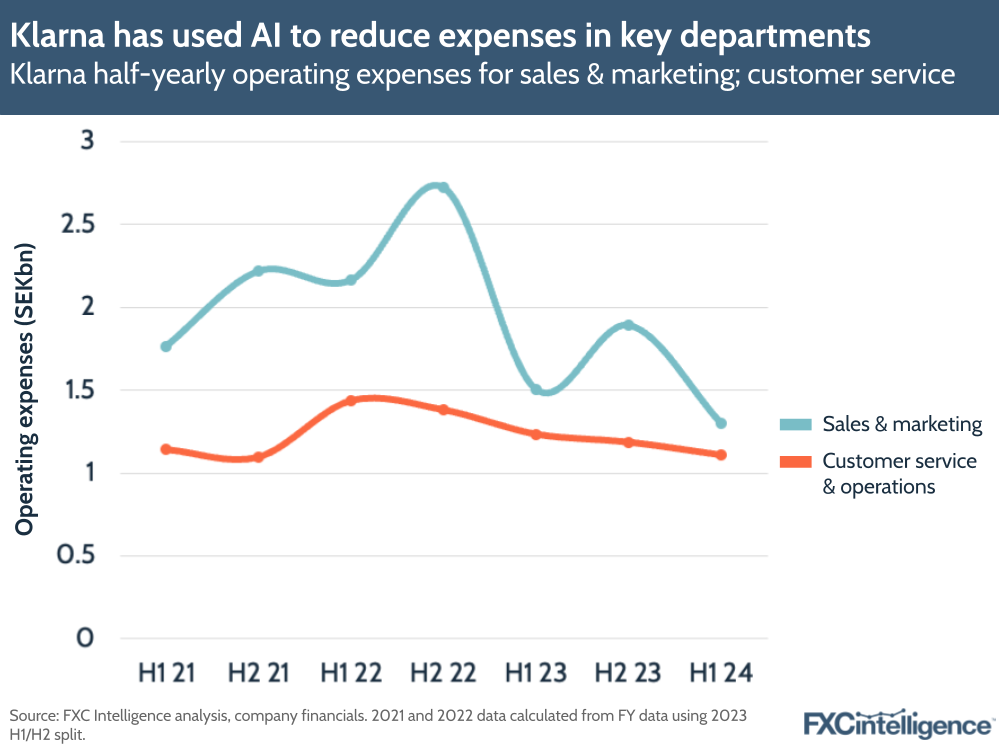

Within this, the biggest reductions have been in the company’s Sales & Marketing and Customer Service & Operations departments, which respectively saw -11% and -10% reductions in adjusted operating expenses, and -14% and -10% reductions in non-adjusted operating expenses to SEK 1.3bn ($153m) and SEK 1.1bn ($130m) respectively.

Both segments have seen successive reductions since their 2022 highs, and have likely been a key focus for efficiency improvements as the company drives towards profitability.

Klarna’s AI initiatives in detail

While using AI is unlikely to be the only driver of Klarna’s move to break-even, it has been a critical focus for the company in communicating its recent gains, and is instrumental in its ongoing headcount reduction.

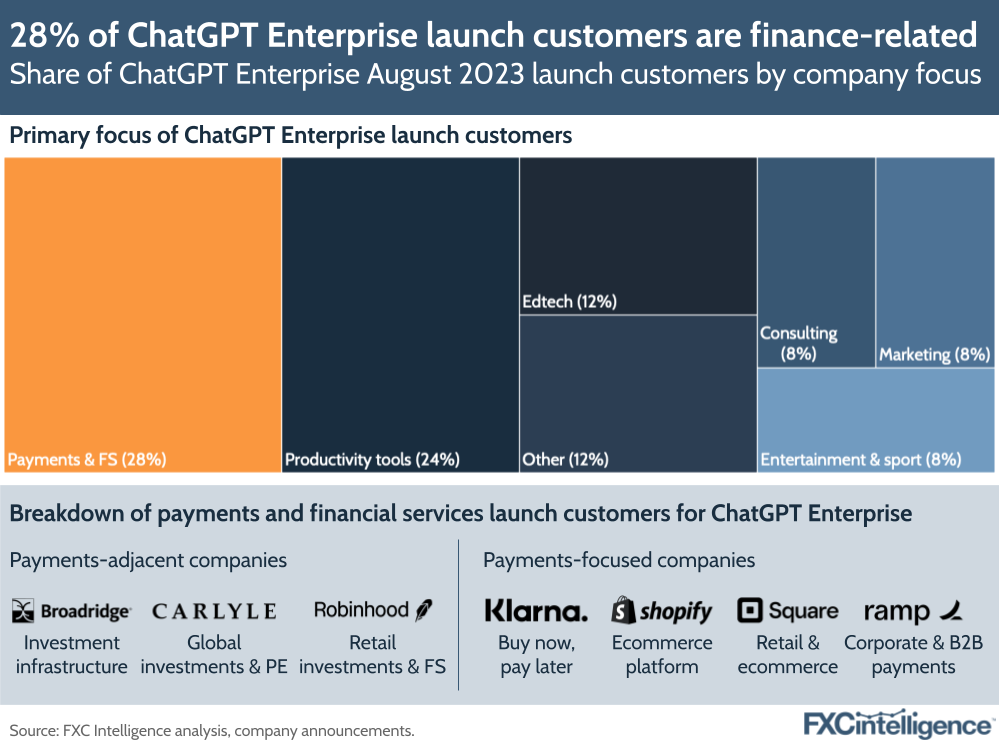

Here, the company has in particular benefited from its partnership with ChatGPT maker OpenAI. While Klarna has mentioned using some forms of AI since 2021, it became an early partner of OpenAI when it launched ChatGPT-based shopping in March 2023, just a week after the launch of GPT-4 – widely considered to be the technology that kick-started the current wave of generative AI (GenAI).Just a few months later Klarna was announced as one of 25 launch customers, 16% of which were in the payments space, of ChatGPT Enterprise, which focused on integrating GPT-4 into companies’ existing operations to drive productivity enhancements.

On the customer-facing side, its early integration with ChatGPT enabled users to shop with Klarna from within ChatGPT itself, with the chatbot making tailored product recommendations based on specific occasions, end-users and use cases. Siemiatkowski at the time said the service was “easy to use and genuinely solves a ton of problems”, saying that it was simple enough to be used by his mother.

It also embraced the use of the technology to support its own customer service solutions. In its H1 23 interim report, it explained how it was using AI to classify case logs from monthly chat conversations, handling more than one million a month. This provided an 18% uplift versus using agency workers to undertake the same work, and drove $4.1m worth of efficiency savings.

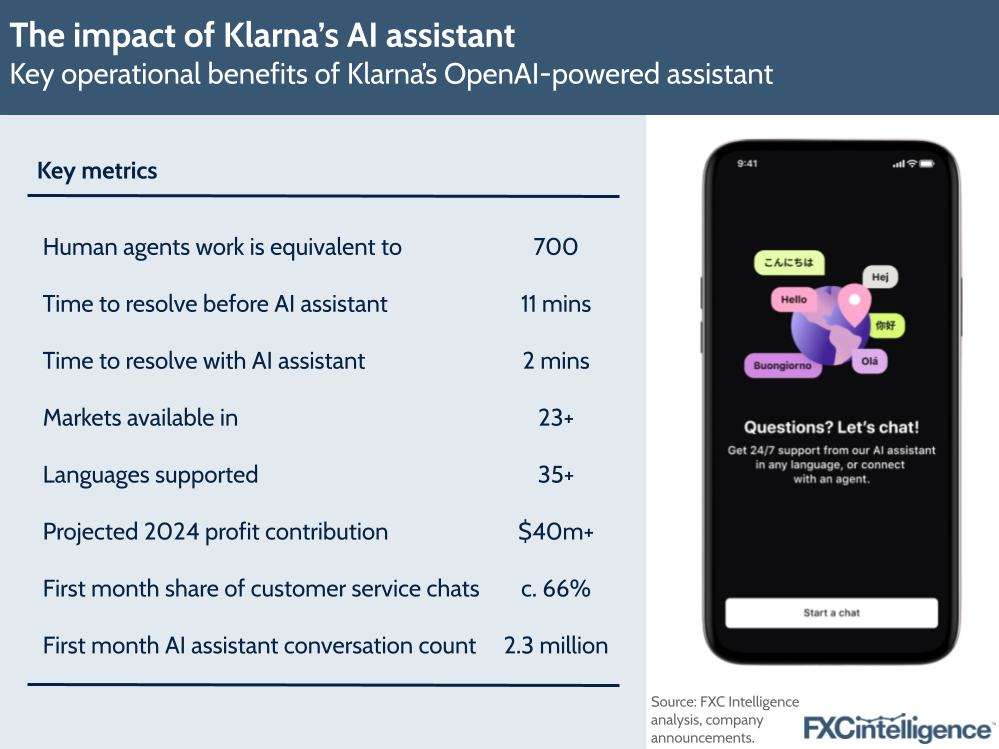

Since then, however, the company has rolled out more substantial AI-powered customer-facing solutions, most notably with the launch of Klarna AI assistant at the start of 2024. Built into the Klarna app, the assistant provides 24/7 multilingual customer service, including the ability to handle refunds and returns without the involvement of a human employee.

One month after launch, Klarna announced that the AI assistant was doing the same work as 700 full-time human agents, having handled two-thirds of the company’s customer service chats during the time it had been live. It also reported that average time to resolve had dropped from 11 minutes to 2 minutes and that repeat inquiries had reduced by 25%, without impacting customer ratings – a claim that our analysis of historical Trustpilot ratings supports.

The company now projects that its AI assistant will drive $40m in profit improvements across 2024.

“Klarna is at the very forefront among our partners in AI adoption and practical application,” said Brad Lightcap, COO of OpenAI, in a press release announcing the assistant.

“Together we are unlocking the vast potential for AI to boost productivity and improve our day-to-day lives.”

While customer-facing AI tools are doing much of the work to reduce headcount and related costs in the company’s Customer Service & Operations department, the company’s Enterprise partnership with OpenAI has also enabled it to streamline back-office operations across multiple areas of the company.

Klarna has integrated ChatGPT Enterprise into the work settings of all its employees globally, who are encouraged to use the tool to reduce the time to complete tasks. This has translated into 90% of all employees using OpenAI-based GenAI tools on a daily basis.

Departments who need to generate significant written content are seeing higher rates of adoption, with Communications leading the way at 93%, followed by Marketing (88%) and Legal (86%). This suggests that Klarna employees are particularly using ChatGPT to draft copy for written content, and potentially also to undertake research. In H1 24, Klarna also reported that Marketing had seen $10m in savings from the use of AI tools.

However, this does not mean that the technology is not also providing benefits to the company’s Engineering departments, despite it continuing to hire in this area. Klarna reports that 100% of its engineers are now using AI-copilot to create and review code, speeding up the time to make technological improvements.

Crucially, while this sort of solution has the potential to support hires with insufficient skills, creating the potential for uncaught errors to increase, Klarna also pairs this with a fairly rigorous multi-stage hiring process, as reflected by the company’s interview reports on Glassdoor.

Drawbacks and challenges from Klarna’s AI-led approach

While Klarna has been effective in reducing costs and increasing productivity with AI, it has not been without its challenges, most notably through employee satisfaction.

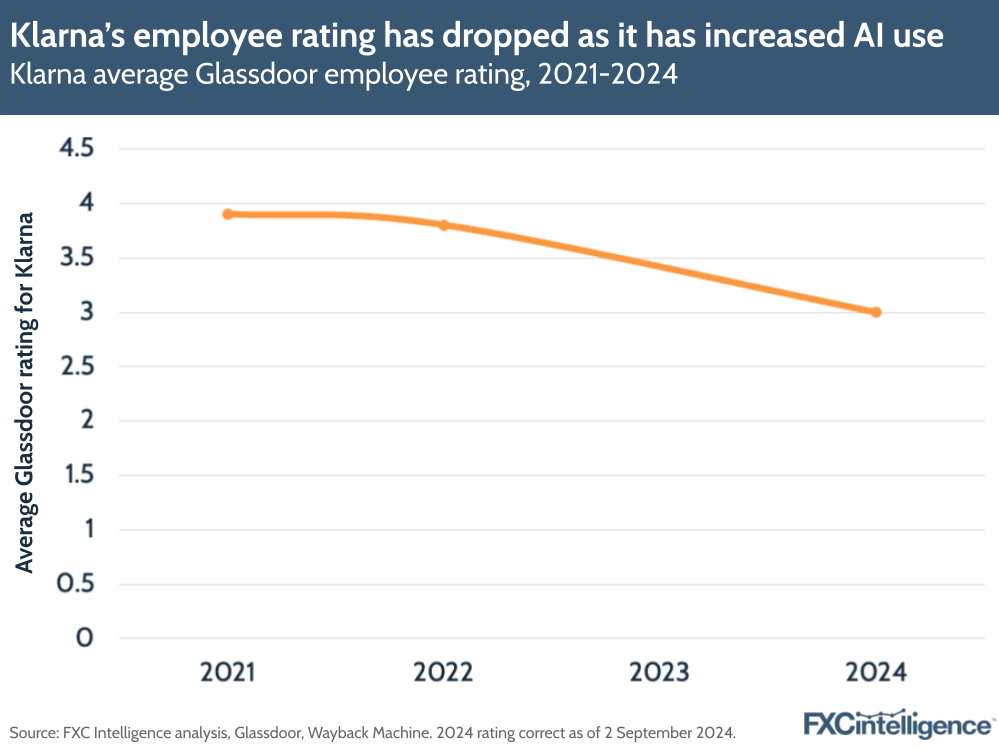

An analysis of the company’s Glassdoor rating shows a notable drop in average rating among Klarna employees between 2022 (3.8) and 2024 (3.0). The average rating for the 23 employee reviews left in August 2024 alone was slightly higher, at 3.2, however 30% of these saw the employee rate Klarna at a 1 or a 2 out of 5.

Of those critical of the company, multiple cited high workloads and stress levels, with at least two specifically raising concerns around burnout. Others also complained of a lack of pay rises or progression opportunities, and some said they were concerned about possible layoffs.

Klarna’s rate of headcount reduction has been extremely high, particularly for a company not currently undertaking active layoffs, and may have been accelerated by increased dissatisfaction among those left to take on the work of colleagues who had left. While AI can provide productivity gains, it does not remove the need to make decisions about specific projects, meaning there will be parts of roles that cannot be automated and thus increasing the burden on those left.

Given that Klarna plans to reduce headcount further, it may have not taken as many steps to combat this phenomenon as an organisation looking to maintain its number of FTEs would have done. However, there will come a point when the company needs to maintain its staff levels and ensuring that it does not burn out those that it relies on to maintain operations is vital as part of this.

Beyond employees, there are also risks associated with brand perception and customer engagement when it comes to being so vocal about using AI to cut headcount. For many, the technology poses an existential threat to jobs and therefore livelihoods, and so any company talking about this in a positive light is going to be met with some negative sentiment, if not a full backlash.

Many people posting on social media have expressed shock and outrage about Klarna’s decision to halve its workforce using AI, while the BBC highlighted potential concerns from unions. However, there is nothing to suggest this has had any measurable impact on Klarna’s sales volume at present.

Concerns have also specifically been raised about the use of AI to cut employment of photographers, writers and designers, citing ongoing concerns around copyright infringement and AI. OpenAI has been accused of infringing copyright in its training data and currently faces lawsuits from several news publications, including a group of newspapers in the US who say that ChatGPT reproduced their copyrighted content “verbatim” when prompted to.

Legal analysis of The New York Times’ case against OpenAI indicates that OpenAI’s defence is focusing on an argument of fair use, and the ultimate ruling may provide a key precedent for how similar claims are handled in the future. If this argument fails, there may be potential ramifications for organisations who unwittingly reproduce copyrighted material through the use of GenAI tools.

Beyond this, there are also potential environmental concerns. Training AI models is highly energy intensive – training a large language model can consume the equivalent of several hundred US households’ annual energy use – and data centres, which are increasingly focused on AI, are expected to account for 6% of US energy consumption by 2026.

There is also a potential risk in relying heavily on the services of OpenAI for such solutions. While the company has gained considerable attention and use, it also has a very high burn rate as it focuses on AI training and the recruitment of staff. Earlier this year, an investigation by The Information projected that OpenAI could post losses of $5bn in financial year 2024, a rate that will require very significant levels of further funding to maintain if it continues to invest at current levels. This therefore risks the company’s potential as a going concern if it finds itself unable to attract sufficient further investment in the future.

AI initiatives across the payments industry

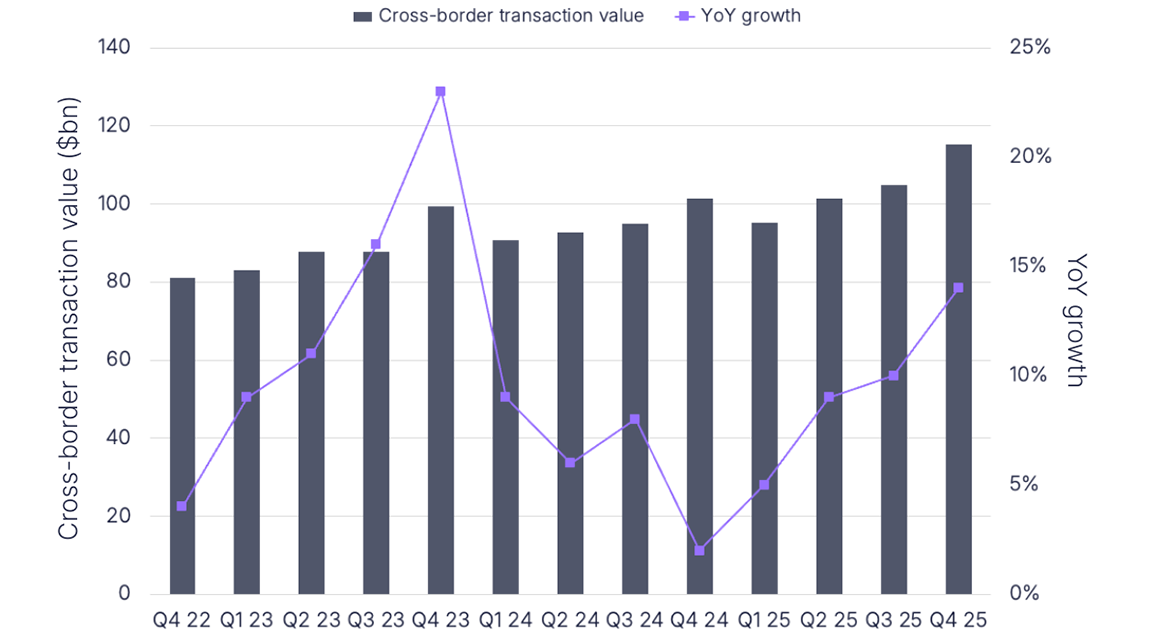

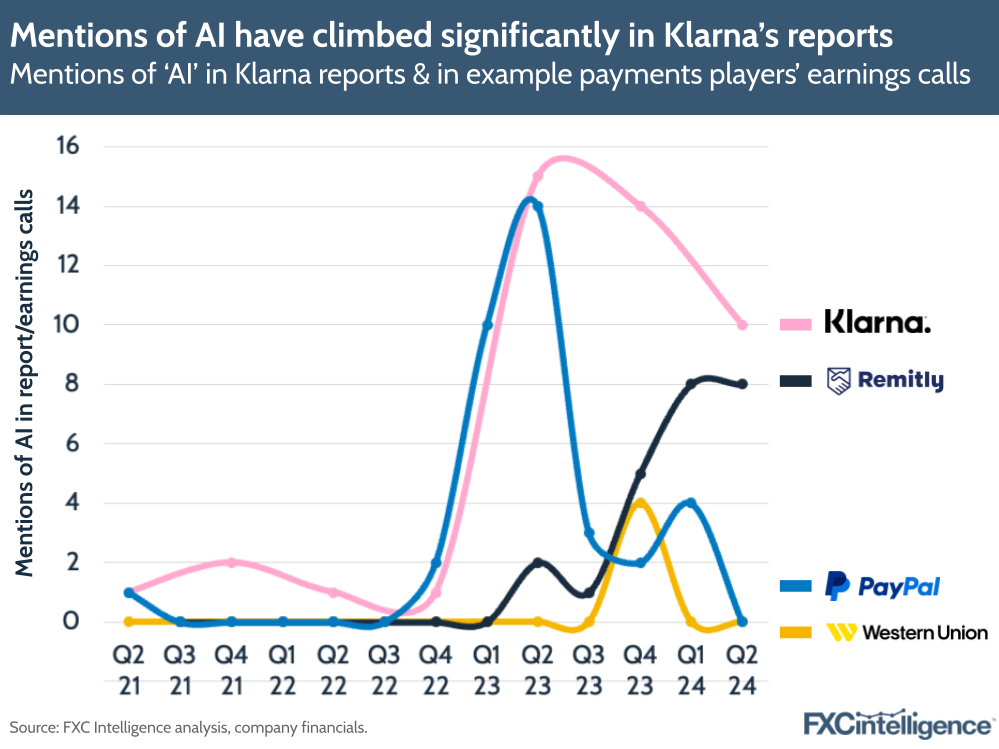

While Klarna has vocally embraced AI more than arguably any other player in the payments industry, it is not the only company to begin to use the technology. Across cross-border payments, multiple other players have repeatedly discussed the technology in earnings reports, with the launch of GPT-4 having a widespread impact on its discussion.

However, how much of this discussion is translated into active projects that are being fully integrated into companies’ day-to-day operations is not always clear, and varies considerably by organisation.

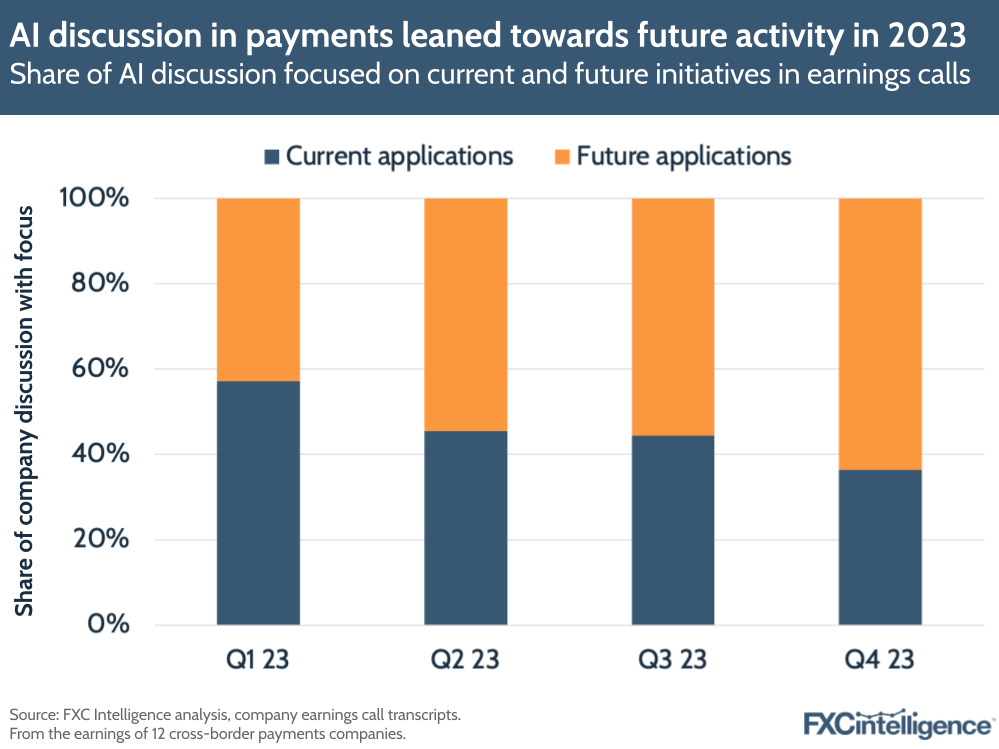

Our analysis of the discussion of AI by 16 different publicly traded cross-border payments companies across their financial 2021-2023 earnings calls earlier this year showed that while less than half (44%) discussed the technology at all in 2021, by 2023 this had risen to 75%.

Within this, discussion centred around fraud protection and risk management; improvements to customer service and experience; and productivity and cost gains. Notably, by Q4 2023, more than half of discussion was centred on future applications, rather than projects already in place.

However, there are organisations in the payments space who are beginning to talk more freely about in-place AI-based solutions. In its Q2 2024 earnings, digital remittances major Remitly reported that its use of AI as a means of first-line customer support had helped drive a 260 bps reduction in non-GAAP expense in the quarter, with CEO Matt Oppenheimer saying that the company’s virtual AI assistant was “really unlocking tangible value to the customer and to the business”.

“The speed of resolution, the therefore cost efficiency gains and the percentage of customers that resolve the issue without having to then be transferred to an agent – a member of our team – is really exciting,” he added.

However, Remitly has not reported any job cuts associated with its use of AI, and has seen its total headcount increase in recent years.

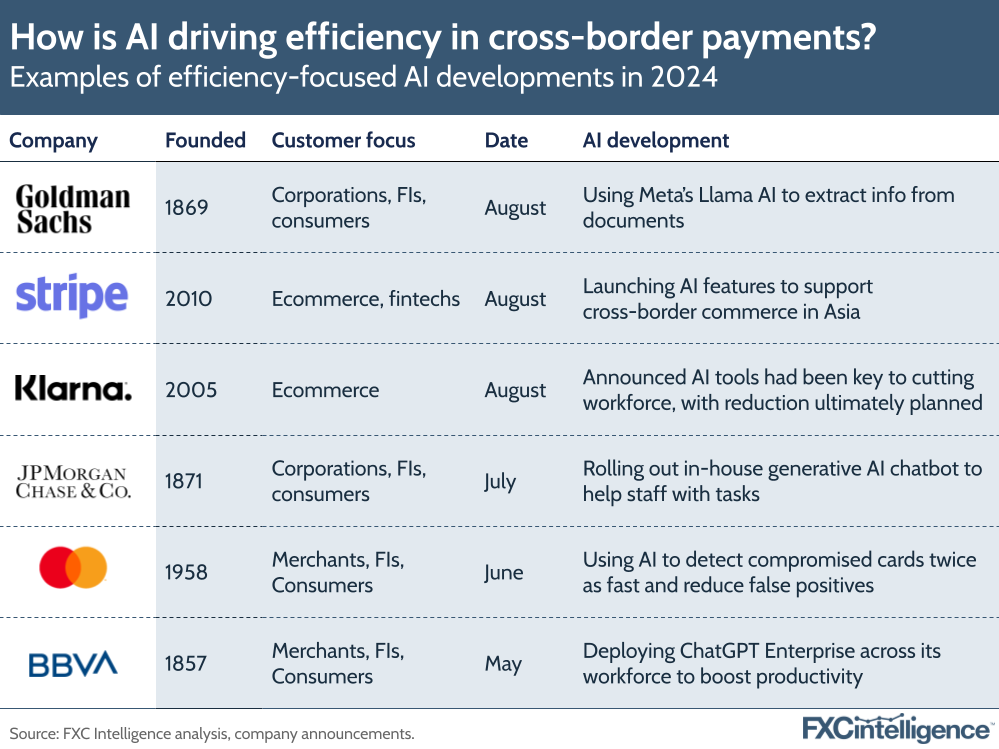

Meanwhile, others are investing for longer-term benefits, with several major banks currently focused on building AI-powered workforces. After becoming the first European bank to become a ChatGPT Enterprise partner in May, BBVA last month announced several hundred new roles at its AI research centre in Spain. Canada’s CIBC has also announced plans to hire in this area, with the addition of a further 200 data and AI specialists over the next year.

Other bank players are focusing more on AI tools, with Goldman Sachs among those named as using Meta’s open-source Llama AI models, which it reportedly uses in an AI solution to quickly extract information from documents. JPMorgan Chase, meanwhile, has rolled out an in-house GenAI chatbot for staff to use, characterising it as akin to having a ‘research analyst’ to help thousands of developers and call centre employees with writing, idea generation and the summarising of documents.

Away from banks, others in the space are also broadening their use of AI-based tools. Stripe has integrated AI into its Optimised Checkout Suite in order to support cross-border commerce for its Asian customers, while Mastercard in May announced that it was using GenAI to enhance its fraud detection capabilities.

There are also those using the technology to make new launches in the space, with Skyfire Systems, a startup founded by former executives from Google and Ripple, being a notable recent example. In August the company launched what it claims is the world’s first payment network specifically built for fully autonomous transactions – that is, payments conducted without direct human intervention by AI agents, large language models, data platforms and service providers.

Lessons for companies looking to adopt AI

For Klarna, AI has proved to be a powerful driver of cost efficiencies and therefore profit, and is likely to have been critical to its ability to reach break-even in the most recent financial quarter. By committing fully and quickly to products rolled out by OpenAI, the company has been able to provide extensive daily support to staff and reduce its headcount significantly in the process.

However, Klarna has engaged with this at such speed because it is working to a deadline focused around its IPO, and it has arguably come at the cost of employee satisfaction – something that may pose problems in the long-term.

For companies looking to increase their use of AI, Klarna provides a showcase of what is possible with high levels of commitments to the technology, and how it can impact different parts of a company’s operations.

Consumer-facing payments companies are likely to be those with the most to learn from Klarna’s AI projects, and particularly the use of its virtual assistant to improve time to resolve and cut operational costs. However, the use of AI to support sales, marketing and other operational roles, as well as assist engineering staff, also has potential across a broad range of company types.

For those not on Klarna’s deadline, however, there may be a case for exercising some caution. In addition to the potential for staff and customer concerns, GenAI can pose issues around data accuracy, requiring additional fact-checking to be built into any process making use of it, and may not integrate easily with all company systems – particularly if an organisation is running multiple legacy solutions.

As AI becomes more widespread, there is also the potential for societal impacts. Earlier this year, the IMF projected that 40% of all jobs will be impacted by AI, a number that rises to 60% when looking only at advanced economies. It also found that the technology risked widening economic inequality, particularly in regions where workforces lacked the skills or infrastructure to engage with the technology.

For those working with AI, it is therefore a matter of measured engagement. Any use of the technology needs careful consideration within the context of the organisation it is being implemented in. Klarna may not provide an instantly replicable model for the use of AI, but it does showcase what is possible.