OFX announced their full year numbers on Tuesday. With a broad product set of consumer, SME and ecommerce offerings, OFX has a competitive set that overlaps with many players in the space.

OFX’s stock price has had a hard time over the past six months but investors reacted very favorably to the full year results above pushing the stock back up c.15%.

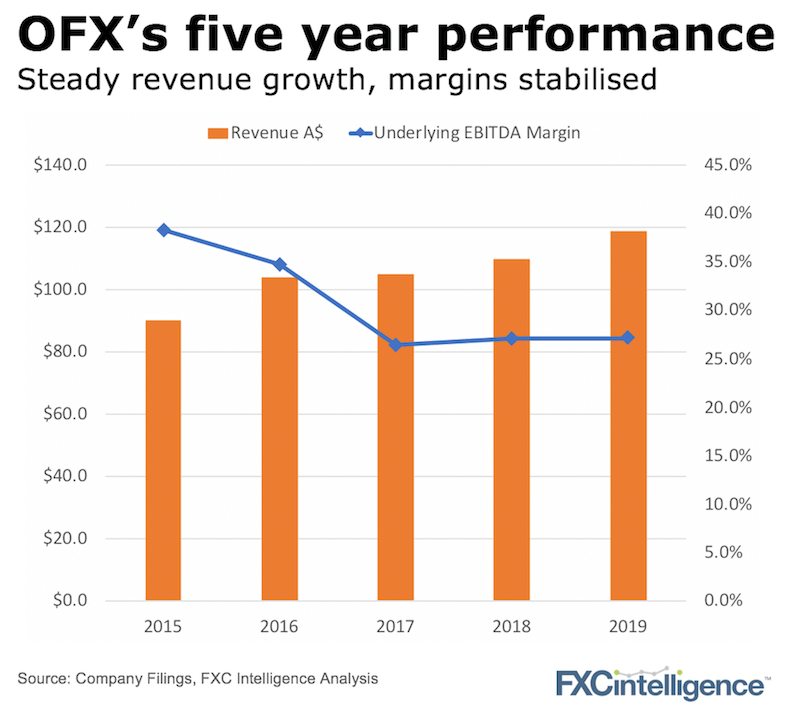

We spoke with Skander Malcolm, OFX’s CEO, late last year as he laid out his vision for the company. The slide in margins has been halted and the firm continues to invest. A few other observations:

- OFX has been successfully optimising its pricing:

We care a lot about pricing so what does this mean? The company reported an improvement on its FX margin (the difference between the amount of FX its customers trade and the revenue OFX makes on these trades) from 52 to 55 basis points. That’s a 6% improvement, worth nearly A$7m in extra income as pricing improvements go straight to the bottom line. At a current 13x EBITDA multiple that work is worth A$87m of value. This tells me our pricing data is way too cheap!

- OFX’s growth is coming from North America and Asia:

Both markets are showing nearly 20% improvements year on year. This growth is currently expensive with little additional contribution to profits for now. Investors will be looking for EBITDA margins in line with the rest of the group (around 27%) to follow.

[fxci_space class=”tailor-6332f7935443h”][/fxci_space]