MoneyGram has made a push into the cryptocurrency space, with the ability to convert crypto to cash through a partnership with Stellar.

Converting cryptocurrencies into cash can be an expensive and potentially time consuming process, and while there are a variety of digital solutions, there are few options that allow people around the world to turn their crypto holdings into hard fiat currency. However, remittance major MoneyGram has been taking on the challenge as part of a growing partnership with blockchain player the Stellar Development Foundation.

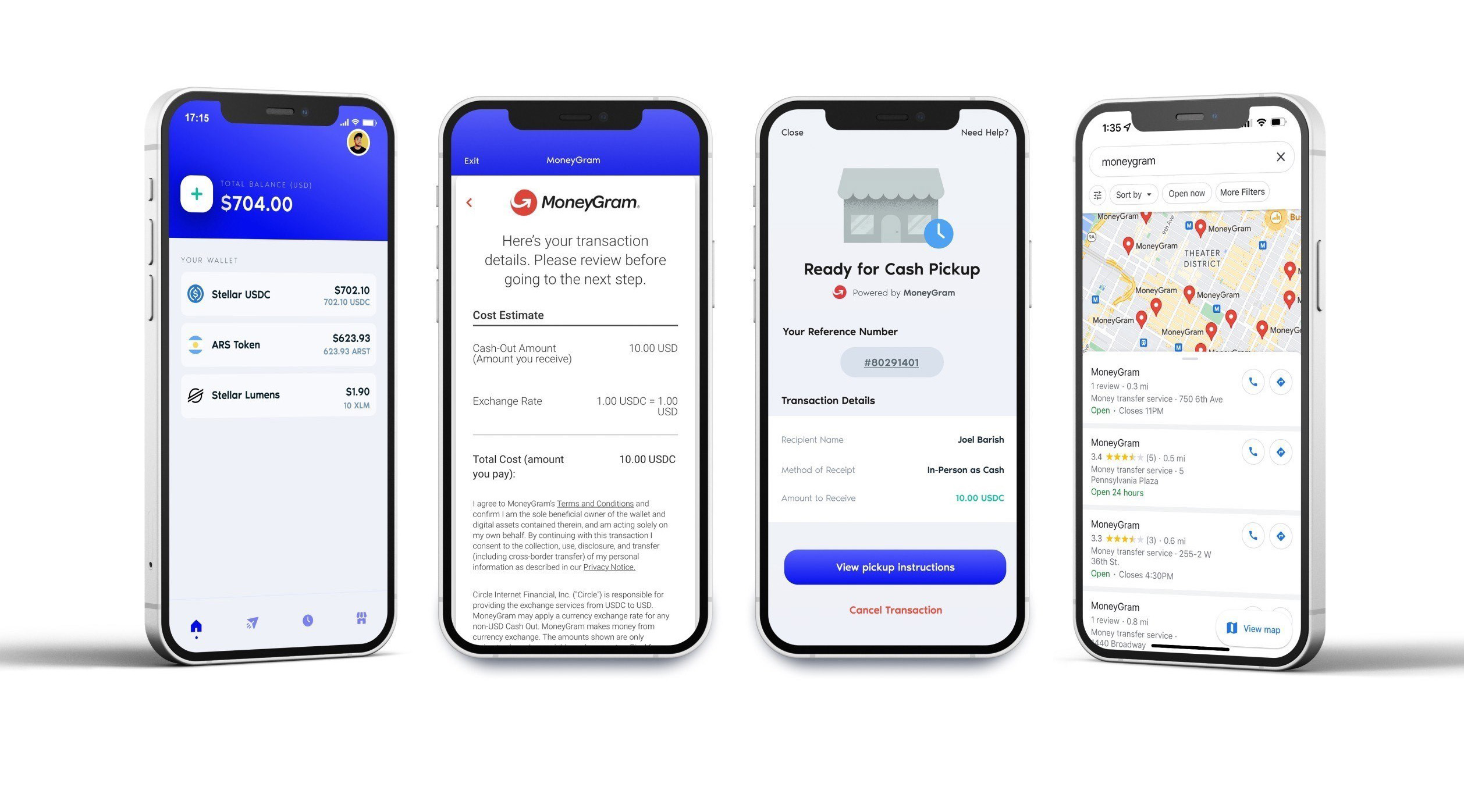

First announced in October 2021 but expanded in June 2022, the service enables cryptocurrencies to be purchased using cash or crypto to be converted back into fiat cash at MoneyGram locations, using the Stellar blockchain and Circle’s stablecoin USDC. Through this, customers can send USDC to others as a form of remittance, before it being cashed out at a MoneyGram location, or use it as an on or off ramp for other cryptocurrencies such as bitcoin by converting their USDC.

As a result, it enables those in cash-based economies to access and utilise crypto without needing a bank account or credit card – something that was not previously available to them.

“For us, it’s really about how you help bridge fiat and crypto, and then also, how do we bring some utility to that space,” explains Alex Holmes, CEO of MoneyGram.

Crypto to cash via MoneyGram

One of the things that makes the project unusual is that it provides an on and off ramp for non-custodial wallets – that is, digital currency wallets that are independent of a specific crypto exchange or related service.

“If you think about anyone that has a custodial wallet, you’re storing your crypto at an exchange, Coinbase, Binance, etcetera,” says Holmes. “You have ways to get your money in and out – not that they’re necessarily efficient or affordable – which let you convert fiat back to crypto and so forth.”

By contrast, a non-custodial wallet gives the holder more freedom in terms of what they can do with their crypto, but this has traditionally limited their ability to convert it back into cash.

“When you’re in a non-custodial wallet, you effectively have ownership keys to your own crypto; you can do a lot in the blockchain and in the crypto space as long as you are staying in crypto,” he explains. “But you’re isolated in terms of exchanging it back into fiat.”

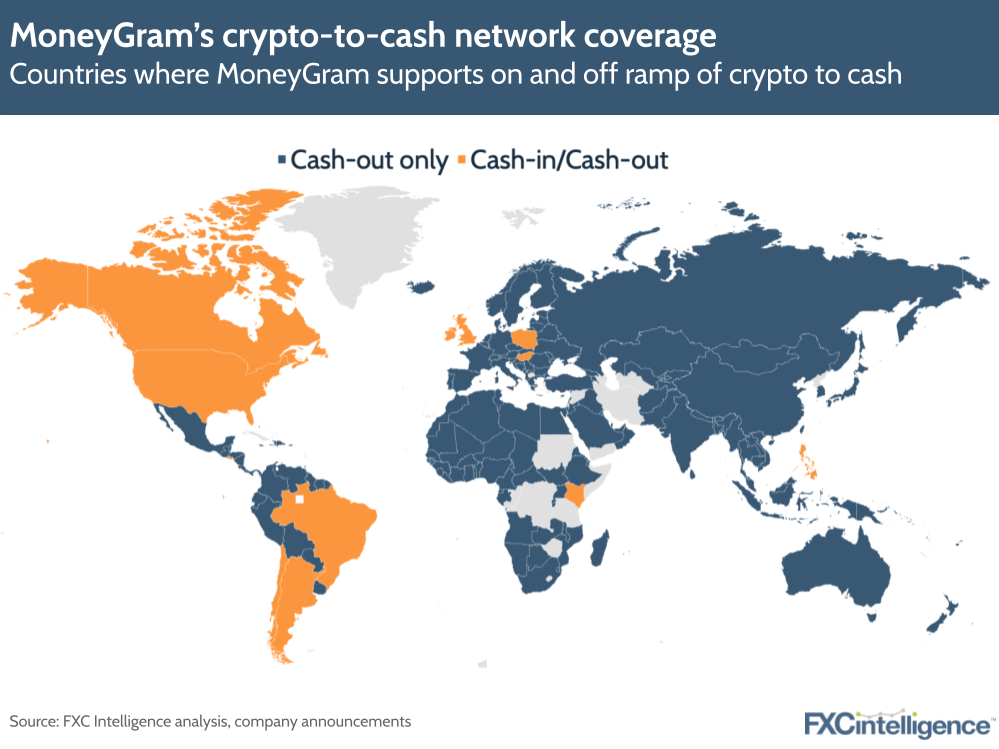

MoneyGram’s solution is designed to respond to this, with the company now able to convert USDC to cash in all the regions it is legally able to offer the service – over 190 countries, as well as support for cash to crypto conversion in 15+ countries and rising. Transfers are near instant, and MoneyGram receives the settlement before it pays out to the customer, which is unheard of in the traditional remittance space.

The offering, says Holmes, is a natural extension of MoneyGram’s core business as it is “just another type of foreign exchange”, but is especially timely given the crypto downturn, with many holders now looking for an accessible way to cash out without losing significant amounts to fees.

“People are getting worried – the value of bitcoin is going down – so if you’ve got bitcoin or other coins in your non-custodial wallets, if you’re getting a little nervous, you want to convert that to cash, you now have an easy off ramp for that,” he says.

“You can pull that straight down and go to any MoneyGram location and pick that up.”

Shifting mindsets around money transfers

While non-custodial wallets are currently the focus, with MoneyGram offering the service with zero fees for the first 12 months, the company is also looking at expanding into custodial wallets too. This would see them provide custodial wallet holders with more options to move money in and out of crypto, with more affordable rates than are currently available through exchanges.

In the long term, however, Holmes sees this kind of on and off ramp between crypto and cash as “changing the paradigm around what moving money and sending money means”.

“When you think about many of the DeFi applications and the payments applications, what people are saying, ‘moving crypto is easier and faster, and it’s better than fiat’ – there’s a lot of arguments that can be made that that’s true. The problem is 100% of the world’s payment applications run on fiat currency, and you’ve got exchange fees, you’ve got expensive rates, etcetera,” he says.

“We’ve actually created theoretically our own exchange application. If a consumer comes to MoneyGram, creates a non-custodial wallet and pushes funds into it, that then can become crypto and then they have the interoperability and way to exchange that back, it gets pretty interesting, pretty fast.”

Holmes gives the example of sending money to Argentina, where if a person is sent USDC rather than pesos, they have the option of keeping it in USDC and using it for crypto-related applications or converting it to pesos.

“We’ll see what happens with crypto, how it gets regulated, the longer term implications of it,” he says.

“But creating that interoperability, having that integration onto the Stellar blockchain directly into our systems, it starts to create different permutations on use cases and opportunities for consumers to think about how to send money around the world differently.”

At present, cryptocurrencies have largely been treated as a savings asset rather than a means of moving money – something that Holmes attributes to most products so far focusing on those who are “already fairly digital in their thinking”. However, he sees the potential for this to change.

“We’re a little bit early in really understanding: can we take the products that we’ve created and actually drive new remittance users into the market?” he says, adding that this potential may be expanded by the addition of a non-custodial wallet directly tied to MoneyGram’s offering.

“Right now we don’t have a non-custodial wallet and technically Stellar doesn’t either: these are third party wallets. I’m not trying to make any representations about that, but in the future, could MoneyGram launch its own type of non-custodial wallet? Yes.

Building transparency and compliance in the crypto space

Any such wallet has the potential to create new compliance challenges for MoneyGram, although Holmes does suggest that the company would likely utilise third parties in order to avoid taking direct custody of digital currencies, and therefore avoid some of the most challenging regulatory issues.

However, the space does post more existential challenges from a regulatory perspective.

“The non-custodial wallet is a totally different and interesting question because technically they don’t exist,” he says. “All you’re really doing is providing a piece of software that enables a consumer to own crypto on the blockchain, which theoretically doesn’t have a home.”

This, he says, “blows your mind”, because it fundamentally changes the geographical approach typically used to regulate fiat.

“Say I’m a Argentinian citizen currently traveling in Europe, and I decide I want to sell some crypto and turn it into USDC, where is that transaction actually occurring? Where’s the money?” he asks.

“There’s a lot of evolutionary stuff that’s going to have to happen from a regulatory perspective, and tax implications and all that. But it’s a pretty fascinating growth.”

The challenges may be quite different than for traditional remittances, but it is clear that crypto, including stablecoins, are seeing increasing regulation, particularly in light of recent market turmoil, as well as the collapse of algorithmic stablecoin UST.

“It’s going to create some turmoil and some chaos, but I think it’s going to bring us into a much more positive place. It is going to force some regulation and some change,” says Holmes, adding that the wide range of crypto types – including stablecoins, ICO coins, corporate coins and similar – create complexity in attempts to legally define the space.

However, he sees the company’s crypto to fiat service creating increased transparency in a space that is historically deeply opaque.

“Our view is that you have to treat it like a standard KYC process, so what we’re doing is pretty unique,” he says.

“You take a non-custodial wallet, which usually doesn’t have a name: it has nothing. When you do the MoneyGram transaction, we’re actually taking that ID directly and we’re locking it into MoneyGram as your name, your address, your birthday, your ID.

“That’s what we need to see at the point of sale, so we’re taking something that really doesn’t have visibility, and actually creating visibility to it.”