MFS Africa has transformed mobile money interoperability in Africa, but it is increasingly focusing on broader digital payments within, into and out of the continent. We spoke to CEO and Founder Dare Okoudjou to find out more.

Mobile money has been a powerful driver of digital payments adoption in many parts of the world, not least in Africa. However, for MFS Africa, it has underpinned the company’s transformation into a full-service digital network provider that not only covers much of the continent, but connects it to payments across the world.

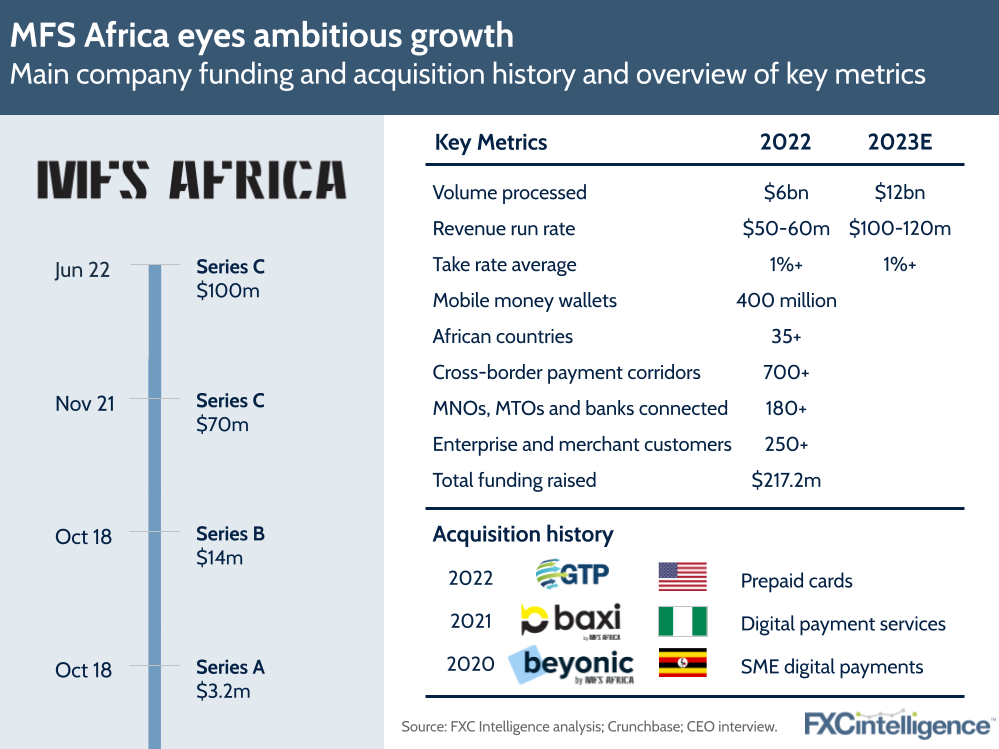

Handling flows of $6bn a year and a revenue run rate of around $50-60m, MFS Africa has grown into a vast business since it was founded in 2009, however it anticipates significantly more growth ahead. The company expects to double its flows and run rate by the end of 2023, while it plans to grow its current figure of 400 million connected mobile money wallets to 500 million by 2025. Its take rate, which varies significantly by region and business but broadly averages above 1%, is also expected to be maintained.

This is achieved in part through the broad range of services it now offers, which include ecommerce, virtual cards, global remittances, intra-Africa money transfers and bulk collections and disbursements. However, with the continent facing significant broader transformation at present, there are key opportunities ahead for MFS Africa.

“Every transaction that we have has at least one leg in Africa, and that does tend to give us much deeper context and perspective on the country that it’s hard to replicate if you’re flying around it,” says Dare Okoudjou, Founder and CEO of MFS Africa.

“Our ambition is to continue to double the size of the business organically on a year-to-year basis, but there are still pockets of the market where we believe we can do so much more.”

MFS Africa: Creating a path for mobile money

Mobile money is at the heart of MFS’s offering, but for Okoudjou its development echoes the rise of telecommunications in the continent between the late 90s and early 2000s.

“MFS Africa’s vision has always been to replicate for money what we have been able to achieve for communication,” he says, adding that his own background in telecommunications allowed him to understand the interoperability challenge that was tackled during this period.

“In the span of maybe 10 years or so, we moved from a world where you couldn’t take for granted that you could call someone [from abroad] to where you could just pick up your phone and call anyone and nobody really thinks about it.”

By the late 2000s, as Okoudjou was moving into the mobile money space, these same interoperability questions were being asked of payments in the continent, which is where MFS Africa came in.

“The idea was very simple: if we are able to connect to all mobile money platforms across the continent, then we will always be able to create the path to mobile money in the same way there’s always a path between two phones so that they can communicate,” he says.

Achieving this level of connectivity in cross-border mobile money became the focus for MFS Africa over its first seven to eight years, primarily around P2P payments within the continent.

“Our use case is: pick up your phone in Uganda and send money to someone in Kenya. Or pick up your phone in Côte d’Ivoire and send money to someone in Benin Republic. And we became very good at that,” says Okoudjou, adding that over time this created a “natural network effect”.

“The more countries we connected, the more countries wanted to be connected to us; the more networks we connected, the more networks wanted to connect with us.”

Adding businesses in Africa and beyond

MFS Africa continues to grow its mobile money connectivity, however after some time it began to recognise that there was a need for cross-border payments interoperability in the continent beyond companies servicing individuals with mobile money accounts. Other businesses also needed payments interoperability, whether they were doing transactions across the continent or looking to make payments from outside of Africa.

“Digital merchants around the world want to sell to African consumers and the connectivity could help them collect money from them,” explains Okoudjou.

“Money transfer companies outside of Africa are interested in sending money into Africa and the connectivity will allow that seamlessly.”

This prompted a transformation in how MFS was thinking about its service, seeing it look beyond its role as an intra-Africa provider to also add into and out-of-Africa capabilities. Here into-Africa is led by remittances and out-of-Africa is dominated by trade.

However, while the company is increasingly catering to companies looking to move money into or out of the continent, its primary focus remains intra-Africa, because it is here where there are the biggest opportunities to bring improvements.

“We still believe that’s where it’s the most broken,” says Okoudjou. “Funnily enough, it might be easier for you to get money from London in Ghana than to get money from Togo, which is next door.”

In service of this, the company has also added additional payment types beyond mobile money.

“It doesn’t have to be just mobile money specific. We can be connected to other ways that businesses send to: bank accounts, cards and so on and so forth,” he says, adding that this has been a particular focus for the company over the past four years.

This has enabled it to increasingly cater to fintechs in the continent, who use the company’s service to bring their solutions to multiple countries in Africa.

“Those are what I would call digital businesses in Africa that are getting at scale,” he says.

However, the company has also increasingly been focusing on small businesses who are looking to do business across the continent.

“You get really small ones, like a tailor in Dakar that is advertising on Instagram, the beautiful dresses that they’re doing and someone wants to buy this in Kenya,” he explains.

“They can check on WhatsApp or Instagram but at the end, that payment needs to happen. So facilitating those kinds of payments is also something that we’re looking at.”

Adding acquisition-led growth

Targeting this growing range of markets is being achieved partially through organic development, but in some cases the company is opting to speed up the process through choice acquisitions.

“Acquisition comes in when we believe the capabilities of what we have to be will not allow us to go organically in the time span that we set ourselves,” says Okoudjou.

The 2020 acquisition of Beyonic, which focused on digital payments for SMEs across Ghana, Uganda, Tanzania, Kenya and Rwanda, is a key example, for the first time giving MFS the ability to cater to small businesses.

“Up to that point, our clients had been mostly mobile networks, which tend to be large corporates, and our sales and account management was really built around those large accounts. It wasn’t easy to repurpose the same thing for smaller businesses that will be like five, 10 or 100 people that you see a lot in East Africa.”

Similarly, this year’s acquisition of cross-Africa prepaid card provider Global Technology Partners (GTP) introduced card issuance capabilities that have allowed MFS to expand both its core mobile money product and add additional services for its customers.

“The ability to issue an associated card to a mobile money account is increasingly something that we believe will become a basic or a must-have in terms of mobile money offering,” he says.

“Our acquisition of GTP was to position us to play in that space as well as continue to be an enabler, a partner to mobile money operators and fintechs. And most importantly, by enabling the interaction between those cards and mobile money will create full interoperability.”

Crypto’s place in African payments

Looking forward, while MFS Africa is looking to continue strong growth through a variety of different avenues, there is also the potential of the crypto space. However, Okoudjou stresses that “we haven’t seen the real stuff” as yet.

“If you remember in the late nineties, we were getting excited about Alta Vista: we hadn’t seen Google and Facebook yet,” he says, adding that the crypto space is in a similar state but there are potential indications of where it may develop, pointing to the need for on-ramp solutions as well as greater developments in the space.

For the latter, the company is attempting to help through a Founder-In-Residence programme that sees it host people with promising crypto-related ideas; however, Okoudjou also points to crypto’s quiet but potentially notable role in cross-border payments as one possible area of future growth.

“Africa is one of the most active crypto markets, but a lot of the buying that we’re seeing is not for people to hold and just speculate about the future value,” says Okoudjou.

“A lot of this is transmission: people are using this as a way around restrictions for cross-border payments where they need to pay money out. So they will buy bitcoin to send to someone in Hong Kong because they’re buying a container from Hong Kong that needs to come to Uganda, and so on and so forth.

“When you look at it from that perspective, you can also see where it will go and things like stablecoin, how they will become more important.”