In the latest in our Post-Earnings Call Series, we speak to Remitly CEO Matt Oppenheimer about the company’s strong Q2 2022 revenue growth, reducing costs and future plans.

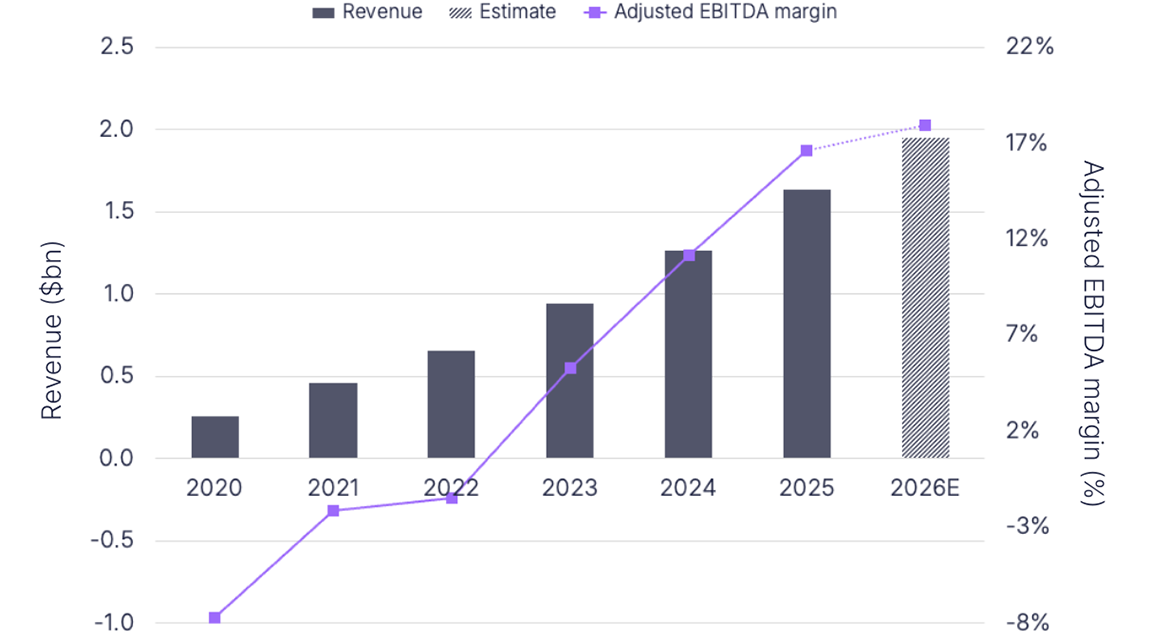

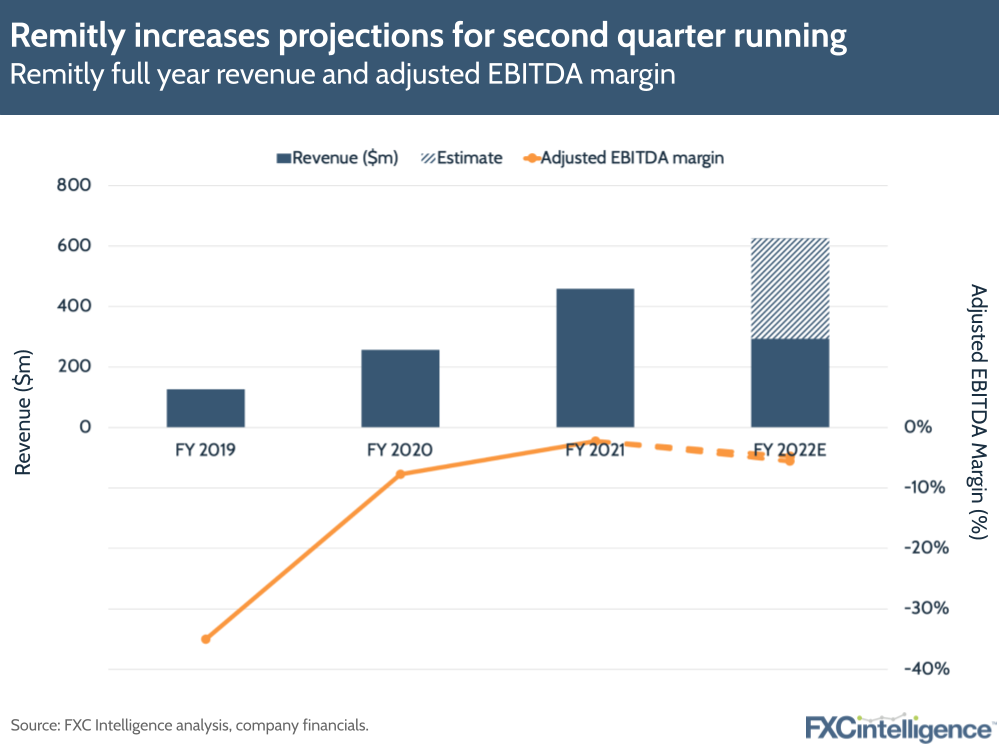

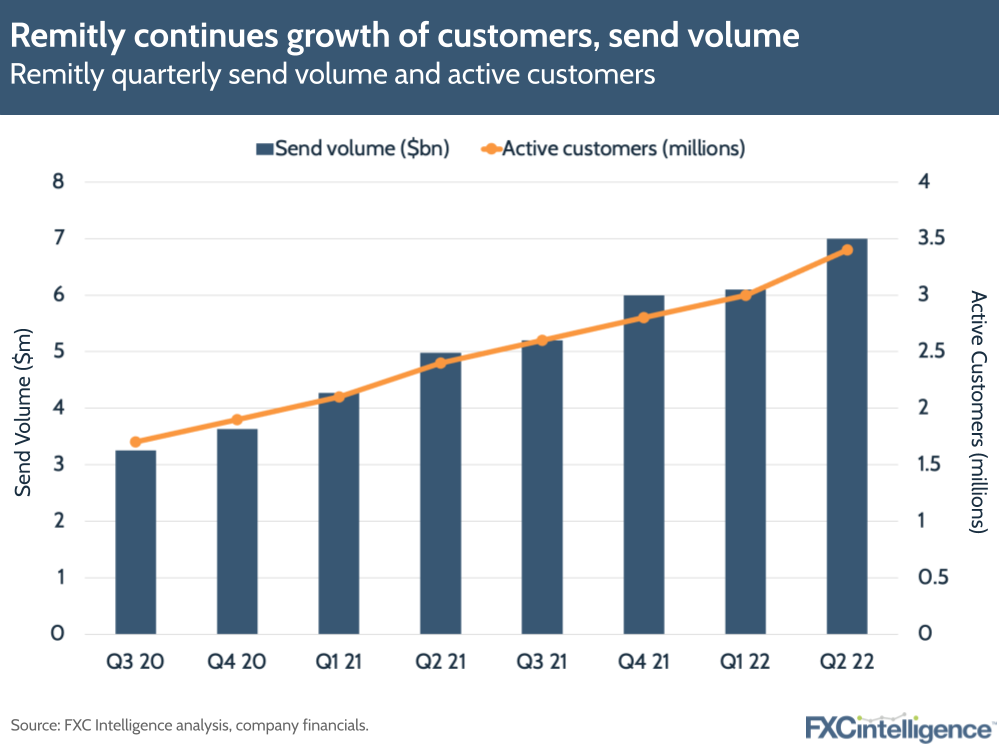

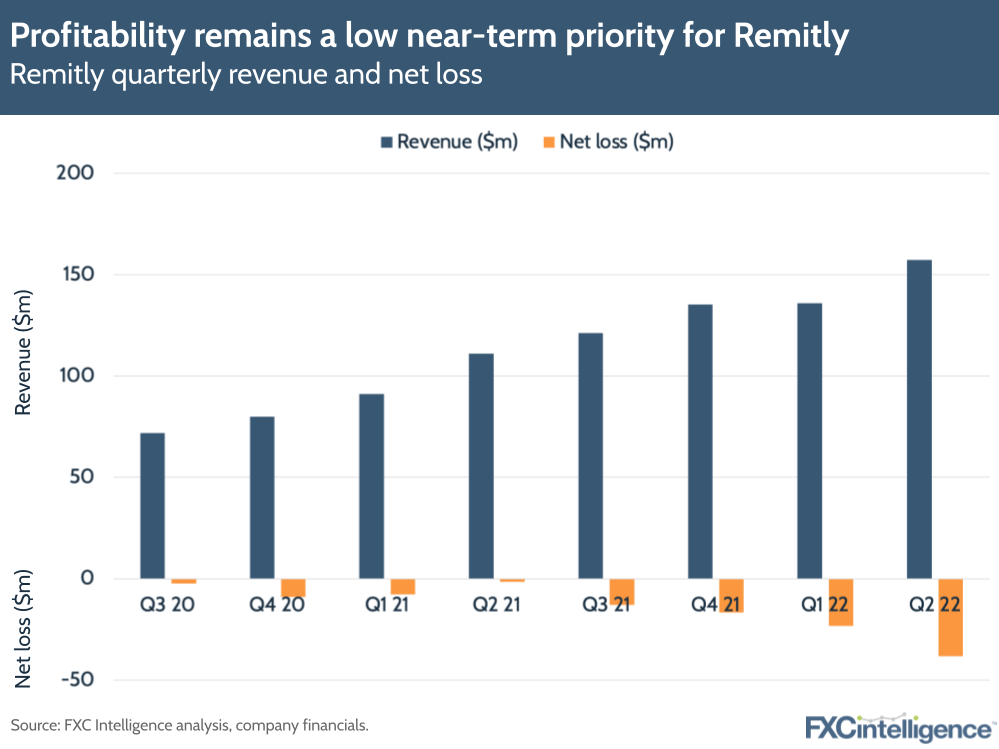

Remitly is continuing its run of success in Q2 2022, with revenue seeing a 42% YoY increase to $157m, while send volume grew 40% to $7bn and active customers climbed 43% to 3.4 million – beating expectations for the quarter.

Meanwhile, the company saw strong corridor expansion in the quarter, adding around 900 in Q2 to bring the total to over 3,200. It plans to continue this for the rest of the year, focusing in particular on the Middle East and Asia, bringing the company’s serviceable addressable market to $630bn in 2022.

Significantly, Remitly has also lowered its customer acquisition costs, which dropped 11% between Q1 and Q2 of this year. The company is now seeing marketing spend reach breakeven within one year of customer acquisition, with more recent customers reaching this faster.

However, Remitly is still making a loss, with this quarter seeing the biggest net loss since it began trading as a public company.

I caught up with Remitly CEO Matt Oppenheimer to discuss the company’s successes in Q2 22 and learn more about how it plans to develop in the future.

The drivers of Remitly’s strong Q2 22 results

Daniel Webber: Let’s start at the top. These are really excellent results. What’s driving them?

Matt Oppenheimer:

Thanks Daniel, we’re really excited about our Q2 results. And I think that the drivers of it are first and foremost that customers continue to come back and use our platform because we deliver a great service.

Second, is that in a choppy macroeconomic environment, remittances have historically fared quite well during recessions because they’re non-discretionary. People are sending money back for food, for tuition, for daily living expenses, for rent to their close family members. Despite the macroeconomic environment, customers continue to prioritize remittances as they have in previous recessions.

Third is we had record new customer additions. We added nearly as many new customers in Q2 22 as we did the entire year of 2019, and we did it at an 11% lower customer acquisition cost sequentially. So those new customers that are coming in, combined with strong retention, not only resulted in a solid Q2, but I think gives us a lot of confidence for continued growth, given that these new customers that we add will continue to come back and use our service in the future.

Figure 1

Reducing customer acquisition costs

Daniel Webber: On the subject of customer acquisition, how are you beginning to drive that cost down?

Matt Oppenheimer:

First and foremost, it comes down to team. That may sound vague, but I mentioned on the call as well, we have a CMO who is doing a phenomenal job. We’ve improved our creative and branding execution and velocity. In a market where advertisers are changing how much they’re spending, I think we’ve done a good job at testing elasticity with our digital advertising especially, and being more scientific around that.

If you look at just new channel testing and growth, things like our referral channel, we saw some gains. But also when we’re adding as many new customers as we are, there’s also an element of word of mouth. We deliver great service. We don’t do a ton of brand marketing, but we deliver great service. And people have this word of mouth: they start telling their friends, that builds that trust that we need to add new customers.

All those things equate to that lower customer acquisition cost that we’re excited about. Ultimately we try to match customer acquisition cost with the lifetime value at a de-aggregated level, marketing channel and geographic-specific level. So customer acquisition cost is just part of the equation, but we’re certainly happy that we brought it down because it improves our unit economics overall.

Figure 2

Remitly’s reasons for making a loss

Daniel Webber: You are still making a loss, and there are CEOs that criticize your company for it. How do you want the market to think about it?

Matt Oppenheimer:

We take a disciplined investment approach to growth. To frame that, we invest in four areas: marketing to new customers at great unit economics, that’s number one.

Two is new geographies: we added 900 new corridors last quarter and that’s planting seeds for future growth in the quarters and years to come. When we launched hundreds of corridors a year or two ago, I said we were going to be able to sustain that rapid growth rate. We delivered the 42% year-over-year growth rate off of what is now a pretty large business, and we expect to see rapid growth for the years to come. Geographic is part of that.

The third area is fortifying and investing in reinventing how remittances are sent abroad. Reinventing international payments to be able to offer other businesses our services, like our Remitly for Developers business. And the fourth area is complementary new products that deepen the relationship with our remittance customers.

Despite investing in all of those areas, we’re still seeing – if you look at the shape of our P&L – a lot of discipline in terms of how much we’re spending relative to our growth.

We did raise the bar – we used to take a really disciplined approach to our investments – we raised the investment hurdle because of the cost of capital, because of the value and profitability, and despite adding record new customers, just take that first bucket, but because we brought down our customer acquisition costs, we’re still seeing some leverage in the business in that way.

We’re excited about it, and we’re excited about the investments that we’re making to not only continue to grow this year, but to be a rapid grower for the years to come and to really transform this industry. We need to do that in a disciplined way, but we’re also going to continue to think long-term so we can continue to deliver the kind of results we delivered in Q2.

Figure 3

Taking market share

Daniel Webber: If you are at 40% growth and remittances is a single-digital growth market, where are you taking share from?

Matt Oppenheimer:

It’s a wide range. Based on our assumptions, most remittances are still sent via offline players, so that’s certainly a big chunk. Then there’s some digital players that we also take share from given our scale. We’re able to invest more in our systems, meaning our risk product, meaning our disbursement network, you name it. That ultimately builds more stickiness, peace of mind and brand with our customer base.

Having scale and being a digital-first player, inherently gives us an advantage to offer a better product to customers. Sub-scale players or legacy folks have a hard time building a great digital product, which is where the world is headed. We can debate on timelines for that, but it’s where the world is headed. That’s indicative based on what you see in terms of our outsized growth compared to the overall remittance market growth.

The potential of the Middle East as a send market for Remitly

Daniel Webber: How are you approaching the Middle East and Asia, which are potentially key extra send markets for you? The Middle East is particularly very cash-based, and both have very different markets to some of your early additions.

Matt Oppenheimer:

A couple things. One, you’re right, every market is a little bit different. Take the Middle East: the UAE is different to Saudi; is different to a variety of other markets in the Middle East in terms of both digital adoption and send, and in terms of how to build a great product for the market.

But generally there’s a trend to become more digitized. I look back to the 11 year journey we’ve been on. We didn’t start with US-to-Mexico because in 2011, when we started, it was not as digitized. It’s a lot more digitized now.

India was a little bit ahead. There were other markets that were a little bit ahead. So it depends on the market within the Middle East, but we think there’s a big opportunity to be able to offer a great digital product that helps people get money home back in a fundamentally more convenient, more affordable way.

Future complementary products

Daniel Webber: Let’s talk about complementary products. You obviously have your migrant banking product Passbook, and we saw comments in the earnings call around learning from that and narrowing your focus. How are you thinking about these types of products?

Matt Oppenheimer:

I’m glad you picked up on the word complementary that we said during the earnings call. Because as we mentioned, we’re seeing increased engagement in Q2 for our Passbook product, but we’re also looking at where we can add the most value fastest to customers.

What we’re seeing there is opportunities where we can drive more engagement and deepen the relationship for remittance customers. Passbook is part of that. When you think about stored value, there’s an element of that that’s very close to remittances.

But we’re thinking more narrowly around how we increase engagement and deepen the relationship with our remittance customers, so more to come there and think about it broader than just Passbook.

But we’re really excited about the opportunity. We’re investing in that in a pretty disciplined way, but I think there’s opportunities to really drive long-term deeper relationships with our customers.

Daniel Webber: Are you broadly thinking send-side mostly, or do you think there’s opportunities on the receive side too? Very different types of customers and needs.

Matt Oppenheimer:

I think there are, and there’s also a nexus of that relationship between the sender and the recipient where there’s opportunities. It’s hard to answer it without talking about some of the products we’re thinking about. But we’ve got some customer pain points that we think we can uniquely solve.

The evolution of Remitly for Developers

Daniel Webber: How is Remitly for Developers going? You started in the crypto space, but how are you seeing that product evolve?

Matt Oppenheimer:

When I look at the pipeline, the value proposition for Remitly for Developers, when you think about our disbursement network and the range of disbursement options, whether that’s mobile wallet, bank deposit, cash pickup, door-to-door delivery, and they look at the global reach that we now have, and some of the other risk systems, treasury, cash management, FX, we’re seeing good reception from businesses in terms of interest in that product.

It’s much, much broader than crypto in terms of the market opportunity there. We started with crypto because there were a couple of large companies that moved quickly and we wanted to stay close to that space. But when we look at the pipeline more broadly, we are excited about what’s to come there. It’s still relatively early, but there’s a good value proposition and good market interest from that. So more to come there.

Remitly’s view of crypto in remittances

Daniel Webber: How are you thinking about the crypto space? You have some very well known partnerships there, but the market has changed from a quarter ago, and it’s hard to forecast when the so-called crypto winter is going to thaw.

Matt Oppenheimer:

It definitely feels like the crypto winter. We continue to be excited about partnerships we have with crypto companies in the space. And a lot of the questions that we got around crypto and how it impacts remittances, we get a lot fewer questions now.

The benefit of some of the crypto winter is there’s a little bit more critical thinking and logical approach that’s coming to some of the visions around solving pain points to really understand how much there is in that vision. What that means from our standpoint is just a little bit less of a focus on it. Which is okay. But we’re still being excited about some of the partnerships that we have.

Daniel Webber: Have you seen much utility in any of the digital asset products from a treasury side or the liquidity management side? That’s been talked about quite a bit in the space. What do you guys think about that?

Matt Oppenheimer:

We definitely stay close to that space, and we’re very open minded around any solutions that could help us from a treasury and cash management standpoint. But we’re a company that will dig into value propositions and offerings there and then will really focus on: will it drive customer value more than a headline partnership? Which I think is obvious but important.

It’s an area that we continue to keep our eye on and say ‘how can this add value to us as a business and ultimately to our customers’.

The remittance customer

Daniel Webber: Is there anything else that we haven’t covered that you’d like to talk about?

Matt Oppenheimer:

I think going back to your first question about revenue, active customers, ultimately that is because of who our customers are and why they spend money. That’s easy to forget, but it probably is the most important thing to emphasize, despite hardships that some of our customers may be facing or that their families are facing. Like the strength of the US dollar: the flip side of that is weakness in currencies in a lot of emerging markets where customers send money to, it’s been hard for our customers.

I am incredibly inspired by their grit, their resilience. It’s part of defining the immigrant experience and who our customers are. But when you take a step back and you think about it: how hard our customers work; how resilient they are to find a different job, if they lose their jobs, and how then they focus on fulfilling what they describe to us, not as a gift or something nice to do, they describe sending remittances as an obligation, as a duty. Those are the words that they use.

What they’re doing is they’re sending hard-earned money back to their families – a big part of their income. That’s our business. That’s fundamentally, to answer your first question, actually more effectively why our business is doing well and why our business matters. That’s the most important thing.

Daniel Webber: Matt, thank you.

Matt Oppenheimer:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.