FIS’s announcement that it is spinning off its Merchant Solutions segment to once again be the standalone merchant acquiring player Worldpay comes just four years after it was purchased. Here’s how the spinoff could help the business.

On 13 February, as part of its FY 2022 earnings call, FIS announced that it would be spinning off its Merchant Solutions business to once again become the standalone company Worldpay. It comes just four years after FIS first purchased the merchant acquiring company in 2019.

The spinoff is thought to have been made to appease investors, and is intended to “strengthen [Worldpay’s] strategic and operational focus, capitalise on growth opportunities and unlock shareholder value”, according to a press release from FIS. However, investors have so far reacted negatively to the news, with the share price currently around 10% lower than it was before first reports of the move broke on Friday.

But how could a newly standalone Worldpay position itself in the wider market, and what challenges will it face as it looks to build a fresh foundation for growth? This report explores Worldpay as a standalone player, using data from FIS and beyond.

FIS spins off Worldpay: Key details

FIS CEO Stephanie Ferris, who was CFO of Worldpay when it was acquired by FIS in 2019, described the spinoff as “creating two world-class public companies” during the earnings call.

“The separation of Worldpay from FIS will result in the creation of two standalone market leaders, each well-positioned to capitalise on the significant value-creation opportunities ahead in their respective markets”, she said, adding that it would “enable FIS to pursue a strong, investment-grade credit rating while enabling Worldpay to invest more aggressively in growth”.

The move will see former Worldpay CEO Charles Drucker return as a strategic advisor who will ultimately return as the company’s CEO once the spinoff is completed. It is expected that this will be achieved within 12 months.

Both companies also intend to maintain close commercial ties, including through the delivery of embedded finance capabilities and continuing to be involved in FIS’s cost-cutting Future Forward initiative.

“Both companies will be market leaders in their own right and by forging a commercial relationship together, we can affect a superior outcome as compared to keeping them together,” said Ferris.

While details of how this commercial relationship will work are yet to be released, it is thought that it will limit potential dis-synergies from spinning off Worldpay, although to what extent remains to be seen.

Worldpay over time

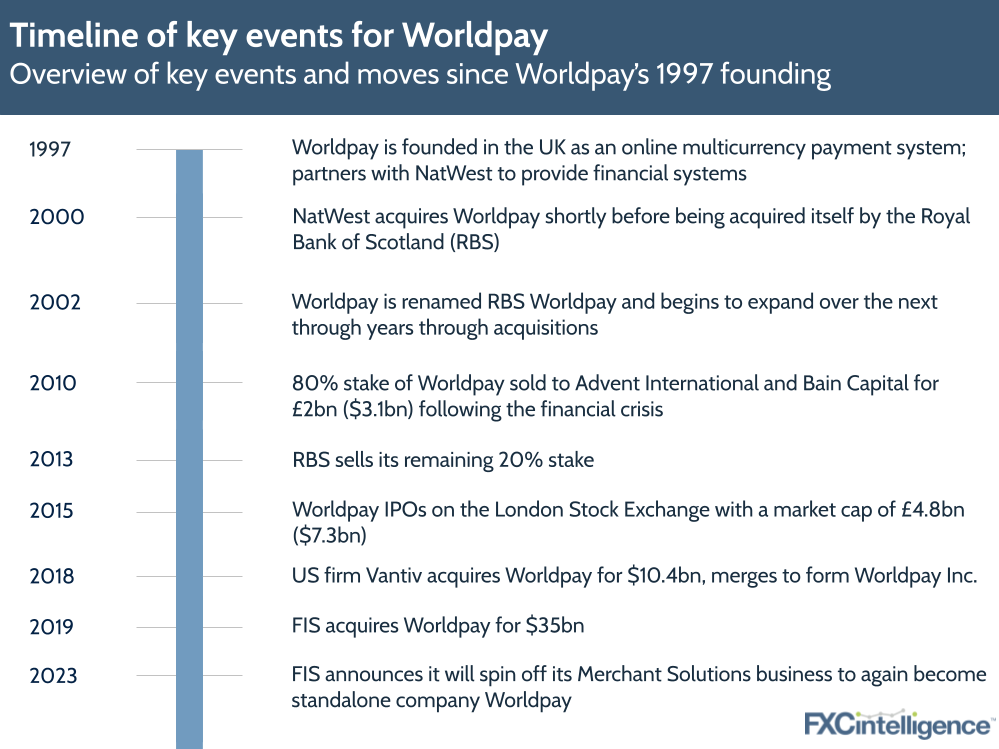

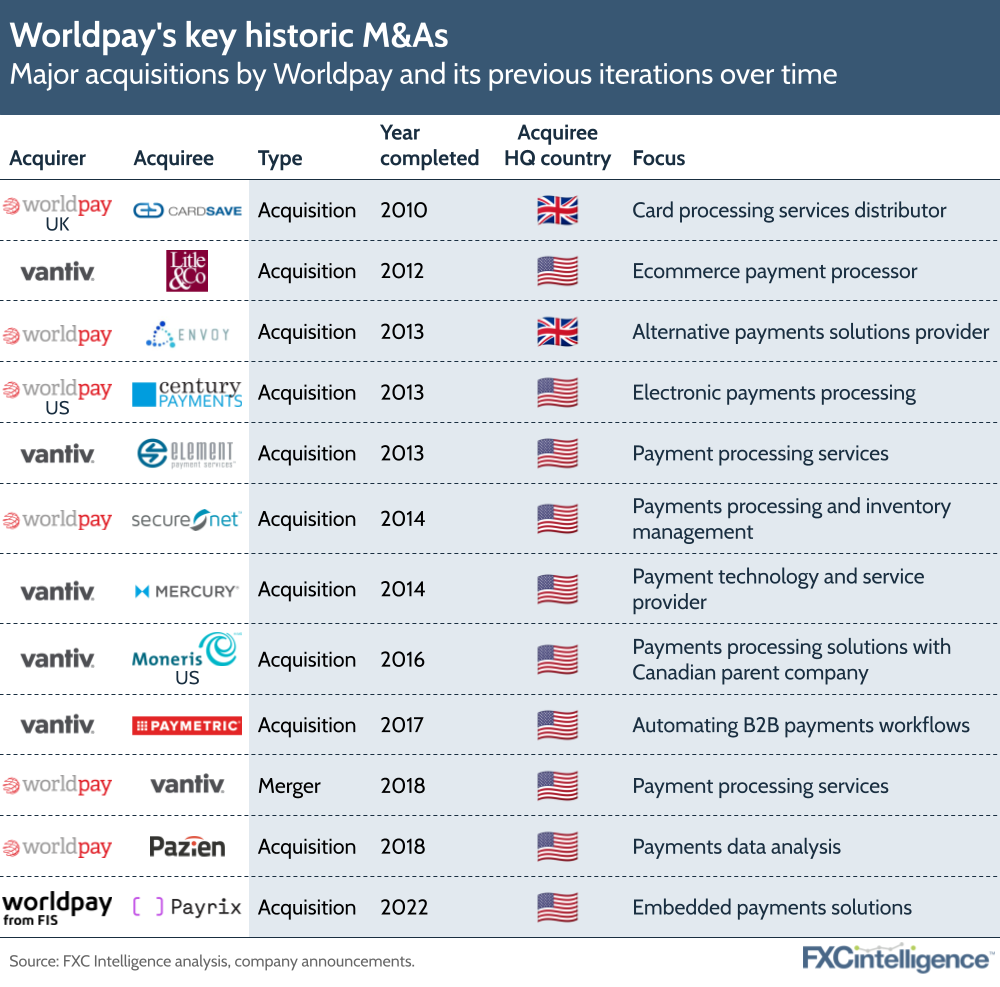

The spinoff of Worldpay is the latest in a host of moves for the company, which have seen it grow largely through acquisitions, as well as being acquired and later sold itself multiple times since its inception.

Many industry commentators are taking the short length of time Worldpay was a part of FIS as a sign that its integration was unsuccessful. It is the shortest length of time that the company has been in one particular state of ownership save for its acquisition by NatWest, which was then itself acquired, however all ownership periods have been relatively short.

Worldpay’s performance under FIS

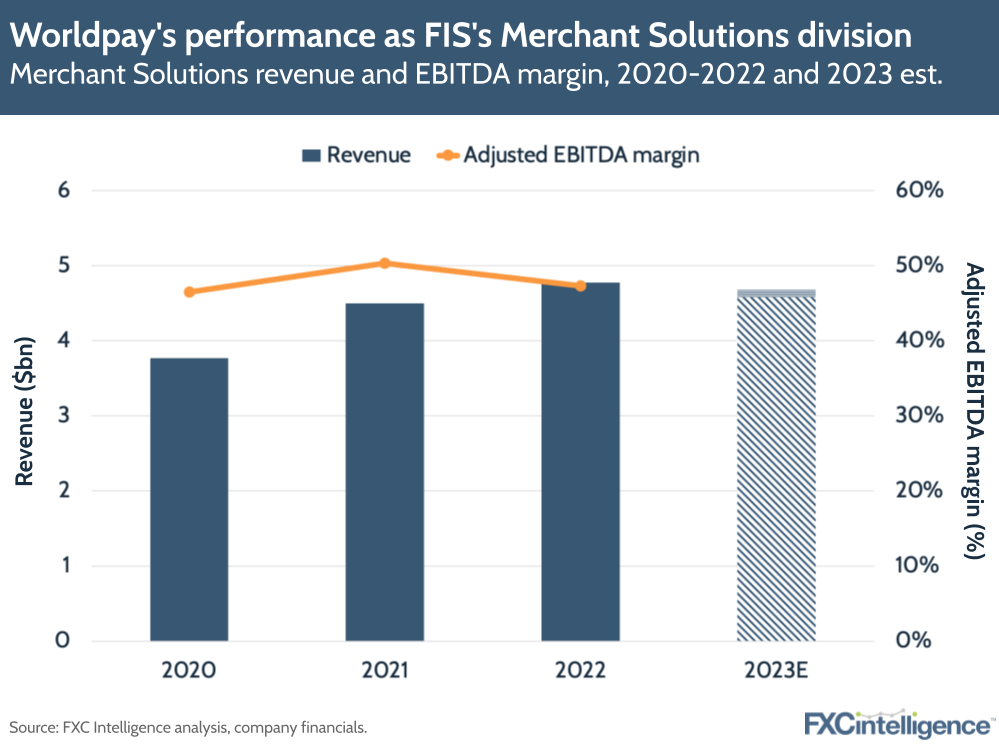

While Worldpay grew steadily under FIS for the first few years of its ownership – likely due to the surging ecommerce market during the pandemic – its recent performance has been weaker.

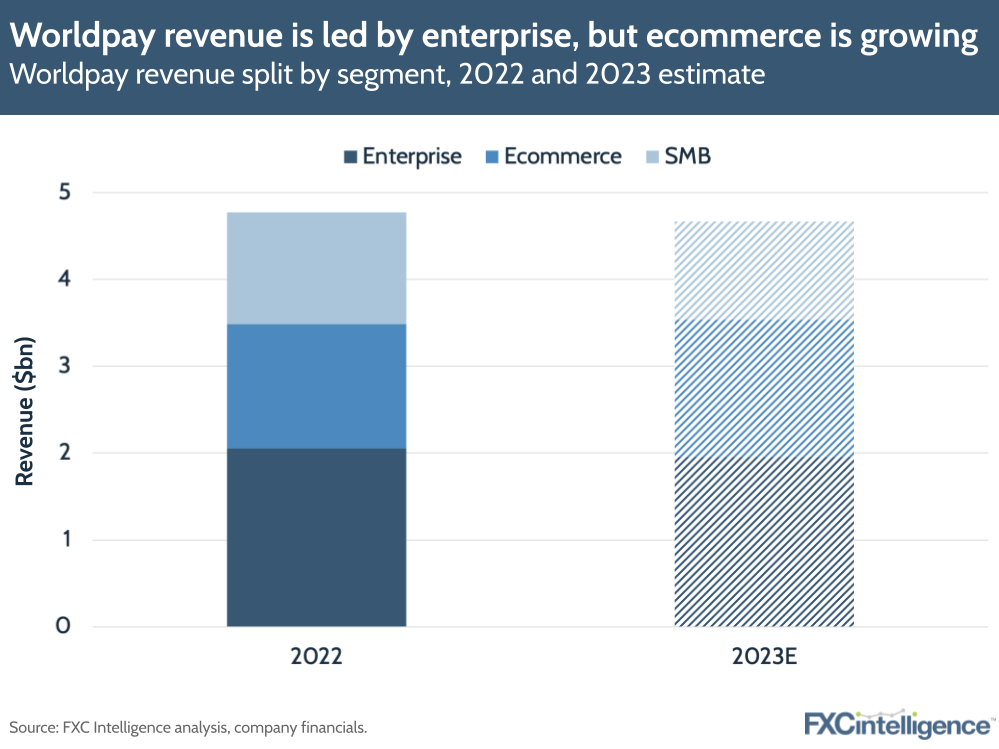

The Merchant Solutions segment of FIS saw slower growth in 2022 than it had in previous years, with the division seeing growth of 2% in Q4 2022. This was buoyed by ecommerce, which saw revenue grow 16% on a constant currency basis; however, SMB and the card-present channel both saw weaker performance, while a UK-based downturn hit the enterprise segment.

This is expected to hit more severely in the coming year, with Worldpay set to see organic revenue decline of 2-4%, with growth only in its ecommerce segment. However, it is anticipated that the company will return to growth once it is spun off.

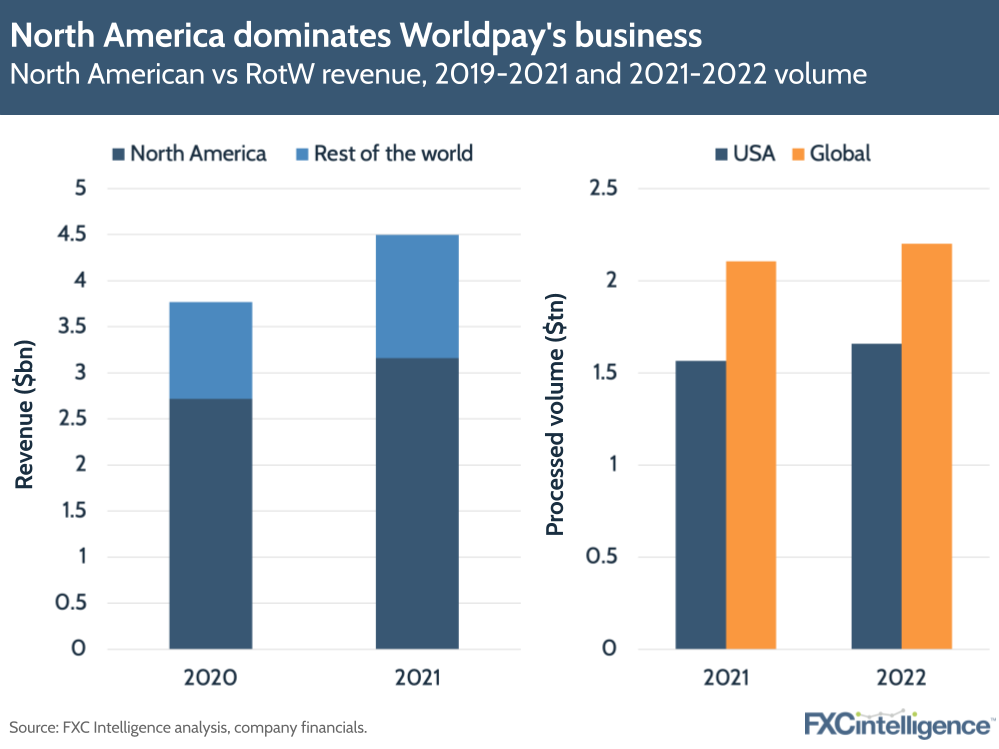

The US market

The US is a significant market for Worldpay, accounting for 70% of its revenue in 2021. However, its global markets cannot be ignored, as reflected by the impact the weak UK economy has had on its latest results. In the future, it is likely to see greater growth potential beyond the US than within its leading market.

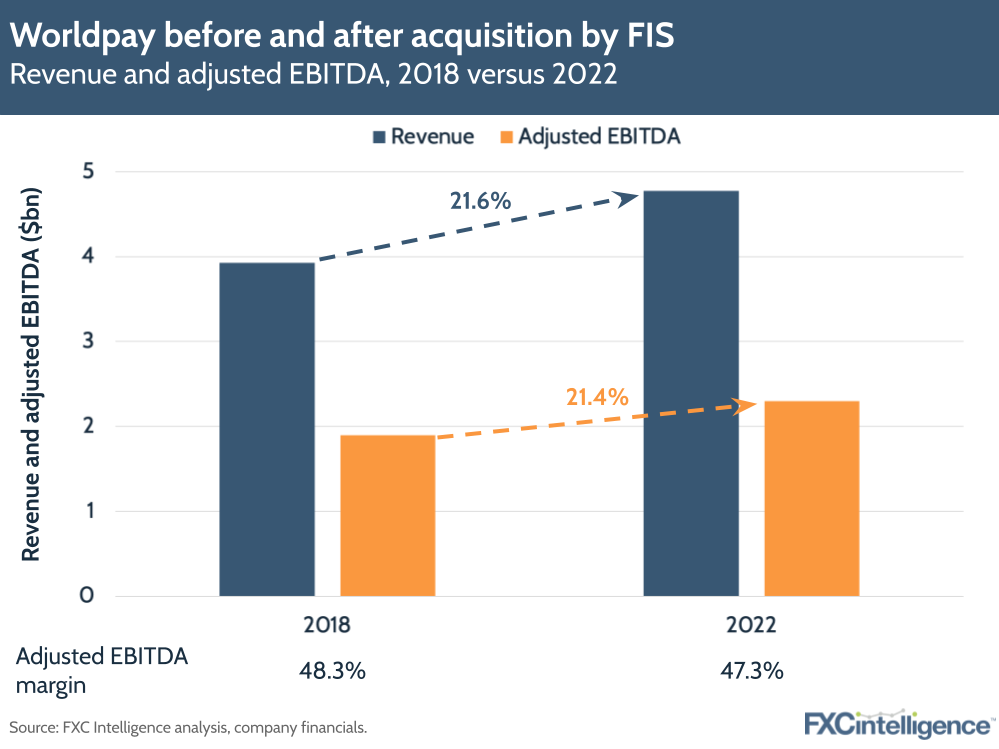

Worldpay before and after FIS’s acquisition

Worldpay has seen both revenue and EBITDA growth of around 21% between 2018 and 2022 – the period during which it was acquired by FIS. However, this does not compare well with the growth trajectory of many of the industry’s major challengers, and the company will need to pursue greater long-term growth as a standalone company.

Worldpay’s place in the market

Supporting 126 currencies and over 300 payment methods, Worldpay supports over a million merchants globally, processing 110 million transactions across mobile, online and retail each day.

As a result, it is a significant player in the market at present, and as a growth-focused standalone company it could see its global presence expand. However, over the last few years, merchant acquiring challengers – including Adyen, Stripe, dLocal and Checkout.com – have grown significantly in reach and scale, creating a tougher market for Worldpay than it arguably faced when it IPO’d almost a decade ago.

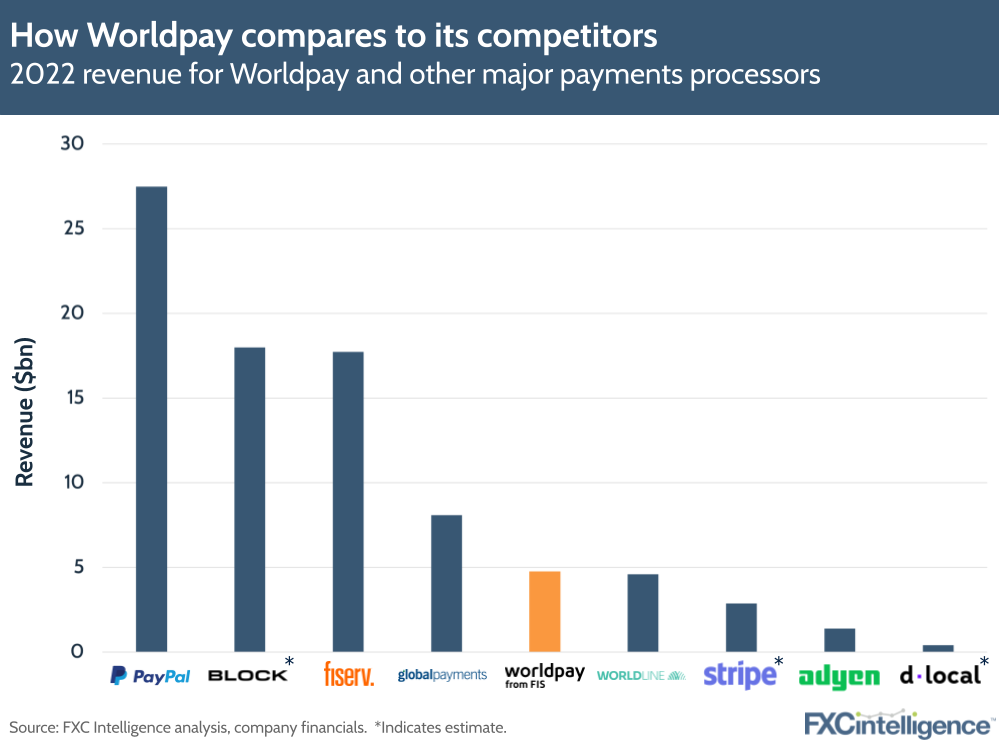

Revenues above challengers for now

While Worldpay’s revenues are currently above those of Stripe and Adyen, Stripe is closing in, and with its recent layoffs is placing significant focus on securing its business for long-term growth. Worldpay will need to find ways to innovate and grow if it is not to be outpaced by more recently founded challengers.

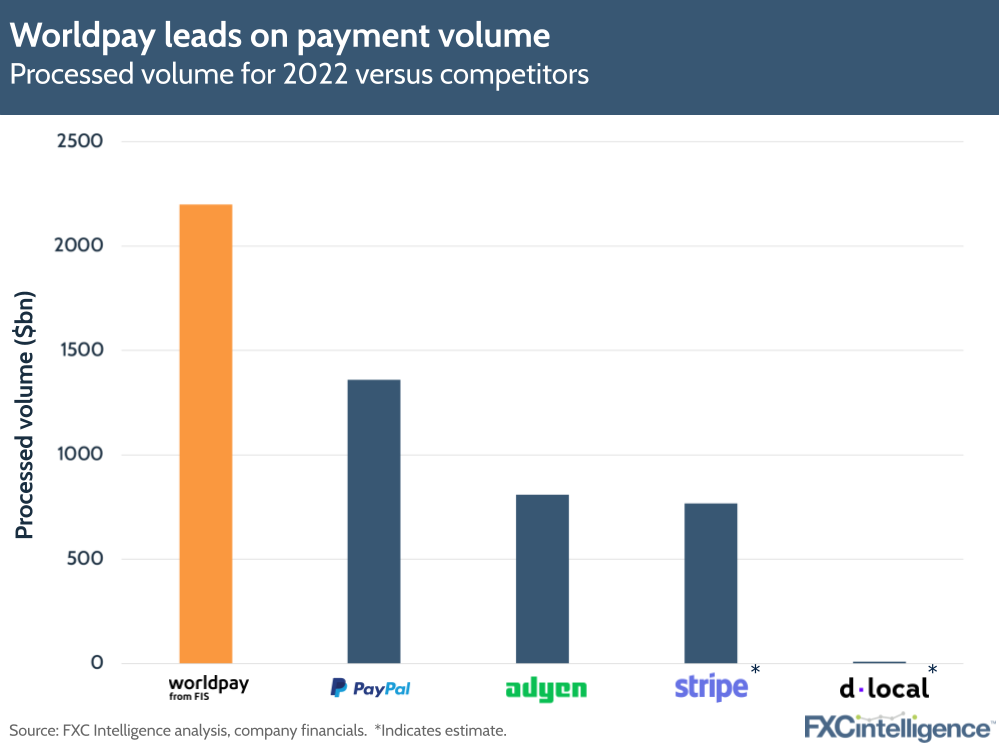

Leading in market volume

When it comes to payment volume, Worldpay is currently leading in its sector – something that Ferris highlighted in the earnings call.

“Worldpay remains the number one global acquirer by transactions,” she said, adding that the company is “the largest ecommerce provider as well”.

This puts it in a strong position to compete and add to its capabilities, however others will be looking to take share from the company, and any mis-steps with the spinoff may provide potential opportunities for this.

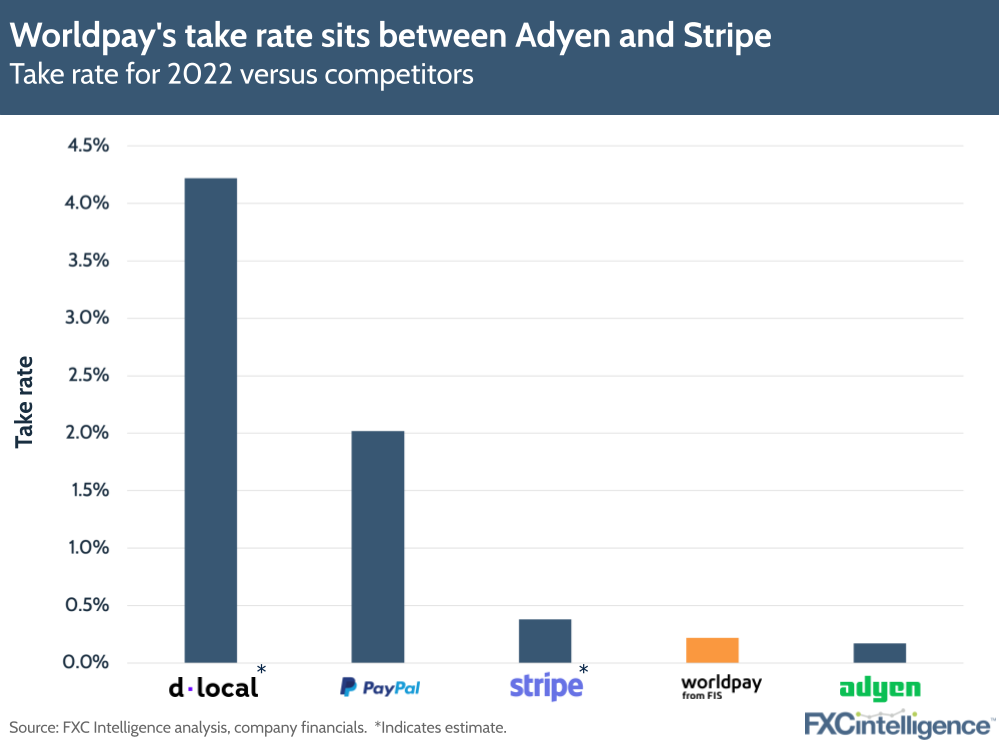

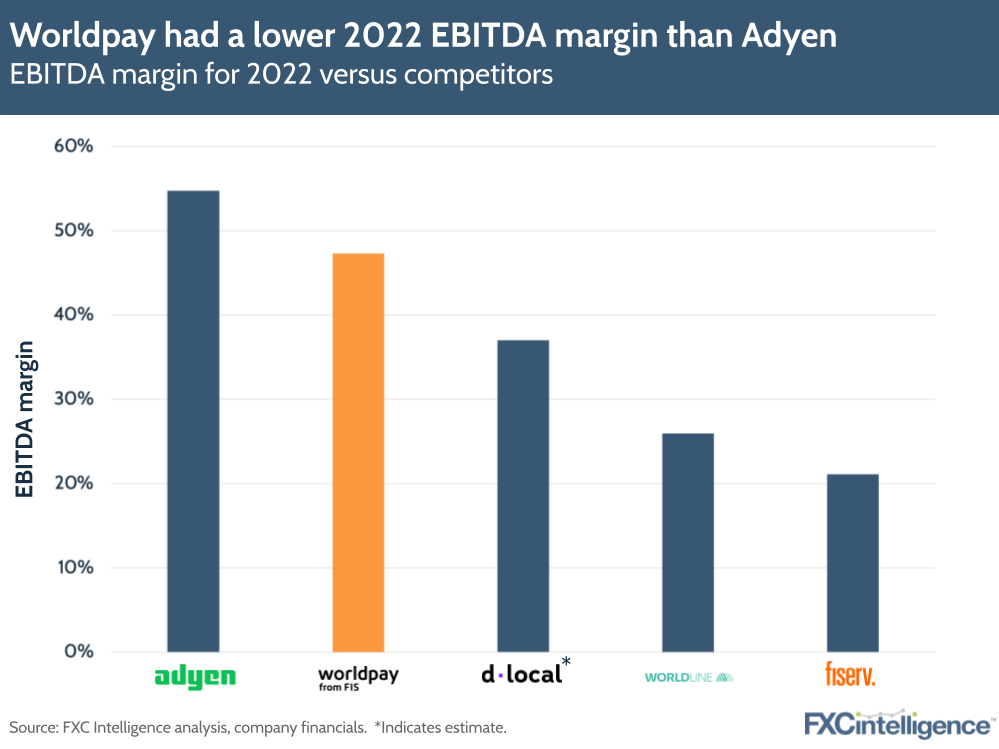

Margins compared to other acquirers

However, when it comes to margins, the company does not sit in as strong a position. From a take rate perspective, the company sits below other key merchant acquirers, with the exception of Adyen, something which it attributes to a mix of investments and the macroeconomic environment.

Meanwhile, while the company has a higher EBITDA margin than some other payment processors, its margin is lower than in previous years and is below Adyen.

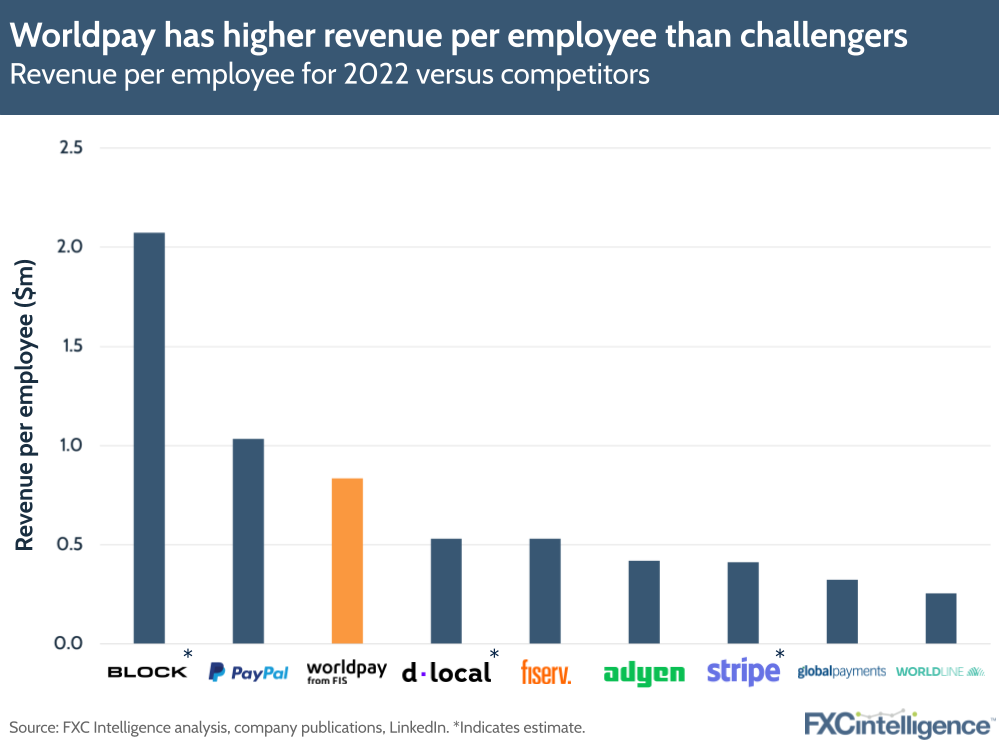

Revenue per employee above some competitors

At present, when it comes to the employees who specifically work for Worldpay rather than FIS, the company does have stronger revenue per employee than many other merchant acquirers. However, this does not account for any potential dis-synergies that will occur as a result of the spinoff.

Worldpay may be forced to increase its direct employees as it loses access to shared teams across FIS and could see its revenue per employee drop once it is a standalone company.

How can FXC Intelligence’s data help my ecommerce strategy?

Challenges, opportunities and strategies for growth

At the heart of FIS’s reasoning for the spinoff is that it will be able to focus more on growth than it can tethered to the legacy business.

“The pace of disruption in payments is rapidly accelerating, requiring increased investment for growth and a different capital allocation strategy for our merchant business,” said Ferris.

“Worldpay operates in a more dynamic and disruptive end market relative to Heritage FIS with more of a growth focus. The separation from FIS will allow Worldpay to pursue a more growth-oriented strategy, which we believe the company is better suited for and aligns more closely with investor expectations.”

M&A opportunities: Could Worldpay buy its way to growth?

One area that was mentioned at several points during the earnings call was the need for M&As, which were characterised as a key part of growing the company. Here, spinning off from FIS allows for a different capital structure that creates better liquidity for such acquisitions, and so is arguably one of the biggest drivers of the spin-off.

Worldpay is no stranger to acquisitions – the company is built on them. At all stages of its existence as a company, it has used acquisitions to help drive its growth, and so it is easy to see why it considers them key to this in the future.

However, there are some concerns about the effectiveness of such repeated acquisitions, particularly when it comes to effectively integrating them and achieving synergies between each segment.

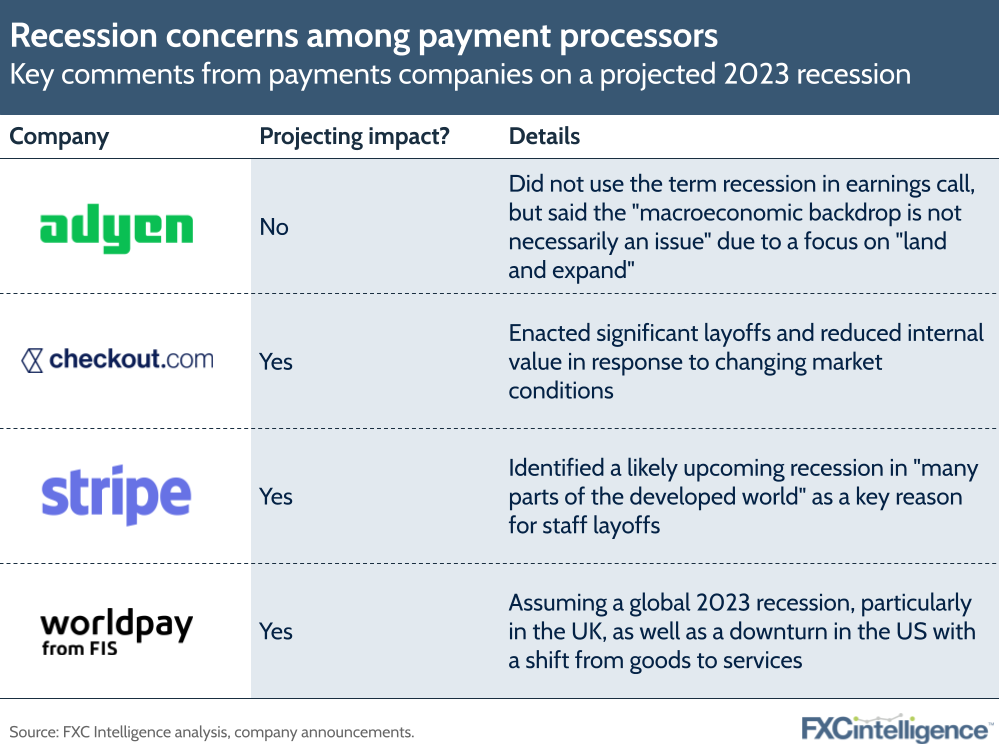

Recession concerns

Meanwhile, the company has flagged concerns about a 2023 recession, providing an outlook for the year that takes into account a global recession hitting commerce. However, normalising for headwinds (the recession and a lack of product investment), the company does project Worldpay to see growth of 4-6% in 2023, and the company is investing to offset the impact of the macroeconomic climate.

“We do think as those recessionary ties recede and with the allocation of more M&A capital, this business can really get back to a mid-single-digit grower and be back in a growth trajectory,” said Ferris.

Repositioning Worldpay for growth

Aside from M&As, Worldpay is looking to drive growth through a number of areas, including through investments in both its ecommerce segment and its platform offering, in part aided by the embedded finance capabilities brought by the recently acquired Payrix.

“The team is taking aggressive steps to repivot the business back towards growth,” said Ferris.

“This includes the investment in the Worldpay for Platforms strategy to strengthen the company’s value proposition with independent software vendors and a continued push toward increasing its total percent of ecommerce revenue.”

As a result, while in 2023 it projects both its SMB and enterprise businesses to contract by low double-digits and mid single-digits respectively, it is expecting its ecommerce business to see a double-digit increase in 2023.

Challenges for Worldpay to overcome

As FIS develops its spinout of Worldpay, it will be looking to convince investors that this is the right move for the companies, and win back those who have so far been sceptical.

In the long run, however, Worldpay will need to position itself to meet the needs of merchants in a rapidly changing landscape, where alternative payment types are on the rise; emerging markets are growing; and spending habits are evolving.

Acquisitions are likely to play a key role for the company to respond to these market needs – and may therefore become an increasingly key sell for investors. However, Worldpay will need to convince detractors that not only can it thrive independently, but that it can continue to acquire in a way that builds strength, rather than drawing from it.