I’m in San Francisco this week visiting some of our great clients in the space (Bill.com, OFX, Ripple) and meeting with some very innovative prospects.

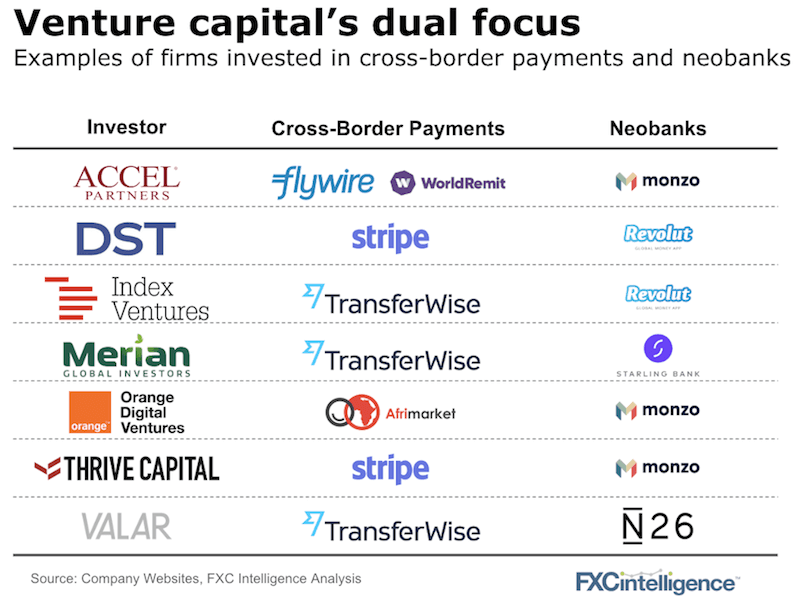

San Francisco is also home of the venture capitalist and in the last five years, a lot of smart money has gone into the payments sector. We’ve analysed who has been investing where and found some interesting patterns.

We found the overlap of investors in cross-border payments and the new neobanks interesting. Two core observations:

- Both groups of companies are attacking the same incumbent – the high street/main street bank. Moreover, these investors clearly think these companies are going to win (which is bad news for the banks).

- The consumer segment within finance offers opportunities for exponential growth (see our recent analysis on TransferWise and our comments in this week’s Economist). Exponential growth can lead to exponential returns, the goal of venture money.

Which means if you’ve spotted an investor who only owns a stake in a neobank or a cross-border payments company, this could be the time to pitch them to invest in the other, especially if it’s your company!

Facebook’s new payment play – afraid?

In mid-April, we looked at the reasons why Facebook decided to pull its messenger P2P money transfer product. This is what we wrote on why Facebook canned the product:

Turns out we might have understated things. What we now know:

There has been no official announcement. Rather, a series of stories, led by the BBC this past week but also the Wall Street Journal and Bloomberg, offering tid-bits of insight.

- The partnerships being discussed are significant and interesting ranging from Visa and Mastercard (to be expected) to Western Union (not necessarily expected unless cross-border or cash pay-in is on the horizon).

- c.$1bn is sought to be raised to back up what would likely be a stablecoin (i.e. linked to the dollar).

- India has been suggested as one of the first markets to launch in (an interesting choice as India does not love crypto right now), likely via WhatsApp. However, expect the product in at least a dozen markets.

Likely much more to come on this front – we’ll be watching and dissecting on your behalf.

Another big payment processor deal

Not wanting to feel left out, Global Payments agreed this week to acquire TSYS for $21.5bn driving further consolidation in the processing space.

This follow FIS’ $43bn deal to acquire Worldpay in March, and Fiserv’s $22bn acquisition of First Data in January.

What is driving these mergers:

- M&A is highly contagious, especially when focused on one sector. Bankers, lawyers and CEOs can all catch it and fast. And they have.

- Scale, scale, scale – the best defensive play for all the high-performing newer entrants in the space (i.e. Stripe, PayPal, Adyen, Square). These players strengths lie in their technology and their product offerings for smaller merchants.

Against this background, we’ve also seen record fundraising in the processing space led by Checkout.com’s $230m. To catch up, a few million here or these isn’t going to cut it and Stripe, PayPal, Adyen and Square are no longer small fish.

[fxci_space class=”tailor-6332fa9d87fdg”][/fxci_space]