Politics aside this week, we’re taking a look at what is driving M&A in the sector. Western Union won the Post Office (UK) digital partnership, and we analyse the reach of post office payments partnerships worldwide.

To M&A…

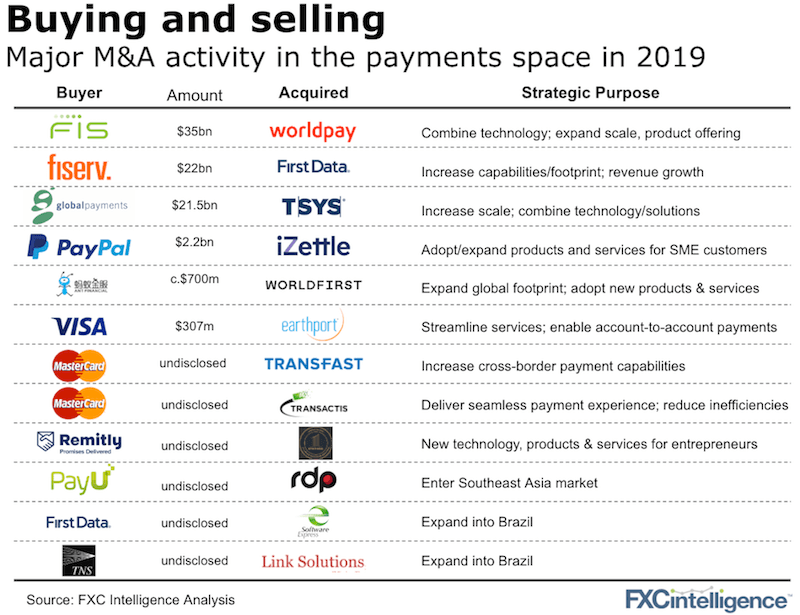

Year to date, we’ve seen a mix of the mega-deals that are vertically integrating and gaining scale (the three at the top of the chart), down to much smaller strategic plays and geographic market entry plays.

The wave of consolidation over the past few months has also seen a range of companies looking to add new technologies, products and services to boost their existing portfolios (i.e. Remitly & Symphoni, Ant Financial & WorldFirst, Mastercard & Transfast).

Our recent deal analysis:

We expect consolidation to continue in the sector but at a slower pace amongst cross-border companies compared to the large payment processors. Cross-border remains highly fragmented with the majority of ownership still in private hands.

The power of the post office

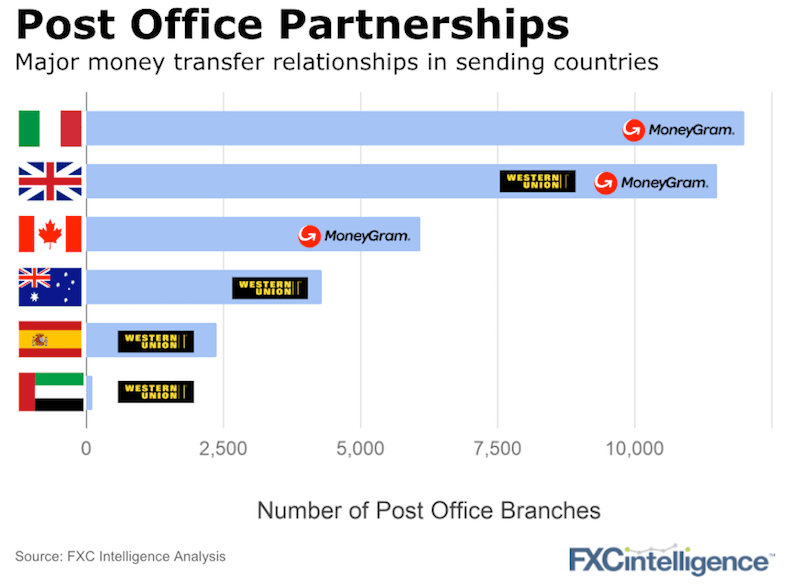

In many countries, post offices still have substantial reach and are household brands. They offer a range of financial services, are trusted and are able to handle cash.

In the UK, Western Union this past week announced it had won the Post Office digital relationship taking over from Moneycorp. Given the prominence of post offices, we would expect to continue to see a mix of splitting of cash and digital partnerships (the UK), and fully exclusive deals.

As the world becomes more digital and bank branches decline, post offices remain an important set of physical locations and a gateway to remittances.

[fxci_space class=”tailor-6333049e09ae4″][/fxci_space]