Payoneer’s full-year (FY) 2022 results saw significant change for the company, including insights into its future strategy. We speak to CEO John Caplan and former CEO Scott Galit to find out more.

Payoneer’s FY 2022 results grabbed attention, with better-than-expected earnings alongside new insights into future strategy. There was also the news that long-time CEO Scott Galit was stepping down with immediate effect, leaving former co-CEO John Caplan to take the helm solo. Galit is taking the role of Special Advisor and will remain on Payoneer’s board.

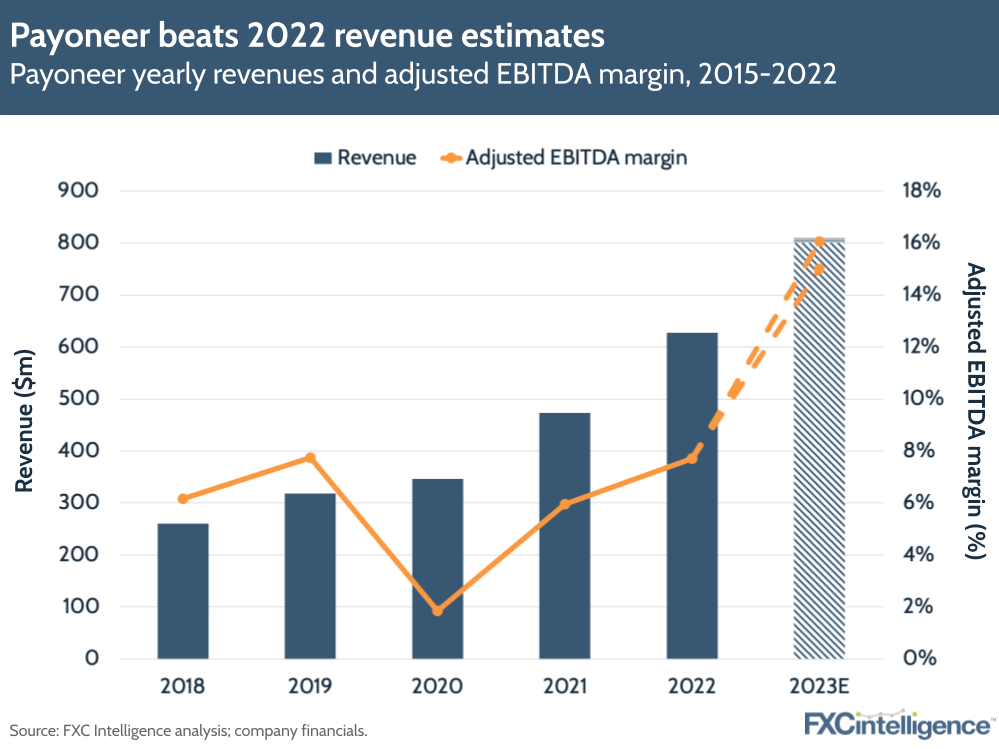

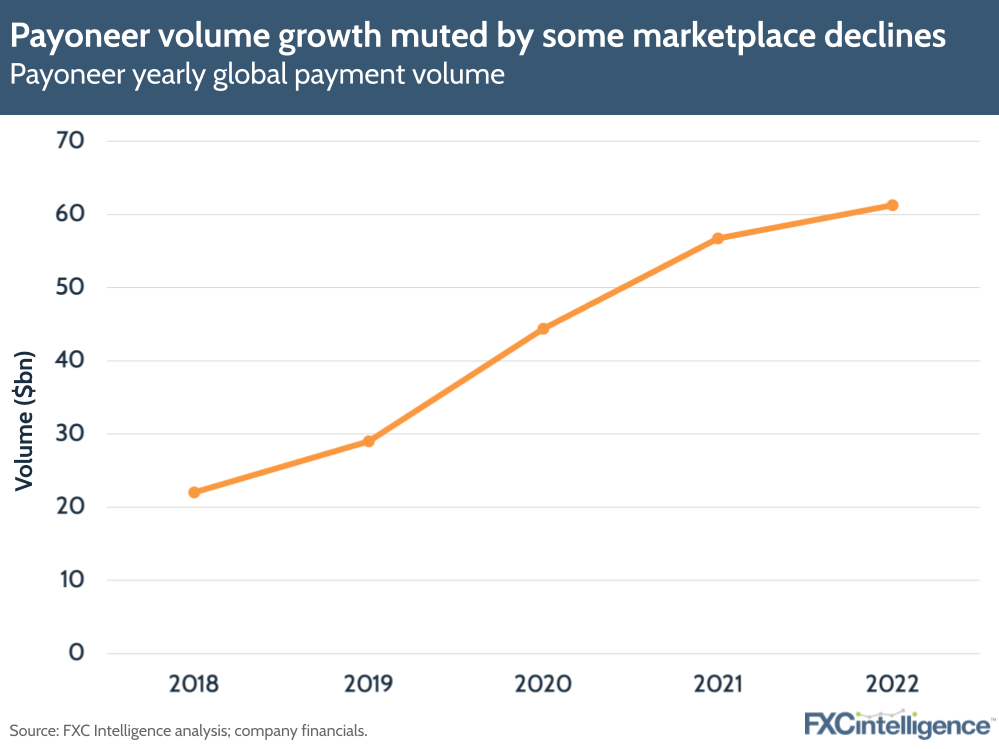

Payoneer’s revenue grew 33% year-on-year to $628m, $13m above its top-end projections a quarter ago and almost $100m above what it projected for FY 22 when it announced its FY 21 results a year ago. Adjusted EBITDA, meanwhile, has seen 72% YoY growth to $48m, while volume grew 8% to $61bn, offset by weakness in some ecommerce marketplaces.

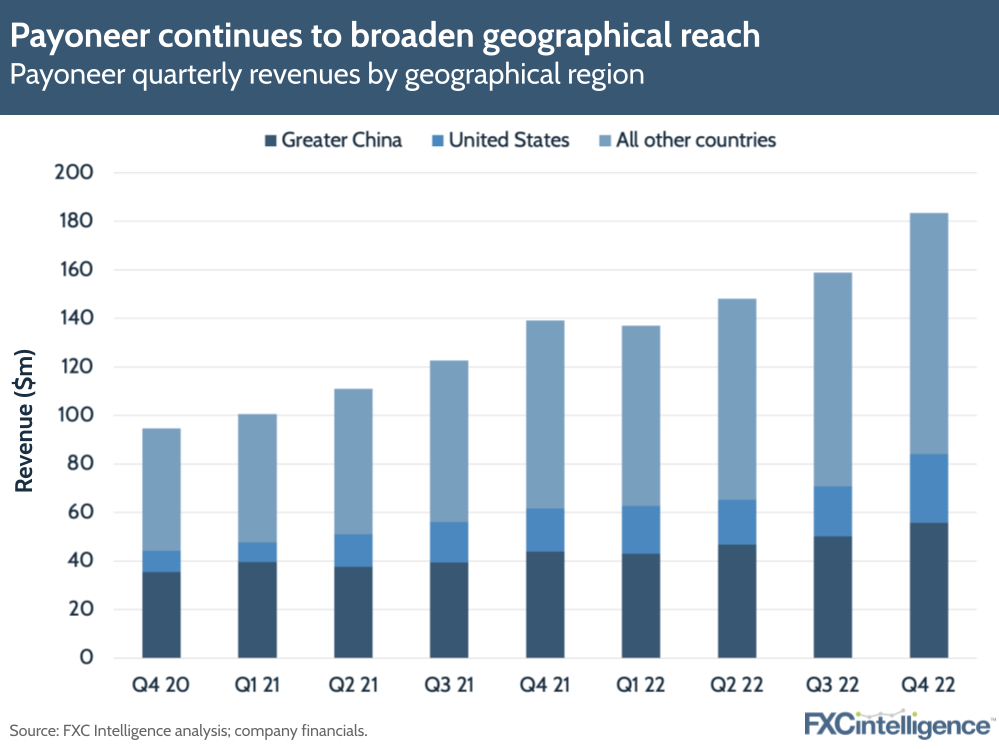

Much of the focus was on diversification, both in terms of geographies and markets. On the geography side, LatAm, APAC and SAMENA (South Asia, Middle East and North Africa) accounted for 35% of all revenue, up from 20% in 2018, and are seeing higher take rates than more established regions.

The company is also increasingly focused on growth in high-value services, particularly B2B AP/AR, which is growing faster than the overall business and now accounts for 12% of all volumes. Meanwhile the virtual Commercial Mastercard service topped $1bn run rate for the first time, and the company’s recently launched checkout service is seeing positive initial growth. In the future, working capital is also expected to play an increasing role. The Payoneer platform is also seeing success, with 80% of customer funds now bearing interest.

The company is currently repositioning its strategy to better focus on the 25% of customers that drive most of its volume and revenue, and is developing a renewed go-to-market approach and technology platform designed to reduce loss-making customers and prioritise high value ones. Payoneer is targeting revenue growth of 20% for the next few years, and expects adjusted EBITDA to more than double in 2023.

To find out, we spoke to CEO John Caplan and former CEO Scott Galit.

Drivers of Payoneer’s growth in FY 2022

Daniel Webber:

You had a very good 2022 and included some nice projections for 2023. What’s driving that?

John Caplan:

We reported record fourth quarter and full year revenue, generating more than 30% year-over-year growth for both periods. Revenue of $628m is 33% year-over-year growth and adjusted EBITDA of $48m is 72% year-over-year growth.

What is powering the business is we’re capturing opportunity in a growing, $5tn addressable market because of the long-term focus we have around building a very diversified business, innovating to evolve the solutions we offer our SMB customers and broadly serving just about every kind of trade that’s happening cross-border.

When all of those things are happening in concert together, you can see that our diverse business – geographically strong – is enabling us to grow quickly and power through the macroeconomic climate that everybody is navigating.

Shifting focus to higher value services

Daniel Webber:

You’ve worked hard to focus more on value-add parts of the cross-border world, which is reflected in your take rate going up. How have you been shifting the mix to increase the role of higher value services?

John Caplan:

We grew our B2B AP/AR volumes nearly 40% year-over-year, and it now represents 12% of our total volume, up from 9% in 2021. When you look at that business, we make high take rates, because we collect on the money coming in as well as on the accounts payable side or the withdrawal to bank.

But we’re also increasingly bundling that product with other high-value services. For example, the B2B AP/AR business and our Commercial Mastercard. We also shared that the Commercial Mastercard has experienced 3x year-over-year growth and we broke $1bn in total volume.

This is a really strong example of how we’re innovating for our customers, because it’s free for our customers. In fact, many of them earn cashback using that.

It’s also a higher take rate for Payoneer and keeps the funds and the utility of the Payoneer account growing. When I think about the take rate expansion, our volumes expanding and our relationships with our customers getting stronger, the high-value services are really the differentiator for us as we see the business in 2023 and forward.

The margins are strong, the take rate is strong. As we look across the globe, our expenses vary based on what card or specific product people are using, but we see strong volume growth and revenue growth in those products.

Scott Galit:

I also want to amplify just how big those addressable markets are that we’re really focused on. Small and medium-sized businesses trading cross-border with other businesses is a $5tn volume market.

We really feel we have a better way for businesses to transact with our trading partners globally. The opportunity in working capital for small and medium-sized businesses globally is enormous.

We’re just scratching the surface there and we’re finding more and more ways to provide access to capital for small businesses in more places around the world. Then there’s things like the Commercial card, where we’re offering an integrated receivables and payable solution.

It’s a really unique position that we’re in, much like with working capital where we’re already in their cash flows and we have unique opportunities to add more value for them and create more value for us. Then things like merchant services, which again is this gigantic market opportunity where we’re able to deliver more value to our customers, help them get paid in more ways, improve their access to the great tools that Payoneer offers.

All of those things are really, really big market expanders, in addition to being value drivers for our customers and revenue drivers for us.

Targeting larger customers

Daniel Webber:

You talked about focusing on the larger, more valuable customers. What is different about them?

John Caplan:

Our customers, for the most part, are being served by legacy local banks and are using analog or traditional methods to deal with their cross-border accounts receivable, loan accounts and payment needs.

As any global entrepreneur will tell you, with 10 employees, 20 employees, 50 employees, that is really hard to do. The solution we provide for them is in its earliest stage of its robustness but it clearly has product-market fit. We have a direct connection to solving a real pain point for global entrepreneurs to be able to pay and get paid in any currency, to hold balances in any currency, to do it in a trusted way.

The smaller customers just don’t have the complexity of needs and volumes that our larger customers do. It isn’t that we don’t like the small customers, we just recognise very clearly that for an SMB that’s doing $50,000, $60,000, $80,000, $200,000 or more annually of international accounts receivable and accounts payable, Payoneer is perfectly positioned to support them. That could be a US business who’s making payments globally, or an international, emerging market small business who’s getting paid from customers around the globe and making payments for vendors around the world. There’s just direct product-market fit.

Our high-touch, high-tech approach means we have people on the ground in Manila; we have people on the ground in Vietnam; we have people on the ground in Argentina; we are there. We’re not just relying on a self-serve application to create a global fintech company. We have a great self-serve application and then we have human beings that are there to help you navigate bundling all of the Payoneer services.

I met with an entrepreneur in Tel Aviv two weeks ago that sells bird feeders. His business has $2m of volume sold on Amazon, exported and manufactured in China. He’s an Israeli entrepreneur sold on Amazon.com in the US, who uses Payoneer to get access to Walmart.com and uses Payoneer working capital to fund his operation. He couldn’t find that bundled solution from Payoneer elsewhere.

So the focus on these customers is that they need what we have.

How Payoneer differentiates from other fintechs

Daniel Webber:

There are other fintechs trying to do different things in this space. What differentiates the Payoneer approach from other non-bank players?

Scott Galit:

It plays to so many of our unique strengths that we’ve developed over the last 17, 18 years at this point.

How truly global we are is quite unique. The breadth and scope of the regulatory infrastructure; our compliance and risk management; our ability to settle locally in over a hundred countries around the world. The scale that we have, the network effects and the low-cost acquisition that comes along with that allows us to cost-effectively acquire and serve the customers that are coming to us.

Some of the proprietary tools that we offer for ways our customers can get paid and the way they’re able to actually manage it; the breadth of the overall offering. The fact that that comes not just with the ability to get paid from all over the world, but the diversity of ways that you can get paid, the diversity of ways we enable you to then make payments around the world, including within the Payoneer network. Access to things like the working capital and the card and other capabilities.

At this point, we are in a position where we offer a really compelling accounts receivable offering; a really compelling Payoneer account with a lot of functionality that’s already embedded; and a lot of tools to help better manage the payable side. We stick that on top of a trusted global brand financial management infrastructure, sophisticated regulatory compliance and risk management.

It really is building on so many of our great strengths that we’ve nurtured and developed for other parts of our business over a long period of time.

Improving perceptions of the company’s offering

Daniel Webber:

You have a very sophisticated offering. How close do you think both investors and your customers are to understanding that? What are the perception gaps that still need to be closed?

John Caplan:

It’s an important question. Cross-border small businesses are different from domestic small businesses, either in the US or in an emerging market. The cross-border entrepreneur has a different set of needs than the local entrepreneur does. That’s one area that is not necessarily fully well understood: the differences, in terms of the challenges that entrepreneurs face, to really act like a multinational company without the resources or staff that most multinational companies have.

That’s something that’s confusing if you grew up in the US. Talking to US investors, helping folks walk a mile in the shoes of our customers would make it very plain, very quickly how valuable we are to our customers, because we actually solve important challenges.

That’s one area that’s a perception-reality delta. A second is that most investors don’t actually handle their own AP or AR. It’s not a business process that people have experience with: it’s not like Apple or Starbucks.

Scott and I are competing to win in a $5tn market and we have a lead. When you think about the people who are not understanding, there’s a lot of beverages drunk and iPhones bought, but there’s a $5tn market dominated by legacy analog businesses. The average one has been in business over a hundred years; they are not going to win the market.

It may not be winner-takes-all, but there’s room for a small number of firms over the next decade to genuinely disrupt what it means to support these global entrepreneurs. So that’s a second area of perception challenge.

In terms of comps, we hear from the market people describing us like Bill.com. The shorthand investors say to me is, “Oh John, it’s like you’re the international Bill.com, with a bigger addressable market”. I don’t argue with them when they say that to me; I’m not going to argue with that comparison. It’s generous for us and we have similarities to their business and some differences. But that’s a comp that I hear.

Payoneer’s future growth

Daniel Webber:

Your growth forecast for 2023 is exceptionally strong. What’s at the heart of that?

John Caplan:

It’s reflected by the diversity of products, diversity of geographies that we serve and diversity of industries. In our travel vertical, our travel customers group is a small absolute percentage but is really growing very quickly. Our B2B AP/AR grew 40% year-over-year, apples to apples, net of some customers we terminated. That’s a pretty special amount of growth happening and our highest value business that’s out in front on the growth curve for us.

Scott Galit:

The only thing I want to add is I personally feel fortunate and I think Payoneer is quite fortunate. We have a terrific team with John at the helm and we’ve got a lot of talented people all over the world at Payoneer, that have been here a long time, and we’ve also added some really talented people that we’ve talked about and are really positioning us for the next leg of growth.

We’re in this wonderfully unique position of being able to deliver meaningful incremental value to investors in the short term, while also making meaningful investments to position the company and delivering lots of value for a long time to come to customers, to employees and to shareholders.

We’ve got the right team in place, we’ve got the right big global addressable market, we’ve got the right resources, we’ve got the right financial capacity. We’re really in a pretty unique position right now. And that’s partially reflected by the reaction of the market today, recognising that there’s a lot of really, really great strengths and great opportunities here and we’re doing everything that we said we’re going to do.

We’re continuing to focus on the long term, delivering more value in the short term, doing it in a thoughtful way with a real focus on customers and empowering them around the world and doing well by doing good.

Daniel Webber:

John, Scott, a pleasure. Thank you.

Scott Galit and John Caplan:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.