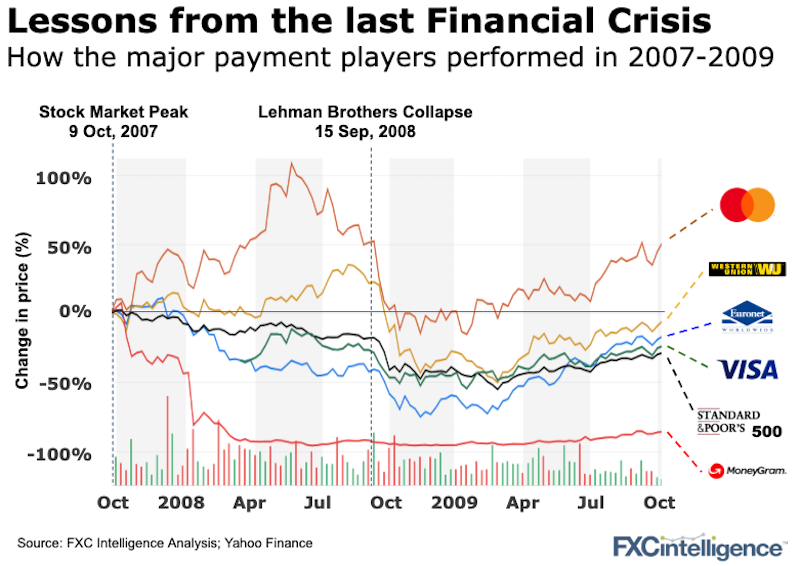

The markets have had a terrible week, the likes of which have not been seen since the 2008 financial crisis. We take a look at how the biggest payment companies were impacted back then and what we may be able to learn from that.

As more companies are pushing to non-cash payments in the current environment, we analyse the impact on their pricing.

Lessons from the Great Recession

This week has seen the stock market fall at rates not seen since the 2008 financial crisis. Payment companies are not faring well but what can we learn from that experience?

From the market peak in October 2007, the S&P 500 benchmark index fell by around 50% before beginning to rally again to reach the historic market highs that were seen earlier this year.

We identified three core groups of companies who emerged post-financial crisis:

- Companies whose fundamentals were always solid but were dragged down with the markets

- Visa and Mastercard are two good examples. They were the fastest to recover but it still took years.

- Companies who were affected by the downturn and took a number of years to recover

- Euronet (owner of Ria) was badly hit, losing around 75% of its value, but by 2013, it had recovered back to the levels of the peak. It then pushed on strongly.

- Western Union was less impacted due to the utility nature of some of its business but took 12 years to get back to its 2007 value.

- Companies who never recovered

- MoneyGram lost nearly 90% of its value through the Great Recession and never recovered. Its business was permanently hit not just by the market downturn (in which it owned a substantial portfolio of sub-prime mortgages and CDOs) but then by all the new competitors that entered the market.

Markets can overreact and often completely miss the fundamentals. The best example of this was Visa, who actually grew its business and performed well through 2007-2009. Still, its stock price was dragged down with the rest of the market. Brave investors who bought into Visa at its low were able to pick up an under-priced asset.

As we showed last week, the declines in values of the payment companies in this crisis are already across a great range of values. The worst performances are skewed to those companies exposed to cash and travel. Most at risk right now is Finablr, which today issued a warning that they may not have enough cash to operate their business. Finablr’s share price is now down 97% from its peak 3 months ago.

Pricing responsibility

If you use (or compete with) Western Union, you may have noticed that they have started posting the following messages on their US website encouraging customers to send money through their app/website instead of, presumably, through their agent network.

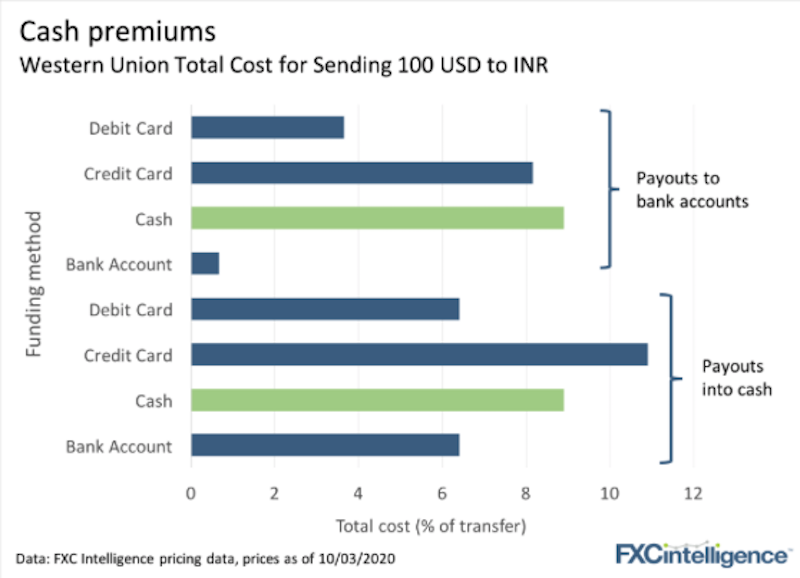

Beyond being a responsible gesture, it may have a real impact on Western Union’s top line (if customers listen that is). Western Union allows customers to lock in pricing online for in-person cash transfers through its agent network, and those transfers command some of the highest margins of all Western Union funding / disbursement options.

Here’s what that looks like for sending $100 to India (cash pay-in options are highlighted in green):

So far, Western Union appears to be the only major remittance player to post such a warning but we’ll see if MoneyGram, Ria and others follow suit.

[fxci_space class=”tailor-633433a0bcee3″][/fxci_space]