Paypal announced its full year earning for 2019 on 29 January. Below, our take on that, plus we look at how pricing is driving margins at Paypal and its remittance subsidiary, Xoom.

PayPal’s cross-border business jumps again

Everything in context. Currencycloud has processed $50bn of FX flow to date – no mean feat. But how does that compare to PayPal, one of the biggest ecosystems in the space?

PayPal reported its 2019 full year results yesterday. The company is now worth $137bn having trebled in value over the past five years.

On total FX flows

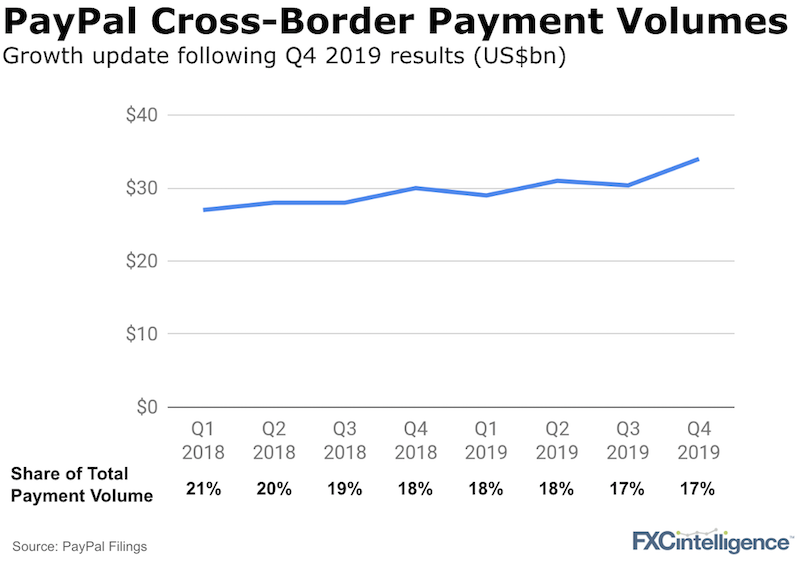

As both Venmo (which processed $102bn in 2019) and Braintree (a US-focused processing division) continue to grow, cross-border payments is slowly becoming a smaller share of total payments at PayPal. Still, cross-border totaled $121bn for 2019 after a strong Q4.

On China

China (a big recent topic for us) was also a big part of the earnings call. In PayPal’s CEO Dan Schulman’s own words on the size of the opportunity for them: “China will be 40% of worldwide cross-border TPV. And this is a market where we have roughly 1% penetration into their 0.5 billion digital users.”

On pricing

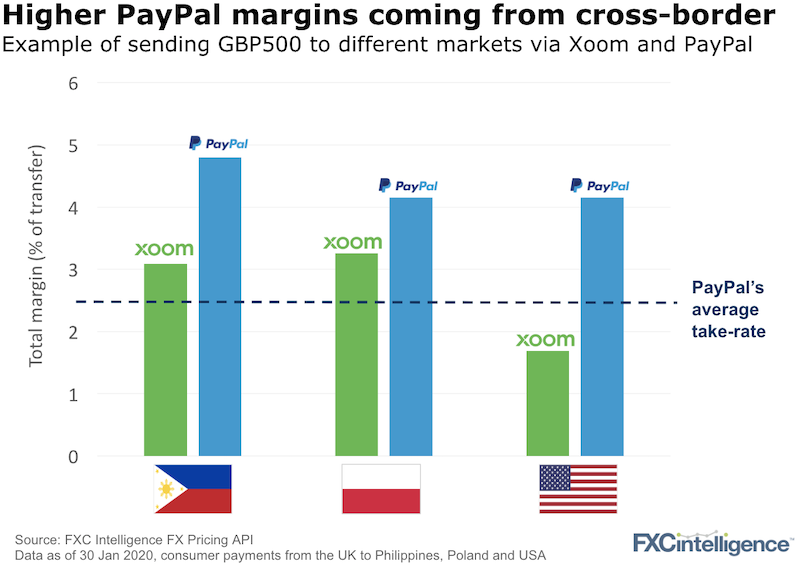

PayPal’s take rate (revenue earned on total payment flow) was 2.5% for the entire business in 2019. Whilst PayPal does not break out cross-border take rates, our pricing data tracking both PayPal and remittance subsidiary Xoom continue to show the importance of their contribution to group revenue.

What’s driving PayPal margins?

PayPal has two core cross-border –products for single payments – PayPal and Xoom. Whilst it took a while to fully embed Xoom into the PayPal ecosystem, both brands are now pushing full steam ahead in cross-border and expanding into new markets. Moreover, they both can drive higher margins (i.e. have higher take rates), than the underlying PayPal business.

Our FX Pricing Product offers streaming prices of Xoom, PayPal and all their competitors. More details here.

[fxci_space class=”tailor-6334251b19702″][/fxci_space]