After a challenging few months, MoneyGram has finally gone private via an acquisition by Madison Dearborn Partners. CEO Alex Holmes discusses what the company plans to do next.

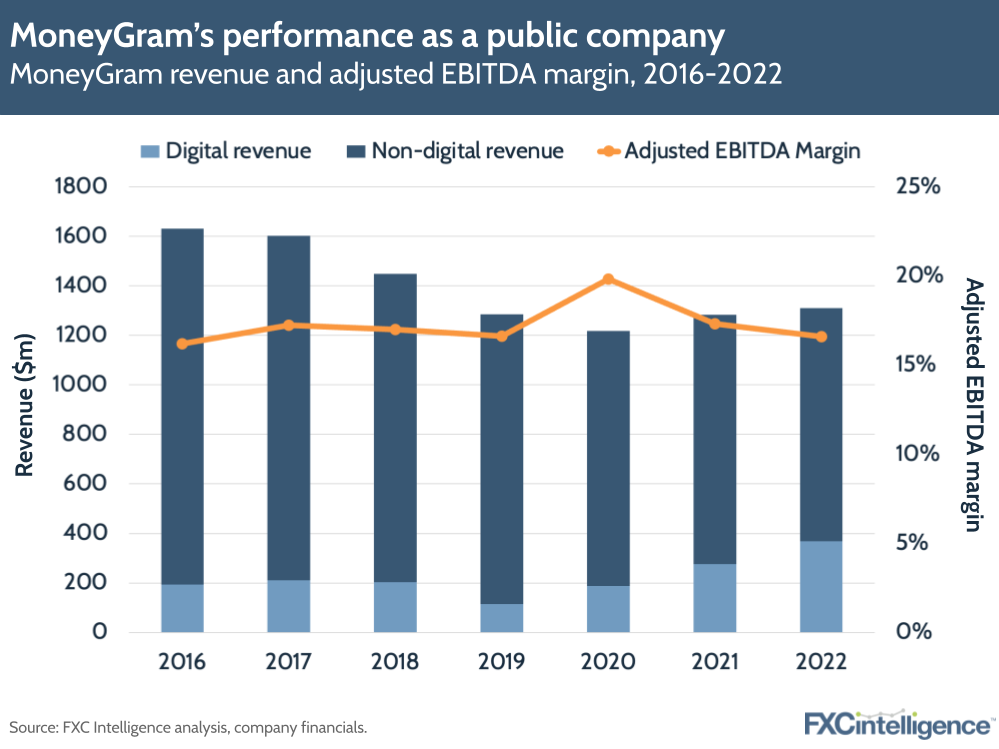

After months of regulatory wrangling, money transfers major MoneyGram has gone private through an acquisition by private equity firm Madison Dearborn Partners. Marking the end of a 19 year-long stint on the NASDAQ, the move positions MoneyGram to make plays that don’t have to immediately deliver within the confines of the three-month earnings cycle.

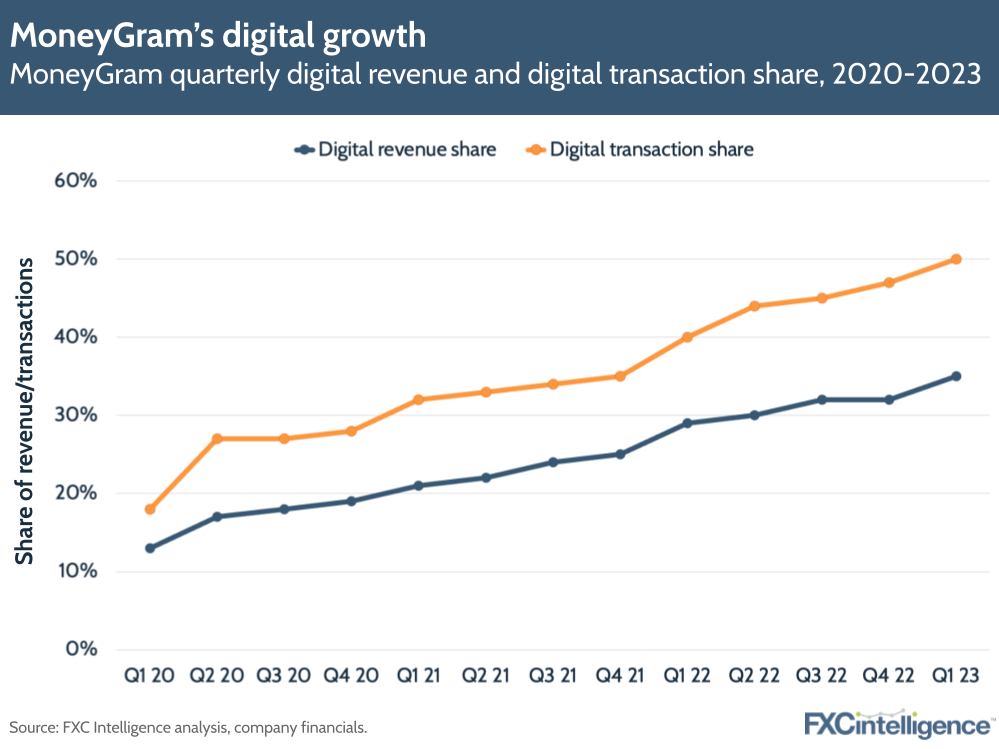

It comes as MoneyGram is increasingly modernising, including shifting to become a digital-first player, and reached a 50% digital share of transactions for the first time in Q1 2023. The company is making a variety of bids to attract a new generation of customers through both technological and service-based changes, as well as marketing that includes its title sponsorship of the Haas F1 team.

Now MoneyGram is privately owned, there are significant opportunities to supercharge these efforts and take new steps in research, development and innovation. With this in mind, what is the company planning next?

Speaking just weeks after the completion of the deal to go private, MoneyGram CEO Alex Holmes discusses the process, as well as his vision and strategy now he is at the helm of a private company.

The process of taking MoneyGram private

Daniel Webber:

You’ve now finished taking MoneyGram private. What are your reflections on the process?

Alex Holmes:

To start with, for the record, it is possible to take a public money transfer company based in the US private. It takes an extraordinary amount of time and effort and heavy lifting, but it is possible. There was a question for a long time of whether it was actually possible.

The last decade plus has been super interesting for me, and I’m very proud of what we built, very proud of everything that the company’s overcome. It’s an exciting time for us.

I’m certainly appreciative of all the effort from Madison, the interest in the story and the opportunity that’s in front of them. I think we’re aligned on direction, where we want to go.

It’s great to finally be closed and on our way. It’s a bit of a surreal experience when I check the ticker and there is no MGI anymore, but it’s good, it’s exciting.

Changing MoneyGram’s strategy: Modernisation, digital and beyond

Daniel Webber:

Now you’re private, how are you thinking about your strategy, and how might you change it?

Alex Holmes:

It was very interesting thinking about all that during the road show on the debt side. When you look at the markets today, what you see in the markets is reflected back by many of the investors in the story, in many respects.

There’s this ongoing question about digital, and I think most of the community out there would agree digital is on its way and it is certainly going to be the future, but there’s as many views of that as there are people who share the sentiment that cash is still king in many ways.

I was just in Spain and 10% of that market is probably digital, the rest is still cash. It’s going to stay that way for a while because it is just not a very digitised marketplace for many things. It’s still a very cash-based economy. A lot of the migrant communities there are less educated, many of them can’t read, etc. So digital is going to take some time in certain markets.

There’s this question around valuations, in the sense of what’s the inflection point around digital. When I look at our opportunity here with Madison Dearborn, obviously the future is where we’re going, so the future is to continue to invest in digital, but we need to maintain our cash business along the way; we need to make sure that we’re driving a great customer experience in the cash world as well as we move things forward.

But getting MoneyGram modernised in the sense of getting the brand elevated, getting consumers across multiple layers to look at MoneyGram as an opportunity and a great platform for cross-border, whether that’s your first-generation migrant or whether that’s a second or third, higher-end consumer who has a cross-border need, I think we’ve got to get the investments into that brand recognition across multiple consumer segments.

That is the exciting opportunity for us, and we’re just going to have to continue to go market by market and look to see what the consumer demand is in that market. Are we meeting that consumer demand with our products and services, and are we recognised for that in that market?

In certain cases, it’s going to be, “Hey, you need to have a great cash-to-cash service”. In which case, we’re going to have to continue to maintain and invest to ensure that that’s still available.

Market challenges for money transfers

Daniel Webber:

What do you think are some of the challenges facing the market at the moment?

Alex Holmes:

There’s numerous challenges out there. One of the things continues to be this yin and yang around pricing. Clearly, from a forward-thinking perspective, competition and governments continue to promote lower prices for remittance, but at the same time, the cost of servicing remittances continues to go up.

Costs of everything are going up, inflation is quite high, interest rates are going up, the costs of operating and maintaining a business continue to increase. When I talk to a lot of our partners around the world, their cost of employees continues to go up, the cost of technology keeps going up, the cost of cash handling, compliance, the investments that they’re making in the business are going up. Yet you’re seeing prices coming down a little bit, so there’s an inflection point at which we’re going to see some pushback there on the business.

I heard it many, many times on my last trip overseas, and it was the same recurring theme: prices are going up everywhere in the world except in remittances. Why is that?

There’s got to be a balance there. Needed service, financial inclusion is critical for a lot of the world, but there’s many, many parties involved in a money transfer transaction. People need to get paid along the way and the consumers need to have the right value. That’s one big area.

The second big area continues to be government intervention in many respects. Central banks are involved in many markets in ways that are not necessarily advantageous to consumers, in the sense of optimisation of service coming in. The many markets across Africa and Asia, where consumers would rather have dollars but governments are controlling their own currencies.

There’s going to continue to be this challenging balance for many companies, particularly the new startups that have come in, in the sense that interest rates are going up and it’s getting more expensive for them to be in the business. You need a big balance sheet to be in the money transfer space, so liquidity pools are important.

You’re seeing a lot of push and pull around needing to continue to invest to optimise your business, yet costs are going up. If prices are coming down, you’re at this inflection point where, how do you drive improvements to cashflow and margin?

That is against the background of a lot of continued economic uncertainty. Obviously the Russia-Ukraine situation has not been helpful. Political turmoil around the world has not been helpful either. I think economic growth cures all ills, and right now it seems to be a little bit of a question of, how much economic growth is really out there?

Those are some of the near-term challenges. Long term there does continue to be a growing need for the service, consumers continue to migrate. While there’s pushback on it, globalisation continues to create opportunities for consumers to participate in the remittance industry and get money back home, so there’s plenty of opportunity in front of us, but certainly there’s some near-term challenges that need to be considered.

The brand impact of MoneyGram Haas F1

Daniel Webber:

From a branding perspective, how should we be thinking about the MoneyGram Haas F1 team going forward? How are you beginning to see it impact the brand?

Alex Holmes:

There’s two fundamental opportunities within the space. First and foremost, there’s the opportunity to really promote our brand through Formula One for our consumers. Not every single race, but most races this year we’ve done some big cash giveaways, and we’ve done a trip of a lifetime: win a trip to the Formula One in Australia.

We had a young student from Nepal win an opportunity to attend the three days, meet Guenther Steiner, talk about hiking and expedition climbing with him. A very unique opportunity for a young kid who made it from Nepal to Australia, and sends money back home to support his family.

In Barcelona, we had a young man who is Ukrainian, who sends money back home to support his grandparents who are still in Ukraine, his parents are in Spain. So a big opportunity for him. Interestingly, he wasn’t the world’s biggest Formula One fan, but was absolutely blown away by the race. The gentleman in Nepal was a big Formula One fan, so for him it was life-changing.

Getting that exposure, being able to promote consumers using moneygram.com, they can enrol to win, and then getting those tangible proof points out, that is very unique in Formula One right now, and there’s no one else who’s really creating those opportunities from a direct-to-consumer perspective.

There’s a lot of B2B in Formula One, and I think being able to make Formula One tangible, and realise a dream for everyday consumers, is really pretty cool.

On the branding side, it’s been a huge success over the course of the first half of the year, in the sense that we are getting extraordinary amounts of TV coverage. We’re getting extraordinary amounts of recognition of the MoneyGram name and brand in markets and industries where you would never have seen us before.

When we think about the challenge of repositioning the brand; elevating the brand across 200 countries and territories; having hundreds of millions of viewers every week across all the various news channels – Sky Sports, ESPN, all the coverage, the general every day NBCs and CBSs and others who are picking up on Formula One stories as they travel through their local markets – has been great.

We’re seeing the brand pop up in many different places. We’re doing a lot of measurements along the way, so that brand elevation and brand exposure and expansion takes a little bit longer than the actual direct-to-consumer activities, but thus far it’s been very, very good for us.

We’ve got a team that is not at the top of the pack, but on the other hand, everyone likes to root for the underdog. Guenther Steiner is a fan favourite, in the sense of being one of the most dynamic team principals out there. So to have him talking about the MoneyGram brand, for us to be able to associate with his increasing fame and fortune, is really, really good for us as well.

I’m quite pleased with that and I think we’ve seen a lot of good feedback so far. 100% of the feedback that I’ve seen has been positive.

Entering stealth mode: Focuses for MoneyGram

Daniel Webber:

Is there anything else you want to mention?

Alex Holmes:

The company is in great shape. I enjoyed being in the public markets. I’m excited about the opportunity to do some things in a little bit of stealth mode here in the private world, but we’ve got a lot we want to do.

We want to continue to focus on the importance of the service, the social responsibility around it, the promotion of financial inclusion, but creating a great experience, creating an affordable price point, expanding our focus on financial services and really expanding the addressable market.

I think that bringing in new consumers that have a cross-border need, that aren’t that traditional remittance customer all the time, is a really important evolution of the company and the brand. So we’re excited about that.

We’ve got some new products coming later this year, some upgrades to a bunch of our services, which we’re really excited about. As the brand elevates, the products will elevate, and you’ll get a bit of a back and forth there as we go forward. So, very exciting things ahead and I certainly look forward to talking to you more about those.

Daniel Webber:

Alex, thank you.

Alex Holmes:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.