Revolut has released its 2021 accounts, for the first time showing FY profit. But how important was crypto to the results, and can this continue into 2022 and beyond?

Slightly over a week ago, financial superapp player Revolut published its FY 2021 accounts, providing a long-awaited view into the company’s growth and performance.

The initial results showed a company in its first year of profit, with the publication thought to be a key move towards gaining a banking licence in the UK. Concerns around the verification of these latest numbers, and whether Revolut has systems in place to effectively monitor its finances, may prove to be a challenge to this. However, the company does see the licence as key to growth in its core market as well as to securing others internationally.

Despite this, much of the growth in the company’s 2021 results are due to a climb in crypto and Revolut has continued to roll out crypto products since. But with the market having since faced a significant downturn, how much is it likely to drive the company’s future growth? This report looks at the role crypto has played in Revolut’s move into profit in 2021, and how much it will contribute in later years.

Key takeaways from Revolut’s FY 2021 results

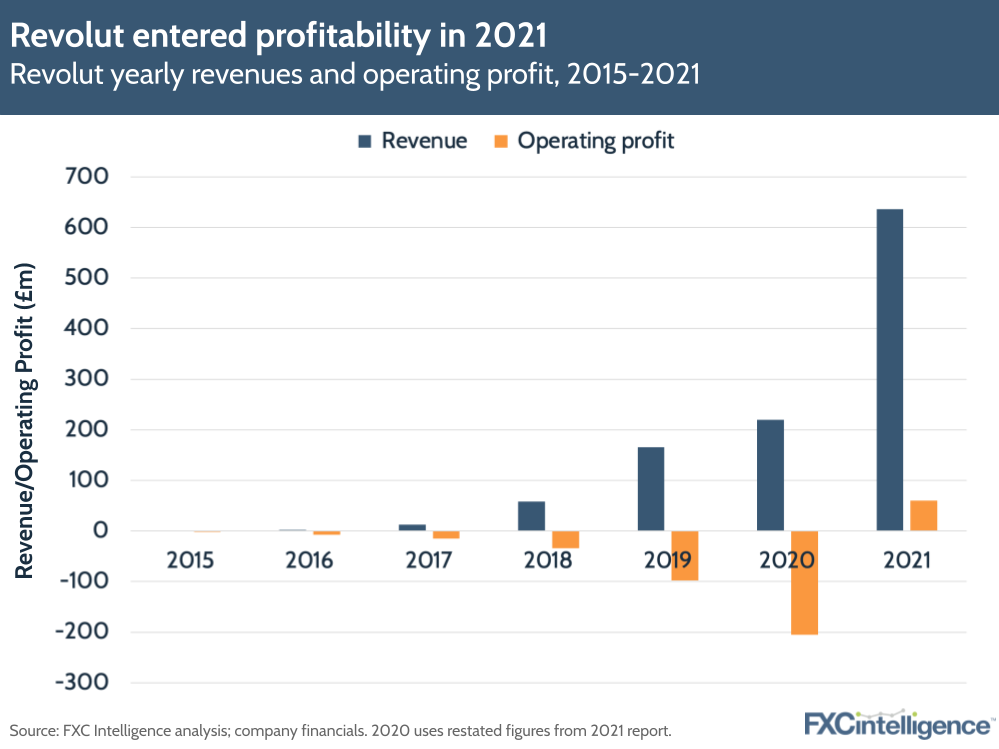

On the top line, Revolut had a strong 2021. Total revenue climbed 189% year-on-year (YoY) to reach £636m, while gross profit increased 513% to £440m. This led to the first year that the company’s total comprehensive profit was in the black, reaching £19.7m, while gross margins reached almost 70%.

As part of this, the company saw significant gains in customer numbers, with personal customers increasing by 46% YoY to 16.4 million. This also translated into a 50% increase in weekly active users, while the number of paying subscribers increased by 75%.

Geographical expansions played some role in driving this growth. While revenue in the UK and Europe saw YoY growth of 215% and 180% respectively, the company also saw its revenue in other regions increase by 130%, with the US identified as a key area for expansion during the year.

Crypto’s contribution to Revolut’s move into profit

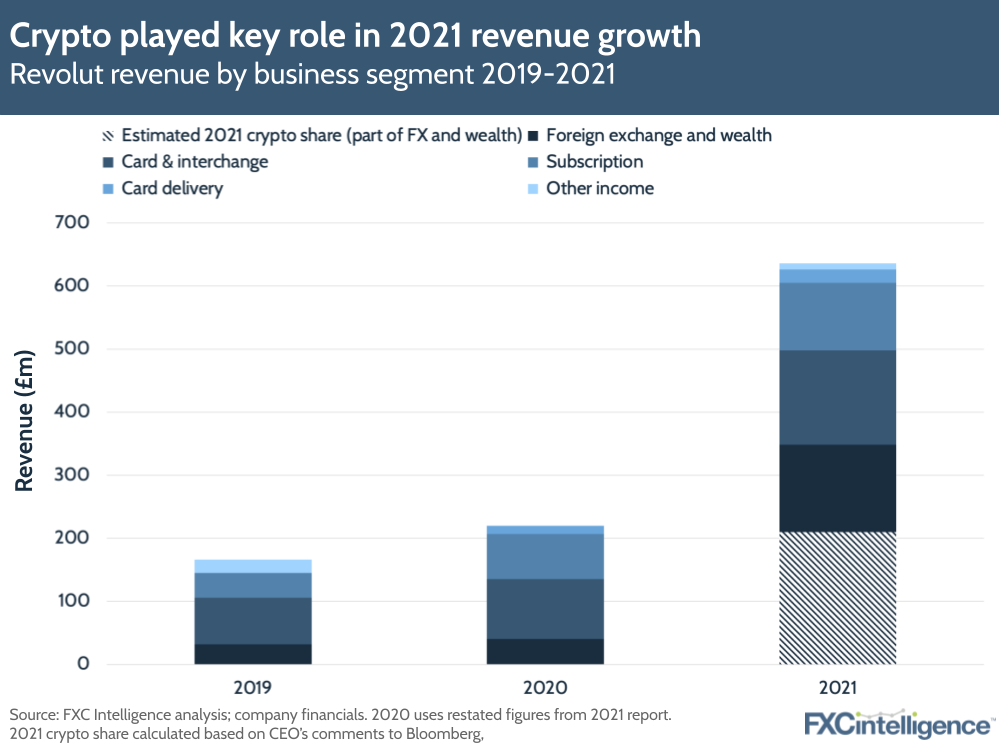

Looking to Revolut’s various business lines, all saw more than 50% YoY growth in 2021, with subscription increasing by 51%, card & interchange by 56% and card delivery by 64%.

However, the company’s Foreign Exchange and Wealth business segment was by far the biggest driver of Revolut’s jump in profits, increasing 760% to £349m in 2021 – over £100m more than the company’s entire revenue for 2020.

This covers foreign exchange services related to the company’s multicurrency and payments products, as well as its wealth segment, which includes both conventional share trading and crypto.

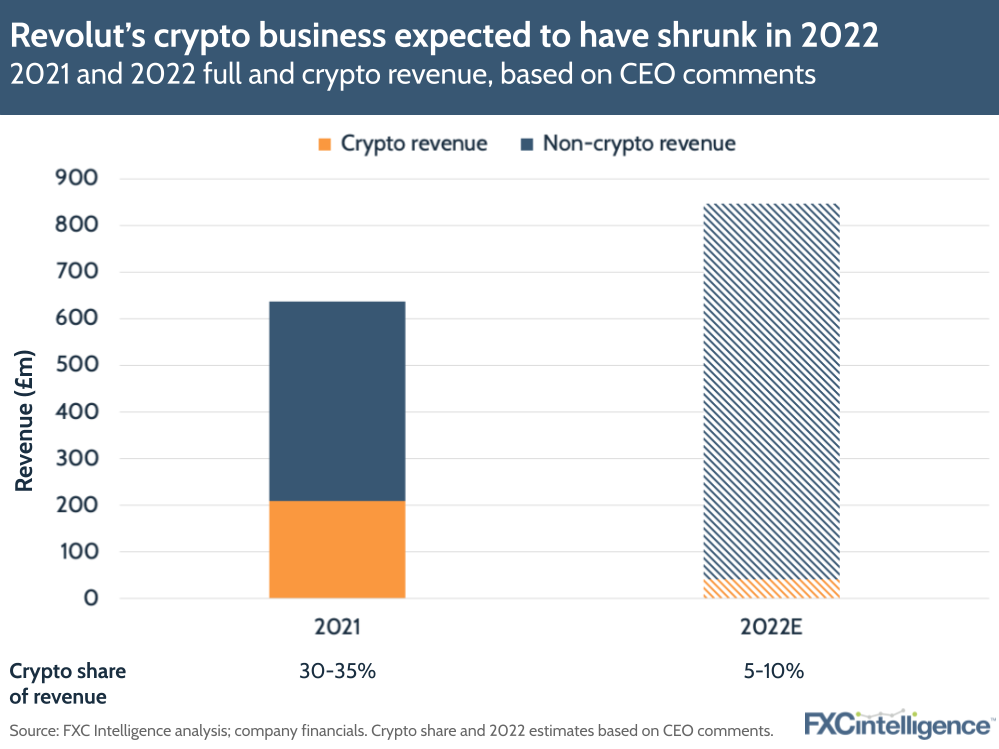

While Revolut does not formally break out its crypto revenues, CEO Nikolay Storonsky told Bloomberg in November that they accounted for 30-35% of all revenues in 2021. This is likely to make crypto the biggest single source of revenue for the company for that year, at around £210m – only slightly below 2020’s total revenue.

Much of this is likely to be a reflection of the rampant enthusiasm for crypto that was seen among retail investors in 2021. During the year, the price of many cryptocurrencies climbed significantly, with bitcoin reaching its all-time-high price of almost $65,000 in late November.

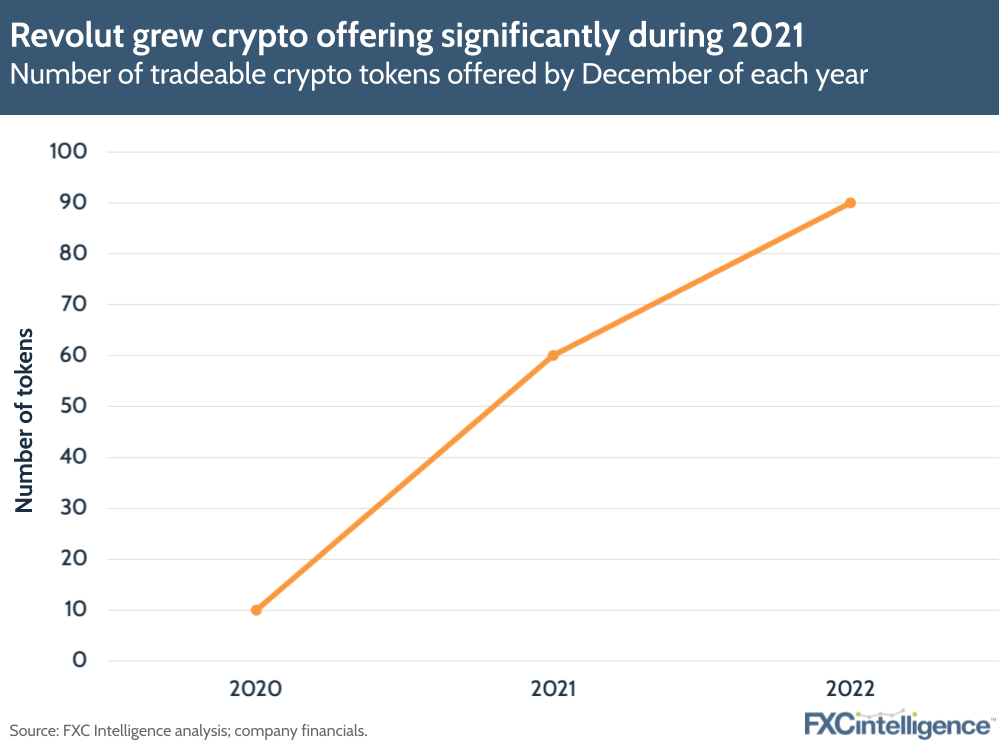

Revolut capitalised on enthusiasm for crypto by significantly expanding on its crypto product offering throughout the year. At the start of 2021, it allowed customers to trade 10 different crypto tokens in about 30 fiat currencies. In April 2021, it added a further 11 tokens, to bring the total to 21, and by the end of the year that number had reached 60.

It has since continued to add further tokens, with the number available to customers now sitting above 90.

Concerns around Revolut’s 2021 results

It should be noted that while Revolut maintains that the top-line numbers of its revenue are materially correct, its auditor has warned that it cannot verify the allocation of revenue to particular business segments.

Revolut has said that the issues are due to the company’s IT infrastructure not keeping pace with its rate of growth, and says that the audit cycle should return to normal for FY 22, which is currently expected to be reported in June.

Convincing UK regulators that this is the case will be critical to securing a banking licence in the country, which Revolut first filed for in January 2021. The company has previously expressed frustration over the time it has taken to secure it, but the delayed 2021 accounts, and their full sign-off by auditors, is perceived as vital to its approval.

Despite concerns over some details, auditor BDO has said that the 2021 accounts give a “true and fair” view of Revolut’s financials.

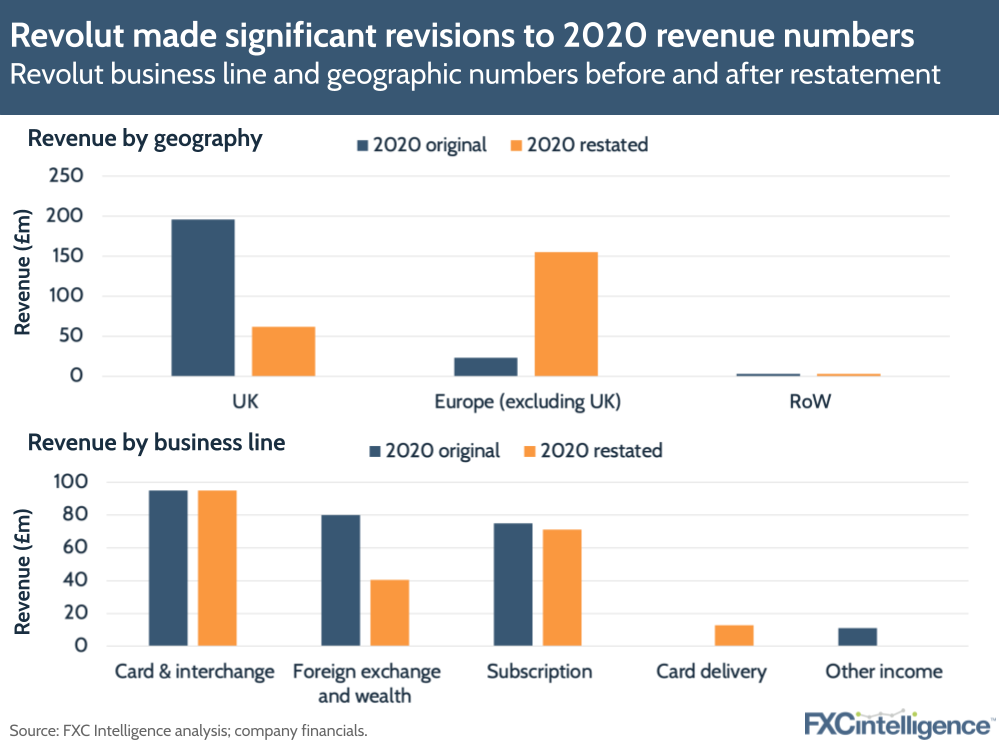

However, we did notice significant differences between the 2020 numbers put out in the company’s FY 2020 report and those re-stated in its 2021 report. While revenue, gross profit and gross margin saw adjustments of -1%, -42% and -33% respectively, there were particularly sharp adjustments to some of the company’s revenue segments both in terms of business line and geographic breakdown.

Will crypto continue to be key to Revolut’s growth?

While crypto was a strong driver of growth in 2021, it is not expected to continue to be as pronounced in 2022. CEO Nikolay Storonsky has said the company saw its total revenue grow 33% YoY in 2022, but he warned that crypto accounted for just 5-10%.

This represents a significant contraction in the revenue that Revolut derived from crypto in 2021, suggesting its success in the sector was more a reflection of the broader enthusiasm for the space than the company’s specific offering in the area.

However, it does also indicate that Revolut can effectively grow without relying on significant gains in crypto. Year-on-year revenue growth of a third when the previous year’s biggest driver has shrunk significantly is a sign of a healthily diversified business, and suggests that the company is building growth in multiple areas.

Despite this downturn, Revolut has continued to build on its crypto offering, suggesting that it does see it continuing to be a part of the company’s revenue mix in the future.

In addition to continuing to add to its token offering, the company also gained a number of approvals in the space, including registration as a crypto asset firm from the UK’s FCA in September 2022 and crypto authorisation from the Cyprus Securities and Exchange Commission in August 2022.

In February 2023, the company also added a ‘staking’ service to its product suite. This will enable customers who own crypto assets built on proof-of-stake blockchains to stake some of their tokens to help validate transactions. In exchange, they have the opportunity to earn transaction fees or new crypto assets, creating a new potential for customers to make money from the service beyond basic buying and selling.

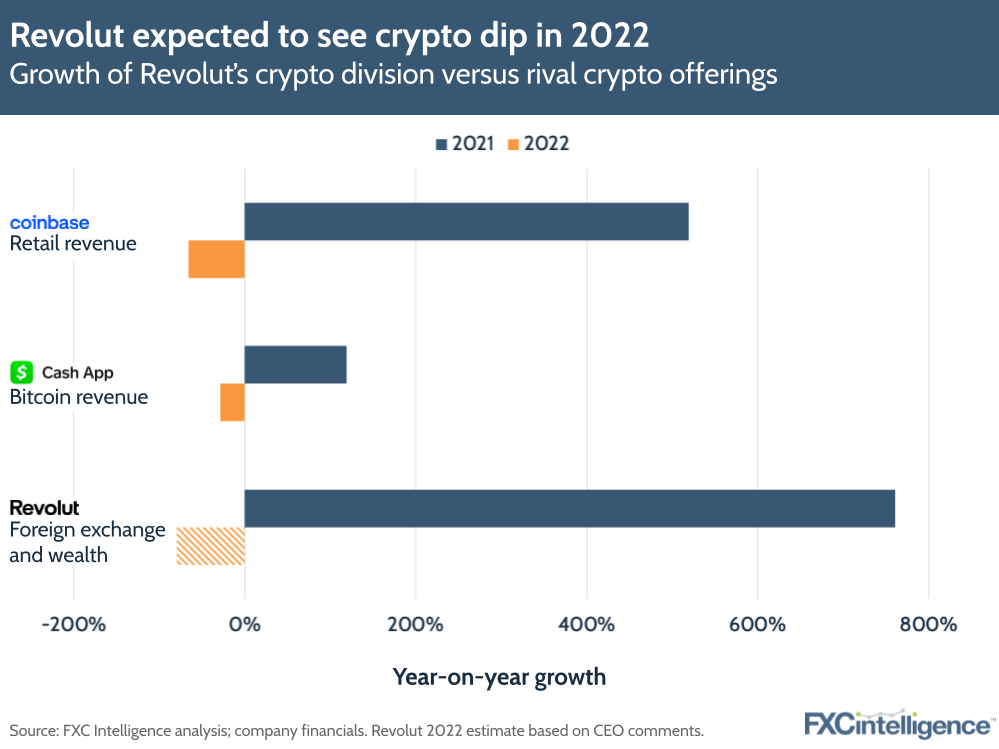

However, despite Revolut’s continued investment in crypto, it may have to do some work to continue to appeal to crypto customers. While other retail crypto players saw a similar downturn in 2022, Revolut’s negative growth has been sharper than that of Cash App, which enables customers to buy and sell bitcoin, or crypto exchange Coinbase’s retail division.

2023 may provide a clearer view of crypto’s ongoing role in Revolut’s strategy. The company has by no means abandoned it, but it is unlikely to again have the outsized influence on revenue growth that it had in 2021.

Diversifying growth: Banking licences and geographical expansion

For Revolut, its ongoing focus on becoming a financial superapp is set to see it continue to diversify its offering among a host of financial services, and critical to this is gaining banking approvals.

While the company gained such a licence in the European Union in 2021 through the European Central Bank, it is still in the process of getting one in the UK. With its 2021 results now published, it may secure this in 2023.

Not only will this strengthen the company’s offering in the UK, enabling it to offer deposit protection and other services, but it may prove critical to its expansion overseas. Revolut is seeking similar licences in several countries, including Mexico and Brazil, and having approval in its home country may help secure these.

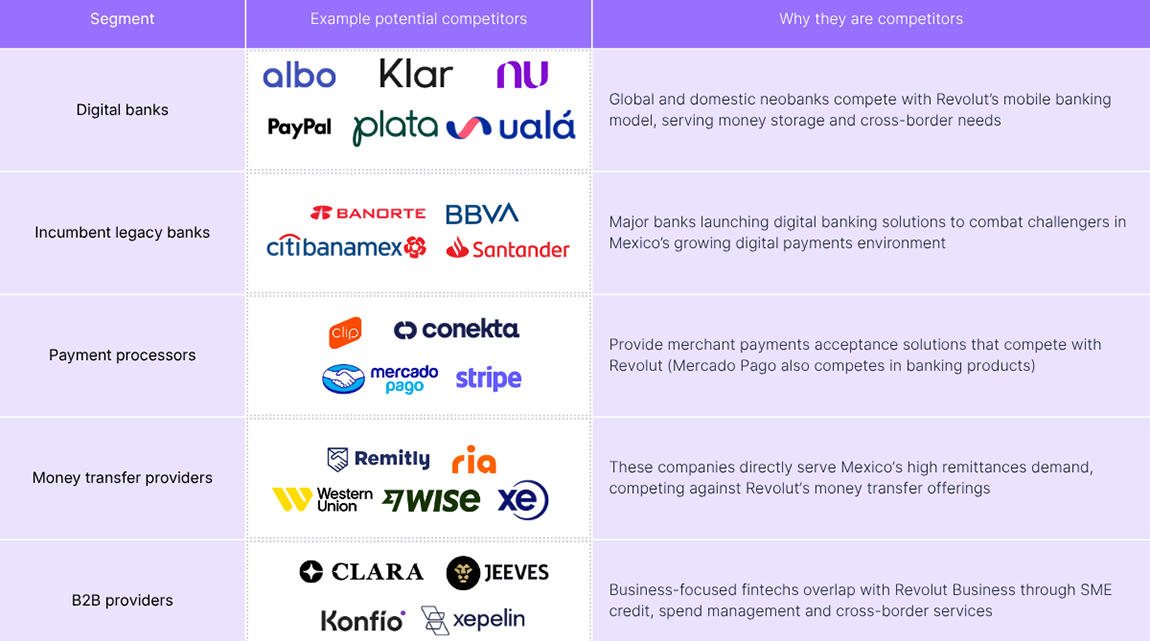

This is particularly key as the company’s geographic growth is likely to be significant in the next few years. Revolut’s 2021 expansion to the US – where its services include US-Mexico remittances, international transfers and fee-free ATM withdrawals – saw it develop a presence in a key, although highly competitive, market.

However, the company sees its biggest focuses of growth being in major emerging markets, namely India, Brazil and Mexico. The 2022 acquisition of Indian money transfers company Arvog Forex is set to help it develop a strong foothold in India, in particular for its multicurrency accounts and remittance offerings.

Meanwhile, Latin America is expected to be a “very attractive opportunity” for Revolut, with the company citing increased digital payments penetration, crypto adoption and complex regional FX markets as key reasons for its decision to begin rolling out in the region in 2021.

Despite the current macroeconomic headwinds, the company is highly bullish about its ability to support increasing demand for digital payments and to help support customers negotiating rising costs of living. But how much crypto will support this focus remains to be seen.