Consumer behaviour is increasingly shifting towards the convenience of mobile applications for remittance, and companies need to keep up by providing a seamless and intuitive user experience. We explore payment-related features and the costs incurred for each of the transfers in our analysis.

This is the second report in our remittance benchmarking series. In the first report we compared the different user journeys of signing up to remittance mobile apps and completing a money transfer. In this report, we will continue with the same six providers and explore payment-related features and the costs incurred for each of the transfers in our analysis.

Below are the providers we benchmark. They were chosen based on their market leading positions and ability to remit money to France, the destination of our money transfers, via the mobile applications:

- MoneyGram

- Ria

- Western Union

- Wise

- WorldRemit

- Xoom

Contents:

Looking for parts one and three?

Benchmarking Mobile Remittance Apps #1: The registration journey and making the first transfer

Benchmarking Mobile Remittance Apps #3: Customer service and other UX features

Methodology

To carry out this exercise, a member of our team registered and processed money transfers as a new customer with six remittance providers.

All benchmarking was carried out solely through mobile applications, hence company websites were not used as a comparison factor in any of the sections.

The data gathered is based on actual money transfers of £10 transferred from the UK to France (GBP to EUR) through the six providers listed above. All mobile applications were downloaded from the iOS App Store UK.

The main elements measured in this report are:

- Number of hours it took for funds to arrive in the recipient bank account.

- Pay-in and pay-out options available through the phone applications.

- Pricing variation – factors affecting money transfer prices, fees (in GBP) and FX margin (as % of the transfer amount).

Key takeaways

Payment features and costs

In this report we explore payment-related features such as paying-in and paying-out methods as well as how long it takes for funds to arrive.

Additionally, we discuss variations in money transfer costs and present transfer fees and FX margins for the money transfers carried out for this benchmarking series.

- What pay-in and pay-out methods do the remittance apps offer?

- How long does it take for funds to arrive in the recipient’s bank account?

- What factors affect pricing? Comparing fees and FX margins of transfers – fees and FX margins.

What pay-in and pay-out methods are offered in-app?

Remittance providers generally offer several options for senders to pay for transfers (pay-in) and for recipients to collect the money (pay-out), to accommodate customers’ preferences. The main paying-in choices are:

- Paying by credit or debit card – this is the most efficient and speedy way to process a transfer as it is carried out directly through the app.

- Bank transfer – transferring money to the remittance provider’s local bank. This would prompt users to go through the whole journey of processing the transfer via the app and, additionally, to set up a bank transfer through their own bank. Some providers aim to simplify this process via open banking which would create a similar user journey as a card payment.

- Paying in cash at one of the nearest branches – this is the most time consuming as senders have to commute to a physical location and then process the transfer. However, these transfers are often available immediately for cash pick-up on the receiving side, which is faster than processing a bank transfer to be picked up in cash.

In terms of receiving the funds, the recipient has two main choices:

- To receive it directly to their bank account.

- To pick up the transfer in cash from a local branch or agent.

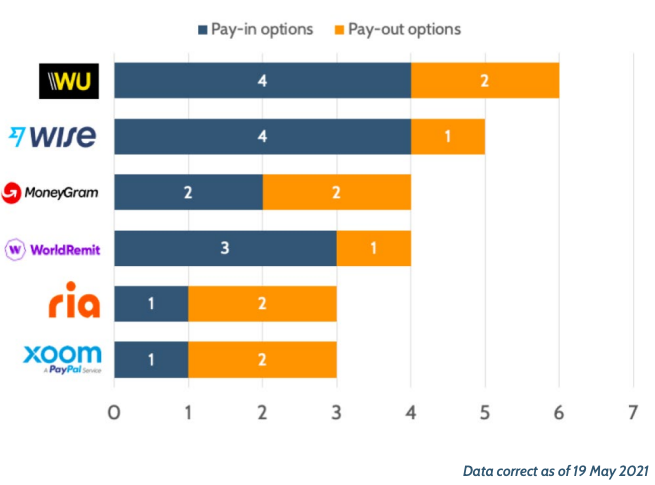

Figure 1

Pay-in options offered by remittance apps, sending from the UK to France

Western Union offers payments by credit or debit card, bank transfer, and cash. To receive the funds, customers have the choice of bank account and cash pickup. The provider is also offering a unique service to pay via Klarna, – a ‘buy now pay later’ company.

Wise offers paying-in by card, bank transfers as well as Apple Pay – one of the two providers offering this feature. It offers pay-outs solely to bank accounts.

MoneyGram allows payments by debit and credit cards and by cash, and bank transfers and cash pickups as the pay-out options.

Ria is the only provider to offer a home delivery service in addition to the bank account and cash pay-out options.

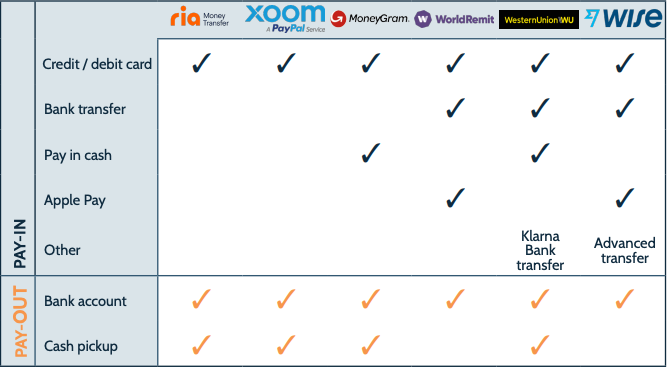

Figure 2

Pay-in and pay-out options offered by remittance apps

All six providers offer the possibility of paying with a credit or debit card as a minimum. Ria and Xoom offer this as the sole pay-in method through their mobile apps. The ‘other’ payment options reflected in the table above include Western Union’s Klarna bank transfer, Wise’s advanced transfer, and Ria’s home delivery service.

Klarna allows customers to ‘buy now, pay later’ or in this case transfer now and pay later. This is a fitting and original partnership for a remittance provider. Wise’s advanced transfers cater for less common instances such as customers sending money using GBP accounts from outside the UK or EUR accounts from outside Europe.

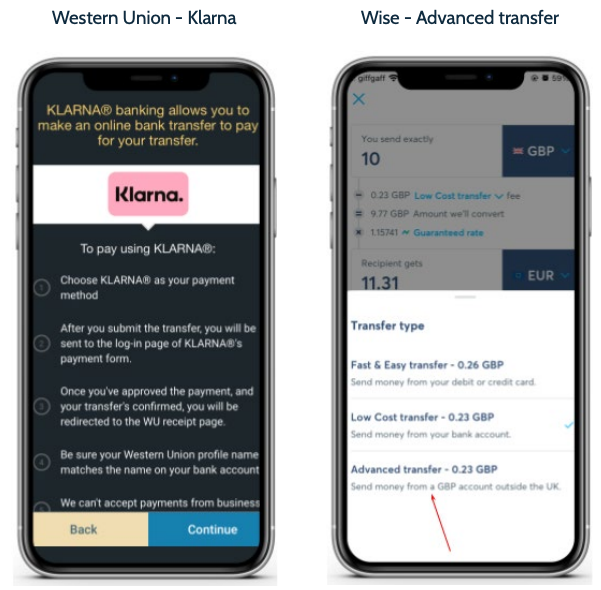

Figure 3

Additional payment methods

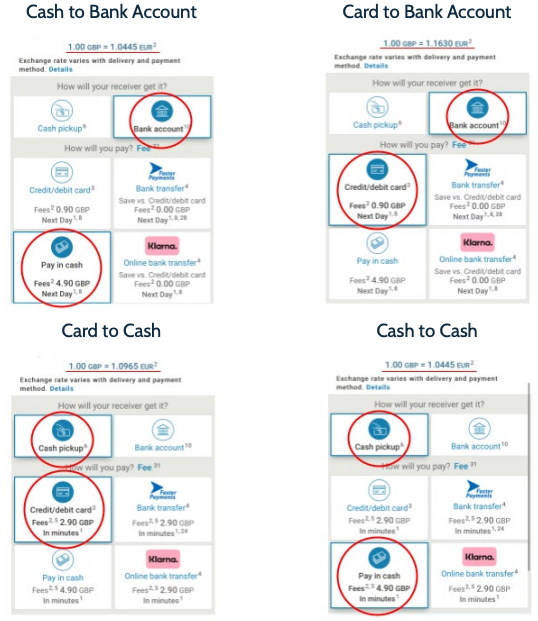

It is worth noting that different pay-in and pay-out methods bear different costs – not just in terms of the transfer fee but also in terms of the FX rate. For example, cash pay-in and pay-out methods are usually the most expensive. This variation in cost isn’t obvious to end users, unless they go through each method individually and compare them.

Figure 4

Fee and FX rate variation between different pay-in and pay-out methods

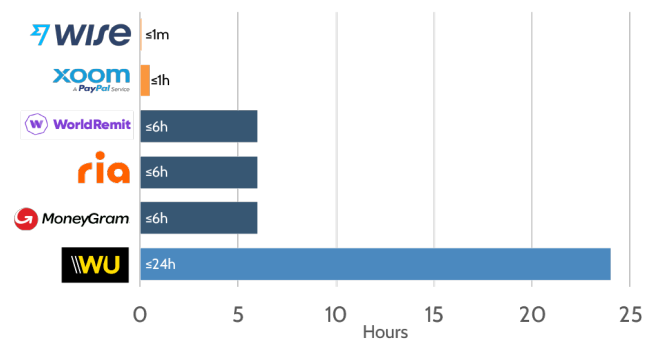

How long does it take for funds to arrive in the recipient’s bank account?

In the first report of this series, we measured the time for different factors including time to register with remittance companies and time to complete a money transfer. In this section, we compare the processing time of money transfers, i.e. from the moment each transfer was placed to the moment funds arrived in the recipient’s bank account.

Each money transfer was carried out at the same time of the day, on separate days, to account for possible external factors causing delays.

For this test transaction, Wise is the only provider to process and transfer money instantly – the transfer arrived in the recipient’s bank account in a matter of seconds. The funds transferred through Xoom were the second fastest to arrive, within 30 minutes.

WorldRemit, Ria, and MoneyGram reflect the median amount of time it takes for a money transfer from the UK to arrive in France – approximately six hours. With Western Union, the funds arrived in the bank account in 24 hours.

Figure 5

Processing time of money transfers: time for funds to arrive in the beneficiary account (debit card pay-in method to bank account pay-out)

Variation in money transfers

In this section we will discuss the costs of money transfers and how these can vary.

Remittance companies generally have elaborate pricing strategies which are subject to many factors including transfer amount, country corridor, pay-in and pay-out methods, FX margins, transfers fees, etc. These bring additional complexities to cost benchmarking, therefore all elements should be taken into account to have an accurate comparison.

To benchmark providers from the consumers’ perspective we give a snapshot of the costs of money transfers for a specific corridor, a set pay-in and pay-out method, and specific amount in Figure 6.

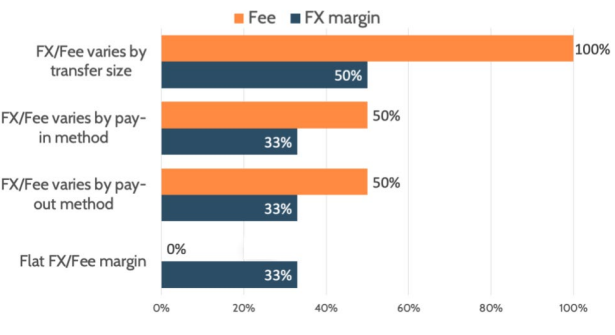

Price variation

In the chart below, we illustrate how providers vary their pricing strategies based on the following four factors: transfer size, pay-in method, pay-out method, flat fee and FX models. This is representative of the six providers studied in this report, for the UK-France corridor.

For example, three providers (50%) in this group vary their FX margins based on the pay-in method, and all providers vary their fees based on the transfer size. This further supports that in order to benchmark providers, all factors should be kept constant.

Figure 6

Price variation across the six money transfer providers for the UK-France corridor

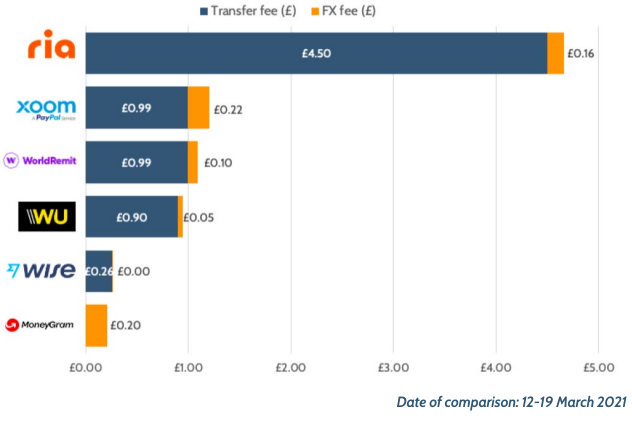

Sample transfer costs

To provide a complete picture of the benchmarking journey, we present the costs incurred for our sample of £10 money transfers. It should be noted that these transfers were carried out for the purpose of comparing different aspects of providers’ user experience and not specifically to compare costs.

As such, these transfers bear a nominal amount of £10, which isn’t necessarily representative of a typical transfer amount. The costs are representative of the GBP-EUR corridor exclusively (UK to France) and specifically for the ‘card to bank account’ pay-in and pay-out methods.

As such these costs do not reflect a comparison across all corridors and all pay-in or pay-out methods which are additional layers of complexities to account for, which we highlighted above. It does, however, provide a comparable view as the transfer amount has been kept constant across all providers.

Figure 7

The cost of sending £10 from the UK to France: FX and transfer fees

MoneyGram didn’t charge transfer fees for the £10 transfer to France and is thus on the lowest side of the chart. On the other hand, Wise was the only provider in this group to offer interbank rates for transfers, and thus only charged a transfer fee.

The provider that stands out the most is Ria – it charged the highest transfer fee of £4.50 as well as a 1.6% margin on the FX rate (£0.16), bringing the total cost of a £10 transfer to £4.66.

WorldRemit aims to entice new customers by offering a promotion. The provider waives transfer fees on the first three transfers for new customers.

It is worth noting how providers incorporate fees into the transfer. For example, Wise subtracts the transfer fee out of the amount to be sent whereas all other providers charged the fee on top of the send amount. These charges can amount to significant sums therefore it could be beneficial for users to have the choice at which end they can pay the fees.

As illustrated above, there are two components to money transfer pricing – the FX margin (or FX cost) and fees. Both are equally important and should be taken into account when analysing the costs of money transfers. For consumers, comparing providers’ FX margins can be impractical thus, stating this explicitly could improve the user journeys and gain trust based on the fee transparency.

Highlights

One of the features that stood out when comparing the costs was “How Wise compares”. This feature indicates what the recipient would get if the same amount is transferred through its competitors even if these are cheaper.

This additional comparative data highlights the transparency of its charges. It might convince some people to create a new account with Western Union or MoneyGram because these may be marginally cheaper in certain cases but users might also take into account how streamlined the process is, the speed of transfer and the additional element of transparency and thus decide to transact with Wise regardless.

Conclusion

This report focuses on the payment element of the money transfer journey. Particularly, it dives into payment-related features such as pay-in and pay-out options offered through the apps and the number of hours it takes for funds to arrive in the recipient’s bank account. It also explains the price variation of money transfers and the costs incurred for a sample of transfers from the UK to France, both transfer fees and the FX margins.

This follows on from the first report of our benchmarking series “The registration journey and making the first transfer” and will be succeeded by the final report on “Customer service and Other UX features” which will also compare additional features such as notifications and tracking, card-scanning, global address lookups, and good and bad UX practices.

A point of comparison in the report was pay-in and pay-out methods supported on mobile apps. All six providers offer the possibility of paying for a money transfer with a credit or debit card, and to receive the funds in a bank account, as a minimum. Western Union offers the largest choice of payment options – users have the choice between four pay-in methods and two pay-out. It also offers a unique service of paying with Klarna, a ‘buy now pay later’ provider.

With regards to the speed of transfers, Wise is the fastest provider to process the funds, which arrived immediately, and the only one to do so. Xoom processed the transfer in half an hour, and on average it took six hours for funds to arrive into the recipient’s bank account.

The last section of the report presents the pricing complexities of money transfers. It highlights that money transfer pricing varies due to factors such as transfer size, pay-in method, pay-out method, flat or percentage-based structure. Therefore, in order to provide a holistic benchmarking, all these factors should be considered.