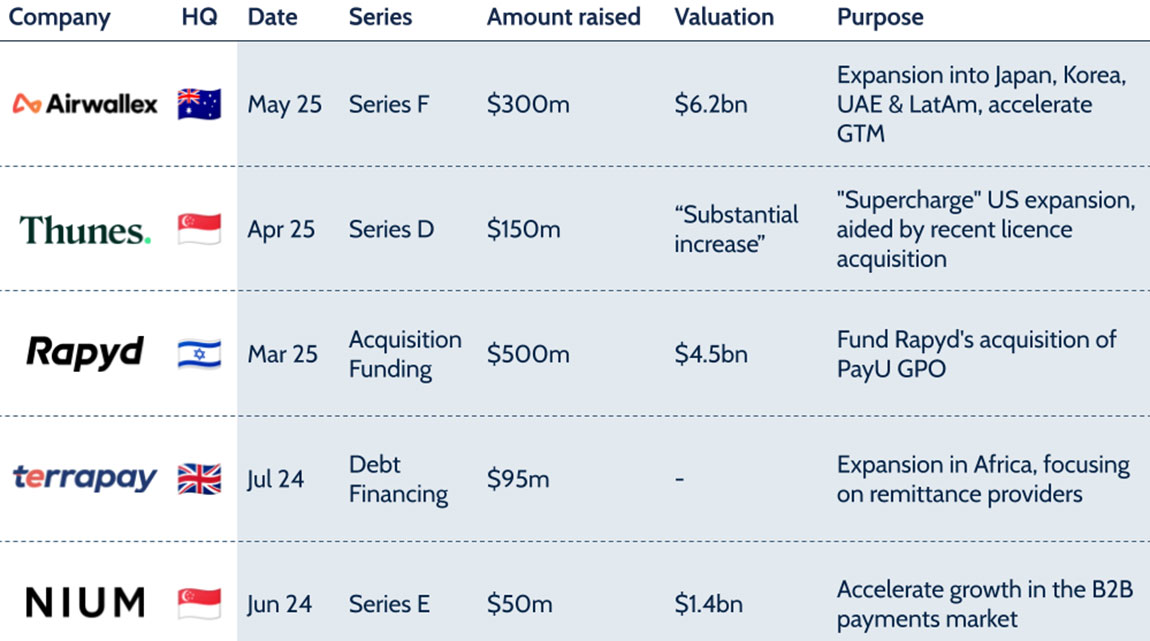

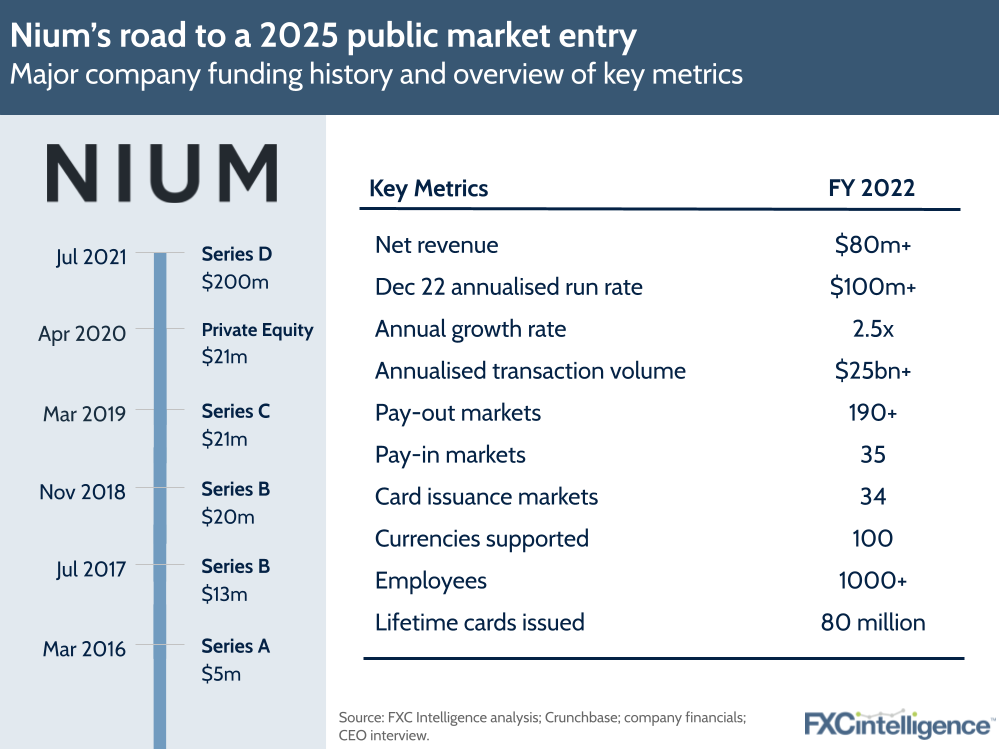

Real-time global infrastructure player Nium has expanded significantly over the past few years, and is now eyeing an IPO in 2025. CEO Prajit Nanu shares the company’s plans to go public as well as its ongoing strategy for growth.

Payment infrastructure player Nium has had a strong few years. With a valuation of $2.1bn and having seen net revenue climb from c.$31m in 2021 to over $80m in 2022, the company has grown from a challenger to a key global player, particularly in Europe.

Now closing in on profitability, and projecting 2023 net revenue of $160m-180m, the Singapore, London and San Francisco-headquartered company has made significant moves over the past 12 months to restructure in support of its multifaceted growth. It is now eyeing its next target: a public market entry.

“The next phase of the business will be going public, and that’s now looking like Q2 2025,” says Prajit Nanu, CEO of Nium.

“By the end of this year we will have the scale to go public, but I don’t think the market is going to be back yet.”

With this in mind, how has Nium shifted its approach over the past year, and where is it focusing its attention now that the company has a two-year road to an IPO? We spoke to Nanu to find out.

Restructuring Nium for the next stage of growth

The past twelve months has seen Nium shift its approach financially as it nears profitability – not a necessity for a public listing, but certainly key to appealing to investors.

“We’ve significantly brought our burn down since January of last year, so we can be profitable by Q2 next year,” says Nanu. “We’ve had a lot of focus on that versus continuing to be dependent on investor cash to feel comfortable.”

However, the company has also changed from a global, centrally managed structure to a regional structure, with revenue management shifting from the responsibility of a single person to being split across three regional leaders. Product development and marketing has remained centralised, but everything else, including operations, has been split regionally. This has seen Nium make a number of key regional hires, including most recently the addition of Payoneer veteran Manuel Sandhofer, who at the start of June joined Nium as Senior Vice President and General Manager for Europe.

“Once we hit $100m revenue, the question we had in front of us is how we take $100m to $300m, to $500m, to $1bn, and a global model doesn’t work in a fragmented company like ours,” explains Nanu. “Unlike the majority of large firms where 80% of revenue comes from one market, today Nium is 45% in Europe, 45% in Asia and 10% in America, so this gave us a great opportunity to have regional focus.”

This approach, says Nanu, allows customers to be served on their own timeframes, and helps support issues around compliance, while also enabling the company to focus on specific regional expansion driven by more localised expertise.

“We’re very focused on regional expansion and we’ve now moved into Latin America strongly. We’ve set up entities in Brazil and Mexico and Peru, Colombia and Argentina are following next,” he explains, adding that the company is also looking at gaining a payment institution licence in Brazil – either through an acquisition or an application.

“By the end of this quarter, we’ll have five entities all across Latin America, which will enable us to collect more money seamlessly.”

The company, he says, is also seeing “strong customer wins in the UK and Europe” and is “creating a very strong pipeline”. However, he also sees the potential of increased expansion in Africa.

“We are looking at assets to buy in Africa or to build out our network,” says Nanu. “Our Africa solution isn’t that great, so there’s the place where we think we can continue to build. Africa is a big opportunity for us.”

Going public: Revenue growth and Nium’s road to a 2025 IPO

With this improved structure in place, and new areas for future growth identified, the company is in a position where it will be ready to go public in Q2 2025, assuming the market is in a suitable place.

“We will have the numbers by the end of this year and then we’ll spend the next year just ensuring the fact that we’re predictably forecasting, everything that a good company needs is in place and then 2025 looks like ideal time for us to kind of move out,” says Nanu.

“If we want to fast track it we can by a couple of quarters, but we are in great shape. We have good capital in the bank. From a valuation perspective, we are rightly valued: we’re not overvalued, we’re not undervalued, we’re not excessively valued.”

As the company moves towards its public market launch, the next two years will see it look to adjust its revenue mix. At present, 80% of Nium comes from its old customers, while 20% is from new, but Nanu says the company is looking to move this to 60/40. Acknowledging this will be “hard” to achieve, he points to the customer cycle as a source of challenge.

“The revenue sales cycles tend to be a bit longer,” he says, giving the example of a Middle Eastern bank that the company is onboarding.

“After I sell to them, it’ll take them three to five months to integrate with them,” he says. “If you think about it, I will actually get revenue up there only for two months this year. So that’s why it’s 80/20.”

Nanu says that despite targeting 60/40, he will be “very happy at 70-30”, although he adds that “the inflow of new customers is very strong”.

“This morning, we were awarded a large payroll customer, which is at least a million dollars plus of revenue. So I think there is a big opportunity in front of us on how we can scale the revenue 100% year on year.”

How Nium is outpacing the market: Beyond networks of networks

On the face of it, Nium is competing with many companies offering similar services, but Nanu argues that the company is outpacing the wider growth of the market because the company’s network is “more direct” than many other players with similar offerings.

“We have direct connections with central banks to process payments. If you look at our euro offering, I don’t need a bank in Europe,” he explains, adding that in the long term the company intends to add similar capabilities in other markets. “Today, people don’t want to have more risks with more banks.”

This puts the company at odds with the ‘network of networks’ providers that the company often encounters on sales pitches.

“What we pitch is once Nium onboards you in Singapore, you are open to use Nium in the UK, in Europe, in Australia, in the US, everywhere, because we have one single KYC policy,” says Nanu.

“The network of networks, they don’t have their own licence in the UK and Europe. What they do is onboard you in Singapore, but when you go to Europe, X partner needs to re-onboarded you, when you go to the UK, Y partner needs to re-onboard you.

“We had a customer who moved out of one of these networks who said at scale it’s too painful for me. I can’t open six markets and do six pieces of KYC.”

Beyond this, Nanu says that Nium’s edge comes from the fact that the company can see the full fund flow, enabling full transparency if a payment goes missing, as well as the level of localisation it offers.

“If you want to do something in Japan, we have a local licence in Japan. If you want to do something in Brazil, we have a local team in Brazil,” he says. “That kind of experience and exposure is very, very different. So if you want to do something specific, especially market expansion, we have a lot of talent that will come and tell you the whole story.”

He also argues that the company has a product stack that is “pretty unique”.

“We are a multi-product company. You want issuing, you can get issuing, but you can get payments as well. So a lot of people come for one product but then choose and stick on for multiple products.”

Card issuing and the impact of the Ixaris acquisition

Nium’s development has also been aided by acquisitions, including payments optimisation player Ixaris. Nium completed the acquisition of Ixaris in August 2021, adding strong virtual card issuing capabilities, particularly in the B2B travel payments space.

The acquisition has contributed over $100m in gross revenue for Nium, and has helped form a strong platform for virtual card issuing at the company.

“We are going to issue 55 to 60 million virtual cards this year. None of my peers are that scale: that’s an incredible scale,” says Nanu, adding that the key revenue generator on cards is not the number issued, but the amount of volume that flows through them.

“Our card business will flow anywhere between $12bn-15bn this year. Net revenue, we’ll make about $75m-80m this year.”

Ixaris has been foundational to this, coming in as a UK and Europe focused business that the company has converted into a “global stack”.

“That means we now have customers in Asia Pacific, we are getting customers in Latin America. We’ve just taken that and moved that stack to multiple markets,” he explains.

“The US is also going to be a big area for 2023. So we just bought a regional product and globalised it.”

The scale challenge: The importance of selecting customers

As Nium focuses on growth over the next five years, it is looking to continue its current rates of increase. Key to this is to move away from a broad infrastructure as a service play that Nanu says “doesn’t scale” and instead focus on catering to the specific needs of select verticals, including regional banks and financial institutions, as well as corporate spend management and payroll.

“Every customer use case can be potentially different. A payroll card is different to a spend management card, which is different to a Nium bank card, which is different to an expense card,” he says. “Every use case can be different and there is no way you can create multiple of these personas on your system.”

Catering to all types is, he says, not scalable, because of the variance in needs globally, however he argues that by selecting specific verticals and focusing on their needs, the company can counter this issue.

“We figured out which industries are going to grow over the next three to five years and focused on building only for that. We don’t believe they’re scalable: compliance is different, regulatory is different, customer use cases are different, customer behaviours are different and all of this stresses your platform,” he explains.

“We don’t want to build for many, we want to build for the few. We believe that building for the few will lead us to that $700m-900m revenue path over the next five years.”