MoneyGram has made significant gains in digital remittances in 2022. In the latest in our Post-Earnings Call series, Daniel Webber speaks to Alex Holmes about how the company will boost its digital services and market presence in 2023.

Leading remittance player MoneyGram’s revenues rose 5% to $342.1m in Q4, meaning its total revenues for full-year (FY) 2022 grew by a moderate 2%.

The strength of the US dollar remained a persistent headwind during the year, with money transfer revenues flat to the prior year at $1.19bn, but increasing 5% on a constant currency basis. Adjusted EBITDA decreased 2% to $217.4m, giving an adjusted EBITDA margin of 16.59% (72 basis points down compared to 2021).

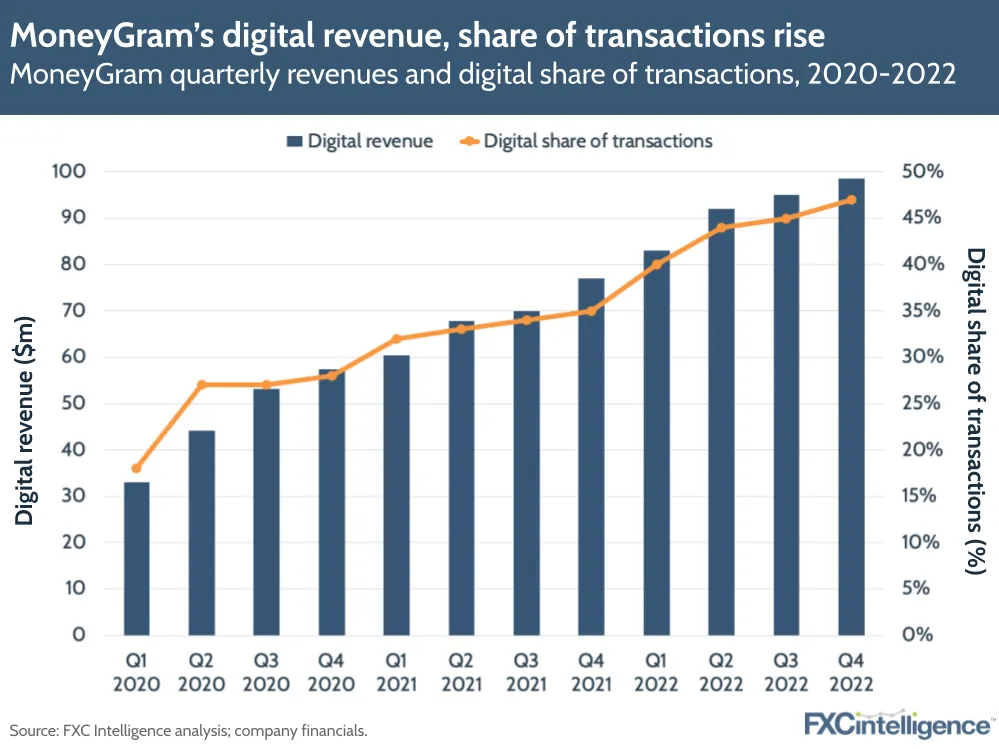

However, the company made great progress towards becoming digital-first in 2022 – a key part of its strategy since announcing it was being acquired by Madison Dearborn Partners (MDP) last year. Digital money transfer revenues rose 33% to $369m over the year, accounting for 31% of money transfer revenues overall, while digital’s average share of total transactions was 44% when calculated across all quarters in 2022. This puts the company well on track to beat its target of being 50% digital by 2024.

Going forward, MoneyGram is hoping its acquisition by MDP will close by the end of Q1 or early Q2. It is also expecting boosted marketing gains from sponsoring Formula 1 team Haas F1, whose team manager Guenther Steiner is currently one of the stars of Netflix’s documentary series Drive to Survive.

With the company ahead of its many competitors on digital, what is it doing to keep the ball rolling in 2023? Daniel Webber spoke to MoneyGram CEO Alex Holmes about the company’s transition to a digital focus, the impact of its headline partnerships and its market expansion strategy this year.

Recapping MoneyGram’s performance in 2022

Daniel Webber:

What factors drove revenues in 2022?

Alex Holmes:

Generally, the industry has remained extremely healthy. We came out of the pandemic, everyone was concerned about the market slowing down, and there was a lot of excess money put in the system. People tapped into savings and it ended up being a good year back in 2020. 2021 stayed the same, if not accelerated a bit, and in 2022 we’ve been growing.

From August onward, with inflationary pressure strengthening the US dollar, we certainly saw challenges in some markets. The Mexican peso is down to $18 and the Indian rupee has fallen as well.

However, generally employment has been strong throughout. Despite the inflationary pressures, we’ve actually seen face values go up a little bit across the board and people continue to send. That being said, some of the big box retailers and markets around the world are still a little bit soft, but that’s being made up for with a lot of digital properties.

MoneyGram’s transition to being a digital-first company

Daniel Webber:

How are you transitioning to becoming a digital-first company?

Alex Holmes:

The affinity for consumers to migrate in that direction continues to be driven by the same factors: the convenience of the online experience; the proliferation of digital; the increase in access points, with banks and telcos and other startups getting involved and finding new ways to interact; and then just that trend towards younger migrants and younger people, who are digital natives and think digital first.

For them, the goal has been to think differently about financial services and fintech and how they interact with each other and social media, as well as how that all influences consumer trends and flows. Over the last several years, we’ve done a nice job positioning the business to get into that mix, whether that’s been the adjustments we’ve made to the receive side and pivoting and adding a lot of account deposit options in the relevant markets, or the growth of our dotcom platforms (and the markets where we don’t have dotcom, supplementing with a lot of send side partners).

For MoneyGram Online (MGO), we had a good fourth quarter generally as a company. The growth rates have come in a little bit. If we can sustain our dotcom business and that 15% to 20% growth rate, that’s going to be a very positive trend and momentum for us. I’ve seen others in the competitive landscape trying to catch up and think the way that we thought. We’ve got a couple of year’s head start on a lot of the competition and it’s been very beneficial to us.

Daniel Webber:

So we’re not that far off of 2024 and your 50% digital target. What’s next after you achieve that?

Alex Holmes:

Number one, clearly we want to continue to outpace the market. The projection is that by 2028 in the industry, 50% of revenue should be generated from digital, so we’re going to continue to push that.

The pricing in the digital space is lower. Transactions are approaching 50% and revenue trails that some, so we want to get revenue up and above 50% over the next couple of years.

From there, a lot of it is going to be a market and corridor perspective. India, from the digital account deposit side (from the receive side), is now north of 80%. Mexico’s a good contrast. Today, there’s a lot of belief that the Mexico market is still 80% plus cash, but it’s trending in the right direction from a digital perspective.

Moneygram.com is in 36 markets today, but we’ve got to get that to 50-100 markets over the next couple of years. In around six of those markets where we have moneygram.com, MGO is more than 50% of the revenue and transactions of the country. I’d like that to be the case in all the markets where we have MGO. I want that to be our biggest source of revenue for every country that we’re in. So that is an aspirational goal for us.

Update on Madison Dearborn Partners acquisition

Daniel Webber:

What is MDP’s vision for MoneyGram? How are they thinking about digital?

Alex Holmes:

The nice thing about the partnership with MDP is that thesis that we’ve been pushing, which is that the sustainability of remittances is a given. It’s an industry that’s projected to grow 2-5% over the next decade and is definitively shifting to digital, particularly on the send side.

The receive side’s a little bit of a different story. Despite the proliferation of digital, you still see cash on the rise in so many markets worldwide, so cash is going to be around for a long time. [A key question is] how we leverage and think differently about the network in terms of facilitation of cash in and cash out as an ancillary service, but not as the main focus of the remittance industry.

MDP are all in on the digital story and want to see that continued migration. With regards to recognition, we have arguably the number two brand awareness in the world for remittance. But if you measured that from a digital perspective, I don’t think we’re going to rank as high.

An important part of that is the perception of the company, how we change that and how we create value through the continued growth in digital, followed by that instantaneous brand recognition in the digital space.

If there’s a positive from the deal taking this long to close, it’s that we’ve been able to work with MDP now for over a year. They’re aligned with everything that we’re doing, the decisions that we’re making and they’ve pushed us in a few areas. Obviously, we’re balancing the public company with the future ownership, but we’re aligned, and that’s super important.

Expanding remittance markets versus ancillary services

Daniel Webber:

How do you think about the balance between growing more markets versus adding more ancillary services for the customer?

Alex Holmes:

Consumers’ perception of financial services is changing. A lot of what you would call challenger banks – as well as the newer digital-only players in the remittance space – have done a nice job challenging the old paradigm. On the outside of that are all the crypto blockchain brands, which are also trying to push for the evolution of money and make people think differently about money movement.

Positioning the company differently from a financial service perspective is important as well, but it’s going to be a market-specific approach. There’s a reason there is no global bank, and that’s because you have to have licenses in every country and deal with the local regulatory pieces. From a marginal perspective, that can be very costly and expensive.

The US still has the largest flows of immigration in the world; having a more robust financial service platform here is an important part of our evolution in the US. We just launched our buy/sell crypto service and are working with Stellar. A fiat wallet would be a nice add-on for the evolution of our business and for customers, and seeing that across Europe probably makes a lot of sense as well.

The farther afield you go, the more challenging that can be. Getting licenses and registration to be able to deal with interchange, local markets and all the tax implications and other things around that can be somewhat cumbersome over time.

If you can’t get the scale, it’s hard to cover those costs. Plus, you’ve got to deal with competition in all those markets. So, it’s going to be a very steady balance between where adding additional financial services makes sense and then where partnering is just going to be a better solution.

The US always creates opportunity. Europe always creates opportunity. They’re very different markets. There’s always an area to expand, so adding alternative financial services is important.

In the future, we want to create the ability to send and receive money and make it more dynamic. For example, if storing funds with MoneyGram for a period of time helps you time a send more efficiently, then that’s important. If that is helpful to our customer base and expansive to their everyday needs, then that’s something that we should be offering.

The front-end side of it is a very important part of the evolution, and that helps change the perception and the interaction with the customers. At the end of the day, what we do extremely well is create a network and an opportunity to effectively move money and translate FX at some of the best prices and in some of the most efficient ways possible. That’s our core strength, and we’re going to keep leveraging that core strength as we go.

Daniel Webber:

It’s interesting because there’s no case study yet of a player that has successfully, at scale, launched other financial services for remitters.

Alex Holmes:

Not only successfully, but profitably too. And that’s always an interesting balance. It’s easy to acquire a customer and spend money acquiring customers. It’s another thing to acquire those customers profitably and turn that into a cash flow business.

MoneyGram’s F1 partnership with Haas F1

Daniel Webber:

The Formula One season is about to start. What have you seen from the Haas F1 partnership so far? What are you hoping to get out of it?

Alex Holmes:

The initial feedback has been very positive. From touchpoints on social media platforms, to branding and messaging, what we wanted to get out of the relationship is starting to show.

We are getting media coverage in areas that normally we wouldn’t be seen. That’s good for the brand, the platform and messaging to consumers. I’m watching interviews that have nothing to do with MoneyGram, and yet there’s the MoneyGram logo. That ancillary branding and that add-on coverage has been very good and fans are engaging quite well.

The idea here wasn’t to make MoneyGram a name in Formula One. The idea was to leverage Formula One’s brand and platform to make MoneyGram a more well-known name outside of the financial service and payment world, and then also create some more affinity around the speed and the excitement that MoneyGram can bring.

So early days are good and on the testing side [for the Hass car], it’s very positive. We’ll see how the race goes this weekend and it should be extremely exciting. As Guenther said, we’ve made some tremendous improvements, but you expect everyone else does too.

We’re going to do a lot of test-and-learn this year, in terms of how much affinity there is, how much crossover there is between the customers that we’re talking to and gaining new customers, as well as visibility of race coverage and measuring activations and downloads and interactions.

So far, so good. We’re very happy with the progress and so far, it’s been a very successful play.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.