Following Wise’s trading update, we spoke to Matt Briers, CFO of Wise, and CPO Nilan Peiris about key revenue drivers for FY23 and how the company is evolving its business product.

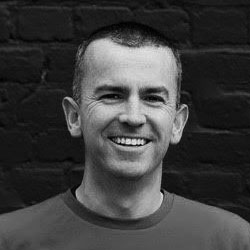

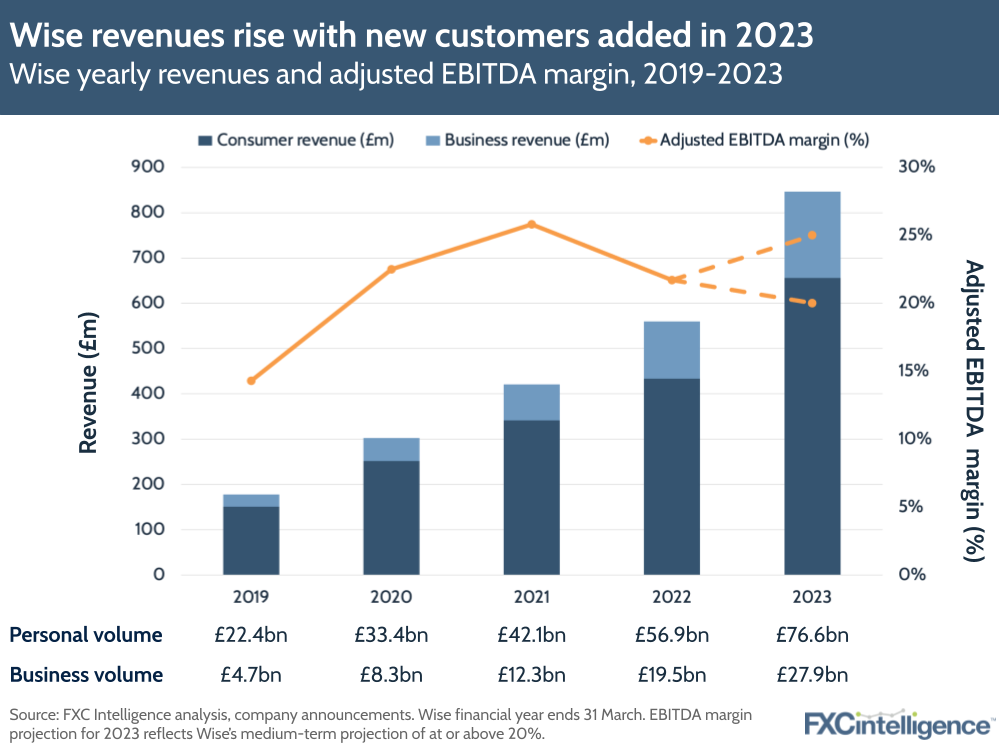

After a visual rebrand in March, Wise has released its trading update for Q4 23 and FY 23 (the company’s financial year ended on 31 March 2023). While the company’s full FY 23 results are expected in June 2023, it did report that revenues had grown 45% in Q4 to £223.5m, and 51% to £846.1m in FY 23.

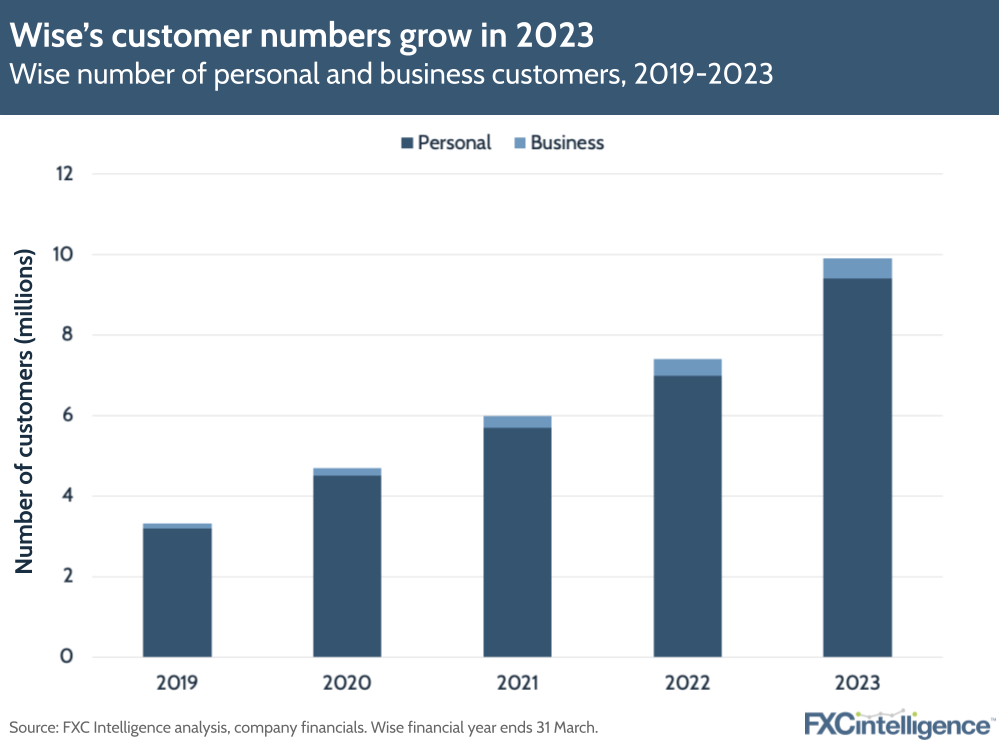

Revenue growth was driven by customer acquisition, with customer numbers growing 33% in Q4 23 to 6.1 million – spanning 5.8 million personal and 340,000 business customers. Across FY 23, customers transferred a total of £104.5bn across borders with Wise, a 37% rise, while the amount of cash customers held in Wise Accounts rose 57% to £10.7bn. Take rate was 0.81% in FY 23, up from 0.73% in FY 22.

Despite these gains, Wise’s share price fell after the update, with some commenting this was due to lower volume growth than investors were expecting in Q4 23 (at 25%). The company put this down to a decline in high volume sends (>£10k) challenging macroeconomic conditions, and seasonal variation in large consumer purchases, but it also said it had seen growth across low-volume (<£10k) sends.

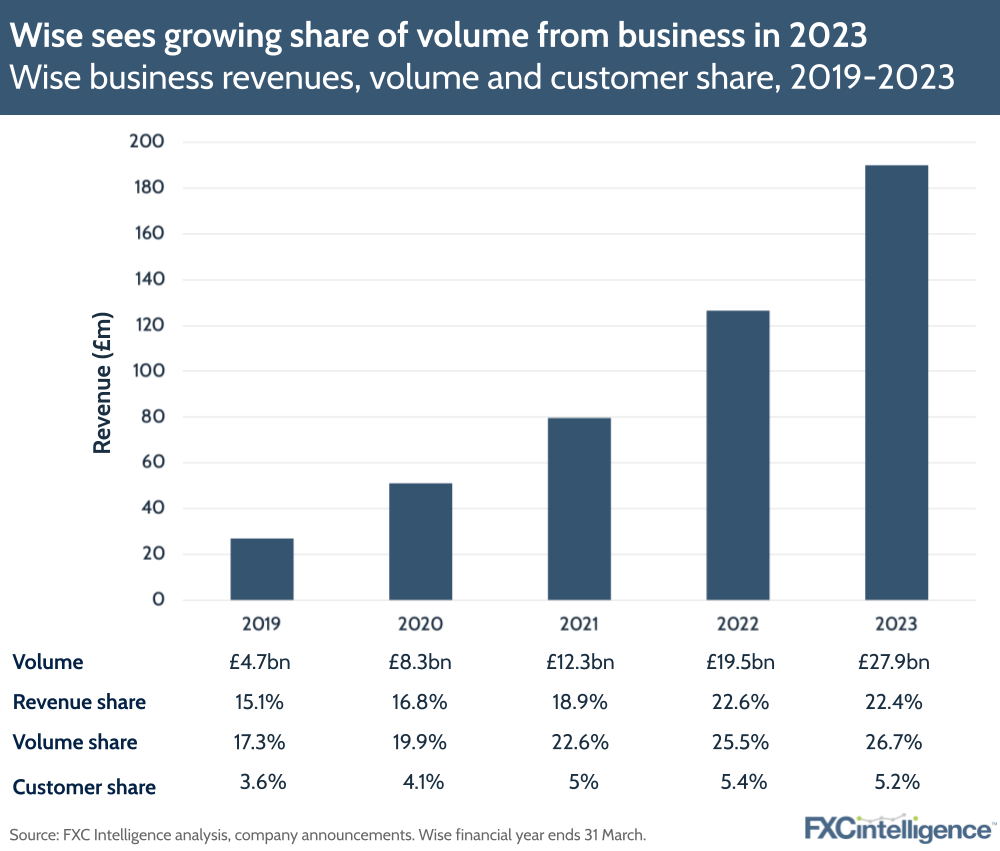

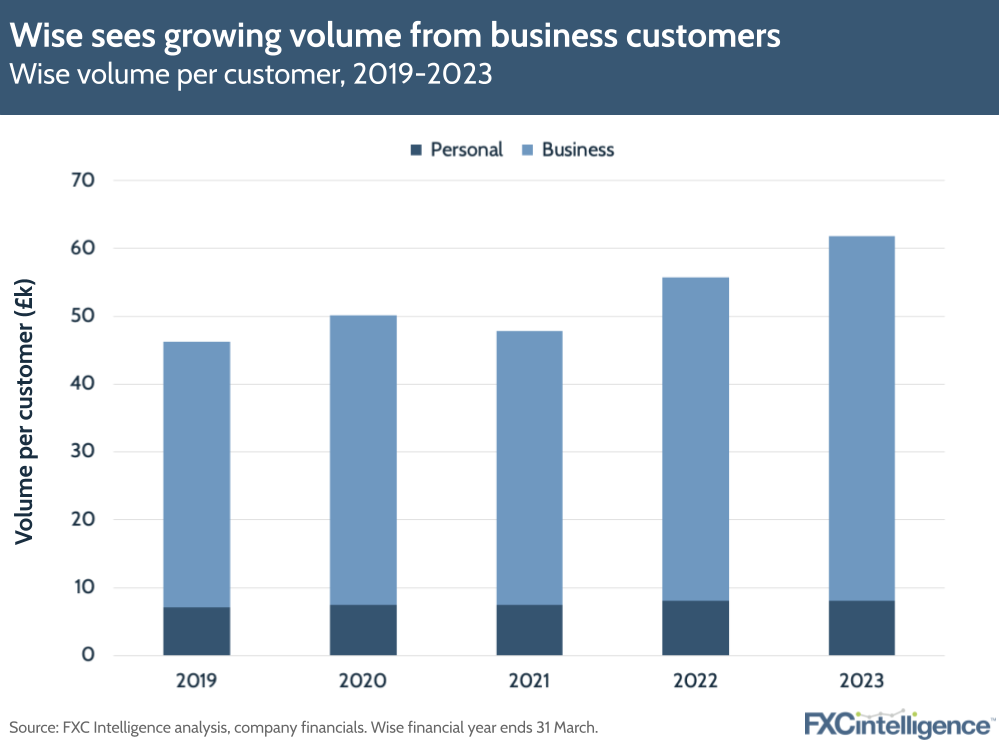

Amidst growth in its core personal segment, Wise is continuing to expand its services to businesses. Revenues from businesses grew 50% to £189.8m and accounted for 22.4% of total revenue, similar to last year. However, the average volume per customer for the business segment grew from approximately £47,700 to £53,700 in FY23, while for the personal segment volume per customer was flat – at around £8,100.

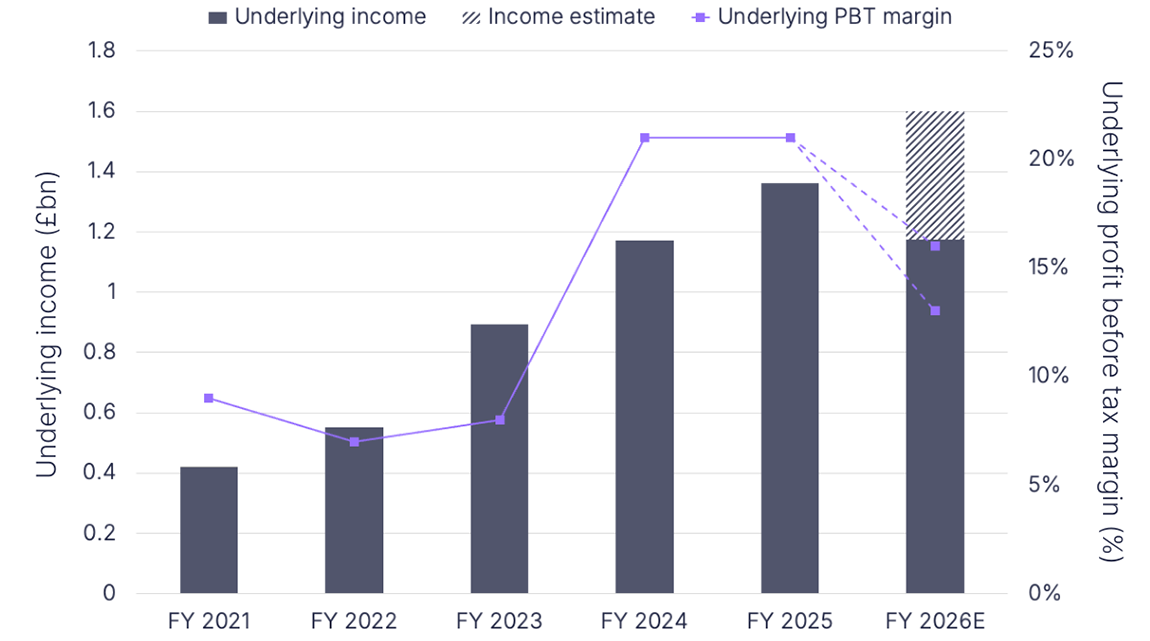

Wise didn’t give FY 24 guidance in this update, but it did restate its medium-term guidance: achieving total income growth greater than 20% and adjusted EBITDA margin at or above 20%. We spoke to CFO Matt Briers and Chief Product Officer Nilan Peiris about how Wise is continuing to evolve its business product this year.

Wise revenue growth drivers in 2023

Daniel Webber:

What’s been driving revenue growth for Wise in 2023?

Matt Briers:

There are an increasing number of people joining Wise and solid performance in the cohorts, both in personal and in business, which means people aren’t leaving us. That translated to £27bn of volume for the quarter, which is up 25% YoY, and a 45% increase in revenue – that’s the cross-border fees and then other fees related to the Wise account that customers pay us. If you add in the net interest income (80% YoY growth) that’s on the same course as the year before. That includes all of our interest, some of which we’d like to be paying back to our customers.

People have really zeroed in on what’s been happening with volume because cross-border volume is one of our major KPIs that we focus on, but it’s not like when we were Transferwise; it’s not the only thing now, but it is a primary driver of what we look at.

The Wise account is much more than just sending money, and that grew pretty healthily YoY. In the last quarter, personal customers that moved less than £10,000 and business have just been growing metronomically, which is pretty amazing given the size of that business now.

We’ve seen some volatility in the personal customers who move more than £10,000. Some of that was last summer, when we saw a feast in the world of rates where large payments moved. We’ve talked about OFX and where they’re really exposed to this. Really, part of that drives some of that business as well. However, we had two really high quarters and now we’ve had two quarters where that’s slowed, so that’s actually had an impact on the blended volume per customer.

The impact of FX rates on higher volume money transfers

Daniel Webber:

Can you explain more about how that volatility is affecting higher volume sends?

Matt Briers:

It really is focused on these larger payments, which make up a big chunk of the volume for people. The biggest use cases are sending money related to buying, selling and refinancing a property. It’s also related to investments; that could be exiting a fund and putting money in another fund or just moving your pension fund around. Those things moved consistently with these high-value payments. But if you look out the window, there are just fewer property sales and in a world of uncertainty, people tend not to move that money around, so it really shouldn’t be a surprise that there’s maybe less of this now than there was a year ago.

We should also just be mindful of FX: it bounces up, down and then back to normal, so it just pulls things from one quarter to another. It’s helpful for people to understand the use cases in Wise and that in the current macro environment, we should be mindful as to when this might come back.

What we do see is that our customers keep coming back and using Wise. We’re seeing more customers join us every month and quarter than before. More than half of those now are using the Wise account, which are even stickier customers. For us in the long run, we’ve watched the volume very closely, but nothing fundamental has changed.

The evolution of Wise’s business product

Daniel Webber:

Wise was a consumer business before it had a business product. Can you tell us more about the evolution of that business product and where it is today?

Nilan Peiris:

We started with our business product, like we did with our consumer product, with transfers. Businesses care about the same things as consumers when it comes to transfers: price, speed and convenience. On price, we found the price points that we had with consumers – especially as we started to roll out our higher volume tiers and lower prices at higher volumes – saw a considerable uptake among SMEs and businesses.

With speeds, we’ve got a best-in-class delivery estimator and every quarter-on-quarter that speed keeps increasing. Businesses want the certainty of knowing that when they’re paying an invoice or the salary of an employee, it’s going to be paid on that day, at that time, by that cutoff. Again, this feature of the underlying infrastructure we spent more than a decade investing in translates well to business.

Finally, I’ll touch on convenience. Signing up and onboarding businesses globally isn’t easy. When you’re onboarding businesses in Europe, you need to verify the ultimate beneficial owner of the business for certain clusters of business. In Australia and other APAC markets, the requirements are different. When I look at the product that we built there and our YoY investment in reducing the costs and improving the convenience for customers to onboard, it’s stunning.

In the UK, the US, and increasingly parts of Europe, we’ve integrated into business registries so you don’t need to type in a lot of information. They’ll automatically look up that information for you and put it in. Customers and businesses love that. We see that driving increased conversion rates and reduced costs to onboard businesses. We continue to expand that out globally. That’s transfers, which has been our heritage.

Benefits of the Wise account for businesses

Daniel Webber:

What are the other benefits of the Wise account for businesses?

Nilan Peiris:

The Wise account really has been adopted by businesses, with pretty close to the majority of businesses using us as the account. If you’re a business and you’ve got a customer in Australia today, pre-Wise, the way to get paid is to send an invoice out to Australia and put your IBAN on there. Three to five days later, some pounds will turn up in your account, but you’re not ever quite sure how much and you’re not ever quite sure when.

If you want an Australian bank account holding AUD, to give your customers an Australian bank account number, you need to fly to Australia, incorporate a business, go to a bank with a bunch of documents and open an Australian bank account. Only then can you invoice your customers in AUD.

Today with Wise, you can get Australian banking details in three clicks, as well as European, Singaporean and US banking details. This is a killer feature for businesses, as they love getting paid in local currencies and paying out their bills locally rather than having to bring it back. They love our multi-currency card, which enables them to spend their business balances in local currencies. We’ve had great success in rolling out multiple employee cards out to businesses, as well. We are also investing towards expense management solutions and things that look more like that for our friends in business.

What do Wise’s business customers look like?

Daniel Webber:

What’s the typical profile/size of the businesses you serve? And what’s the mix between micro, small and mid-size businesses?

Nilan Peiris:

We’re targeted today at the micro to small end of the scale. Not solo traders, not freelancers, but micro to small. That’s where we see the greatest product market fit. As we build out features – more and more fine grain controls for businesses; more card management type features; tighter integration into different accounting systems; and syncing with accounting platforms and enterprise resource planning platforms – we’ll see ourselves slowly working our way up the value chain. But for today, it’s small to micro-size businesses.

Wise’s approach to cards and paying businesses interest

Daniel Webber:

Are you also thinking about the credit side at all?

Nilan Peiris:

It’s not something we’ve heard yet from our customers and hence something we’ve not prioritised. At the moment, it’s around cards, card management, integration into accounting systems, permissions and sign-off approvals, as well as returns and interest on balances.

This has been one of the surprising wins for businesses on the Wise products over the last six months. Six to nine months ago, we didn’t give customers a return on their balances. This is now live in varying forms for businesses in the US, across parts of Europe with our cashback scheme, with our assets products rolled out in the UK and in Singapore as well.

This is offering something that looks similar to an interest rate paid back from government bonds, up to around 3% or so depending on the market that you are in. Businesses love this and it’s another reason they’re keeping their balances with us for longer.

How Wise is acquiring customers

Daniel Webber:

How is Wise acquiring customers? And what’s the overlap between someone that has a consumer Wise account and then has a business Wise account?

Nilan Peiris:

We acquire businesses predominantly through word of mouth. There is an acquisition motion from our consumer business through to people who start up as consumers, then become business customers as well. And we also find businesses through marketing on marketing channels, too.

Wise’s appeal to SMBs and enterprise businesses

Daniel Webber:

Is there any extra colour you can share on the business side?

Nilan Peiris:

On the SMB side, they value the same things as consumers: price and speed. The other one is convenience, especially the speed with which you can open and onboard an account. In the wake of the Silicon Valley Bank collapse, we saw a bunch of businesses opening accounts really quickly. That matters to businesses, the speed and convenience with which they can do that.

The other part is the enterprise side of the business. With Wise Platform [the company’s global payments and FX infrastructure product for banks and enterprises], we’ve seen tremendous success with business campaigns, especially in the US. Aside from our recent announcement with BlueVine, we have a bunch of other business banks in the pipeline in the process of going live as well. This is a testament to the speed with which we can onboard the end business customers, as well as the quality of the underlying infrastructure. So increasingly, business banks are turning to Wise for our underlying business product.

Daniel Webber:

Matt, Nilan, thank you.

Matt Briers:

Thank you.

Nilan Peiris:

Thanks very much.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.