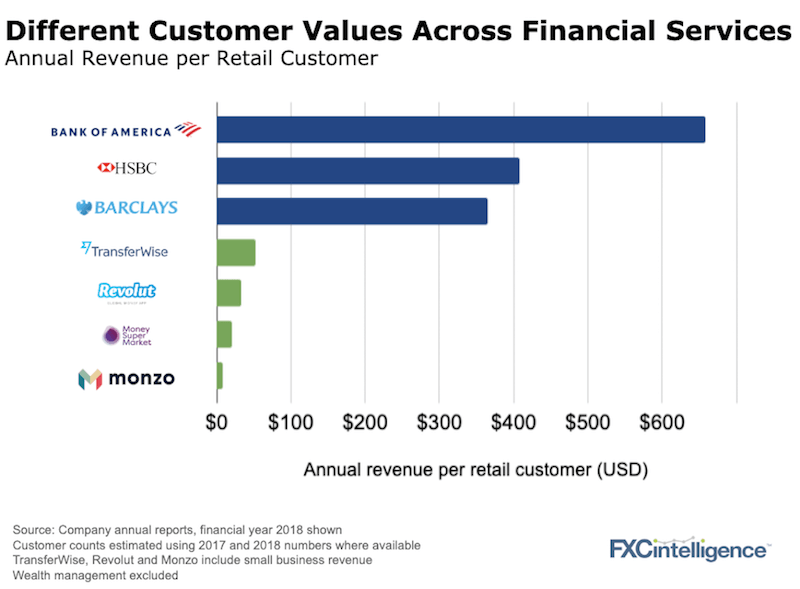

Banks are still worth a lot more than the fintechs chasing them. For all the hype, no big bank has bought any of the major neobanks or payments fintechs offering competing products. Too expensive or the customers just aren’t valuable enough?

Also this week, the UAE is attracting more and more payment companies, Euronet (Ria & XE) reports earnings and the US continues to pose regulatory challenges.

The value of a full customer offering

High street banks still dominate financial services, especially when it comes to offering full product sets. A number of leading payment companies and neobanks are chasing them but with just a fraction of the products. What are their customers really worth?

We cover four types of company in the chart above:

- The high street banks

They are highly profitable and generate significant revenue annually per customer. They offer very sticky long-term products such as mortgages and are the mainstay of older, wealthier customers. - The neobanks

Chasing the high street banks and adding customers at a rapid rate but not taking much in terms of share of wallet or revenue. - Payment companies

Specialising in one product area, doing it well and earning good revenue. The single product focus (cross-border payments above) likely has a ceiling on possible revenue per customer. - Financial marketplaces

Offer no financial products directly but are able to introduce customers to the full suite of products offered by the high street banks.

What does this mean for the neobanks (who are trying to beat everyone else on this list)?

The leading neobanks are excellent at acquiring customers but this is usually done by offering free or below-cost services. Their revenue per customer is in line with a single product offering and, being card led, their core revenue is currently driven by interchange fees.

The neobanks stated goal of providing marketplaces/gateways to other financial services sounds great, but if you look at one of the leaders in this space (e.g. Moneysupermarket, worth c.$2.3bn), the revenue per customer made by introducing a customer to a full range of services is just a fraction of what you can make by being the actual provider of the service (ie the high street bank).

Which tells us…

For the neobanks to really change high street banking, an introducer/marketplace model is not going to cut it on its own. But if they are able and willing to provide competing services at a significantly lower cost, will that land us a new normal?

More regulatory challenges in the US

Last week, we covered the cold regulatory winds blowing straight at Libra, Facebook and the payment companies who were going to be part of Libra.

This week is no better. Two items of note:

There won’t be a fintech fast-track for now

- The Office of the Controller of the Currency (OCC) proposed a fast-track regulatory path for fintechs, avoiding the need for state by state regulation. It was denied by a judge this week, deciding that it would create an unfair playing field. The ruling means the OCC cannot issue bank charters to institutions that don’t take deposits.

- The OCC was hoping to give fintechs a path to banking licences without going state by state. Such a ruling will only slow the growth and increase the expense for the US challenger banks and the overseas entrants. The ruling will be appealed but the status quo remains for now.

What’s next for consumer financial protection in the US?

- The Consumer Financial Protection Bureau (CFPB) was created after the 2008 financial crisis to help protect consumers (as well as to provide some other financial oversight). In the UK, the FCA takes on this role.

- Last Friday, the US Supreme Court said that it will hear a case challenging the reach and power of the CFPB. Those in favour of the CFPB say it needs independence to be able to protect the consumer, the counter-argument being the overreach of power. The lawyers and politicians may do well from this journey but the consumer may not.

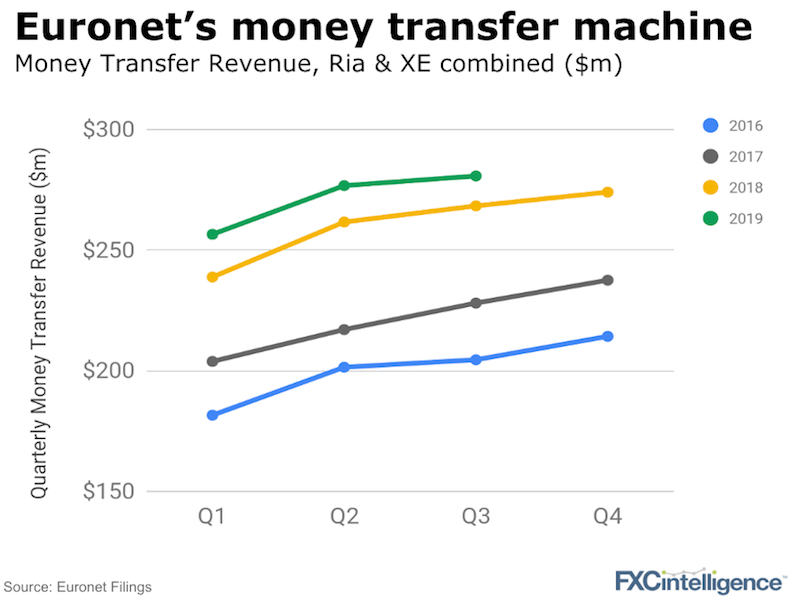

Euronet’s money transfer business rolls on

Euronet, owner of the Ria and XE brands announced solid third quarter results this week.

Growth was driven by US outbound remittances but Brexit remains a drag on UK revenues. Additional ID requirements on the domestic US business also continued to hold back growth.

Visa and TransferWise head to the Emirates

A few weeks ago, we looked at cross-border payment pricing in the UAE (here). Although regulations and ownership rules are complex in the region, there have been a number of significant announcements for the UAE this past week.

Visa announced it will open its regional HQ in Dubai in 2021. On Tuesday, TransferWise announced it received a licence as a Money Services Provider in Abu Dhabi, with its first products coming to the UAE in 2020. Airwallex also publicised this week plans to expand to the Middle East.

Who’s already there?

Finablr, with its UAE Exchange brand, is the dominant player in the region and already offers tightly priced products compared to the banks. IFX has been active in the UAE since 2013 and WorldFirst opened an office in the region in August 2019.

More competition is coming so let’s assume that’s only good for consumers and businesses in the UAE.

[fxci_space class=”tailor-63330d33c3f1e”][/fxci_space]