Zepz, the digital money transfer parent company of WorldRemit and Sendwave, enjoyed a strong 2025, achieving strong financials and launching a major new stablecoin-powered product through its Sendwave brand. To find out more about the company’s strategy and its plans for the future, we spoke to Zepz CEO Mark Lenhard.

In 2022, Zepz decided to postpone plans for an initial public offering, choosing to instead double down on achieving profitability by streamlining its operations, integrating four systems from across its two brands into one platform and cutting out unnecessary costs.

Now, the company appears to have made significant progress and recently unveiled a new stablecoin-powered Sendwave wallet across over 100 countries. We spoke to CEO Mark Lenhard to understand what went into recent milestones and how stablecoins are transforming its strategy for the future.

Inside Zepz’s offerings

Daniel Webber: First of all, talk us through Zepz’s core remittance business and tell us how the company is evolving.

Mark Lenhard: We operate multiple brands today. Zepz is the merger of two fantastic remittance brands and platforms – Sendwave and WorldRemit. We have found both of those brands to be incredibly powerful in the markets we serve. In some cases, they serve overlapping markets and in some markets they operate alone, but each of them has a very strong brand.

Trust is obviously a very important factor in what we do, both in our remittance business but even more so beyond remittances. We’ve found that operating multiple brands is very helpful for us. It serves the markets we’re in as we double down and expand on broadening our product suite.

Both companies are critically important to us today and incredibly well known – I’m still astonished at how much brand popularity there is out there in the markets we serve.

Daniel Webber: How would you define your core customer base and what trends have you seen emerge there?

Mark Lenhard: This is starting to evolve, but in the core remittance business our customers are some of the 300 million migrants and immigrants that pick up and move halfway around the world, whether it be to the US, Canada, Europe, the UK, Australia, New Zealand, Japan, South Africa or Malaysia, and want to send money back home. These customers often want to send money home on a regular ongoing basis, effectively serving as the income for friends or family back home.

What we’ve found along the way is a lot of small dollar transactions, with people wanting to send small amounts home to friends and family.

Over time, as this has become increasingly prolific, with greater numbers of people moving around the world to make a better life for themselves and earn more money, those dollar amounts have kept growing. We’re finding more people want to send a large portion of their income back home. In fact, in many cases, if it’s not their biggest expense, it’s their second-highest. This means they’re often sending more money back home than they’re spending on rent and things like that.

Zepz’s expansion strategy

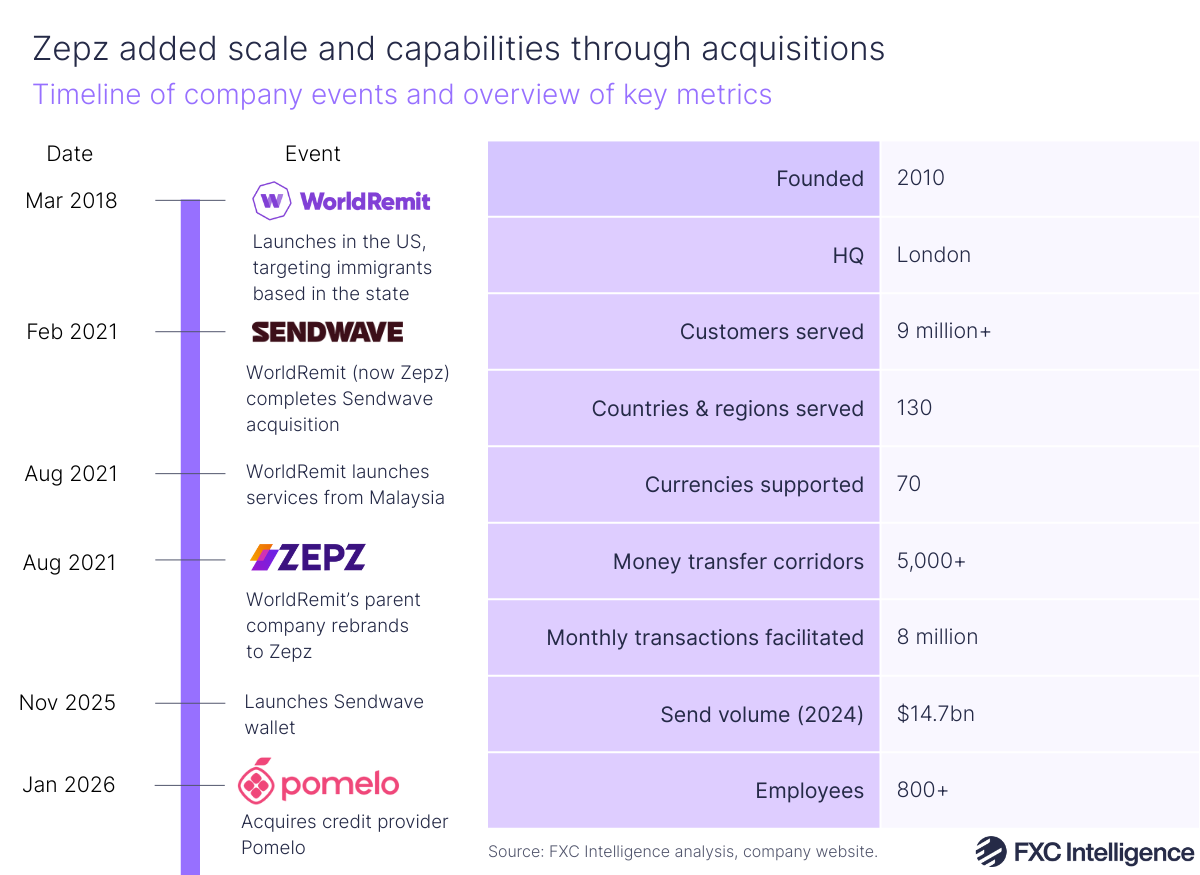

Following the acquisition of Sendwave in 2021, Zepz has expanded its money transfer services across the globe, including launching and expanding services from Malaysia and the Netherlands. Across both WorldRemit and Sendwave, Zepz now serves more than nine million customers across 5,000 corridors, sending from 50 markets to 130 receiving countries.

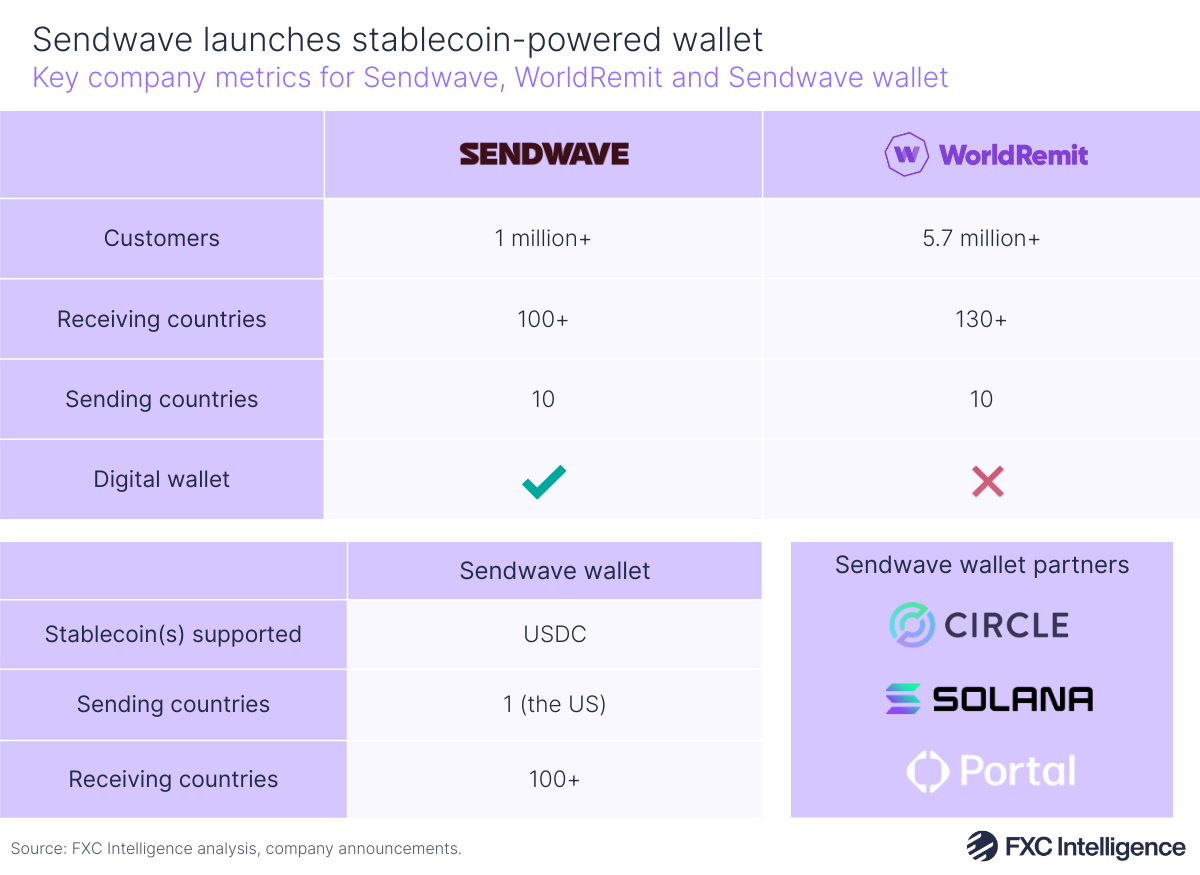

Across its two brands, Zepz says it now serves over nine million customers across 5,000 different corridors and facilitates around eight million monthly transactions. With the launch of the Sendwave wallet, Zepz plans to move beyond simply enabling cross-border transactions by starting to help customers manage and spend their money.

Scaling Zepz: Integrating WorldRemit and Sendwave

Daniel Webber: Only a small number of players have managed to reach scale and maintain it globally in this space. What has enabled Zepz to get there and stay there?

Mark Lenhard: Fundamentally, this is a tough business. It’s a lot harder to send money halfway across the world in real-time than it may appear. The user experience is also part of the challenge, as well as working out how you get the best FX rates in some of the markets where the currency is a little more liquid. Different regulatory and compliance rules in different jurisdictions also pose a significant challenge. We have to send money days in advance of a transaction actually happening in order to make sure the money arrives there on time.

However, this business scales really well. Over the past few years, we’ve cut our operating expenses by almost 50%. In part, we’ve achieved this by integrating the Sendwave and WorldRemit platforms together. I think that gives a good indication of the power of scale in this business with a solid platform, great technology and infrastructure – with the right people and procedures behind it.

This industry is massive, which means there is a huge opportunity while much of the world still doesn’t have access to the ability to send money back home with the speed and reliability of a platform like ours. As a result, for us, we’re focusing on doubling down and continuing to expand our corridors and enter new markets.

More often than not, we’re not going directly head to head against competitors. We’re just attracting customers that are currently sending money through informal or high-cost channels and want to move to digital channels. As more younger people move around the world and become immigrants, we’re going to see more of that trend.

Streamlining operations to bolster revenue

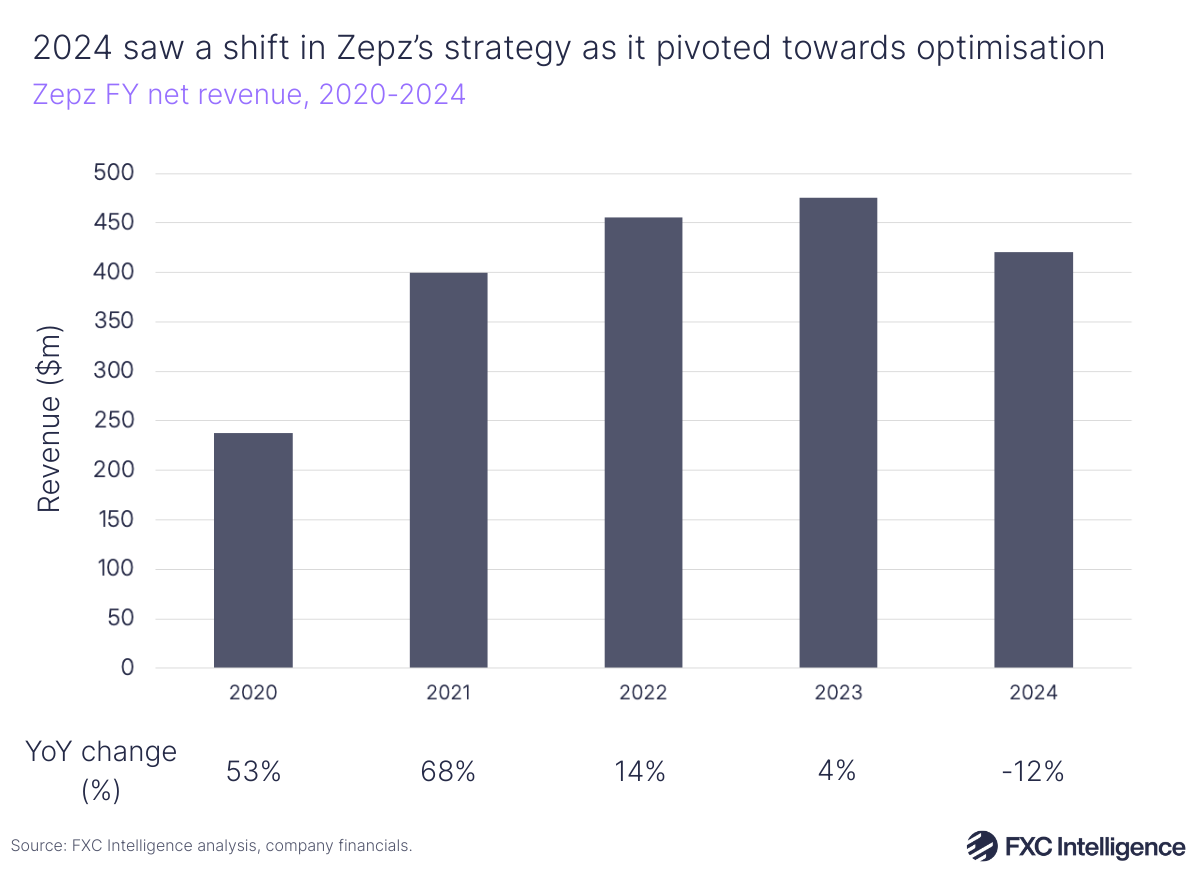

Since 2020, Zepz has mostly reported strong revenue growth, seeing its fastest YoY growth in 2021, rising 68% compared to 2020. This growth was largely driven by the company’s acquisition of Sendwave, which continues to contribute the majority of group revenue. According to Zepz, as of the end of 2025 the Sendwave brand accounts for around two-thirds of group revenue, signalling the strength of the brand.

However, in 2024, Zepz saw group revenue contract 12% YoY to $420.1m, down from $475.1m. This drop coincided with the group’s send volume declining 8%, from $16bn in 2023 to $14.7bn in 2024; the company attributed this to a change in strategy to optimise expenditure, bolster operational efficiency and enhance the customer experience it offers. As part of this, Zepz scaled back costs by reducing its headcount and restructured its debt.

These efforts saw the company cut its interest costs by 61% from $41.3m in 2024 to $16m in 2025. Zepz also achieved over 20% volume growth for the year and told us that it exited 2025 with revenue up around 25% YoY.

Zepz also focused on removing costs that did not create value for customers, reducing its annual operating expenses from $207m in 2022 to $108m in 2025 – a reduction of 48%.

How is Zepz leveraging stablecoins?

Daniel Webber: Where does Zepz stand on the use of stablecoins and how are you using them?

Mark Lenhard: Stablecoins are certainly helping or at least providing a different rail for us, which helps speed our processes up or make them easier. It can take up to six to eight days during holidays to move funds around and we have to anticipate that ahead of time, which makes it clunky, difficult and costly to run a remittance business.

However, stablecoins can potentially make that whole process easier, more transparent and lower costs all without the customer knowing – they send fiat currency and the recipient receives fiat currency.

It is important to note that while stablecoins are beginning to help us in this respect, it’s actually making it more difficult for our business in the short-term because stablecoins are new currencies and channels that we have to open up and manage – requiring very different treasury management to traditional methods.

In the medium to long term, we have really exciting plans. We’ve solved a lot of the core issues for our senders, but recipients have access to even fewer financial services. Those financial services tend to be more costly and in many cases aren’t as mature or effective as the ones from the Global North. So we’ve been spending a lot of time thinking, both from a product and a go-to-market perspective, how we can help these individuals out.

They already have access to some financial services in their home countries – we want to be supportive of that and continue to help make that easy for them to operate. But a lot of them don’t have access in many of these markets, unless you’re wealthy or a larger business, to stable currencies. They don’t have access to dollars or euros.

For them, it is incredibly difficult to save money and build wealth because the currencies that they can hold in a lot of their markets often depreciate over time and can depreciate in ways that it’s very unhelpful, and they can lose value when they need it most.

Therefore, just being able to hold dollars and choose when they want to convert that into local currency is huge. But I don’t think that simply holding USDC or holding a stablecoin is enough right now. Like I say all the time, you can’t eat stablecoins. In most of these countries it’s generally not accepted as a form of payment. So they pose a great way to save – we’re working on helping people build yield on top of it and more ways they can build wealth – but when they actually need to go use it, it’s very difficult.

What we enable them to do is when they want to use it, they can run it through all our existing payout rails. We also recently announced that you’ll be able to add a card on top of it soon and we’ll be adding more payout options to that as we go on. I think the people that are going to win in this space will be able to not just do stablecoins, not just do fiat, but be able to combine the two together.

We’ll see evolution around both of them, both the fiat and the stablecoin side, but it’s going to be a while before stablecoins take over the world and even then, I think there’s going to be opportunity for fiat.

Launching the Sendwave wallet

Zepz’s first major foray into the stablecoin world comes in the form of the Sendwave wallet, which it launched in October as part of a transition away from simply moving money across borders and towards helping customers manage their money.

The wallet enables customers across the Global South to open a digital dollar balance powered by USDC, Circle’s stablecoin pegged to the US dollar, which will help avoid currency fluctuations that traditionally occur with cryptocurrency wallets or less stable fiat currencies. To make the idea a reality, Zepz has also joined forces with two other web3 players prior to launch: Portal to provide its wallet infrastructure and Solana for its blockchain network capabilities.

In December, Zepz partnered stablecoin infrastructure platform Bridge to launch new Visa cards that enable Sendwave wallet customers to spend their stablecoin balances at any merchants that already accept Visa cards worldwide. The card product is set to go live in selected markets, including Brazil, early this year. Zepz has also signed an agreement with Stripe to expand into new markets including the US, Canada and Australia.

As part of its efforts to expand its capabilities, Zepz has also acquired Pomelo, a US-based credit card and lending-focused company with a strong presence in the Philippines. Following this move, Zepz will look to offer its customers credit cards and credit services – expanding its product suite while further diversifying its revenue mix.

Dealing with stablecoin complexity

Daniel Webber: You mentioned that stablecoins are actually making operations more complicated, which is something that we aren’t hearing much about in the industry. What is it about stablecoins that is adding to the complexity of sending money across borders?

Mark Lenhard: It is true that it is easier if you run your entire business on stablecoin and have a set of particular payout partners that are well integrated and using it. I can’t see anywhere in the near future or medium term where this is actually a possibility. Businesses like ours are going to have to operate both on fiat and stablecoins.

They use different treasury management systems, they operate differently and they work differently. So you ultimately have to build infrastructure, processes, procedures and technology around both approaches. That just adds to the complexity of how we run our business.

It’s on us to make sure we don’t expose that to the customer. We have to make it simple and transparent for the customer, but for us, it makes it more difficult to operate, even if there are benefits for stablecoin, and some of the settlement times and the costs can be lower if done well. Right now, the off-ramps are not as well established as the off-ramps and the payment infrastructure is for fiat. That will change over time. We’ve certainly already seen that change in the last three to six months. However, in the interim, it does make things more complicated.

As we build out and continue to grow and expand, some of those complexities will go away and it will become even easier, but some will stick around because I don’t think we’ll get to a point where fiat goes away.

Daniel Webber: How have you found the process of finding stablecoin infrastructure players to work with?

Mark Lenhard: There are certainly a lot of well-known infrastructure providers in the space, as well as lots of other smaller players getting started, but it’s early days. With any kind of immature ecosystem, you’ve got to spend more time vetting partners, you’ve got to work with some partners; some will work out, some will not and in some areas there are big gaps where partners don’t exist.

One of the benefits around the stablecoin hype cycle that we’ve seen is that it drives a lot of activity in the space. It makes more businesses modify their offering from being direct stablecoins into the infrastructure they developed because they realise the value of it alongside their ability to off-ramp and integrate in with some of the local fiat ecosystems.

We’re working with a lot of those players and are looking for more opportunities to work with them over time. Ultimately, some will do fantastically well and will scale, while others won’t necessarily get to become big players in the industry.

Zepz’s next steps

Daniel Webber: Looking to the future, what positions Zepz so well for the next wave in this industry?

Mark Lenhard: First of all, we fundamentally believe in a fiat plus stablecoin world and we have already integrated stablecoins. We plan to continue to focus on that as it grows and scales and hopefully we will play a part in really pushing that forward.

I believe we’ve only gotten started on all the on-chain stuff you can do, whether that’s yield, payment products or lending, and generally financial services. We’ve barely gotten started on that. I think there’s a lot of opportunity to really build a strong financial services ecosystem around that.

Secondly, for us, it’s really about how we expand our customer base. 300 million immigrant customers is our market today and they create trillions of dollars of GDP around the world – which way outsizes the number of people they represent. But now we have an opportunity to really go to the next six billion folks out there and provide them with financial services that, before stablecoins, were very difficult to serve in a compliant, low-cost way.

I think that technology really helps to serve those customers, particularly those lower dollar transaction senders. But also, the go-to-market mechanism we’ve got with the sender-receiver model of remittances gives us an opportunity to really build a core fundamental base there.

So we’re focused on continuing to double down on our core fiat business and as we expand by using stablecoins to make our business better, more safe, more reliable and low cost. We need to continue to expand and grow while we’re expanding into a broader suite of financial services, not only for our immigrant customers but also for everybody else who really needs it and deserves it.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.