After FXC revealed its Cross-Border Payments 100 for 2024, we’re once again breaking down the data about the companies included to give insights into how the industry is shaping up.

Now in its sixth year, our Cross-Border Payments 100 recognises the most important players in the cross-border payments industry, spanning online ecommerce players, banks, money transfer providers, B2B payments and more. Last week, we published a comprehensive report on our 2024 Cross-Border Payments 100, featuring complete bios and information on all 100 companies in our Top 100 list.

While the makeup of companies on our map this year has changed slightly, our primary criteria has stayed the same: companies make our list if there would be a meaningful impact if they were removed from the sector. For this reason, analysing where these players come from, how old they are and who they serve provides further insights about the wider cross-border payments industry.

First of all, here’s another look at our market map for 2024:

Our map has seen a few new entries this year, including Apple and Google, on account of the global success of their digital payment methods; ecommerce giants Temu and Shein; global payroll companies Papaya Global and Deel; and LatAm-focused players DolFinTech, Grupo Elektra and TransNetwork.

Other new entrants include Worldpay (now a standalone company after its departure from FIS), B2B payments provider SUNRATE and CAB Payments, which joined our public companies section after its much publicised IPO last year.

Several of the entrants on our list this year – including SUNRATE, CAB Payments, Papaya Global and Inpay – were also featured on our 30 Most Promising Cross-Border Payments Companies for 2023.

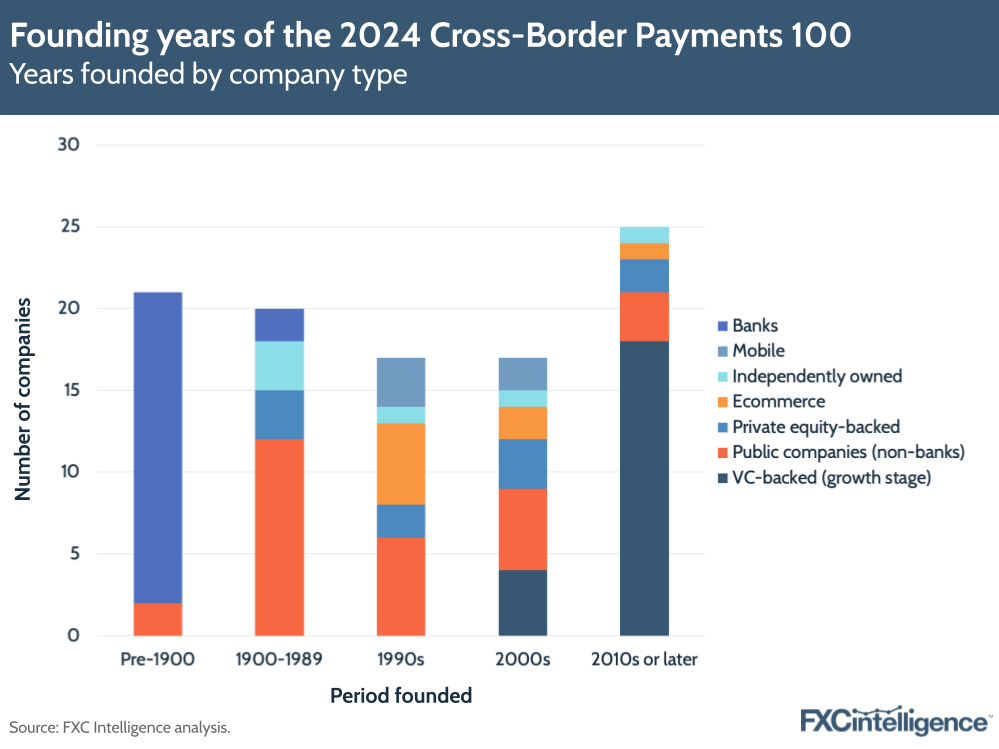

Most companies on our list were founded after 1990

As with previous maps, we split our Top 100 across a number of categories, including ecommerce players, banks, mobile payment services, VC-backed (growth stage), public companies (non-banks), independently owned companies and private equity-backed companies.

This year, we continue to see the prominence of established financial institutions (banks) on our cross-border payments list, with the majority of these having been founded more than a century ago.

At the other end of the scale, a large proportion of the companies on our list were founded after 2010, with VC-backed companies making a particular appearance in the 2000s and 2010s or later. Venture capital saw a surge in the 2010s, with more seed funding going into businesses at earlier stages, helping establish startups as global players much more quickly.

While the VC market has grown more challenging amidst the inflation seen in recent years, the space has continued to see some major investments this decade, such as Revolut’s $800m funding round in 2021 and Flutterwave’s $250m round in 2022.

Another relevant trend that has impacted our Cross-Border Payments 100 list has been a move from public to private equity backing over the last few years. One example is money transfer player MoneyGram, which went private in 2023 after being acquired by private equity investor Madison Dearborn Partners. Another is Worldpay, which was bought by FIS in 2019 and subsequently sold to GTCR, another private equity investor, last year.

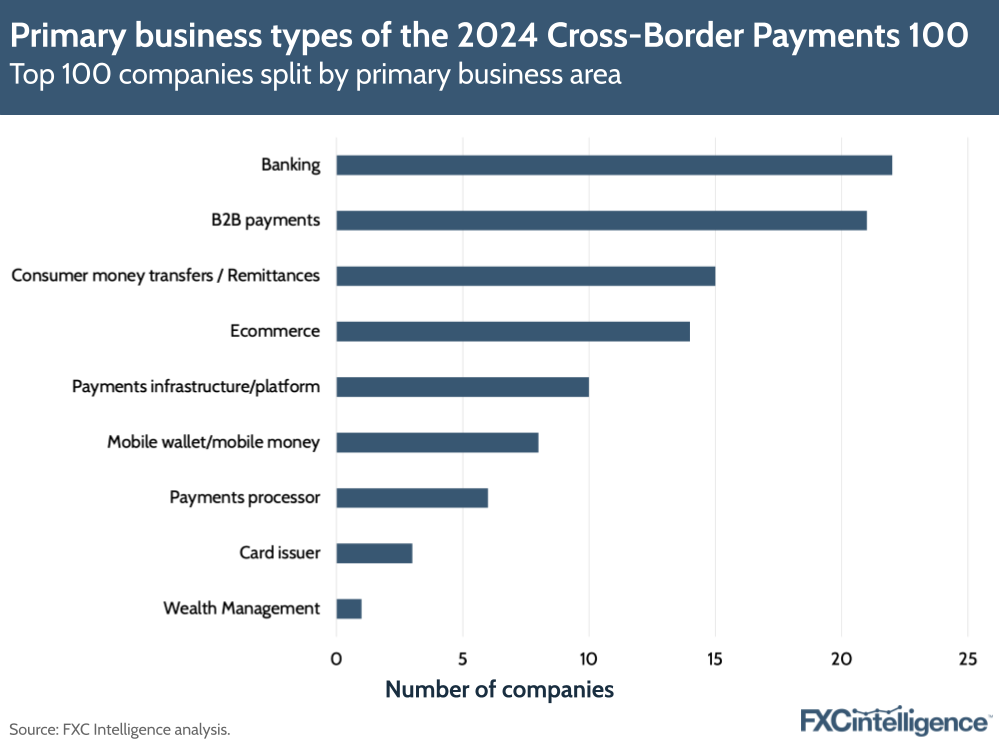

Companies on our list mainly have a banking or B2B payments focus

Companies on our list often cover multiple services related to cross-border payments, so we’ve also broken them down based on their main business focus. While some are more focused on the consumer side (e.g. money transfers providers like Western Union), others primarily target businesses (B2B payments).

Looking specifically at companies’ primary business area, we found that 22 of the companies on our list focused on banking services, with B2B payments services as the next biggest category (21 companies). The next highest categories on the list were consumer money transfers/remittances, followed by ecommerce, which contains players enabling cross-border services to consumers.

Out of the total companies on our list with B2B payments as a main focus area, 71% of them were founded in or after 2000, with 43% founded in 2010 or later. Looking at the companies on our list that were founded in 2010 or later, 36% of them had a B2B focus, compared to 35% of companies founded in the 2000s and 6% in the 1990s. This reflects a shift that we have seen in the cross-border payments space as companies look to capitalise on B2B payments, a fragmented market with no clear frontrunners.

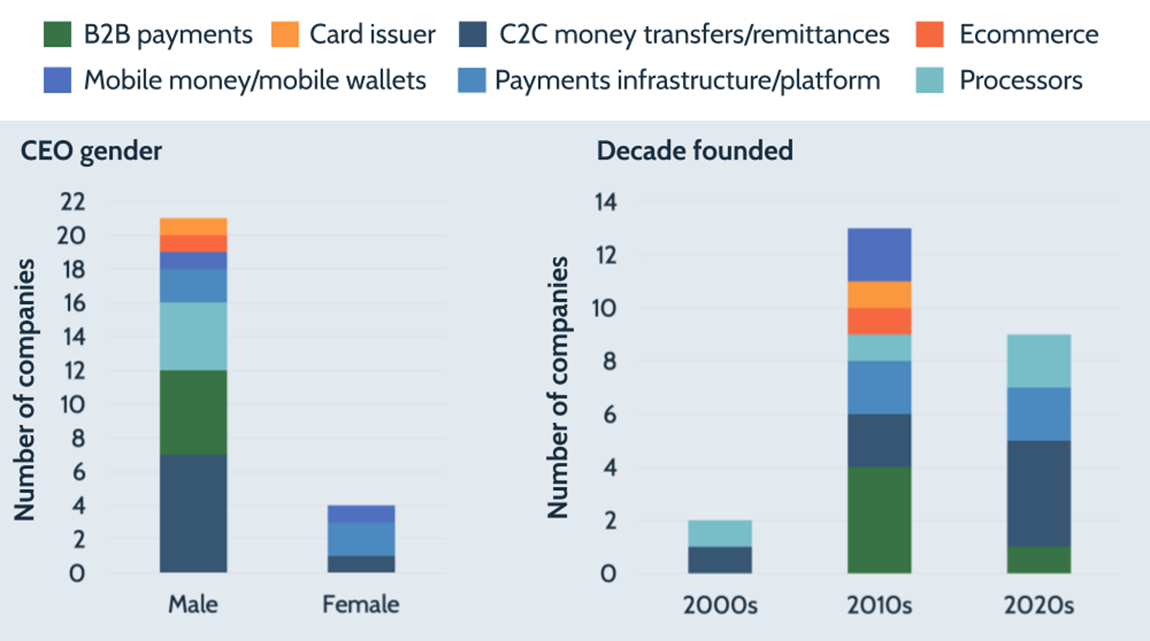

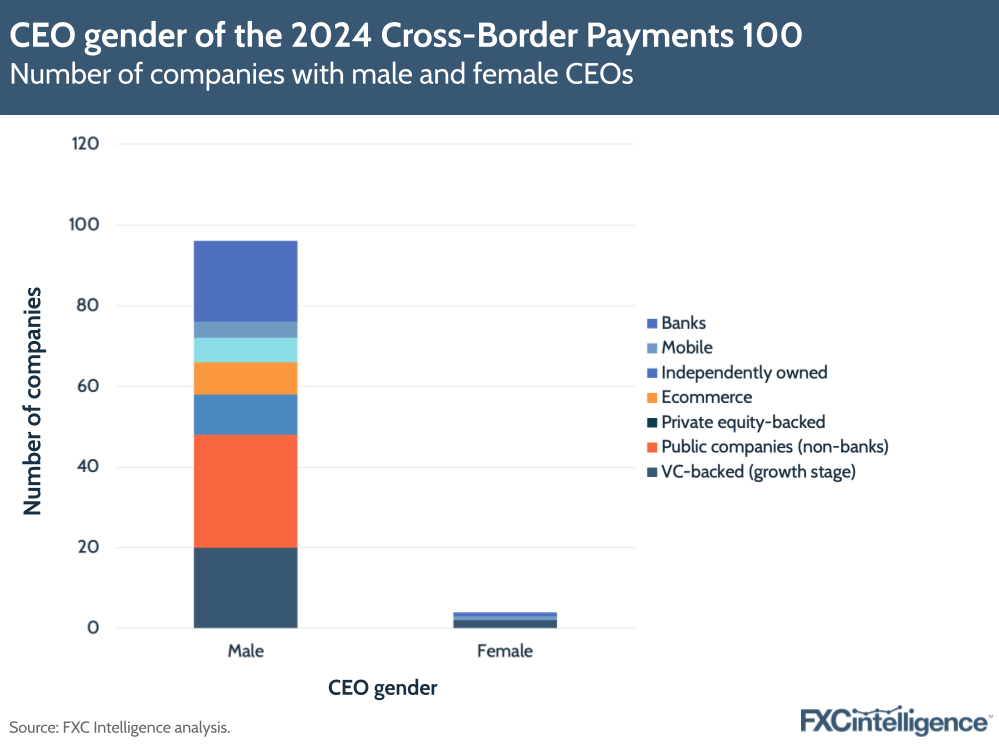

Gender diversity is still a challenge for global payments

This year, only four companies – namely Citi, Orange Money, Transfermate and Papaya Global – had a woman as CEO or in an equivalent leadership role, highlighting an ongoing diversity issue amongst the most senior roles at cross-border payments companies (though this will improve with incoming Expedia CEO Ariane Gorin, who is set to take over from Peter Kern in May 2024).

Though women continue to play a role at C-suite level and in senior roles across many of the businesses we track, it is telling that the most senior position at almost all of the companies on our list is occupied by a man. It should be noted that in a few cases companies either do not disclose their CEO or do not have a named CEO. In these cases, the most senior relevant executive/official has been named.

The industry’s progress on gender diversity was discussed in our historical analysis of our Top 100 reports last year, in which we found that internal promotions and long-term incumbent CEOs have made it harder to diversify at the top level.

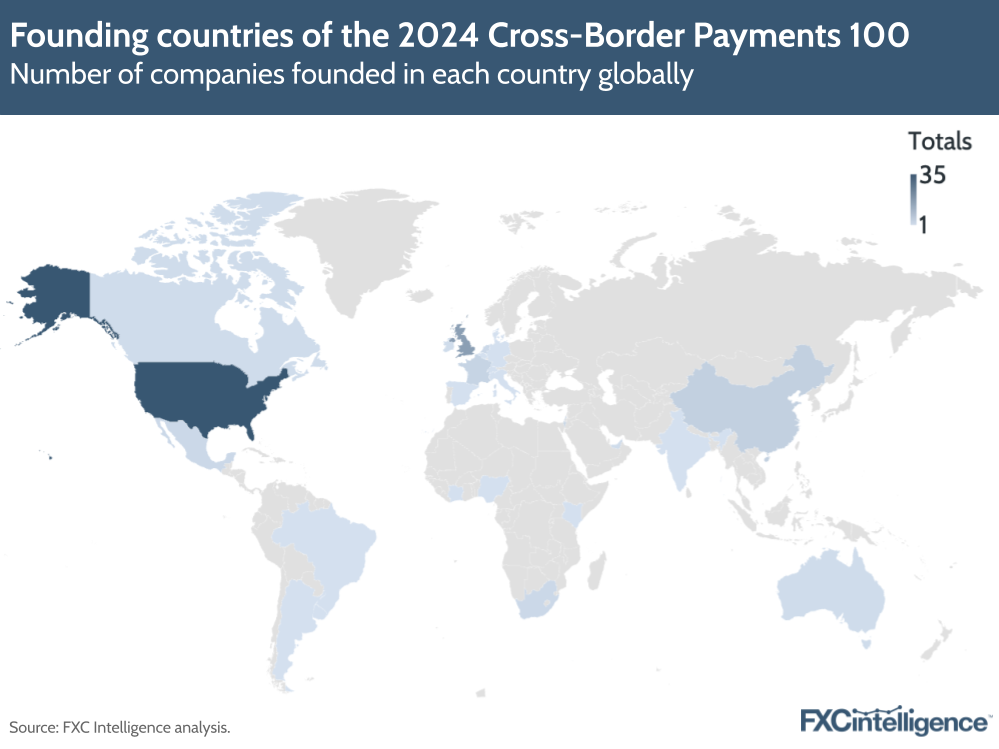

The US remains a strong breeding ground for cross-border payments – but emerging markets are key too

Out of 100 companies in our 2024 list, 35 were founded in the US, while 17 were founded in the UK. With the exception of these frontrunners, companies have been founded at a diverse set of locations worldwide.

Breaking it down by region, 37 companies were founded in North America (the vast majority in the US), with the next highest number of companies being found in Europe (32) and Asia (11). The Middle East, Africa and South America each had six companies founded there. Across all three of these regions, there are a higher number of companies featured than when we first started our market map in 2019, which reflects the industry’s shifting attention to emerging markets.

Several additions this year have focused more on the LatAm market, including DolFinTech, Grupo Elektra and TransNetwork, which serve money transfers; ecommerce and financial services; and B2B payments respectively.

It is also notable that several players on our list were founded in different places to where they are based. One example is Shein, which was originally founded in China but has since relocated its headquarters to Singapore.

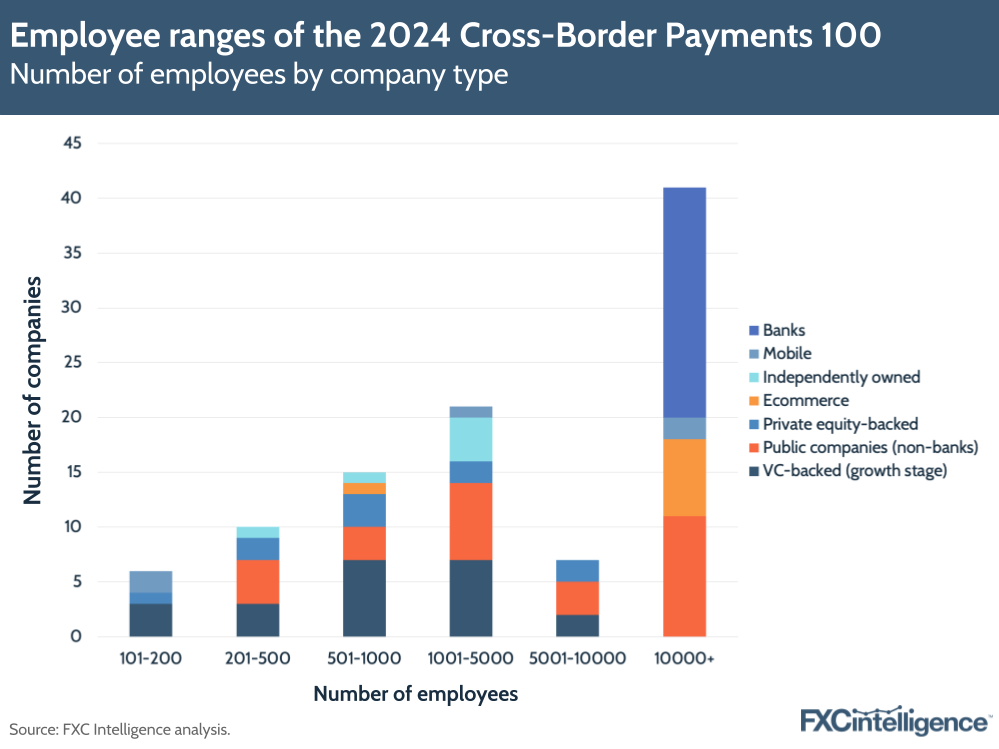

Employee numbers highlight growth of VC-backed companies

Banks and ecommerce players on our list have a global presence, with offices around the world, which explains why the majority of companies across these categories have more than 10,000 employees. Aside from banking and ecommerce, companies in other categories on our list are distributed much more evenly across employee ranges.

Employee numbers are by no means a singular measure of growth and as we’ve seen in the industry, some companies are cutting back on expanding employee numbers to help drive profitability. However, it is interesting that many of the VC-backed companies on our list already have more than 1,000 employees, which reflects how these companies have been able to scale rapidly in a short amount of time.