The crisis continues to envelop the cross-border sector and this week we cover some different angles. Startups are an important source of new customers to many segments of the payments market. What can we expect in the months ahead? It’s not all bad news.

We also take a look at Xoom, the remittance player now owned by PayPal, as the first in a series of case studies of cross-border payment companies who grew through an economic downturn.

New businesses, new growth opportunities

This past week, Nationwide, the UK bank, announced it would pull its plans to enter business banking because of the impact of coronavirus on the economy. Against this, the recent bull market has seen the emergence of many new players dedicated to serving business customers and, especially, startups.

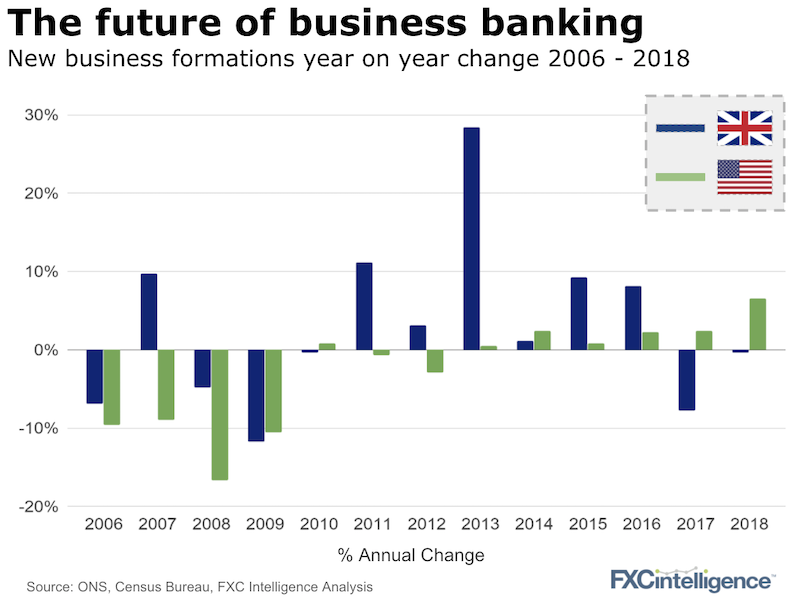

We analyse startup creation over the last 12 years in the UK and the US and its implications for the sector.

Our main takeaways:

- The establishment of fewer startups will put the squeeze on digital banks

Digital banks like Revolut, Tide and Starling are desperate to onboard SMEs. New startups, unencumbered by a current banking relationship and attracted by bundles such as company formation services, are a perfect target segment. In the short-term there will simply be fewer startups around to compete for. - A brighter outlook for some in e-commerce

More people, in lock-downs around the world, are migrating to shopping online. New players, trading both domestically and cross-border, will likely arise (ecommerce is a startup segment that struggled in the last recession). Those fintech companies offering the most complete offering for a new marketplace seller or home delivery client will be best set to thrive. - A platform to create the next unicorns

The 2008 recession taught us that great companies can develop within the most impacted industries in the hardest of times (think about AirBnB, Pinterest, Slack, Uber). But with lower consumer spending, trade and limited availability of immediate liquidity, what will their launchpad be this time?

While it is clear that the current economic downturn might pose significant challenges in the short-term for players reliant on startup customers (new digital banks and fintechs). Those who can weather the storm (measured in years, not months) are likely to benefit from a flurry of new businesses created from the crisis. A handful of these new companies will even become household names.

Growing through a downturn: Xoom

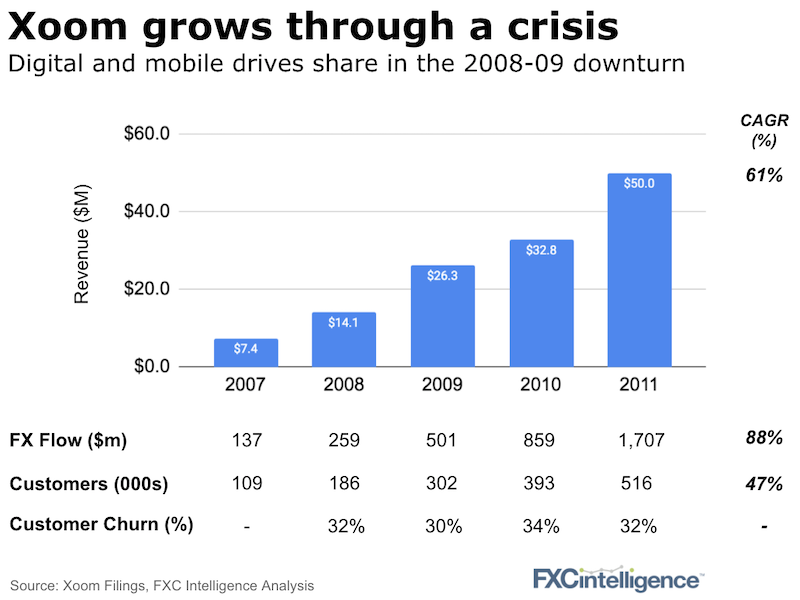

We begin our series covering case studies of growth in the sector during economic downturns. This week we turn to Xoom (now owned by PayPal) and its performance during the 2008/9 Global Recession.

Xoom was established in 2001 and by the late 2000s was the leading digital-only money transfer provider. At the time, Western Union’s digital business accounted for less than 2% of its total revenue (it’s now over 14%) and it wasn’t until 2012 that Western Union started reporting numbers on its digital business.

Although starting from a relatively small revenue base, Xoom was able to gain share in the US market with a straight forward, convenient, digital and mobile offering. Around three quarters of revenue came from the US to the Philippines, Mexico and India corridors.

Xoom was also a partial victim of its own success, paving the way for much of its current competition. In the US, Remitly launched in 2011 and, in Europe, TransferWise and WorldRemit were both founded a year earlier. At the time, Xoom didn’t even have to be that price competitive, with FX margins in the 1-3% range.

In the current crisis, convenience alone (i.e. digital and mobile) won’t be enough. Pricing promotions are already being seen to support revenues, with many in the sector reporting revenue down by 20-30%. The bigger question will be whether we will see a significantly new innovation enabling any player to gain meaningful share in what is a currently declining and overall more mature market.

[fxci_space class=”tailor-63345126b2f4e”][/fxci_space]