Banks are the biggest source of new customers for both consumer and B2B money transfers providers, but how much are they working to retain their customers for these services? We review the website-based marketing efforts of the top 100 Tier 2 North American banks for their cross-border payments services.

Among most cross-border payments players catering to both consumers and businesses, the biggest source of new customers continues to be banks. While all companies take some customers from direct competitors, banks remain a major source of new business across remittances, money transfers and B2B payments.

This makes better addressing the cross-border payments needs of customers a significant business opportunity for banks around the world. However, it is a particularly key opportunity for Tier 2 banks operating in the US and Canada. As the largest send market in the world in terms of consumer money transfers flows and SME cross-border payments flows, the US is a particularly significant market for money transfers among the main business and consumer customers of Tier 2 banks.

Customers in the US have traditionally been less aware of FX pricing than in other countries with more interdependent economies, which is thought to have resulted in a less competitive environment than in other regions. However, with digital money transfers services becoming more widespread, banks’ share of business is continuing to be lost to money transfers players, suggesting that banks are falling behind in how they cater to such customers.

With this in mind, what effort are Tier 2 North American banks making to attract cross-border payments customers? Is the common perception that banks do little to attract or inform customers about their cross-border payments offerings correct, or is the reality more nuanced?

All such banks will be able to provide some kind of cross-border payments service to their customers upon request, but whether they are actively promoting this is a very different matter. In this report, we explore how the top 100 Tier 2 US and Canadian banks are communicating their cross-border payments products for businesses and consumers on their website – and considering where there is the opportunity for greater communications in the future.

Assessing website marketing of Tier 2 North American banks: Methodology

In order to assemble this report, we started with the top 100 North American banks in terms of Tier 2 capital – the secondary layer of bank reserves that is made up capital types that are harder to liquidate than the primary layer – as of November 2022. The top four (J.P. Morgan, Bank of America, Wells Fargo and Citigroup) were removed as Tier 1 banks. Two further banks were also discounted, in one case due to a recent merger and another due to an umbrella structure that resulted in no products being advertised on the overall website.

We then conducted an extensive review of the remaining 94 banks’ websites to determine whether marketing content focused around key cross-border payments services was present. This included browsing the overall website, as well as using internal and external search functions to find copy related to cross-border products and services and determining which service type it fell under.

Of the 94, five served customers in Canada, while the remaining 89 served customers in the US. 90 served consumer customers, while 87 served business and/or commercial customers.

For consumer-target products, we checked to see if the banks mentioned the provision of the following products and services in the website’s marketing copy:

- International bank wires, money transfers or remittances

- Multicurrency accounts or international banking services

- Multicurrency or international use-focused cards not tied to a specific account

Currency exchange services for travel were not included in this research.

For business-targeted products, we checked to see if banks mentioned the provision of the following products and services in the website’s marketing copy:

- International bank wires, international payments or money transfers

- Foreign exchange/risk management and related services

- Multicurrency accounts or international banking services

- Multicurrency or international use-focused cards not tied to a specific account

We included mentions where the topic was either a page or section in its own right, or was part of a wider section, but not where the only mention was in small print or similar. However, we also reviewed small print, terms and conditions and other similar resources to determine if the bank in question offered such services in any form.

As a result, this report identifies banks actively including mention of their cross-border services in their website marketing copy as distinct from those that offer the service in some form, but do not mention it in their marketing copy. This reflects the ability of customers to find out about a bank’s provision of such services and so serves as a key indicator of whether a bank is actively promoting such services.

Cross-border payments marketing among US and Canadian banks: An overview

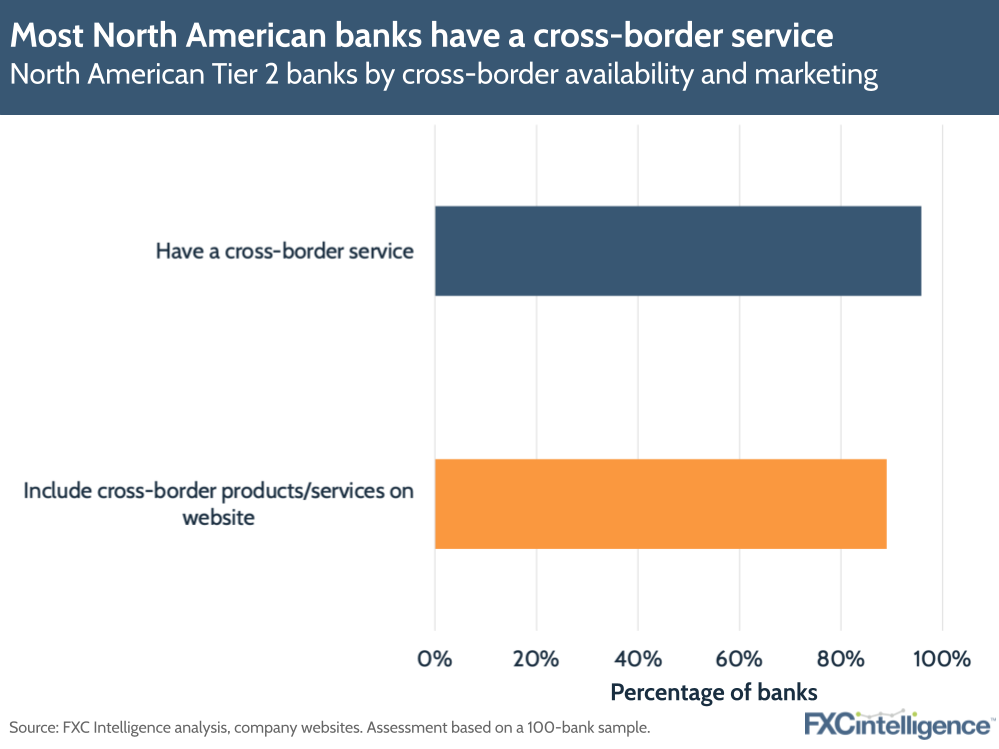

Of the US and Canadian banks researched, the vast majority (96%) have some form of cross-border product or service, and those that don’t are generally highly specialized or small. However, the percentage of the total banks researched that market a cross-border product or service is lower, at 85%.

Significantly, the lack of cross-border products is specific overall to US banks. While all of the Canadian banks both have and market a cross-border product or service, 97% of the US banks have a cross-border product or service and only 85% market the same.

Among all banks with some form of cross-border product or service, 11% do not market it at all on their website, rising to 12% among US banks.

Business cross-border payments products among Tier 2 US and Canadian banks

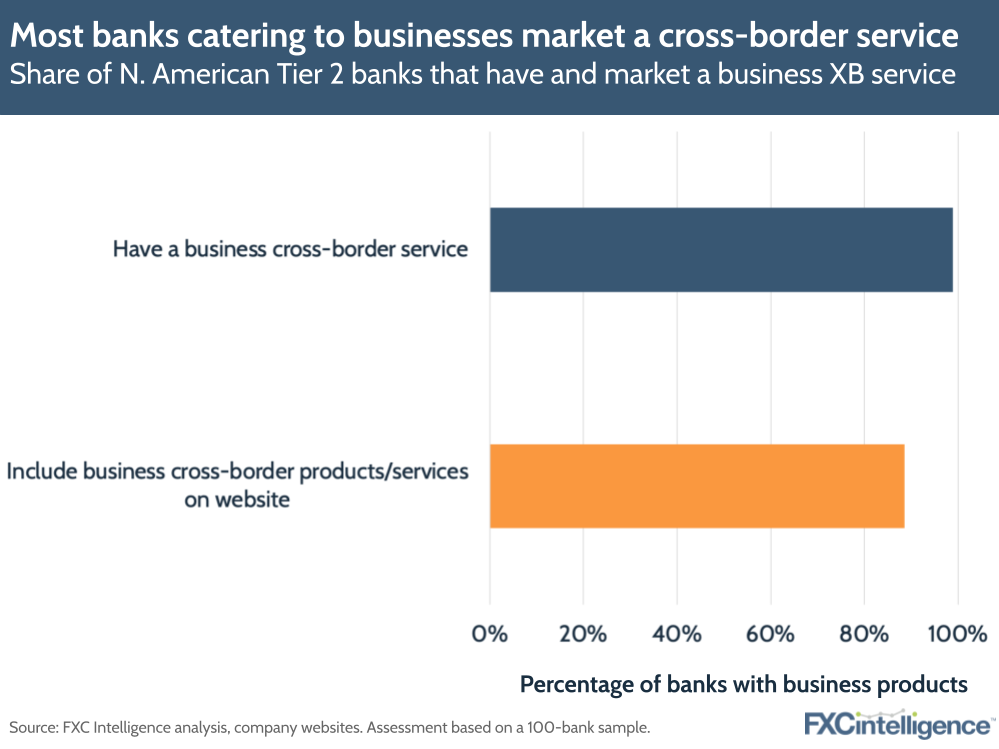

Among US and Canadian Tier 2 banks that cater to business and commercial customers, 99% support some form of cross-border payments product or service, while 89% market such a service.

This means that while the majority of North American Tier 2 banks do market cross-border payments services to business, 10% of those that have the capability do not actively market this on their website.

Types of cross-border payments services marketed to businesses

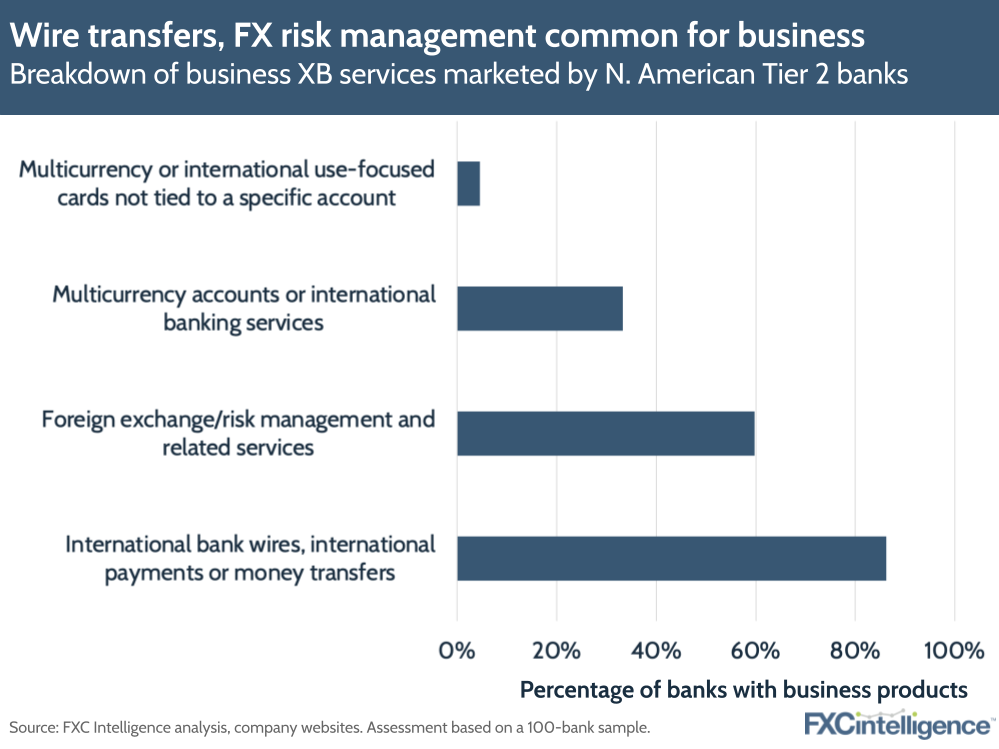

Looking at the types of cross-border services banks marketed to businesses, wire transfers and/or international payments are the most common offering, with almost all banks marketing such services to businesses (97%). Foreign exchange, risk management and related services come in second at 68%, and are often offered as a complementary service to international payments.

Multicurrency accounts – accounts that enable businesses to make payments in a second currency and services that allow businesses to open partner foreign currency accounts – are also fairly common, with offerings from 38% of banks marketing any form of cross-border service to business. Meanwhile, card products that are either multicurrency or are designed to be used internationally (e.g. with no fees on international purchases) came in third, with 5% offering this product type.

Key trends among business cross-border payment marketing

When it comes to the types of Tier 2 North American banks marketing these cross-border services to businesses, there are some notable trends. Larger banks and investment banks are more likely to market some form of product, with those not having any form of market tending to be smaller, more regional banks.

Bigger banks and those catering to commercial customers are also more likely to have a wider range of products, including foreign exchange and risk management services, as well as multicurrency accounts. However, many of the multicurrency products are limited to adding CAD or USD, with broad multicurrency products largely limited to very international or business-specific banks. Predictably, cards are often offered by specialist card providers, although some larger banks also offered this service.

Consumer cross-border payments products among Tier 2 US and Canadian banks

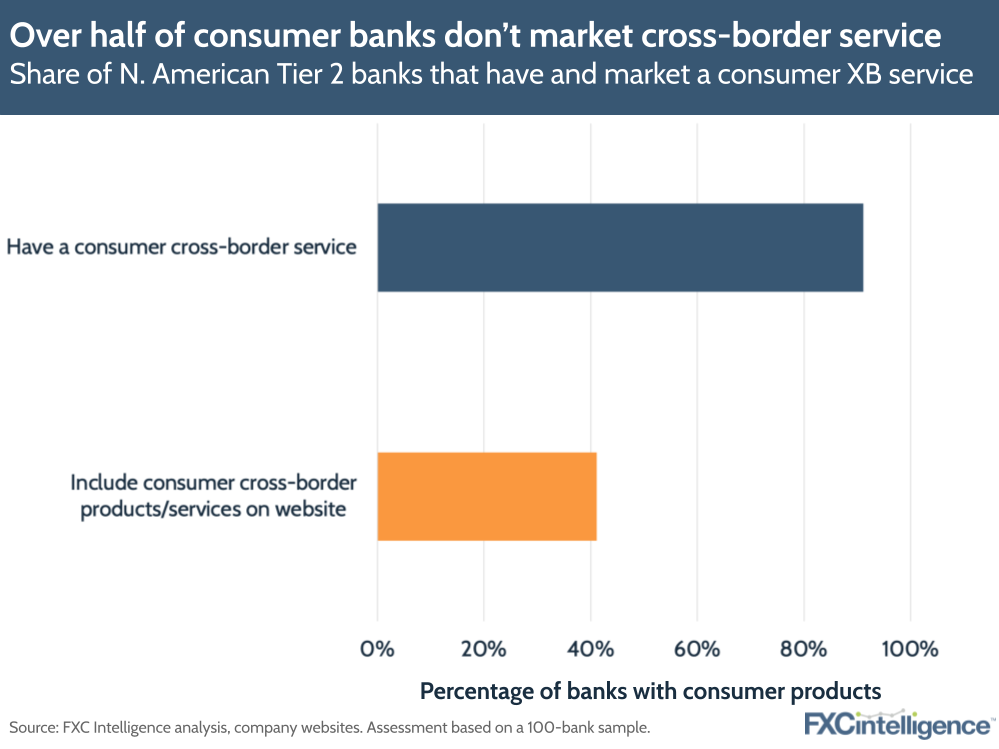

By contrast to business-targeted products, there is a stark difference between the number of banks that could provide some form of cross-border service to consumers, and those that actively market such a service.

While 91% of banks catering to consumers have a cross-border service for consumers, only 41% of such banks actively market a service on their website. This means that 55% of Tier 2 North American banks with consumer cross-border payment services do not market these.

Types of cross-border payments services marketed to consumers

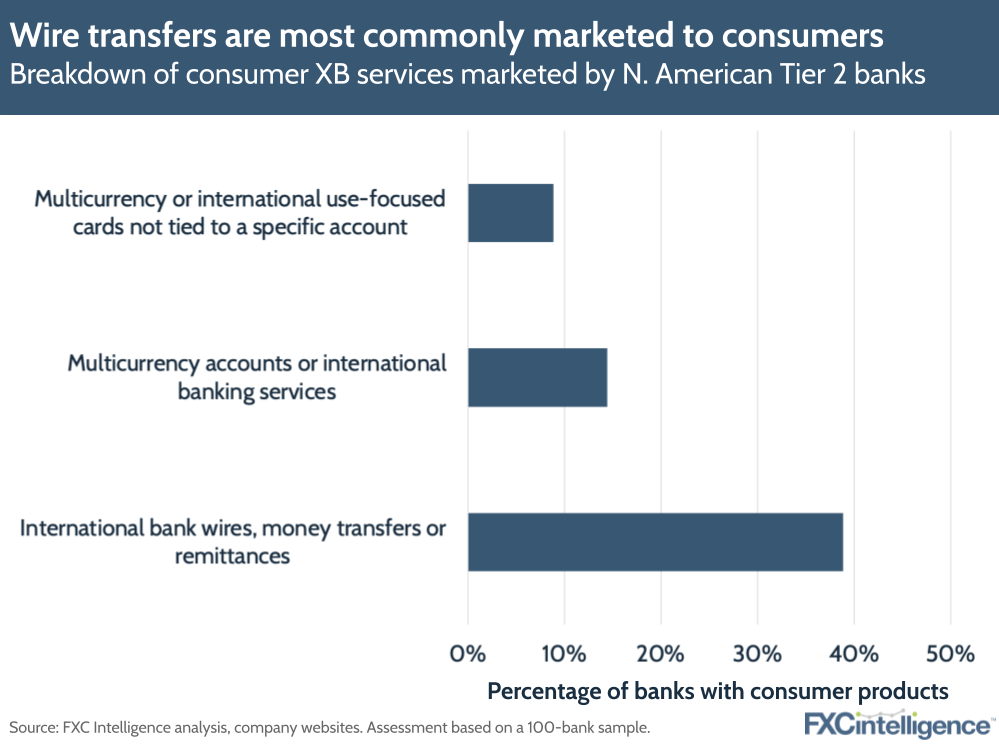

Among those that do market cross-border payment services, wire transfers, money transfers and remittances are again the most common product or service type, with 95% of banks advertising this service. In most cases, this is a standard transfer via SWIFT, although a small number offer money transfers in partnership with a named provider.

Meanwhile, multicurrency accounts or services enabling customers to bank in a second currency are offered by 35% of banks with some form of consumer-facing cross-border payments marketing. Multicurrency or international use-focused cards are also available from 22% of those sampled.

Key trends among consumer cross-border payment marketing

The large number of banks that have cross-border services but opt not to market them is likely to be in part due to the fact that in many cases these services are only available in-branch and are relatively rudimentary. Such banks are also likely to consider these services as unimportant to their core customers. However, given that many of these banks primarily cater to parts of the US with high numbers of migrants, it is likely that they have customers who regularly make cross-border payments.

Among those that do provide such services, they are generally larger, highly international or have specific products for migrants. Many are also investment banks, which generally more closely align their consumer offerings with their business offerings due to the high net-worth status of their target customers.

However, in many cases, even those that do provide such services often do not give them much focus, with very little marketing copy given over to them. As a result, particularly for smaller banks, this information is likely to be easy to miss for customers.

As with business services, multicurrency banking services are largely limited to larger and more international-focused banks, while cards are largely provided by card-specific players.

Interested in developing your cross-border product offering? Get in touch with our team

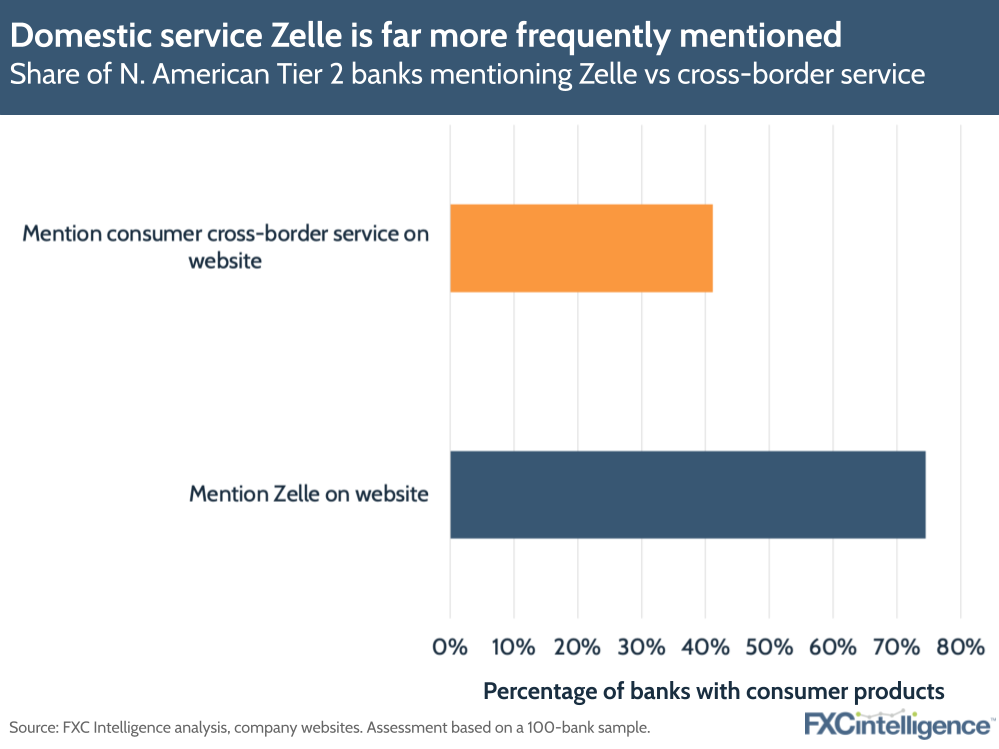

Zelle and domestic payments

Notably, we do see a far greater instance of marketing copy around domestic payments service Zelle among US banks than cross-border payments services. This shows that while banks see their customers as interested in being able to make money transfers, they do not see international payments as a priority.

Key takeaways

This research highlights the stark contrast between Tier 2 North American banks with the ability to provide cross-border payment services to customers, and those that actively market this ability. This is particularly pronounced among consumer-facing products, with larger banks typically including cross-border payments as part of their product range for businesses.

However, with the US being the world’s biggest send market in terms of consumer money transfers, it is clear that there is a strong opportunity for banks serving customers in the region – and one that, at present, they are not taking advantage of.

Banks have the potential to stem the flow of customers to money service businesses not only by increasing their marketing and communication of existing products, but also by upping their cross-border product range.

Want to develop your go-to-market strategy selling to Tier 2 banks? Get in touch