Kicking off the latest batch of entrants in our Post-Earnings Call series, we speak to Matt Briers, CFO of Wise, about the company’s evolving consumer strategy and Q3 2023 results.

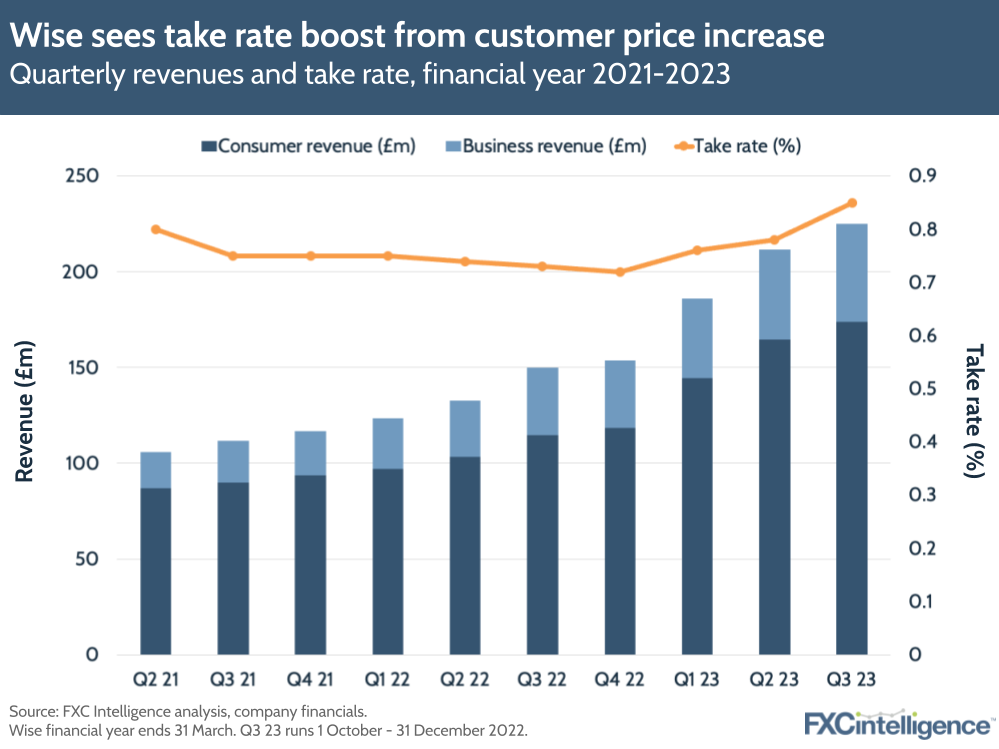

Wise has released its Q3 2023 results, equivalent to calendar Q4 2022, and the headline numbers are once again positive. Revenue has increased 50% year-on-year to £225.2m, while consumer volume increased 26% to £19bn and business volume climbed 35% to £7.4bn.

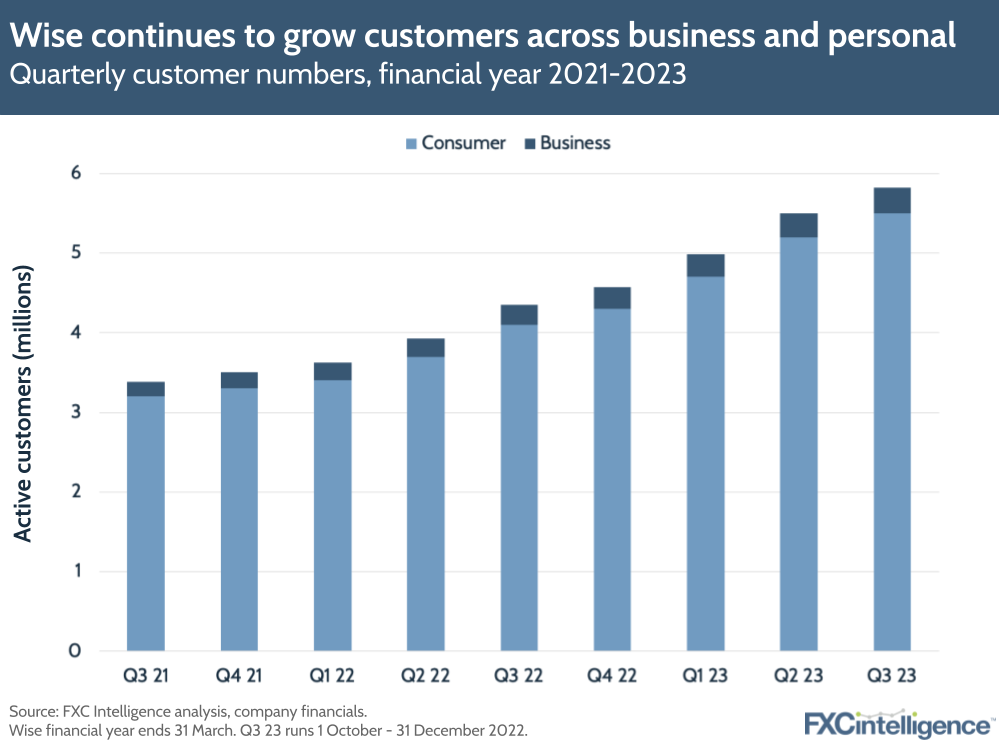

Overall customers also climbed 33% YoY overall, with consumer customers increasing 34% to 5.5 million and business customers growing 26% to 320,000. Meanwhile, take rate grew 12bps YoY, to 0.85%, driven by increased prices and a change in the mix of routes used by customers. Nevertheless, some routes saw significant drops in pricing, including Mexico, where prices dropped by 50%, and Brazil, where integration with instant payments system Pix helped cut prices by 10%.

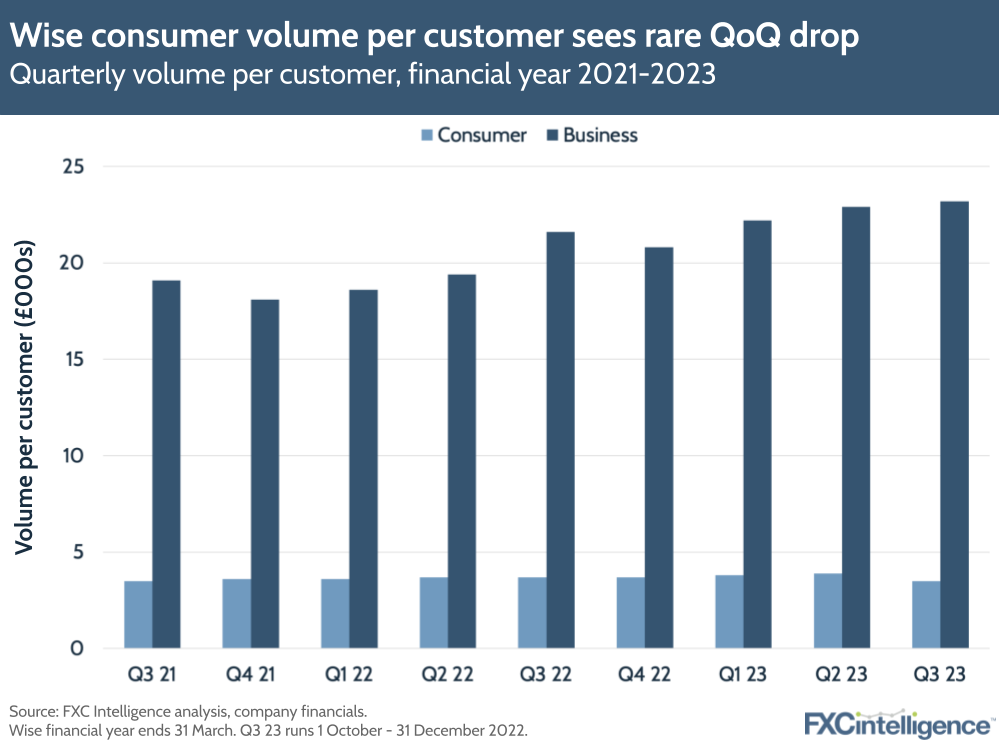

However, while volume per customer increased quarter-on-quarter, among consumers it shrank by 10%. In the company’s earnings call, CFO Matt Briers attributed this to increased volatility in the way customers are converting money – likely a result of the ongoing macroeconomic climate.

He also stressed that this was largely coming from customers that send over £10,000 – a minority of customers – with those with lower send amounts being “very stable”. In the long term, the increasing use of a mix of customer products, including the Wise multicurrency account, is expected to push volume per customer higher.

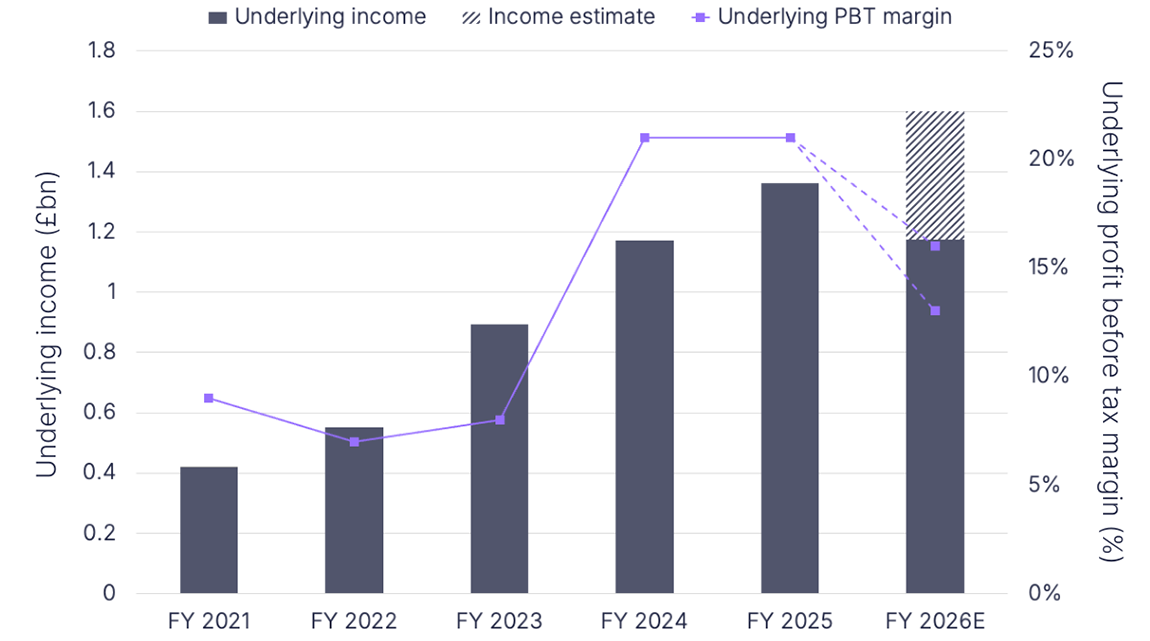

The company has once again upgraded its FY 2023 guidance as a result of the earnings. It now expects total income growth to reach 68-72%, up from a projected 55-60%, while adjusted EBITDA margin is expected to be higher for H2 23 than H1’s 22%.

With this in mind, how is Wise thinking about the development of its business, and in particular its consumer segment? We caught up with CFO Matt Briers to find out more.

Maintaining Wise’s growth rates in Q3 23 and beyond

Daniel Webber:

A really nice set of continued numbers, particularly in the broader economic context. What’s allowing you to maintain your growth rates amid the wider market conditions?

Matt Briers:

There’s a few fundamentals here. Are you growing your business? Are you growing the number of customers that are using your product?

There’s companies out there that are growing gross market value or transaction value, or people might be talking about growing revenue. But really, fundamental growth in the end comes from growing your customer activity.

There’s a bunch of other factors that are affecting people’s top lines at the minute, which is obviously the amount of money there or, if you think about an online or a food retailer, it’d be the basket size. People are spending less but they’re still going to the shops.

Then there’s other factors. So this is macro driven around things like the cost of living crisis, which pretty much every country in the world is struggling with.

Then in our industry, the FX volatility drives this as well. It’s not like the food retailer, how many things are in your basket each week. If you’ve got a £20,000 or a £50,000 or even £100,000 payment to make, you may do that once a year and you may choose to make that at a point where the rates suddenly move.

All these factors are playing into some of our numbers, but if you look underneath it, the fundamental reason why we are growing is the fact that we’ve got more and more customers joining us every month. We try to build products that more and more customers want to use. There’s over 300 million people around the world that suffer with this problem of international money; their money is across the border. We only had 5.8 million users in the last quarter, but that was up on the previous quarter and 33% up on the previous year.

We’re constantly trying to build products that just get more and more of those customers to use our products over time. If you do that, yes on the odd quarter they’ll move more money or move less money, but in the long run that’s the only way to sustainably grow.

We keep an eye on the number of customers that join and therefore the number of active customers that keep using us. Why do they join? We’ve got a customer base that is active in selling our product for us. Why do they do that? We have a net promoter score of around 70, which is pretty high.

We’ve got over a million customers joining us on a quarterly basis, that’s growing. Two-thirds of those are coming through direct referrals from the people that join in the previous quarters. So you have this flywheel of continual recommendation. And it’s very hard to not grow when you have this.

Avoiding customer churn

Daniel Webber:

That growth model works as long as you don’t have a high churn rate. How do you avoid that?

Matt Briers:

Back in the day, we launched in the US with a very attractive deal to get your first payment free or get your first few payments free.

It was amazing, we saw this massive spike in growth. And then none of them came back the next month because they went to the next shop that basically had the same offer. So we don’t typically do this now: we don’t really offer the first payments free.

By offering that deal you’ll attract a bunch of customers who really like it, and you therefore have a set of customers who, by definition, will want to find the next one of those offers. They’re not really going to stick around.

You’ll also train the market to like it: it’s a quick way to give away money to customers.

In the US, we just stopped doing this, and then we realised that the product we’d shipped was pretty bad. The net promoter score of the product was maybe 20 or 30, which isn’t actually bad, but it wasn’t great.

We decided to stop spending all that money and just make the product better for you when you use it. Then we saw NPS tick up and word of mouth tick up.

So when we launch a market everyone assumes we’re just going to spend some money on marketing and set the fire going. No: it’s totally the other way around. You don’t spend any money on marketing until the product’s good, because it’s just a waste of money.

Sourcing future customer growth: Remittances or banks?

Daniel Webber:

A big part of your 300 million potential consumer customers number is the remittance market. How do you think about remittances and are they key to how you plan to grow your customer base?

Matt Briers:

I actually think there’s more flows outside of the classic World Bank remittances than inside, or there’s a meaningful amount of this market that we believe is outside. This typically can be through the brokers, but primarily it’s through banks.

We ask our customers, “Who did you use before us?” If they used someone, it’s typically their bank. It’s not a broker, it might be PayPal. But it’s very rare that it’s a remittance provider. If you think about the chart of Western Union’s volume since we got started, we’ve done this and they stay flat.

Most of our customers have come from banks and that’s where the volume is. The volume is in banks of people doing a SWIFT transfer through their bank for an opaque rate, basically.

We don’t really think about the value of customers. We’d hate to think that we discriminate or target high-value customers. What stops us [attracting remittance customers] is dealing with cash. Especially on the way in. We don’t deal with cash: this just brings a totally different risk and these companies do an amazing job in dealing with this.

The compliance cost is just too high. But cash is becoming digital and so when these things start to move to wallets, for example, and those wallets start to become credible, what’s the difference between a wallet and a bank account in the future? I don’t think there’s going to be much difference.

We can happily integrate these wallets. So if we can serve these customers with an instant payment through a wallet that’s credible and verifiable at a low price and instant, we’d love to.

If there’s volume and we can save people money profitably, if we can build a model that works for us and works for the customer radically better than their alternatives, we’ll happily build this. But actually when we look at the volume, the volume moving is in banks. And not just in euro, pound or dollar.

Customer service to attract the higher end of the market

Daniel Webber:

On the product side, higher-end brokers have a human available to talk about the market, and sometimes offer forwards, for customers with needs such as buying an overseas house. How do you think about that end of the market or a product to serve that customer?

Matt Briers:

We do this quite a lot. We have quite a lot of this volume. So you can load $250,000 into your Wise account today. We’d advise you to do it now rather than when you need to make the payment. You have it in your dollar account. You obviously want to buy a house in London, because they’re a lot cheaper than they were last year for you.

You’ll get a rate alert or you can look at it and you can press convert and you’ll instantly convert into your pound account as you want it. You don’t need to phone a broker and hope they’re at the other end of the phone.

If you want somebody to speak to, to talk you through the transaction, we actually do have a team that handles large amounts. But the idea is you shouldn’t really need to do that. $250,000 is a payment you should be able to load into a dollar account and get yourself verified, then you can watch the rate and hit convert. It’s an instant conversion.

Then you’ve got the pounds there so you can send that to the lawyer the next day to make the transfer. Part of the benefit of the Wise account, rather than cross-board a transfer, is you can have the money there, you can convert it and it’s still in your account – it’s in a pound account now instead of a dollar account. And by the way you can do that on the weekend.

Investment and the Wise account

Daniel Webber:

The Wise account has been a nice revenue boost for you, but it also allows customers to earn interest. How much of that revenue are you giving back to customers?

Matt Briers:

We’ll definitely give some of this back to our customer, but if you’re a customer that has this fair amount of money, or whatever is a meaningful amount of money to you, you can earn interest and still spend the money on your card. So it’s instant access – you don’t need to lock it up for a month or put it in a separate savings pot.

It’s a little bit complicated still because we’re working through it, but if you think about what we shipped this quarter, we’ve launched interest on assets in the UK; we have an investment licence.

Let’s say you’ve got £1,000 in your dollar account in the UK and £1,000 in your pound account in the UK. You can click a button and say invest it. You’re holding cash, you can click put into interest and we move the money in the backend to a BlackRock Money Market Fund, which has government bonds in there.

Then on the dollars, you earn the US dollar interest rate, which is above 4% now. Then on the pounds, you’re going to earn the central bank interest rate. You pay a 20bps fee on that, so it’s pretty good. Then instead of you having to lock that up, you can go down to Starbucks and spend on your card and we’ll just reduce the balance.

So effectively it’s instant access, no term on it or anything like this, and it’s government-backed. It’s a pretty cool product, actually. It’s quite neat.

We’ve got the licence to do something similar in Europe and Singapore and we’ll put that live. But also in Europe, we’ve started paying a balance cashback to our customers who hold a balance. And we’ll explore what we can do in the US, so we’re working on this.

If you think of all these customers, these hundreds of millions of customers, six million of them are using us. The ones that aren’t, we ask why not? And there’s probably a hurdle to get over. They’re saying, “It’s just still convenient for me to sit with my bank.” For those customers you say, “Well there’s no reason, you can earn more interest if you hold the money in our bank account than with your bank.”

We’re in the business of moving money around the world. We’re not in the business of earning interest. Yes, it helps us and it gives us cashflow. But you as a customer, with your bank that interest doesn’t come to you. They lend that money out to somebody else and then they earn a return on that and you just suffer the inconvenience. So we think we can disrupt that model quite a bit, which should be quite fun, and quite good for you as a customer because you should get a reward for holding your funds with us.

Daniel Webber:

Matt, great to talk to you – next time we’ll dig into the business side. Thank you.

Matt Briers:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.